UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-KSB A-2

(Mark One)

|X| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the fiscal year ended December 31, 2007

Or

|_| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the transition period from ____________to___________

Commission file number: 000-26703

Union Dental Holdings, Inc.

(Name of small business issuer in its charter)

Florida 65-0710392

------------------------------------- --------------------------------

(State or other jurisdiction of (I.R.S. Employer

incorporation or organization) Identification No.)

1700 University Drive, Suite 200

Coral Springs, Florida 33071

------------------------------------- --------------------------------

(Address of principal executive offices) (Zip Code)

|

Issuer's telephone number: (954) 575-2252

Securities registered pursuant to Section 12(b) of the Exchange Act: None

Securities registered pursuant to Section 12(g) of the Exchange Act:

Common Stock, Par Value $0.0001 Per Share

Check whether the issuer (1) has filed all reports required to be filed by

section 13 or 15(d) of the Exchange Act during the past 12 months (or for such

shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Yes |X| No |_|

Check if there is no disclosure of delinquent filers in response to Item 405 of

Regulation S-B is not contained in this form, and no disclosure will be

contained, to the best of registrant's knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-KSB

or any amendment to this Form 10-KSB. |X|

Indicate by check mark whether the registrant is an accelerated filer (as

defined in Rule 12b-2 of the Act). Yes |_| No |X|

State issuer's revenues for its most recent fiscal year ended December 31, 2007:

$2,593,176

Of the 109,722,510 shares of our common stock issued and outstanding as of March

7, 2008 approximately 76,582,310 shares were held by non-affiliates. The

aggregate market value of the voting stock held by non-affiliates of the

registrant computed by reference to the closing bid price of $0.006 of our

Common Stock as reported on the OTC Bulletin Board on March 7, 2008 was

approximately $459,494.

DOCUMENTS INCORPORATED BY REFERENCE

Post Effective Registration Statement No. 3 filed on August 16, 2007

Transitional Small Business Disclosure Format (check one): Yes |X| No |_|

This Form 10-KSB A-2 contains "forward-looking statements" relating to Union

Dental Holdings, Inc. ("Union Dental" "we", "our", or the "Company") which

represent our current expectations or beliefs including, but not limited to,

statements concerning our operations, performance, financial condition and

growth. For this purpose, any statements contained in this Form 10-KSB A-2 that

are not statements of historical fact are forward-looking statements. Without

limiting the generality of the foregoing, words such as "may", "anticipate",

"intend", "could", "estimate", or "continue" or the negative or other comparable

terminology are intended to identify forward-looking statements. These

statements by their nature involve substantial risks and uncertainties, such as

credit losses, dependence on management and key personnel, variability of

quarterly results, and our ability to continue our growth strategy and

competition, certain of which are beyond our control. Should one or more of

these risks or uncertainties materialize or should the underlying assumptions

prove incorrect, actual outcomes and results could differ materially from those

indicated in the forward-looking statements.

Any forward-looking statement speaks only as of the date on which such statement

is made, and we undertake no obligation to update any forward-looking statement

or statements to reflect events or circumstances after the date on which such

statement is made or to reflect the occurrence of unanticipated events. New

factors emerge from time to time and it is not possible for us to predict all of

such factors, nor can we assess the impact of each such factor on the business

or the extent to which any factor, or combination of factors, may cause actual

results to differ materially from those contained in any forward-looking

statements.

EXPLANATORY NOTE

Union Dental Holdings, Inc. is filing this Amendment No. 2 to our Annual

Report on Form 10-KSB for the fiscal year ended December 31, 2007 as filed with

the U.S. Securities and Exchange Commission on March 31, 2008. This Amendment

No. 2 is being filed to amend and restate the information provided under Item

8(a) of Part II. In addition, we have amended the consent of our auditors. This

Amendment No. 2 responds to the comments of the Staff of the Securities and

Exchange Commission in connection with its review of our Annual Report on

Form 10-KSB for the fiscal year ended December 31, 2007.

