false000175419500017541952024-11-052024-11-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM 8-K

___________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November 5, 2024

___________________

TRULIEVE CANNABIS CORP.

(Exact Name of Registrant as specified in its charter)

___________________

| | | | | | | | |

| British Columbia | 000-56248 | 84-2231905 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

6749 Ben Bostic Road

Quincy, FL 32351

(Address of principal executive offices and zip code)

(850) 298-8866

(Registrant’s telephone number, including area code)

Not Applicable

(Registrant’s name or former address, if change since last report)

___________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| N/A | | N/A | | N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On November 5, 2024, Trulieve Cannabis Corp. (the “Company”) announced via press release its results for the three and nine months ended September 30, 2024. A copy of the Company’s press release is hereby furnished to the Commission and incorporated herein by reference as Exhibit 99.1.

Item 7.01 Regulation FD Disclosure.

The Company from time to time presents at various industry and other conferences and provides summary business information. A copy of the slide presentation that will be used by representatives of the Company in connection with such presentations (the “Corporate Presentation”) is attached to this Current Report on Form 8-K as Exhibit 99.2. The Corporate Presentation is current as of November 5, 2024, and the Company disclaims any obligation to correct or update this material in the future.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits

| | | | | | | | |

Exhibit No. | | Description |

| |

| 99.1* | | |

| |

| 99.2* | | |

| |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

*The information in the press release attached as Exhibit 99.1 and the corporate presentation attached as Exhibit 99.2 is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such filing.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Trulieve Cannabis Corp. |

| | |

| By: | /s/ Eric Powers |

| Name: | Eric Powers |

| Title: | Chief Legal Officer |

Date: November 5, 2024

Exhibit 99.1

Trulieve Reports Third Quarter 2024 Results

Ahead of Florida Adult-Use Vote

| | |

•Third quarter revenue of $284 million, up 3% year over year, in line with guidance |

•Gross margin of 61%, compared to 52% during the third quarter of 2023 |

•Year to date cash flow from operations of $241 million and free cash flow of $162 million* |

•Florida adult-use campaign support of $48 million during the third quarter |

Tallahassee, FL – November 5, 2024 – Trulieve Cannabis Corp. (CSE: TRUL) (OTCQX: TCNNF) (“Trulieve” or “the Company”), a leading and top-performing cannabis company in the U.S., today announced its results for the quarter ended September 30, 2024. Results are reported in U.S. dollars and in accordance with U.S. Generally Accepted Accounting Principles unless otherwise indicated. Numbers may not sum perfectly due to rounding.

Q3 2024 Financial and Operational Highlights*

•Revenue of $284 million increased 3% year over year, with 95% of revenue from retail sales.

•Achieved gross margin of 61%, with GAAP gross profit of $173 million.

•Reported net loss attributable to common shareholders of $60 million. Adjusted net loss of $12 million* excludes $48 million in campaign support and other non-recurring charges, asset impairments, disposals and discontinued operations.

•Achieved adjusted EBITDA of $96 million*, or 34% of revenue, up 24% year over year.

•Generated cash flow from operations of $30 million and free cash flow of $(7) million*, both of which were impacted by $48 million in campaign support.

•Cash and short term investments at quarter end totaled $319 million.

•Launched adult use sales at three Ohio locations: Beavercreek, Columbus, and Westerville.

•Rolled out #YesOn3 product line to support Smart and Safe Florida adult-use campaign.

•Entered partnership with Professional Pickleball Association and Major League Pickleball to sponsor events in Arizona, Florida, and Georgia.

•Opened 15 new dispensaries in Florida and Pennsylvania.

•Ended the quarter with 30% of retail locations outside of the state of Florida.

*See “Non-GAAP Financial Measures” below for additional information and a reconciliation to GAAP for all Non-GAAP metrics.

Recent Developments

•Opened five new retail locations in Bonita Springs, Hallandale, Lake Placid, Orlando, and St. Augustine, Florida.

•Currently operate 220 retail dispensaries and over four million square feet of cultivation and processing capacity in the United States.

Management Commentary

“As voters in Florida cast their ballots across the state today, there is an opportunity to make history by approving cannabis legalization for personal use,” said Kim Rivers, Trulieve CEO. “With 156 stores in Florida, scaled production capacity, and sufficient capital to support further investment, if approved, Trulieve is best positioned to fully prepare for the launch of recreational sales next Spring.”

Financial Highlights*

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Results of Operations | For the Three Months Ended | For the Nine Months Ended |

| (Figures in millions except per share data) | September 30, 2024 | September 30, 2023 | | % Better / (Worse) | June 30, 2024 | % Better / (Worse) | September 30, 2024 | September 30, 2023 | % Better / (Worse) |

| Revenue | $ | 284 | $ | 275 | | 3% | $ | 303 | (6%) | $ | 885 | $ | 842 | 5% |

| Gross profit | $ | 173 | $ | 143 | | 21% | $ | 182 | (5%) | $ | 529 | $ | 435 | 22% |

| Gross margin % | | 61% | | 52% | | | | 60% | | | 60% | | 52% | |

| Operating expenses | $ | 173 | $ | 120 | | (44%) | $ | 132 | (31%) | $ | 432 | $ | 686 | 37% |

| Operating expenses % | | 61% | | 43% | | | | 43% | | | 49% | | 81% | |

| Net loss** | $ | (60) | $ | (25) | | (137%) | $ | (12) | NMF | $ | (95) | $ | (493) | 81% |

| Net loss continuing operations | $ | (60) | $ | (23) | | (163%) | $ | (11) | NMF | $ | (94) | $ | (399) | 76% |

| Adjusted net (loss) income | $ | (12) | $ | (15) | | 19% | $ | 0 | NMF | $ | (22) | $ | (47) | 53% |

| Basic and diluted shares outstanding | | 190 | | 189 | | | | 190 | | | 190 | | 189 | |

| EPS continuing operations | $ | (0.32) | $ | (0.12) | | (168%) | $ | (0.04) | NMF | $ | (0.52) | $ | (2.09) | 75% |

| Adjusted EPS | $ | (0.06) | $ | (0.08) | | 20% | $ | 0.00 | NMF | $ | (0.12) | $ | (0.25) | 54% |

| Adjusted EBITDA | $ | 96 | $ | 78 | | 24% | $ | 107 | (10%) | $ | 309 | $ | 235 | 32% |

| Adjusted EBITDA Margin % | | 34% | | 28% | | | | 35% | | | 35% | | 28% | |

NMF - No Meaningful Figure

*See “Non-GAAP Financial Measures” below for additional information and a reconciliation to GAAP for all Non-GAAP metrics.

