0001754195December 312024Q3falseUnlimitedUnlimitedxbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:pure00017541952024-01-012024-09-300001754195tcnnf:SubordinateVotingSharesMember2024-10-310001754195tcnnf:MultipleVotingSharesMember2024-10-3100017541952024-09-3000017541952023-12-3100017541952023-01-012023-12-3100017541952024-07-012024-09-3000017541952023-07-012023-09-3000017541952023-01-012023-09-300001754195tcnnf:MultipleVotingSharesMember2024-06-300001754195tcnnf:SubordinateVotingSharesMember2024-06-300001754195us-gaap:CommonStockMember2024-06-300001754195us-gaap:AdditionalPaidInCapitalMember2024-06-300001754195us-gaap:RetainedEarningsMember2024-06-300001754195us-gaap:NoncontrollingInterestMember2024-06-3000017541952024-06-300001754195us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300001754195tcnnf:SubordinateVotingSharesMember2024-07-012024-09-300001754195us-gaap:CommonStockMember2024-07-012024-09-300001754195us-gaap:NoncontrollingInterestMember2024-07-012024-09-300001754195us-gaap:RetainedEarningsMember2024-07-012024-09-300001754195tcnnf:MultipleVotingSharesMember2024-09-300001754195tcnnf:SubordinateVotingSharesMember2024-09-300001754195us-gaap:CommonStockMember2024-09-300001754195us-gaap:AdditionalPaidInCapitalMember2024-09-300001754195us-gaap:RetainedEarningsMember2024-09-300001754195us-gaap:NoncontrollingInterestMember2024-09-300001754195tcnnf:MultipleVotingSharesMember2023-06-300001754195tcnnf:SubordinateVotingSharesMember2023-06-300001754195us-gaap:CommonStockMember2023-06-300001754195us-gaap:AdditionalPaidInCapitalMember2023-06-300001754195us-gaap:RetainedEarningsMember2023-06-300001754195us-gaap:NoncontrollingInterestMember2023-06-3000017541952023-06-300001754195us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001754195us-gaap:RetainedEarningsMember2023-07-012023-09-300001754195us-gaap:NoncontrollingInterestMember2023-07-012023-09-300001754195tcnnf:MultipleVotingSharesMember2023-09-300001754195tcnnf:SubordinateVotingSharesMember2023-09-300001754195us-gaap:CommonStockMember2023-09-300001754195us-gaap:AdditionalPaidInCapitalMember2023-09-300001754195us-gaap:RetainedEarningsMember2023-09-300001754195us-gaap:NoncontrollingInterestMember2023-09-3000017541952023-09-300001754195tcnnf:MultipleVotingSharesMember2023-12-310001754195tcnnf:SubordinateVotingSharesMember2023-12-310001754195us-gaap:CommonStockMember2023-12-310001754195us-gaap:AdditionalPaidInCapitalMember2023-12-310001754195us-gaap:RetainedEarningsMember2023-12-310001754195us-gaap:NoncontrollingInterestMember2023-12-310001754195us-gaap:AdditionalPaidInCapitalMember2024-01-012024-09-300001754195tcnnf:SubordinateVotingSharesMember2024-01-012024-09-300001754195us-gaap:CommonStockMember2024-01-012024-09-300001754195us-gaap:NoncontrollingInterestMember2024-01-012024-09-300001754195tcnnf:MultipleVotingSharesMember2024-01-012024-09-300001754195us-gaap:RetainedEarningsMember2024-01-012024-09-300001754195tcnnf:MultipleVotingSharesMember2022-12-310001754195tcnnf:SubordinateVotingSharesMember2022-12-310001754195us-gaap:CommonStockMember2022-12-310001754195us-gaap:AdditionalPaidInCapitalMember2022-12-310001754195us-gaap:RetainedEarningsMember2022-12-310001754195us-gaap:NoncontrollingInterestMember2022-12-3100017541952022-12-310001754195us-gaap:AdditionalPaidInCapitalMember2023-01-012023-09-300001754195us-gaap:NoncontrollingInterestMember2023-01-012023-09-300001754195us-gaap:RetainedEarningsMember2023-01-012023-09-300001754195tcnnf:CannabisPlantsMember2024-09-300001754195tcnnf:CannabisPlantsMember2023-12-310001754195tcnnf:PackagingAndSuppliesMember2024-09-300001754195tcnnf:PackagingAndSuppliesMember2023-12-310001754195tcnnf:UnmedicatedMember2024-09-300001754195tcnnf:UnmedicatedMember2023-12-310001754195tcnnf:MedicatedMember2024-09-300001754195tcnnf:MedicatedMember2023-12-310001754195us-gaap:OtherNonoperatingIncomeExpenseMember2024-07-012024-09-300001754195us-gaap:OtherNonoperatingIncomeExpenseMember2024-01-012024-09-300001754195us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2023-12-310001754195us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2024-01-012024-09-300001754195us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2024-09-300001754195us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2024-09-300001754195us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2024-09-300001754195us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2024-09-300001754195us-gaap:MoneyMarketFundsMember2024-09-300001754195us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2023-12-310001754195us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2023-12-310001754195us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2023-12-310001754195us-gaap:MoneyMarketFundsMember2023-12-310001754195us-gaap:FairValueInputsLevel1Memberus-gaap:CertificatesOfDepositMember2024-09-300001754195us-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMember2024-09-300001754195us-gaap:FairValueInputsLevel3Memberus-gaap:CertificatesOfDepositMember2024-09-300001754195us-gaap:CertificatesOfDepositMember2024-09-300001754195us-gaap:FairValueInputsLevel1Memberus-gaap:CertificatesOfDepositMember2023-12-310001754195us-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMember2023-12-310001754195us-gaap:FairValueInputsLevel3Memberus-gaap:CertificatesOfDepositMember2023-12-310001754195us-gaap:CertificatesOfDepositMember2023-12-310001754195us-gaap:FairValueInputsLevel1Member2024-09-300001754195us-gaap:FairValueInputsLevel2Member2024-09-300001754195us-gaap:FairValueInputsLevel3Member2024-09-300001754195us-gaap:FairValueInputsLevel1Member2023-12-310001754195us-gaap:FairValueInputsLevel2Member2023-12-310001754195us-gaap:FairValueInputsLevel3Member2023-12-310001754195us-gaap:FairValueInputsLevel1Memberus-gaap:InterestRateSwapMember2024-09-300001754195us-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMember2024-09-300001754195us-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateSwapMember2024-09-300001754195us-gaap:InterestRateSwapMember2024-09-300001754195us-gaap:FairValueInputsLevel1Memberus-gaap:InterestRateSwapMember2023-12-310001754195us-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMember2023-12-310001754195us-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateSwapMember2023-12-310001754195us-gaap:InterestRateSwapMember2023-12-310001754195us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2024-07-012024-09-300001754195us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2023-07-012023-09-300001754195us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2024-01-012024-09-300001754195us-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2023-01-012023-09-300001754195us-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMember2024-01-012024-09-300001754195us-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMember2024-07-012024-09-300001754195tcnnf:SubordinateVotingSharesMember2024-01-012024-03-310001754195tcnnf:ConsolidatedSubsidiaryMember2024-09-300001754195tcnnf:ConsolidatedSubsidiaryMember2023-12-310001754195us-gaap:RestrictedStockUnitsRSUMember2023-12-310001754195us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-09-300001754195us-gaap:RestrictedStockUnitsRSUMember2024-09-300001754195us-gaap:RestrictedStockUnitsRSUMember2021-09-012021-09-300001754195us-gaap:RestrictedStockUnitsRSUMember2024-09-012024-09-300001754195us-gaap:RetailMember2024-07-012024-09-300001754195us-gaap:RetailMember2023-07-012023-09-300001754195us-gaap:RetailMember2024-01-012024-09-300001754195us-gaap:RetailMember2023-01-012023-09-300001754195tcnnf:WholesaleMember2024-07-012024-09-300001754195tcnnf:WholesaleMember2023-07-012023-09-300001754195tcnnf:WholesaleMember2024-01-012024-09-300001754195tcnnf:WholesaleMember2023-01-012023-09-300001754195us-gaap:LicenseMember2024-07-012024-09-300001754195us-gaap:LicenseMember2023-07-012023-09-300001754195us-gaap:LicenseMember2024-01-012024-09-300001754195us-gaap:LicenseMember2023-01-012023-09-300001754195tcnnf:BusinessCombinationContingentConsiderationLiabilityCurrentMemberus-gaap:PendingLitigationMember2024-09-300001754195tcnnf:BusinessCombinationContingentConsiderationLiabilityCurrentMemberus-gaap:PendingLitigationMember2023-12-310001754195tcnnf:EightPercentageSeniorSecuredNotesTrancheOneMember2024-09-300001754195tcnnf:EightPercentageSeniorSecuredNotesTrancheOneMember2023-12-310001754195tcnnf:EightPercentageSeniorSecuredNotesTrancheTwoMember2024-09-300001754195tcnnf:EightPercentageSeniorSecuredNotesTrancheTwoMember2023-12-310001754195tcnnf:PromissoryNotesDatedDecemberTwentyOneTwoThousandTwentyTwoMemberus-gaap:MortgagesMember2024-09-300001754195tcnnf:PromissoryNotesDatedDecemberTwentyOneTwoThousandTwentyTwoMemberus-gaap:MortgagesMember2023-12-310001754195tcnnf:PromissoryNoteDatesDecemberTwentySecondTwoThousandTwentyThreeMemberus-gaap:MortgagesMember2024-09-300001754195tcnnf:PromissoryNoteDatesDecemberTwentySecondTwoThousandTwentyThreeMemberus-gaap:MortgagesMember2023-12-310001754195tcnnf:PromissoryNotesDatedDecemberTwentyTwoTwoThousandTwentyTwoOneMemberus-gaap:MortgagesMember2024-09-300001754195tcnnf:PromissoryNotesDatedDecemberTwentyTwoTwoThousandTwentyTwoOneMemberus-gaap:MortgagesMember2023-12-310001754195tcnnf:PromissoryNotesDatedOctoberOneTwoThousandTwentyOneMemberus-gaap:MortgagesMember2024-09-300001754195tcnnf:PromissoryNotesDatedOctoberOneTwoThousandTwentyOneMemberus-gaap:MortgagesMember2023-12-310001754195us-gaap:MortgagesMember2024-09-300001754195us-gaap:MortgagesMember2023-12-310001754195tcnnf:PromissoryNotesAcquiredInHarvestAcquisitionMembertcnnf:PromissoryNotesMember2024-09-300001754195tcnnf:PromissoryNotesAcquiredInHarvestAcquisitionMembertcnnf:PromissoryNotesMember2023-12-310001754195tcnnf:PromissoryNoteOfConsolidatedVariableInterestEntityDatedFebruaryOneTwoThousandTwentyTwoMembertcnnf:PromissoryNotesMember2024-09-300001754195tcnnf:PromissoryNoteOfConsolidatedVariableInterestEntityDatedFebruaryOneTwoThousandTwentyTwoMembertcnnf:PromissoryNotesMember2023-12-310001754195tcnnf:PromissoryNotesMember2024-09-300001754195tcnnf:PromissoryNotesMember2023-12-310001754195tcnnf:PromissoryNotesAcquiredInHarvestAcquisitionMembersrt:MinimumMember2024-09-300001754195tcnnf:PromissoryNotesAcquiredInHarvestAcquisitionMembersrt:MaximumMember2024-09-300001754195tcnnf:PromissoryNotesAcquiredInHarvestAcquisitionMembersrt:WeightedAverageMember2024-09-300001754195srt:MinimumMember2024-09-300001754195srt:MaximumMember2024-09-300001754195us-gaap:RestrictedStockUnitsRSUMembertcnnf:NotContractuallyIssuableUntilTheEarlierOfDecember12031Member2024-09-300001754195tcnnf:UnrecognizedTaxBenefitsInventoryCostsMember2024-06-300001754195tcnnf:UnrecognizedTaxBenefitsInventoryCostsMember2023-12-310001754195tcnnf:UnrecognizedTaxBenefitsInventoryCostsMember2024-07-012024-09-300001754195tcnnf:UnrecognizedTaxBenefitsInventoryCostsMember2024-01-012024-09-300001754195tcnnf:UnrecognizedTaxBenefitsInventoryCostsMember2024-09-300001754195tcnnf:UncertainTaxLiabilitiesMember2024-06-300001754195tcnnf:UncertainTaxLiabilitiesMember2023-12-310001754195tcnnf:UncertainTaxLiabilitiesMember2024-07-012024-09-300001754195tcnnf:UncertainTaxLiabilitiesMember2024-01-012024-09-300001754195tcnnf:UncertainTaxLiabilitiesMember2024-09-300001754195us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-09-300001754195us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310001754195us-gaap:RelatedPartyMember2024-07-012024-09-300001754195us-gaap:RelatedPartyMember2023-07-012023-09-300001754195us-gaap:RelatedPartyMember2024-01-012024-09-300001754195us-gaap:RelatedPartyMember2023-01-012023-09-300001754195srt:ManagementMember2024-09-300001754195srt:ManagementMember2023-12-310001754195us-gaap:DiscontinuedOperationsDisposedOfBySaleMembertcnnf:MassachusettsAndNevadaOperationsMember2024-07-012024-09-300001754195us-gaap:DiscontinuedOperationsDisposedOfBySaleMembertcnnf:MassachusettsAndNevadaOperationsMember2023-07-012023-09-300001754195us-gaap:DiscontinuedOperationsDisposedOfBySaleMembertcnnf:MassachusettsAndNevadaOperationsMember2024-01-012024-09-300001754195us-gaap:DiscontinuedOperationsDisposedOfBySaleMembertcnnf:MassachusettsAndNevadaOperationsMember2023-01-012023-09-300001754195stpr:MA2023-04-012023-06-300001754195us-gaap:SegmentDiscontinuedOperationsMember2024-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________________________________________

