0001376804

false

0001376804

2023-01-01

2023-03-31

0001376804

2023-03-31

0001376804

2022-12-31

0001376804

us-gaap:SeriesAPreferredStockMember

2023-03-31

0001376804

us-gaap:SeriesAPreferredStockMember

2022-12-31

0001376804

us-gaap:SeriesBPreferredStockMember

2023-03-31

0001376804

us-gaap:SeriesBPreferredStockMember

2022-12-31

0001376804

us-gaap:SeriesCPreferredStockMember

2023-03-31

0001376804

us-gaap:SeriesCPreferredStockMember

2022-12-31

0001376804

2022-01-01

2022-03-31

0001376804

vnue:PreferredASharesMember

2021-12-31

0001376804

vnue:PreferredBSharesMember

2021-12-31

0001376804

vnue:PreferredCShareMember

2021-12-31

0001376804

vnue:CommonStocksMember

2021-12-31

0001376804

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001376804

us-gaap:RetainedEarningsMember

2021-12-31

0001376804

2021-12-31

0001376804

vnue:PreferredASharesMember

2022-12-31

0001376804

vnue:PreferredBSharesMember

2022-12-31

0001376804

vnue:PreferredCShareMember

2022-12-31

0001376804

vnue:CommonStocksMember

2022-12-31

0001376804

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001376804

us-gaap:RetainedEarningsMember

2022-12-31

0001376804

vnue:PreferredASharesMember

2022-01-01

2022-03-31

0001376804

vnue:PreferredBSharesMember

2022-01-01

2022-03-31

0001376804

vnue:PreferredCShareMember

2022-01-01

2022-03-31

0001376804

vnue:CommonStocksMember

2022-01-01

2022-03-31

0001376804

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-03-31

0001376804

us-gaap:RetainedEarningsMember

2022-01-01

2022-03-31

0001376804

vnue:PreferredASharesMember

2023-01-01

2023-03-31

0001376804

vnue:PreferredBSharesMember

2023-01-01

2023-03-31

0001376804

vnue:PreferredCShareMember

2023-01-01

2023-03-31

0001376804

vnue:CommonStocksMember

2023-01-01

2023-03-31

0001376804

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001376804

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001376804

vnue:PreferredASharesMember

2022-03-31

0001376804

vnue:PreferredBSharesMember

2022-03-31

0001376804

vnue:PreferredCShareMember

2022-03-31

0001376804

vnue:CommonStocksMember

2022-03-31

0001376804

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001376804

us-gaap:RetainedEarningsMember

2022-03-31

0001376804

2022-03-31

0001376804

vnue:PreferredASharesMember

2023-03-31

0001376804

vnue:PreferredBSharesMember

2023-03-31

0001376804

vnue:PreferredCShareMember

2023-03-31

0001376804

vnue:CommonStocksMember

2023-03-31

0001376804

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001376804

us-gaap:RetainedEarningsMember

2023-03-31

0001376804

2022-01-01

2022-12-31

0001376804

vnue:TgriMember

2023-01-01

2023-03-31

0001376804

2022-02-14

0001376804

vnue:TgriMember

2022-01-01

2022-12-31

0001376804

vnue:RobThomasMember

2023-03-31

0001376804

vnue:RobThomasMember

2022-12-31

0001376804

2021-01-01

2021-12-31

0001376804

us-gaap:FurnitureAndFixturesMember

2023-01-01

2023-03-31

0001376804

us-gaap:OfficeEquipmentMember

2023-01-01

2023-03-31

0001376804

us-gaap:OfficeEquipmentMember

2022-01-01

2022-12-31

0001376804

us-gaap:FurnitureAndFixturesMember

2022-01-01

2022-12-31

0001376804

2020-01-09

0001376804

vnue:MTAgreementMember

2023-01-01

2023-03-31

0001376804

vnue:MTAgreementMember

2022-01-01

2022-12-31

0001376804

vnue:ChiefExecutiveOfficersMember

2022-12-31

0001376804

vnue:ChiefExecutiveOfficersMember

2021-12-31

0001376804

vnue:VNUEAcquisitionMember

2022-02-01

2022-02-14

0001376804

vnue:VNUEAcquisitionMember

2022-02-13

0001376804

vnue:NotePayableMember

2021-12-31

0001376804

vnue:VariousConvertibleNotesMember

2023-03-31

0001376804

vnue:VariousConvertibleNotesMember

2022-12-31

0001376804

vnue:GolockCapitalLlcConvertibleNotesMember

2023-03-31

0001376804

vnue:GolockCapitalLlcConvertibleNotesMember

2022-12-31

0001376804

vnue:GolockCapitalLlcConvertibleNotesMember

2018-02-02

0001376804

vnue:GolockCapitalLlcConvertibleNotesMember

2018-01-02

2018-02-02

0001376804

vnue:GolockCapitalLlcConvertibleNotesMember

2018-12-31

0001376804

vnue:VariouConvertibleNotesMember

2022-12-31

0001376804

vnue:VariouConvertibleNotesMember

2021-12-31

0001376804

vnue:GolockCapitalLlcConvertibleNotesMember

2021-12-31

0001376804

vnue:OtherConvertibleNotesMember

2022-12-31

0001376804

vnue:OtherConvertibleNotesMember

2021-12-31

0001376804

vnue:AmendmentMember

vnue:GolockMember

2019-04-01

2019-04-29

0001376804

vnue:AmendmentMember

vnue:GolockMember

2019-12-31

0001376804

vnue:AmendmentMember

vnue:GolockMember

2019-01-01

2019-12-31

0001376804

vnue:GolockCapitalLlcConvertibleNotesMember

2023-01-01

2023-03-31

0001376804

vnue:GolockCapitalLlcConvertibleNotesMember

2022-01-01

2022-12-31

0001376804

vnue:GHSInvestmentsMember

2022-12-31

0001376804

vnue:GHSInvestmentsMember

2021-01-01

2021-12-31

0001376804

vnue:AmendmentMember

vnue:LenderMember

2022-12-31

0001376804

2019-06-01

2019-07-02

0001376804

vnue:SeriesAConvertiblePreferredStockMember

2019-05-22

0001376804

vnue:GHSInvestmentsMember

us-gaap:SeriesBPreferredStockMember

2023-01-01

2023-03-31

0001376804

us-gaap:SeriesBPreferredStockMember

2023-01-01

2023-03-31

0001376804

vnue:SeriesBConvertiblePreferredStockMember

2023-03-31

0001376804

us-gaap:SeriesCPreferredStockMember

2022-05-25

0001376804

us-gaap:SeriesCPreferredStockMember

2022-05-01

2022-05-25

0001376804

srt:BoardOfDirectorsChairmanMember

2022-05-01

2022-05-25

0001376804

2022-04-01

2022-06-30

0001376804

vnue:PreferredStockSeriesCMember

2022-12-31

0001376804

vnue:SeriesAConvertiblePreferredStockMember

2019-07-02

0001376804

us-gaap:SeriesAPreferredStockMember

2021-12-31

0001376804

vnue:SeriesBConvertiblePreferredStockMember

2022-01-03

0001376804

us-gaap:SeriesBPreferredStockMember

vnue:GHSInvestmentsMember

2022-01-01

2022-12-31

0001376804

us-gaap:SeriesBPreferredStockMember

2022-01-01

2022-12-31

0001376804

vnue:SeriesCConvertiblePreferredStockMember

2022-05-22

0001376804

vnue:SeriesCConvertiblePreferredStockMember

2022-01-01

2022-12-31

0001376804

vnue:SeriesCConvertiblePreferredStockMember

srt:BoardOfDirectorsChairmanMember

2022-01-01

2022-12-31

0001376804

2020-12-31

0001376804

us-gaap:SubsequentEventMember

vnue:GHSMember

2023-04-01

2023-05-19

0001376804

srt:ScenarioForecastMember

2023-12-01

2023-12-31

0001376804

srt:ScenarioForecastMember

vnue:GHSMember

2023-12-01

2023-12-31

0001376804

us-gaap:SeriesBPreferredStockMember

2021-12-31

0001376804

us-gaap:SeriesCPreferredStockMember