**Net loss attributable to common shareholders which excludes non-controlling interest.

Conference Call

The Company will host a conference call and live audio webcast on November 5, 2024, at 8:30 A.M. Eastern time, to discuss its third quarter 2024 financial results. Interested parties can join the conference call by dialing in as directed below. Please dial in 15 minutes prior to the call.

| | | | | | | | |

| North American toll free: 1-844-824-3830 | | Passcode: 3735709 |

| | |

| International: 1-412-542-4136 | | Passcode: 3735709 |

A live audio webcast of the conference call will be available at:

Trulieve Cannabis Corp Q3 2024 Earnings

A powerpoint presentation and archived replay of the webcast will be available at:

https://investors.trulieve.com/events

The Company’s Form 10-Q for the quarter ended September 30, 2024, will be available on the SEC’s website or at https://investors.trulieve.com/quarterly-results. The Company’s Management Discussion and Analysis for the period and the accompanying financial statements and notes will be available under the Company’s profile on https://www.sedarplus.ca/landingpage/ and on its website at https://investors.trulieve.com/quarterly-results. This news release is not in any way a substitute for reading those financial statements, including the notes to the financial statements.

Trulieve Cannabis Corp.

Condensed Consolidated Balance Sheets (Unaudited)

(in millions, except for share data)

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

| ASSETS | | | |

| Current Assets: | | | |

| Cash and cash equivalents | $ | 237.7 | | | $ | 201.4 | |

| Short-term investments | 80.2 | | | — | |

| Restricted cash | 0.9 | | | 6.6 | |

| Accounts receivable, net | 9.0 | | | 6.7 | |

| Inventories | 220.9 | | | 213.1 | |

| Income tax receivable | 5.8 | | | — | |

| Prepaid expenses | 19.2 | | | 17.6 | |

| Other current assets | 26.6 | | | 23.7 | |

| Notes receivable - current portion, net | 1.8 | | | 6.2 | |

| Assets associated with discontinued operations | 0.9 | | | 2.0 | |

| Total current assets | 603.0 | | | 477.3 | |

| Property and equipment, net | 701.6 | | | 676.4 | |

| Right of use assets - operating, net | 116.1 | | | 95.9 | |

| Right of use assets - finance, net | 65.6 | | | 58.5 | |

| Intangible assets, net | 873.3 | | | 917.2 | |

| Goodwill | 483.9 | | | 483.9 | |

| Notes receivable, net | 5.8 | | | 7.4 | |

| Other assets | 23.0 | | | 10.4 | |

| Long-term assets associated with discontinued operations | 2.0 | | | 2.0 | |

| TOTAL ASSETS | $ | 2,874.2 | | | $ | 2,729.1 | |

| LIABILITIES | | | |

| Current Liabilities: | | | |

| Accounts payable and accrued liabilities | $ | 96.1 | | | $ | 83.2 | |

| | | |

| Deferred revenue | 6.7 | | | 1.3 | |

| Notes payable - current portion | 3.3 | | | 3.8 | |

| | | |

| Operating lease liabilities - current portion | 11.6 | | | 10.1 | |

| Finance lease liabilities - current portion | 9.1 | | | 7.6 | |

| Construction finance liabilities - current portion | 1.8 | | | 1.5 | |

| Contingencies | 4.6 | | | 4.4 | |

| Liabilities associated with discontinued operations | 3.5 | | | 3.0 | |

| Total current liabilities | 136.7 | | | 114.8 | |

| Long-Term Liabilities: | | | |

| Private placement notes, net | 364.4 | | | 363.2 | |

| Notes payable, net | 112.8 | | | 115.9 | |

| | | |

| Operating lease liabilities | 113.4 | | | 92.2 | |

| Finance lease liabilities | 68.4 | | | 61.7 | |

| Construction finance liabilities | 135.9 | | | 136.7 | |

| Deferred tax liabilities | 204.2 | | | 207.0 | |

| Uncertain tax position liabilities | 384.1 | | | 180.4 | |

| Other long-term liabilities | 6.5 | | | 7.1 | |

| Long-term liabilities associated with discontinued operations | 39.4 | | | 41.6 | |

| TOTAL LIABILITIES | $ | 1,565.8 | | | $ | 1,320.4 | |

| MEZZANINE EQUITY | | | |

| Redeemable non-controlling interest | $ | 7.1 | | | $ | — | |

| SHAREHOLDERS’ EQUITY | | | |

Common stock, no par value; unlimited shares authorized. 189,154,228 and 186,235,818 shares issued and outstanding as of September 30,

2024 and December 31, 2023, respectively. | $ | — | | | $ | — | |

| Additional paid-in-capital | 2,048.0 | | | 2,055.1 | |

| Accumulated deficit | (736.0) | | | (640.6) | |

| Non-controlling interest | (10.7) | | | (5.9) | |

| TOTAL SHAREHOLDERS’ EQUITY | 1,301.3 | | | 1,408.6 | |

| TOTAL LIABILITIES, MEZZANINE EQUITY, AND SHAREHOLDERS' EQUITY | $ | 2,874.2 | | | $ | 2,729.1 | |

Trulieve Cannabis Corp.

Condensed Consolidated Statements of Operations (Unaudited)

(in millions, except for share data) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | $ | 284.3 | | | $ | 275.2 | | | $ | 885.3 | | | $ | 842.2 | |

| Cost of goods sold | 111.0 | | | 132.3 | | | 356.6 | | | 407.4 | |

| Gross profit | 173.3 | | | 142.9 | | | 528.7 | | | 434.8 | |

| Expenses: | | | | | | | |

| Sales and marketing | 66.7 | | | 59.4 | | | 191.0 | | | 181.2 | |

| General and administrative | 81.9 | | | 34.5 | | | 161.5 | | | 108.7 | |

| Depreciation and amortization | 28.3 | | | 27.0 | | | 84.2 | | | 82.6 | |

| Impairment and disposal of long-lived assets, net of (recoveries) | (4.3) | | | (1.2) | | | (4.4) | | | 5.5 | |

| Impairment of goodwill | — | | | — | | | — | | | 307.6 | |

| Total expenses | 172.7 | | | 119.6 | | | 432.3 | | | 685.6 | |

| Income (loss) from operations | 0.6 | | | 23.3 | | | 96.5 | | | (250.8) | |

| Other income (expense): | | | | | | | |

| Interest expense, net | (17.5) | | | (20.8) | | | (47.6) | | | (60.9) | |

| Interest income | 4.2 | | | 1.9 | | | 11.5 | | | 4.3 | |

| Gain on debt extinguishment | — | | | 8.2 | | | — | | | 8.2 | |

| Other (expense) income, net | (0.2) | | | 1.1 | | | (4.8) | | | 5.9 | |

| Total other expense, net | (13.5) | | | (9.6) | | | (40.9) | | | (42.6) | |

| (Loss) income before provision for income taxes | (12.8) | | | 13.7 | | | 55.6 | | | (293.4) | |

| Provision for income taxes | 47.4 | | | 36.6 | | | 150.0 | | | 105.9 | |

| Net loss from continuing operations | (60.2) | | | (22.9) | | | (94.4) | | | (399.3) | |

