UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

(Amendment No. 8)

Under the Securities Exchange

Act of 1934

Pacific

Coast Oil Trust

(Name of Issuer)

Units

of Beneficial Interest

(Title of Class of Securities)

694103102

(CUSIP Number)

Carson Mitchell

Shipyard Capital LP

1477 Ashford Avenue, #2006

San Juan, PR 00907

1-646-509-9519

(Name, Address and Telephone

Number of Person

Authorized to Receive Notices and Communications)

July 10, 2024

(Date of Event which Requires

Filing of this Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. x

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

| CUSIP No. 694103102 |

13D |

Page 2 of 11 |

| 1. |

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

|

| |

47-4835562

SHIPYARD CAPITAL LP |

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

|

| |

(a) x |

|

| |

(b) ¨ |

|

| 3. |

SEC Use Only |

|

| |

|

|

| 4. |

SOURCE OF FUNDS (SEE INSTRUCTIONS) |

|

| |

|

|

| |

WC |

|

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) |

¨ |

| |

|

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

| |

United States |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7. |

SOLE VOTING POWER

3,212,503 |

|

8. |

SHARED VOTING POWER

0 |

| 9. |

SOLE DISPOSITIVE POWER

3,212,503 |

| 10. |

SHARED DISPOSITIVE POWER

0 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

| |

3,212,503 |

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES* |

¨ |

| |

|

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

| |

8.33% |

|

| 14. |

TYPE OF REPORTING PERSON (see instructions) |

|

| |

|

|

| |

PN |

|

|

| * | Percentage calculated based on 38,583,158 units outstanding as of August 1, 2019, as reported in the 10-Q of Pacific Coast Oil Trust,

filed with the Securities and Exchange Commission on August 1, 2019. |

| CUSIP No. 694103102 |

13D |

Page 3 of 11 |

| 1. |

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

|

| |

47-4663148

SHIPYARD CAPITAL MANAGEMENT LLC |

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

|

| |

(a) x |

|

| |

(b) ¨ |

|

| 3. |

SEC Use Only |

|

| |

|

|

| 4. |

SOURCE OF FUNDS (SEE INSTRUCTIONS) |

|

| |

|

|

| |

WC |

|

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) |

¨ |

| |

|

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

| |

United States |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7. |

SOLE VOTING POWER

3,212,503 |

|

8. |

SHARED VOTING POWER

0 |

| 9. |

SOLE DISPOSITIVE POWER

3,212,503 |

| 10. |

SHARED DISPOSITIVE POWER

0 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

| |

3,212,503 |

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES* |

¨ |

| |

|

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

| |

8.33% |

|

| 14. |

TYPE OF REPORTING PERSON (see instructions) |

|

| |

|

|

| |

IA |

|

| * | Percentage calculated based on 38,583,158 units outstanding as of August 1, 2019, as reported in the 10-Q of Pacific Coast Oil Trust,

filed with the Securities and Exchange Commission on August 1, 2019.

|

| CUSIP No. 694103102 |

13D |

Page

4 of 11 |

| 1. |

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

|

| |

|

|

| |

CEDAR CREEK PARTNERS LLC |

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

|

| |

(a) x |

|

| |

(b) ¨ |

|

| 3. |

SEC Use Only |

|

| |

|

|

| 4. |

SOURCE OF FUNDS (SEE INSTRUCTIONS) |

|

| |

|

|

| |

WC |

|

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) |

¨ |

| |

|

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

| |

United States |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7. |

SOLE VOTING POWER

2,342,877 |

|

8. |

SHARED VOTING POWER

0 |

| 9. |

SOLE DISPOSITIVE POWER

2,342,877 |

| 10. |

SHARED DISPOSITIVE POWER

0 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

| |

2,342,877 |

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES* |

¨ |

| |

|

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

| |

6.07% |

|

| 14. |

TYPE OF REPORTING PERSON (see instructions) |

|

| |

|

|

| |

PN |

|

| * | Percentage calculated based on 38,583,158 units outstanding

as of August 1, 2019, as reported in the 10-Q of Pacific Coast Oil Trust, filed with the Securities and Exchange Commission on August