2021-12-31

0001376804

vnue:PreferredASharesMember

2020-12-31

0001376804

vnue:PreferredBSharesMember

2020-12-31

0001376804

vnue:PreferredCSharesMember

2020-12-31

0001376804

us-gaap:CommonStockMember

2020-12-31

0001376804

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001376804

us-gaap:RetainedEarningsMember

2020-12-31

0001376804

vnue:PreferredCSharesMember

2021-12-31

0001376804

us-gaap:CommonStockMember

2021-12-31

0001376804

vnue:PreferredASharesMember

2021-01-01

2021-12-31

0001376804

vnue:PreferredBSharesMember

2021-01-01

2021-12-31

0001376804

vnue:PreferredCSharesMember

2021-01-01

2021-12-31

0001376804

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0001376804

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-12-31

0001376804

us-gaap:RetainedEarningsMember

2021-01-01

2021-12-31

0001376804

vnue:PreferredASharesMember

2022-01-01

2022-12-31

0001376804

vnue:PreferredBSharesMember

2022-01-01

2022-12-31

0001376804

vnue:PreferredCSharesMember

2022-01-01

2022-12-31

0001376804

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001376804

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001376804

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001376804

vnue:PreferredCSharesMember

2022-12-31

0001376804

us-gaap:CommonStockMember

2022-12-31

0001376804

us-gaap:DividendDeclaredMember

2022-12-31

0001376804

us-gaap:DividendDeclaredMember

2021-12-31

0001376804

us-gaap:DividendDeclaredMember

2017-10-01

2017-10-16

0001376804

us-gaap:DividendDeclaredMember

2017-10-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

VNUE, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

98-0543851 |

| (State of Incorporation) |

|

(IRS Employer

Identification Number) |

104 West 29th Street, 11th Floor

New York, NY 10001

(833) 937-5493

(Address, including zip code, and telephone number, including area code,

of registrant’s principal executive offices)

Copies of all correspondence to:

Frederick M. Lehrer, P. A.

2108 Emil Jahna Road

Clermont, Florida 34711

(561) 706-7646

(Address, including zip code, and telephone, including area code)

Approximate date of commencement of proposed sale of the securities to the public:

From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

Emerging Growth Company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The Selling Stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer, solicitation or sale is not permitted.

PRELIMINARY PROSPECTUS, SUBJECT TO COMPLETION, DATED JUNE 16, 2023

VNUE, INC.

Up to 400,000,000 Shares of Common Stock

This prospectus relates to the resale of up to 400,000,000 shares of common stock, represented as Purchase Notice Shares issuable to GHS Investments, LLC (“GHS”), the selling stockholder, pursuant to an Equity Financing Agreement (the “Financing Agreement”), dated June 6, 2022, that we entered into with GHS. The Purchase Agreement permits us to issue Purchase Notices to GHS for up to Ten Million Dollars ($10,000,000) in shares of our common stock through the earlier of 24 months from the date of the Financing Agreement or until $10,000,000 of such shares have been subject of a Purchase Notice.

The selling stockholder may sell all or a portion of the shares being offered pursuant to this prospectus at fixed prices, at prevailing market prices at the time of sale, at varying prices or at negotiated prices.

GHS is an “underwriter” within the meaning of the Securities Act, in connection with the resale of our common stock under the equity line Financing Agreement, and any broker-dealers or agents that are involved in such resales may be deemed to be “underwriters” within the meaning of the Securities Act in connection therewith. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act.

We are not selling any shares of Common Stock under this prospectus and will not receive any of the proceeds from the resale of the Common Stock by GHS (referred to herein as the “Selling Stockholder”). We will pay for expenses of this offering, except that the Selling Stockholder will pay any broker discounts or commissions or equivalent expenses and expenses of its legal counsel applicable to the sale of its shares. There are no arrangements to place the funds received in an escrow, trust, or similar arrangement and the funds will be available to us following deposit into our bank account.

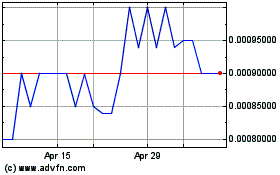

The

Common Stock is quoted on the OTC Markets, under the symbol “VNUE.” On June 14, 2023, the closing price of the Common Stock

on the OTC Markets was $0.0034 per share.

Investing in our common stock involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks that we have described on page 5 of this prospectus under the caption “Risk Factors” and in the documents incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is June 16, 2023.

TABLE OF CONTENTS

We have not, and the Selling Stockholder has not, authorized anyone to provide you with information other than that contained or incorporated by reference in this prospectus and any applicable prospectus supplement or amendment. We have not, and the Selling Stockholder has not, authorized any person to provide you with different information. This prospectus is not an offer to sell, nor is it an offer to buy, these securities in any jurisdiction where the offer is not permitted. The information contained or incorporated by reference in this prospectus and any applicable prospectus supplement or amendment is accurate only as of its date. Our business, financial condition, results of operations, and prospects may have changed since that date.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”) pursuant to which the Selling Stockholder named herein may, from time to time, offer and sell or otherwise dispose of the securities covered by this prospectus. You should not assume that the information contained in this prospectus is accurate on any date subsequent to the date set forth on the front cover of this prospectus or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus is delivered or securities are sold or otherwise disposed of on a later date. It is important for you to read and consider all information contained in this prospectus, including the Information Incorporated by Reference herein, in making your investment decision. You should also read and consider the information in the documents to which we have referred you under the captions “Where You Can Find More Information” and “Incorporation of Information by Reference” in this prospectus.