This Amendment No. 2 does not affect the original financial statements or

footnotes as originally filed. This Amendment No. 2 does not reflect events that

have occurred after the original filing of the Annual Report on Form 10-KSB on

March 31, 2008.

Pursuant to Rule 12b-15 under the Securities Exchange Act of 1934, as a

result of this Amendment No. 2, the certifications pursuant to Section 302 and

Section 906 of the Sarbanes-Oxley Act of 2002, filed and furnished respectively,

as exhibits to the original filing, have been amended and refiled as of the date

of this Amendment No. 2 and are included as Exhibits 31.2, 31.2, 32.1 and 32.2

hereto.

This Amendment No. 2 should be read in conjunction with the original filing

of our Annual Report on Form 10-KSB and our other filings made with the

Securities and Exchange Commission subsequent to the filing of the original

Annual Report on Form 10-KSB.

Item 8A(T). Controls and Procedures.

Based on the periodic review of our Annual Report by the Securities and

Exchange Commission, our chief executive officer/chief financial officer, George

Green, ("Management") conducted and re-evaluated the effectiveness of our

disclosure controls and procedures as of the end of the period covered by this

Annual Report (December 31, 2007), as defined in Rule 13a-15(e) promulgated

under the Securities and Exchange Act of 1934 which require that (i) the

information required to be disclosed by us in this Annual Report on Form 10-KSB

was recorded, processed, summarized and reported within the time periods

specified in the SEC's rules and forms, and (ii) information required to be

disclosed by us in our reports that we file or submit under the Exchange Act is

accumulated and communicated to our Management, or persons performing similar

functions, as appropriate to allow timely decisions regarding required

disclosure.

As amended, our Management has determined that the Company failed to use

the appropriate disclosure language requirements by Items 307 and 308T of

Regulation S-K( 17 CFR 229.307 and 229.308T) with respect to the annual report

that the registrant is required to file for a fiscal year end on or after

December 15, 2007 but before December 15, 2008.

Therefore, in connection with the filing of this Amendment, our Management

concluded that, as of the end of the period covered by this Annual Report, our

disclosure controls and procedures were ineffective.

It is worth noting that management re-affirms its position that the

financial statements included in the Form 10-KSB present fairly, in all material

respects our financial position, results of operations and cash flows for the

periods presented in conformity with generally accepted accounting principles.

Additionally, it should be noted that management will take steps to address

its disclosure controls requirements which will include hiring and engaging

experienced consultants to review Quarterly and Annual Reports to assist

management in the review and preparation of financial statements and

disclosures.

3

In designing and evaluating the disclosure controls and procedures, our

management recognizes that any controls and procedures, no matter how well

designed and operated, can provide only reasonable assurances of achieving the

desired control objectives, and management necessarily was required to apply its

judgment in designing and evaluating the controls and procedures. The Company is

currently is in the process of further reviewing and documenting its disclosure

controls and procedures, and its internal control over financial reporting, and

may from time to time make changes aimed at enhancing their effectiveness and to

ensure that our systems evolve with our business. Management's Annual Report on

Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate

internal control over financial reporting, as defined in Exchange Rule

13a-15(f). Our internal control over financial reporting is designed to provide

reasonable assurance regarding the reliability of financial reporting and the

preparation of consolidated financial statements for external purposes in

accordance with generally accepted accounting principles.

Under supervision and with the participation of our Management, we

conducted an evaluation of the effectiveness of our internal control over

financial reporting based on the framework established by the Committee of

Sponsoring Organizations of the Treadway Commission (COSO) as set forth in

Internal Control-Integrated Framework.