FORM 10-Q

_________________________________________________________

(Mark One)

| | | | | |

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2024

OR

| | | | | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-56248

_________________________________________________________

TRULIEVE CANNABIS CORP.

(Exact Name of Registrant as Specified in its Charter)

_________________________________________________________

| | | | | |

| British Columbia | 84-2231905 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer

Identification No.) |

6749 Ben Bostic Road

Quincy, FL 32351

(Address of principal executive offices and zip code)

(850) 298-8866

(Registrant’s telephone number, including area code)

_________________________________________________________

Securities registered pursuant to Section 12(b) of the Act: None

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange on which registered |

| N/A | | N/A | | N/A |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | x | Accelerated filer | o |

| | | | |

| Non-accelerated filer | o | Smaller reporting company | o |

| | | | |

| Emerging growth company | o | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of October 31, 2024, the registrant had 165,964,290 Subordinate Voting Shares and 23,226,386 Multiple Voting Shares (on an as converted basis) outstanding.

TRULIEVE CANNABIS CORP.

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of safe harbor provisions of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify these statements by forward-looking words such as “may”, “will”, “would”, “could”, “should”, “believes”, “estimates”, “projects”, “potential”, “expects”, “plans”, “intends”, “anticipates”, “targeted”, “continues”, “forecasts”, “designed”, “goal”, or the negative of those words or other similar or comparable words. Any statements contained in this Quarterly Report on Form 10-Q that are not statements of historical facts may be deemed to be forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition, results of operations and future growth prospects. The forward-looking statements contained herein are based on certain key expectations and assumptions, including, but not limited to, with respect to expectations and assumptions concerning receipt and/or maintenance of required licenses and third party consents and the success of our operations, are based on estimates prepared by us using data from publicly available governmental sources, as well as from market research and industry analysis, and on assumptions based on data and knowledge of this industry that we believe to be reasonable. These forward-looking statements are not guarantees of future performance or developments and involve known and unknown risks, uncertainties and other factors that are in some cases beyond our control. As a result, any or all of our forward-looking statements in this Quarterly Report on Form 10-Q may turn out to be inaccurate. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under “Risk Factors” and discussed elsewhere in this Quarterly Report on Form 10-Q and in “Part I, Item 1A – Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023. These forward-looking statements speak only as of the date of this Quarterly Report on Form 10-Q. Except as required by law, we assume no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future. You should, however, review the factors and risks we describe in the reports we will file from time to time with the SEC after the date of this Quarterly Report on Form 10-Q.

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements.

TRULIEVE CANNABIS CORP.