Neither we nor the Selling Stockholder have authorized any dealer, salesman or other person to give any information or to make any representation other than those contained or incorporated by reference in this prospectus. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any of our securities other than the securities covered hereby, nor does this prospectus constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about, and to observe, any restrictions as to the offering and the distribution of this prospectus applicable to those jurisdictions.

We further note that the representations, warranties and covenants made in any agreement that is filed as an exhibit to any document that is incorporated by reference in the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Unless the context otherwise requires, references in this prospectus to “VNUE,” the “Company,” “we,” “us,” and “our” refer to VNUE, Inc.

PROSPECTUS SUMMARY

The following is a summary of what we believe to be the most important aspects of our business and the offering of our securities under this prospectus. We urge you to read this entire prospectus, including the more detailed financial statements, notes to the financial statements and other information incorporated by reference from our other filings with the SEC. Each of the risk factors could adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment in our securities.

Overview

We are a music technology company that utilizes our platforms to record love concerts and then sell the content to consumers. We make content we record available to the set.fm platform, as well as our website, immediately after the show is finished. Our technology helps artists and record labels generate alternative income from the recorded content. We also offer high end collectible products such as CDs, USB drives and laminates, which feature our fully mixed and mastered live concert content.

Until the acquisition of Stage It, described below, we had two products:

|

● |

Set.fm™ / DiscLive Network™ - Our consumer app platform allows customers to download and purchase, via their individual mobile device, the concert they just attended. There are also physical collectible products which are recorded and sold at shows as well as online through the Company’s exclusive partner DiscLive Network™. The app itself is free to download, and allows for in app purchases regarding the content. (Currently, this is the only platform that generates any revenue for the Company.) |

|

● |

Soundstr™ - a comprehensive music identification and rights management Cloud platform that we are developing, when fully deployed, can accurately track and audit public performances of music, creating a more transparent ecosystem for general music licensing and associated royalty payments, which will help ensure the correct stakeholders are compensated through the use of our “big data” collection. |

While Set.fm™ and Soundstr™ are proprietary marks of the Company, DiscLive, and its related marks and names are not owned by the Company and are owned and utilized by RockHouse Live Media Productions, Inc. The Company has not filed any formal trademark applications relating to Set.fm™ with the United States US Patent and Trademark Office but has been using these marks openly since 2017 and claims common law rights to them.

The Company currently only generates revenue from Set.fm and from DiscLive by (a) recording the audio of live concerts and then selling the content “instantly” through its set.fm website, as well as the IOS Set.fm mobile application, and (b) selling content on physical products such as CDs, which are burned on-site where customers can purchase them. Our customers are fans of live music and the bands which we record.

Customers want to “take home” their experience of the concerts they attend. Our Company enters into agreement with certain bands and artists, and record labels if a particular artist under contract with the label. Our teams then follow that artist or band while they are on tour and record every show on that tour. Our Company uses its own recording and sound equipment while recording concerts.

As we partner with both artists and labels, we market our services on their websites, their social media platforms, their mailing lists, as well as our own websites and social networks. Furthermore, partnerships, with companies similar to Ticketmaster, allow us to market to customers when they buy tickets to see certain artists in concert.

On February 13, 2022, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) with VNUE Acquisition Inc., a Delaware corporation and wholly-owned subsidiary of the Company (“MergerCo”), Stage It Corp., a Delaware corporation (“Stage It”), and the stockholders’ representative for Stage It, pursuant to which the Company agreed to acquire Stage It for $10 million (the “Merger Consideration”), by merging MergerCo with and into Stage It, with Stage It continuing as the surviving entity and wholly owned subsidiary of the Company (the “Merger”).

Pursuant to the Merger Agreement, each of Stage It’s outstanding shares (including common and preferred shares) will be converted into the right to receive the applicable portion of the Merger Consideration. A portion of the Merger Consideration will be paid in cash and take the form of satisfying certain outstanding debt obligations of Stage It, as outlined in a Closing Payment Certificate to the Merger Agreement, and the other portion will be paid in shares of the Company’s common stock or preferred stock, with the actual number of such shares to be issued reduced by the cash component outlaid in the transaction. A portion of the Merger Consideration, $1 million, will be held back for the purposes of satisfying certain contingent obligations of Stage It. Though the period ended March 31, 2022 the Company has paid approximately $1,568,000 in purchase consideration and expenses related to the acquisition.

The Merger Agreement also allows for the issuance of earn out shares, not to exceed the overall Merger Consideration, provided that certain EBIDTA requirements are met over the course of 18 months.

On February 14, 2022, the Company completed the acquisition of Stage It. As a result of the Closing, Stage It became a wholly-owned subsidiary of the Company. For the acquisition, the Company will issue the initial 135,000,000 shares and pay certain amounts as detailed under Merger Consideration in the Merger Agreement. The price to be paid in cash and stock for the Earnout Shares and Holdback Shares are set forth in the Merger Agreement.

With the addition of Stage It (Stage It.com), VNUE will have the ability to livestream concerts and other events, adding to the pool of other live music focused technology services. Stage It is an established platform where concerts or other live events may be ticketed (just like an in-person event), and fans who pay for tickets may enjoy a performance or other engagement by watching digital video as it occurs on their web browser. For example, an artist can create an event through the platform, and then, in advance, let their fans know they can purchase the ability to view the concerts on the Stage It platform. Fans then buy the ability to access these concerts, and at the designated time, the fan may then observe the live performance on Stage It.com.

Covid-19

The full extent of the impact of the COVID-19 pandemic on our business, operations and financial results will depend on numerous evolving factors that we may not be able to accurately predict at the present time. In an effort to contain COVID-19 or slow its spread, governments around the world have enacted various measures, including orders to close all businesses not deemed “essential,” isolate residents to their homes or places of residence, and practice social distancing when engaging in essential activities. We anticipate that these actions and the global health crisis caused by COVID-19 will negatively impact business activity across the globe. The music industry in general has changed dramatically as a result of the pandemic restrictions. While concerts and other events struggle to stay alive, virtual entertainment has increased. Covid-19 has had a material adverse effect on our live recording business and the music industry in general. Substantially all of our future set.fm and DiscLive business is dependent on success of public events and gatherings. We believe that the vaccination efforts throughout the world are having a positive impact on the population that may enable more live music events to be held in the future which would be beneficial to our business, however, there can be no assurances on the timing of when this may occur or whether it will occur at all.

