false

0001524872

0001524872

2023-10-23

2023-10-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of

The Securities Exchange

Act of 1934

Date of Report (Date

of earliest event reported): October 23, 2023

Thunder

Energies Corporation

(Exact name of registrant

as specified in its charter)

FLFlorida

(State or other jurisdiction of incorporation)

| 000-54464 |

45-1967797 |

| (Commission

File Number) |

(I.R.S.

Employer Identification No.) |

1100

Peachtree St. NE8, Suite 200,

Atlanta, GA

30339

(Address of principal executive offices)

(786)

855-6190

(Registrant’s telephone

number, including area code)

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section

12(b) of the Act:

| Title

of Each Class |

Trading

Symbol |

Name

of Exchange on Which Registered |

| None |

None |

None |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☒

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Table of Contents

| |

|

|

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS |

1 |

| EXPLANATORY NOTE |

2 |

| Item 1.01 |

Entry into a Martial Definitive Agreement |

3 |

| Item 8.01 |

Other Events |

5 |

| Item 9.01 |

Financial Statements and Exhibits |

5 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report contains forward-looking statements, including,

without limitation, in the sections captioned “Description of Business,” “Risk Factors,” and “Management’s

Discussion and Analysis of Financial Condition and Plan of Operations,” and elsewhere. Any and all statements contained in

this Report that are not statements of historical fact may be deemed forward-looking statements. Terms such as “may,” “might,”

“would,” “should,” “could,” “project,” “estimate,” “pro-forma,”

“predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,”

“plan,” “help,” “believe,” “continue,” “intend,” “expect,” “future,”

and terms of similar import (including the negative of any of the foregoing) may be intended to identify forward-looking statements.

However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements

in this Report may include, without limitation, statements regarding (i) the plans and objectives of management for future operations,

including plans or objectives relating to the development of commercially viable pharmaceuticals, (ii) a projection of income (including

income/loss), earnings (including earnings/loss) per share, capital expenditures, dividends, capital structure or other financial items,

(iii) our future financial performance, including any such statement contained in a discussion and analysis of financial condition by

management or in the results of operations included pursuant to the rules and regulations of the Securities and Exchange Commission (the

“SEC”), and (iv) the assumptions underlying or relating to any statement described in points (i), (ii) or (iii) above.

The forward-looking statements are not meant to predict or guarantee

actual results, performance, events or circumstances and may not be realized because they are based upon our current projections, plans,

objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences,

many of which we have no control over. Actual results and the timing of certain events and circumstances may differ materially from those

described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to

the inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include,

without limitation, our inability to obtain adequate financing, the significant length of time associated with drug development and related

insufficient cash flows and resulting illiquidity, our inability to expand our business, significant government regulation of pharmaceuticals

and the healthcare industry, lack of product diversification, volatility in the price of our raw materials, existing or increased competition,

results of arbitration and litigation, stock volatility and illiquidity, and our failure to implement our business plans or strategies.

A description of some of the risks and uncertainties that could cause our actual results to differ materially from those described

by the forward-looking statements in this Report appears in the section captioned “Risk Factors” and elsewhere in this Report.

Readers are cautioned not to place undue reliance on forward-looking

statements because of the risks and uncertainties related to them and to the risk factors. We disclaim any obligation to update

the forward-looking statements contained in this Report to reflect any new information or future events or circumstances or otherwise.

Readers should read this Report in conjunction with the discussion

under the caption “Risk Factors,” our financial statements and the related notes thereto in this Report, and other documents

which we may file from time to time with the SEC.

EXPLANATORY NOTE

As used in this Current Report henceforward, unless otherwise stated

or the context clearly indicates otherwise, the terms “Thunder Energies,” the “Company,” the “Registrant,”

“we,” “us,” and “our” refer to Thunder Energies Corp., after giving effect to the Share Exchange

and the Split-Off.

This Current Report contains summaries of the material terms of various

agreements executed in connection with the transactions described herein. The summaries of these agreements are subject to, and are qualified

in their entirety by, reference to these agreements, which are filed as exhibits hereto and incorporated herein by reference.

This Current Report is being filed in connection with a series of

transactions consummated by the Company and certain related events and actions taken by the Company.

This Current Report responds to the following Items in Form 8-K:

Item 1.01.

