Idorsia announces financial results for the first quarter 2024 –

advancing the company with renewed vigor

Ad hoc announcement pursuant to Art. 53 LR

Allschwil, Switzerland – May 21, 2024

Idorsia Ltd (SIX: IDIA) today announced its financial results

for the first quarter of 2024.

Business highlights

- Viatris collaboration: Global research and

development collaboration, focused on the development and

commercialization of two innovative compounds, selatogrel and

cenerimod.

Commercial highlights

- QUVIVIQ™ (daridorexant): Total net sales of

CHF 10 million in Q1 2024.

- QUVIVIQ in the US: Citizens petition to

deschedule the DORA class progressing.

- QUVIVIQ in Europe: Further launches, including

France, provide a solid base to increase European sales in

2024.

Pipeline highlights

- TRYVIO™ (aprocitentan): Approved by the US FDA

in March 2024.

- JERAYGO™ (aprocitentan): Recommended for

approval in Europe.

- Daridorexant: Phase 3 study conducted by

Simcere in Chinese patients fully recruited.

Financial highlights

- Net revenue Q1 2024 at CHF 10 million.

- US GAAP operating expenses Q1 2024 benefiting

from extraordinary income from Viatris deal with non-GAAP

operating expenses Q1 2024 at CHF 96 million.

- US GAAP operating income Q1 2024 of CHF 31

million and non-GAAP operating loss of CHF 85

million.

- The Viatris deal: The upfront consideration of

USD 350 million (CHF 308 million) was fully paid by Viatris to

Idorsia in Q1 2024.

- Convertible bond 2024: Bondholders approve an

extension of maturity by six months.

Guidance for 2024

- QUVIVIQ net sales of around CHF 55

million.

- US GAAP operating loss to reach CHF 340

million (which includes a one-off benefit of CHF 125 million

from the Viatris deal), non-GAAP operating loss of

around CHF 420 million (excluding contract revenues and the

one-off benefit from the Viatris deal) – unforeseen events

excluded.

Jean-Paul Clozel, MD and Chief Executive Officer,

commented:

“We have already reached significant milestones in 2024. The deal

with Viatris to accelerate the development of selatogrel and

cenerimod brought cash and security for these assets, while

retaining shareholder value. We came to an arrangement with holders

of the convertible bond 2024 due for repayment in July, giving us

the time we need to secure additional funding and avoid liquidity

constraints. Also, the quality of our research and development

engine was once again confirmed by the FDA’s approval of TRYVIO

(aprocitentan) and the CHMP positive opinion received for JERAYGO

(the trade name of aprocitentan in Europe). This will now unlock

value for Idorsia as we evaluate possible launch strategies –

including potential partnership – for the first antihypertensive

working on a new pathway seen in almost 40 years.”

Jean-Paul continued: “Since the first launch of

QUVIVIQ, more than 14 million tablets have been dispensed

worldwide, with well over 150,000 patients benefiting from QUVIVIQ.

We continue to believe in the huge potential offered by this

product and – thanks to a long patent life – there is plenty of

time for this potential to be realized. Continued innovation is

essential to securing the company’s future. Despite the reduction

of the workforce, we continue to discover and develop new drugs

with great potential in many areas of medicine. I am very confident

that our vision to create an innovative, profitable, and

sustainable science-based company will become a reality in the

coming years.”

Financial results

|

US GAAP results |

|

First Quarter |

|

in CHF millions, except EPS (CHF) and number of shares

(millions) |

|

|

2024 |

2023 |

|

Net revenues |

|

|

10 |

21 |

|

Operating expenses |

|

|

20 |

(219) |

|

Operating income (loss) |

|

|

31 |

(198) |

|

Net income (loss) |

|

|

30 |

(212) |

|

Basic EPS |

|

|

0.17 |

(1.19) |

|

Basic weighted average number of shares |

|

|

179.1 |

178.0 |

|

Diluted EPS |

|

|

0.13 |

(1.19) |

|

Diluted weighted average number of shares |

|

|

233.3 |

178.0 |

Net revenue of CHF 10 million in the first quarter of 2024 is

the result of QUVIVIQ product sales. This compares to CHF 21

million in the first quarter of 2023, which included CHF 13.5

million sales of PIVLAZ in Japan (now assigned to Nxera Pharma as

part of a transaction, more details can be found in the dedicated

press release) and CHF 1 million revenue share from Johnson &

Johnson related to ponesimod sales (revenue-sharing agreement now

eliminated as part of the reacquisition of aprocitentan, more

details can be found in the dedicated press release).

