UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q/A

(Mark One)

Quarterly report under Section 13 or 15(d) of the Securities Exchange

Act of 1934

For the quarterly period ended June 30, 2009

Transition report under Section 13 or 15(d) of the Exchange Act

Commission file number: 0-32749

TRIMAX CORPORATION

(Exact name of small business issuer as specified in its charter)

Nevada

76-0616468

(State of incorporation) (I.R.S. Employer Identification No.)

375 University Avenue, #800

Toronto, Ontario, M5G 2J5

(Address of principal executive offices)

|

|

|

|

|

|

|

|

|

|

416-907-5785

|

|

|

|

(Issuer’s telephone number)

|

(Issuer’s website)

|

Check whether the issuer (1)filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2)has been subject to such filing requirements for the past 90 days.

Yes X No

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes No X

1

State the number of shares outstanding of each of the issuer's classes of common equity, as of the latest practicable date: 7,250,725 shares of common stock as of September 6, 2009.

Transitional Small Business Disclosure Format (check one):

Yes No X

TABLE OF CONTENTS

PART I - FINANCIAL INFORMATION

3

Item 1. Financial Statements

4

Item 2. Management's Discussion and Analysis

14

Item 3. Controls and Procedures

18

PART II - OTHER INFORMATION

19

Item 1. Legal Proceedings

19

Item 2. Unregistered Sales of Equity Securities, Use of Proceeds

19

Item 3. Defaults Upon Senior Securities

19

Item 4. Submission of Matters to a Vote of Security Holders

19

Item 5. Other Information

19

Item 6. Exhibits

20

Form 10-Q AMENDMENT

The Form 10-Q for the nine months ended June 30, 2009 and filed September 4, 2009 was riddled with errors, was filed without approval of the board of directors, and was filed without review by the Company’s auditors. The parties filing the September 4, 2009 10-Q were unauthorized to do so and neither act for, nor represent, the Company. The Company is reviewing with its lawyers the irresponsible action of filing the September 4, 2009 10-Q and is considering legal action against the responsible party(s).

2

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

The unaudited financial statements for the quarter ended June 30, 2009 are incorporated herein by reference.

The unaudited financial statements have been prepared by management in accordance with accounting principles generally accepted in the US for interim financial information and within the instructions to Form 10-Q. Accordingly, they do not include all of the information and footnotes required by generally accepted accounting principles for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation have been included. Operating results for the three months and nine months ended June 30, 2009 and for the period August 25, 2000 (inception) to June 30, 2009 are not necessarily indicative of the results that may be expected for the year ended September 30, 2009. For further information, refer to the consolidated financial statements and footnotes thereto included in the Company’s annual report on Form 10-K for the year ended September 30, 2008.

3

|

|

|

|

|

|

|

|

|

|

|

|

TRIMAX CORPORATION

|

|

(An Exploration Stage Company)

|

|

BALANCE SHEETS

|

|

(Expressed in United States Dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30,

|

|

September 30,

|

|

|

|

|

|

|

2009

|

|

2008

|

|

|

|

|

|

|

|

(Unaudited)

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT ASSET

|

|

|

|

|

|

|

|

Cash

|

|

|

$

|

-

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL CURRENT ASSETS

|

|

|

|

-

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

|

|

$

|

-

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' (DEFICIT)

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES

|

|

|

|

|

|

|

|

|

|

Bank indebtedness

|

|

|

$

|

-

|

|

$

|

121

|

|

|

Accounts payable and accrued liabilities

|

|

|

|

201,691

|

|

|

351,077

|

|

|

Notes payable to related parties

|

|

|

|

261,017

|

|

|

172,792

|

|

|

Other loans and advances payable

|

|

|

|

310,186

|

|

|

114,267

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL CURRENT LIABILITIES

|

|

|

|

772,894

|

|

|

638,257

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES

|

|

|

|

772,894

|

|

|

638,257

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY (DEFICIT)

|

|

|

|

|

|

|

|

|

|

Preferred stock, 20,000,000 authorized

|

|

|

|

|

|

|

|

|

|

with a par value of $0.001 per share, no shares

|

|

|

|

|

|

|

|

|

outstanding

|

|

|

|

-

|

|

|

-

|

|

|

Common stock; $0.001 par value;

|

|

|

|

|

|

|

|

|

|

100,000,000 shares authorized, 7,250,725

|

|

|

|

|

|

|

|

|

|

and 5,853,898 issued and outstanding,

|

|

|

|

|

|

|

|

|

|

respectively

|

|

|

|

7,251

|

|

|

5,854

|

|

|

Additional paid-in capital

|

|

|

|

15,910,960

|

|

|

15,893,195

|

|

|

Accumulated other comprehensive income

|

|

|

|

-

|

|

|

20,620

|

|

|

Deficit accumulated during the development stage

|

|

(16,691,105)

|

|

|

(16,557,926)

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL STOCKHOLDERS' EQUITY (DEFICIT)

|

|

|

|

(772,894)

|

|

|

(638,257)

|

|

TOTAL LIABILITIES AND

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY (DEFICIT)

|

|

|

$

|

-

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these financial statements.

