TIDMAGD

Report to shareholders

for the quarter and year ended 31 December 2010

Group results for the quarter....

Adjusted headline earnings, excluding accelerated hedge buy-back costs, $294m.

Hedge book eliminated, giving full exposure to gold price from 7 October.

Net debt of $1.3bn, better than pro-forma guidance due to robust cash

generation.

Production of 1.148Moz at a total cash cost of $672/oz; both improved on

guidance.

Strong performances from West Wits, Cerro Vanguardia and Siguiri.

Australasia region delivers strong performance of 102,000oz, with significant

cost improvement.

Uranium production of 374,000lbs.

Tropicana project approved for development after successful feasibility study.

Strong safety performance in fourth quarter with no fatal accidents.

For the year....

Adjusted headline earnings, excluding accelerated hedge buy-back costs, $787m.

Production of 4.52Moz at a total cash cost of $638/oz; within exchange-rate

adjusted guidance.

Uranium production of 1.46Mlbs on continued strong grade and recovery

performance.

Geita, Cripple Creek and South Africa turnarounds successfully executed.

Final dividend of 80 South African cents per share (approximately 11 US cents

per share), declared, resulting in a total dividend of 145 South African cents

per share (approximately 20 US cents per share) for the 2010 year.

Quarter Year Quarter Year

ended ended ended ended ended ended ended ended

Dec Sep Dec Dec Dec Sep Dec Dec

2010 2010 2010 2009 2010 2010 2010 2009

SA rand / Metric US dollar / Imperial

Operating

review

Gold

Produced - kg / oz (000) 35,703 36,129 140,418 143,049 1,148 1,162 4,515 4,599

Price

received - R/kg / $/oz 99,671 (47,750) 135,862 201,805 452 (239) 561 751

Price

received

excluding

hedge

buy-back

costs - R/kg / $/oz 303,454 267,707 271,018 246,048 1,372 1,141 1,159 925

Total

cash costs - R/kg / $/oz 148,474 151,007 149,577 136,595 672 643 638 514

Total

production

costs - R/kg / $/oz 201,465 187,695 190,889 171,795 912 800 816 646

Financial

review

Adjusted

gross (loss)

profit - Rm / $m (3,718) (8,670) (8,027) 3,686 (540) (1,229) (1,191) 412

Adjusted

gross profit

excluding

hedge

buy-back

costs - Rm / $m 3,598 2,969 10,927 10,001 522 408 1,507 1,209

Profit

(loss)

attributable

to equity

shareholders - Rm / $m 404 443 637 (2,762) 56 51 76 (320)

- cents/share 105 120 171 (765) 15 14 20 (89)

Adjusted

headline

loss - Rm / $m (5,263) (8,389) (12,210) (211) (764) (1,184) (1,758) (50)

- cents/share (1,368) (2,277) (3,283) (58) (199) (321) (473) (14)

Adjusted

headline

earnings

excluding

hedge

buy-back

costs - Rm / $m 2,026 2,184 5,652 5,795 294 303 787 708

- cents/share 527 593 1,520 1,604 76 82 212 196

Cash flow

from

operating

activities

excluding

hedge

buy-back

costs - Rm / $m 5,076 3,238 12,603 10,096 679 424 1,669 1,299

Capital

expenditure - Rm / $m 2,572 1,855 7,413 8,726 365 253 1,015 1,027

$ represents US dollar, unless otherwise stated.

Rounding of figures may result in computational discrepancies.

Operations at a glance

for the quarter ended 31 December 2010

Adjusted

Production Total cash costs gross profit (loss)

excluding hedge

buy-back costs

oz (000) % Variance 1 $/oz % Variance 1 $m $m Variance 1

SOUTH AFRICA 476 - 616 4 239 50

Great Noligwa 34 (6) 915 7 6 3

Kopanang 78 (1) 658 (1) 33 11

Moab Khotsong 76 (8) 669 22 16 (7)

Tau Lekoa - (100) - (100) - (1)