Specific to our company operations, during the pandemic period, we have enacted precautionary measures to protect the health and safety of our employees and partners. These measures include closing our office, having employees work from home, and eliminating all travel. While having employees work from home may have a negative impact on efficiency and may result in negligible increases in costs, it does have an impact on our ability to execute on our agreements to deliver our core products.

We will continue to actively monitor the situation and may take further actions that alter our business operations as may be required by federal, state, local or foreign authorities, or that we determine are in the best interests of our employees, customers, partners and stockholders. It is not clear what the potential effects any such alterations or modifications may have on our business, including the effects on our customers, partners, or vendors, or on our financial results.

Description of the Equity Financing Agreement

On June 6, 2022, the Company entered into an Equity Financing Agreement (“Financing Agreement”) and Registration Rights Agreement (“Registration Agreement”) with GHS. Under the terms of the Financing Agreement, GHS agreed to provide the Company with up to Ten Million ($10,000,000) upon effectiveness of a registration statement on Form S-1 (the “Registration Statement”) filed with the U.S. Securities and Exchange Commission (the “Commission”)

Following effectiveness of the Registration Statement, the Company shall have the discretion to deliver puts to GHS and GHS will be obligated to purchase shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”) based on the investment amount specified in each put notice. The maximum amount that the Company shall be entitled to put to GHS in each put notice shall not exceed two hundred percent (200%) of the average daily trading dollar volume of the Company’s Common Stock during the ten (10) trading days preceding the put, in an amount equaling less than ten thousand dollars ($10,000) or greater than five hundred thousand dollars ($500,000). Pursuant to the Equity Financing Agreement, GHS and its affiliates will not be permitted to purchase and the Company may not put shares of the Company’s Common Stock to GHS that would result in GHS’s beneficial ownership equaling more than 4.99% of the Company’s outstanding Common Stock. The price of each put share shall be equal to eighty percent (80%) of the Market Price (as defined in the Equity Financing Agreement). Following an up-list to the NASDAQ or an equivalent national exchange by the Company, the Purchase price shall mean ninety percent (90%) of the Market Price, subject to a floor of $.0001 per share. Puts may be delivered by the Company to GHS until the earlier of twenty-four (24) months after the effectiveness of the Registration Statement or the date on which GHS has purchased an aggregate of $10,000,000 worth of Common Stock under the terms of the Equity Financing Agreement.

Additionally,

concurrently with the execution of definitive agreements, the Company is required to issue common shares to the Investor representing

a dollar value equal to one percent (1.0%) of the Commitment Amount (the “Commitment Shares”), which equalled 29,069,768

Commitment Shares ( calculated at the applicable Purchase Price on the trading day immediately preceding the execution of the definitive

agreements), which shares have not yet been issued. By mutual understanding between GHS and us, we plan to issue the shares after the

Company’s Definitive Form 14C (“14C) is filed on the SEC Edgar System, we have mailed the 14C to our shareholders, and our

authorized share increase is approved by the state of Nevada, which we anticipate will occur by mid-July 2023.

The Registration Rights Agreement provides that the Company shall (i) use its best efforts to file with the Commission the Registration Statement within 30 days of the date of the Registration Rights Agreement; and (ii) have the Registration Statement declared effective by the Commission within 30 days after the date the Registration Statement is filed with the Commission, but in no event more than 90 days after the Registration Statement is filed.

THE OFFERING

| Common stock to be offered by the Selling Stockholder |

|

Up to 400,000,000 shares. |

| |

|

|

| Shares of Common Stock outstanding before this offering |

|

1,878,356,854 shares. |

| |

|

|

| Shares of Common Stock outstanding after this offering |

|

2,278,356,854 shares. |

| |

|

|

| Offering Price Per Share |

|

The Selling Stockholder GHS identified in this prospectus may sell all or a portion of the shares being offered under the Financing Agreement at fixed prices and prevailing market prices at the time of sale, at varying prices or at negotiated prices. |

| |

|

|

| Use of Proceeds |

|

We will not receive any proceeds from the sale of Common Stock by the Selling Stockholder. |

| |

|

|

| Duration of Offering |

|

The offering shall terminate on the earlier of (i) the date when the sale of all shares being registered is completed, or (ii) a year from the date of effectiveness of this Prospectus. |

| |

|

|

| Risk Factors |

|

This investment involves a high degree of risk. See “Risk Factors” for a discussion of factors you should consider carefully before making an investment decision. |

| |

|

|

| OTC Markets symbol |

|

“VNUE.” |

RISK FACTORS

This investment has a high degree of risk. Before you invest you should carefully consider the risks and uncertainties described below and the other information in this prospectus. If any of the following risks actually occur, our business, operating results and financial condition could be harmed and the value of our stock could go down. This means you could lose all or a part of your investment.

Risk Related to Covid 19

Our business and future operations may be adversely affected by epidemics and pandemics, such as the recent COVID-19 outbreak.

We may face risks related to health epidemics and pandemics or other outbreaks of communicable diseases, which could result in a widespread health crisis that could adversely affect general commercial activity and the economies and financial markets of the country as a whole. For example, the recent outbreak of Covid-19, which began in China, has been declared by the World Health Organization to be a “pandemic,” has spread across the globe, including the United States of America.

Covid-19 has had a material adverse effect on our live recording business and the music industry in general. Substantially all of our future set.fm and DiscLive business is dependent on success of public events and gatherings. We believe that the vaccination efforts throughout the world are having a positive impact on the population that may enable more live music events to be held in the future which would be beneficial to our business, however, there can be no assurances on the timing of when this may occur or whether it will occur at all.

Risks Related to Our Financial Condition

Because we have a limited operating history, you may not be able to accurately evaluate our operations.

We have had limited operations to date and have generated limited revenues. Therefore, we have a limited operating history upon which to evaluate the merits of investing in our company. Potential investors should be aware of the difficulties normally encountered by new companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the operations that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to the ability to generate sufficient cash flow to operate our business, and additional costs and expenses that may exceed current estimates. We expect to incur significant losses into the foreseeable future. We recognize that if the effectiveness of our business plan is not forthcoming, we will not be able to continue business operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and it is doubtful that we will continue to generate operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

We are dependent on outside financing for continuation of our operations.

Because we have generated limited revenues and currently operate at a loss, we are completely dependent on the continued availability of financing in order to continue our business. There can be no assurance that financing sufficient to enable us to continue our operations will be available to us in the future.

We are dependent on outside financing for continuation of our operations.

Because we have generated limited revenues and currently operate at a loss, we are completely dependent on the continued availability of financing in order to continue our business operations. There can be no assurance that financing sufficient to enable us to continue our operations will be available to us in the future.