Net loss from discontinued operations, net of tax benefit (provision) of zero, zero, zero, and $(0.6), respectively | (1.6) | | | (2.9) | | | (4.6) | | | (99.1) | |

| Net loss | (61.9) | | | (25.8) | | | (99.0) | | | (498.3) | |

| Less: net loss attributable to non-controlling interest from continuing operations | (1.4) | | | (0.5) | | | (2.8) | | | (3.8) | |

| Less: net loss attributable to redeemable non-controlling interest from continuing operations | (0.3) | | | — | | | (0.9) | | | — | |

| Less: net loss attributable to non-controlling interest from discontinued operations | — | | | — | | | — | | | (1.2) | |

| Net loss attributable to common shareholders | $ | (60.2) | | | $ | (25.4) | | | $ | (95.3) | | | $ | (493.4) | |

| | | | | | | |

| Earnings Per Share (see numerator reconciliation below) | | | | | | | |

| Net loss per share - Continuing operations: | | | | | | | |

| Basic and diluted | $ | (0.32) | | | $ | (0.12) | | | $ | (0.52) | | | $ | (2.09) | |

| Net loss per share - Discontinued operations: | | | | | | | |

| Basic and diluted | $ | (0.01) | | | $ | (0.02) | | | $ | (0.02) | | | $ | (0.52) | |

| Weighted average number of common shares used in computing net loss per share: | | | | | | | |

| Basic and diluted | 190.2 | | 188.9 | | 190.0 | | 189.0 |

| | | | | | | |

| EPS Numerator Reconciliation | | | | | | | |

| Net loss attributable to common shareholders (from above) | $ | (60.2) | | | $ | (25.4) | | | $ | (95.3) | | | $ | (493.4) | |

| Net loss from discontinued operations, net of tax, attributable to common shareholders | 1.6 | | | 2.9 | | | 4.6 | | | 97.9 | |

| Adjustment of redeemable non-controlling interest to maximum redemption value | (2.1) | | | — | | | (9.0) | | | — | |

| Net loss from continuing operations available to common shareholders | $ | (60.6) | | | $ | (22.5) | | | $ | (99.7) | | | $ | (395.5) | |

Trulieve Cannabis Corp.

Condensed Consolidated Statements of Cash Flows (Unaudited)

(in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cash flows from operating activities | | | | | | | |

| Net loss | $ | (61.9) | | | $ | (25.8) | | | $ | (99.0) | | | $ | (498.3) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | | | | | |

| Depreciation and amortization | 28.3 | | | 27.0 | | | 84.2 | | | 83.6 | |

| Depreciation included in cost of goods sold | 13.3 | | | 14.5 | | | 40.1 | | | 45.4 | |

| Gain on debt extinguishment | — | | | (8.2) | | | — | | | (8.2) | |

| Impairment and disposal of long-lived assets, net of (recoveries) | (4.3) | | | (1.2) | | | (4.4) | | | 5.5 | |

| Impairment of goodwill | — | | | — | | | — | | | 307.6 | |

| Amortization of operating lease right of use assets | 3.0 | | | 2.5 | | | 8.3 | | | 7.8 | |

| Share-based compensation | 5.5 | | | 4.5 | | | 15.6 | | | 7.4 | |

| Allowance for credit losses | 0.5 | | | 0.5 | | | 4.9 | | | 0.9 | |

| Deferred income taxes | (6.2) | | | (6.5) | | | (2.7) | | | (18.7) | |

| Loss from disposal of discontinued operations | — | | | 0.6 | | | — | | | 69.8 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other non-cash changes | (0.3) | | | 1.7 | | | 0.9 | | | 5.0 | |

| Changes in operating assets and liabilities: | | | | | | | |

| Inventories | (13.3) | | | 26.2 | | | (8.3) | | | 66.5 | |

| Accounts receivable | (1.5) | | | (1.2) | | | (0.7) | | | (1.9) | |

| Prepaid expenses and other current assets | 4.9 | | | 4.3 | | | (0.9) | | | 9.3 | |

| Other assets | (1.1) | | | 0.3 | | | (6.1) | | | 2.0 | |

| Accounts payable and accrued liabilities | 4.9 | | | 8.9 | | | 4.6 | | | 4.5 | |

| Income tax receivable / payable | 0.5 | | | (0.1) | | | (4.3) | | | (49.9) | |

| Other liabilities | — | | | 0.9 | | | 0.2 | | | (14.4) | |

| Operating lease liabilities | (1.6) | | | (2.1) | | | (6.0) | | | (6.9) | |

| Deferred revenue | 2.3 | | | (2.2) | | | 5.3 | | | (6.0) | |

| Uncertain tax position liabilities | 51.0 | | | 50.7 | | | 203.8 | | | 61.8 | |

| Other long-term liabilities | 1.8 | | | (1.8) | | | (0.7) | | | (2.6) | |

| Proceeds received from insurance for operating expenses | 4.4 | | | — | | | 5.9 | | | — | |

| Net cash provided by operating activities | 30.3 | | | 93.4 | | | 240.8 | | | 70.4 | |

| Cash flows from investing activities | | | | | | | |

| Purchases of property and equipment | (36.9) | | | (6.3) | | | (79.0) | | | (31.0) | |

| | | | | | | |

| Capitalized interest | (1.2) | | | 0.9 | | | (0.9) | | | 0.1 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Purchases of internal use software | (6.8) | | | (3.4) | | | (18.3) | | | (7.7) | |

| Purchases of short-term investments | (80.0) | | | — | | | (80.0) | | | — | |

| Cash paid for licenses | (6.5) | | | — | | | (7.0) | | | (4.0) | |

| Payment for initial direct costs on finance leases | (0.6) | | | — | | | (0.6) | | | — | |

| Proceeds from disposal activities | 0.3 | | | 3.5 | | | 1.0 | | | 11.7 | |

| Proceeds from notes receivable repayments | 0.3 | | | 0.2 | | | 0.9 | | | 0.6 | |

| | | | | | | |

| Proceeds received from insurance recoveries on property and equipment | — | | | — | | | 0.5 | | | — | |

| | | | | | | |

| Net cash used in investing activities | (131.5) | | | (5.0) | | | (183.4) | | | (30.3) | |

| Cash flows from financing activities | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Payments for taxes related to net share settlement of equity awards | (12.2) | | | — | | | (12.3) | | | — | |

| Payments on finance lease obligations | (1.9) | | | (1.8) | | | (5.5) | | | (5.7) | |

| Payments on notes payable | (1.4) | | | (0.7) | | | (3.8) | | | (5.5) | |

| Payments on construction finance liabilities | (0.9) | | | (0.7) | | | (2.5) | | | (1.3) | |

| Payments and costs related to consolidated VIE settlement transaction | — | | | — | | | (5.1) | | | — | |

| Distributions to subsidiary non-controlling interest | — | | | — | | | (1.1) | | | (0.1) | |

| Payments on private placement notes | — | | | (47.6) | | | — | | | (47.6) | |

| Payments for debt issuance costs | — | | | (0.4) | | | — | | | (0.4) | |

| Proceeds from non-controlling interest holders' subscription | — | | | — | | | 3.0 | | | — | |

| Proceeds from equity exercises | — | | | — | | | 0.2 | | | — | |

| | | | | | | |

| | | | | | | |

| Net cash used in financing activities | (16.4) | | | (51.3) | | | (27.1) | | | (60.6) | |

| Net (decrease) increase in cash, and cash equivalents | (117.5) | | | 37.2 | | | 30.3 | | | (20.5) | |

| Cash, cash equivalents, and restricted cash, beginning of period | 356.1 | | | 159.9 | | | 208.0 | | | 213.8 | |

| Cash and cash equivalents of discontinued operations, beginning of period | — | | | 1.8 | | | 0.3 | | | 5.7 | |

| Less: cash and cash equivalents of discontinued operations, end of period | — | | | (0.1) | | | — | | | (0.1) | |

| Cash, cash equivalents, and restricted cash, end of period | $ | 238.6 | | | $ | 198.9 | | | $ | 238.6 | | | $ | 198.9 | |

The consolidated statements of cash flows include continuing operations and discontinued operations for the periods presented.

