true

client made edits to veribage on the cover

0001434601

0001434601

2023-06-01

2024-05-31

0001434601

dei:BusinessContactMember

2023-06-01

2024-05-31

0001434601

2024-05-31

0001434601

2023-05-31

0001434601

2022-06-01

2023-05-31

0001434601

us-gaap:PreferredStockMember

2022-05-31

0001434601

us-gaap:CommonStockMember

2022-05-31

0001434601

us-gaap:AdditionalPaidInCapitalMember

2022-05-31

0001434601

us-gaap:RetainedEarningsMember

2022-05-31

0001434601

2022-05-31

0001434601

us-gaap:PreferredStockMember

2023-05-31

0001434601

us-gaap:CommonStockMember

2023-05-31

0001434601

us-gaap:AdditionalPaidInCapitalMember

2023-05-31

0001434601

us-gaap:RetainedEarningsMember

2023-05-31

0001434601

us-gaap:PreferredStockMember

2022-06-01

2023-05-31

0001434601

us-gaap:CommonStockMember

2022-06-01

2023-05-31

0001434601

us-gaap:AdditionalPaidInCapitalMember

2022-06-01

2023-05-31

0001434601

us-gaap:RetainedEarningsMember

2022-06-01

2023-05-31

0001434601

us-gaap:PreferredStockMember

2023-06-01

2024-05-31

0001434601

us-gaap:CommonStockMember

2023-06-01

2024-05-31

0001434601

us-gaap:AdditionalPaidInCapitalMember

2023-06-01

2024-05-31

0001434601

us-gaap:RetainedEarningsMember

2023-06-01

2024-05-31

0001434601

us-gaap:PreferredStockMember

2024-05-31

0001434601

us-gaap:CommonStockMember

2024-05-31

0001434601

us-gaap:AdditionalPaidInCapitalMember

2024-05-31

0001434601

us-gaap:RetainedEarningsMember

2024-05-31

0001434601

TMGI:CEOAgreement2017Member

2024-05-31

0001434601

TMGI:CEOAgreement2017Member

2023-05-31

0001434601

TMGI:WifeOfCEOMember

2024-05-31

0001434601

TMGI:WifeOfCEOMember

2023-05-31

0001434601

TMGI:MotherOfCEOMember

2024-05-31

0001434601

TMGI:MotherOfCEOMember

2023-05-31

0001434601

TMGI:ServiceProviderMember

2024-05-31

0001434601

TMGI:ServiceProviderMember

2023-05-31

0001434601

TMGI:ServiceProvider1Member

2024-05-31

0001434601

TMGI:ServiceProvider1Member

2023-05-31

0001434601

TMGI:TwoOtherServiceProvidersMember

2024-05-31

0001434601

TMGI:TwoOtherServiceProvidersMember

2023-05-31

0001434601

TMGI:NotePayable1Member

2024-05-31

0001434601

TMGI:NotePayable1Member

2023-05-31

0001434601

TMGI:NotePayable2Member

2024-05-31

0001434601

TMGI:NotePayable2Member

2023-05-31

0001434601

TMGI:NotePayable3Member

2024-05-31

0001434601

TMGI:NotePayable3Member

2023-05-31

0001434601

TMGI:NotePayable4Member

2024-05-31

0001434601

TMGI:NotePayable4Member

2023-05-31

0001434601

TMGI:NotePayable5Member

2024-05-31

0001434601

TMGI:NotePayable5Member

2023-05-31

0001434601

TMGI:NotePayable6Member

2024-05-31

0001434601

TMGI:NotePayable6Member

2023-05-31

0001434601

TMGI:NotePayable7Member

2024-05-31

0001434601

TMGI:NotePayable7Member

2023-05-31

0001434601

TMGI:NotePayable8Member

2024-05-31

0001434601

TMGI:NotePayable8Member

2023-05-31

0001434601

TMGI:NotePayable9Member

2024-05-31

0001434601

TMGI:NotePayable9Member

2023-05-31

0001434601

TMGI:NotePayable10Member

2024-05-31

0001434601

TMGI:NotePayable10Member

2023-05-31

0001434601

TMGI:NotePayable11Member

2024-05-31

0001434601

TMGI:NotePayable11Member

2023-05-31

0001434601

TMGI:NotePayable12Member

2024-05-31

0001434601

TMGI:NotePayable12Member

2023-05-31

0001434601

TMGI:NotePayable13Member

2024-05-31

0001434601

TMGI:NotePayable13Member

2023-05-31

0001434601

TMGI:NotePayable14Member

2024-05-31

0001434601

TMGI:NotePayable14Member

2023-05-31

0001434601

TMGI:NotePayable15Member

2024-05-31

0001434601

TMGI:NotePayable15Member

2023-05-31

0001434601

TMGI:NotePayable16Member

2024-05-31

0001434601

TMGI:NotePayable16Member

2023-05-31

0001434601

TMGI:NotePayable17Member

2024-05-31

0001434601

TMGI:NotePayable17Member

2023-05-31

0001434601

TMGI:NotePayable18Member

2024-05-31

0001434601

TMGI:NotePayable18Member

2023-05-31

0001434601

TMGI:NotePayable19Member

2024-05-31

0001434601

TMGI:NotePayable19Member

2023-05-31

0001434601

TMGI:NotePayable20Member

2024-05-31

0001434601

TMGI:NotePayable20Member

2023-05-31

0001434601

TMGI:NotePayable21Member

2024-05-31

0001434601

TMGI:NotePayable21Member

2023-05-31

0001434601

TMGI:NotePayable22Member

2024-05-31

0001434601

TMGI:NotePayable22Member

2023-05-31

0001434601

TMGI:NotePayable23Member

2024-05-31

0001434601

TMGI:NotePayable23Member

2023-05-31

0001434601

TMGI:NotePayable24Member

2024-05-31

0001434601

TMGI:NotePayable24Member

2023-05-31

0001434601

TMGI:NotePayable25Member

2024-05-31

0001434601

TMGI:NotePayable25Member

2023-05-31

0001434601

TMGI:NotePayable26Member

2024-05-31

0001434601

TMGI:NotePayable26Member

2023-05-31

0001434601

TMGI:NotePayable27Member

2024-05-31

0001434601

TMGI:NotePayable27Member

2023-05-31

0001434601

TMGI:NotePayable28Member

2024-05-31

0001434601

TMGI:NotePayable28Member

2023-05-31

0001434601

TMGI:NotePayable29Member

2024-05-31

0001434601

TMGI:NotePayable29Member

2023-05-31

0001434601

TMGI:NotePayable30Member

2024-05-31

0001434601

TMGI:NotePayable30Member

2023-05-31

0001434601

TMGI:LenderAMember

2024-05-31

0001434601

TMGI:LenderAMember

2023-05-31

0001434601

TMGI:LenderBMember

2024-05-31

0001434601

TMGI:LenderBMember

2023-05-31

0001434601

TMGI:OtherLenders14Member

2024-05-31

0001434601

TMGI:OtherLenders14Member

2023-05-31

0001434601

TMGI:CompanyLawFirmMember

2024-05-31

0001434601

TMGI:CompanyLawFirmMember

2023-05-31

0001434601

TMGI:OZCorporationMember

2024-05-31

0001434601

TMGI:OZCorporationMember

2023-05-31

0001434601

srt:ChiefExecutiveOfficerMember

2024-05-31

0001434601

srt:ChiefExecutiveOfficerMember

2023-05-31

0001434601

TMGI:WifeOfCEOMember

2024-05-31

0001434601

TMGI:WifeOfCEOMember

2023-05-31

0001434601

TMGI:ConvertibleNote1Member

2024-05-31

0001434601

TMGI:ConvertibleNote1Member

2023-05-31

0001434601

TMGI:ConvertibleNote2Member

2024-05-31

0001434601

TMGI:ConvertibleNote2Member

2023-05-31

0001434601

TMGI:ConvertibleNote3Member

2024-05-31

0001434601

TMGI:ConvertibleNote3Member

2023-05-31

0001434601

TMGI:ConvertibleNote4Member

2024-05-31

0001434601

TMGI:ConvertibleNote4Member

2023-05-31

0001434601

TMGI:ConvertibleNote5Member

2024-05-31

0001434601

TMGI:ConvertibleNote5Member

2023-05-31

0001434601

TMGI:ConvertibleNote6Member