|

|

|

4

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TRIMAX CORPORATION

|

|

(An Exploration Stage Company)

|

|

STATEMENTS OF OPERATIONS

|

|

(Expressed in United States Dollars)

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From Inception

|

|

|

|

|

|

|

|

|

|

|

On August 25,

|

|

|

For the Three Months Ended

|

For the Nine Months Ended

|

2000 Through

|

|

|

June 30,

|

|

|

June 30,

|

|

June 30,

|

|

|

2009

|

|

2008

|

|

2009

|

|

2008

|

|

2009

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REVENUES

|

$

|

-

|

|

$

|

-

|

|

$

|

-

|

|

$

|

-

|

|

$

|

-

|

|

COST OF SALES

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

GROSS PROFIT

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative

|

|

55,515

|

|

|

-

|

|

|

55,515

|

|

|

-

|

|

|

55,515

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL OPERATING EXPENSES

|

|

55,515

|

|

|

-

|

|

|

55,515

|

|

|

-

|

|

|

55,515

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS FROM CONTINUING OPERATIONS

|

|

(55,515)

|

|

|

-

|

|

|

(55,515)

|

|

|

-

|

|

|

(55,515)

|

|

DISCONTINUED OPERATIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain of disposal of discontinued operations

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

283,191

|

|

Loss from discontinued operations

|

|

-

|

|

|

(47,206)

|

|

|

(77,664)

|

|

|

(400,287)

|

|

|

(16,918,781)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOSS BEFORE INCOME TAX

|

|

(55,515)

|

|

|

(47,206)

|

|

|

(133,179)

|

|

|

(400,287)

|

|

|

(16,691,105)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME TAX

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS

|

$

|

(55,515)

|

|

$

|

(47,206)

|

|

$

|

(133,179)

|

|

$

|

(400,287)

|

|

$

|

(16,691,105)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOREIGN CURRENCY TRANSLATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTMENT

|

|

-

|

|

|

(6,784)

|

|

|

(20,620)

|

|

|

2,041

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMPREHENSIVE INCOME (LOSS)

|

$

|

(55,515)

|

|

$

|

(53,990)

|

|

$

|

(153,799)

|

|

$

|

(398,246)

|

|

$

|

(16,691,105)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS PER COMMON SHARE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Basic and diluted)

|

$

|

(0.01)

|

|

$

|

(0.01)

|

|

$

|

(0.02)

|

|

$

|

(0.10)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE COMMON SHARES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OUTSTANDING

|

|

6,852,483

|

|

|

5,433,985

|

|

|

6,841,564

|

|

|

3,952,777

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an intregal part of these financial statements

|

|

|

5

|

|

|

|

|

|

|

|

|

|

|

TRIMAX CORPORATION

|

|

(An Exploration Stage Company)

|

|

STATEMENTS OF CASH FLOWS

|

|

(Expressed in United States Dollars)

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From Inception

|

|

|

|

|

|

|

|

|

August 25,

|

|

|

For the Nine Months Ended

|

|

2000 through

|

|

|

June 30,

|

|

June 30,

|

|

|

2009

|

|

2008

|

|

2009

|

|

|

|

|

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

$

|

(133,179)

|

|

$

|

(400,287)

|

|

$

|

(16,691,105)

|

|

Adjustments to reconcile net loss to

|

|

|

|

|

|

|

|

|

|

net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation of tangible and intangible assets

|

|

-

|

|

|

4,568

|

|

|

219,946

|

|

Gain on disposal of subsidiary

|

|

-

|

|

|

-

|

|

|

(283,191)

|

|

Losses on write off and impairment of investments

|

|

-

|

|

|

-

|

|

|

198,768

|

|

Cancellation of common stock

|

|

-

|

|

|

-

|

|

|

(16,000)

|

|

Stock compensation expense - warrants

|

|

-

|

|

|

-

|

|

|

87,940

|

|

Common stock issued in settlement of legal claim

|

|

-

|

|

|

-

|

|

|

59,408

|

|

Accretion of beneficial conversion feature

|

|

-

|

|

|

-

|

|

|

436,239

|

|

Common stock issued for services

|

|

-

|

|

|

67,200

|

|

|

11,961,237

|

|

Write off of directors compensation

|

|

-

|

|

|

-

|

|

|

(311,355)

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities

|

|

(130,345)

|

|

|

209,335

|

|

|

1,772,633

|

|

NET CASH (USED IN) PROVIDED BY

|

|

|

|

|

|

|

|

|

|

OPERATING ACTIVITIES

|

|

(263,524)

|

|

|

(119,184)

|

|

|

(2,565,480)

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Advances to Multi-Source Inc.

|

|

-

|

|

|

-

|

|

|

(226,680)

|

|

Deposits on acquisitions

|

|

|

|

|

(13,387)

|

|

|

(299,380)

|

|

Acquisition of equipment

|

|

-

|

|

|

-

|

|

|

(58,190)

|

|

CASH FLOWS (USED IN)

|

|

|

|

|

|

|

|

|

|

INVESTING ACTIVITIES

|

|

-

|

|

|

(13,387)

|

|

|

(584,250)