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(in thousands)

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

| ASSETS | | | |

| Current Assets: | | | |

| Cash and cash equivalents | $ | 237,666 | | | $ | 201,372 | |

| Short-term investments | 80,179 | | | — | |

| Restricted cash | 907 | | | 6,607 | |

| Accounts receivable, net | 9,031 | | | 6,703 | |

Inventories | 220,916 | | | 213,120 | |

| Income tax receivable | 5,844 | | | — | |

| Prepaid expenses | 19,154 | | | 17,620 | |

| Other current assets | 26,620 | | | 23,735 | |

| Notes receivable - current portion, net | 1,770 | | | 6,233 | |

| Assets associated with discontinued operations | 924 | | | 1,958 | |

| Total current assets | 603,011 | | | 477,348 | |

| Property and equipment, net | 701,613 | | | 676,352 | |

| Right of use assets - operating, net | 116,083 | | | 95,910 | |

| Right of use assets - finance, net | 65,550 | | | 58,537 | |

| Intangible assets, net | 873,317 | | | 917,191 | |

| Goodwill | 483,905 | | | 483,905 | |

| Notes receivable, net | 5,773 | | | 7,423 | |

| Other assets | 23,011 | | | 10,379 | |

| Long-term assets associated with discontinued operations | 1,980 | | | 2,010 | |

| TOTAL ASSETS | $ | 2,874,243 | | | $ | 2,729,055 | |

| LIABILITIES | | | |

| Current Liabilities: | | | |

| Accounts payable and accrued liabilities | $ | 96,051 | | | $ | 83,162 | |

| | | |

| Deferred revenue | 6,663 | | | 1,335 | |

| | | |

| Notes payable - current portion | 3,342 | | | 3,759 | |

| Operating lease liabilities - current portion | 11,614 | | | 10,068 | |

| Finance lease liabilities - current portion | 9,132 | | | 7,637 | |

| Construction finance liabilities - current portion | 1,801 | | | 1,466 | |

| Contingencies | 4,635 | | | 4,433 | |

| Liabilities associated with discontinued operations | 3,455 | | | 2,989 | |

| Total current liabilities | 136,693 | | | 114,849 | |

| Long-Term Liabilities: | | | |

| Private placement notes, net | 364,419 | | | 363,215 | |

| Notes payable, net | 112,757 | | | 115,855 | |

| Operating lease liabilities | 113,402 | | | 92,235 | |

| Finance lease liabilities | 68,384 | | | 61,676 | |

| Construction finance liabilities | 135,856 | | | 136,659 | |

| Deferred tax liabilities | 204,242 | | | 206,964 | |

| Uncertain tax position liabilities | 384,130 | | | 180,350 | |

| Other long-term liabilities | 6,511 | | | 7,086 | |

| Long-term liabilities associated with discontinued operations | 39,386 | | | 41,553 | |

| TOTAL LIABILITIES | $ | 1,565,780 | | | $ | 1,320,442 | |

Commitments and contingencies (see Note 3) | | | |

| MEZZANINE EQUITY | | | |

| Redeemable non-controlling interest | $ | 7,119 | | | $ | — | |

| SHAREHOLDERS' EQUITY | | | |

Common stock, no par value; unlimited shares authorized. 189,154,228 and 186,235,818 shares issued and outstanding as of September 30, 2024 and December 31, 2023, respectively. | $ | — | | | $ | — | |

| Additional paid-in-capital | 2,047,963 | | | 2,055,112 | |

| Accumulated deficit | (735,959) | | | (640,639) | |

| Non-controlling interest | (10,660) | | | (5,860) | |

| TOTAL SHAREHOLDERS' EQUITY | 1,301,344 | | | 1,408,613 | |

| TOTAL LIABILITIES, MEZZANINE EQUITY, AND SHAREHOLDERS' EQUITY | $ | 2,874,243 | | | $ | 2,729,055 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

TRULIEVE CANNABIS CORP.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(in thousands, except for share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

Revenue | $ | 284,284 | | | $ | 275,210 | | | $ | 885,345 | | | $ | 842,219 | |

| Cost of goods sold | 111,006 | | | 132,264 | | | 356,617 | | | 407,444 | |

| Gross profit | 173,278 | | | 142,946 | | | 528,728 | | | 434,775 | |

| Expenses: | | | | | | | |

| Sales and marketing | 66,727 | | | 59,398 | | | 191,016 | | | 181,206 | |

| General and administrative | 81,897 | | | 34,455 | | | 161,500 | | | 108,668 | |

| Depreciation and amortization | 28,332 | | | 26,958 | | | 84,163 | | | 82,624 | |

| Impairment and disposal of long-lived assets, net of (recoveries) | (4,296) | | | (1,209) | | | (4,423) | | | 5,480 | |

| Impairment of goodwill | — | | | — | | | — | | | 307,590 | |

| Total expenses | 172,660 | | | 119,602 | | | 432,256 | | | 685,568 | |

Income (loss) from operations | 618 | | | 23,344 | | | 96,472 | | | (250,793) | |

| Other income (expense): | | | | | | | |

Interest expense, net | (17,459) | | | (20,834) | | | (47,577) | | | (60,925) | |

| Interest income | 4,202 | | | 1,927 | | | 11,499 | | | 4,323 | |

| Gain on debt extinguishment | — | | | 8,161 | | | — | | | 8,161 | |

Other (expense) income, net | (198) | | | 1,126 | | | (4,778) | | | 5,875 | |

Total other expense, net | (13,455) | | | (9,620) | | | (40,856) | | | (42,566) | |

(Loss) income before provision for income taxes | (12,837) | | | 13,724 | | | 55,616 | | | (293,359) | |

Provision for income taxes | 47,383 | | | 36,640 | | | 150,018 | | | 105,933 | |

Net loss from continuing operations | (60,220) | | | (22,916) | | | (94,402) | | | (399,292) | |

Net loss from discontinued operations, net of tax benefit (provision) of zero, $5, zero, and $(625), respectively | (1,636) | | | (2,927) | | | (4,613) | | | (99,054) | |

Net loss | (61,856) | | | (25,843) | | | (99,015) | | | (498,346) | |

Less: net loss attributable to non-controlling interest from continuing operations | (1,384) | | | (451) | | | (2,779) | | | (3,788) | |

Less: net loss attributable to redeemable non-controlling interest from continuing operations | (259) | | | — | | | (916) | | | — | |

Less: net loss attributable to non-controlling interest from discontinued operations | — | | | — | | | — | | | (1,193) | |

Net loss attributable to common shareholders | $ | (60,213) | | | $ | (25,392) | | | $ | (95,320) | | | $ | (493,365) | |

| | | | | | | |

| Earnings Per Share (see numerator reconciliation below) | | | | | | | |

| Net loss per share - Continuing operations: | | | | | | | |

| Basic and diluted | $ | (0.32) | | | $ | (0.12) | | | $ | (0.52) | | | $ | (2.09) | |

| Net loss per share - Discontinued operations: | | | | | | | |

| Basic and diluted | $ | (0.01) | | | $ | (0.02) | | | $ | (0.02) | | | $ | (0.52) | |

| Weighted average number of common shares used in computing net loss per share: | | | | | | | |

| Basic and diluted | 190,190,923 | | 188,924,694 | | 190,004,261 | | 188,959,454 |

| | | | | | | |

EPS Numerator Reconciliation (see Note 5) | | | | | | | |

Net loss attributable to common shareholders (from above) | $ | (60,213) | | | $ | (25,392) | | | $ | (95,320) | | | $ | (493,365) | |

Net loss from discontinued operations, net of tax, attributable to common shareholders | 1,636 | | | 2,927 | | | 4,613 | | | 97,861 | |

| Adjustment of redeemable non-controlling interest to maximum redemption value | (2,065) | | | — | | | (9,010) | | | — | |

Net loss from continuing operations available to common shareholders | $ | (60,642) | | | $ | (22,465) | | | $ | (99,717) | | | $ | (395,504) | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

TRULIEVE CANNABIS CORP.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY (UNAUDITED)

(in thousands, except for share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | |

| Multiple Voting Shares | | Subordinate Voting Shares | | Total Common Shares | | Additional Paid-in-Capital | | Accumulated Deficit | | Non-Controlling Interest | | Total Shareholders' Equity | | | | |

| | | | | | | | | | | | | | | | | |

| Balance, June 30, 2024 | 23,226,386 | | 164,098,272 | | 187,324,658 | | $ | 2,056,072 | | | $ | (675,746) | | | $ | (9,276) | | | $ | 1,371,050 | | | | | |

| Share-based compensation | — | | — | | — | | 5,469 | | | — | | | — | | | 5,469 | | | | | |

Subordinate Voting Shares issued under share compensation plans (see Note 3) | — | | 2,904,079 | | 2,904,079 | | — | | | — | | | — | | | — | | | | | |

Tax withholding related to net share settlements of equity awards (see Note 3) | — | | (1,074,509) | | (1,074,509) | | (12,164) | | | — | | | — | | | (12,164) | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Adjustment of redeemable non-controlling interest to maximum redemption value (see Note 3) | — | | — | | — | | (2,065) | | | — | | | — | | | (2,065) | | | | | |

| | | | | | | | | | | | | | | | | |

| Consolidated VIE settlement transaction | — | | — | | — | | 651 | | | — | | | — | | | 651 | | | | | |

| Net loss | — | | — | | — | | — | | | (60,213) | | | (1,384) | | | (61,597) | | | | | |

| Balance, September 30, 2024 | 23,226,386 | | 165,927,842 | | 189,154,228 | | $ | 2,047,963 | | | $ | (735,959) | | | $ | (10,660) | | | $ | 1,301,344 | | | | | |

| | | | | | | | | | | | | | | | | |

| Balance, June 30, 2023 | 26,226,386 | | 159,761,126 | | 185,987,512 | | $ | 2,047,879 | | | $ | (581,816) | | | $ | (4,050) | | | $ | 1,462,013 | | | | | |

| Share-based compensation | — | | — | | — | | 4,539 | | | — | | | — | | | 4,539 | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net loss | — | | — | | — | | — | | | (25,392) | | | (451) | | | (25,843) | | | | | |

| Balance, September 30, 2023 | 26,226,386 | | 159,761,126 | | 185,987,512 | | $ | 2,052,418 | | | $ | (607,208) | | | $ | (4,501) | | | $ | 1,440,709 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended |

| | Multiple Voting Shares | | Subordinate Voting Shares | | Total Common Shares | | Additional Paid-in-Capital | | Accumulated