Mponeng 143 4 485 2 106 22

Savuka 11 38 885 16 4 2

TauTona 81 14 645 (12) 33 19

Surface Operations 52 (2) 536 28 42 4

CONTINENTAL AFRICA 374 - 790 9 141 32

Ghana

Iduapriem 58 2 746 30 25 3

Obuasi 66 (12) 949 14 10 6

Guinea

Siguiri - Attributable 85% 71 15 687 (2) 44 19

Mali

Morila - Attributable 40% 2 24 4 760 (4) 14 5

Sadiola - Attributable 41% 2 29 (3) 783 26 15 (1)

Yatela - Attributable 40% 2 9 (10) 1,386 4 (3) (1)

Namibia

Navachab 28 22 748 - 17 10

Tanzania

Geita 90 (3) 749 6 26 1

Non-controlling interests, exploration

and other (5) (9)

AUSTRALASIA 102 10 894 (16) 41 46

Australia

Sunrise Dam 102 10 860 (19) 44 49

Exploration and other (4) (4)

AMERICAS 196 (10) 465 7 125 (9)

Argentina

Cerro Vanguardia - Attributable 92.50% 50 4 357 (5) 39 13

Brazil

AngloGold Ashanti Brasil Mineração 85 (9) 460 11 32 (23)

Serra Grande - Attributable 50% 19 (5) 509 9 13 3

United States of America

Cripple Creek & Victor 42 (25) 558 13 27 (2)

Non-controlling interests, exploration

and other 14 -

OTHER 2 (2)

Sub-total 1,148 (1) 672 5 548 117

Equity accounted investments included above (26) (3)

AngloGold Ashanti 522 114

1 Variance December 2010 quarter on September 2010 quarter - increase

(decrease).

2 Equity accounted joint ventures.

Rounding of figures may result in computational discrepancies.

Financial and Operating Report

OVERVIEW FOR THE QUARTER

FINANCIAL AND CORPORATE REVIEW

As previously announced, AngloGold Ashanti eliminated its hedge book on 7

October 2010, ending the contractual sale of a portion of its production at

discounts to market prices. The company now has full exposure to the price of

gold, which increases its potential for cash-flow generation and earnings. Of

the $2.64bn spent to undertake this final restructuring of the hedge book,

which straddled September and October, $1.58bn was spent in the third quarter

and the remaining $1.06bn in October of the fourth quarter.

Turning to the balance sheet, strong cash generation during the quarter and the

year left the company with a net debt level (excluding the mandatory

convertible bonds) of $1.3bn, better than guidance of $1.7bn given on 11

November. Debt maturities are well spread and range from three to 30 years.

Adjusted headline earnings, excluding the hedge buy-back and related costs,

were $294m, or 76 US cents a share, compared with $303m, or 82 US cents the

previous quarter. The result is especially significant, given that the third

quarter earnings were boosted by a once-off tax credit of $82m. The company

generated cash flow from operations, excluding hedge buy back costs, of $679m.

After taking account of the hedge buy back costs, the company posted an

adjusted headline loss of $764m for the quarter and a profit attributable to

ordinary shareholders of $56m.

OPERATING RESULTS

Production and total cash costs for the three months to 31 December were both

within the guidance set by the company. Production over the period was

1.148Moz, following the sale of the Tau Lekoa mine, compared to 1.162Moz the

previous quarter. Total cash costs rose 5% to $672/oz, during a quarter again

characterized by significant appreciation in the Brazilian real, the Australian

dollar and the South African rand. Strong production performances were

delivered by several key operations, including the West Wits mines in South

Africa, Sunrise Dam in Australia, Siguiri in Guinea, Navachab in Namibia and

Cerro Vanguardia in Argentina. Uranium production was 374,000lbs, compared to

389,000lbs in the third quarter.

Guidance for the fourth quarter was 1.14Moz at a total cash cost of $675/oz,

assuming an average exchange rate of R6.75/$ and $640/oz assuming a weaker rand

at R7.25/$. This compares to an average realised exchange rate of R6.88/$ over

the quarter.

SAFETY

AngloGold Ashanti delivered a fatality free performance for only the second

time in the company's history. This demonstrates not only the strides made in

changing working practices and attitudes toward safety by every member in the

organisation, but also the possibility to work safely at depth. This

achievement provides powerful motivation to redouble efforts to eliminate

injuries from the workplace. The all-injury frequency rate ended the year at

11.5 per million hours worked - an improvement of 11% on the level of 2009.