We will need additional funds to complete further development of our business plan to achieve a sustainable level where ongoing operations can be funded out of revenues. We anticipate that we must raise $2,500,000 for our operations for the next 12 months, and $5,000,000 to fully implement our business plan to its fullest potential and achieve our growth plans. There is no assurance that any additional financing will be available or if available, on terms that will be acceptable to us.

Our failure to obtain future financing or to produce levels of revenue to meet our financial needs could result in our inability to continue as a going concern and, as a result, our investors could lose their entire investment.

Our operating results may fluctuate, which could have a negative impact on our ability to grow our client base, establish sustainable revenues and succeed overall.

Our results of operations may fluctuate as a result of a number of factors, some of which are beyond our control including but not limited to:

|

● |

general economic conditions in the geographies and industries where we sell our services and conduct operations; legislative policies where we sell our services and conduct operations; |

|

● |

the budgetary constraints of our customers; seasonality; |

|

● |

success of our strategic growth initiatives; |

|

● |

costs associated with the launching or integration of new or acquired businesses; timing of new product introductions by us, our suppliers and our competitors; product and service mix, availability, utilization and pricing; |

|

● |

the mix, by state and country, of our revenues, personnel and assets; movements in interest rates or tax rates; |

|

● |

changes in, and application of, accounting rules; changes in the regulations applicable to us; and litigation matters; |

As a result of these factors, we may not succeed in our business and we could go out of business.

As a growing company, we have yet to achieve a profit and may not achieve a profit in the near future, if at all.

We have not yet produced any profit and may not in the near future, if at all. While we have generated limited revenue, all related party, we cannot be certain that we will be able to realize sufficient revenue to achieve profitability. Further, many of our competitors have a significantly larger industry presence and revenue stream but have yet to achieve profitability. Our ability to continue as a going concern is dependent upon raising capital from financing transactions, increasing revenue and keeping operating expenses below our revenue levels in order to achieve positive cash flows, none of which can be assured.

Risks Related to Intellectual Property

We may be subject to intellectual property infringement claims, which may be expensive to defend and may disrupt our business and operations.

We cannot be certain that our operations or any aspects of our business do not or will not infringe upon or otherwise violate intellectual property rights held by third parties. We have not but in the future may be, subject to legal proceedings and claims relating to the intellectual property rights of others. There could also be existing intellectual property of which we are not aware that our products may inadvertently infringe. We cannot assure you that holders of intellectual property purportedly relating to some aspect of our technology or business, if any such holders exist, would not seek to enforce such intellectual property against us in the United States, or any other jurisdictions. If we are found to have violated the intellectual property rights of others, we may be subject to liability for our infringement activities or may be prohibited from using such intellectual property, and we may incur licensing fees or be forced to develop alternatives of our own. In addition, we may incur significant expenses, and may be forced to divert management’s time and other resources from our business and operations to defend against these infringement claims, regardless of their merits. Successful infringement or licensing claims made against us may result in significant monetary liabilities and may materially disrupt our business and operations by restricting or prohibiting our use of the intellectual property in question, and our business, financial position and results of operations could be materially and adversely affected.

Our commercial success depends significantly on our ability to develop and commercialize our services and platform without infringing the intellectual property rights of third parties.

Our commercial success will depend, in part, on operating our business without infringing the trademarks or proprietary rights of third parties. Third parties that believe we are infringing on their rights could bring actions against us claiming damages and seeking to enjoin the development, marketing and distribution of our services and platform. If we become involved in any litigation, it could consume a substantial portion of our resources, regardless of the outcome of the litigation. If any of these actions are successful, we could be required to pay damages and/or to obtain a license to continue to develop or market our products, in which case we may be required to pay substantial royalties. However, any such license may not be available on terms acceptable to us or at all.

Risks Related to Legal Uncertainty

Compliance with changing regulation of corporate governance and public disclosure may result in additional expenses.

Changing laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002 and new SEC regulations, are creating uncertainty for companies such as ours. These new or changed laws, regulations and standards are subject to varying interpretations in many cases due to their lack of specificity, and as a result, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies, which could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. We are committed to maintaining high standards of corporate governance and public disclosure. As a result, we intend to invest resources to comply with evolving laws, regulations and standards, and this investment may result in increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities. If our efforts to comply with new or changed laws, regulations and standards differ from the activities intended by regulatory or governing bodies due to ambiguities related to practice, our reputation may be harmed.

If we fail to comply with the new rules under the Sarbanes-Oxley Act related to accounting controls and procedures, or if material weaknesses or other deficiencies are discovered in our internal accounting procedures, our stock price could decline significantly.

We are exposed to potential risks from legislation requiring companies to evaluate internal controls under Section 404(a) of the Sarbanes-Oxley Act of 2002. As a smaller reporting company, we are required to provide a report on the effectiveness of its internal controls over financial reporting, and we will be exempt from auditor attestation requirements concerning any such report so long as we are a smaller reporting company. There is a greater likelihood of material weaknesses in our internal controls, which could lead to misstatements or omissions in our reported financial statements as compared to issuers that have conducted such evaluations.

In its assessment of the effectiveness of internal control over financial reporting as of September 30, 2021, the Company determined that there were deficiencies that constituted material weaknesses, as described below.

|

● |

Lack of proper segregation of duties due to limited personnel. |

|

● |

Lack of a formal review process that includes multiple levels of review. |

|

● |

Lack of adequate policies and procedures for accounting for financial transactions. |

|

● |

Lack of independent board member(s) |

|

● |

Lack of independent audit committee |

Material weaknesses and deficiencies could cause investors to lose confidence in our company and result in a decline in our stock price and consequently affect our financial condition. In addition, if we fail to achieve and maintain the adequacy of our internal controls, we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act. Moreover, effective internal controls, particularly those related to revenue recognition, are necessary for us to produce reliable financial reports and are important to helping prevent financial fraud. If we cannot provide reliable financial reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial information, and the trading price of our common stock could drop significantly. In addition, we cannot be certain that additional material weaknesses or significant deficiencies in our internal controls will not be discovered in the future.

Risks Related to Our Business

If we fail to keep up with industry trends or technological developments, our business, results of operations and financial condition may be materially and adversely affected.

The live music content industry is rapidly evolving and subject to continuous technological changes. Our success will depend on our ability to keep up with the changes in technology and user behavior resulting from new developments and innovations. For example, as we provide our product and service offerings across a variety of mobile systems and devices, we are dependent on the interoperability of our services with popular mobile devices and mobile operating systems that we do not control, such as Android and iOS. If any changes in such mobile operating systems or devices degrade the functionality of our services or give preferential treatment to competitive services, the usage of our services could be adversely affected.

Technological innovations may also require substantial capital expenditures in product development as well as in modification of products, services or infrastructure. We cannot assure you that we can obtain financing to cover such expenditure. If we fail to adapt our products and services to such changes in an effective and timely manner, we may suffer from decreased user base, which, in turn, could materially and adversely affect our business, financial condition and results of operations

Rapidly evolving technologies could cause demand for our products to decline or could cause our products to become obsolete.