Deficit | | Non-Controlling Interest | | Total Shareholders' Equity |

| | | | | | | | | | | | | |

| Balance, December 31, 2023 | 26,226,386 | | 160,009,432 | | 186,235,818 | | $ | 2,055,112 | | | $ | (640,639) | | | $ | (5,860) | | | $ | 1,408,613 | |

| Share-based compensation | — | | — | | — | | 15,579 | | | — | | | — | | | 15,579 | |

Subordinate Voting Shares issued under share compensation plans (see Note 3) | — | | 3,030,218 | | 3,030,218 | | 210 | | | — | | | — | | | 210 | |

Tax withholding related to net share settlements of equity awards (see Note 3) | — | | (1,086,738) | | (1,086,738) | | (12,258) | | | — | | | — | | | (12,258) | |

| Distributions to subsidiary non-controlling interest | — | | — | | — | | — | | | — | | | (1,081) | | | (1,081) | |

| Conversion of Multiple Voting to Subordinate Voting Shares | (3,000,000) | | 3,000,000 | | — | | — | | | — | | | — | | | — | |

Redeemable non-controlling interest mezzanine equity (see Note 3) | — | | — | | — | | — | | | — | | | 1,504 | | | 1,504 | |

Adjustment of redeemable non-controlling interest to maximum redemption value (see Note 3) | — | | — | | — | | (9,010) | | | — | | | — | | | (9,010) | |

Subordinate Voting Shares issued pursuant to redemption of non-controlling interest (see Note 3) | — | | 974,930 | | 974,930 | | 2,471 | | | — | | | — | | | 2,471 | |

| Consolidated VIE settlement transaction | — | | — | | — | | (4,141) | | | — | | | (2,444) | | | (6,585) | |

| Net loss | — | | — | | — | | — | | | (95,320) | | | (2,779) | | | (98,099) | |

| Balance, September 30, 2024 | 23,226,386 | | 165,927,842 | | 189,154,228 | | $ | 2,047,963 | | | $ | (735,959) | | | $ | (10,660) | | | $ | 1,301,344 | |

| | | | | | | | | | | | | |

| Balance, December 31, 2022 | 26,226,386 | | 159,761,126 | | 185,987,512 | | $ | 2,045,003 | | | $ | (113,843) | | | $ | (3,456) | | | $ | 1,927,704 | |

| Share-based compensation | — | | — | | — | | 7,415 | | | — | | | — | | | 7,415 | |

| Termination of purchase of variable interest entity | — | | — | | — | | (1,643) | | | — | | | — | | | (1,643) | |

| Deconsolidation and divestment of variable interest entities | — | | — | | — | | — | | | — | | | 3,986 | | | 3,986 | |

| Distributions to subsidiary non-controlling interest | — | | — | | — | | — | | | — | | | (50) | | | (50) | |

| Value of shares earned for purchase of variable interest entity | — | | — | | — | | 1,643 | | | — | | | — | | | 1,643 | |

| Net loss | — | | — | | — | | — | | | (493,365) | | | (4,981) | | | (498,346) | |

| Balance, September 30, 2023 | 26,226,386 | | 159,761,126 | | 185,987,512 | | $ | 2,052,418 | | | $ | (607,208) | | | $ | (4,501) | | | $ | 1,440,709 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

TRULIEVE CANNABIS CORP.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(in thousands)

| | | | | | | | | | | |

| Nine Months Ended

September 30, |

| 2024 | | 2023 |

| Cash flows from operating activities | | | |

| Net loss | $ | (99,015) | | | $ | (498,346) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Depreciation and amortization | 84,163 | | | 83,618 | |

| Depreciation included in cost of goods sold | 40,098 | | | 45,397 | |

| | | |

| Gain on debt extinguishment | — | | | (8,161) | |

| | | |

| Impairment and disposal of long-lived assets, net of (recoveries) | (4,423) | | | 5,480 | |

| Impairment of goodwill | — | | | 307,590 | |

| Amortization of operating lease right of use assets | 8,339 | | | 7,794 | |

| | | |

| Share-based compensation | 15,579 | | | 7,415 | |

| | | |

| | | |

| Allowance for credit losses | 4,910 | | | 866 | |

| Deferred income taxes | (2,676) | | | (18,696) | |

| Loss from disposal of discontinued operations | — | | | 69,840 | |

| Other non-cash changes | 898 | | | 5,031 | |

| Changes in operating assets and liabilities: | | | |

| Inventories | (8,281) | | | 66,527 | |

| Accounts receivable | (712) | | | (1,856) | |

| Prepaid expenses and other current assets | (856) | | | 9,286 | |

| Other assets | (6,101) | | | 2,047 | |

| Accounts payable and accrued liabilities | 4,632 | | | 4,519 | |

| Income tax receivable / payable | (4,337) | | | (49,869) | |

| Other liabilities | 202 | | | (14,392) | |

| Operating lease liabilities | (5,959) | | | (6,933) | |

| Deferred revenue | 5,327 | | | (6,005) | |

| Uncertain tax position liabilities | 203,780 | | | 61,837 | |

| Other long-term liabilities | (662) | | | (2,612) | |

| Proceeds received from insurance for operating expenses | 5,903 | | | — | |

| Net cash provided by operating activities | 240,809 | | | 70,377 | |

| Cash flows from investing activities | | | |

| Purchases of property and equipment | (79,036) | | | (30,998) | |

| | | |

| Capitalized interest | (866) | | | 114 | |

| | | |

| | | |

| | | |

| Purchases of internal use software | (18,287) | | | (7,741) | |

| Purchases of short-term investments | (80,000) | | | — | |

| Cash paid for licenses | (7,000) | | | (3,971) | |

| Payment for initial direct costs on finance leases | (647) | | | — | |

| | | |

| | | |

| Proceeds from disposal activities | 1,003 | | | 11,723 | |

| Proceeds from notes receivable repayments | 872 | | | 565 | |

| Proceeds received from insurance recoveries on property and equipment | 527 | | | — | |

| Net cash used in investing activities | (183,434) | | | (30,308) | |

| Cash flows from financing activities | | | |

| | | |

| | | |

| | | |

| Payments for taxes related to net share settlement of equity awards | (12,258) | | | — | |

| Payments on finance lease obligations | (5,513) | | | (5,720) | |

| Payments on notes payable | (3,839) | | | (5,521) | |

| Payments on construction finance liabilities | (2,524) | | | (1,285) | |

| Payments and costs related to consolidated VIE settlement transaction | (5,077) | | | — | |

| Distributions to subsidiary non-controlling interest | (1,081) | | | (50) | |

| Payments on private placement notes | — | | | (47,595) | |

| Payments for debt issuance costs | — | | | (428) | |

| Proceeds from non-controlling interest holders' subscription | 3,000 | | | — | |

| Proceeds from equity exercises | 210 | | | — | |

| Net cash used in financing activities | (27,082) | | | (60,599) | |

| Net increase (decrease) in cash and cash equivalents | 30,293 | | | (20,530) | |

| Cash, cash equivalents, and restricted cash, beginning of period | 207,979 | | | 213,792 | |

| Cash and cash equivalents of discontinued operations, beginning of period | 301 | | | 5,702 | |

| Less: cash and cash equivalents of discontinued operations, end of period | — | | | (94) | |

| Cash, cash equivalents, and restricted cash, end of period | $ | 238,573 | | | $ | 198,870 | |

| | | |

| Supplemental disclosure of cash flow information | | | |

| Cash paid during the period for | | | |

| Interest | $ | 41,608 | | | $ | 52,036 | |

| Income taxes paid, net of (refunds) | (46,748) | | | 113,187 | |

| Noncash investing and financing activities | | | |

| ASC 842 lease additions - operating and finance leases | $ | 42,881 | | | $ | 12,019 | |

| Purchases of property and equipment in accounts payable and accrued liabilities | 10,462 | | | 4,284 | |

| | | |

| Reclassification of assets to held for sale | 7,044 | | | 18,396 | |

| Adjustment of redeemable non-controlling interest to maximum redemption value | 9,010 | | | — | |

| Noncash partial extinguishment of construction finance liability | — | | | 18,486 | |

| | | |

| | | |

The condensed consolidated statements of cash flows include continuing operations and discontinued operations for the periods presented.

| | | | | | | | | | | |

| September 30, |

| 2024 | | 2023 |

| Beginning of period: | | | |

Cash and cash equivalents (1) | $ | 201,372 | | | $ | 207,185 | |

| Restricted cash | 6,607 | | | 6,607 | |

| Cash, cash equivalents and restricted cash | $ | 207,979 | | | $ | 213,792 | |

| End of period: | | | |

Cash and cash equivalents (2) | $ | 237,666 | | | $ | 192,159 | |

| Restricted cash | 907 | | | 6,711 | |

| Cash, cash equivalents and restricted cash | $ | 238,573 | | | $ | 198,870 | |

(1)Excludes cash associated with discontinued operations totaling $0.3 million and $5.7 million as of December 31, 2023 and 2022, respectively.