Entry into a Martial Definitive Agreement

On October 4, 2021, Aditxt,

Inc. (the “Company”) entered into a transaction agreement (the “Transaction Agreement”) with AiPharma

Global Holdings LLC (“AiPharma Global”), pursuant to which the Company agreed to reach a definitive agreement (the

“Definitive Agreement”) no later than November 30, 2021 to acquire a subsidiary (“AiPharma Subsidiary” or

“Holdco”) of AiPharma Global, which is to own all of the assets of AiPharma Global following a restructuring of AiPharma

Global, subject to certain termination rights described below. The Company previously announced that it had entered into a letter of

intent to acquire a target company (the “Letter of Intent”), which was reported in the Company’s Current Report on

Form 8-K dated August 25, 2021.

As previously disclosed in the Company’s

Current Report on Form 8-K dated August 30, 2021, in connection with the Letter of Intent, the Company entered into a secured credit agreement dated

August 27, 2021 (the “Credit Agreement”) with the target and certain affiliated entities, pursuant to which the Company

made a secured loan to the target company in the principal amount of $6.5 million. In connection with the Credit Agreement, the

Company entered into security agreements with certain affiliates of the target company.

On October 5, 2021, the Company issued a press

release announcing signing of the Transaction Agreement and the identity of the target company as AiPharma Global. AiPharma

Global is a biopharmaceutical company that holds directly, or through its affiliates worldwide (excluding Japan), exclusive rights to

certain oral antiviral drugs that target COVID-19.

Pursuant to the Transaction Agreement, the

Company also agreed to permit AiPharma Global to borrow an additional principal amount of $8.5 million (the “Additional Borrowings”)

under the Credit Agreement. The Company and AiPharma Global agreed to amend the Credit Agreement and related documents

as promptly as practicable and to extend the maturity date under the Credit Agreement to November 30, 2021.

The Transaction Agreement contemplates

two events. First, upon the execution of the Definitive Agreement (the “Initial Closing”), AiPharma Global

would acquire 19.99% of the Company’s common stock as of September 30, 2021, subject to the filing of the Company’s Quarterly

Report on Form 10-Q (the “Initial Shares”), in exchange for 10% of the issued and outstanding equity interests of AiPharma

Subsidiary. In addition, the Company would forgive all amounts then outstanding under the Credit Agreement, as amended. Following

the execution of the Definitive Agreement, the Company has also agreed to take all necessary action to cause two individuals

designated by AiPharma Global to be appointed to the board of directors of the Company.

The Transaction Agreement may

be terminated: (i) by the mutual agreement of the parties, (ii) by either party

if the Definitive Agreement has

not been executed by November 30, 2021, (iii) by either party if there has been a material breach

or any material failure to perform any covenant or agreement and

such breach or failure has not been cured or is incapable of being cured, (iv) by the Company if the Company is not satisfied with certain

due diligence conditions, (v) by the board of directors of the Company if it received a proposal that it deems to be superior to the

AiPharma Global proposal described in the Transaction Agreement, (vi) by AiPharma

Global if the Company breaches certain covenants under the Transaction Agreement restricting

issuances of securities during the period from execution of the Transaction Agreement through

the Initial Closing or termination of the Transaction Agreement, or (vii) if at any

time prior to the Initial Closing or earlier termination of the Transaction Agreement,

the Initial Shares and Secondary Shares (defined below) represent less than 50.1% of the issued and outstanding shares of the Company.

In the event that the Transaction Agreement is terminated pursuant to (i) or

(ii), AiPharma Global is required to pay the Termination Fee to the Company by November 30, 2021. The Credit Agreement provides

for a termination fee of $4 million (the “Termination Fee”) in the event that the Definitive Agreement is

not entered into by November 30, 2021.In the event that the Transaction Agreement is

terminated by the Company pursuant to (iii) or (iv), AiPharma Global is required to pay the Termination Fee to the Company by November

30, 2021. In the event that the Transaction Agreement is terminated by AiPharma

Global pursuant to (iii) or (vi), the Company is required to pay AiPharma Global a termination fee of $4 million and AiPharma Global

is not required to pay the Termination Fee. In the event that the Transaction Agreement is

terminated by AiPharma Global pursuant to (vii), the Company is not required to pay a termination fee and AiPharma Global is not required

to pay the Termination Fee.

The Secondary Closing (as defined below) is conditioned

upon certain closing conditions, including but not limited to: (i) the approvals of the stockholders of the Company of all matters required

for the Secondary Closing, and (ii) Nasdaq approval of the issuance of shares to AiPharma Global at the Secondary Closing and the continued

listing of the Company’s common stock following the Secondary Closing (collectively, the “Closing Conditions”).

The second event under the Transaction Agreement occurs

upon the satisfaction of all Closing Conditions (the “Secondary Closing”), the Company shall issue an additional number of

shares of the Company’s common stock, that yields 65.00% of the Company’s outstanding shares of common stock as of September

30, 2021 (the “Secondary Shares”) to AiPharma Global in exchange for all remaining equity interests of AiPharma Subsidiary.