1, 2019. |

| CUSIP No. 694103102 |

13D |

Page

5 of 11 |

| 1. |

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

|

| |

|

|

| |

ERIKSEN CAPITAL MANAGEMENT LLC |

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

|

| |

(a) x |

|

| |

(b) ¨ |

|

| 3. |

SEC Use Only |

|

| |

|

|

| 4. |

SOURCE OF FUNDS (SEE INSTRUCTIONS) |

|

| |

|

|

| |

WC |

|

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) |

¨ |

| |

|

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

| |

United States |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7. |

SOLE VOTING POWER

2,402,877 |

|

8. |

SHARED VOTING POWER

0 |

| 9. |

SOLE DISPOSITIVE POWER

2,402,877 |

| 10. |

SHARED DISPOSITIVE POWER

0 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

| |

2,402,877 |

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES* |

¨ |

| |

|

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

| |

6.23% |

|

| 14. |

TYPE OF REPORTING PERSON (see instructions) |

|

| |

|

|

| |

IA |

|

| * | Percentage calculated based

on 38,583,158 units outstanding as of August 1, 2019, as reported in the 10-Q of Pacific Coast Oil Trust, filed with the Securities and

Exchange Commission on August 1, 2019. |

| CUSIP No. 694103102 |

13D |

Page

6 of 11 |

| 1. |

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

|

| |

|

|

| |

Tim Eriksen |

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

|

| |

(a) x |

|

| |

(b) ¨ |

|

| 3. |

SEC Use Only |

|

| |

|

|

| 4. |

SOURCE OF FUNDS (SEE INSTRUCTIONS) |

|

| |

|

|

| |

WC |

|

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) |

¨ |

| |

|

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

| |

United States |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7. |

SOLE VOTING POWER

20,000 |

|

8. |

SHARED VOTING POWER

0 |

| 9. |

SOLE DISPOSITIVE POWER

20,000 |

| 10. |

SHARED DISPOSITIVE POWER

0 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

| |

20,000 |

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES* |

¨ |

| |

|

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

| |

0.05% |

|

| 14. |

TYPE OF REPORTING PERSON (see instructions) |

|

| |

|

|

| |

IN |

|

| * | Percentage calculated based on 38,583,158 units outstanding

as of August 1, 2019, as reported in the 10-Q of Pacific Coast Oil Trust, filed with the Securities and Exchange Commission on August

1, 2019. |

| CUSIP No. 694103102 |

13D |

Page

7 of 11 |

| 1. |

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

|

| |

|

|

| |

Eriksen Family LLC |

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS) |

|

| |

(a) x |

|

| |

(b) ¨ |

|

| 3. |

SEC Use Only |

|

| |

|

|

| 4. |

SOURCE OF FUNDS (SEE INSTRUCTIONS) |

|

| |

|

|

| |

WC |

|

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E) |

¨ |

| |

|

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

| |

United States |

|

|

NUMBER OF SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON WITH

|

7. |

SOLE VOTING POWER

40,000 |

|

8. |

SHARED VOTING POWER

0 |

| 9. |

SOLE DISPOSITIVE POWER

40,000 |

| 10. |

SHARED DISPOSITIVE POWER

0 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

| |

40,000 |

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES* |

¨ |

| |

|

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

| |

0.10% |

|

| 14. |

TYPE OF REPORTING PERSON (see instructions) |

|

| |

|

|

| |

PN |

|

| CUSIP No. 694103102 |

13D |

Page 8 of 11 |

| Item 1. | Security and Issuer |

This Schedule 13D relates to units of beneficial

interest (the “Units”), of Pacific Coast Oil Trust (the “Issuer” or “Pacific Coast”). The address

of the issuer is 601 Travis Street, 16th Floor, Houston, Texas 77002.

| Item 2. | Identity and Background |

(a) This Statement is filed by:

(1) Shipyard Capital Management LLC (“Shipyard”)

(2) Cedar Creek Partners LLC (“CCP”),

Eriksen Capital Management LLC (“ECM”), Eriksen Family LLC and Tim Eriksen (“Mr. Eriksen”).

Each of the foregoing is referred to as a “Reporting

Person” and collectively as the “Reporting Persons.”

(b) The principal business

address of Shipyard is 1477 Ashford Avenue, #2006, San Juan, PR 00907. The principal business address of CCP, ECM, Eriksen Family LLC

and Mr. Eriksen is 8695 Glendale Road, Custer, WA 98240.

(c) The principal business

of Shipyard is acquiring, holding and disposing of investments in various companies. The principal business of CCP and Eriksen Family

LLC is acquiring, holding and disposing of investments in various companies. The principal business of Mr. Eriksen is investment advisory

services.

(d) No Reporting Person described

herein has, during the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) None of the Reporting

Parties described herein has, during the last five years, been party to a civil proceeding of a judicial or administrative body of competent

jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of,

or prohibiting or mandating activities subject to, federal or state securities laws or finding any violations with respect to such laws.