Current or future competitors may develop technological or product innovations that address live music content in a manner that is, or is perceived to be, equivalent or superior to our products. In the technology market in particular, innovative products have been introduced which have the effect of revolutionizing a product category and rendering many existing products obsolete. If competitors introduce new products or services that compete with or surpass the quality or the price/performance of our products, we may be unable to attract and retain users or to maintain or increase revenues from our users. We may not anticipate such developments and may be unable to adequately compete with these potential solutions. As a result of these or similar potential developments, in the future it is possible that competitive dynamics in our market may require us to reduce prices for our paid for products, which could harm our net revenues, gross margin and operating results or cause us to incur losses.

Our business depends on our users having continued and unimpeded access to the Internet. Companies providing access to the Internet may be able to block or degrade our calls, or block access to our website or charge us or our users additional fees for our products.

All of our users rely on open, unrestricted access to the Internet to use our products. If they have limited, restricted or no access at all to the Internet, or their connection to the Internet is interrupted or disturbed, they may be less likely to use our products as a result.

Some of these internet providers have stated that they may take measures that could increase the cost of customers’ use of our products by restricting or prohibiting the use of their lines or access points to the Internet for our products, by filtering, blocking, delaying, or degrading the packets of data used to transmit our communications, and by charging increased fees to our users for access to our products.

Some Internet access providers have additionally, or alternatively, contractually restricted their customers’ access to Internet communications products through their terms of service. Customers of these and other Internet access providers may not be aware that technical disruptions or additional tariffs are the act of other parties, which could harm our brand. Even if customers understand that we are not the source of such disruptions, they may be less likely to use our products as a result.

In the United States, the European Union and other jurisdictions, regulatory authorities are in the process of examining the adoption of “network neutrality” policies, which aim to treat all Internet traffic equally, and developing or considering laws and regulations to codify acceptable behaviors on the part of network operators and access providers when providing consumers and businesses with access to the Internet. Different regulatory authorities have different approaches to this policy area both from a substantive and procedural perspective. Any failure on the part of regulatory authorities to protect the accessibility of the Internet to all, or any particular category of, Internet subscribers, or their failure to protect the delivery on a non-discriminatory basis of user communications over the Internet, regardless of type or service, could harm our results of operations and prospects.

Our business depends on the continued reliability of the Internet infrastructure.

If Internet service providers and other third parties providing Internet services have outages or deteriorations in their quality of service, our customers will not have access to our products or may experience a decrease in the quality of our products.

Furthermore, as the rate of adoption of new technology increases, the networks on which our products rely in certain countries may not be able to sufficiently adapt to the increased demand for their products and services. Frequent or persistent interruptions could cause current or potential users to believe that our systems are unreliable, leading them to switch to our competitors or to avoid our products, and could permanently harm our reputation and brands.

We cannot control internet based delays and interruptions, which may negatively affect our customers and thus our revenues.

Any delay or interruption in the services by these third parties service providers could result in delayed or interrupted service to our customers and could harm tour business. Accordingly, we could be adversely affected if such third party service providers fail to maintain consistent and reliable services, or fail to continue to make these services available to us on economically acceptable terms, or at all. These suppliers could also be adversely impacted by the COVID-19 pandemic, which could affect their ability to deliver their services to our customers in a satisfactory manner, or at all.

Digital piracy continues to adversely impact our business.

A substantial portion of our revenue comes from the distribution of music which is potentially subject to unauthorized consumer copying and widespread digital dissemination without an economic return to us, including as a result of “stream-ripping.” In its Music Listening 2019 report, IFPI surveyed 34,000 Internet users to examine the ways in which music consumers aged 16 to 64 engage with recorded music across 21 countries. Of those surveyed, 23% used illegal stream-ripping services, the leading form of music piracy. Organized industrial piracy may also lead to decreased revenues. The impact of digital piracy on legitimate music revenues and subscriptions is hard to quantify, but we believe that illegal file sharing and other forms of unauthorized activity, including stream manipulation, have a substantial negative impact on music revenues. If we fail to obtain appropriate relief through the judicial process or the complete enforcement of judicial decisions issued in our favor (or if judicial decisions are not in our favor), if we are unsuccessful in our efforts to lobby governments to enact and enforce stronger legal penalties for copyright infringement or if we fail to develop effective means of protecting and enforcing our intellectual property (whether copyrights or other intellectual property rights such as patents, trademarks and trade secrets) or our music entertainment-related products or services, our results of operations, financial position and prospects may suffer.

If we are unable to successfully manage growth, our operations could be adversely affected.

Our progress is expected to require the full utilization of our management, financial and other resources, which to date has occurred with limited working capital. Our ability to manage growth effectively will depend on our ability to improve and expand operations, including our financial and management information systems, and to recruit, train and manage personnel. There can be no absolute assurance that management will be able to manage growth effectively.

If we do not properly manage the growth of our business, we may experience significant strains on our management and operations and disruptions in our business. Various risks arise when companies and industries grow quickly. If our business or industry grows too quickly, our ability to meet customer demand in a timely and efficient manner could be challenged. We may also experience development delays as we seek to meet increased demand for our services and platform. Our failure to properly manage the growth that we or our industry might experience could negatively impact our ability to execute on our operating plan and, accordingly, could have an adverse impact on our business, our cash flow and results of operations, and our reputation with our current or potential customers.

We may fail to successfully integrate our acquisitions or otherwise be unable to benefit from pursuing acquisitions.

We believe there are meaningful opportunities to grow through acquisitions and joint ventures across all service categories and we expect to continue a strategy of selectively identifying and acquiring businesses with complementary services. We may be unable to identify, negotiate, and complete suitable acquisition opportunities on reasonable terms. There can be no assurance that any business acquired by us will be successfully integrated with our operations or prove to be profitable to us. We may incur future liabilities related to acquisitions. Should any of the following problems, or others, occur as a result of our acquisition strategy, the impact could be material:

|

● |

difficulties integrating personnel from acquired entities and other corporate cultures into our business; difficulties integrating information systems; |

|

● |

the potential loss of key employees of acquired companies; |

|

● |

the assumption of liabilities and exposure to undisclosed or unknown liabilities of acquired companies; or the diversion of management attention from existing operations. |

Risks Associated with Management and Control Persons

We are dependent on the continued services of Zach Bair and if we fail to keep him or fail to attract and retain qualified senior executive and key technical personnel, our business will not be able to expand.