2024-05-31

0001434601

TMGI:ConvertibleNote6Member

2023-05-31

0001434601

TMGI:ConvertibleNote7Member

2024-05-31

0001434601

TMGI:ConvertibleNote7Member

2023-05-31

0001434601

TMGI:ConvertibleNote8Member

2024-05-31

0001434601

TMGI:ConvertibleNote8Member

2023-05-31

0001434601

TMGI:ConvertibleNote9Member

2024-05-31

0001434601

TMGI:ConvertibleNote9Member

2023-05-31

0001434601

TMGI:ConvertibleNote10Member

2024-05-31

0001434601

TMGI:ConvertibleNote10Member

2023-05-31

0001434601

TMGI:ConvertibleNote11Member

2024-05-31

0001434601

TMGI:ConvertibleNote11Member

2023-05-31

0001434601

TMGI:ConvertibleNote12Member

2024-05-31

0001434601

TMGI:ConvertibleNote12Member

2023-05-31

0001434601

TMGI:ConvertibleNote13Member

2024-05-31

0001434601

TMGI:ConvertibleNote13Member

2023-05-31

0001434601

TMGI:ConvertibleNote14Member

2024-05-31

0001434601

TMGI:ConvertibleNote14Member

2023-05-31

0001434601

TMGI:LenderAMember

2024-05-31

0001434601

TMGI:LenderAMember

2023-05-31

0001434601

TMGI:LenderBMember

2024-05-31

0001434601

TMGI:LenderBMember

2023-05-31

0001434601

TMGI:LenderCMember

2024-05-31

0001434601

TMGI:LenderCMember

2023-05-31

0001434601

TMGI:LenderDMember

2024-05-31

0001434601

TMGI:LenderDMember

2023-05-31

0001434601

TMGI:OtherLenders5Member

2024-05-31

0001434601

TMGI:OtherLenders5Member

2023-05-31

0001434601

TMGI:EquityAgreementMember

2023-06-01

2024-05-31

0001434601

TMGI:EquityAgreementMember

us-gaap:TransferAgentMember

2023-06-01

2024-05-31

0001434601

us-gaap:CommonStockMember

2022-06-01

2023-05-31

0001434601

us-gaap:CommonStockMember

2023-06-01

2024-05-31

0001434601

TMGI:SimplyWhimMember

2022-09-19

2022-09-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

Table of Contents

As filed with the Securities

and Exchange Commission on October 4, 2024.

Registration No. 333-282356

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

REGISTRATION STATEMENT UNDER THE SECURITIES ACT

OF 1933

The MARQUIE GROUP, INC.

(Exact name of Registrant as specified in its charter)

| florida |

|

4461 |

|

26-2091212 |

| (Incorporation or |

|

(Primary Standard Industrial |

|

(I.R.S. Employer |

| organization) |

|

Classification Code Number) |

|

Identification Number) |

7901 4th Street North, Suite 4887

St. Petersburg, FL 33702

(800) 351-3021

(Name, address, telephone number of agent for service)

Marc Angell

Chief Executive Officer

7901 4th Street North, Suite 4887

St. Petersburg, FL 33702

(800) 351-3021

(Address and Telephone Number of Registrant’s

Principal Executive Offices and Principal Place of Business)

Communication Copies to

Jeff Turner

JDT Legal

7533 S Center View Ct, #4291

West Jordan, UT 84084

Telephone: (801) 810-4465

Facsimile: (888) 920-1297

Email: jeff@jdt-legal.com

Approximate date of proposed sale to the public:

As soon as practicable and from time to time after the effective date of this Registration Statement.

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following

box. ☒

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed

pursuant to rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number

of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large

accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange

Act. (Check one):

| |

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| |

Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

Emerging Growth Company |

☐ |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration

statement on such date or dates, as may be necessary to delay its effective date until the registrant shall file a further amendment,

which specifically states that this registration statement shall thereafter become effective in accordance with Act 1, Section 8A of

the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities Exchange

Commission, acting pursuant to Section 8A, may determine.

The information in this prospectus is not complete

and may be changed without notice. The Selling Security Holders may not sell these securities until the registration statement filed with

the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and neither the Registrant

nor the Selling Security Holders are soliciting offers to buy these securities, in any state where the offer or sale of these securities

is not permitted.

| PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION |

DATED October 4, 2024 |

5,000,000,000 Shares of Common Stock

The Marquie Group, Inc.

This prospectus covers

5,000,000,000 shares of our common stock that may be offered for resale or otherwise disposed of by the Selling Stockholder listed on

the Selling Stockholder table on page 11 (the “Selling Stockholder”).

We will not receive any

proceeds from the sale or other disposition of the securities by the Selling Stockholder. However, we may receive up to approximately

$794,430.00 in gross proceeds upon the cash exercise of the warrants by the Selling Stockholder. We will use such proceeds, if and when

received, for general working capital.

The Selling Stockholder

has informed us that it is not a broker-dealer, is not an affiliate of a broker dealer, and does not have any agreement or understanding,

directly or indirectly, with any person to distribute our common stock. Our common stock is traded on the over-the-counter market under

the symbol “TMGI”. The closing price for our common stock on September 20, 2024, was $0.0001 per share, as reported by OTC

Markets.

Our auditors have expressed substantial doubt

as to our ability to continue as a going concern. We expect that we will need approximately $1,000,000 in capital to continue as a going

concern for the next twelve months from the date of this prospectus. We intend to raise capital to fund our operations through sales of

multi-media and entertainment related products and services, borrowings, and private placements of our common stock.

An investment in our common stock is

subject to many risks and an investment in our shares will also involve a high degree of risk. The shares issuable from the Equity

Financing Agreement will dilute the ownership interest and voting power of existing stockholders. See “Risk Factors” on

page 5 to read about factors you should consider before purchasing shares of our common stock.