(2)Excludes cash associated with discontinued operations totaling zero and $0.1 million as of September 30, 2024 and 2023, respectively.

The accompanying notes are an integral part of these condensed consolidated financial statements.

TRULIEVE CANNABIS CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

NOTE 1. BASIS OF PRESENTATION

The accompanying unaudited condensed consolidated financial statements of Trulieve Cannabis Corp., ("Trulieve," the "Company," "we," "our," or "us") has been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and, therefore, do not include all financial information and footnotes required by GAAP for complete financial statements. In management's opinion, the condensed consolidated financial statements include all adjustments of a normal recurring nature necessary for a fair statement of the Company's financial position as of September 30, 2024, and the results of its operations and cash flows for the periods ended September 30, 2024 and 2023. The results of the Company's operations for the three and nine months ended September 30, 2024 are not necessarily indicative of the results to be expected for the full 2024 fiscal year.

The accompanying unaudited condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements for Trulieve Cannabis Corp. and the notes thereto, included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the Securities and Exchange Commission ("SEC") on February 29, 2024 (the "2023 Form 10-K").

Discontinued Operations

In June 2023, the Company exited operations in Massachusetts and in July 2022, the Company exited operations in Nevada. Both actions represented a strategic shift in business; therefore, the related assets and liabilities associated with the discontinued operations are classified as discontinued operations on the condensed consolidated balance sheets and the results of the discontinued operations have been presented as discontinued operations within the condensed consolidated statements of operations for all periods presented. Unless specifically noted otherwise, footnote disclosures only reflect the results of continuing operations.

Basis of Measurement

These condensed consolidated financial statements have been prepared on the going concern basis, under the historical cost convention, except for certain financial instruments that are measured at fair value as described herein.

Functional Currency

The functional currency of the Company and its subsidiaries, as determined by management, is the United States (“U.S.”) dollar. These condensed consolidated financial statements are presented in U.S. dollars.

Reclassifications

Certain reclassifications have been made to the condensed consolidated financial statements of prior periods to conform to the current period presentation.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The Company’s significant accounting policies are described in the Company’s 2023 Annual Report on Form 10-K, filed with the SEC on February 29, 2024. Our management has reviewed these significant accounting policies and related disclosures and determined that there were no significant changes to our significant accounting policies during the nine month period ended September 30, 2024, except for the following:

Cash, Cash Equivalents, and Short-Term Investments

The Company considers cash deposits and all highly liquid investments with an original maturity of three months or less to be cash equivalents. Cash and cash equivalents include cash deposits in financial institutions plus cash held at retail locations. Cash held in money market investments are recorded at fair value. Cash held in financial institutions and cash held at retail locations have carrying values that approximate fair value.

Investments not considered cash equivalents and with maturities of one year or less are classified as short-term investments. Short-term investments consist of certificates of deposit with original maturity dates greater than three months and less than twelve months. The classification is determined at the time of purchase. The short-term investments are classified as held-to-maturity and recorded at amortized cost. If the cost of an individual investment exceeds its fair value, the Company evaluates, among other factors, general market conditions, the duration and extent to which the fair value is less than cost, and the Company's intent and ability to hold the investment. Once a decline in fair value is determined to be other-than-temporary, an impairment charge is recorded and a new cost basis in the investment is established.

NOTE 3. SUPPLEMENTARY FINANCIAL INFORMATION

Inventories

Inventories are comprised of the following as of:

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

| | | |

| (in thousands) |

| Raw materials | | | |

| Cannabis plants | $ | 21,182 | | | $ | 21,429 | |

| Packaging and supplies | 31,461 | | | 36,472 | |

| Total raw materials | 52,643 | | | 57,901 | |

| Work in process | 119,542 | | | 104,428 | |

| Finished goods - unmedicated | 5,947 | | | 6,516 | |

| Finished goods - medicated | 42,784 | | | 44,275 | |

Total inventories | $ | 220,916 | | | $ | 213,120 | |

Notes Receivable

As of September 30, 2024 and December 31, 2023, the allowance for credit losses on notes receivable was $5.7 million and zero, respectively. The provision for credit losses is recorded to other (expense) income, net on the condensed consolidated statements of operations and was $0.5 million and $5.7 million for the three and nine months ended September 30, 2024, respectively.

Held for Sale Assets

Held for sale assets primarily consist of property and equipment and are recorded in other current assets on the condensed consolidated balance sheets. The following table shows the activity of the Company's assets held for sale during the nine months ended September 30, 2024:

| | | | | |

| Held for sale assets |

| |

| (in thousands) |

| Balance, beginning of period | $ | 15,580 | |

| Assets moved to held for sale | 7,044 | |

| |

| Impairments | (1,207) | |

| Assets sold | (775) | |

| |

| Balance, end of period | $ | 20,642 | |

The Company recorded a $1.2 million loss on the impairment and disposal of held for sale assets during the nine months ended September 30, 2024, which was recorded to impairment and disposal of long-lived assets, net of recoveries, on the condensed consolidated statements of operations.

Deferred Revenue

Deferred revenue primarily consists of the liability related to the Company's customer rewards program, which was $6.2 million and $0.8 million as of September 30, 2024 and December 31, 2023, respectively.

Leases

Future minimum lease payments under the Company's non-cancellable operating and finance leases as of September 30, 2024 are as follows:

| | | | | | | | | | | | | | | | | |

| Operating

Leases | | Finance

Leases | | Total

Leases |

| | | | | |

| Year | (in thousands) |

| Remainder of 2024 | $ | 5,320 | | | $ | 3,769 | | | $ | 9,089 | |

| 2025 | 24,209 | | | 15,945 | | | 40,154 | |

| 2026 | 23,809 | | | 15,595 | | | 39,404 | |

| 2027 | 23,370 | | | 14,950 | | | 38,320 | |

| 2028 | 22,720 | | | 13,675 | | | 36,395 | |

| Thereafter | 92,173 | | | 44,805 | | | 136,978 | |

| Total | $ | 191,601 | | | $ | 108,739 | | | $ | 300,340 | |

Fair Value Measurements

The fair values of financial instruments measured on a recurring basis by class are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| Level 1 | | Level 2 | | Level 3 | | Total | | Level 1 | | Level 2 | | Level 3 | | Total |

| | | | | | | | | | | | | | | |

| (in thousands) |

Financial Assets (1): | | | | | | | | | | | | | | | |

Money market funds (2) | $ | 210,303 | | | $ | — | | | $ | — | | | $ | 210,303 | | | $ | 145,995 | | | $ | — | | | $ | — | | | $ | 145,995 | |

Certificates of deposit (3) | — | | | 80,179 | | | — | | | 80,179 | | | — | | | — | | | — | | | — | |

| Total financial assets | $ | 210,303 | | | $ | 80,179 | | | $ | — | | | $ | 290,482 | | | $ | 145,995 | | | $ | — | | | $ | — | | | $ | 145,995 | |

| Financial Liabilities: | | | | | | | | | | | | | | | |

Interest rate swap (4) | $ | — | | | $ | 2,533 | | | $ | — | | | $ | 2,533 | | | $ | — | | | $ | 2,341 | | | $ | — | | | $ | 2,341 | |

(1)There were no transfers between hierarchy levels during the periods ending September 30, 2024 or December 31, 2023.

(2)Money market funds are included within cash and cash equivalents on the Company’s condensed consolidated balance sheets. Interest income from money market funds was $3.0 million and $1.6 million for the three months ended September 30, 2024 and 2023, respectively, and was $9.6 million and $3.4 million for the nine months ended September 30, 2024 and 2023, respectively.

(3)The Company's certificates of deposit are included within short-term investments on the Company's condensed consolidated balance sheets and are classified as held-to-maturity securities as the Company intends to hold until their maturity dates. The certificates of deposit carry interest rates of 5.3% with original maturity dates ranging from five to six months and are scheduled to mature in December 2024 and January 2025. They are valued using Level 2 inputs based on industry standard data and due to their short maturities, their amortized cost approximates fair value. Interest income from certificates of deposit was $0.9 million for the three and nine months ended September 30, 2024.

(4)The fair value of the interest rate swap liability is recorded in other long-term liabilities on the condensed consolidated balance sheets.