Non-GAAP Financial Measures (Unaudited)

In addition to our results determined in accordance with GAAP, we supplement our results with non-GAAP financial measures, including EBITDA, adjusted EBITDA, adjusted EBITDA margin %, adjusted net (loss) income, adjusted net (loss) income per diluted share, and free cash flow. The Company calculates EBITDA as net income (loss) before net interest expense, income tax expense, depreciation and amortization; adjusted EBITDA as net income (loss) before net interest expense, interest income, income tax expense, depreciation and amortization and also excludes certain extraordinary items; adjusted EBITDA margin as adjusted EBITDA as % of revenue, adjusted net (loss) income as net income (loss) less certain extraordinary items; adjusted EPS as adjusted net (loss) income divided by basic and diluted shares outstanding; and free cash flow as cash flow from operations less capital expenditures. Our management uses these non-GAAP financial measures in conjunction with GAAP financial measures to evaluate our operating results and financial performance. We believe these measures are useful to investors as they are widely used measures of performance and can facilitate comparison to other companies. These non-GAAP financial measures are not, and should not be considered as, measures of liquidity. These non-GAAP financial measures have limitations as analytical tools in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP. Because of these limitations, these non-GAAP financial measures should be considered along with GAAP financial performance measures. The presentation of these non-GAAP financial measures is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. Investors are encouraged to review the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures. A reconciliation of the non-GAAP financial measures to such GAAP measures can be found below. These non-GAAP financial measures should be considered supplemental to, and not a substitute for, our reported financial results prepared in accordance with GAAP.

Reconciliation of Non-GAAP EBITDA and Adjusted EBITDA (Unaudited)

The following table presents a reconciliation of GAAP net loss attributable to common shareholders to non-GAAP EBITDA and Adjusted EBITDA for each of the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(Amounts expressed in millions of United States dollars) | Three Months Ended | For the Nine Months Ended |

| September 30, 2024 | September 30, 2023 | June 30, 2024 | September 30, 2024 | September 30, 2023 |

| Net loss attributable to common shareholders | $ | (60.2) | $ | (25.4) | $ | (12.0) | $ | (95.3) | $ | (493.4) |

| Add (deduct) impact of: | | | | | | | | | | |

| Interest expense, net | $ | 17.5 | $ | 20.8 | $ | 15.4 | $ | 47.6 | $ | 60.9 |

| Interest income | $ | (4.2) | $ | (1.9) | $ | (4.0) | $ | (11.5) | $ | (4.3) |

| Provision for income taxes | $ | 47.4 | $ | 36.6 | $ | 47.2 | $ | 150.0 | $ | 105.9 |

| Depreciation and amortization | $ | 28.3 | $ | 27.0 | $ | 28.1 | $ | 84.2 | $ | 82.6 |

| Depreciation included in cost of goods sold | $ | 13.3 | $ | 14.6 | $ | 13.3 | $ | 40.1 | $ | 42.7 |

| EBITDA (Non-GAAP) | $ | 42.1 | $ | 71.8 | $ | 88.0 | $ | 215.0 | $ | (205.5) |

| EBITDA Margin (Non-GAAP) | | 15% | | 26% | | 29% | | 24% | | (24%) |

| | | | | | | | | | |

| Impairment of goodwill | $ | — | $ | — | $ | — | $ | — | $ | 307.6 |

| Impairment and disposal of long-lived assets, net of (recoveries) | $ | (4.3) | $ | (1.2) | $ | 1.2 | $ | (4.4) | $ | 5.5 |

| Legislative campaign contributions | $ | 48.4 | $ | 0.5 | $ | 5.0 | $ | 62.7 | $ | 19.6 |

| Acquisition, transaction, and other non-recurring costs | $ | 2.6 | $ | 8.5 | $ | 4.3 | $ | 10.6 | $ | 16.1 |

| Share-based compensation | $ | 5.5 | $ | 4.5 | $ | 5.0 | $ | 15.6 | $ | 7.4 |

| Gain on debt extinguishment | $ | — | $ | (8.2) | $ | — | $ | — | $ | (8.2) |

| Other (expense) income, net | $ | 0.2 | $ | (1.1) | $ | 1.8 | $ | 4.8 | $ | (5.9) |

| Discontinued operations, net of tax, attributable to common shareholders | $ | 1.6 | $ | 2.9 | $ | 1.6 | $ | 4.6 | $ | 97.9 |

| Adjusted EBITDA (Non-GAAP) | $ | 96.1 | $ | 77.7 | $ | 107.0 | $ | 308.8 | $ | 234.5 |

| Adjusted EBITDA Margin (Non-GAAP) | | 34% | | 28% | | 35% | | 35% | | 28% |

Reconciliation of Non-GAAP Adjusted Net (Loss) Income (Unaudited)

The following table presents a reconciliation of GAAP net loss attributable to common shareholders to non-GAAP adjusted net (loss) income, for each of the periods presented: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | For the Nine Months Ended |

| (Amounts expressed in millions of United States dollars) | September 30, 2024 | September 30, 2023 | June 30, 2024 | September 30, 2024 | September 30, 2023 |

| Net loss attributable to common shareholders | $ | (60.2) | $ | (25.4) | $ | (12.0) | $ | (95.3) | $ | (493.4) |

| Net loss from discontinued operations, net of tax, attributable to common shareholders | $ | 1.6 | $ | 2.9 | $ | 1.6 | $ | 4.6 | $ | 97.9 |

| Adjustment of redeemable non-controlling interest to maximum redemption value | $ | (2.1) | $ | — | $ | 1.9 | $ | (9.0) | $ | — |

| Net loss from continuing operations available to common shareholders | $ | (60.6) | $ | (22.5) | $ | (8.5) | $ | (99.7) | $ | (395.5) |

| Add (deduct) impact of: | |

| Adjustment of redeemable non-controlling interest to maximum redemption value | $ | 2.1 | $ | — | $ | (1.9) | $ | 9.0 | $ | — |

| Impairment of goodwill | $ | — | $ | — | $ | — | $ | — | $ | 307.6 |

| Impairment and disposal of long-lived assets, net of (recoveries) | $ | (4.3) | $ | (1.2) | $ | 1.2 | $ | (4.4) | $ | 5.5 |

| Legislative campaign contributions | $ | 48.4 | $ | 0.5 | $ | 5.0 | $ | 62.7 | $ | 19.6 |

| Acquisition, transaction, and other non-recurring costs | $ | 2.6 | $ | 8.5 | $ | 4.3 | $ | 10.6 | $ | 16.1 |

| Fair value of derivative liabilities - warrants | $ | — | $ | — | $ | — | $ | — | $ | (0.3) |

| Adjusted net (loss) income (Non-GAAP) | $ | (11.9) | $ | (14.7) | $ | 0.2 | $ | (21.9) | $ | (47.0) |