US GAAP operating expenses in the first quarter of 2024

benefitted from extraordinary income of CHF 125 million from

the Viatris deal resulting in a negative expense of CHF 20 million

(CHF 219 million in the first quarter of 2023), of which

CHF 4 million related to cost of sales (CHF 1 million in

the first quarter of 2023), CHF 33 million to R&D expenses (CHF

93 million in the first quarter of 2023), and CHF 68 million to

SG&A expenses (CHF 125 million in the first quarter of

2023).

US GAAP net income in the first quarter of 2024 amounted to CHF

30 million (CHF 212 million net loss in the first quarter of 2023).

The decrease of the net loss is mainly attributable to the one-off

income related to the Viatris Deal but was also driven by lower

operating expenses throughout all functions.

The US GAAP net income resulted in a basic net income per share

of CHF 0.17 (diluted net income per share of CHF 0.13) in the first

quarter of 2024, compared to a net loss per share of CHF 1.19

(basic and diluted) in the first quarter of 2023.

|

Non-GAAP* measures |

|

First Quarter |

|

in CHF millions, except EPS (CHF) and number of shares

(millions) |

|

|

2024 |

2023 |

|

Net revenues |

|

|

10 |

21 |

|

Operating expenses |

|

|

(96) |

(202) |

|

Operating income (loss) |

|

|

(85) |

(181) |

|

Net income (loss) |

|

|

(86) |

(189) |

|

Basic EPS |

|

|

(0.48) |

(1.06) |

|

Basic weighted average number of shares |

|

|

179.1 |

178.0 |

|

Diluted EPS |

|

|

(0.48) |

(1.06) |

|

Diluted weighted average number of shares |

|

|

179.1 |

178.0 |

* Idorsia measures, reports, and issues guidance on non-GAAP

operating performance. Idorsia believes that these non-GAAP

financial measurements more accurately reflect the underlying

business performance and therefore provide useful supplementary

information to investors. These non-GAAP measures are reported in

addition to, not as a substitute for, US GAAP financial

performance.

Non-GAAP net loss in the first quarter of 2024 amounted to CHF

86 million: the CHF 116 million difference versus US GAAP net

income was mainly due to the one-off effect of the Viatris Deal

(CHF 125 million income), depreciation and amortization (CHF 4

million), and share-based compensation (CHF 4 million).

The non-GAAP net loss resulted in a net loss per share of CHF

0.48 (basic and diluted) in the first quarter of 2024, compared to

a net loss per share of CHF 1.06 (basic and diluted) in the first

quarter of 2023.

Viatris collaboration

In March 2024, Idorsia closed agreements with Viatris Inc. (NASDAQ:

VTRS), a global healthcare company, for collaboration on the global

development and commercialization of two Phase 3 assets –

selatogrel and cenerimod – with Idorsia receiving an upfront

payment of USD 350 million, and the right to potential development

and regulatory milestone payments of up to USD 300 million,

potential sales milestone payments of up to

USD 2.1 billion, and potential contingent tiered

royalties from mid-single- to low-double-digit percentage on annual

net sales.

A joint development committee is overseeing the development of

the ongoing Phase 3 programs for selatogrel and cenerimod up to

regulatory approval. Idorsia will contribute up to USD 200 million

in the next 3 years and transferred the dedicated personnel for

both programs to Viatris.

Viatris has worldwide commercialization rights for both

selatogrel and cenerimod (excluding, for cenerimod only, Japan,

South Korea, and certain countries in the Asia-Pacific region).

Idorsia has also granted Viatris a right of first refusal and first

negotiation for certain other pipeline assets.

Convertible bonds 2024

In July 2018, the Group issued CHF 200 million of senior unsecured

convertible bonds (ISIN: CH0426820350), which were due to mature on

July 17, 2024. On May 6, 2024, a bondholder meeting was held, where

83.5% of the total outstanding bondholders voted in favor of

amendments to the terms of the bonds. The approved bond terms

include an amended conversion price of CHF 6.00, extended

maturity date of January 17, 2025, and the option to call the bonds

at par, in full or in part, at any time upon giving ten trading

days' notice. The company has applied to the higher cantonal

composition authority and upon approval the amendments to the bond

terms will become binding and effective. A consent fee of 8,000,000

Idorsia shares will be delivered through SIX SIS once the amendment

of the bond terms is effective.