AngloGold is in the process of implementing a new procedure for accident

investigation and incident management, as well as an electronic Workplace

Management Reporting System (WMRS) across all operations to improve incident

analysis. This will create a platform from which specific initiatives can be

developed to drive further improvements in safety.

OPERATING REVIEW

The South Africa operations produced 476,000oz at a total cash cost of $616/oz

in the fourth quarter of 2010, compared with 478,000oz at a total cash cost of

$594/oz the previous quarter. The performance was driven by another strong set

of results from the core operations, with rand-denominated costs improving by

2% from the previous quarter as management continued to focus on improving

safety and productivity. The success of the business improvement interventions

made in the region are evident in overall productivity figures for AngloGold

Ashanti's South African mines, which are 14% higher in the fourth quarter,

compared with the same period in 2009. At the West Wits operations, Mponeng,

the company's largest mine, output increased by 4% to 143,000oz due to

increased tonnages resulting from fewer safety related stoppages and improved

tramming efficiencies. The neighbouring TauTona mine delivered a 14% rise in

production to 81,000oz, driven by improved grade from higher face values,

together with increased flexibility across its high grade areas. At the Vaal

River operations, production from Moab Khotsong declined by 8% to 76,000oz due

to grade challenges arising from ore dilution and the overall mining mix.

Costs rose 22% to $669/oz. Following a successful effort in returning Great

Noligwa to profitability, production declined 6% to 34,000oz because of an

increase in off-reef mining necessitated by the geological structure

encountered during the period. Kopanang's output was marginally lower at

78,000oz as lower volumes were mined. The Surface operations, which replaced

Tau Lekoa feed with marginal ore, had a 2% decrease in production to 52,000oz.

The Continental Africa operations produced 374,000oz at a total cash cost of

$790/oz in the fourth quarter of 2010, compared with 373,000oz at a total cash

cost of $725/oz the previous quarter. Geita's production declined by 3% to

90,000oz mainly due to fewer tons of higher grade material processed compared

with the previous quarter, although this was partly offset by an increase in

overall tonnage throughput. Total cash costs increased by 6% to $749/oz.

Production from Iduapriem rose 2% to 58,000oz following improvements to plant

availability and utilisation, which offset lower grade. The 30% rise in cash

costs followed an increase in the 2010 electricity tariff which was effected in

the fourth quarter.

At Obuasi, the high level taskforce appointed in November, started work to

define the long-term turnaround strategy for the operation, which continued to

be challenged by poor blasting fragmentation and restricted ore passes, in

addition to an unplanned plant shutdown for maintenance on the tailings

facility. Production declined by 12% to 66,000oz and costs, also impacted by

the higher power price, rose 14% to $949/oz. In Guinea, Siguiri's production

rose by 15% to 71,000oz as conveyor belt modifications and consistent feed of

dry ore drove higher tonnage throughput. Total cash costs decreased by 2% to

$687/oz. Mali continued to deliver strong operational free cashflow to the

business. Production from Morila rose 4% to 24,000oz at an improved total cash

cost of $760/oz. At Yatela, output fell 10% to 9,000oz due to the lower grade

ore stacked during previous periods. Lower recovered grade at Sadiola led to a

3% drop in production to 29,000oz. Costs increased by 26% to $783/oz as new

sources of ore were accessed. In Namibia, Navachab's production jumped by 22%

to 28,000oz as higher-grade ore was mined from the base of the pit, along with

higher overall tonnages and improved performance from the operations at the

bottom of the main pit and the benefits of the dense-media-separator (DMS

plant).

The Americas operations produced 196,000oz at a total cash cost of $465/oz in

the fourth quarter of 2010, compared with 218,000oz at a total cash cost of

$433/oz the previous quarter. Cerro Vanguardia, in Argentina, delivered yet

another strong operating quarter with a 4% rise in production to 50,000oz due

to an increase in tonnages mined. Silver credits and the weaker peso helped

offset higher fuel consumption and accelerating inflation in Argentina with

total cash costs dropping 5% to $357/oz. At Cripple Creek & Victor in the

United States, production fell by 25% as planned, to 42,000oz due to stacking

ore on higher sections of the pad. Cash cost rose 13% to $558/oz. At

AngloGold Ashanti Brasil Mineração, production was 9% lower at 85,000oz due to

lower grades and a drop in tonnages caused by the performance of the Cuiabá

fleet and geomechanical problems which affected the Queiroz plant. The 11%

increase in cash costs to $460/oz reflects the stronger real as well as higher

maintenance costs and lower by-product credits. Serra Grande's production was

5% lower at 19,000oz reflecting lower grades as expected, while costs climbed

9%.