Reconciliation of Non-GAAP Adjusted Net (Loss) Income Per Diluted Share (Unaudited)

The following table presents a reconciliation of GAAP net loss attributable to common shareholders per share to non-GAAP adjusted net (loss) income per diluted share, for each of the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended | For the Nine Months Ended |

| (Amounts expressed are per share except for shares which are in millions) | September 30, 2024 | September 30, 2023 | June 30, 2024 | September 30, 2024 | September 30, 2023 |

| Net loss attributable to common shareholders | $ | (0.32) | $ | (0.13) | $ | (0.06) | $ | (0.50) | $ | (2.61) |

| Net loss from discontinued operations, net of tax, attributable to common shareholders | $ | 0.01 | $ | 0.02 | $ | 0.01 | $ | 0.02 | $ | 0.52 |

| Adjustment of redeemable non-controlling interest to maximum redemption value | $ | (0.01) | $ | — | $ | 0.01 | $ | (0.05) | $ | — |

| Net loss from continuing operations available to common shareholders | $ | (0.32) | $ | (0.12) | $ | (0.04) | $ | (0.52) | $ | (2.09) |

| Add (deduct) impact of: | |

| Adjustment of redeemable non-controlling interest to maximum redemption value | $ | 0.01 | $ | — | $ | (0.01) | $ | 0.05 | $ | — |

| Impairment of goodwill | $ | — | $ | — | $ | — | $ | — | $ | 1.63 |

| Impairment and disposal of long-lived assets, net of (recoveries) | $ | (0.02) | $ | (0.01) | $ | 0.01 | $ | (0.02) | $ | 0.03 |

| Legislative campaign contributions | $ | 0.25 | $ | 0.00 | $ | 0.03 | $ | 0.33 | $ | 0.10 |

| Acquisition, transaction, and other non-recurring costs | $ | 0.01 | $ | 0.05 | $ | 0.02 | $ | 0.06 | $ | 0.09 |

| Fair value of derivative liabilities - warrants | $ | — | $ | — | $ | — | $ | — | $ | 0.00 |

| Adjusted net (loss) income (Non-GAAP) | $ | (0.06) | $ | (0.08) | $ | 0.00 | $ | (0.12) | $ | (0.25) |

| Basic and diluted shares outstanding | | 190.2 | | 188.9 | | 190.3 | | 190.0 | | 189.0 |

Reconciliation of Non-GAAP Free Cash Flow (Unaudited)

The following table presents a reconciliation of GAAP cash flow from operating activities to non-GAAP free cash flow, for each of the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | For the Nine Months Ended |

| (Amounts expressed in millions of United States dollars) | September 30, 2024 | September 30, 2023 | June 30, 2024 | September 30, 2024 | September 30, 2023 |

| Cash flow from operating activities | $ | 30.3 | $ | 93.4 | $ | 71.3 | $ | 240.8 | $ | 70.4 |

| Payments for property and equipment | $ | (36.9) | $ | (6.3) | $ | (26.5) | $ | (79.0) | $ | (31.0) |

| Free cash flow (Non-GAAP) | $ | (6.6) | $ | 87.2 | $ | 44.8 | $ | 161.8 | $ | 39.4 |

Forward-Looking Statements

This news release includes forward-looking information and statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements relate to the Company’s expectations or forecasts of business, operations, financial performance, cash flows, prospects, and other plans, intentions, expectations, estimates, and beliefs and include statements regarding the potential approval of cannabis legalization for personal use in Florida, the Company’s growth opportunities and the Company’s positioning for the future. Words such as “expects”, “continue”, “will”, “anticipates” and “intends” or similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on the Company’s current projections and expectations about future events and financial trends that management believes might affect its financial condition, results of operations, business strategy and financial needs, and on certain assumptions and analysis made by the Company in light of the experience and perception of historical trends, current conditions and expected future developments and other factors management believes are appropriate. Forward-looking information and statements involve and are subject to assumptions and known and unknown risks, uncertainties, and other factors which may cause actual events, results, performance, or achievements of the Company to be materially different from future events, results, performance, and achievements expressed or implied by forward-looking information and statements herein, including, without limitation, the risks discussed under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023 and in our periodic reports subsequently filed with the United Sates Securities and Exchange Commission and in the Company’s filings on https://www.sedarplus.ca/landingpage/. Although the Company believes that any forward-looking information and statements herein are reasonable, in light of the use of assumptions and the significant risks and uncertainties inherent in such information and statements, there can be no assurance that any such forward-looking information and statements will prove to be accurate, and accordingly readers are advised to rely on their own evaluation of such risks and uncertainties and should not place undue reliance upon such forward-looking information and statements. Any forward-looking information and statements herein are made as of the date hereof and, except as required by applicable laws, the Company assumes no obligation and disclaims any intention to update or revise any forward-looking information and statements herein or to update the reasons that actual events or results could or do differ from those projected in any forward looking information and statements herein, whether as a result of new information, future events or results, or otherwise.

About Trulieve

Trulieve is an industry leading, vertically integrated cannabis company and multi-state operator in the U.S., with leading market positions in Arizona, Florida, and Pennsylvania. Trulieve is poised for accelerated growth and expansion, building scale in retail and distribution in new and existing markets through its hub strategy. By providing innovative, high-quality products across its brand portfolio, Trulieve delivers optimal customer experiences and increases access to cannabis, helping patients and customers to live without limits. Trulieve is listed on the CSE under the symbol TRUL and trades on the OTCQX market under the symbol TCNNF. For more information, please visit Trulieve.com.