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from long term debt

|

|

|

|

|

-

|

|

|

165,356

|

|

Advances from related parties

|

|

88,225

|

|

|

|

|

|

825,564

|

|

(Repayment) to related parties

|

|

-

|

|

|

169,598

|

|

|

(126,100)

|

|

Other loans and advances

|

|

195,919

|

|

|

(51,211)

|

|

|

1,206,371

|

|

Proceeds from the issuance of common stock

|

|

-

|

|

|

-

|

|

|

1,133,049

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS USED IN FINANCING ACTIVITIES

|

|

284,144

|

|

|

118,387

|

|

|

3,204,240

|

|

|

|

|

|

|

|

|

|

|

|

EFFECT OF FOREIGN CURRENCY TRANSLATION

|

|

(20,620)

|

|

|

2,173

|

|

|

(54,510)

|

|

NET (DECREASE) INCREASE IN CASH

|

|

20,620

|

|

|

(14,184)

|

|

|

54,510

|

|

CASH, BEGINNING OF PERIOD

|

|

-

|

|

|

12,011

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

CASH, END OF PERIOD

|

$

|

-

|

|

$

|

-

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL CASH FLOW DISCLOSURES:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH PAID FOR:

|

|

|

|

|

|

|

|

|

|

Interest

|

$

|

-

|

|

$

|

-

|

|

$

|

-

|

|

Income taxes

|

$

|

-

|

|

$

|

-

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

NON CASH FINANCING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

Common stock issued for debt

|

$

|

19,162

|

|

$

|

-

|

|

$

|

19,162

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an intregal part of these financial statements

|

|

|

6

TRIMAX CORPORATION

(An Exploration Stage Company)

Notes to the Condensed Financial Statements

June 30, 2009

NOTE 1 - CONDENSED FINANCIAL STATEMENTS

The accompanying financial statements have been prepared by the Company without audit. In the opinion of management, all adjustments (which include only normal recurring adjustments) necessary to present fairly the financial position, results of operations and cash flows at June 30, 2009 and for all periods presented have been made.

Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been condensed or omitted. It is suggested that these condensed financial statements be read in conjunction with the financial statements and notes thereto included in the Company's September 30, 2008 audited financial statements. The results of operations for the period ended June 30, 2009 are not necessarily indicative of the operating results for the full year.

NOTE 2 - GOING CONCERN

The Company’s financial statements are prepared using generally accepted accounting principles applicable to a going concern which contemplates the realization of assets and liquidation of liabilities in the normal course of business. The Company has had no revenues and has generated losses from operations. These circumstances create

substantial doubt as to the Company’s ability to continue as a going concern.

In order to continue as a going concern and achieve a profitable level of operations, the Company will need, among other things, additional capital resources

and needs to develop a consistent source of revenues. Management’s plans include investing in and developing business related to the mining industry.

The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish its business objectives and eventually attain profitable operations. The accompanying financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

7

TRIMAX CORPORATION

(An Exploration Stage Company)

Notes to the Condensed Financial Statements

June 30, 2009

NOTE 3 - SIGNIFICANT ACCOUNTING POLICIES

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the US requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Recent Accounting Pronouncements

In May 2009, the FASB issued FAS 165, “Subsequent Events”. This pronouncement establishes standards for accounting for and disclosing subsequent events (events which occur after the balance sheet date but before financial statements are issued or are available to be issued). FAS 165 requires the entity to disclose the date subsequent events were evaluated and whether that evaluation took place on the date financial statements were issued or were available to be issued. It is effective for interim and annual periods ending after June 15, 2009. The adoption of FAS 165 did not have a material impact on the Company’s financial condition or results of operation.

In June 2009, the FASB issued FAS 166, “Accounting for Transfers of Financial Assets” an amendment of FAS 140. FAS 140 is intended to improve the relevance, representational faithfulness, and comparability of the information that a reporting entity provides in its financial statements about a transfer of financial assets: the effects of a transfer on its financial position, financial performance , and cash flows; and a transferor’s continuing involvement, if any, in transferred financial assets. This statement must be applied as of the beginning of each reporting entity’s first annual reporting period that begins after November 15, 2009. The Company does not expect the adoption of FAS 166 to have an impact on the Company’s results of operations, financial condition or cash flows.

8

TRIMAX CORPORATION

(An Exploration Stage Company)

Notes to the Condensed Financial Statements

June 30, 2009

Recent Accounting Pronouncements (Continued)

In June 2009, the FASB issued FAS 167, “Amendments to FASB Interpretation No. 46(R)”. FAS 167 is intended to (1) address the effects on certain provisions of FASB Interpretation No. 46 (revised December 2003),

Consolidation of Variable Interest Entities

, as a result of the elimination of the qualifying special-purpose entity concept in FAS 166, and (2) constituent concerns about the application of certain key provisions of Interpretation 46(R), including those in which the accounting and disclosures under the Interpretation do not always provide timely and useful information about an enterprise’s involvement in a variable interest entity. This statement must be applied as of the beginning of each reporting entity’s first annual reporting period that begins after November 15, 2009. The Company does not expect the adoption of FAS 167 to have an impact on the Company’s results of operations, financial condition or cash flows.