Australasia produced 102,000oz at a total cash cost of $894/oz in the fourth

quarter of 2010, compared with 93,000oz at a total cash cost of $1,064/oz the

previous quarter. Sunrise Dam, the only operating mine in the region,

delivered a significant increase in both ore tonnage and grades from the

underground section of the operation. The economies of scale achieved helped

drive down unit costs. Total cash costs improved 16% from the previous quarter

which included a lower non-cash deferred stripping charge of $160/oz.

PROJECTS

AngloGold Ashanti incurred capital expenditure of $365m during the quarter, of

which $95m was spent on growth projects. Of the growth-related capital, $54m

was spent in the Americas, $14m was spent in Continental Africa, $3m in

Australasia and $23m in South Africa.

Detailed engineering work for the refurbishment of the São Bento plant, at the

Córrego do Sítio project in Brazil's Minas Gerais state, remains on schedule.

Manufacturing of the autoclave was also completed on schedule and the unit was

delivered in January 2011. Mine stopes and underground infrastructure were

completed on time in preparation for the beginning of ramp-up activities in

December. The Lamego mine reached full production at the end of the fourth

quarter as planned, with completion of the main surface facilities expected at

the end of April 2011. Of the 11,884m drilled at AngloGold Ashanti Córrego do

Sítio Mineraçáo, the majority was at Córrego do Sítio II.

In the Democratic Republic of Congo, significant progress was made on the

Kibali joint venture, operated by AngloGold Ashanti's joint venture partner

Randgold Resources. The project team has largely been assembled, with the

appointments of the project manager, construction manager, cost engineer and

financial controller. Good progress has been made on determining the

hydropower strategy, with environmental impact assessments now underway, while

procurement of items necessary for site establishment started ahead of

schedule. Road infrastructure critical to development of the project, was

completed, including a network of 28km in the site and surrounding communities

and the 179km stretch between the towns of Aru and Doko, a key staging point

for Kibali's construction. The commute between these communities, which in the

past could take several days during the rainy season, has been cut to three

hours.

Work continued on completion of a feasibility study on the Mongbwalu project,

which is due for submission to the boards of AngloGold Ashanti and Okimo, the

DRC's state-owned gold company and the 13.78% partner on the project, during

the first quarter of 2011.

In Australia, the bankable feasibility study for the Tropicana project was

completed, presented to the joint venture partners AngloGold Ashanti (70%) and

Independence Group NL (30%), and approved by their boards in November, paving

the way for the project's development. Primary state and federal environmental

approvals were received during the quarter. AngloGold Ashanti plans to announce

appointment of the EPCM and open-pit mining contract during the first quarter

of 2011. Detailed design of the plant and infrastructure construction will

commence in 2011, with construction of the 220km site access road the first

major contract. Exploration of the Havana Deeps and Boston Shaker areas

continued with a feasibility study of open pit mining at Boston Shaker approved

during the quarter. A decision on advancing Havana Deeps to pre-feasibility

stage is also expected in the March 2011 quarter.

EXPLORATION

Total exploration expenditure during the fourth quarter, inclusive of

expenditure at equity accounted joint ventures, was $65m ($23m on brownfield,

$26m on greenfield and $16m on pre-feasibility studies), compared with $72m the

previous quarter ($28m on brownfield, $19m on greenfield and $25m on

pre-feasibility studies). The following are highlights from the company's

exploration activities during the quarter. More detail on AngloGold Ashanti's

exploration programme can be found at www.anglogoldashanti.com.

During the quarter 58,823m of greenfield exploration drilling was completed at

existing priority sites and used to delineate new targets in Australia, Canada,

Guinea, Gabon, Colombia and the Solomon Islands. This compares with 98,000m

the previous quarter.