Facebook: @Trulieve

Instagram: @Trulieve_

X: @Trulieve

Investor Contact

Christine Hersey, Vice President of Investor Relations

+1 (424) 202-0210

Christine.Hersey@Trulieve.com

Media Contact

Phil Buck, APR, Corporate Communications Manager

+1 (406) 370-6226

Philip.Buck@Trulieve.com

Third Quarter 2024 Investor Presentation November 2024 CSE: TRUL OTCQX: TCNNF

www.trulieve.com 2 Forward Looking Statements and Industry Data Unless the context otherwise requires, the terms “Trulieve,” “we,” “us” and “our” in this presentation refer to Trulieve Cannabis Corp. and its subsidiaries. Certain statements in this presentation constitute forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and applicable Canadian securities legislation (collectively herein referred to as “forward-looking statements”), which can often be identified by words such as “will”, “may”, “estimate”, “expect”, “plan”, “project”, “intend”, “anticipate” and other words indicating that the statements are forward-looking. These forward-looking statements relate to Trulieve’s expectations or forecasts of business, operations, financial performance, prospects, and other plans, intentions, expectations, estimates, and beliefs and include statements regarding Trulieve’s 2024 objectives, financial targets, and its plans for potential acquisitions and expansion of the Company’s operations. Such forward-looking statements are expectations only and are subject to known and unknown risks, uncertainties and other important factors, including, but not limited to, risk factors included in this presentation, that could cause the Company’s actual results, performance or achievements or industry results to differ materially from any future results, performance or achievements implied by such forward-looking statements. Such risks and uncertainties include, among others, dependence on obtaining and maintaining regulatory approvals, including acquiring and renewing state, local or other licenses; engaging in activities which currently are illegal under United States federal law and the uncertainty of existing protection from United States federal or other prosecution; regulatory or political change such as changes in applicable laws and regulations, including United States state-law legalization, particularly in Florida, due to inconsistent public opinion, perception of the medical-use and adult-use cannabis industry, bureaucratic delays or inefficiencies or any other reasons; uncertainty regarding our tax liability and refunds under Section 280E of the US tax code; any other factors or developments which may hinder market growth; reliance on management; and the effect of capital market conditions and other factors on capital availability; competition, including from more established or better financed competitors; and the need to secure and maintain corporate alliances and partnerships, including with customers and suppliers. Additional factors that could cause results to differ materially from those described in the forward-looking statements can be found in the company’s filings with the Securities and Exchange Commission (“SEC”), including the company’s most recent Annual Report on Form 10-K and subsequent SEC filings. These factors should be considered carefully, and readers are cautioned not to place undue reliance on such forward-looking statements. You are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Although it may voluntarily do so from time to time, the Company undertakes no commitment to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Unless otherwise noted, the forecasted industry and market data contained herein are based upon management estimates and industry and market publications and surveys. The information from industry and market publications has been obtained from sources believed to be reliable, but there can be no assurance as to the accuracy or completeness of the included information. The Company has not independently verified any of the data from third-party sources, nor has the Company ascertained the underlying economic assumptions relied upon therein. While such information is believed to be reliable for the purposes used herein, the Company makes no representation or warranty with respect to the accuracy of such information. PLEASE NOTE: MARIJUANA IS ILLEGAL UNDER U.S. FEDERAL LAW, INCLUDING ITS CONSUMPTION, POSSESSION, CULTIVATION, DISTRIBUTION, MANUFACTURING, DISPENSING, AND POSSESSION WITH INTENT TO DISTRIBUTE. Forward-looking statements made in this document are made only as of the date of their initial publication, and the Company undertakes no obligation to publicly update any of these forward-looking statements as actual events unfold.

www.trulieve.com 3 Management’s Use of Non-GAAP Financial Measures In addition to our results determined in accordance with GAAP, we supplement our results with non-GAAP financial measures, including adjusted net income (loss), adjusted gross profit, adjusted gross profit margin, adjusted SG&A, adjusted SG&A as % revenue, adjusted earnings per share, EBITDA, adjusted EBITDA, adjusted EBITDA margin %, and free cash flow. The Company calculates EBITDA as net income (loss) before net interest expense, income tax expense, depreciation and amortization; adjusted EBITDA as net income (loss) before net interest expense, income tax expense, depreciation and amortization and also excludes certain extraordinary items; adjusted EBITDA margin as adjusted EBITDA as % of revenue; adjusted net income (loss) as net income (loss) less certain extraordinary items; adjusted gross profit as gross profit less extraordinary expenses; adjusted gross margin as adjusted gross profit as % of revenue; adjusted SG&A as SG&A less extraordinary expenses; and free cash flow as cash flow from operations less capital expenditures. Our management uses these non-GAAP financial measures in conjunction with GAAP financial measures to evaluate our operating results and financial performance. We believe these measures are useful to investors as they are widely used measures of performance and can facilitate comparison to other companies. These non-GAAP financial measures are not and should not be considered as measures of liquidity. These non-GAAP financial measures have limitations as analytical tools in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP. Because of these limitations, these non-GAAP financial measures should be considered along with GAAP financial performance measures. The presentation of these non-GAAP financial measures is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. Investors are encouraged to review the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures. A reconciliation of the non-GAAP financial measures to such GAAP measures can be found at the end of this presentation on the slides captioned “Reconciliation of Non-GAAP Financial Measures. These non-GAAP financial measures should be considered supplemental to, and not a substitute for, our reported financial results prepared in accordance with GAAP.

www.trulieve.com 4 Agenda • Third Quarter 2024 Financial and Operational Highlights • Retail Highlights • Recent Developments • Tax Position • 2024 Objectives • Financial Targets • Financial Highlights

www.trulieve.com 5 Third Quarter 2024 Financial and Operational Highlights* • Revenue $284 million, increased 3% year over year, with 95% of revenue from retail sales • GAAP gross profit of $173 million and 61% gross margin • Net loss attributable to common shareholders of $60 million • Adjusted net loss of $12 million excludes $48 million in campaign support and other non-recurring charges, asset impairments, disposals and discontinued operations • Adjusted EBITDA of $96 million or 34% of revenue, up 24% year over year • Cash flow from operations of $30 million and free cash flow of $(7) million • Cash and short-term investments as of September 30, 2024 totaled $319 million • Launched adult use sales in Ohio at three locations: Beavercreek, Columbus, and Westerville • Rolled out #YesOn3 product line to support Smart and Safe Florida adult use campaign • Entered partnership with Professional Pickleball Association and Major League Pickleball to sponsor events in Arizona, Florida, and Georgia • Opened 15 new dispensaries in Florida and Pennsylvania * Adjusted net loss, adjusted EBITDA and free cash flow are non-GAAP financial measures. See slides 15-17 for reconciliation to GAAP for all non-GAAP financial measures. Numbers may not sum perfectly due to rounding.

www.trulieve.com 6 Retail Highlights • Retail revenue $269 million, up 2% compared to last year and down 7% sequentially • Traffic up 10% versus last year and 1% sequentially • Sold over 11.5 million branded products • Up 6% year over year and flat sequentially • Customer retention 65% companywide and 74% medical only • Exited quarter with 30% of retail locations outside of the state of Florida and 87% of dispensaries serving only medical patients

www.trulieve.com 7 Recent Developments • Partnered with Black Buddha Cannabis to launch premium products in Arizona and Pennsylvania • Opened five new retail locations in Bonita Springs, Hallandale, Lake Placid, Orlando, and St. Augustine, Florida • Currently operate 220 retail dispensaries and over 4 million square feet of cultivation and processing capacity in the United States

www.trulieve.com 8 Tax Position • In Q4 2023, Trulieve filed amended federal tax returns for 2019, 2020, and 2021 claiming $143 million of refunds and corresponding amended state returns claiming $31 million of refunds • Amended returns were supported by legal interpretations that challenge the tax liability under Section 280E of the Internal Revenue Code • Refund checks of approximately $115 million received to date of $174 million claimed • $62 million in Q4:23, $50 million in Q1:24 and $2 million in Q2:24 • Rejection notices for returns seeking $5.2 million of refunds • Trulieve continues to make tax payments as a customary U.S. taxpayer without tax payments associated with 280E of the tax code until final resolution is reached • While challenge is ongoing, taxes are swept into an uncertain tax position • Balance sheet includes amended return refund checks received, the amount of tax underpaid if 280E applied, and interest accrued • Balance sheet uncertain tax position liability was $384 million at September 30, 2024, with $352 million related to this tax challenge • Without the effect of 280E, year to date net income would have been positive Numbers may not sum perfectly due to rounding.

