Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

August 08 2024 - 3:16PM

Edgar (US Regulatory)

Free Writing Prospectus

Filed Pursuant to Rule 433

Registration Statement No. 333-270939

Southern California Gas Company

Final Term Sheet

August 8,

2024

5.050% First Mortgage Bonds, Series CCC, due 2034

This free writing prospectus relates only to the securities described below and should be read together with Southern California Gas

Company’s preliminary prospectus supplement dated August 8, 2024 (the “Preliminary Prospectus Supplement”), the accompanying prospectus dated April 27, 2023 and the documents incorporated and deemed to be incorporated by

reference therein.

|

|

|

| Issuer: |

|

Southern California Gas Company (the “Company”) |

|

|

| Anticipated Ratings:1 |

|

Aa3 (stable) by Moody’s Investors Service, Inc. |

|

|

|

|

A+ (negative) by S&P Global Ratings |

|

|

|

|

AA- (stable) by Fitch Ratings |

|

|

| Trade Date: |

|

August 8, 2024 |

|

|

| Settlement Date: |

|

August 14, 2024 (T+4) |

|

|

| Securities Offered: |

|

5.050% First Mortgage Bonds, Series CCC, due 2034 (the “Bonds”) |

|

|

| Aggregate Principal Amount Offered: |

|

$600,000,000 |

|

|

| Interest Payment Dates: |

|

March 1 and September 1, commencing March 1, 2025 |

|

|

| Coupon: |

|

5.050% per annum, accruing from August 14, 2024 |

|

|

| Maturity: |

|

September 1, 2034 |

|

|

| Yield to Maturity: |

|

5.112% |

|

|

| Spread to Benchmark Treasury: |

|

+110 basis points |

|

|

| Benchmark Treasury: |

|

4.375% due May 15, 2034 |

|

|

| Benchmark Treasury Yield: |

|

4.012% |

|

|

| Optional Redemption Provision: |

|

At the Company’s option, prior to June 1, 2034 (the “Par Call Date”), make-whole call at Treasury Rate (as defined in the Preliminary Prospectus Supplement) +20 basis points. At the Company’s option, on and

after the Par Call Date, at 100% of the principal amount. See the Preliminary Prospectus Supplement for the definition of “Treasury Rate” and for further terms and provisions applicable to optional

redemption. |

| 1 |

Note: A securities rating is not a recommendation to buy, sell or hold securities and is subject to revision or

withdrawal at any time. |

|

|

|

|

|

| Price to Public: |

|

99.514%, plus accrued interest, if any |

|

|

| CUSIP: |

|

842434 DB5 |

|

|

| ISIN: |

|

US842434DB54 |

|

|

| Total Net Proceeds: |

|

Approximately $593.2 million, after deducting the underwriting discount but before deducting the Company’s estimated offering expenses. |

|

|

| Joint Book-Running Managers: |

|

Credit Agricole Securities (USA) Inc. |

|

|

MUFG Securities Americas Inc. |

|

|

RBC Capital Markets, LLC |

|

|

Truist Securities, Inc. |

|

|

Loop Capital Markets LLC |

|

|

| Co-Managers: |

|

AmeriVet Securities, Inc. |

|

|

MFR Securities, Inc. |

The issuer has filed a registration statement (including a prospectus) with the U.S. Securities and Exchange Commission

(“SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the

issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you

request it by calling Credit Agricole Securities (USA) Inc. toll-free at 1-866-807-6030, by calling MUFG Securities Americas Inc.

toll-free at 1-877-649-6848, by calling RBC Capital Markets, LLC toll-free at 1-866-375-6829 or by calling Truist Securities, Inc. toll-free at

1-800-685-4786.

Any

legends, disclaimers or other notices that may appear below are not applicable to this communication and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of this communication having

been sent via Bloomberg or another system.

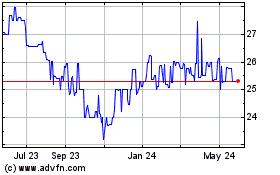

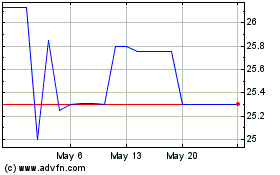

Southern California Gas (QB) (USOTC:SOCGP)

Historical Stock Chart

From Oct 2024 to Oct 2024

Southern California Gas (QB) (USOTC:SOCGP)

Historical Stock Chart

From Oct 2023 to Oct 2024