In Australia, exploration in the Tropicana joint venture (JV) during the

quarter focused on reverse circulation and diamond drill testing of targets

adjacent to the project resource. The Boston Shaker resource lies 360m north

of the Tropicana open pit resource and has been tested to a maximum vertical

depth of 230m. A full feasibility study on Boston Shaker started in September

2010, with exploration drilling suggesting potential for expansion of the open

pit resource determined in the scoping study. Significant results included:

8.0m @ 8.08 g/t Au from 242m, 6m @ 6.54 g/t Au from 82m, 13m @ 3.66 g/t Au from

33m, 11m @ 3.34 g/t Au from 48m and 16m @ 4.88 g/t Au from 397m. An

underground scoping study on Havana Deeps was completed in October 2010 and

indicates potential viability of underground mining outside the Havana open pit

resource. Drill holes targeting Havana Deeps returned further significant

results, including: 9m @ 11.7 g/t Au from 462m, 11m @ 11.2 g/t Au from 416m and

10m @ 14.5 g/t Au from 374m.

At the Saxby JV with Falcon Minerals in northwest Queensland, geochemical

results were returned for all samples from the 4,000m programme of five

pre-collared diamond drill holes completed in mid-2010. A high-grade gold

intersection of 15m @ 9.09 g/t Au from 701m was returned and further check

assays are pending.

In the Solomon Islands, exploration activities continued at the Kele and Mase

JVs with XDM Resources. At Kele, about 1,515m of diamond drilling was

completed in the quarter, along with mechanical trenching and geochemical

sampling focussed on the Babatia and Vulu prospects. Best results from the

drilling at Kele included 15.5m @ 7.89 g/t Au and 30.2m @ 2.74 g/t Au from

argillic alteration zones. Best results from trenching include 25m @ 3.1g/t Au

and 9m @ 2.99 g/t Au. At Mase, about 985m of diamond drilling was completed.

In the Americas, drilling was undertaken at four regions in Colombia.

Exploration continued at the La Colosa project in Colombia, where three rigs

are now in operation, while 3,477m was drilled at the Gramalote deposit.

Additional sampling and mapping was conducted at the Quebradona property, while

an extensive ground IP survey was completed at Loma Esperanza anomaly.

Encouraging results from infill soil sampling were received from the Falcão JV

with Horizonte Minerals in Brazil's southern Para state. In Argentina, a scout

RC drill programme at the La Volcan prospect for a total of 1,794m in 12 holes.

Assay results included some narrow mineralised quartz zones with up to 3 g/t Au

and 40 g/t Au. Deeper diamond drilling is warranted to test anticipated higher

Au grade horizons of the mineralised system.

In Continental Africa, regional exploration in the DRC continued on the 5,487km

² Kilo project, owned by Ashanti Goldfields Kilo (AGK), in which AngloGold

Ashanti has a 86.22% stake and Okimo 13.78%. Regional exploration initiatives,

including a 5,000m diamond drilling programme over key targets, commenced to

test mineralisation in and around intrusive bodies at the Mount Tsi prospect.

The first phase of a regional reconnaissance sampling and mapping programme was

completed and several regional scale anomalies identified. Trenching, detailed

mapping and sampling of these anomalies is ongoing in the northern and central

areas, with encouraging results. At the Kibali joint venture, 5,705m of

mineral-resource conversion drilling targeted planned underground

infrastructure. One hole aimed to upgrade KCD down-plunge mineral resource

from inferred to the indicated category, proved successful. Regional

exploration work on Blocks 2, 3 and 4 around the Siguiri mine in Guinea is

ongoing.

At the Saraya South extension and Foulata East targets in Block 2, a further

1,658m was drilled with a best intercept of 32m @ 5.27 g/t Au, from 4m in the

oxides. In Block 3, soil geochemistry confirms consistent anomalism along the

sediment-amphibolite contact extending a further 1.6km southward, resulting in

an anomaly with a strike length of about 6.8km, still open towards the south; a

programme to test these anomalies in underway. At Obuasi in Ghana, the

brownfield team completed 1,074m of drilling, with four new reef intersections

obtained.