As a result of the change on the disclosure controls conclusion in this

Amendment, management has determined that the conclusion on ineffective

disclosure controls affects the conclusion on internal controls over financial

reporting because as part of the Company's external reporting process, the

Company failed to use the appropriate disclosure checklists and procedures to

ensure that the appropriate disclosures were included in our Annual Report. As

such, our internal controls as of December 31, 2007, failed to reveal the

breakdown in the disclosure process. Therefore, we have deemed that our internal

controls procedures were ineffective. However, it is worth noting that the

Amendment and modification in our conclusion did not change the Company's

previously reported consolidated revenues, net income, income per share or other

results of operations and did not require restatement of the basic consolidated

financial statements (Balance Sheets, Statements of Income, Shareholders' Equity

and Cash Flows).

Therefore, as noted above, Management will take steps to address its

disclosure controls requirements which include using experienced consultants to

review Quarterly and Annual Reports to provide reasonable assurance that

accurate, complete financial statements and disclosure requirements are

presented in our Report filings.

This Annual Report does not include an audit or attestation report of our

registered public accounting firm regarding our internal control over financial

reporting. Our management's report was not subject to an audit or attestation by

our registered public accounting firm pursuant to temporary rules of the SEC

that permit us to provide only management's report in this Annual Report.

Because of its inherent limitations, internal control over financial

reporting may not prevent or detect misstatements. A control system, no matter

how well designed and operated, can provide only reasonable, not absolute,

assurance that the control system's objectives will be met. Further, the design

of a control system must reflect the fact that there are resource constraints,

and the benefits of controls must be considered relative to their costs. Because

of the inherent limitations in all control systems, no evaluation of controls

can provide absolute assurance that all control issues and instances of fraud,

if any, have been detected. These inherent limitations include the realities

that judgments in decision-making can be faulty, and that breakdowns can occur

because of simple error or mistake. The design of any system of controls is

based in part upon certain assumptions about the likelihood of future events,

and there can be no assurance that any design will succeed in achieving its

stated goals under all potential future conditions. Also, projections of any

4

evaluation of effectiveness to future periods are subject to risk that controls

may become inadequate because of changes in conditions, or that the degree of

compliance with the policies or procedures may deteriorate.

Evaluation of Changes in Internal Controls over Financial Reporting

During the year ended December 31, 2007, there have been no changes in our

internal controls over financial reporting that have materially affected, or are

reasonably likely to materially affect, internal controls over financial

reporting.

Item 13. Exhibits and Reports on Form 8-K.

(a) The exhibits required to be filed herewith by Item 601 of Regulation

S-B, as described in the following index of exhibits, are either filed herewith

or incorporated herein by reference.

Exhibit

No. Description

-------- ----------------------------------------------------

2.2 Share Exchange Agreement between Shava, Inc. and National Business

Holdings, Inc. dated May 28, 2004.

2.3 Reorganization Agreement, dated December 28, 2004, by and among the

Company, Union Dental, DDS and the shareholders of Union Dental and

DDS. (4)

2.4 Asset Purchase Agreement dated October 15, 2004 by and among Union

Dental and George D. Green, DDS, P.A. (4)

3(i).1 Amended and Restated Articles of Amendment to the Articles of

Incorporation of Mecaserto, Inc., A Florida Corporation

3(i).2 Articles of Incorporation of National Business Investors, Inc.

3(i).3 Articles of Incorporation of Union Dental Corp.(5)

3(i).4 Articles of Incorporation of Direct Dental Services, Inc. (5)

|

3(ii).1 Bylaws of National Business Holdings, Inc. (5)

3(ii).2 Bylaws of Union Dental Corp. (5)

3(ii).3 Bylaws of Direct Dental Services, Inc.

4.1 Form of Option issued to Union Dental optionholders. (4)

5.* Opinion re: Legality

16.1 Letter from Lawrence Scharfman, CPA, P.A. (3)

10.1 Business Associate Agreement dated October 15, 2004 by and among Union

Dental and George D. Green, DDS, P.A. (5)

10.2 Management Services Agreement dated October 15, 2004 by and among

Union Dental and George D. Green, DDS, P.A. (5)

10.3 Employment Agreement dated March 20, 2004 by and among Union Dental

and Dr. George D. Green. (4)

