Babcock & Wilcox Hits 52-Week High - Analyst Blog

May 29 2013 - 3:30PM

Zacks

The shares of engineering firm

The Babcock & Wilcox Company (BWC) soared to a

52-week high of $30.23 on Tuesday, May 28, 2013, buoyed by a slew

of positive developments. The closing price of the company as of

the said date was $29.95, representing an impressive 1-year return

of 20.67%. Additionally, Babcock & Wilcox – with a market cap

of $3.36 billion – boasts of a long-term expected earnings growth

rate of 13.50%.

Earlier this month, Babcock & Wilcox reported first quarter

2013 adjusted earnings per share of 46 cents, below the year-ago

adjusted earnings of 50 cents. But its revenue improved 5.2% from

the year-earlier level to 805.4 million. This was aided by strong

performance by the Power Generation segment.

Last week, Babcock & Wilcox won a U.S. Naval Reactors Program

contract to render procurement and assembling services. The company

will execute the deal, worth $366 million, through its affiliate

Babcock & Wilcox Nuclear Operations Group Inc.

Earlier in Feb, Babcock & Wilcox received two contracts worth

$36 million, also from U.S. Naval Reactors Program to render

procurement and assembling services.

With the success of the past contracts, Babcock & Wilcox is on

an expansion path. It looks forward to more such opportunistic

programs in 2013 to gain a significant market share. We believe

such accomplishments will garner profits for Babcock & Wilcox

in the upcoming quarters.

Headquartered in Charlotte, N.C., Babcock & Wilcox is engaged

in providing clean energy technology and services for the nuclear,

fossil and renewable power markets worldwide. The company – which

was spun off as an independent and publicly traded entity from

energy-focused engineering and construction firm McDermott

International (MDR) in Aug 2010 – operates in four

business units: Power Generation, Nuclear Operations, Technical

Services and Nuclear Energy.

Babcock & Wilcox currently carries a Zacks Rank #3 (Hold),

implying that it is expected to perform in line with the broader

U.S. equity market over the next one to three months.

However, certain other engineering firms in the energy sector like

Tri-Tech Holding Inc. (TRIT) and Graco

Inc. (GGG) are expected to outperform the equity market in

the next one to three months. Both the stocks currently hold a

Zacks Rank #1 (Strong Buy).

BABCOCK&WILCOX (BWC): Free Stock Analysis Report

GRACO INC (GGG): Free Stock Analysis Report

MCDERMOTT INTL (MDR): Free Stock Analysis Report

TRI-TECH HOLDNG (TRIT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

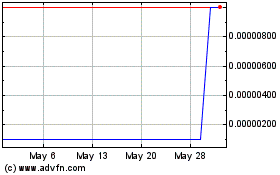

Tri Tech (CE) (USOTC:TRITF)

Historical Stock Chart

From Apr 2024 to May 2024

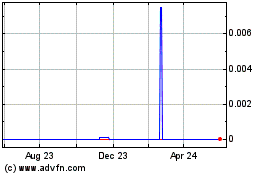

Tri Tech (CE) (USOTC:TRITF)

Historical Stock Chart

From May 2023 to May 2024

Real-Time news about Tri Tech Holding Inc (CE) (OTCMarkets): 0 recent articles

More Tri-Tech Holding Inc. - Ordinary Shares (MM) News Articles