In the Middle East & North Africa, where AngloGold Ashanti has a joint venture

with Thani Investments, exploration work included Phase II sampling and mapping

at the Wadi Kareem and Hodine concessions in Egypt. At Hodine, diamond

drilling commenced at the Hutite prospect, to follow-up on the encouraging

results from traverse rock chip sampling of 33m @ 4.37 g/t Au, including 7.5m @

8.85 g/t Au. In Eritrea, a 10,000 line km airborne electromagnetic, magnetic

and radiometric survey commenced at the Kerkasha and Akordat North exploration

licences and will be completed in the first quarter of 2011. Thani Ashanti

entered into a binding Heads of Terms with Stratex International to explore for

epithermal gold deposits in the Afar region of Ethiopia and in Djibouti.

ANNUAL REVIEW

Adjusted headline earnings, normalised to exclude the $2.5bn post taxation cost

of restructuring the hedge book during the year, was $787m. The company

reported an adjusted headline loss of $1,758m, when taking the restructuring

cost into account. A final dividend of 80 South African cents per share

(approximately 11 US cents per share), declared, resulting in a total dividend

of 145 South African cents per share (approximately 20 US cents per share) for

the 2010 year. This represents an 11.5% increase from the total dividend paid

in 2009.

Production in 2010 declined 2% to 4.52Moz, within the range forecast by the

company at the beginning of 2010, while total cash costs rose 24% to $638/oz,

in line with exchange-rate adjusted guidance. Significant improvements were

made at the South African operations, which experienced fewer safety-related

stoppages; at Geita, where improvements related to Project ONE continued to

show results; and at Cripple Creek & Victor, where the revised pad-stacking

strategy yielded the desired outcome. The sale of Tau Lekoa, seismic impact at

Savuka, the ten week shut down at Iduapriem and ongoing operational challenges

at Obuasi contributed to the lower production. A multi-disciplinary taskforce

has been established to design and execute the turnaround strategy for Obuasi.

Uranium production reached 1.46Mlbs in 2010, compared with 1.44Mlbs the

previous year, as grades and recoveries improved.

AngloGold Ashanti also saw the acceleration of 'mining inflation' impact prices

of skilled and unskilled labour, contractors, heavy equipment and consumables

in several of its operating regions as rising metal prices spurred activity in

the global resources sector. The impact on dollar-denominated costs was

magnified by significant strengthening of the Brazilian real, the South African

rand and the Australian dollar.

Project ONE, AngloGold Ashanti's new operating model central to the achievement

of long-term productivity, safety, environmental and financial targets, was

implemented at 15 operations. To date, the business improvement initiatives

introduced since the articulation of AngloGold Ashanti's new strategy in April

2008, has improved operational cashflow by around $500m.

Tragically, there were 15 fatalities across the company's 21 mines during the

year, with 10 occurring at the South African operations. Eliminating injuries

from the workplace remains AngloGold Ashanti's most important objective and the

particular focus is being placed on the Safety Transformation component of

Project ONE to achieve this goal.

The overall quality and tenor of the balance sheet was greatly improved during

the year with the award of investment grade ratings by Standard & Poor's and

Moody's Investor Services, which paved the way for the successful issue in

April of a $700m, 10-year bond and a $300m, 30-year bond. A dual tranche

capital raising for net proceeds of $1.53bn - comprising roughly equal parts of

equity and a three-year mandatory convertible note - were concluded in

September. This created the platform for the elimination of the final 3.2Moz

hedge on 7 October. This fulfilled a long-standing strategic objective of the

company, to reduce financial risk and improve cashflow generation ability by

increasing overall exposure to the gold price. The balance sheet ended stronger

with a net debt level (excluding the mandatory convertible bond) of $1.3bn at

year end.

The company estimated in September that it would grow production from its

current operating and exploration portfolio to between 5.4Moz and 5.6Moz over

five years and estimated expansion capital of $2.4bn to be invested over the

next three years. The board approved the Sao Bento and Tropicana projects

during the course of the year and feasibility studies progressed on the Kibali

and Mongbwalu projects. In Colombia, drilling resumed on the La Colosa deposit

after a two-year hiatus and started on the Gramalote joint venture. Both assets

are undergoing feasibility studies. Greenfield exploration accelerated

dramatically from 2009, with encouraging results from Colombia, Australia, the

Solomon Islands, Egypt, Gabon and Canada's Baffin Island region.