Financial outlook 2024

For 2024 – excluding unforeseen events – the company expects

QUVIVIQ net sales of around CHF 55 million; SG&A expenses of

around CHF 300 million; R&D expense of around CHF 165 million

for Idorsia-led pipeline assets; non-GAAP operating expenses of up

to CHF 470 million. This performance would result in a

non-GAAP operating loss of around CHF 420 million

(excluding contract revenues and the one-off benefit from the

Viatris deal).

The company expects US GAAP operating loss for 2024 to reach CHF

340 million which includes a one-off benefit of CHF 125

million from the Viatris deal.

André C. Muller, Chief Financial Officer,

commented:

“In addition to the funds already raised from our business

development activities, I am confident in our ability to raise

additional funding this year. We will continue to evaluate and

prepare possible launch strategies – including potential

partnership – for TRYVIO. The significant progress with access and

availability of QUVIVIQ has started to gain traction, particularly

in Europe, this will translate into higher sales in 2024. At the

same time, the cost reduction initiative that took place in the

latter part of 2023 is fully effective and reflected in our 2024

guidance, with significantly lower expenses. We must continue to

control our costs and explore all avenues to extend our cash

runway, but I see many reasons to be optimistic for the future of

Idorsia.”

Liquidity and indebtedness

At the end of the first quarter of 2024, Idorsia’s liquidity

amounted to CHF 335 million.

|

(in CHF millions) |

|

March 31, 2024 |

Dec 31, 2023 |

|

Liquidity |

|

|

|

|

Cash and cash equivalents |

|

335 |

145 |

|

Short-term deposits |

|

- |

- |

|

Total liquidity* |

|

335 |

145 |

|

|

|

|

|

|

Indebtedness |

|

|

|

|

Convertible loan |

|

335 |

335 |

|

Convertible bond |

|

797 |

796 |

|

Other financial debt |

|

162 |

162 |

|

Total indebtedness |

|

1,293 |

1,293 |

*rounding differences may occur

Commercial operations

In the first quarter of 2024, QUVIVIQ™ (daridorexant) in the US,

Germany, Italy, Switzerland, Spain, UK, Canada, Austria, and France

generated total product sales of CHF 10 million.

United States

|

Product |

Mechanism of action |

Indication |

Commercially available since |

|

Dual orexin receptor antagonist |

Treatment of adult patients with insomnia, characterized by

difficulties with sleep onset and/or sleep maintenance |

May 2022 |

In the US, net sales of

QUVIVIQ®

(daridorexant) in the first quarter of 2024

reached CHF 6.5 million. This net sales number includes the QUVIVIQ

copay program aimed at driving demand and product uptake, and thus

does not reflect the actual number of prescriptions dispensed.

As of the end of the first quarter of 2024, more than 140,000

patients have been treated with QUVIVIQ, almost 400,000

prescriptions have been dispensed, and the product has been

prescribed by more than 42,000 healthcare professionals. To begin

with, the company ran a direct-to-consumer (DTC) television and

digital campaign and offered a copay program. The strategy was to

create a recognizable brand, enabling market access discussions.

During 2023, the company made significant progress, reaching over

65% reimbursement in the commercial sector. As access increased,

the commercial approach was adjusted, with the aim being to switch

from a consignment model (providing substantially reduced or free

prescriptions) to a payer paid model. In the first quarter of 2024,

paid prescriptions accounted for 68% of the total – an increase of

36 percentage points from the same period in 2023 and of 7

percentage points from the previous quarter.

The first Medicare Part D coverage – reaching 27% of covered

lives – began in January 2024, opening an entirely new channel

which has the potential to substantially improve product access and

paid prescriptions.

In February, there was a cyberattack on Change Healthcare

(UnitedHealth Group), the largest adjudicator/processor of copay

cards in the US, causing major disruption across the pharmaceutical

industry, including the QUVIVIQ copay cards, with a negative impact

on prescription dispensing levels. In March, the Idorsia US Market

Access team put a solution in place to remedy the disruption,

though the impact was still appreciable through to the end of

March.

In April 2023, Idorsia filed a citizen petition (CP), urging the

Drug Enforcement Administration (DEA) to deschedule the DORA class

of chronic insomnia medications, based on a review of evidence from

available data, including post-marketing surveillance data.

Starting in 2015, the independent FDA approvals of other DORAs

included a recommendation that these drug products be scheduled

based on preclinical data. The CP to deschedule the DORA class

outlines current scientific and medical evidence demonstrating that

the DORA class has a negligible abuse profile and potential for

abuse, lacks non-medical use in the community, lacks physical and

psychological dependence, and therefore, should not be a scheduled

class under the Controlled Substances Act.