Nonrecurring Fair Value Measurements

In addition to assets and liabilities that are recorded at fair value on a recurring basis, the Company's assets and liabilities are subject to nonrecurring fair value measurements. If events or indicators occur that require an impairment assessment, impairment charges may be recorded to reduce the assets to fair value. The Company recorded impairment charges totaling $1.2 million related to assets moved to held for sale during the nine months ended September 30, 2024. The impairment charges were recorded to impairment and disposal of long-lived assets, net of recoveries on the condensed consolidated statements of operations and were derived from the difference between the carrying value and the estimated fair value of the relevant asset, minus estimated selling costs. The fair value was estimated using an income capitalization approach with estimates and assumptions regarding the asset's future cash flows and return on investment (Level 3).

Redeemable Non-Controlling Interest

One of the Company’s consolidated variable interest entities ("VIE") is party to a shareholder agreement which provides certain of the non-controlling interest holders with optional redemption rights where they may put their shares in the consolidated subsidiary to the Company in exchange for a fixed number of Company shares. The non-controlling interest is redeemable at the option of the shareholder and is therefore recorded in temporary or "mezzanine" equity on the condensed consolidated balance sheets in accordance with ASC Topic 480-10-S99. Certain put holders are required to pay a subscription fee prior to their put right becoming exercisable.

During the first quarter of 2024, certain redeemable non-controlling interest holders executed their put rights following the payment of their subscription amount to the consolidated subsidiary, resulting in the issuance of 974,930 of Company Shares. This redemption resulted in an increase in the Company's ownership interest to 65% from 46%.

At September 30, 2024, the currently redeemable non-controlling interest could be settled with the issuance of 649,954 shares with a redemption value totaling $7.9 million.

The following table presents the components of the change in redeemable non-controlling interest for the periods presented:

| | | | | | | | | | | | | | |

| | September 30, 2024 |

| | Three Months Ended | | Nine Months Ended |

| | |

| | | | |

| | (in thousands) |

| Balance, beginning of period | | $ | 5,313 | | | $ | — | |

| Reclassification to mezzanine equity | | — | | | (1,504) | |

| Redemption | | — | | | 529 | |

| Adjustment to maximum redemption value | | 2,065 | | | 9,010 | |

| Allocation of net loss | | (259) | | | (916) | |

| Balance, end of period | | $ | 7,119 | | | $ | 7,119 | |

Shared Based Compensation

Stock Options

The following table summarizes the Company's stock option activity for the nine months ended September 30, 2024:

| | | | | |

| Number of options |

| Outstanding options, beginning of period | 4,197,058 |

Granted (1) | 992,166 |

| Exercised | (81,839) |

| Forfeited | (335,620) |

| Outstanding options, end of period | 4,771,765 |

| Vested and exercisable options, end of period | 3,284,248 |

(1) The weighted average exercise price for stock options granted was $10.00.

Restricted Stock Units

The following table summarizes the Company's restricted stock unit ("RSU") activity for the nine months ended September 30, 2024:

| | | | | |

| Number of

restricted stock units |

| Unvested balance, beginning of period | 2,686,216 |

Granted (1) | 2,194,918 |

| Vested | (93,665) |

| Forfeited | (144,823) |

| Unvested balance, end of period | 4,642,646 |

(1) The weighted average grant date fair value of RSUs granted was $10.00.

In September 2021, the Board of Directors approved a grant of 2,904,079 RSUs for two executive officers as a replacement for canceled warrants. The RSUs immediately vested at grant, but were not contractually issuable until three years after the vesting date. In September 2024, the three-year contractual obligation was met and the holders elected to net settle their tax obligations, resulting in the issuance of 1,829,570 shares of common stock and a $12.2 million payment for taxes.

Revenue Disaggregation

Revenue is comprised of the following for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| (in thousands) |

| Retail | $ | 269,237 | | | $ | 263,165 | | | $ | 843,544 | | | $ | 809,899 | |

| Wholesale | 14,585 | | | 11,553 | | | 40,434 | | | 30,460 | |

| Licensing and Other | 462 | | | 492 | | | 1,367 | | | 1,860 | |

| Total Revenue | $ | 284,284 | | | $ | 275,210 | | | $ | 885,345 | | | $ | 842,219 | |

Commitments and Contingencies

Claims and Litigation

From time to time, the Company may be involved in litigation relating to claims arising out of operations in the normal course of business. As of September 30, 2024, there were no pending or threatened lawsuits that could reasonably be expected to have a material effect on the results of the Company’s condensed consolidated statements of operations. There are also no proceedings in which any of the Company’s directors, officers or affiliates is an adverse party or has a material interest adverse to the Company’s interest.

Contingencies

The Company records contingent liabilities which primarily consists of litigation on various claims in which it believes a loss is probable and can be estimated. As of September 30, 2024 and December 31, 2023, $4.6 million and $4.2 million, respectively, was included in contingent liabilities on the condensed consolidated balance sheets related to pending litigation.

NOTE 4. FINANCING ARRANGEMENTS

Private Placement Notes

Private placement notes payable consisted of the following:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 | | Stated Interest Rate | | Effective Interest Rate | | Maturity Date |

| | | | | | | | | |

| (in thousands) | | | | | | |

| 2026 Notes - Tranche One | $ | 293,000 | | | $ | 293,000 | | | 8.00% | | 8.52% | | 10/6/2026 |

| 2026 Notes - Tranche Two | 75,000 | | | 75,000 | | | 8.00% | | 8.43% | | 10/6/2026 |

| Total private placement notes | 368,000 | | | 368,000 | | | | | | | |

| Less: unamortized debt discount and issuance costs | (3,581) | | | (4,785) | | | | | | | |

| Less: current portion of private placement notes | — | | | — | | | | | | | |

| Private placement notes, net | $ | 364,419 | | | $ | 363,215 | | | | | | | |

Notes Payable

Notes payable consisted of the following:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 | | Stated Interest Rate | | Effective Interest

Rate | | Maturity Date | | |

| | | | | | | | | | | |

| (in thousands) | | | | | | | | |

Mortgage Notes Payable (1) | | | | | | | | | | | |

| Notes dated December 21, 2022 | $ | 68,833 | | | $ | 70,046 | | | 7.53% | | 7.87% | | 1/1/2028 | | |

| Notes dated December 22, 2023 | 24,605 | | | 25,000 | | | 8.31% | | 8.48% | | 12/23/2028 | | |

| Notes dated December 22, 2022 | 18,131 | | | 18,470 | | | 7.30% | | 7.38% | | 12/22/2032 | | |

Notes dated October 1, 2021 | 5,308 | | | 5,645 | | | 8.14% | | 8.29% | | 10/1/2027 | | |

| Total mortgage notes payable | 116,877 | | | 119,161 | | | | | | | | | |

| Promissory Notes Payable | | | | | | | | | | | |

Notes acquired in Harvest Acquisition in October 2021 (2) | 1,037 | | | 1,707 | | | (2) | | (2) | | (2) | | |

| Notes of consolidated variable-interest entity dated February 1, 2022 | — | | | 885 | | | | | | | | | |

| Total promissory notes payable | 1,037 | | | 2,592 | | | | | | | | | |

Total notes payable (3) | 117,914 | | | 121,753 | | | | | | | | | |

| Less: unamortized debt discount and issuance costs | (1,815) | | | (2,139) | | | | | | | | | |

| Less: current portion of notes payable | (3,342) | | | (3,759) | | | | | | | | | |

| Notes payable, net | $ | 112,757 | | | $ | 115,855 | | | | | | | | | |

(1)Mortgage notes payable are secured by assets underlying the mortgages.

(2)Interest rates range from 0.00% to 7.50%, with a weighted average interest rate of 7.34% as of September 30, 2024. Maturity dates range from April 27, 2026 to October 24, 2026.

(3)Notes payable are subordinated to the private placement notes.

Construction Finance Liabilities

Total construction finance liabilities were $137.7 million and $138.1 million as of September 30, 2024 and December 31, 2023, respectively. The contractual terms range from 10.0 years to 25.0 years with a weighted average remaining lease term of 16.1 years.