www.trulieve.com 9 Tax Position • Uncertain Tax Position • $384 million at September 30, 2024 • $32 million unrelated to the challenge of the applicability of 280E to Trulieve • $352 million related to the challenge of the applicability of 280E to Trulieve • Cash refunds total $115 million to date • $62 million cash refunds received in Q4:2023 • $50 million cash refunds received in Q1:2024 • $2 million cash refunds received in Q2:2024 • 280E tax liability accruals total $237 million • $49 million net Q3:2023 280E tax liability accrual • $40 million net Q4:2023 280E tax liability accrual • $46 million net Q1:2024 280E tax liability accrual • $53 million net Q2:2024 280E tax liability accrual • $49 million net Q3:2024 280E tax liability accrual Numbers may not sum perfectly due to rounding.

www.trulieve.com 10 2024 Objectives Deliver Exceptional Customer Experiences and Build Brand Loyalty • Provide superb service, expedient transactions, and frictionless returns • Innovate across product and consumer categories Expand Distribution of Branded Products Through Branded Retail Locations • Invest in cornerstone markets: Florida, Pennsylvania, and Arizona • Expand retail and wholesale distribution networks Maintain disciplined approach to cash generation and preservation Invest in infrastructure, technology, and talent to support long term growth • Prepare for potential growth catalysts • Invest for cannabis 2.0 future

Financials

www.trulieve.com 12 Financial Targets Financial Targets: • Anticipate fourth quarter revenue will be up low single digits compared to the third quarter • Anticipate gross margin will be comparable to year to date gross margin • 2024 cash flow from operations expected of at least $250 million • Q3:2024 cash flow from operations of $30 million • Cash interest payments on private placement notes are paid in June and December • 2024 capital expenditures expected to be approximately $130 million Financial Position as of September 30, 2024: • $319 million in cash and short-term investments • $481 million of debt at 7.9% interest

www.trulieve.com 13 Financial Highlights* *Adjusted gross profit, adjusted gross profit margin, adjusted SG&A, adjusted SG&A as % revenue, adjusted net (loss) income, adjusted net (loss) income per diluted share, adjusted EBITDA and adjusted EBITDA margin are Non-GAAP financial measures. See slides 15-17 for reconciliation to GAAP for all non-GAAP financial measures. **Includes discontinued operations. INCOME STATEMENT HIGHLIGHTS (USD millions, except per share data) Q3:24 Q2:24 Q1:24 Q4:23 Q3:23 Q2:23 Q1:23 Q4:22 Q3:22 Q2:22 Q1:22 2023 2022 Revenue 284.3 303.4 297.6 287.0 275.2 281.8 285.2 298.5 295.4 313.8 310.6 1,129.2 1,218.2 Gross profit 173.3 181.6 173.8 153.9 142.9 141.6 150.2 157.1 168.7 183.4 179.9 588.6 689.1 Gross margin 61.0 % 59.9 % 58.4 % 53.6 % 51.9 % 50.3 % 52.6 % 52.6 % 57.1 % 58.4 % 57.9 % 52.1 % 56.6 % Adjusted gross profit 173.4 181.6 173.8 153.9 143.1 143.4 150.2 161.1 172.5 183.2 184.6 590.6 701.4 Adjusted gross margin 61.0 % 59.9 % 58.4 % 53.6 % 52.0 % 50.9 % 52.7 % 54.0 % 58.4 % 58.4 % 59.5 % 52.3 % 57.6 % SG&A 148.6 102.6 101.3 96.3 93.9 96.0 100.0 122.8 111.9 107.5 104.9 386.2 447.0 SG&A as % revenue 52.3 % 33.8 % 34.0 % 33.6 % 34.1 % 34.1 % 35.1 % 41.1 % 37.9 % 34.2 % 33.8 % 34.2 % 36.7 % Adjusted SG&A 96.1 93.0 86.6 83.7 84.6 81.1 86.7 96.0 90.4 90.5 93.5 336.1 370.4 Adjusted SG&A as % revenue 33.8 % 30.6 % 29.1 % 29.2 % 30.7 % 28.8 % 30.4 % 32.2 % 30.6 % 28.8 % 30.1 % 29.8 % 30.4 % Depreciation and amortization 28.3 28.1 27.8 27.2 27.0 26.1 29.6 29.8 29.5 29.4 27.8 109.8 116.4 Net (loss) income** (60.2) (12.0) (23.1) (33.4) (25.4) (403.8) (64.1) (77.0) (114.6) (22.5) (32.0) (526.8) (246.1) Net (loss) income continuing operations (60.2) (10.7) (23.5) (36.6) (22.9) (342.1) (34.3) (64.2) (72.6) (18.7) (27.0) (435.9) (182.6) Adjusted net (loss) income (11.9) 0.2 (10.2) (22.8) (14.7) (14.6) (17.7) (34.0) 7.9 2.8 4.7 (69.8) (18.7) Net (loss) income per diluted share** (0.33) (0.05) (0.17) (0.18) (0.13) (2.14) (0.34) (0.41) (0.61) (0.12) (0.17) (2.79) (1.31) Net (loss) income continuing operations per diluted share** (0.32) (0.04) (0.16) (0.19) (0.12) (1.80) (0.18) (0.33) (0.38) (0.09) (0.14) (2.28) (0.95) Adjusted net (loss) income per diluted share** (0.06) 0.00 (0.05) (0.12) (0.08) (0.08) (0.09) (0.18) 0.04 0.01 0.03 (0.37) (0.10) Adjusted EBITDA 96.1 107.0 105.8 87.8 77.7 78.7 78.1 82.8 99.6 110.9 105.0 322.3 398.1 Adjusted EBITDA Margin 33.8 % 35.2 % 35.5 % 30.6 % 28.2 % 27.9 % 27.4 % 27.7 % 33.7 % 35.3 % 33.8 % 28.5 % 32.7 %

www.trulieve.com 14 Financial Highlights SHARE COUNT ESTIMATE (millions as of September 30, 2024 on as if converted basis) Subordinate Voting Shares 165.9 Multiple Voting Shares* 0.2 Total Shares Outstanding 189.2 *converted at 100 subordinate shares per 1 multiple voting share Employee Stock Options/RSUs 3.4 excludes 1.49 million unexercisable options excludes 4.64 million nonvested RSUs Pro Forma Estimated Shares 192.6