The DEA and FDA acknowledged the CP, and the process to analyze

and examine the request is moving forward. Notably, a report

accompanying the FDA appropriations bill that was finalized in

March 2024 informed the FDA that the process for descheduling the

DORA class is a priority for Congress.

Tausif ‘Tosh’ Butt, President, and General Manager of

Idorsia US, commented:

“I believe one of the biggest barriers to prescribing QUVIVIQ is

the fact it is currently a scheduled drug. Apart from the obstacles

to prescribing scheduled drugs, some payers require patients to be

treated with low-cost drugs not indicated for insomnia, and others

that carry black box warnings before covering QUVIVIQ. The US

Congress has long supported the efforts of the FDA to address the

opioid and addiction crisis, and this year it encouraged the FDA to

also consider the impact of treatments for insomnia as a part of

that larger public health mission. I am very hopeful for our

citizen petition requesting a review of the evidence can lead to

the descheduling of the DORA class of chronic insomnia

medications.”

For more information about QUVIVIQ in the US, see the Full

Prescribing Information (PI and Medication Guide).

|

Product |

Mechanism of action |

Indication |

Commercially available since |

|

Dual endothelin receptor antagonist |

Treatment of hypertension in combination with other

antihypertensive drugs, to lower blood pressure in adult patients

who are not adequately controlled on other drugs |

Approved Mar. 2024

Planned availability: H2 2024 |

On March 19, 2024, the US Food and Drug Administration (FDA)

approved TRYVIO™ (aprocitentan) for the treatment

of hypertension in combination with other antihypertensive drugs,

to lower blood pressure in adult patients who are not adequately

controlled on other drugs. Lowering blood pressure reduces the risk

of fatal and non-fatal cardiovascular events, primarily strokes and

myocardial infarctions. The recommended dosage of TRYVIO is 12.5 mg

orally once daily, with or without food.

Idorsia plans to make TRYVIO available in the second half of

2024 to the millions of patients in the US whose high blood

pressure is not adequately controlled by other drugs.

Further details on the approval, together with commentary from

company management can be found in the dedicated press release and

investor webcast available from the company corporate website.

For more information see the Full Prescribing Information

including BOXED Warning (PI and Medication Guide).

Europe and Canada

|

Product |

Mechanism of action |

Indication |

Commercially available |

|

Dual orexin receptor antagonist |

Treatment of adult patients with insomnia characterised by symptoms

present for at least three months and considerable impact on

daytime functioning |

France: Mar. 2024

Austria: Feb. 2024

UK: Oct. 2023

Spain: Sep. 2023

Switzerland: Jun. 2023

Germany: Nov. 2022

Italy: Nov. 2022 |

|

|

|

Management of adult patients with insomnia, characterized by

difficulties with sleep onset and/or sleep maintenance |

Canada: Nov. 2023 |

QUVIVIQ (daridorexant) net sales in the first

quarter of 2024 reached CHF 3.5 million in the EUCAN region.

In November 2023, treatment with daridorexant was added to the

insomnia treatment guidelines for Europe. In “The European Insomnia

Guideline: An update on the diagnosis and treatment of insomnia

2023”, published in the Journal of Sleep Research, the

authors note that “The introduction of DORAs has probably been the

most significant recent development in the pharmacological

treatment of insomnia.”

In Germany, QUVIVIQ was launched in November 2022. By law, sleep

medications were then subject to a 4-week prescribing limitation

(Anlage III BtMG). Following a review by the Federal Joint

Committee (G-BA) – the highest decision-making body of the joint

self-government of physicians, dentists, hospitals, and health

insurance funds in Germany – this limitation was lifted for QUVIVIQ

in November 2023. This makes it the only sleep medication in

Germany that can be prescribed for long-term treatment of chronic

insomnia. In December 2023, the price negotiated for QUVIVIQ under

the AMNOG process became effective. Following the lifting of the

prescribing limitation, the company submitted a second AMNOG

dossier for the long-term treatment of chronic insomnia disorder

(beyond 4 weeks), reflecting the indication approved by the EMA in

2022. The progress made in Germany is reflected by the performance

of QUVIVIQ on the market, with a 63% increase in demand seen in Q4

2023 (compared to Q3 2023), followed by a strong start to 2024

(February +41% compared to December 2023).

In Italy, QUVIVIQ was launched in November 2022. Currently,

QUVIVIQ can only be prescribed by neurologists, psychiatrists, and

specialists from sleep centers, and no sleep therapy is reimbursed.

The company submitted a reimbursement dossier in June 2023 and

requested the expansion of the prescriber base. The submission –

detailing the efficacy and safety profile of QUVIVIQ and its

estimated budget impact and cost-effectiveness in Italy – is under

review, with the final outcome expected in the second half of

2024.