Maturities

Stated maturities of the principal portion of private placement and notes payable outstanding and future minimum lease payments for the construction finance liabilities, including interest, as of September 30, 2024 are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Private Placement Notes | | Notes Payable | | Construction Finance Liabilities | | Total Maturities |

| | | | | | | | |

| Year | | (in thousands) |

| Remainder of 2024 | | $ | — | | | $ | 797 | | | $ | 4,303 | | | $ | 5,100 | |

| 2025 | | — | | | 3,446 | | | 17,521 | | | 20,967 | |

| 2026 | | 368,000 | | | 4,655 | | | 18,013 | | | 390,668 | |

| 2027 | | — | | | 70,034 | | | 18,519 | | | 88,553 | |

| 2028 | | — | | | 23,199 | | | 19,039 | | | 42,238 | |

| Thereafter | | — | | | 15,783 | | | 283,384 | | | 299,167 | |

| Total | | $ | 368,000 | | | $ | 117,914 | | | $ | 360,779 | | | $ | 846,693 | |

NOTE 5. EARNINGS PER SHARE

The following is a reconciliation for the calculation of basic and diluted earnings per share for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Numerator | (in thousands, except for share data) |

| Continuing operations | | | | | | | |

| Net loss from continuing operations | $ | (60,220) | | | $ | (22,916) | | | $ | (94,402) | | | $ | (399,292) | |

Less: net loss attributable to non-controlling interest | (1,384) | | | (451) | | | (2,779) | | | (3,788) | |

| Less: net loss attributable to redeemable non-controlling interest from continuing operations | (259) | | | — | | | (916) | | | — | |

| Less: adjustment of redeemable non-controlling interest to maximum redemption value | 2,065 | | | — | | | 9,010 | | | — | |

| Net loss from continuing operations available to common shareholders. | $ | (60,642) | | | $ | (22,465) | | | $ | (99,717) | | | $ | (395,504) | |

| Discontinued operations | | | | | | | |

| Net loss from discontinued operations, net of tax | $ | (1,636) | | | $ | (2,927) | | | $ | (4,613) | | | $ | (99,054) | |

| Less: net loss attributable to non-controlling interest | — | | | — | | | — | | | (1,193) | |

| Net loss from discontinued operations, net of tax, attributable to common shareholders | $ | (1,636) | | | $ | (2,927) | | | $ | (4,613) | | | $ | (97,861) | |

| Denominator | | | | | | | |

Weighted average number of common shares outstanding - Basic and diluted (1) | 190,190,923 | | 188,924,694 | | 190,004,261 | | 188,959,454 |

| Loss per Share - Continuing operations | | | | | | | |

| Basic and diluted loss per share | $ | (0.32) | | | $ | (0.12) | | | $ | (0.52) | | | $ | (2.09) | |

| Loss per Share - Discontinued operations | | | | | | | |

| Basic and diluted loss per share | $ | (0.01) | | | $ | (0.02) | | | $ | (0.02) | | | $ | (0.52) | |

(1) Potentially dilutive securities representing 10.6 million shares of common stock were excluded from the computation of diluted earnings per share for the three and nine months ended September 30, 2024 and 7.8 million shares of common stock were excluded from the computation of diluted earnings per share for the three and nine months ended September 30, 2023.

As of September 30, 2024, 189.2 million shares were issued and outstanding, which excluded 0.1 million fully vested RSUs that are not contractually issuable until the earlier of a defined triggering event or the award anniversary date, either December 1, 2030 or December 1, 2031.

NOTE 6. INCOME TAXES

The following table summarizes the Company’s income tax expense and effective tax rate for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| (in thousands) |

(Loss) income before provision for income taxes | $(12,837) | | $13,724 | | $55,616 | | $(293,359) |

Provision for income taxes | $47,383 | | $36,640 | | $150,018 | | $105,933 |

| Effective tax rate | (369%) | | 267% | | 270% | | (36%) |

The Company has computed its provision for income taxes based on the actual effective tax rate for the quarter as the Company believes this is the best estimate for the annual effective tax rate. The Company is subject to income taxes in the United States and Canada.

Significant judgment is required in evaluating the Company’s uncertain tax positions and determining the provision for income taxes. The Company recognizes benefits from uncertain tax positions based on the cumulative probability method whereby the largest benefit with a cumulative probability of greater than 50% is recorded. An uncertain tax position is not recognized if it has less than a 50% likelihood of being sustained.

A reconciliation of the beginning and ending amount of unrecognized tax benefits:

| | | | | | | | | | | |

| September 30, 2024 |

| Three Months Ended | | Nine Months Ended |

| | | |

| (in thousands) |

| Balance, beginning of period | $ | 610,623 | | | $ | 542,762 | |

| Reductions based on tax positions related to the prior year | 30 | | | (1,613) | |

| Reductions based on refunds requested but not received related to the prior year | 4 | | | (46,549) | |

| Additions based on tax positions related to the current year | 29,458 | | | 93,130 | |

| Additions based on refunds received related to prior years | — | | | 52,385 | |

| Balance, end of period | $ | 640,115 | | | $ | 640,115 | |

A reconciliation of the beginning and ending amount of uncertain tax position liabilities, net:

| | | | | | | | | | | | | |

| September 30, 2024 | | |

| Three Months Ended | | Nine Months Ended | | |

| | | | | |

| (in thousands) |

| Balance, beginning of period | $ | 333,102 | | | $ | 180,350 | | | |

| | | | | |

| Reductions based on tax positions related to the prior year | — | | | (731) | | | |

| Additions based on tax positions related to the current year | 32,344 | | | 106,368 | | | |

| | | | | |

| Additions based on refunds received related to prior years | — | | | 52,385 | | | |

| | | | | |

| Reclass tax payment on deposit | 11,017 | | | 28,566 | | | |

Interest recorded in income tax expense, net of reversals (1) | 7,667 | | | 17,192 | | | |

| | | | | |

Balance, end of period (2) | $ | 384,130 | | | $ | 384,130 | | | |

(1) Amounts represent the interest and penalties recorded on uncertain tax positions during the respective years which are recorded in the provision for income taxes on the condensed consolidated statements of operations.

(2) Of the $384.1 million in uncertain tax position liabilities, net, $352.0 million is related to the Company's tax positions based on legal interpretations that challenge the Company's tax liability under IRC Section 280E.

The Company’s uncertain tax position liabilities, net, which includes interest and tax payments on deposit, were approximately $384.1 million and $180.4 million as of September 30, 2024 and December 31, 2023, respectively. The $203.8 million increase in uncertain tax positions is primarily due to receipt of $52.4 million in refunds in the current year, as well as $106.4 million current year accruals, each related to tax positions based on legal interpretations that challenge the Company's tax liability under IRC Section 280E.

The Company recorded interest on uncertain tax positions totaling $7.7 million and $0.7 million for the three months ended September 30, 2024 and 2023, respectively, and $17.2 million and $2.2 million for the nine months ended September 30, 2024 and 2023, respectively, to the provision for income taxes on the condensed consolidated statements of operations, which was primarily related to the tax positions based on legal interpretations that challenge the Company's tax liability under IRC Section 280E and related to a tax position taken related to inventory costs for tax purposes in the Company's Florida dispensaries.

NOTE 7. VARIABLE INTEREST ENTITIES

The Company has entered into certain agreements in several states with various entities related to the purchase and operation of cannabis dispensary, cultivation, and production licenses, and has determined these to be variable interest entities for which it is the primary beneficiary and/or holds a controlling voting equity position. The Company holds a 0% ownership interest in these entities as of September 30, 2024.

The summarized assets and liabilities of the Company's consolidated VIEs in which the Company does not hold a majority interest are presented in the table below as of the periods presented and include third-party assets and liabilities of the Company's VIEs only and exclude intercompany balances that were eliminated in consolidation.

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

| | | |

| (in thousands) |

| Current assets: | | | |

| Cash | $ | 195 | | | $ | 9,491 | |

| Accounts receivable, net | 71 | | | 1,308 | |

Inventories | 538 | | | 8,341 | |

| Prepaid expenses | 187 | | | 423 | |

| Other current assets | — | | | 7 | |

| Total current assets | 991 | | | 19,570 | |

| Property and equipment, net | 300 | | | 28,068 | |

| Right of use asset - operating, net | — | | | 2,744 | |

| Right of use asset - finance, net | — | | | 259 | |

| Intangible assets, net | 2,071 | | | 17,162 | |

| Other assets | 167 | | | 140 | |

| Total assets | $ | 3,529 | | | $ | 67,943 | |

| Current liabilities: | | | |

| Accounts payable and accrued liabilities | $ | 194 | | | $ | 1,939 | |

| Income tax payable | — | | | 2,017 | |

| Deferred revenue | — | | | 2 | |

Operating lease liability - current portion | — | | | 63 | |

| Finance lease liability - current portion | — | | | 60 | |

| Total current liabilities | 194 | | | 4,081 | |

| Notes payable | — | | | 885 | |

| Operating lease liability | — | | | 2,926 | |

| Finance lease liability | — | | | 210 | |

| Deferred tax liabilities | — | | | 3,638 | |

| Other long-term liabilities | — | | | 671 | |

| Total liabilities | $ | 194 | | | $ | 12,411 | |

Consolidated VIE Settlement Transaction

During the three months ended June 30, 2024, the Company entered into a settlement agreement with the non-controlling interest holders of consolidated VIEs in Ohio in which the Company acquired the remaining ownership interest in dispensary businesses and agreed to provide funding and operational support for a cultivation and production business with new unrelated third parties.

The Company re-evaluated the VIEs after settlement and concluded that the Company continues to be the primary beneficiary of the cultivation and production business and there are no longer variable interests in the dispensary businesses as the Company increased its ownership to 100%. As a result, the Company accounted for this settlement as an equity transaction in accordance with ASC Topic 810-10.