In June 2009, the FASB issued FAS 168, “The FASB Accounting Standards Codification and the Hierarchy of Generally Accepted Accounting Principles”. FAS 168 will become the source of authoritative U.S. generally accepted accounting principles (GAAP) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (SEC) under authority of federal securities laws are also sources of authoritative GAAP for SEC registrants. On the effective date of this Statement, the Codification will supersede all then-existing non-SEC accounting and reporting standards. All other nongrandfathered non-SEC accounting literature not included in the Codification will become nonauthoritative. This statement is effective for financial statements issued for interim and annual periods ending after September 15, 2009.The Company does not expect the adoption of FAS 168 to have an impact on the Company’s results of operations, financial condition or cash flows.

NOTE 4 - COMMON STOCK

During the nine months ended June 30, 2009 the Company cancelled 200,000 shares of common stock. On March 9, 2009 the Company issued 1,596,833 common shares to satisfy $19,162 in outstanding debt.

The Company has appointed Holladay Stock Transfer as its Transfer Agent of Record. Holladay Stock Transfer has been the Company’s transfer agent of record since 2001. The Company is notifying the public that First American Stock Transfer is not the Company’s transfer agent.

9

TRIMAX CORPORATION

(An Exploration Stage Company)

Notes to the Condensed Financial Statements

June 30, 2009

NOTE 4 - COMMON STOCK (continued)

Subsequent to the quarter, and following a majority vote of shareholders electing the directors of the Company, Mr. Robert Stewart, who was not elected as a Director, issued to himself Six Million Five Hundred Thousand Shares of common stock, and One Million Shares of common stock each to Mr. Reg Olson and Mr. Gary Reid. The Company does not recognize the issuance of these shares due to lack of consideration and improper issuances as these were not approved by the Board of Directors of the Company, and not issued through the Company’s Transfer Agent of Record.

NOTE 5 – BUSINESS DEVELOPMENT

On March 23, 2009, the Company entered into an option agreement with Exploraciones San Bernardo S.A. de C.V, a Mexican company, to purchase five mining claims located in the Municipality of Alamos, Sonora county, Mexico. As part of the transaction, the Company formulated a new plan of operations and divested itself of its broadband over power line business plans, trade secrets and proprietary information, and any remaining digital signage equipment. The Company is now engaged in business as an exploration stage mineral exploration and mining development company. Accordingly, the Company’s financial statements have been restated to reflect its prior operations as discontinued operations. Subsequently the San Bernardo option agreement was abandoned and the Company is in discussions with another company to acquire mining claims.

NOTE 6 – SIGNIFICANT EVENTS

The Company has appointed Holladay Stock Transfer as its Transfer Agent of Record. Holladay Stock Transfer has been the Company’s transfer agent of record since 2001. The Company is notifying the public that First American Stock Transfer is not the Company’s transfer agent.

On April 2, 2009, Robert Vivacqua resigned as a Director and officer of Trimax and appointed Robert S. Stewart to be the Company Director and President, all subject to the closing of the San Bernardo miming claims option (see note 5).

10

TRIMAX CORPORATION

(An Exploration Stage Company)

Notes to the Condensed Financial Statements

June 30, 2009

NOTE 6 - SIGNFICANT EVENTS (continued)

The Company intends to pursue early, middle and late stage exploration and development of mineral properties worldwide for the purposes of developing projects by joint venturing, selling or retaining them.

Pursuant to its agreement with Exploraciones San Bernardo S.A. de C.V. (see note 5) the Company agreed to issue 10,000,000 shares of the Company’s common stock to the San Bernardo shareholders on closing and to issue a further 20,000,000 shares over two years to acquire 100% of the Claims. The Company further agreed to issue 2,000,000 shares of common stock to Robert Stewart for his services to be performed as officer of the company in developing the San Bernardo Claims. Both of these commitments to issue common shares were based on the Company proceeding with the San Bernardo Claims and receiving a financing of $500,000 to be provided by the majority owner of San Bernardo.

Effective May 29, 2009, the Company revised their Agreement with both the San Bernardo subscribers and Mr. Stewart, and all parties agreed to not issue the above shares, in order to enter into an agreement with Hawk Uranium Inc, Toronto, Canada ("Hawk"). To that effect, the Company filed an amended 8-K revising the original Agreement between Trimax and San Bernardo. The Company did not issue the shares to San Bernardo or to Mr. Stewart and did not pursue the San Bernardo option agreement.