_______________________________________________________

Neither the Securities and Exchange Commission

(“SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense. The information in this prospectus is not complete

and may be changed. This prospectus is included in the registration statement that was filed by us with the SEC. The Selling Stockholder

may not sell these securities until the registration statement becomes effective. This prospectus is not an offer to sell these securities

and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The date of this prospectus is October 4, 2024

ADDITIONAL INFORMATION

You should rely only

on the information contained or incorporated by reference in this prospectus and in any accompanying prospectus supplement. No one has

been authorized to provide you with different information. The shares are not being offered in any jurisdiction where the offer is not

permitted. You should not assume that the information in this prospectus or any prospectus supplement is accurate as of any date other

than the date on the front of such documents.

TABLE OF CONTENTS

The following table of

contents has been designed to help you find information contained in this prospectus. We encourage you to read the entire prospectus.

Please read this Prospectus carefully and in its

entirety. This Prospectus contains disclosure regarding our business, our financial condition and results of operations and risk factors

related to our business and our Common Stock, among other material disclosure items. We have prepared this Prospectus so that you will

have the information necessary to make an informed investment decision.

You should rely only on information contained

in this Prospectus. We have not authorized any other person to provide you with different information. This Prospectus is not an offer

to sell, nor is it seeking an offer to buy these securities in any state where the offer or sale is not permitted. The Selling Stockholder

may not sell the securities listed in this Prospectus until the Registration Statement filed with the Securities and Exchange Commission

is effective. The information in this Prospectus is complete and accurate as of the date on the front cover, but the information may have

changed since that date.

The Registration Statement containing this

Prospectus, including the exhibits to the Registration Statement, provides additional information about us and our Common Stock

offered under this Prospectus. The Registration Statement, including the exhibits and the documents incorporated herein by

reference, can be read on the Securities and Exchange Commission website or at the Securities and Exchange Commission offices

mentioned under the heading “Additional Information.”

FORWARD-LOOKING STATEMENTS AND PROJECTIONS

All statements contained in this prospectus that

are not historical facts, including statements regarding anticipated activity, are “forward-looking statements” within the

meaning of the federal securities laws, involve a number of risks and uncertainties and are based on our beliefs and assumptions and information

currently available to us. In some cases, you can identify forward-looking statements by words such as “may,” “will,”

“should,” “expect,” “objective,” “plan,” “intend,” “anticipate,”

“believe,” “estimate,” “predict,” “project,” “potential,” “forecast,”

“continue,” “strategy,” or “position” or the negative of such terms or other variations of them or

by comparable terminology. In particular, statements, express or implied, concerning future actions, conditions or events, future operating

results or the ability to generate sales, income or cash flow are forward-looking statements. These statements are not guarantees of future

performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and difficult to predict and

could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements, including:

| |

· |

The level of competition in the health and beauty product industry and multi-media entertainment; |

| |

|

|

| |

· |

The availability of wholesale goods to fulfill product orders, and expand the product line; |

| |

|

|

| |

· |

Our ability to obtain additional capital to finance the expansion of our business, to maintain reporting requirements, to maintain adequate inventory, or to extend terms of credit to our customers; |

| |

|

|

| |

· |

Our reliance upon management and particularly Marc Angell, our Chief Executive Officer, to execute our business plan; |

| |

|

|

| |

· |

The willingness and ability of third parties to honor their contractual commitments; |

| |

|

|

| |

· |

The amount of dilution that our shareholders will experience as a result of the Equity Financing Agreement and the underlying shares that that may be sold from time to time pursuant thereto; |

| |

|

|

| |

· |

The volatility of our common stock price; and |

| |

|

|

| |

· |

The risks, uncertainties and other factors we identify in “Risk Factors” and elsewhere in this prospectus and in our filings with the SEC. |

We caution readers not to place undue reliance

on any such forward-looking statements, which statements are made pursuant to the Private Securities Litigation Reform Act of 1995 and,

as such, speak only as of the date made. We undertake no obligation to publicly update or revise any forward-looking statements, whether

as a result of new information, future events, or otherwise, after the date of this prospectus.

PROSPECTUS SUMMARY

This summary highlights some of the information

in this prospectus. It is not complete and may not contain all of the information that you may want to consider. You should read carefully

the more detailed information set forth under “Risk Factors” and the other information included in this prospectus. Except

where the context suggests otherwise, the terms “we,” “us,” “our,” “TMGI” and the “Company”

refer to The Marquie Group, Inc. We refer in this prospectus to our executive officers and other members of our management team, collectively,

as “Management.”

The Marquie Group, Inc. is

an emerging direct-to-consumer firm specializing in marketing, product development, and media, including a dynamic terrestrial, and streaming

radio network. We craft and promote top-tier health and beauty solutions that enrich lives, showcased through engaging radio content for

our audience.

On May 31, 2013 the Company

acquired Music of Your Life, Inc., a Nevada corporation (“MYL Nevada”). As a result of the acquisition, MYL Nevada became

a wholly owned subsidiary of the Company, and the Company changed its name to Music of Your Life, Inc. effective July 26, 2013 operating

as a syndicated radio network producing live concerts, television shows and radio programming. With the dramatic increase in music licensing

fees and the decrease in traditional radio advertising formats, the Company found it difficult to achieve profitability with its Music

of Your Life syndication radio service. In response to this, the Company began to explore partnering with products to be marketed through

radio spots on the Company’s wide-reaching radio network.

On August 16, 2018, the Company

merged into The Marquie Group, Inc., a development stage health and beauty products company for the exclusive right to market and sell

products under development, and subsequently changed its name to The Marquie Group, Inc.

On September 26, 2022,

the Company acquired 25% of Simply Whim, LLC, a skincare company with a full line of health and beauty products under the

“Whim” brand. As a result, the Company is now a direct-to-consumer sales and marketing company with its own line of

innovative health and beauty products. The Company markets these products through its wholly owned subsidiary Music of Your Life, a

syndicated radio network heard nationwide on AM, FM and HD terrestrial radio stations, and simulcast over the internet. This is made

possible by 30 and 60 second commercials airing every hour which are targeted toward the Music of Your Life listening audience.

Broadcasting more than 40 years, Music of Your Life is the longest running music radio format in syndication. Information regarding

the Whim products, including the Whim store can be found at www.simplywhim.com. You can learn more about the Company

at www.themarquiegroup.com. Our website, however, does not constitute a part of this prospectus.

We are governed by our sole

officer and director Marc Angell. Our principal office is located at 7901 4th Street North, Suite 4887, St. Petersburg, FL 33702-4305.

We have one full-time employee and utilize the services of various contract personnel from time to time.

Recent Financings and Material Agreements

Quick Capital, LLC

– Warrant

On June 10,

2022, we entered into a Securities Purchase Agreement with Quick Capital, LLC (“QC”) under which we received a loan of $35,000

for which we issued a convertible note to QC in the principal amount of $38,800 bearing interest at 12% per annum with a maturity date

12 months from the date of the note (“2022 Note”). As of the date hereof, the 2022 Note has been fully converted and is no

longer outstanding. Under the terms of the Securities Purchase Agreement, we also issued a warrant to allow QC to purchase 776,000,000

shares of our common stock during a five-year period ending June 10, 2027 at an exercise price of $0.00005 per share, subject to adjustment.

The number of shares being registered hereunder for warrant issued in conjunction with the June Note is 776,000,000.