10.4 Employment Agreement dated October 26, 2004 by and among Union Dental

and Dr. Leonard I. Weinstein. (4)

|

5

10.5 Shareholder's Agreement and Management Contract by and among Union

Dental and Tropical Medical Services. (4)

10.6 Employment Agreement dated February 15, 2004 by and among Union Dental

and Robert Gene Smith. (4)

10.7 2004 Stock Option Plan for Union Dental (4)

10.8 Form of Management Service Agreement with Participating Dentists

10.9 Form of Service Agreement with Participating Unions

10.10 Debenture Agreement executed between the Company and Dutchess Private

Equities Fund II, L.P. (6)

10.11 Registration Rights Agreement between the Company and Dutchess Private

Equities Fund II, L.P. (6)

10.12 Warrant Registration Rights Agreement between the Company and Dutchess

Private Equities Fund II, L.P. (6)

10.13 Equity Line of Credit Registration Rights Agreement between the

Company and Dutchess Private Equities Fund II, L.P. (6)

10.14 Investment Agreement between the Company and Dutchess Private Equities

Fund II, L.P. (6)

10.15 Debenture Agreement between the Company and Dutchess Private Equities

Fund II, L.P. (7)

14.1 Code of Ethics (4)

16.1 Letter from Lawrence Scharfman to the Securities and Exchange

Commission dated January 3, 2005 (4)

16.2 Letter of Consent from DeMeo, Young, McGrath, dated March 31, 2007

17.1 Letter of Resignation of Dr. Melvyn Greenstein (4)

17.2 Letter of Resignation of Roger E. Pawson (4)

23 * Consent of experts and counsel

31 * Certificate of the Chief Executive Officer and Chief Financial Officer

pursuant Section 302 of the Sarbanes-Oxley Act of 2002

32 * Certificate of the Chief Executive Officer and Chief Financial Officer

pursuant to Section 906 of the Sarbanes-Oxley Act of 2002

---------------------------

|

(1) Filed as Exhibits 2.1, 2.2, 2.3 to the Company's Form 10-SB filed with the

Securities and Exchange Commission on July 14, 1999, and incorporated by

Reference herein.

(2) Filed as Exhibit 3.1 to the Company's Form 8-K filed with the Securities

and Exchange Commission on March 10, 2003, and incorporated by reference

herein.

(3) Filed as Exhibits 16.1 and 16.2 to the Company's Form 8-K filed with the

Securities and Exchange Commission on February 26, 2004.

(4) Filed as Exhibits to the Company's Form 8-K filed with the Securities and

Exchange Commission on January 4, 2005.

(5) Filed as Exhibits to the Company's Form 8-K/A filed with the Securities and

Exchange Commission on February 4, 2005.

(6) Filed as an exhibit to the Company's Form 8-k filed August 22, 2005.

(7) Filed as an exhibit to the Company's Form 8-k filed December 27, 2006

* Included herein

(b) Reports on Form 8-k. During the last quarter of the fiscal year ended

December 31, 2007, no reports we filed on Form 8-k with the Securities and

Exchange Commission.

6

SIGNATURES

In accordance with the Exchange Act, this report has been signed below by

the following persons on our behalf and in the capacities and on the dates

indicated.

Date: October 7, 2008

Union Dental Holdings, Inc.

(Registrant)

By: /s/ GEORGE D. GREEN

----------------------------------------

GEORGE D. GREEN, President and Director

|

Pursuant to the requirements of the Exchange Act, this Report has been

signed below by the following persons on behalf of the Registrant and in the

capacities and on the dates indicated.

Signature Title Date

/s/ GEORGE D. GREEN CEO, President & Director October 7, 2008

-------------------

GEORGE D. GREEN

|

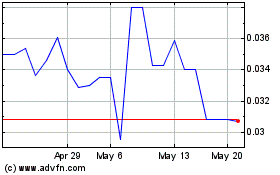

Xcelerate (QB) (USOTC:XCRT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Xcelerate (QB) (USOTC:XCRT)

Historical Stock Chart

From Jul 2023 to Jul 2024