May

22, 2012

Press

Release Regarding Geology andMining Activities at

Asset

#27(Mt. Boy) and Asset #26(Reveille)

The company

recently received a memofrom our Geologist Brian R. Bond regarding

our second property Asset #27 (Mt.Boy/Eureka) which has 58 claims

covering 1,160 acres near Eureka, Nevada. The memo is shown

here.

“GEOLOGICALSUMMARY,

Mountain Boy Mining Claims, Eureka Mining District; Eureka,

Nevada,Re. CJT Mining, Inc. By Brian R. Bond,Geologist March

30, 2013

MountainBoy

Mining Claims

TheMountain

Boy property consists of 58 lode mining claims (1,160 acres)

locatedin the Battle Mountain/Eureka gold belt. The contiguous

claim block is adjacentto American Barrick’s Ruby Hill mine, which

is to the northeast.

Barrick’sEast

Archimedes open pit produced 125,000 oz. of gold in 2011 and 41,000

oz. in2012 ; it has 326,000 ounces of gold reserves. The gold grade

increases withdepth.

Mostof

the historic production from the claim block came from the Mountain

Boy andKentucky mines. There are also prospect pits scattered

throughout the property.Historic gold grades range from .01 ounces

per ton (opt) Au to .527 opt Au;silver concentrations range from

1.25 opt Ag to 47.8 opt Ag. The ratio ofsilver to gold increases to

the west and southwest.

Mostof

the old workings are aligned alongthe mineralized

northeast-southwest lineament which passes through theArchimedes

pit and the east-west trend which was mined at Prospect

mountain.These two trends intersect in the middle of the Mountain

Boy claim block, alongthe northwest strike of the Battle

Mountain/Eureka gold belt.

Existingmine

workings on the property require geological mapping and sampling.

TheBattle Mountain/Eureka, Ruby Hill and Prospect Mountain trends

merit detailedexamination. Mine dumps should also be sampled.

“

This memo

confirms that our claimswhich are adjacent to Barrick Gold’s Ruby

Hill/Eureka operations are in thecross hairs of major

mineralization trends from the east and the northculminating at the

locations of the Kentucky Mine, Mt. Boy and about 12 otherprevious

prospecting/mining sites.

Some of the

historical information wehave gathered from these previous

activities have provided us with some verypromising

opportunities.

Asset #27 (Mt. Boy Eureka) –

58 claims 1,160 acres

Asset #27 is

adjacent on two sides tosome highly regarded precious metals

properties:

1.

Approximately

75 claims and 1,500acres, the Prospect

Ridgeimmediately to the east is

certifiedto contain over 10 million tons of

minable ore containing a minimum of 10million ounces of gold and 20

million ounces of silver. This property has been actively

mined by oldtimers from 1870 to 1930 with recent activity from 1995

to 2002 by the currentowners but due to the age of the owners they

do not appear ready to go intoproduction at this time.

2.

Over 1,000

claims, 20,000 acres ownedby Barrick Gold.

Claims are filed in the names of BarrickGold, Ruby Hill Mine and

Homestake Mining. The Ruby Hill mine is located on the Battle

Mountain/Eureka gold trend,less than one kilometer from the town of

Eureka. Barrick acquired the mine through a mergerwith

Homestake. Ruby Hill is anopen-pit, heap leach operation. In

2011 after an extended redevelopment phase,Ruby Hill produced

127,000 ounces (approx. $200 M) of gold at total cash costsof $334

per ounce. Proven and probablemineral reserves as of December

31, 2011 were 978,000 ounces of gold.

Asset #27

(Mt. Boy) located in the Mt.Boy Range just to the west of Prospect

Ridge and South of Barrick Gold’s claims.

Mined intermittentlyfrom 1860 up to the 1930s, approximately 15

different independent miningoperations were conducted with horses

and mules as the primary means of accessin and out of the steep

terrain.

Historical Information

from samples gathered from the various historicalmining operations

at Asset #27 (Mt. Boy) have been charted and tabulated. The

tonnage estimates use the Jensen methodof estimating which

estimates apercentage of mineralization, in this case 10% in only

the top 100 feet and inonly 13 of the 58 claims. The

estimateindicates a very significant potential tonnage of ore of

over 10 million tonsand the historical samples assay results which

we have not had the chance toverify yet show very high grade

mineralization with an average of 0.192 ouncesof gold per ton and

12.756 ounces of silver per ton.

Asset#26

(Reveille) Trenching and Drilling

Historical Information

Asset #26 at

Reveille is much furtheralong than Asset #27 as far as preparation

for drilling, mining and processingof ore. Asset #26 also has

a historicalanalysis that is very similar to that shown above for

Asset #27, using theJensen method

of estimating which estimates a percentage of mineralization,

inthis case 10% in only the top 100 feet and in only 14 of the 54

claims. The estimate indicates a very significantpotential

tonnage of ore of over 6 million tons and the historical

samplesassay results which we have not had the chance to fully

verify yet show veryhigh grade mineralization with an average of

0.01 ounces of gold per ton and 17.546 ounces of silver per

ton.

AboveGround

Stockpiled Ore Value - Thestockpiled

ore derives it’s valuation numbers from certifications in July

2009by a qualified individual as to the tonnage and grade of the

stockpiled ore andhas been extended at today’s prices to show an

above ground asset value of

$39,178,000.

Because

Asset #26 has roads,stockpiled ore and a more developed

infrastructure, the decision has been madeto bring it into

production before Asset #27.

The next

step in the pre-productionactivity is an expansion of drilling

activities by proceeding to do additionalsampling in thirty-three

(33) fifty (50) foot long trenches in 20 of the miningclaims on the

west side of our mining claim properties.

The results

of this trenching, rippingand sampling will establish a more

thorough understanding of near surfacemineralization where the

initial mining is to start. From the trenching analysis,

another 25 drillhole locations will be identified and

drilled. These 25 drill holes will provide the data needed to

block out and provethe ore reserves needed to commence mining, and

construction of the gold-silverprocessing facility.

Posted by N.

Fred Anderson, President

Statements

contained in this summary that are not statementsof historical fact

are "forward-looking statements" as that term isdefined under

federal securities laws, including, without limitation,

allstatements concerning expectations, beliefs, goals, intention or

strategies forthe future of CJT Financial, Inc. and/or CJT

Mining, Inc. Forward-looking statements may beidentified by

words such as "goals," "plans,""believes," "will," "expects" and

other words ofsimilar meaning used in conjunction with, among other

things, discussions offuture operations, financial performance,

product development and new ventures.Many factors could cause

actual events or results to differ materially fromthose expressed

in any forward-looking statement. This document is not

asolicitation to invest. Investors arecautioned not to place

any undue reliance on any forward-looking

statements.

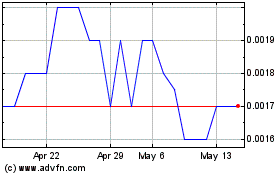

Rainmaker Worldwide (PK) (USOTC:RAKR)

Historical Stock Chart

From Jun 2024 to Jul 2024

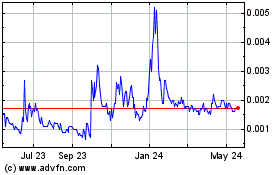

Rainmaker Worldwide (PK) (USOTC:RAKR)

Historical Stock Chart

From Jul 2023 to Jul 2024