Filed

pursuant to Rule 424(b)(3)

Registration

Statement No. 333-249469

Prospectus

Supplement DATED DECEMBER 1, 2020

(to

the Prospectus dated October 28, 2020)

RespireRx

Pharmaceuticals Inc.

This

Prospectus Supplement No. 2 supplements and amends the final prospectus dated October 28, 2020 (as previously supplemented by

Prospectus Supplement No. 1, the “Final Prospectus”) relating to the resale of up to 115,000,000 shares of our common

stock, $0.001 par value per share, issuable to White Lion Capital, LLC (the “Selling Stockholder”), pursuant to a

“put right” under an equity purchase agreement, dated July 28, 2020, as amended, by and between us and the Selling

Stockholder. This Prospectus Supplement No. 2 should be read in conjunction with the Final Prospectus and is qualified by reference

to the Final Prospectus except to the extent that the information in this Prospectus Supplement No. 2 supersedes the information

contained in the Final Prospectus.

On

November 25, 2020 and December 1, 2020, we filed with the U.S. Securities and Exchange Commission the attached Current Reports

on Form 8-K.

Our

Common Stock is quoted by the OTCQB Venture Market operated by the OTC Markets Group, Inc. (“OTCQB”) under the symbol

“RSPI.” On November 30, 2020, the closing price of our Common Stock was $0.0029 per share.

Investing

in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the

heading “Risk Factors” beginning on page 7 of the Final Prospectus, and under similar headings in any amendments or

supplements to this prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this Prospectus Supplement No. 2 is December 1, 2020

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

Current

Report

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 24, 2020

RESPIRERX

PHARMACEUTICALS INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

1-16467

|

|

33-0303583

|

(State

or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S

Employer

Identification No.)

|

|

126

Valley Road, Suite C

Glen

Rock, New Jersey

|

|

07452

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (201) 444-4947

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On

November 24, 2020, RespireRx Pharmaceuticals Inc. (the “Company”) filed with the Secretary of State of the State of

Delaware a Fifth Certificate of Amendment (the “Certificate of Amendment”) to its Second Restated Certificate of Incorporation.

The Certificate of Amendment increased the number of authorized shares of common stock of the Company, par value $0.001 per share

(“Common Stock”), from 1,000,000,000 to 2,000,000,000.

The

above description of the Certificate of Amendment does not purport to be complete and is qualified in its entirety by reference

to the Certificate of Amendment, which is attached hereto as Exhibit 3.1 to this Current Report on Form 8-K.

Item

5.07. Submission of Matters to a Vote of Security Holders

On

November 24, 2020, the Company held a Special Meeting of Stockholders (the “Special Meeting”). The record date for

stockholders to receive notice of and to be eligible to vote at the Special Meeting was October 16, 2020. A total of 577,842,003

shares were eligible to be voted at the Special Meeting.

The

Company’s shareholders approved the following amendments to the Second Restated Certificate of Incorporation (the “Charter”)

of the Company: (i) to effect, at the discretion of the Company’s Board of Directors (the “Board”), a ten-to-one

(10 to 1) reverse stock split of all of the outstanding shares of Common Stock (the “Reverse Split Amendment”), and

(ii) to set the Company’s authorized shares of stock at 2,005,000,000 shares consisting of 2,000,000,000 shares designated

as Common Stock, and 5,000,000 shares designated as preferred stock, with stated value and other terms to be determined at the

discretion of the Board (the “Authorized Shares Amendment”).

The

following was the result of the vote to approve the Reverse Split Amendment:

|

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

Total Shares Voted

|

|

|

Votes Cast

|

|

|

453,160,917

|

|

|

|

62,572,978

|

|

|

|

2,563,891

|

|

|

|

518,297,786

|

|

|

Percentage of Shares Eligible to be Voted

|

|

|

78.4

|

%

|

|

|

10.8

|

%

|

|

|

0.4

|

%

|

|

|

89.7

|

%

|

As

set forth in the proxy statement for the Special Meeting, an amendment to the Charter to implement the Reverse Split Amendment

may be filed with the Secretary of State of the State of Delaware if and when the Board so determines. The Proxy Statement further

states that the Board intends to effect such amendment, or abandon it, within sixty days of the Special Meeting. Until such amendment

becomes effective, the Board reserves the right to abandon the Reverse Split Amendment without further action by the Company’s

stockholders.