Effective June 1, 2009, the Company announced it had entered into a Letter of Intent with Hawk Uranium Inc. This Agreement enabled Hawk to acquire up to a 100-per-cent interest in the San Bernando (Sonora) mining claims; Trimax and San Bernardo had previously signed a letter agreement, whereby Trimax obtained the right to acquire a 100-per-cent interest in the Sonora claims. Pursuant to the LOI with Hawk, Trimax agreed to terminate and release all interests it was granted by San Bernardo in the Sonora claims, in order to allow Hawk's proposed acquisition of a 100% interest in the five strategic mining claims San Bernardo holds near the Municipality of Alamos, Sonora, Mexico. Under the LOI, Hawk would acquire the 100% unencumbered interest upon payment of 15,000,000 of its common shares. These shares were to be issued and distributed on a one third equal basis each to: 1) Trimax Corporation, 2) San Bernardo, and 3) Robert S. Stewart and Reg Olson.

11

TRIMAX CORPORATION

(An Exploration Stage Company)

Notes to the Condensed Financial Statements

June 30, 2009

NOTE 6 - SIGNFICANT EVENTS (continued)

On July 16, 2009, the majority shareholders of the Company filed a Definitive 14c electing directors to its Board. The new directors are: Mr. John Riccio, Mr. Naim Chaudry, and Mr. Gary Newman. Mr. Stewart was not elected to the Board.

On or about July 17, 2009, Mr. Stewart issued to himself Six Million Five Hundred Thousand Shares, and One Million Shares each to Mr. Reg Olson and Mr. Gary Reid. This had not been approved by the new Board and was contrary to the conditions

agreed to by Trimax, San Bernardo, and Mr. Stewart and Mr. Olson, as part of the Hawk LOI with Trimax whereby they were receiving Hawk shares directly as compensation for their work with Trimax, as opposed to Hawk delivering all shares to Trimax and then Trimax issuing shares to San Bernardo, Mr. Stewart and Mr. Olson. Mr. Reid had no previous association with Trimax.

Subsequent to this issuance of shares, Mr. Stewart filed an amended Definitive 14c/A using the votes from Mr.Olson, Mr. Reid, and himself as a result of these newly issued shares in an attempt to overturn the vote of the majority shareholders of the Company in electing its new Board. This action is not allowed under Nevada law, and was invalid.

On July 27, 2009, Hawk announced that it was proceeding with its initial payment to acquire the Sonora claims. On the same day, Mr. Stewart revised the Agreement with Hawk, and directed that the one third of the Hawk shares belonging to Trimax, be issued to Mr. Stewart personally in his name, in addition to the Hawk shares he was receiving for himself as part of his one third portion shared with Mr. Olson. In

addition, Mr. Stewart also revised the Agreement such that the one third of the Hawk shares that were being issued to San Bernardo were also to be issued to Mr. Stewart instead. In fact, the entire 5 Million Hawk shares that were being delivered as part of the first tranche of the Hawk purchase were all to be issued to Mr. Stewart, instead of the one third portion to each of the three parties named in the original LOI between Trimax and Hawk announced on June 1, 2009. These changes to the Hawk Agreement were not disclosed to the shareholders or the new Directors of Trimax.

The new board appointed by the majority shareholder vote on July 16, 2009 informed Mr. Olson of the change in management, and requested that Mr. Stewart work with the Board to facilitate a smooth transition in handing over of corporate and banking records. Mr. Stewart did not turn over any of the Company’s records. Mr. Stewart was informed that he was no longer an officer or director of the Company. Mr. Olson and Mr. Malloy were informed that they were no longer officers of the Company.

12

TRIMAX CORPORATION

(An Exploration Stage Company)

Notes to the Condensed Financial Statements

June 30, 2009

NOTE 6 - SIGNFICANT EVENTS (continued)

Subsequent to this date, Mr. Stewart changed the Company’s name in Nevada without a shareholder vote, a Definitive 14c filing, or a shareholder mail out. This attempted change of the corporate name was not approved by the Board, and the Company has retained its original name of Trimax Corporation.

On August 5, 2009, Hawk was informed by Trimax of the change in management and also notified that the Company did not approve of the changes to the Hawk Agreement whereby Mr. Stewart would receive the one

t

hird of the Hawk shares belonging to Trimax for himself personally. Hawk was also informed by the San Bernardo shareholders that they would also not agree to giving up their one third of the Hawk shares to Mr. Stewart personally. On August 18, 2009 Hawk Uranium announced that it would not be proceeding with its acquisition of the San Bernardo Claims.

The Company has revoked any and all actions taken by Mr. Stewart subsequent to the new Board being voted in by the majority shareholders June 16, 2009. The Company is actively trying to recover all of its corporate records from Mr. Stewart. The Company has reported the actions taken by Mr. Stewart to the Attorney General for the State of Nevada. The Company has cancelled the Six Million Five Hundred Thousand Shares of common stock issued by Mr. Robert Stewart to himself and the One Million Shares of common stock each Mr. Stewart issued to Mr. Reg Olson and Mr. Gary Reid due to lack of consideration and improper issuances as these were not approved by the Board of Directors of the Company and not issued through the Company’s Transfer Agent of Record.