In Switzerland, QUVIVIQ was launched to the self-pay market in

June 2023. Following the launch of QUVIVIQ, awareness has increased

among all specialties, and demand has increased solidly (+32% in Q4

2023 compared to Q3 2023) ahead of reimbursement, which is expected

in the summer of 2024.

In Spain, QUVIVIQ was launched to the self-pay market in

September 2023. Spain represents the largest insomnia market in

Europe, as was apparent in the first months of this product’s

availability, despite it only being launched to the self-pay

market. The company is assessing the opportunity to submit a

reimbursement dossier to the Spanish authorities, in order to allow

equal access for all patients with chronic insomnia.

In the UK, QUVIVIQ was launched in October 2023. At the same

time, technology appraisal guidance was published by the National

Institute for Health and Care Excellence (NICE), allowing the

transition to local access discussions and listing by healthcare

boards for England, Wales, and Northern Ireland. In April 2024, the

Scottish Medicines Consortium (SMC) also accepted QUVIVIQ for use

within NHS Scotland. This means that the company has achieved full

reimbursement throughout the UK, where QUVIVIQ is now recommended

as first-line pharmaceutical treatment for patients with chronic

insomnia, after, or as an alternative to, cognitive behavioral

therapy for insomnia (CBT-I). The priority in the UK now, is to

secure regional access.

In France, QUVIVIQ was launched in March 2024 as the first and

only pharmacotherapy recommended for the treatment of chronic

insomnia disorder. In January 2024, the inclusion of QUVIVIQ in

both the hospital and the retail formulary list of reimbursed

pharmaceutical specialties was announced in the French Official

Gazette, together with the French public price. This official

publication means that, with a prescription from their doctor,

patients with chronic insomnia in France have access to the

treatment if they meet the requirements of the EU prescribing label

for QUVIVIQ. The publication follows the positive recommendation by

the Transparency Committee in May 2023, recognizing QUVIVIQ as

providing clinical added value.

In Canada, after being approved in April 2023, QUVIVIQ was

launched in November 2023 to the private market, representing 55%

of the Canadian insomnia market. The reimbursement dossier was

submitted to private market payers in the third quarter of 2023,

and just a few months after the submission the team had secured

reimbursement for more than 60% of private market patients. The

focus is now on public payers with the submission to INESSS

(Institut national d’excellence en santé et en services sociaux)

finalized in March 2024 and the submission to CADTH (Canada’s Drug

and Health Technology Agency) expected in the second quarter of

2024.

Jean-Yves Chatelan, President of Europe and Canada

region, commented:

“The launch of Europe’s first and only dual orexin receptor

antagonist is progressing well across all markets where we have

made QUVIVIQ available. Including Canada, we have expanded

availability into more markets and improved the reimbursement

environment beyond many expectations. With continued positive

feedback from physicians and patients on the differentiated profile

of QUVIVIQ, I am very optimistic that the progress we have made

will now translate into many more patients benefiting from QUVIVIQ

and increasing volumes advancing the region towards

profitability.”

For more information about QUVIVIQ in the EU, see the Summary of

Product Characteristics. For more information about QUVIVIQ in

Switzerland, see the Patient Information and Information for

Healthcare Professionals. For more information on the marketing

authorization of QUVIVIQ in Canada, see the Product

Monograph.

Research & Development

Idorsia has a diversified and balanced portfolio, comprising assets

developed and/or marketed by Idorsia and assets that are

partner-led to maximize the value we have created. Our drug

discovery engine has produced innovative drugs with the potential

to transform the treatment paradigm in multiple therapeutic areas,

including CNS, cardiovascular, and immunological disorders, as well

as orphan diseases.

The company also has a vaccine platform for the discovery and

development of glycoconjugate vaccines containing synthetic

antigenic glycan molecules, with or without a carrier protein, to

prevent infection.

Alberto Gimona, MD and Head of Global Clinical

Development of Idorsia, commented:

“Despite a difficult period for our organization, the team has

shown extraordinary commitment and made great progress with our

portfolio. This is particularly evident in the successful

registration of aprocitentan in the US and the positive opinion

from the European Union’s CHMP, with labels that reflect the value

of the compound. I was also very pleased to have found a way for

both selatogrel and cenerimod programs to be fully supported

through the collaboration with Viatris, while maintaining our

involvement in their development. I look forward to advancing the

portfolio and bringing benefits to patients in many areas of

medical need.”