www.trulieve.com 15 Reconciliation of Non-GAAP Financial Measures EBITDA and Adjusted EBITDA Net loss attributable to common shareholders $ (60.2) $ (25.4) $ (12.0) $ (95.3) $ (493.4) Add (deduct) impact of: Interest expense, net $ 17.5 $ 20.8 $ 15.4 $ 47.6 $ 60.9 Interest income $ (4.2) $ (1.9) $ (4.0) $ (11.5) $ (4.3) Provision for income taxes $ 47.4 $ 36.6 $ 47.2 $ 150.0 $ 105.9 Depreciation and amortization $ 28.3 $ 27.0 $ 28.1 $ 84.2 $ 82.6 Depreciation included in cost of goods sold $ 13.3 $ 14.6 $ 13.3 $ 40.1 $ 42.7 EBITDA (Non-GAAP) $ 42.1 $ 71.8 $ 88.0 $ 215.0 $ (205.5) EBITDA Margin (Non-GAAP) 15% 26 % 29 % 24 % (24)% Impairment of goodwill $ — $ — $ — $ — $ 307.6 Impairment and disposal of long-lived assets, net of (recoveries) $ (4.3) $ (1.2) $ 1.2 $ (4.4) $ 5.5 Legislative campaign contributions $ 48.4 $ 0.5 $ 5.0 $ 62.7 $ 19.6 Acquisition, transaction, and other non-recurring costs $ 2.6 $ 8.5 $ 4.3 $ 10.6 $ 16.1 Share-based compensation $ 5.5 $ 4.5 $ 5.0 $ 15.6 $ 7.4 Gain on debt extinguishment $ — $ (8.2) $ — $ — $ (8.2) Other (expense) income, net $ 0.2 $ (1.1) $ 1.8 $ 4.8 $ (5.9) Discontinued operations, net of tax, attributable to common shareholders $ 1.6 $ 2.9 $ 1.6 $ 4.6 $ 97.9 Adjusted EBITDA (Non-GAAP) $ 96.1 $ 77.7 $ 107.0 $ 308.8 $ 234.5 Adjusted EBITDA Margin (Non-GAAP) 34 % 28 % 35 % 35 % 28 % For the Nine Months Ended September 30, 2023 September 30, 2024(Amounts expressed in millions of United States dollars; unaudited) September 30, 2024 September 30, 2023 June 30, 2024 For the Three Months Ended

www.trulieve.com 16 Reconciliation of Non-GAAP Financial Measures Adjusted Net (Loss) Income and Adjusted Net (Loss) Income Per Diluted Share Net loss attributable to common shareholders $ (60.2) $ (25.4) $ (12.0) $ (95.3) $ (493.4) Net loss from discontinued operations, net of tax, attributable to common shareholders $ 1.6 $ 2.9 $ 1.6 $ 4.6 $ 97.9 Adjustment of redeemable non-controlling interest to maximum redemption value $ (2.1) $ — $ 1.9 $ (9.0) $ — Net loss from continuing operations available to common shareholders $ (60.6) $ (22.5) $ (8.5) $ (99.7) $ (395.5) Add (deduct) impact of: Adjustment of redeemable non-controlling interest to maximum redemption value $ 2.1 $ — $ (1.9) $ 9.0 $ — Impairment of goodwill $ — $ — $ — $ — $ 307.6 Impairment and disposal of long-lived assets, net of (recoveries) $ (4.3) $ (1.2) $ 1.2 $ (4.4) $ 5.5 Legislative campaign contributions $ 48.4 $ 0.5 $ 5.0 $ 62.7 $ 19.6 Acquisition, transaction, and other non-recurring costs $ 2.6 $ 8.5 $ 4.3 $ 10.6 $ 16.1 Fair value of derivative liabilities - warrants $ — $ — $ — $ — $ (0.3) Adjusted net (loss) income (Non-GAAP) $ (11.9) $ (14.7) $ 0.2 $ (21.9) $ (47.0) Net loss attributable to common shareholders $ (0.32) $ (0.13) $ (0.06) $ (0.50) $ (2.61) Net loss from discontinued operations, net of tax, attributable to common shareholders $ 0.01 $ 0.02 $ 0.01 $ 0.02 $ 0.52 Adjustment of redeemable non-controlling interest to maximum redemption value $ (0.01) $ — $ 0.01 $ (0.05) $ — Net loss from continuing operations available to common shareholders $ (0.32) $ (0.12) $ (0.04) $ (0.52) $ (2.09) Add (deduct) impact of: Adjustment of redeemable non-controlling interest to maximum redemption value $ 0.01 $ — $ (0.01) $ 0.05 $ — Impairment of goodwill $ — $ — $ — $ — $ 1.63 Impairment and disposal of long-lived assets, net of (recoveries) $ (0.02) $ (0.01) $ 0.01 $ (0.02) $ 0.03 Legislative campaign contributions $ 0.25 $ 0.00 $ 0.03 $ 0.33 $ 0.10 Acquisition, transaction, and other non-recurring costs $ 0.01 $ 0.05 $ 0.02 $ 0.06 $ 0.09 Fair value of derivative liabilities - warrants $ — $ — $ — $ — $ (0.00) Adjusted net (loss) income per diluted share (Non-GAAP) $ (0.06) $ (0.08) $ 0.00 $ (0.12) $ (0.25) Basic and diluted shares outstanding 190.2 188.9 190.3 190.0 189.0 (Amounts expressed in millions of United States dollars; unaudited) September 30, 2024 September 30, 2023 June 30, 2024 For the Three Months Ended For the Nine Months Ended September 30, 2024 September 30, 2023 September 30, 2024 September 30, 2023 For the Nine Months Ended (Amounts expressed are per share except for shares which are in millions; unaudited) For the Three Months Ended September 30, 2023 June 30, 2024 September 30, 2024

www.trulieve.com 17 Reconciliation of Non-GAAP Financial Measures Free Cash Flow and Adjusted SG&A SG&A $ 148.6 $ 93.9 $ 102.6 $ 352.5 $ 289.9 Integration, transaction, and other non-recurring costs $ (52.5) $ (9.3) $ (9.6) $ (76.8) $ (37.5) Adjusted SG&A (Non-GAAP) $ 96.1 $ 84.6 $ 93.0 $ 275.7 $ 252.3 September 30, 2023 September 30, 2024 For the Nine Months EndedFor the Three Months Ended June 30, 2024 September 30, 2023 September 30, 2024(Amounts expressed in millions of United States dollars; unaudited) Cash flow from operating activities $ 30.3 $ 93.4 $ 71.3 $ 240.8 $ 70.4 Payments for property and equipment $ (36.9) $ (6.3) $ (26.5) $ (79.0) $ (31.0) Free cash flow (Non-GAAP) $ (6.6) $ 87.2 $ 44.8 $ 161.8 $ 39.4 (Amounts expressed in millions of United States dollars; unaudited) September 30, 2024 September 30, 2023 For the Nine Months Ended September 30, 2024 September 30, 2023 For the Three Months Ended June 30, 2024

www.trulieve.com 18 House of Brands Trulieve Brands VA LU E M ID P RE M IU M Partner Brands

THANK YOU CSE: TRUL OTCQX: TCNNF @Trulieve/@Trulieve_IR ir@trulieve.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

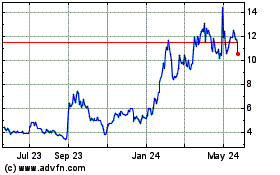

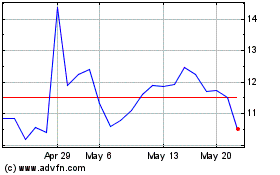

Trulieve Cannabis (QX) (USOTC:TCNNF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Trulieve Cannabis (QX) (USOTC:TCNNF)

Historical Stock Chart

From Feb 2024 to Feb 2025