(f) Mr. Mitchell is a citizen

of the United States. Shipyard is a Delaware limited liability company. Mr. Eriksen is a citizen of the United States. CCP, ECM and Eriksen

Family LLC are Washington limited liability companies.

| Item 3. | Source and amount of Funds or Other Consideration |

The units were acquired in open market purchases

with working capital of Shipyard, CCP, Mr. Eriksen and Eriksen Family LLC, respectively. The amount of funds expended, excluding commissions,

to acquire units held by Shipyard, CCP, Mr. Eriksen, and Eriksen Family LLC is $469,225, $792,432, $6,400, and $12,800 respectively.

| Item 4. | Purpose of Transaction |

The Reporting Persons acquired shares of Pacific

Coast for investment purposes.

| CUSIP No. 694103102 |

13D |

Page

9 of 11 |

Shipyard, CCP, ECM, Mr. Eriksen, and Eriksen Family

LLC believe that the trustee is not properly representing unitholders. The trustee has refused to file suit against Pacific Coast Energy

Company LP (“PCEC”), the operator of Pacific Coast Oil Trust, for what we believe are illegal and improper assessments against

the trust, preventing the trust from making distributions and potentially forcing dissolution and liquidation, which we believe would

harm unitholders. In addition, the Trustee has not required escrow of the assessed asset retirement obligations which we believe could

subject them to potential appropriation by the owners of PCEC or be subject to any claims against PCEC. While we continue to believe the

assessment was improper, we believe that the assessed funds, along with interest, should be returned to the Trust (unitholders) should

the trust be liquidated and sold since asset retirement obligations transfer to any new buyer.

In pursuing such investment purposes, the Reporting

Persons may further purchase, hold, vote, trade, dispose or otherwise deal in the units at times, and in such manner, as they deem advisable

to benefit from, among other things, (1) changes in the market prices of the units; (2) changes in the Issuer’s operations, business

strategy or prospects; or (3) from the sale or merger of the Issuer. To evaluate such alternatives, the Reporting Persons will closely

monitor the Issuer’s operations, prospects, business development, management, competitive and strategic matters, capital structure,

and prevailing market conditions, as well as other economic, securities markets, and investment considerations. Consistent with their

investment research methods and evaluation criteria, the Reporting Persons may discuss such matters with the trustee of the Issuer (the

“Trustee”), other unitholders, industry analysts, existing or potential strategic partners or competitors, investment and

financing professionals, sources of credit, and other investors. Such evaluations and discussions may materially affect, and result in,

among other things, the Reporting Persons (1) modifying their ownership of the units; (2) exchanging information with the Issuer pursuant

to appropriate confidentiality or similar agreements; (3) proposing changes in the Issuer’s operations, governance or capitalization;

(4) proposing changes of the trust’s trustee or bylaws; or (5) pursuing one or more of the other actions described in subsections

(a) through (j) of Item 4 of Schedule 13D.

In addition to the information disclosed in this

Statement, the Reporting Persons reserve the right to (1) formulate other plans and proposals; (2) take any actions with respect to their

investment in the Issuer, including any or all of the actions set forth in subsections (a) through (j) of Item 4 of Schedule 13D; and

(3) acquire additional units or dispose of some or all of the units beneficially owned by them, in each case in the open market, through

privately negotiated transactions or otherwise. The Reporting Persons may at any time reconsider and change their plans or proposals relating

to the foregoing.

Since the filing of the 7th Amended

13D on May 31, 2024, no material events have occurred.

| Item 5. | Interest in Securities of the Issuer |

The following sets forth the aggregate number and

percentage (based on 38,583,158 units outstanding on August 1, 2019, as reported in the 10-Q of the Issuer filed with the Securities and

Exchange Commission on August 1, 2019) of outstanding units owned beneficially by the Reporting Persons.