We

are dependent on the continued availability of Zach Bair, and the availability of new employees to implement our business plans. The

market for skilled employees is highly competitive, especially for employees in our industry. Although we expect that our planned compensation

programs will be intended to attract and retain the employees required for us to be successful, there can be no assurance that we will

be able to retain the services of all our key employees or a sufficient number to execute our plans, nor can there be any assurance we

will be able to continue to attract new employees as required.

Our personnel may voluntarily terminate their relationship with us at any time, and competition for qualified personnel is intense. The process of locating additional personnel with the combination of skills and attributes required to carry out our strategy could be lengthy, costly and disruptive.

If we lose the services of key personnel or fail to replace the services of key personnel who depart, we could experience a severe negative effect on our financial results and stock price. The loss of the services of any key personnel, marketing or other personnel or our failure to attract, integrate, motivate and retain additional key employees could have a material adverse effect on our business, operating and financial results and stock price.

Our lack of adequate D&O insurance may also make it difficult for us to retain and attract talented and skilled directors and officers.

In the future we may be subject to additional litigation, including potential class action and stockholder derivative actions. Risks associated with legal liability are difficult to assess and quantify, and their existence and magnitude can remain unknown for significant periods of time. To date, we have not obtained directors and officers liability (“D&O”) insurance. Without adequate D&O insurance, the amounts we would pay to indemnify our officers and directors should they be subject to legal action based on their service to the Company could have a material adverse effect on our financial condition, results of operations and liquidity. Furthermore, our lack of adequate D&O insurance may make it difficult for us to retain and attract talented and skilled directors and officers, which could adversely affect our business.

The elimination of monetary liability against our directors, officers and employees under our Articles of Incorporation and the existence of indemnification rights to our directors, officers and employees may result in substantial expenditures by our Company and may discourage lawsuits against our directors, officers and employees.

Our Articles of Incorporation contain provisions that eliminate the liability of our directors for monetary damages to our Company and shareholders. Our bylaws also require us to indemnify our officers and directors. We may also have contractual indemnification obligations under our agreements with our directors, officers and employees. The foregoing indemnification obligations could result in our company incurring substantial expenditures to cover the cost of settlement or damage awards against directors, officers and employees that we may be unable to recoup. These provisions and resulting costs may also discourage our company from bringing a lawsuit against directors, officers and employees for breaches of their fiduciary duties, and may similarly discourage the filing of derivative litigation by our shareholders against our directors, officers and employees even though such actions, if successful, might otherwise benefit our Company and shareholders.

Our officers and directors have limited experience managing a public company.

Our officers and directors have limited experience managing a public company. Consequently, we may not be able to raise any funds or run our public company successfully. Our executive’s officer’s and director’s lack of experience of managing a public company could cause you to lose some or all of your investment.

Our failure to adopt certain corporate governance procedures may prevent us from obtaining a listing on a national securities exchange.

We do not have an audit, compensation or nominating and corporate governance committee. The functions such committees would perform are performed by the board as a whole. Consequently, there is a potential conflict of interest in board decisions that may adversely affect our ability to become a listed security on a national securities exchange and as a result adversely affect the liquidity of our Common Stock.

Risks Related to Our Securities and the Over the Counter Market

Since we are traded on the OTC Pink Market, an active, liquid trading market for our common stock may not develop or be sustained. If and when an active market develops the price of our common stock may be volatile.

Presently,

our common stock is quoted on the OTC Markets and the closing price of our stock on June 13, 2033 was $0.0034. Presently there is limited

trading in our stock and in the absence of an active trading market investors may have difficulty buying and selling or obtaining market

quotations, market visibility for shares of our common stock may be limited, and a lack of visibility for shares of our common stock

may have a depressive effect on the market price for shares of our common stock.

The lack of an active market impairs your ability to sell your shares at the time you wish to sell them or at a price that you consider reasonable. The lack of an active market may also reduce the fair market value of your shares. An inactive market may also impair our ability to raise capital to continue to fund operations by selling shares.

Trading in stocks quoted on the Pink Markets is often thin and characterized by wide fluctuations in trading prices, due to many factors that may have little to do with our operations or business prospects. The securities market has from time to time experienced significant price and volume fluctuations that are not related to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of shares of our common stock. Moreover, the pink sheets is not a stock exchange, and trading of securities is often more sporadic than the trading of securities listed on a quotation system like Nasdaq or a national stock exchange like the NYSE. Accordingly, stockholders may have difficulty reselling any shares of common stock.

There is no assurance that we will be able to pay dividends to our shareholders, which means that you could receive little or no return on your investment.

Payment of dividends from our earnings and profits may be made at the sole discretion of our board of directors. There is no assurance that we will generate any distributable cash from operations. Our board may elect to retain cash for operating purposes, debt retirement, or some other purpose. Consequently, you may receive little or no return on your investment.

Our shares will be subordinate to all of our debts and liabilities, which increases the risk that you could lose your entire investment.

Our shares are equity interests that will be subordinate to all of our current and future indebtedness with respect to claims on our assets. In any liquidation, all of our debts and liabilities must be paid before any payment is made to our shareholders. The amount of any debt financing we incur creates a substantial risk that in the event of our bankruptcy, liquidation or reorganization, we may have no assets remaining for distribution to our shareholders after payment of our debts.

Our Board of Directors may authorize and issue shares of new classes of stock that could be superior to or adversely affect you as a holder of our common stock.

Our board of directors has the power to authorize and issue shares of classes of stock, including preferred stock that have voting powers, designations, preferences, limitations and special rights, including preferred distribution rights, conversion rights, redemption rights and liquidation rights without further shareholder approval which could adversely affect the rights of the holders of our common stock. In addition, our board could authorize the issuance of a series of preferred stock that has greater voting power than our common stock or that is convertible into our common stock, which could decrease the relative voting power of our common stock or result in dilution to our existing common stockholders.

Any of these actions could significantly adversely affect the investment made by holders of our common stock. Holders of common stock could potentially not receive dividends that they might otherwise have received. In addition, holders of our common stock could receive less proceeds in connection with any future sale of the Company, whether in liquidation or on any other basis.

Our

existing stockholders will experience significant dilution from the merger and conversion of existing preferred stock to common stock

and the exercise of warrants.

As

of the date of this Prospectus, we are required to issue a total of 833,377,889 shares of common stock as a result of voluntary conversions

of our preferred stock. As may be adjusted by our stock price in the case of Series B Preferred Stock, but as of the date of this prospectus,

we may be required to issue 212,528,950 shares of common stock as a result of any voluntary conversion of 4,250,579 shares of Series

A Preferred Stock, which are issued and outstanding, 620,845,939 shares of common stock as a result of any voluntary conversion of 2,093

shares of our Series B Preferred Stock, which are issued and outstanding, and 3,000 shares of common stock as a result of any voluntary

conversion of 3,000 shares of our Series C Preferred Stock, which are issued and outstanding.