Idorsia-led portfolio

Compound

Mechanism of action

Target indication |

Status |

QUVIVIQ™ (daridorexant)

Dual orexin receptor antagonist

Insomnia |

Commercially available as QUVIVIQ in the US, Germany, Italy,

Switzerland, Spain, the UK, Canada, Austria, and France; approved

throughout the EU |

TRYVIO™ (aprocitentan)

Dual endothelin receptor antagonist

Systemic hypertension in combination with other

antihypertensives |

Approved as TRYVIO in the US, launch planned for H2 2024 |

JERAYGO™ (aprocitentan)

Dual endothelin receptor antagonist

Resistant hypertension in combination with other

antihypertensives |

Positive opinion from the European Committee for Medicinal Products

for Human Use (CHMP) received in April 2024 – European Commission

decision expected in approx. 2 months |

Lucerastat

Glucosylceramide synthase inhibitor

Fabry disease |

Phase 3 primary endpoint not met; open-label extension study

ongoing

Phase 3 focused on renal function in preparation |

Daridorexant

Dual orexin receptor antagonist

Pediatric insomnia |

Phase 2 in pediatric insomnia ongoing |

ACT-1004-1239

ACKR3/CXCR7 antagonist

Demyelinating diseases including multiple

sclerosis |

Phase 2 in preparation |

Sinbaglustat

GBA2/GCS inhibitor

Rare lysosomal storage disorders |

Phase 1 complete |

ACT-777991

CXCR3 antagonist

Recent-onset Type 1 diabetes |

Phase 1 complete |

IDOR-1117-2520

Undisclosed

Immune-mediated disorders |

Phase 1 ongoing |

IDOR-1134-2831

Synthetic glycan vaccine

Clostridium difficile

infection |

Phase 1 initiating |

Daridorexant

Daridorexant is a dual orexin receptor antagonist (DORA) which

blocks the binding of the wake-promoting orexin neuropeptides.

Rather than inducing sleep through broad inhibition of brain

activity, daridorexant only blocks the activation of orexin

receptors. Daridorexant is commercially available as QUVIVIQ in the

US, Germany, Italy, Switzerland, Spain, the UK, Canada, Austria,

and France, and is approved throughout the EU (see “Commercial

operations” above).

A post-approval study to investigate the efficacy of

daridorexant in patients with insomnia and comorbid nocturia has

completed recruitment and is expected to report results in mid-2024

(NCT05597020).

Idorsia has initiated a Phase 2 dose-finding study to assess the

efficacy, safety, and pharmacokinetics of multiple-dose oral

administration of daridorexant in pediatric patients aged 10 to

<18 years with insomnia disorder (NCT05423717). The primary

objective of the study is to characterize the dose-response

relationship of daridorexant on objective total sleep time (TST),

using polysomnography. The study is expected to enroll around 150

patients, who will be randomized in a 1:1:1:1 ratio to 10 mg, 25

mg, or 50 mg daridorexant, or placebo. The study is part of a US

FDA-approved Pediatric Study Plan and an EU PDCO-approved

Paediatric Investigation Plan.

Aprocitentan

Aprocitentan is a once-daily, orally active, dual endothelin

receptor antagonist, which inhibits the binding of ET-1 to

ETA and ETB receptors. Aprocitentan has a low

potential for drug-drug interaction and a mechanism of action

suited for lowering blood pressure in adult patients whose

hypertension is not adequately controlled by other drugs. On March

19, 2024, aprocitentan was approved as TRYVIO in the US, with

availability planned for H2 2024. On April 25, 2024, Idorsia

received a positive opinion for aprocitentan (as JERAYGO™) from the

Committee for Medicinal Products for Human Use (CHMP) as a

treatment of resistant hypertension. A CHMP positive opinion is one

of the final steps before marketing authorization can be granted by

the European Commission; a final decision is expected approximately

two months after publication of the CHMP opinion.

Lucerastat

Lucerastat is an oral inhibitor of glucosylceramide synthase,

offering a potential new treatment approach for all patients living

with Fabry disease, irrespective of the mutation type of the GLA

gene. In October 2021, the company reported that lucerastat 1000 mg

b.i.d. did not meet the primary endpoint of reducing neuropathic

pain during 6 months of treatment versus placebo. However,

Lucerastat demonstrated a substantial reduction in levels of the

Fabry disease biomarker plasma Gb3 during the treatment period,

with a decrease of approximately 50% observed in plasma Gb3 in the

lucerastat treatment group compared to an increase of 12% in the

placebo group. Furthermore, results suggested a treatment effect on

kidney function. Lucerastat was well tolerated. Analysis of the

ongoing open-label extension (OLE) of the Phase 3 study

corroborated the long-term effect on plasma Gb3 levels and a

potential positive long-term effect on kidney function. The

analysis also showed a safety and tolerability profile consistent

with that observed during the 6-month randomized treatment period.

