1-for-375 reverse stock split effective at

market open today

Exchanged $43.2 million in principal amount of

convertible notes and warrants previously exercisable for

approximately 1.7 billion pre-split shares for approximately 4.0

million post-split shares

Closed $10.3 million equity only PIPE offering

at $8.25 per share of common stock led by certain institutional

investors, including AWM Investment Company, Inc., the investment

adviser of the Special Situations Funds and with participation from

Manchester Management and Opaleye, LP

Outstanding share count following the reverse

stock split, exchange and PIPE offering is approximately 8.5

million

EDEN PRAIRIE, MN -- October 18, 2024 -- InvestorsHub NewsWire --

SANUWAVE Health, Inc. (the "Company" or "SANUWAVE") (OTCQB:

SNWV), a leading provider of next-generation FDA-approved wound

care products, is pleased to announce a reverse stock split, a

convertible note and warrant exchange, and the consummation of a

PIPE offering in the Company.

Effective at 12:01 a.m. Mountain Time on October 18, 2024, the

Company implemented a 1-for-375 reverse stock split of its

outstanding common stock. The Company's common stock will continue

to trade under the symbol "SNWV" on the OTCQB and is expected to

begin trading on a split-adjusted basis at the opening of the

market today, under a new CUSIP number, 80303D 305. For a

period of 20 business days, a "D" will be placed on the Company's

ticker symbol to reflect the reverse stock split making the

Company's equity ticker "SNWVD" during that period.

Upon the effectiveness of the reverse stock split, all of the

holders of the Company's outstanding convertible notes and

associated warrants issued in August 2022, November 2022, May 2023,

December 2023, January 2024 and June 2024 were converted into

approximately 4.0 million shares of post-split common stock.

In addition, NH Expansion Credit Fund Holdings LP ("NH Expansion"),

the agent under the Company's Note and Warrant Purchase and

Security Agreement (the "NWPSA"), exercised all of its outstanding

warrants for 146,302 post-split shares of common stock. In

connection with this warrant exercise, the Company and NH Expansion

entered into a Consent and Limited Waiver to Note and Warrant

Purchase and Security Agreement, pursuant to which the Company

agreed to repay in full all amounts owed to HealthTronics, Inc.,

among other matters, after which the Company expects to regain full

compliance with the covenants under the NWPSA.

The Company also has sold approximately 1.3 million shares in a

PIPE offering priced at a post-split price of $8.25 per

share. This deal was led by certain institutional investors,

including AWM Investment Company, Inc., the investment adviser of

the Special Situations Funds, and included participation from

Manchester Management and Opaleye, LP, as well as other existing

and new investors. Gross proceeds were approximately $10.3

million, and the Company did not engage a bank or agent in

connection with the offering. The use of proceeds will

include working capital and general corporate purposes and the

repayment of certain indebtedness, including the satisfaction of

all amounts owed to HealthTronics, Inc. for $1.4 million.

"The goal of these transactions is to simplify and rationalize

SANUWAVE's cap table to put the company on a sound financial

footing to pursue growth and profitability," said CEO Morgan

Frank. "By reducing our share count and cap structure

complexity and regaining compliance with our debt covenants, our

hope is to create a company that can be valued for its business

instead of its cap stack and to allow us to focus our energy on

accelerating our growth rate and better serving the wound care

market. It's an exciting time at SANUWAVE, and I'm grateful

to the employees who got us here and will take us yet

further. I look forward to providing further updates on the

Company's progress soon."

About SANUWAVE

SANUWAVE Health is focused on the research, development, and

commercialization of its patented, non-invasive and biological

response-activating medical systems for the repair and regeneration

of skin, musculoskeletal tissue, and vascular structures.

SANUWAVE's end-to-end wound care portfolio of regenerative medicine

products and product candidates helps restore the body's normal

healing processes. SANUWAVE applies and researches its patented

energy transfer technologies in wound healing, orthopedic/spine,

aesthetic/cosmetic, and cardiac/endovascular conditions.

Forward-Looking Statements

This press release may contain "forward-looking statements" within

the meaning of the Private Securities Litigation Reform Act of

1995, such as statements relating to the Company's expectation that

it will regain full compliance with the covenants under the NWPSA,

future financial results, production expectations, and plans for

future business development activities. Forward-looking statements

include all statements that are not statements of historical fact

regarding intent, belief or current expectations of the Company,

its directors or its officers. Investors are cautioned that any

such forward-looking statements are not guarantees of future

performance and involve risks and uncertainties, many of which are

beyond the Company's ability to control. Actual results may differ

materially from those projected in the forward-looking statements.

Among the key risks, assumptions and factors that may affect

operating results, performance and financial condition are risks

associated with regulatory oversight, the Company's ability to

manage its capital resources, competition and the other factors

discussed in detail in the Company's periodic filings with the

Securities and Exchange Commission. The Company undertakes no

obligation to update any forward-looking statement.

Contact: investors@sanuwave.com

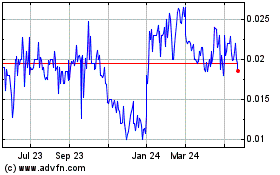

SANUWAVE Health (QB) (USOTC:SNWV)

Historical Stock Chart

From Feb 2025 to Mar 2025

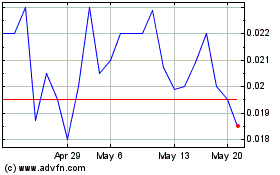

SANUWAVE Health (QB) (USOTC:SNWV)

Historical Stock Chart

From Mar 2024 to Mar 2025