We

also have warrants outstanding to purchase 335,440,817 shares of common stock at exercise prices within the range of $0.00264 and $0.01122,

all of which are owned by GHS. GHS also owns 2498 Preferred B shares, which can result in 1,665,333,334 shares of common stock being

issued to GHS.

Finally,

we are still required to complete the exchange of shares in the Stage It merger. As of the time of the Stage It merger agreement, 93,523,037

shares were reserved for this purpose. Currently there are 72,026,422 shares reserved for the Stage It merger. The issuance of our common

stock in accordance with foregoing will have a dilutive impact on our shareholders. As a result, the market price of our common stock

could decline. In addition, the lower our stock price is at the time we the Series B Preferred converts to common stock, the more shares

of our common stock we will have to issue. If our stock price decreases, then our existing shareholders would experience greater dilution.

The perceived risk of dilution may cause our stockholders to sell their shares, which may cause a decline in the price of our common

stock. Moreover, the perceived risk of dilution and the resulting downward pressure on our stock price could encourage investors to engage

in short sales of our common stock. By increasing the number of shares offered for sale, material amounts of short selling could further

contribute to progressive price declines in our common stock.

We

may not have available shares of common stock to fulfil our obligations under existing agreements if we are unable to increase our authorized

shares.

We

are registering 400,000,000 shares of common stock under a Financing Agreement that we entered into with GHS. We currently have 1,878,356,854

shares issued and outstanding as of the date of this Prospectus. When the 400,000,000 shares we are registering are combined with our

overall issued and outstanding, we will have a total of 2,278,356,854 shares issued and outstanding.

Shares eligible for future sale may adversely affect the market price of our common stock, as the future sale of a substantial amount of outstanding common stock in the public marketplace could reduce the price of our common stock.

The market price of our shares could decline as a result of sales of substantial amounts of our shares in the public market, or the perception that these sales could occur. In addition, these factors could make it more difficult for us to raise funds through future offerings of our common stock.

If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or prevent fraud.

The SEC, as required by Section 404 of the Sarbanes-Oxley Act of 2002, adopted rules requiring every public company to include a management report on such company’s internal controls over financial reporting in its annual report, which contains management’s assessment of the effectiveness of internal controls over financial reporting.

Our reporting obligations as a public company place a significant strain on our management and operational and financial resources and systems. Effective internal controls, particularly those related to revenue recognition, are necessary for us to produce reliable financial reports and are important to prevent fraud. As a result, our failure to achieve and maintain effective internal controls over financial reporting may result in the loss of investor confidence in the reliability of our financial statements, which in turn may harm our business and negatively impact the trading price of our stock. Furthermore, we anticipate that we will continue to incur considerable costs and use significant management time and other resources in an effort to comply with Section 404 and other requirements of the Sarbanes-Oxley Act.

We may, in the future, issue additional common shares, which would reduce investors’ percent of ownership and may dilute our share value.

Our

Articles of Incorporation authorizes the issuance of 4,000,000,000 shares of common stock. We currently have 1,878,356,854 shares of

common stock issued and outstanding. The future issuance of common stock will result in substantial dilution in the percentage of our

common stock held by our then existing shareholders. We may value any common stock issued in the future on an arbitrary basis. The issuance

of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares

held by our investors and might have an adverse effect on any trading market for our common stock.

There is a limited market for our common stock, which may make it difficult for holders of our common stock to sell their stock.

Our common stock currently trades on the OTC Pink Markets under the symbol “VNUE” and currently there is no trading in our common stock or current information regarding our company. Accordingly, there can be no assurance as to the liquidity of any markets that may develop for our common stock, the ability of holders of our common stock to sell our common stock, or the prices at which holders may be able to sell our common stock. Further, many brokerage firms will not process transactions involving low price stocks, especially those that come within the definition of a “penny stock.” If we cease to be quoted, holders of our common stock may find it more difficult to dispose of, or to obtain accurate quotations as to the market value of our common stock, and the market value of our common stock would likely decline.

The trading price of our Common Stock is likely to be volatile, which could result in substantial losses to investors.

The trading price of our common stock is likely to be volatile and could fluctuate widely due to factors beyond our control. This may happen because of broad market and industry factors, including the performance and fluctuation of the market prices of other companies with business operations located outside of the United States. In addition to market and industry factors, the price and trading volume for our common stock may be highly volatile for factors specific to our own operations, including the following:

| |

● |

variations in our revenues, earnings and cash flow; |

| |

|

|

| |

● |

announcements of new investments, acquisitions, strategic partnerships or joint ventures by us or our competitors; |

| |

● |

announcements of new offerings, solutions and expansions by us or our competitors; |

| |

|

|

| |

● |

changes in financial estimates by securities analysts; |

| |

|

|

| |

● |

detrimental adverse publicity about us, our brand, our services or our industry; |

| |

|

|

| |

● |

additions or departures of key personnel; |

| |

|

|

| |

● |

release of lock-up or other transfer restrictions on our outstanding equity securities or sales of additional equity securities; and |

| |

|

|

| |

● |

potential litigation or regulatory investigations. |

Any of these factors may result in large and sudden changes in the volume and price at which our common stock will trade.

In the past, shareholders of public companies have often brought securities class action suits against those companies following periods of instability in the market price of their securities. If we were involved in a class action suit, it could divert a significant amount of our management’s attention and other resources from our business and operations and require us to incur significant expenses to defend the suit, which could harm our results of operations. Any such class action suit, whether or not successful, could harm our reputation and restrict our ability to raise capital in the future. In addition, if a claim is successfully made against us, we may be required to pay significant damages, which could have a material adverse effect on our financial condition and results of operations.

We are subject to be the penny stock rules which will make shares of our common stock more difficult to sell.

We are subject now and, in the future, may continue to be subject, to the SEC’s “penny stock” rules if our shares of common stock sell below $5.00 per share. Penny stocks generally are equity securities with a price of less than $5.00. The penny stock rules require broker-dealers to deliver a standardized risk disclosure document prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer must also provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson, and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information must be given to the customer orally or in writing prior to completing the transaction and must be given to the customer in writing before or with the customer’s confirmation.

In addition, the penny stock rules require that prior to a transaction, the broker dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. The penny stock rules are burdensome and may reduce purchases of any offerings and reduce the trading activity for shares of our common stock. As long as our shares of common stock are subject to the penny stock rules, the holders of such shares of common stock may find it more difficult to sell their securities.

The sale or availability for sale of substantial amounts of our common stock could adversely affect their market price.

Sales

of substantial amounts of our common stock in the public market after the filing of this Form S-1, or the perception that these

sales could occur, could adversely affect the market price of our common stock and could materially impair our ability to raise