By Paul Page

Sign up:With one click, get this newsletter delivered to your

inbox.

Wal-Mart Stores Inc. is betting big on distribution Mexico. The

retailer's Wal-Mart de Mexico SAB unit plans to invest $1.3 billion

to improve logistics in the country by extending its network of

distribution centers and upgrading existing warehouses, the WSJ's

Anthony Harrup reports. The commitment on top of annual spending

Wal-Mart already is undertaking in the country comes as many

companies are showing concern over investments in Mexico as the

incoming Donald Trump administration raises questions over the

future of U.S. cross-border trade. Mexico touts this week's

successful auction of oil exploration blocks as a sign of foreign

investment interest and of future economic growth. With 2,300

stores and 200,000 workers, Wal-Mart remains the country's biggest

retailer and private-sector employer, and the spending on logistics

suggests the election hasn't diminished the company's confidence in

the market.

The pending sale of the biggest container terminal at

California's Port of Long Beach may trigger more waves of change

across container shipping competition. Hyundai Merchant Marine Co.

and Mediterranean Shipping Co. are in pole position to buy a

majority stake in Total Terminals International LLC, the WSJ's

Costas Paris reports, in a joint bid that may bolster the Korean

operator's effort to join a shipping alliance. The stake comes from

Hanjin Shipping Co., which went bankrupt in August and now is being

sold off in pieces. MSC holds the other 46% of the Long Beach

terminal, and co-ownership of a critical gateway facility may give

Hyundai Merchant Marine more standing to work with the 2M Alliance

made up of MSC and Maersk Line. Shippers are balking at having a

Korean carrier included in 2M after the abrupt demise of Hanjin,

but the carriers are anxious for an operating agreement even if it

falls short of full alliance membership.

A bigger piece of the Apple Inc. supply chain may be moving to

the U.S. Foxconn Technology Group, a major producer of the iPhone

and other Apple products, says it is in talks to expand in the

U.S., the WSJ's Eva Dou and Tripp Mickle report, marking what could

be a big shift in electronics manufacturing as President-elect

Donald Trump pledges to revive American factories. A small share of

Apple products are already made in the U.S. by other contract

manufacturers, but the overwhelming majority of Apple products are

assembled in China, and most of them by Foxconn at factories in

China that employ hundreds of thousands of workers in its Chinese

factories. It isn't clear that any Foxconn expansion in the U.S.

would be to make Apple products, and shifting the assembly would

trigger big changes across the extensive distribution network that

pulls high-value components into Foxconn sites. The company,

formally known as Hon Hai Precision Industry Co., has been looking

at U.S. expansion for some time, however, noting that it would mean

making goods closer to the buyers of electronics.

SUPPLY CHAIN STRATEGIES

IKEA is rethinking its famously sprawling, remote stores to meet

big changes in distribution and the retail business. The iconic

Sweden-based furniture retailer is adapting to shifting trends by

creating smaller stores closer to population centers, a move that

means rebuilding its simple but highly efficient distribution

channels. IKEA Chief Executive Peter Agnefjäll tells the WSJ's

Saabira Chaudhuri the company expects to use more of its stores as

"click and collect" sites, allowing customers to order goods online

and pick them up at the sites. But bigger changes are moving

through its supply chains, with some distribution centers

refurbished to handle both shipping to stores and e-commerce

fulfillment and work underway to bypass stores entirely and ship

directly to customers. That means reconfiguring logistics

operations and a business strategy built on cheap land far from

city centers. New retail buying patterns suggest, however, that

IKEA has to get closer to its customers rather than waiting for

consumers to trek to IKEA.

The high-tech supply chain that Nokia Corp. built and then

dismantled in a corner of Finland may be rising again. Several

technology startups are heading to the provincial Finnish city of

Salo, the WSJ's Matthias Verbergt reports, lured by the expertise

and the infrastructure in the community known by some as Nokia

Town. Nokia left the town with a big gap when the pioneer of the

cellular phone abandoned manufacturing. But when San Diego-based

Nuviz Inc. recently hired 20 engineers and developed its high-tech

head-up displays for motorcyclists in less than six months in Salo,

it suggested the town's technology supply chain isn't completely

broken. More than dozen a companies have set up shop in former

Nokia premises, including cellphone maker Turing Robotics Inc.

Though still fledgling, the revival suggests how the ruins of a

large tech business can become fertile ground for startup

industries.

QUOTABLE

IN OTHER NEWS

The Supreme Court pressed lawyers for defunct New Jersey trucker

Jevic Transportation Inc. on why a settlement that left workers

unpaid didn't violate bankruptcy law's repayment rules. (WSJ)

Third-quarter volume of U.S. home construction loans grew at the

fastest rate in more than two years. (WSJ)

German manufacturing orders surged 4.9% from September to

October. (WSJ)

Mining giant Consol Energy Inc. gains more earnings from natural

gas than coal, highlighting the difficulty in delivering in

political promises to revive the coal industry. (WSJ)

Drone maker AeroVironment Inc. swung to a loss in its latest

quarter as sales in its unmanned-aircraft-systems business fell.

(WSJ)

Costco Wholesale Corp. expanded its fiscal first-quarter profit

as same-store sales grew for the first time in three quarters.

(WSJ)

Bankrupt retailer American Apparel LLC will close nine stores

this month, including sites in Washington, D.C., and New York

City.

Pebble Technology Corp. will close operations and stop selling

smartwatches as Fitbit Inc. buys its intellectual property and

hires key personnel. (WSJ)

Handbag retailer Vera Bradley Inc. lowered its full-year outlook

after same-store sales fell for the eighth straight quarter.

(WSJ)

Office products retailer Staples Inc. will sell its European

operations to private-equity firm Cerberus Capital Management L.P.

(WSJ)

Taiwan Semiconductor Manufacturing Co. will build a $15.7

billion plant in Taiwan to make the world's most advanced chips.

(Nikkei Asian Review)

Blue Bell Creameries will reopen the Tucson, Ariz., distribution

center it closed in 2015 after products tested positive for

Listeria. (Arizona Daily Star)

Rhode Island will install electronic tolls to charge heavy-duty

trucks traveling through the state. (WPRI)

Global air cargo traffic grew at the fastest pace in 18 months

in October following the collapse of Hanjin Shipping Co.

(Reuters)

Material-handling products maker Columbus McKinnon Inc. will

acquire Stahl Cranesystems, a unit of Konecranes PLC, for $240

million. (Industrial Distribution)

United Parcel Service Inc. is testing use of electric-powered

tricycles for delivery in Portland, Ore. (DC Velocity)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin, @lorettachao, @smithjenBK and @EEPhillips_WSJ and

follow the WSJ Logistics Report on Twitter at @WSJLogistics.

Subscribe to this email newsletter by clicking here:

http://on.wsj.com/Logisticsnewsletter .

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

December 08, 2016 06:53 ET (11:53 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

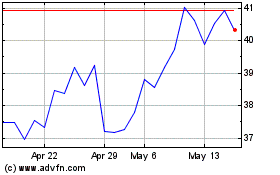

Wal Mart de Mexico SAB d... (QX) (USOTC:WMMVY)

Historical Stock Chart

From Nov 2024 to Dec 2024

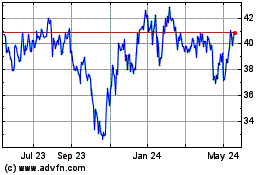

Wal Mart de Mexico SAB d... (QX) (USOTC:WMMVY)

Historical Stock Chart

From Dec 2023 to Dec 2024