The company is conducting a kidney biopsy substudy within a subset

of patients currently participating in the OLE study in order to

steer further development in Fabry disease.

Further details including the current status of each project in

our portfolio can be found in our innovation fact sheet.

Idorsia partner-led portfolio

For Idorsia, sophisticated partnerships are a way of gaining

strategic access to technologies or products and fully exploiting

our discovery engine and clinical pipeline. We seek suitable

external project partners to maximize the value of internal

innovation.

Compound

Mechanism of action

Target indication |

Partner/status |

Daridorexant

Dual orexin receptor antagonist

Insomnia |

Nxera Pharma: license to develop and commercialize

for Asia-Pacific region (excluding China)

NDA submitted in Japan |

Daridorexant

Dual orexin receptor antagonist

Insomnia |

Simcere: license to develop and commercialize for

Greater China region

Phase 3 ongoing |

Selatogrel

P2Y12 inhibitor

Acute myocardial infarction |

Viatris: worldwide development and

commercialization rights

Phase 3 “SOS-AMI” program ongoing |

Cenerimod

S1P1 receptor modulator

Systemic lupus erythematosus |

Viatris: worldwide development and

commercialization rights (excluding Japan, South Korea, and certain

countries in the Asia-Pacific region)

Phase 3 “OPUS” program ongoing |

Daridorexant

Dual orexin receptor antagonist

Posttraumatic stress disorder (PTSD) |

US Department of Defense (DOD): Idorsia is

supporting a clinical study sponsored by the US DOD to develop new

therapies to treat PTSD |

ACT-709478 (NBI-827104)

T-type calcium channel blocker

Epileptic encephalopathy with continuous spike-and-wave

during sleep (CSCW) |

Neurocrine Biosciences: global license to develop

and commercialize

Phase 2 OLE study ongoing |

ACT-1002-4391

EP2/EP4 receptor antagonist

Immuno-oncology |

Owkin: global license to develop and

commercialize

Phase 1 in preparation |

Daridorexant (Nxera Pharma)

Daridorexant is licensed to Nxera Pharma (previously known as Sosei

Heptares) in the Asia-Pacific region (excluding China), and a New

Drug Application (NDA) is under review with the Japanese Ministry

of Health, Labor, and Welfare (MHLW).

In Japan, Idorsia has a license agreement with Mochida

Pharmaceutical for the supply, co-development and co-marketing of

daridorexant. All potential milestones have been assigned to

Nxera.

Asia-Pacific region (excluding China): Australia, Brunei,

Cambodia, Indonesia, Japan, Laos, Malaysia, Myanmar, New Zealand,

Philippines, Singapore, South Korea, Thailand, Taiwan, and

Vietnam.

Daridorexant (Simcere)

Daridorexant is licensed to Simcere in the Greater China region

(Mainland China, Hong Kong, and Macau), and a Phase 3 study with

daridorexant in Chinese patients has completed recruitment. Results

are expected in June 2024 and, if the study is successful, an NDA

in Mainland China is planned for the second half of 2024. An NDA is

already under review with the Hong Kong Department of Health.

Selatogrel and cenerimod (Viatris)

A joint development committee from Idorsia and Viatris is

overseeing the development of two ongoing Phase 3 programs up to

regulatory approval.

Selatogrel is a potent, fast-acting, reversible, and highly

selective P2Y12 inhibitor being developed in a Phase 3

study (NCT04957719) for the treatment of acute myocardial

infarction (“SOS-AMI”) in patients with a recent history of AMI. It

is intended to be self-administered subcutaneously via a drug

delivery system (autoinjector).

Cenerimod is a highly selective S1P1 receptor

modulator, given as an oral once-daily tablet, which is being

developed in a Phase 3 program known as “OPUS” (NCT05648500,

NCT05672576) for the treatment of systemic lupus erythematosus

(SLE).

Viatris has worldwide commercialization rights for both

selatogrel and cenerimod (excluding, for cenerimod only, Japan,

South Korea, and certain countries in the Asia-Pacific region).

Daridorexant (US Department of Defense)

Idorsia is supporting a clinical study sponsored by the US

Department of Defense (DOD) to develop new therapies for

posttraumatic stress disorder (PTSD). The Phase 2 study will

evaluate the safety, tolerability, and efficacy of potential

therapeutic interventions, including daridorexant, in active-duty

US service members and veterans with PTSD (NCT05422612).

