US Energy Initiatives Corp - Current report filing (8-K)

December 28 2007 - 2:22PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C.

20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF

1934

DATE

OF REPORT (DATE OF EARLIEST EVENT REPORTED): December 21,

2007

US

ENERGY INITIATIVES CORPORATION

(Exact

name of registrant as specified in its charter)

|

Georgia

|

000-51789

|

58-2267238

|

|

(State or other jurisdiction of

incorporation)

|

(Commission File

Number)

|

(IRS

Employer Identification No.)

|

|

|

|

|

12812

Dupont Circle, Tampa, Florida 33626

(Address

of principal executive offices and Zip Code)

Registrant's

telephone number, including area code (813) 287-5787

Copies

to:

Darrin

M.

Ocasio, Esq.

Sichenzia

Ross Friedman Ference LLP

61

Broadway, 32

nd

Fl.

New

York,

New York 10006

Phone:

(212) 930-9700

Fax:

(212) 930-9725

Check

the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

[

]

Written communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

[

]

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

[

]

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act

(17 CFR 240.14d-2(b))

[

]

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act

(17 CFR 240.13e-4(c))

ITEM

1.01 Entry

into a Material Definitive Agreement.

ITEM

2.01 Disposition

of Assets.

On

December 21, 2007, U.S. Energy

Initiatives Corporation (the "Company") and Dutchess Private Equities Fund

Ltd.

( “Dutchess”) entered into and closed a Stock Purchase Agreement (the “Stock

Purchase Agreement”) pursuant to which the Company sold 80%of the outstanding

capital stock of Advanced Aerosol Technologies, Inc., a Delaware corporation

(f/k/a Sea Spray Aeorosol, Inc.) and wholly owned subsidiary of the Company

(“AAT”), to Dutchess in consideration for the forgiveness outstanding

indebtedness in the aggregate principal amount of $2,148,000 currently owed

to

Dutchess. Furthermore, Dutchess also agreed to assume the debt of AAT, including

that certain promissory note, dated August 24, 2007, in the name of Marc Mathys

in the amount of one million three hundred and thirty-three thousand dollars

($1,333,000.00).

The

Company shall be entitled to

receive up to one hundred thousand dollars ($100,000) within thirty (30) days

of

closing from the current equity of line of credit currently in place between

the

Company and Dutchess in consideration for shares of common stock of the

Company. Pursuant to the terms of the Investment Agreement, dated

March 23, 2006, by and between the Company and Dutchess, Dutchess has

contractually agreed to restrict their ability to receive shares of our common

stock such that the number of shares of the Company common stock held by them

and their affiliates after such conversion or exercise does not exceed 4.99%

of

the Company’s then issued and outstanding shares of common stock.

In

connection with the Stock Purchase

Agreement, the Company and Dutchess entered into a Non-Competition Agreement,

dated December 27, 2007, pursuant to which in consideration for the forgiveness

of outstanding indebtedness owed to Dutchess in the aggregate principal amount

of $10,042,798, the Company agreed that it would not compete with Dutchess

or

AAT by starting a competing business or by consulting or taking employment

with

a competition of AAT for a period of 6 months from the date of the Stock

Purchase Agreement. A copy of the Non-Competition Agreement is

attached as Exhibit to the Stock Purchase Agreement.

Item

5.02

Departure of Directors or Principal Officers; Election of Directors; Appointment

of Principal Officers

On

December 28, 2007, Philip Rappa

resigned as chief executive officer of the Company, effective December 31,

2007. There was no disagreement or dispute between Mr. Rappa and the

Company which led to his resignation.

On

December 28, 2007, Michelle Hamilton

resigned as chief financial officer of the Company, effective December 31,

2007. There was no disagreement or dispute between Ms. Hamilton and

the Company which led to her resignation.

ITEM

9.01

FINANCIAL STATEMENTS AND EXHIBITS.

(a)

FINANCIAL STATEMENTS OF BUSINESS ACQUIRED.

Not

applicable.

(b)

PRO

FORMA FINANCIAL INFORMATION.

Not

applicable.

(c)

EXHIBITS.

|

Exhibit

No.

|

|

Description

|

|

|

|

|

|

2.1

|

|

Stock

Purchase Agreement, dated December 21, 2007, by and among U.S. Energy

Initiatives Corporation and Dutchess Private Equities Fund

Ltd.

|

|

|

|

|

|

99.1

|

|

Resignation

Letter of Philip Rappa, dated December 28, 2007

|

|

|

|

|

|

99.2

|

|

Resignation

Letter of Michelle Hamilton, dated December 28,

2007

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant

has

duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

|

|

US

ENERGY INITIATIVES CORPORATION

|

|

|

|

|

|

|

|

Date: December

28, 2007

|

By:

|

/s/ PHILIP

RAPPA

|

|

|

|

|

Philip

Rappa

|

|

|

|

|

Chief

Executive Officer

|

|

|

|

|

(Principal

Executive Officer)

|

|

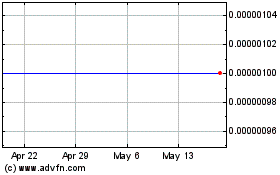

US Energy Initiatives (CE) (USOTC:USEI)

Historical Stock Chart

From Mar 2025 to Apr 2025

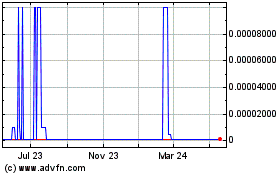

US Energy Initiatives (CE) (USOTC:USEI)

Historical Stock Chart

From Apr 2024 to Apr 2025

Real-Time news about US Energy Initiatives Corporation Inc (CE) (OTCMarkets): 0 recent articles

More US Energy Initiatives Corp News Articles