Change in Directors and Officers

On July 16, 2009, a majority of shareholders elected, by written consent without a meeting, the following directors: John Riccio, Naim Chaudhry, and Gary Newman, each to act until the next annual general meeting of the Company or until successors are appointed. The action taken was effective August 5, 2009 in accordance with Rule 14c-2(b) of the Securities Exchange Act of 1934.

Mr. John Riccio, 52, has been a businessman and a consultant to business for over 25 years. Mr. Riccio has been the Chief Financial Officer and/or Director for VIPR Industries Inc., a junior mining company, for the past 2 years.

13

TRIMAX CORPORATION

(An Exploration Stage Company)

Notes to the Condensed Financial Statements

June 30, 2009

Change in Directors and Officers (continued)

Mr. Naim Chaudhry, 58, has a Diploma in Electrical Engineering and has been President and sole owner of DSPTV and DSPRadio, a private Ontario company that is involved in assisting businesses in marketing themselves through Television and Radio.

Mr. Gary Newman, 65, former Vice Consul of Peru, has been working with Global Lottery Corporation full time since 2001.

Mr. Naim Chaudhry has been appointed President of the Company.

Item 2. Management's Discussion and Analysis

The following discussion should be read in conjunction with the information contained in our consolidated financial statements and the notes thereto appearing elsewhere in this quarterly report, and in conjunction with the Management's Discussion and Analysis set forth in (1) our annual report on Form 10-K for the year ended September 30, 2008.

Overview

Trimax attempted to become a broadband over power line (“BPL”) integrator and service provider. Using existing powerline infrastructures, it tried to deliver innovative data, voice and video communications to commercial, residential and other markets. Utility companies have been slow to adopt the technology as further test pilots are required for any eventual broad scale deployment. Consequently, Trimax divested its wholly owned subsidiary PLC Network Solutions Inc. to a third party for a nominal fee.

On March 23, 2009, the Company entered into an option agreement with Exploraciones San Bernardo S.A. de C.V, a Mexican company, to purchase five strategic mining claims the Mexican company holds near the Municipality of Alamos, Sonora, Mexico. Subsequently, the Company agreed to terminate and release all interests it was granted by San Bernardo in the Sonora claims, in order to allow Hawk Uranium Inc.'s proposed acquisition of a 100% interest in the five strategic mining claims San Bernardo holds near the Municipality of Alamos, Sonora, Mexico. Under the LOI, Hawk would acquire the 100% unencumbered interest upon payment of 15,000,000 of its common shares.

14

These shares were to be issued and distributed on a one third equal basis each to: 1)Trimax Corporation, 2)San Bernardo, and 3)Robert S. Stewart and Reg Olson.

On July 16, 2009, the majority shareholders, by written consent, elected the following directors to its Board: Mr. John Riccio, Mr. Naim Chaudry, and Mr. Gary Newman. Mr. Stewart was not elected to the Board.

On July 27, 2009, Hawk announced that it was proceeding with its initial payment to acquire the Sonora claims. On the same day, Mr. Stewart revised the Agreement with Hawk, and directed that the one third of the Hawk shares belonging to Trimax, be issued to Mr. Stewart personally in his name, in addition to the Hawk shares he was receiving for himself as part of his one third portion shared with Mr. Olson. In addition, Mr. Stewart also revised the Agreement such that the one third of the Hawk shares that were being issued to San Bernardo were also to be issued to Mr. Stewart instead. In fact, the entire 5 Million Hawk shares that were being delivered as part of the first tranche of the Hawk purchase were all to be issued to Mr. Stewart, instead of the one third portion to each of the three parties named in the original LOI between Trimax and Hawk announced on June 1, 2009. These changes to the Hawk Agreement were not disclosed to the shareholders or the new Directors of Trimax.

On August 5, 2009, Hawk was informed by Trimax of the change in management and also notified that the Company did not approve of the changes to the Hawk Agreement whereby Mr. Stewart would receive the one

t

hird of the Hawk shares belonging to Trimax for himself personally. Hawk was also informed by the San Bernardo shareholders that they would also not agree to giving up their one third of the Hawk shares to Mr. Stewart personally. On August 18, 2009 Hawk Uranium announced that it would not be proceeding with its acquisition of the San Bernardo Claims.

Going Concern

The Company's financial statements are presented on a going concern basis, which contemplates the realization of assets and satisfaction of liabilities in the normal course of business. The Company has experienced losses from operations since inception that raise substantial doubt as to its ability to continue as a going concern.

The Company's ability to continue as a going concern is contingent upon its ability to obtain the financing and strategic alliances necessary to attain profitable operations.

The financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result from the possible inability of the Company to continue as a going concern.

15

Principles of Accounting

The accompanying financial statements as of June 30, 2009 include the accounts of the Company and have been prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP"). The Company has no subsidiaries as of June 30, 2009.

The Company has not earned any revenues from limited principal operations and accordingly, the Company's activities have been accounted for as those of a "Development Stage Enterprise" as set forth in SFAS No. 7, Accounting and Reporting by Development Stage Enterprises.