| Name |

|

No. of Shares |

|

|

Percent of

Class |

|

| Shipyard Capital LP (1) |

|

|

3,212,503 |

|

|

|

8.3 |

% |

| Cedar Creek Partners LLC (2) |

|

|

2,342,877 |

|

|

|

6.1 |

% |

| Eriksen Family LLC (3) |

|

|

40,000 |

|

|

|

0.1 |

% |

| Tim Eriksen (4) |

|

|

20,000 |

|

|

|

0.1 |

% |

| Total for Shipyard, CCP, Eriksen Family LLC and Mr. Eriksen |

|

|

5,615,830 |

|

|

|

14.6 |

% |

| (1) | These units are owned by Shipyard, an investment partnership, for which Shipyard Capital Management LLC is General Partner and acts

as the discretionary portfolio manager. |

| (2) | These units are owned by CCP, an investment partnership, for which Eriksen Capital Management LLC is the Managing Member, and acts

as the discretionary portfolio manager. |

| (3) | These units are owned by Eriksen Family LLC, a family partnership, for which Mr. Eriksen is the Managing Member, and acts as the discretionary

portfolio manager. |

| (4) | These units are owned by Tim Eriksen. |

| CUSIP No. 694103102 |

13D |

Page

10 of 11 |

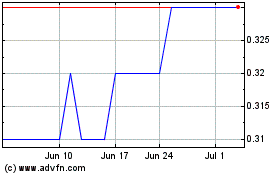

There following table sets forth all transactions

with respect to the units effected by the Reporting Persons within 60 days of the filing of Amendment No. 8 to the Statement.

| | |

Date | |

Shares | |

Buy/Sell | |

Price |

| Cedar Creek Partners | |

6/3/2024 | |

78,881 | |

Buy | |

0.320 |

| Tim Eriksen | |

6/3/2024 | |

20,000 | |

Buy | |

0.320 |

| Eriksen Family LLC | |

6/3/2024 | |

40,000 | |

Buy | |

0.320 |

| Cedar Creek Partners | |

6/7/2024 | |

849 | |

Buy | |

0.310 |

| Cedar Creek Partners | |

6/11/2024 | |

400 | |

Buy | |

0.310 |

| Cedar Creek Partners | |

6/12/2024 | |

1,150 | |

Buy | |

0.310 |

| Cedar Creek Partners | |

6/13/2024 | |

10,000 | |

Buy | |

0.310 |

| Cedar Creek Partners | |

6/17/2024 | |

1,147 | |

Buy | |

0.320 |

| Cedar Creek Partners | |

6/20/2024 | |

10,006 | |

Buy | |

0.320 |

| Cedar Creek Partners | |

6/21/2024 | |

30 | |

Buy | |

0.320 |

| Cedar Creek Partners | |

6/25/2024 | |

5,026 | |

Buy | |

0.330 |

| Cedar Creek Partners | |

6/27/2024 | |

2,930 | |

Buy | |

0.330 |

| Cedar Creek Partners | |

6/28/2024 | |

5,000 | |

Buy | |

0.330 |

| Cedar Creek Partners | |

7/1/2024 | |

3,700 | |

Buy | |

0.330 |

| Cedar Creek Partners | |

7/2/2024 | |

2,100 | |

Buy | |

0.330 |

| Cedar Creek Partners | |

7/5/2024 | |

100 | |

Buy | |

0.310 |

| Cedar Creek Partners | |

7/8/2024 | |

55,225 | |

Buy | |

0.329 |

| Cedar Creek Partners | |

7/8/2024 | |

22,278 | |

Buy | |

0.300 |

| Cedar Creek Partners | |

7/10/2024 | |

133,000 | |

Buy | |

0.300 |

| Item 6. | Contracts, Arrangements, Understanding or Relationships with Respect to Securities of the Issuer. |

Other than as described herein, there are no contracts,

arrangements, understandings or relationships among the Reporting Persons, or between the Reporting Persons and any other person, with

respect to the securities of the Issuer.

| Item 7. | Material to be Filed as Exhibits. |

None

| CUSIP No. 694103102 |

13D |

Page

11 of 11 |

SIGNATURE

After reasonable inquiry, and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: July 11, 2024

| |

SHIPYARD CAPITAL MANAGEMENT LLC |

| |

|

| |

By: |

/s/ Carson Mitchell |

| |

|

Carson Mitchell |

| |

|

Managing Member |

| |

|

| |

CEDAR CREEK PARTNERS LLC |

| |

|

| |

By: |

/s/ Tim Eriksen |

| |

|

Tim Eriksen |

| |

|

Managing Member |

| |

|

| |

ERIKSEN FAMILY LLC |

| |

|

| |

By: |

/s/ Tim Eriksen |

| |

|

Tim Eriksen |

| |

|

Managing Member |

| |

|

| |

TIM ERIKSEN |

| |

|

| |

By: |

/s/ Tim Eriksen |

| |

|

Tim Eriksen |

Pacific Coast Oil (CE) (USOTC:ROYTL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Pacific Coast Oil (CE) (USOTC:ROYTL)

Historical Stock Chart

From Feb 2024 to Feb 2025