Quick Capital, LLC

– Note 1

On November

8, 2022, we entered into a Note Purchase Agreement with Quick Capital, LLC (“QC”) under which we received a loan of $27,500

for which we issued a convertible note to QC in the principal amount of $30,555 bearing interest at 12% per annum with a maturity date

12 months from the date of the note (“Note 1”). As of the date hereof, the Note 1 has been fully converted and is no longer

outstanding. The number of shares being registered hereunder for warrant issued in conjunction with the June Note is 6,111,000 warrant

shares).

Quick Capital, LLC

– Note 2

On January

23, 2024, we entered into a Note Purchase Agreement with QC under which we received a loan of $27,500 for which we issued a convertible

note to QC in the principal amount of $30,555 bearing interest at 12% per annum with a maturity date 12 months from the date of the note

(“Note 2”). Note 2 is convertible into shares of our common stock at a 45% of the lowest trading price of our common stock

during the twenty (20) day period ending on the latest complete trading day prior to the conversion date and is subject to customary default

provisions. Note 2 may not be prepaid unless the lender consents. Under the terms of the Note Purchase Agreement, we also issued a warrant

to allow QC to purchase 152,775,000 shares of our common stock during a five-year period ending November 8, 2027 at an exercise price

of $0.005 per share, subject to adjustment. The total balance outstanding as of the date hereof is $31,619.82. The number of shares being

registered hereunder for QC Note 2 is 785,171,416 (632,396,416 conversion shares and 152,775,000 warrant shares).

Quick Capital, LLC

– Note 3

On May 21,

2024, we entered into a Note Purchase Agreement with QC under which we will receive a loan of up to $500,000 for which we issued a convertible

note to QC in the principal amount of $555,555.55 bearing interest at 12% per annum with a maturity date 9 months from the date of the

note (“Note 3”). Note 3 is convertible into shares of our common stock at a 45% of the lowest trading price of our common

stock during the twenty (20) day period ending on the latest complete trading day prior to the conversion date. Note 3 may not be prepaid

unless the lender consents. Under the terms of the Note Purchase Agreement, we also issued a warrant to allow QC to purchase up to 5,555,555,500

shares of our common stock during a five-year period ending May 10, 2029 at an exercise price of $0.0001 per share, subject to adjustment.

The number of shares being registered hereunder for QC Note 3 is 1,455,524,579, which shares can be issued as conversion shares and/or

warrant shares.

We are filing this prospectus

in connection with shares of our common stock that may be offered and sold from time to time by the Selling Stockholder. The Selling Stockholder

is not an affiliate of the Company.

Issuances of our common stock

in this offering will not affect the rights or privileges of our existing stockholders, except that the economic and voting interests

of each of our existing stockholders will be diluted as a result of any such issuance. Although the number of shares of common stock that

our existing stockholders own will not decrease, the shares owned by our existing stockholders will represent a smaller percentage of

our total outstanding shares after any such issuance to the Selling Stockholder.

We are subject to the information

requirements of the Securities Exchange Act of 1934, as amended, and in accordance therewith file quarterly and annual reports, as well

as other information with the Securities and Exchange Commission (“SEC”) under File No. 000-54163. Such reports and other

information filed with the SEC can be inspected and copied at the public reference facilities maintained by the SEC at 450 Fifth Street,

N.W., Washington, D.C. 20549 at prescribed rates, and at various regional and district offices maintained by the SEC throughout the United

States. Information about the operation of the SEC’s public reference facilities may be obtained by calling the SEC at 1-800-SEC-0330.

The SEC also maintains a website at http://www.sec.gov that contains reports and other information regarding us and other

registrants that file electronic reports and information with the SEC.

THE OFFERING

| Securities Offered |

Up to 5,000,000,000 shares of our common stock

for public and private resale.

|

| |

|

| Offering Price |

The Selling Stockholder will offer and

sell its shares of common stock at a price of $0.0001 per share as quoted on OTC Markets as of October 4, 2024, at other prevailing

prices, or at privately negotiated prices.

|

| |

|

| Shares Outstanding |

We are authorized to issue 20,000,000,000 shares

of common stock, par value $0.0001 per share. As of the date of this prospectus, we have 3,888,065,460 shares of common stock issued and

outstanding.

|

| |

|

|

Symbol for

Our Common Stock |

TMGI |

| |

|

| Use of Proceeds |

We are not selling any shares of common stock

in this offering. We, therefore, will not receive any proceeds from the sale of the shares by the Selling Stockholder.

|

| |

|

|

Distribution

Arrangements |

The Selling Stockholder may, from time to

time, sell any or all of their shares of common stock on the OTC Pink or other market or trading platform on which our shares are traded

or quoted or in private transactions. These sales may be at fixed or negotiated prices. We will not be involved in any of the selling

efforts of the Selling Stockholder. |

| |

|

| Risk Factors |

An investment in our common stock is subject to significant risks that

you should carefully consider before investing in our common stock. For a further discussion of these risk factors, please see

“Risk Factors” beginning on page 5. |

RISK FACTORS

An investment in our securities

involves certain risks relating to our business and operations. You should carefully consider these risks, together with all of the other

information included in this prospectus, before you decide whether to purchase shares of our Company. If any of the following risks actually

occur, our business, financial condition or results of operations could be materially adversely affected. If that happens, the trading

price of our common stock could decline and you may lose all or part of your investment.

Risks Related to Our Business

Our auditors have expressed

substantial doubt about our ability to continue as a going concern.

Our audited financial statements

for the fiscal years ended May 31, 2024 and 2023 were prepared assuming that we will continue our operations as a going concern. We do

not, however, have a history of operating profitably. Consequently, our independent accountants in their audit report have expressed substantial

doubt about our ability to continue as a going concern. Our continued operations are highly dependent upon our ability to increase revenues,

decrease operating costs, and complete equity and/or debt financings. Such financings may not be available or may not be available on

reasonable terms. Our financial statements do not include any adjustments that may result from the outcome of this uncertainty. We estimate

that we will not be able to continue as a going concern after December 31, 2024 unless we are able to secure capital from one of these

sources of financing. If we are unable to secure such financing, we may cease operations and investors in our common stock could lose

all of their investment.

We have not voluntarily

implemented various corporate governance measures, in the absence of which, shareholders may have more limited protections against interested

director transactions, conflicts of interest and similar matters.

Federal legislation, including

the Sarbanes-Oxley Act of 2002, has resulted in the adoption of various corporate governance measures designed to promote the integrity

of the corporate management and the securities markets. Some of these measures have been adopted in response to legal requirements. Others

have been adopted by companies in response to the requirements of national securities exchanges, such as the NYSE or the Nasdaq Stock

Market, on which their securities are listed. Among the corporate governance measures that are required under the rules of national securities

exchanges are those that address board of directors’ independence, and audit committee oversight. We have not yet adopted any of these

corporate governance measures and, since our securities are not yet listed on a national securities exchange, we are not required to do

so. It is possible that if we were to adopt some or all of these corporate governance measures, stockholders would benefit from somewhat

greater assurances that internal corporate decisions were being made by disinterested directors and that policies had been implemented

to define responsible conduct. Prospective investors should bear in mind our current lack of corporate governance measures in formulating

their investment decisions.