Among the disclosures required by SFAS No. 7 are that the Company's financial statements be identified as those of an exploration stage company, and that the statements of operation, stockholders' deficiency and cash flows disclose activity since the date of the Company's inception.

Capital Stock

The stockholders' equity section of the Company contains the following classes of capital stock as of June 30, 2009:

Common stock, $0.001 par value; 100,000,000 shares authorized: 7,250,725 shares issued and outstanding.

Preferred stock, $0.001 par value; 20,000,000 shares authorized, no shares issued and outstanding.

The Company's board of directors is negotiating to settle liabilities as stated previously with creditors and debtors.

Preliminary Note Regarding Forward-Looking Statements

This quarterly report and the documents incorporated herein by reference contain forward-looking statements within the meaning of the federal securities laws, which generally include

the plans and objectives of management for future operations, including plans and objectives relating to our future economic performance and our current beliefs regarding revenues we might earn if we are successful in implementing our business strategies.

The forward-looking statements and associated risks may include, relate to or be qualified by other important factors. You can identify forward-looking statements generally by the use of forward-looking terminology such as "believes”, "expects”, "may”, "will” “intends”, "plans”, "should”, "could", "seeks”, "pro forma” "anticipates”, "estimates”, "continues”, or other variations of those terms, including their use in the negative, or by discussions of strategies, opportunities, plans or intentions.

You may find these forward-looking statements in this Item 2, Management's Discussion and Analysis of Financial Condition and Results of Operations, as well as throughout this quarterly report. A number of unforeseen factors could cause results to differ materially from those anticipated by forward-looking statements. These forward-looking statements necessarily depend upon assumptions and estimates that may prove to be incorrect.

16

Although we

believe that the assumptions and estimates reflected in the forward-looking statements are reasonable, we cannot guarantee that we will achieve our plans, intentions or expectations. The forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results to differ in significant ways from any future results expressed or implied by the forward-looking statements.

Any of the factors described in this quarterly report, and other factors unknown to the Company at this time, could cause our financial results, including our net (loss) or growth in net income (loss) to differ materially from prior results, which in turn could, among other things, cause the price of our common stock to fluctuate substantially. We base our forward-looking statements on information currently available to us, and we assume no obligation to update them.

In addition, readers are also advised to refer to the information contained in our filings with the SEC, especially on Forms 10-K, 10-Q and 8-K, in which we discuss in more detail various important factors that could cause actual results to differ from expected or historic results. It is not possible to foresee or identify all such factors. As such, investors should not consider any list of such factors to be an exhaustive statement of all risks and uncertainties or potentially inaccurate assumptions.

Plan of Operations

Trimax through its previously wholly owned subsidiary PLC Network Solutions Inc. were providers of BPL communication technologies. The Company was attempting to specialize in the development, distribution implementation, and servicing technologies that use the power grid to deliver 128-bit encrypted high-speed symmetrical broadband for data, voice and video transmission.

The Company discontinued its operations during the quarter ended March 31, 2009. The Company has no revenues and $55,515 of expenses from continuing operations during the three months and nine months ended June 30, 2009 compared to no revenues and expenses from continuing operations during three months and nine months ended June 30, 2008. The Company has a loss from discontinued operations of $-0- and $47,206 for the three months ended June 30, 2009 and 2008, respectively. The Company also has losses from discontinued operations of $77,664 and $400,287 for the nine months ended June 30, 2009 and 2008, respectively

.

Liquidity and Capital Resources

The forecasted expenses of implementing the Company's business plan will exceed the Company's current resources. The Company therefore will need to secure additional funding through an offering of its securities or through capital contributions from its stockholders.

17

No commitments to provide additional funds have been made by management. During the nine months ended June 30, 2009, $88,225 was advanced to the company by independent third parties for working capital There can be no assurances that any additional funds will be available on terms acceptable to the Company, or at all.

Item 3. Controls and Procedures

We maintain disclosure controls and procedures that are designed to be effective in providing reasonable assurance that information required to be disclosed in our reports under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified in the rules and forms of the SEC, and that such

information is accumulated and communicated to our management to allow timely decisions regarding required disclosure.

In designing and evaluating disclosure controls and procedures, management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable, not absolute assurance of achieving the desired objectives. Also, the design of a control system must reflect the fact that there are resource constraints and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty and that breakdowns can occur because of simple error or mistake. The design of any system of controls is based, in part, upon certain assumptions about the likelihood of future events and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions.

As of the end of the period covered by this report, we carried out an evaluation, under the supervision and with the participation of management, including our chief executive officer and principal financial officer, of the effectiveness of the design and operation of our disclosure controls and procedures as defined in Rules 13a-15(e) and 15d-15(e) of the Exchange Act. Based upon that evaluation, management concluded that our disclosure controls and procedures are ineffective to cause the information required to be disclosed by us in reports that we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods prescribed by SEC, and that such information is accumulated and communicated to management, including our chief executive officer and principal financial officer, as appropriate, to allow timely decisions regarding required disclosure.