NOTE 8. RELATED PARTIES

In the third quarter of 2023, the Company entered into an agreement to rent an asset from an entity that is directly owned in part by the Company’s Chief Executive Officer and Chair of the board of directors. The expense related to the use of this asset was $0.1 million and $0.1 million for the three months ended September 30, 2024 and 2023, respectively, and $0.2 million and $0.1 million for the nine months ended September 30, 2024 and 2023, respectively.

The Company leases a cultivation facility and corporate office facility from an entity that is directly or indirectly owned by the Company's Chief Executive Officer and Chair of the board of directors, a former member of the Company's board of directors, and another member of the Company's board of directors.

The Company had the following related party operating leases on the condensed consolidated balance sheets, under ASC 842, as of:

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

| | | |

| (in thousands) |

| Right-of-use assets, net | $ | 614 | | | $ | 706 | |

| Lease liabilities: | | | |

| Lease liabilities - current portion | $ | 138 | | | $ | 127 | |

| Lease liabilities | 520 | | | 624 | |

| Total related parties lease liabilities | $ | 658 | | | $ | 751 | |

Lease expense recognized on related party leases was $0.1 million and $0.1 million for the three months ended September 30, 2024 and 2023, respectively, and $0.2 million and $0.2 million for the nine months ended September 30, 2024 and 2023, respectively.

NOTE 9. DISCONTINUED OPERATIONS

The following table summarizes the Company's loss from discontinued operations for the periods presented.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| (in thousands) |

Revenue | $ | — | | | $ | 2,332 | | | $ | — | | | $ | 10,679 | |

| Cost of goods sold | — | | | 2,812 | | | — | | | 29,843 | |

| Gross margin | — | | | (480) | | | — | | | (19,164) | |

| Expenses: | | | | | | | |

| Operating expenses | 731 | | | 916 | | | 1,866 | | | 5,298 | |

| Impairment and disposal of long-lived assets, net | — | | | 565 | | | — | | | 69,840 | |

| Total expenses | 731 | | | 1,481 | | | 1,866 | | | 75,138 | |

Loss from operations | (731) | | | (1,961) | | | (1,866) | | | (94,302) | |

| Other expense: | | | | | | | |

| Other expense, net | (905) | | | (971) | | | (2,747) | | | (4,127) | |

| Total other expense, net | (905) | | | (971) | | | (2,747) | | | (4,127) | |

| Loss before income taxes | (1,636) | | | (2,932) | | | (4,613) | | | (98,429) | |

| Income tax benefit | — | | | 5 | | | — | | | (625) | |

| Net loss from discontinued operations, net of tax benefit | (1,636) | | | (2,927) | | | (4,613) | | | (99,054) | |

| Less: net loss attributable to non-controlling interest from discontinued operations | — | | | — | | | — | | | (1,193) | |

| Net loss from discontinued operations excluding non-controlling interest | $ | (1,636) | | | $ | (2,927) | | | $ | (4,613) | | | $ | (97,861) | |

The condensed consolidated statements of cash flows include continuing operations and discontinued operations. The following table summarizes the depreciation of long-lived assets, amortization of long-lived assets, and capital expenditures of discontinued operations for the prior year as the activity during the nine months ended September 30, 2024 was nominal.

| | | | | | | |

| | | Nine Months Ended

September 30, 2023 |

| | | (in thousands) |

Depreciation and amortization | | | $ | 3,798 | |

| Purchases of property and equipment | | | 67 | |

| Loss on impairment of long-lived assets | | | 69,840 | |

| Other noncash investing and financing activities | | | |

| Noncash partial extinguishment of construction finance liability | | | $ | 18,486 | |

As a result of the Company's exit from the Massachusetts market during the second quarter of 2023, the Company performed a lease term reassessment for the Holyoke failed sale-leaseback financing arrangement due to lease renewals previously included in the lease term being excluded as of the Massachusetts exit. The Company concluded the failed sale-leaseback accounting conclusion is maintained. The Company recognized a gain on partial extinguishment of $18.5 million as a result of the lease term reassessment, which was recorded to net loss from discontinued operations, net of taxes.

Future minimum lease payments, including interest, for the construction finance liability associated with discontinued operations as of September 30, 2024, are as follows:

| | | | | | | | |

| Year | | (in thousands) |

| Remainder of 2024 | | $ | 1,387 | |

| 2025 | | 5,619 | |

| 2026 | | 5,788 | |

| 2027 | | 5,961 | |

| 2028 | | 6,140 | |

| Thereafter | | 12,287 | |

| Total future payments | | $ | 37,182 | |

NOTE 10. SUBSEQUENT EVENTS

The Company’s management evaluates subsequent events through the date of issuance of the condensed consolidated financial statements. There have been no subsequent events that occurred during such period that would require adjustment to or disclosure in the condensed consolidated financial statements.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

This "Management's Discussion and Analysis of Financial Condition and Results of Operations" of Trulieve Cannabis Corp., together with its subsidiaries ("Trulieve," the "Company," "we," "our," or "us") should be read in conjunction with the accompanying unaudited condensed consolidated financial statements and the related notes included elsewhere within this Quarterly Report on Form 10-Q and the Audited Consolidated Financial Statements and the related Notes thereto and "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations" contained in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the "2023 Form 10-K").

This discussion contains forward-looking statements and involves numerous risks and uncertainties, including but not limited to those described in the “Risk Factors” section of this Quarterly Report on Form 10-Q in “Part I, Item 1A. Risk Factors” in our 2023 Form 10-K. Actual results may differ materially from those contained in any forward-looking statements. You should read “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” contained herein and in our 2023 Form 10-K. See “Special Note Regarding Forward-Looking Statements and Projections” in “Part II. Other Information” of this report. You should consider our forward-looking statements in light of the risks discussed in “Item 1A. Risk Factors” in “Part II. Other Information” of this report and our unaudited condensed consolidated financial statements, related notes and other financial information appearing elsewhere in this report, and the risks discussed in "Item 1A, Risk Factors" of the Form 10-K and our other filings with the Securities and Exchange Commission (the “SEC”).

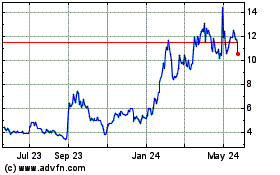

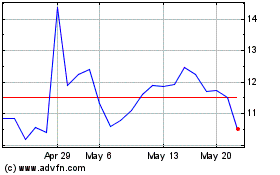

Overview

Trulieve Cannabis Corp. is a reporting issuer in the United States and Canada. The Company’s Subordinate Voting Shares (as hereinafter defined) are listed for trading on the Canadian Securities Exchange (“CSE”) under the symbol “TRUL” and are also traded in the United States on the OTCQX Best Market (“OTCQX”) under the symbol “TCNNF”.

Trulieve is a vertically integrated cannabis company and multi-state operator with operations in nine states. Headquartered in Quincy, Florida, we are the largest cannabis retailer in the United States with market leading retail operations in Arizona, Florida, Georgia, Pennsylvania, and West Virginia. We are committed to delivering exceptional customer experiences through elevated service and high-quality branded products. We aim to be the brand of choice for medical and adult-use customers in all of the markets that we serve. The Company operates in highly regulated markets that require expertise in cultivation, manufacturing, and retail. We have developed proficiencies in each of these functional areas and are passionate about expanding access to regulated cannabis products through advocacy, education and expansion of our distribution network.

All of the states in which we operate have developed programs to permit the use of cannabis products for medicinal purposes to treat specific conditions and diseases, which we refer to as medical cannabis. Recreational cannabis, or adult-use cannabis, is legal cannabis sold in licensed dispensaries to adults ages 21 and older. Thus far, of the states in which we operate, Arizona, Colorado, Connecticut, Maryland, and Ohio, have already launched programs permitting the commercialization of adult-use cannabis products. Trulieve operates its business through its directly and indirectly owned subsidiaries which hold licenses and have entered into managed service agreements in the states in which they operate.

As of September 30, 2024, we operated the following:

| | | | | | | | | | | | | | |

| State | | Number of Dispensaries | | Number of Cultivation and Processing Facilities |

| Florida | | 151 | | 6 |

| Arizona | | 21 | | 3 |

| Pennsylvania | | 21 | | 3 |

| West Virginia | | 10 | | 1 |

| Georgia | | 5 | | 1 |

| Maryland | | 3 | | 1 |

Ohio | | 3 | | — | |

| Connecticut | | 1 | | — | |

Colorado | | — | | | 1 |

| Total | | 215 | | 16 |

Regional Hub Structure

Trulieve’s production, retail and distribution areas are organized into regional hubs whereby teams and assets are aggregated in order to effectively pair national structure and support with localized operations tailored to each market. Trulieve has established cannabis operations in three hubs: Southeast, Northeast, and Southwest. Each of our three regional hubs are anchored by market leading positions in cornerstone states of Florida, Pennsylvania, and Arizona.