As a smaller public

company, our costs of complying with SEC reporting rules are disproportionately high relative to other larger companies.

The Marquie Group, Inc. is

considered a “reporting issuer” under the Securities Exchange Act of 1934, as amended. Therefore, we incur certain costs of

compliance with applicable SEC reporting rules and regulations including, but not limited to attorney’s fees, accounting and auditing

fees, other professional fees, financial printing costs and Sarbanes-Oxley compliance costs in an amount estimated at approximately $200,000

per year. In proportion to our operations, these costs are far more significant than our publicly-traded competitors. Unless we are able

to reduce these costs or increase our operating revenues, our costs to remain a reporting issuer will limit our ability to use our cash

resources for other more productive uses that could provide returns to our shareholders.

We are highly dependent

upon a few key contracts, the termination of which would have a material adverse effect on our business and financial condition.

Although we intend to grow

The Marquie Group, Inc. to become a larger health and beauty product, and broadcasting company, at present we have a small customer base

and are highly dependent upon a few key customers. We are therefore highly dependent upon repeat orders from our existing customers while

we generate sales to new customers. The loss of any of these customers until we have added new customers, would have a material adverse

effect on our business and financial condition.

We do not presently

have a traditional credit facility with a financial institution. This absence may adversely affect our operations.

To expand our business, we

require access to capital and credit. We do not presently have a traditional credit facility with a financial institution. The absence

of a traditional credit facility with a financial institution could adversely impact our operations. If we are unable to access lines

of credit, we may be unable to produce health and beauty products to certain customers who would otherwise be willing to enter into purchase

contracts with us. The loss of potential and existing customers because of an inability to finance the purchase of products and services

would have a material adverse effect on our financial condition and results of operations.

Non-performance

of suppliers on their sale commitments and customers on their purchase commitments could disrupt our business.

We enter into sales and purchase

orders with customers and suppliers for products and services at fixed prices. To the extent either a customer or supplier fails to perform

on their commitment, we may be required to sell or purchase other available products and services at prevailing market prices, which could

be significantly different than the fixed price within the sale and purchase order and therefore significant differences in these prices

could cause losses that would have a material adverse effect on our business, financial condition, results of operations and cash flows.

If we are unable to

retain our sales staff, our business and results of operations could be harmed.

Our ability to compete with

other health, beauty and broadcasting companies, and develop our business is largely dependent on the services of Marc Angell, our Chief

Executive Officer, and certain other third-party consultants and suppliers which assist him in securing sales of certain products and

services. If we are unable to retain Mr. Angell’s services and to attract other qualified senior management and key personnel on

terms satisfactory to us, our business will be adversely affected. We do not have key man life insurance covering the life of Mr. Angell

and, even if we are able to afford such a key man policy, our coverage levels may not be sufficient to offset any losses we may suffer

as a result of Mr. Angell’s death, disability, or other inability to perform services for us.

We may acquire businesses

and enter into joint ventures that will expose us to increased operating risks.

As part of our growth strategy,

we intend to acquire other health, beauty companies and other related service businesses in broadcasting. We cannot provide any assurance

that we will find attractive acquisition candidates in the future, that we will be able to acquire such candidates on economically acceptable

terms or that we will be able to finance acquisitions on economically acceptable terms. Even if we are able to acquire new businesses

in the future, they could result in the incurrence of substantial additional indebtedness and other expenses or potentially dilutive issuances

of equity securities and may affect the market price of our common stock or restrict our operations. We have also entered into joint venture

arrangements intended to complement or expand our business and will likely continue to do so in the future. These joint ventures are subject

to substantial risks and liabilities associated with their operations, as well as the risk that our relationships with our joint venture

partners do not succeed in the manner that we anticipate.

We face intense competition

and, if we are not able to effectively compete in our markets, our revenues may decrease.

Competitive pressures in our

markets could adversely affect our competitive position, leading to a possible loss of customers or a decrease in sales, either of which

could result in decreased revenues and profits. Our competitors are numerous, ranging from large multinational corporations, which have

significantly greater capital resources than us, to relatively small and specialized firms. Our business could be adversely affected because

of increased competition from these companies, who may choose to increase their direct marketing or provide less advantageous price and

credit terms to us than to our competitors.

Current and future litigation

could adversely affect us.

Though we are currently not

involved in any legal proceedings, from time to time we are involved in legal proceedings in our ordinary course of business. Lawsuits

and other legal proceedings can involve substantial costs, including the costs associated with investigation, litigation and possible

settlement, judgment, penalty or fine. As a smaller company, the collective costs of litigation proceedings can represent a drain on our

cash resources, as well as an inordinate amount of our management’s time and addition. Moreover, an adverse ruling in respect of

certain litigation could have a material adverse effect on our results of operation and financial condition.

We have limited the

liability of our board of directors and management.

We have adopted provisions

in our Articles of Incorporation which limit the liability of our directors and officers and have also adopted provisions in our bylaws

which provide for indemnification by the Company of our officers and directors to the fullest extent permitted by Florida corporate law.

Our articles of incorporation generally provides that our directors shall have no personal liability to the Company or its stockholders

for monetary damages for breaches of their fiduciary duties as directors, except for breaches of their duties of loyalty, acts or omissions

not in good faith or which involve intentional misconduct or knowing violation of law, acts involving unlawful payment of dividends or

unlawful stock purchases or redemptions, or any transaction from which a director derives an improper personal benefit. Such provisions

substantially limit our shareholders’ ability to hold directors liable for breaches of fiduciary duty.

In addition to provisions

in our Articles of Incorporation and Bylaws, we have also entered into indemnification agreements with our directors and officers that

provide a right of indemnification to the fullest extent permissible under Florida law. These charter, Bylaw, and contractual provisions

may limit our shareholders’ ability to hold our directors and officers accountable for breaches of their duties, or otherwise discourage

shareholders from enforcing their rights, either directly or derivatively, against our directors or officers.

Risks Relating To This Offering and Our Common

Stock

If the selling shareholder

sells a large number of shares all at once or in blocks, the market price of our shares would most likely decline.

The Selling Shareholder is

offering up to 5,000,000,000 shares of our common stock through this prospectus. Should the Selling Stockholder decide to sell our shares

at a price below the current market price at which they are quoted, such sales will cause that market price to decline. Moreover, we believe

that the offer or sale of a large number of shares at any price may cause the market price to fall. A steep decline in the price of our

common stock would adversely affect our ability to raise additional equity capital, and even if we were successful in raising such capital,

the terms of such raise may be substantially dilutive to current shareholders.

The sale of our common

stock under a separate Equity Financing Agreement may cause dilution, and the sale of the shares of common stock, or the perception that

such sales may occur, could cause the price of our common stock to fall.

On October 12, 2022, we entered

into an Equity Financing Agreement with another shareholder. Pursuant to the Equity Financing Agreement, said shareholder has committed

to purchase up to $5 million of our common stock. The per share purchase price for the shares that we may sell under the Equity Financing

Agreement will fluctuate based on the price of our common stock and will be equal to 90% of the average of the two (2) lowest volume weighted

average prices of the Company’s Common Stock on OTC Pink during the five (5) Trading Days immediately following the Clearing Date.