ACT-709478

Neurocrine Biosciences has a global license to develop and

commercialize ACT-709478 (NBI-827104), Idorsia’s novel T-type

calcium channel blocker. ACT-709478 is being investigated in a

Phase 2 open-label extension (OLE) study for the treatment of

pediatric patients with epileptic encephalopathy with continuous

spike-and-wave during sleep (CSCW), a rare form of pediatric

epilepsy. While the blinded study did not meet the primary

endpoint, ACT-709478 was generally well tolerated and Neurocrine

continues to analyze the totality of data coming from the OLE study

to determine the next steps.

ACT-1002-4391

Owkin has a global license to develop and commercialize

ACT-1002-4391, Idorsia’s novel, potent

EP2/EP4 receptor antagonist with antitumor

efficacy, to be used both as monotherapy and in combination with

other oncology agents. The compound is in preparation for Phase 1

clinical pharmacology studies. Owkin will use its proprietary

AI-based data-mining platform to generate clinical trial designs

and to identify patients who may benefit from, and potential

targets for, the compound.

Martine Clozel, MD and Chief Scientific Officer,

commented:

“The way we work in research is focused on and built around

innovation and our core competencies. While we had to cut back on

the number of people conducting research in 2023, we have

maintained this fundamental approach to our drug discovery efforts.

We have taken the restructuring as an opportunity to focus on fewer

key areas of research and will advance our discoveries either

through our own clinical development expertise, or with the right

partner, aiming to maximize the benefit for patients and

Idorsia.”

Results Day Center

Investor community: To make your job easier, we provide all

relevant documentation via the Results Day Center on our corporate

website: www.idorsia.com/results-day-center.

Upcoming Financial Updates

- Annual General Meeting of Shareholders on June 13, 2024

- Half-Year 2024 Financial Results reporting on July 25,

2024

- Nine-Months 2024 Financial Results reporting on October 29,

2024

Notes to the editor

About Idorsia

Idorsia Ltd is reaching out for more – We have more ideas, we see

more opportunities and we want to help more patients. In order to

achieve this, we will develop Idorsia into a leading

biopharmaceutical company, with a strong scientific core.

Headquartered near Basel, Switzerland – a European biotech-hub –

Idorsia is specialized in the discovery, development, and

commercialization of small molecules to transform the horizon of

therapeutic options. Idorsia has a 25-year heritage of drug

discovery, a broad portfolio of innovative drugs in the pipeline,

an experienced team of professionals covering all disciplines from

bench to bedside, and commercial operations in Europe and North

America – the ideal constellation for bringing innovative medicines

to patients.

Idorsia was listed on the SIX Swiss Exchange (ticker symbol:

IDIA) in June 2017 and has over 750 highly qualified specialists

dedicated to realizing our ambitious targets.

For further information, please contact

Andrew C. Weiss

Senior Vice President, Head of Investor Relations & Corporate

Communications

Idorsia Pharmaceuticals Ltd, Hegenheimermattweg 91, CH-4123

Allschwil

+41 58 844 10 10

investor.relations@idorsia.com

media.relations@idorsia.com

www.idorsia.com

The above information contains certain "forward-looking

statements", relating to the company's business, which can be

identified by the use of forward-looking terminology such as

"estimates", "believes", "expects", "may", "are expected to",

"will", "will continue", "should", "would be", "seeks", "pending"

or "anticipates" or similar expressions, or by discussions of

strategy, plans or intentions. Such statements include descriptions

of the company's investment and research and development programs

and anticipated expenditures in connection therewith, descriptions

of new products expected to be introduced by the company and

anticipated customer demand for such products and products in the

company's existing portfolio. Such statements reflect the current

views of the company with respect to future events and are subject

to certain risks, uncertainties and assumptions. Many factors could

cause the actual results, performance or achievements of the

company to be materially different from any future results,

performances or achievements that may be expressed or implied by

such forward-looking statements. Should one or more of these risks

or uncertainties materialize, or should underlying assumptions

prove incorrect, actual results may vary materially from those

described herein as anticipated, believed, estimated or

expected.

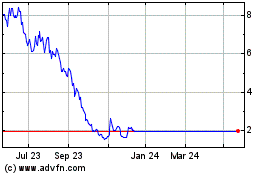

Idorsia (LSE:0RQE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Idorsia (LSE:0RQE)

Historical Stock Chart

From Dec 2023 to Dec 2024