The

following was the result of the vote to approve the Authorized Shares Amendment:

|

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

Total Shares Voted

|

|

|

Votes Cast

|

|

|

431,415,755

|

|

|

|

85,861,745

|

|

|

|

1,020,286

|

|

|

|

518,297,786

|

|

|

Percentage of Shares Eligible to be Voted

|

|

|

74.7

|

%

|

|

|

14.9

|

%

|

|

|

0.2

|

%

|

|

|

89.7

|

%

|

As described above in Item 5.03 of this Current

Report on Form 8-K, the Certificate of Amendment effecting the Authorized Shares Amendment was filed with the Secretary of State

of the State of Delaware on November 24, 2020.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits.

*Filed

herewith

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

Date:

November 25, 2020

|

RESPIRERX

PHARMACEUTICALS INC.

(Registrant)

|

|

|

|

|

|

|

By:

|

/s/

Jeff E. Margolis

|

|

|

|

Jeff

E. Margolis

SVP,

CFO, Secretary and Treasurer

|

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

Current

Report

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 24, 2020

RESPIRERX

PHARMACEUTICALS INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

1-16467

|

|

33-0303583

|

(State

or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S

Employer

Identification No.)

|

126

Valley Road, Suite C

Glen Rock, New Jersey

|

|

07452

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (201) 444-4947

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

1.01. Entry into a Material Definitive Agreement.

On

November 24, 2020, RespireRx Pharmaceuticals Inc. (the “Company”) and Primary Capital LLC (“Primary Capital”)

entered into a Financing and Additional Services Agreement (the “Services Agreement”) under which Primary Capital

agreed to render investment banking services to the Company beginning on November 24, 2020 for a period of one year (the “Engagement

Period”).

Under

the terms of the Services Agreement, Primary Capital will act as a placement agent in connection with a proposed up to $10 million

best-efforts offering (the “Reg A Offering”) under Regulation A promulgated under the Securities Act of 1933, as amended.

The

services to be provided by Primary Capital under the Services Agreement will include, but are not limited to, reviewing the offering

materials and identifying and contacting potential investors.

In

consideration for the services provided by Primary Capital under the Services Agreement, the Company will pay (i) a non-refundable

due diligence fee, (ii) a placement fee equal to a percentage of the gross proceeds from the Reg A Offering from investors originated

by Primary Capital, along with a three-year warrant to purchase a percentage of that number of shares of the Company’s Common

Stock, par value $0.001 per share (“Common Stock”), as are sold to any such investor, (iii) a placement fee equal

to a lesser percentage of the gross proceeds from the Reg A Offering from investors referred by the Company to Primary Capital,

along with a three-year warrant to purchase a percentage of that number of shares of Common Stock as are sold to any such investor,

and (iv) up to a threshold amount to reimburse Primary Capital for its reasonable legal expenses incurred in the performance of

its duties under the Services Agreement. In certain circumstances, the Company will also be required to pay the compensation described

in (ii) above to Primary Capital if, during the 12-month period following the expiration of the Engagement Period, the Company

consummates a transaction with an investor introduced to the Company by Primary Capital. The Company also agreed not to solicit,

negotiate with or enter into any agreement with any other person or entity performing similar services as Primary Capital in connection

with the Reg A Offering during the Engagement Period. The Company is also subject to standard indemnification and contribution

obligations in favor of Primary Capital.

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

Date:

December 1, 2020

|

RESPIRERX

PHARMACEUTICALS INC.

|

|

|

(Registrant)

|

|

|

|

|

|

|

By:

|

/s/

Jeff E. Margolis

|

|

|

|

Jeff

E. Margolis

|

|

|

|

SVP,

CFO, Secretary and Treasurer

|

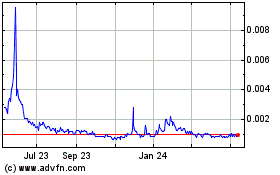

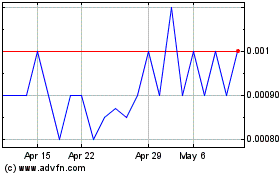

RespireRx Pharmaceuticals (CE) (USOTC:RSPI)

Historical Stock Chart

From Dec 2024 to Jan 2025

RespireRx Pharmaceuticals (CE) (USOTC:RSPI)

Historical Stock Chart

From Jan 2024 to Jan 2025