Depending on market liquidity at the time, sales of such shares may cause the trading price of our common stock to fall.

The market price of

our common stock may fluctuate significantly.

The market price and marketability

of shares of our common stock may be affected significantly by numerous factors, including some over which we have no control, and which

may not be directly related to us. These factors include the following:

| |

· |

The lack of trading volume in our shares; |

| |

|

|

| |

· |

Price and volume fluctuations in the stock market from time to time, which often are unrelated to our operating performance; |

| |

|

|

| |

· |

Variations in our operating results; |

| |

|

|

| |

· |

Any shortfall in revenue or any increase in losses from expected levels; |

| |

|

|

| |

· |

Announcements of new initiatives, joint ventures, or commercial arrangements; and |

| |

|

|

| |

· |

General economic trends and other external factors. |

| |

|

|

| |

· |

If the trading price of our common stock falls significantly following completion of this offering, this may cause some of our shareholders to sell our shares, which would further adversely affect the trading market for, and liquidity of, our common stock. If we seek to raise capital through future equity financings, this volatility may adversely affect our ability to raise such equity capital |

Our common stock is

subject to the “penny stock” rules of the SEC and the trading market in our securities is limited, which makes transactions

in our stock cumbersome and may reduce the value of an investment in our stock.

Under U.S. federal securities

legislation, our common stock will constitute “penny stock”. A penny stock is any equity security that has a market price

of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require

that a broker or dealer approve a potential investor’s account for transactions in penny stocks, and the broker or dealer receive

from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

In order to approve an investor’s account for transactions in penny stocks, the broker or dealer must obtain financial information

and investment experience objectives of the person and make a reasonable determination that the transactions in penny stocks are suitable

for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions

in penny stocks. The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prepared by

the SEC relating to the penny stock market, which, in highlight form sets forth the basis on which the broker or dealer made the suitability

determination. Brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This

may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock. Disclosure

also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions

payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies

available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent

price information for the penny stock held in the account and information on the limited market in penny stocks.

Because we do not intend

to pay any cash dividends on our common stock, our stockholders will not be able to receive a return on their shares unless they sell

them.

We have never paid a dividend,

and we intend to retain any future earnings to finance the development and expansion of our business. Consequently, we do not anticipate

paying any cash dividends on our common stock in the foreseeable future. Unless we pay dividends, our stockholders will not be able to

receive a return on their shares unless they sell them. We cannot assure you that stockholders will be able to sell shares when desired.

PLAN OF DISTRIBUTION

As of the date of this prospectus,

our shares of common stock are quoted via OTC Markets. The Selling Stockholder may, from time to time, sell any or all of their shares

of common stock on any stock exchange, market or trading facility on which the shares are traded or quoted or in private transactions.

These sales may be at fixed or negotiated prices.

The Selling Stockholder may use any one or more

of the following methods when selling shares:

| |

· |

ordinary brokerage transactions and transactions in which the broker-dealer solicits investors; |

| |

|

|

| |

· |

block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| |

|

|

| |

· |

purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

|

|

| |

· |

an exchange distribution in accordance with the rules of the applicable exchange; |

| |

|

|

| |

· |

privately negotiated transactions; |

| |

|

|

| |

· |

to cover short sales made after the date that this registration statement is declared effective by the SEC; |

| |

|

|

| |

· |

broker-dealers may agree with the Selling Stockholder to sell a specified number of such shares at a stipulated price per share; |

| |

|

|

| |

· |

a combination of any such methods of sale; and |

| |

|

|

| |

· |

any other method permitted pursuant to applicable law. |

The Selling Stockholder may

also sell shares under Rule 144 under the Securities Act, if available, rather than under this prospectus.

Broker-dealers engaged by

the Selling Stockholder may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts

from the Selling Stockholder (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be

negotiated. The Selling Stockholder do not expect these commissions and discounts to exceed what is customary in the types of transactions

involved.

The Selling Stockholder and

any broker-dealers or agents that are involved in selling the shares are “underwriters” within the meaning of the Securities

Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale

of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act.

We have advised the Selling

Stockholder that it may not use shares registered on this registration statement to cover short sales of common stock made prior to the

date on which this registration statement shall have been declared effective by the SEC. If a Selling Stockholder uses this prospectus

for any sale of the common stock, it will be subject to the prospectus delivery requirements of the Securities Act. The Selling Stockholder

will be responsible to comply with the applicable provisions of the Securities Act and Exchange Act, and the rules and regulations thereunder

promulgated, including, without limitation, Regulation M, as applicable to the Selling Stockholder in connection with resales of its shares

under this registration statement.

Penny Stock Rules

The SEC has also adopted rules

that regulate broker-dealer practices in connection with transactions in “penny stocks” as such term is defined by Rule 15g-9.

Penny stocks are generally equity securities with a price of less than $5.00 (other than securities registered on certain national securities

exchanges or quoted on the Nasdaq system provided that current price and volume information with respect to transactions in such securities

is provided by the exchange or system).

The shares offered by this

prospectus constitute penny stocks under the Exchange Act. The shares may remain penny stocks for the foreseeable future. The classification

of our shares as penny stocks makes it more difficult for a broker-dealer to sell the stock into a secondary market, which makes it more

difficult for a purchaser to liquidate his or her investment. Any broker-dealer engaged by the purchaser for the purpose of selling his

or her shares in The Marquie Group, Inc. will be subject to the penny stock rules.

The penny stock rules require

a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, deliver a standardized risk disclosure

document approved by the SEC, which: (i) contains a description of the nature and level of risk in the market for penny stocks in both

public offerings and secondary trading; (ii) contains a description of the broker’s or dealer’s duties to the customer and

of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of the Securities

Act; (iii) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and significance

of the spread between the bid and ask price; (iv) contains a toll-free telephone number for inquiries on disciplinary actions; (v) defines

significant terms in the disclosure document or in the conduct of trading in penny stocks; and (vi) contains such other information and

is in such form as the SEC shall require by rule or regulation. The broker-dealer also must provide to the customer, prior to effecting

any transaction in a penny stock, (i) bid and offer quotations for the penny stock; (ii) the compensation of the broker-dealer and its

salesperson in the transaction; (iii) the number of shares to which such bid and ask prices apply, or other comparable information relating

to the depth and liquidity of the market for such stock; and (iv) monthly account statements showing the market value of each penny stock

held in the customer’s account.

In addition, the penny stock

rules require that, prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special

written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment

of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy

of a written suitability statement. These disclosure requirements will have the effect of reducing the trading activity in the secondary

market for our stock because it will be subject to these penny stock rules. Therefore, stockholders may have difficulty selling those

securities.

Regulation M

During such time as we may

be engaged in a distribution of any of the shares, we are registering by this registration statement, we are required to comply with Regulation

M of the Securities Exchange Act of 1934. In general, Regulation M precludes any selling security holder, any affiliated purchasers and

any broker-dealer or other person who participates in a distribution from bidding for or purchasing or attempting to induce any person

to bid for or purchase, any security which is the subject of the distribution until the entire distribution is complete. Regulation M

defines a “distribution” as an offering of securities that is distinguished from ordinary trading activities by the magnitude

of the offering and the presence of special selling efforts and selling methods. Regulation M also defines a “distribution participant”

as an underwriter, prospective underwriter, broker, dealer, or other person who has agreed to participate or who is participating in a

distribution.