The foregoing description of the Transaction Agreement is

qualified in its entirety to the complete text of the Transaction Agreement, a copy

of which will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2021, and

is intended to provide investors and security holders with information regarding its terms. It is not intended to provide any other

factual information about the Company, AiPharma Global or AiPharma Subsidiary. The Transaction Agreement contains

representations and warranties that the parties to the Transaction Agreement made

to, and solely for the benefit of, each other. The assertions embodied in those representations and warranties are subject, in

some cases, to specified exceptions, qualifications, limitations and supplemental information, including knowledge qualifiers and contractual

standards of materiality, such as materiality qualifiers and the occurrence of a material adverse

effect, that are different from those generally applicable under federal securities law, as well as detailed information set forth in

disclosure letter provided by us in connection with signing the Transaction Agreement.

In addition, some representations and warranties may have been included in the Transaction Agreement for

the purpose of allocating risk between the Company, AiPharma Global and AiPharma rather than to establish matters as facts. The

Transaction Agreement is described in this Current Report on Form 8-K only

to provide you with information regarding its terms and conditions, and not to provide any other factual information regarding the Company

or its business. Accordingly, you should not rely on the representations and warranties as characterizations of the actual state

of facts, since (i) they were made only as of the date of the Transaction Agreement or a prior, specified date, (ii) in

some cases they are subject to knowledge, materiality and material adverse effect

qualifiers, and (iii) they are modified in important part by detailed information included in the disclosure letter. Finally,

information concerning the subject matter of the representations and warranties may have changed since the date of the Transaction Agreement,

which subsequent information may or may not be fully reflected in the Company’s public disclosures.

Additional Information and Where to Find It

If the Definitive Agreement is

entered into, it is contemplated by the Transaction Agreement that, a Proxy Statement / Registration Statement on Form S-4

(the “Registration Statement”) will be filed with the Securities and Exchange Commission (the “SEC”), which will

include preliminary and definitive proxy statements to be distributed to Aditxt’s shareholders in connection with Aditxt’s

solicitation for proxies for the vote by Aditxt’s shareholders in connection with the proposed transaction and other matters

specified in the Proxy Statement / Registration Statement, as well as the prospectus relating to the offer of securities to be issued

to AiPharma Global’s shareholders in connection with the completion of the proposed transaction. After the Proxy Statement

/ Registration Statement has been filed and declared effective, Aditxt will mail a definitive proxy statement and other relevant

documents to its shareholders as of the record date established for voting on the proposed business combination. WE URGE INVESTORS

TO READ THESE MATERIALS CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY AND THE DEFINITIVE AGREEMENT.

Investors will be able to obtain free copies of these materials on the SEC’s website at http://www.sec.gov. Free copies of

the Company’s SEC filings are also available from Aditxt, Inc., 737 N. Fifth Street, Suite 200, Richmond, VA 23219, Attn: Amro

Albanna, Chief Executive Officer.

INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN

HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS

OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Participants in the Solicitation

The Company and its executive officers, directors,

other members of management, employees and AiPharma Global may be deemed, under SEC rules, to be participants in the solicitation of

proxies from the Company’s shareholders with respect to the proposed transaction. Information regarding the executive officers

and directors of the Company is set forth in its definitive proxy statement for its 2021 annual meeting filed with the SEC

on April 5, 2021. More detailed information regarding the identity of potential participants, and their direct or indirect interests,

by securities holdings or otherwise, will be set forth in the Proxy Statement / Registration Statement on Form S-4 and other materials

to be filed with the SEC in connection with the Definitive Agreement.

Item 8.01. Other Events.

On October 5, 2021, the Company issued a press

release announcing the signing of the Transaction Agreement. A copy of the press release is filed herewith as Exhibit 99.1

and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Thunder Energies Corporation |

| |

|

| |

By: |

/s/ Corinne

Pankovcin |

| |

|

Corinne

Pankovcin |

| |

|

President |

Date: October

24, 2023

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

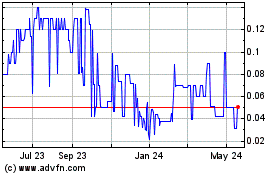

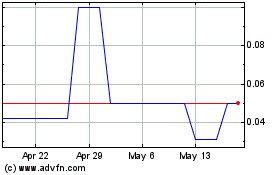

Thunder Energies (CE) (USOTC:TNRG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Thunder Energies (CE) (USOTC:TNRG)

Historical Stock Chart

From Feb 2024 to Feb 2025