There was no change in our internal controls over financial reporting identified in connection with the requisite evaluation that occurred during our last fiscal quarter that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

18

PART II - OTHER INFORMATION

Item 1. Legal Proceedings

The Company is proceeding in reporting the actions of Mr. Stewart against the shareholders of Trimax, and is seeking legal advice on pursuing this matter.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

During the nine months ended June 30, 2009 the Company cancelled 200,000 shares of common stock. On March 9, 2009 the Company issued 1,596,833 common shares to satisfy $19,162 in outstanding debt.

The Company has appointed Holladay Stock Transfer as its Transfer Agent of Record. Holladay Stock Transfer has been the Company’s transfer agent of record since 2001. The Company is notifying the public that First American Stock Transfer is not the Company’s transfer agent.

Subsequent to the quarter, and following a majority vote of shareholders electing the directors of the Company, Mr. Robert Stewart, who was not elected as a Director, issued to himself Six Million Five Hundred Thousand Shares of common stock, and One Million Shares of common stock each to Mr. Reg Olson and Mr. Gary Reid. The Company has cancelled these shares, due to lack of consideration and improper issuances as these were not approved by the Board of Directors of the Company, and not issued through the Company’s Transfer Agent of Record.

Item 3. Defaults Upon Senior Securities

Not applicable.

Item 4. Submission of Matters to a Vote of Security Holders

Not applicable.

Item 5. Other Information

Not applicable.

19

Item 6. Exhibits

The following exhibits are being filed as part of this quarterly report:

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

31.1

|

|

Certification of Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and Rule 13a-14(a)/15d-14(a) of the Securities Exchange Act of 1934.

|

|

|

|

|

|

31.2

|

|

Certification of Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and Rule 13a-14(a)/15d-14(a) of the Securities Exchange Act of 1934.

|

|

|

|

|

|

32.1

|

|

Certification of Chief Executive Officer and Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

|

SIGNATURES

In accordance with the requirements of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

TRIMAX CORPORATION

|

|

|

|

|

|

September

23, 2009

|

By:

|

/s/ Naim Chaudhry

|

|

|

|

Name: Naim Chaudhry

|

|

|

|

Title: President and Director

|

20

CERTIFICATIONS OF CEO PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002

Exhibit 31.1

I, Naim Chaudhry, certify that

1. I have reviewed this quarterly report on Form 10-Q of Trimax Corporation;

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4. I am responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) for the registrant and have:

a) Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

b) Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

c) Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5. I have disclosed, based on my most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of registrant’s board of directors (or persons performing the equivalent functions):

a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

September 23, 2009

__

/s/ Naim Chaudhry

__________________

Naim Chaudhry, Acting Chief Executive Officer

21

CERTIFICATIONS OF CFO PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002

Exhibit 31.2

I, Naim Chaudhry, certify that:

1. I have reviewed this quarterly report on Form 10-Q of Trimax Corporation;

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the

registrant as of, and for, the periods presented in this report;

4. I am responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) for the registrant and have:

a) Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

b) Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

c) Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5. I have disclosed, based on my most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of registrant’s board of directors (or persons performing the equivalent functions):

a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

September 23, 2009

_

/s/ Naim Chaudhry

______________________

Naim Chaudhry, Acting Chief Financial Officer

22

CERTIFICATIONS PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

(18 U.S.C. SECTION 1350)

Exhibit 32.1

In connection with the quarterly report of Trimax Corporation, a Nevada corporation (the “Company”), on Form 10-Q for the quarter ended June 30, 2009, as filed with the Securities and Exchange Commission (the “Report”), Naim Chaudhry, Acting Chief Executive Officer and Acting Chief Financial Officer of the Company do hereby certify, pursuant to § 906 of the Sarbanes-Oxley Act of 2002 (18 U.S.C. § 1350), that to his knowledge:

(1) The Report fully complies with the requirements of section 13(a) or 15(d) of the Securities Exchange Act of 1934; and

(2) The information contained in the Report fairly presents, in all material respects, the financial condition and result of operations of the Company.

By: __

/s/ Naim Chaudhry

_____________________________

Name: Naim Chaudhry

Title: Acting Chief Executive Officer and Acting Chief Financial Officer

Date: September

23, 2009

|

|

|

|

|

[A signed original of this written statement required by Section 906 has been provided to Trimax Corporation and will be retained by Trimax Corporation and furnished to the Securities and Exchange Commission or its staff upon request.]

|

23

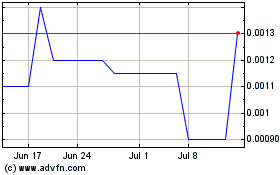

Trimax (PK) (USOTC:TMXN)

Historical Stock Chart

From Jun 2024 to Jul 2024

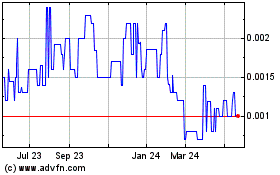

Trimax (PK) (USOTC:TMXN)

Historical Stock Chart

From Jul 2023 to Jul 2024