Regulation M prohibits, with

certain exceptions, participants in a distribution from bidding for or purchasing, for an account in which the participant has a beneficial

interest, any of the securities that are the subject of the distribution. Regulation M also governs bids and purchases made in order to

stabilize the price of a security in connection with a distribution of the security. We have informed the Selling Stockholder that the

anti-manipulation provisions of Regulation M may apply to the sales of their shares offered by this prospectus, and we have also advised

the Selling Stockholder of the requirements for delivery of this prospectus in connection with any sales of the common stock offered by

this prospectus.

USE OF PROCEEDS

This prospectus relates to

shares of our common stock that may be offered and sold from time to time by the Selling Stockholder. We will not receive any proceeds

upon the sale of shares by the Selling Stockholder in this offering. See “Plan of Distribution” elsewhere in this prospectus

for more information.

DETERMINATION OF THE OFFERING PRICE

The Selling Stockholder will

determine at what price it may sell the offered shares, and such sales may be made at prevailing market prices or at privately negotiated

prices.

SELLING STOCKHOLDERS

The following table sets forth

the shares beneficially owned, as of the date of this prospectus, by the Selling Stockholder prior to the offering contemplated by this

prospectus, the number of shares the Selling Stockholder is offering by this prospectus and the number of shares it would own beneficially

if all such offered shares are sold.

Beneficial ownership is determined

in accordance with rules of attribution as promulgated by the SEC. Under these rules, a person is deemed to be a beneficial owner of a

security if that person has or shares voting power, which includes the power to vote or direct the voting of the security, or investment

power, which includes the power to vote or direct the voting of the security. The person is also deemed to be a beneficial owner of any

security of which that person has a right to acquire beneficial ownership within 60 days. Under SEC rules, more than one person may be

deemed to be a beneficial owner of the same securities, and a person may be deemed to be a beneficial owner of securities as to which

he or she may not have any pecuniary beneficial interest. Except as noted below, each person has sole voting and investment power.

The percentages below are

calculated based on 3,888,065,460 shares of our common stock issued and outstanding as of the date of this prospectus.

| Selling Stockholder | |

Number of Shares Beneficially Owned Before this Offering(1)(2)(3) | |

Maximum Number of Shares to be Sold Pursuant to this Prospectus | |

Number Of Shares Beneficially Owned After this Offering(4) | |

Percentage of Outstanding Shares Beneficially Owned After this Offering |

| Quick Capital LLC (5) | |

| -0- | | |

| 5,000,000,000 | | |

| -0- | | |

| -0- | |

| (1) |

Under applicable SEC rules, a person is deemed

to beneficially own securities which the person has the right to acquire within 60 days through the exercise of any option or warrant

or through the conversion of a convertible security. Also under applicable SEC rules, a person is deemed to be the “beneficial owner”

of a security with regard to which the person directly or indirectly, has or shares (a) voting power, which includes the power to vote

or direct the voting of the security, or (b) investment power, which includes the power to dispose, or direct the disposition, of the

security, in each case, irrespective of the person’s economic interest in the security. Each listed selling stockholder has the

sole investment and voting power with respect to all shares of Common Stock shown as beneficially owned by such selling stockholder, except

as otherwise indicated in these footnotes.

|

| |

|

| (2) |

Beneficial ownership of shares of common stock that could be obtained pursuant to convertible notes is calculated as the original principal balance of the note divided by the conversion price. |

| |

|

| (3) |

Beneficial ownership is limited by conversion

and exercise limitations in the convertible notes and warrants, respectively, issued to Quick Capital, LLC to 4.99% of the number of shares

of our Common Stock issued and outstanding on the date of any given conversion or exercise.

|

| |

|

| (4) |

Represents the amount and percentage of shares

in the event all of the registered securities are sold during the offering.

|

| |

|

| (5) |

Eilon Natan, manager of Quick Capital, LLC, has sole voting and dispositive power over the shares held by or issuable to Quick Capital, LLC. Mr. Natan disclaims beneficial ownership over the securities listed except to the extent of his pecuniary interest therein. The principal business address of Quick Capital, LLC is 66 West Flagler Street, Suite 900 - #2292, Miami, FL 33130. Quick Capital, LLC is not a broker-dealer or affiliate of a broker-dealer. |

Except for the agreements

discussed in the Prospectus Summary beginning on page 2, and other documents ancillary thereto, and the shares as described in this prospectus,

there is no prior or existing material relationship between us or any of our directors, executive officers, or control persons and the

Selling Stockholder.

MARKET PRICE OF AND DIVIDENDS ON OUR COMMON

EQUITY

AND

RELATED STOCKHOLDER MATTERS

Our common stock is listed

on the OTC Pink under the symbol “TMGI”. We had approximately 2,262 registered holders of our common stock as of the filing

of this prospectus. Registered holders do not include those stockholders whose stock has been issued in street name. The price for our

common stock as of the date of this prospectus was $0.0001 per share.

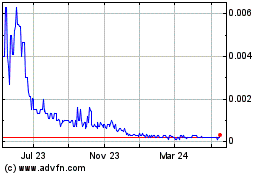

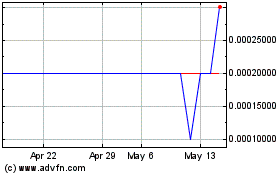

The following table reflects

the high and low closing sales prices per share of our common stock during each calendar quarter as reported on the OTC Pink, during the

two previous years.

| | |

Price Range(1) |

| | |

High | |

Low |

| FYE quarter August 31, 2025 | |

| |

|

| First quarter | |

$ | 0.0001 | | |

$ | 0.0001 | |

| | |

| | | |

| | |

| FYE ended May 31, 2024 | |

| | | |

| | |

| Fourth quarter | |

$ | 0.0001 | | |

$ | 0.0001 | |

| Third quarter | |

$ | 0.0001 | | |

$ | 0.0001 | |

| Second quarter | |

$ | 0.0002 | | |

$ | 0.0001 | |

| First quarter | |

$ | 0.0003 | | |

$ | 0.0001 | |

| | |

| | | |

| | |

| FYE ended May 31, 2023 | |

| | | |

| | |

| Fourth quarter | |

$ | 0.0072 | | |

$ | 0.0022 | |

| Third quarter | |

$ | 0.0093 | | |

$ | 0.001 | |

| Second quarter | |

$ | 0.009 | | |

$ | 0.0032 | |

| First quarter | |

$ | 0.10 | | |

$ | 0.001 | |

| (1) |

The above quotations reflect inter-dealer prices, without retail mark-up, mark-down, or commission and may not necessarily represent actual transactions. |

Dividends and Distributions

We have not paid any cash

dividends on our common stock since inception and do not anticipate paying cash dividends in the foreseeable future. We expect that that

any future earnings will be retained for use in developing and/or expanding our business.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward-Looking Statements

This report contains forward-looking

statements that involve risks and uncertainties. We use words such as anticipate, believe, plan, expect, future, intend and similar expressions

to identify such forward-looking statements. You should not place too much reliance on these forward-looking statements. Our actual results

are likely to differ materially from those anticipated in these forward-looking statements for many reasons.

Results of Operations

Following is management’s

discussion of the relevant items affecting results of operations for the years ended May 31, 2024, and May 31, 2023.

Revenues. The Company

generated no revenues for Broadcasting during the years ended May 31, 2024 and 2023. Broadcast radio revenues are primarily generated

by pay per call spot sales from various advertisers represented by the advertising agency, MSH Marketing. However, MSH went out of business

in 2023, and we are currently reviewing new opportunities for a spot sales agency. Through barter arrangements with our terrestrial radio

station affiliates, Music of Your Life owns three minutes per hour to sell goods and services on these stations. Revenue for Health and

Beauty will be included in future operations.

Cost of Sales. Our

cost of sales for Broadcasting was $-0- for both years ended May 31, 2024 and 2023. Our cost of sales in the future will consist principally

of licensing costs and royalties associated with our syndicated radio network, other related services provided directly or outsourced

through our affiliates, as well as operational and staffing costs with respect thereto. Our Cost of Sales for Health and Beauty will be

included in future operations.

Salaries and Consulting

Expenses. Salaries remain unpaid and accruing for the years ending May 31, 2024 and 2023. Salaries and consulting expenses for the

year ended May 31, 2024 were $407,905 as compared to $240,000 for the year ended May 31, 2023. The increase during the year ended May

31, 2024 was mostly the result of additional expenses of $128,205 related to investor relations. The company also issued 185,000,000 shares

valued at $39,700 for consulting services rendered to the Company. We expect that salaries and consulting expenses, that are cash-based

instead of share-based, will increase as we add personnel to build our multi-media entertainment business and expand our offering of health

and beauty products.

Professional Fees. Professional

fees for the year ended May 31, 2024 were $101,970 as compared to $85,190 for the year ended May 31, 2023. Professional fees consist mainly

of the fees related to the audits and reviews of the Company’s financial statements as well as the filings with the Securities and

Exchange Commission. We anticipate that professional fees will increase in future periods as we scale up our operations.

Selling, General and Administrative

Expenses.

Other selling, general and

administrative expenses were $39,598 for the year ended May 31, 2024 as compared to $31,280 for the year ended May 31, 2023. We anticipate

that Other SG&A expenses will increase commensurate with an increase in our operations.

Other Income (Expense).

The Company had net other income of $384,017 for the year ended May 31, 2024. For the year ended May 31, 2024, the company incurred

interest expense of $521,923 and recorded income from derivative liability of $905,940. The Company had net other income of $1,536,629

for the year ended May 31, 2023. For the year ended May 31, 2023, the company incurred interest expense of $375,008 and recorded income

from derivative liability of $1,911,637.

Liquidity and Capital Resources

As of May 31, 2024, our primary

source of liquidity consisted of $1,250 in cash and cash equivalents. We hold most of our cash reserves in local checking accounts with

local financial institutions. Since inception, we have financed our operations through a combination of short and long-term loans, and

through the private placement of our common stock

We have sustained significant

net losses which have resulted in an accumulated deficit at May 31, 2024 of $14,863,486 and are currently experiencing a substantial shortfall

in operating capital which raises doubt about our ability to continue as a going concern. We generated a net loss for the year ended May

31, 2024 of $165,456. Without additional revenues, working capital loans, or equity investment, there is substantial doubt as to our ability

to continue operations.

We believe these conditions

have resulted from the inherent risks associated with small public companies. Such risks include, but are not limited to, the ability

to (i) generate revenues and sales of our products and services at levels sufficient to cover our costs and provide a return for investors,

(ii) attract additional capital in order to finance growth, and (iii) successfully compete with other comparable companies having financial,

production and marketing resources significantly greater than those of the Company, and (iv) increasing costs associated with maintaining

public company reporting requirements.

We believe that our capital

resources are insufficient for ongoing operations, with minimal current cash reserves, particularly given the resources necessary to expand

our multi-media entertainment business. We will likely require considerable amounts of financing to make any significant advancement in

our business strategy. Other than the agreement discussed below, there is presently no agreement in place that will guarantee financing

for our Company, and we cannot assure you that we will be able to raise any additional funds, or that such funds will be available on

acceptable terms. Funds raised through future equity financing will likely be substantially dilutive to current shareholders. Lack of

additional funds will materially affect our Company and our business, and may cause us to substantially curtail or even cease operations.

Consequently, you could incur a loss of your entire investment in the Company.

Off-Balance Sheet Arrangements

We do not have any off-balance

sheet arrangements.

Critical Accounting Policies

We believe the following more

critical accounting policies are used in the preparation of our financial statements:

Use of Estimates. The

preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires

management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual

results could differ from those estimates. On a periodic basis, management reviews those estimates, including those related to valuation

allowances, loss contingencies, income taxes, and projection of future cash flows.

Research and Development.

Research and development costs are charged to operations when incurred and are included in operating expenses.

Recent Accounting Pronouncements

There were various accounting

standards and interpretations recently issued, none of which are expected to have a material impact on the Company’s consolidated financial

position, operations, or cash flows.

MANAGEMENT’S PLAN TO CONTINUE AS A GOING

CONCERN

In order to continue as a

going concern, the Company will need, among other things, additional capital resources. Management’s plans to obtain such resources

for the Company include (1) obtaining capital from the sale of its securities, and (2) short-term borrowings from shareholders or related

party when needed. However, management cannot provide any assurance that the Company will be successful in accomplishing any of its plans.

The ability of the Company

to continue as a going concern is dependent upon its ability to successfully accomplish the plans described in the preceding paragraph

and eventually secure other sources of financing and attain profitable operations.

Our independent registered

public accounting firm’s report contains an explanatory paragraph which has expressed substantial doubt about our ability to continue

as a going concern, which may hinder our ability to obtain future financing.

Forward-Looking Statements

This report contains or incorporates

by reference forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 concerning

our future business plans and strategies, the receipt of working capital, future revenues and other statements that are not historical

in nature. In this report, forward-looking statements are often identified by the words “anticipate,” “plan,”

“believe,” “expect,” “estimate,” and the like. These forward-looking statements reflect our current

beliefs, expectations and opinions with respect to future events, and involve future risks and uncertainties which could cause actual

results to differ materially from those expressed or implied.

Other uncertainties that could affect the accuracy

of forward-looking statements include:

| |

· |

the worldwide economic situation; |

| |

|

|

| |

· |

any changes in interest rates or inflation; |

| |

|

|

| |

· |

the willingness and ability of third parties to honor their contractual commitments; |

| |

|

|

| |

· |

our ability to raise additional capital, as it may be affected by current conditions in the stock market and competition for risk capital; |

| |

|

|

| |

· |

our capital expenditures, as they may be affected by delays or cost overruns; |

| |

|

|

| |

· |

environmental and other regulations, as the same presently exist or may later be amended; |

| |

|

|

| |

· |

our ability to identify, finance and integrate any future acquisitions; and |

| |

|

|

| |

· |

the volatility of our common stock price. |

This list is not exhaustive

of the factors that may affect any of our forward-looking statements. You should read this report completely and with the understanding

that our actual future results may be materially different from what we expect. These forward-looking statements represent our beliefs,