Reserves (which were calculated at a gold price of US$850/oz) improved by

0.6Moz to end the year at 71.2Moz*, after accounting for depletion. Resources

were largely unchanged after depletion, at 220Moz*. *Restated for the sale of

Tau Lekoa.

OUTLOOK

AngloGold Ashanti's production and total cash cost guidance for the full year

2011 is expected to be 4.55Moz - 4.75Moz at a total cash cost of $660/oz to

$685/oz. This assumes an average exchange rate of R7.11/$, BRL1.70/$, A$/$0.98

and Argentinean peso 4.12/$ and an oil price of $95/barrel.

First quarter production and total cash cost guidance is expected to be 1.04Moz

at a total cash cost of between $675/oz and $700/oz. This assumes an average

exchange rate of R7.00/$, BRL1.70/$, A$/$1.00 and Argentinean peso 4.03/$ and

an oil price of $95/barrel.

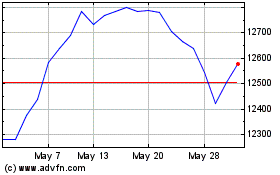

Review of the Gold Market

Gold price movement and investment markets

Gold price data

During the fourth quarter, gold hit new highs in both US dollar and Euro terms,

reaching $1,431/oz and EUR1,075/oz. The gold price averaged $1,370/oz over the

period, 12% more than the preceding quarter. Although the announcement of the

much anticipated second round of quantitative easing by the Federal Reserve

helped propel bullion back above $1,400/oz level in early November, it was the

return of Sovereign risk in the Euro zone that saw gold largely maintain that

level over the balance of the quarter after Ireland became the second EU member

to accept a bailout from the European Financial Stability Fund.

Investment demand

Despite heightened Sovereign Risk in the fourth quarter, exchange traded funds

(ETF) did not reflect the same levels of growth exhibited in the second quarter

when this uncertainty first presented itself. ETF holdings remained relatively

stagnant during the quarter at 2,100 tonnes or 68Moz. On the COMEX, the largest

position for the quarter was reported at 32.6Mozs long, some 1.1Mozs less than

the largest ever long position reported. In China, retail bar investment

increased by approximately 45% and local gold supply was once again

insufficient to meet demand. As a result of this deficit, gold sold at a

premium of RMB 5/gram over the international gold price. The fourth quarter saw

the Middle East investment markets receiving a welcome boost with bar and coin

sales rising in the United Arab Emirates, Turkey and the Kingdom of Saudi

Arabia.

Official sector

The second year of the current Central Bank Accord, which commenced at the end

of September 2009, has seen sales totalling 54 tonnes in the period up to

December 2010. This is comprised almost entirely of sales from the IMF, which

has subsequently concluded its sale of 403 tonnes, with a little more than half

sold to Official Sector participants.

Jewellery sales

The fourth quarter saw the Indian gold market, still the world's largest,

growing by more than 20%. It appears 2009's poor showing has been shrugged off.

The Rupee price for a gram of gold exceeded INR2,100 for the first time ever

during the quarter and encouragingly, this new peak did not prompt a rise in

gold recycling. Dollar weakness and Rupee strength were once again the hallmark

of the quarter, which did not deter Indian buyers. Similarly, in China, the

jewellery market grew by over 8%. Consumers still favour pure gold jewellery as

an investment to safeguard from economic uncertainty and rising inflation. The

18 carat jewellery market did not fare as well due largely to its inferior

investment status and showed a small decline from the previous quarter. In the

United Arab Emirates, a strong quarter for tourism contributed to good sales of

22 carat jewellery, while Turkish exports rose marginally over the fourth

quarter, with shipments primarily to the U.S. and Russia. The Kingdom of Saudi

Arabia experienced a weaker fourth quarter with demand down by some 10% on the

previous quarter.

Mineral Resource and Ore Reserve

Mineral Resource and Ore Reserve are reported in accordance with the minimum

standards described by the Australasian Code for Reporting of Exploration

Results, Mineral Resource and Ore Reserve (JORC Code, 2004 Edition), and also

conform to the standards set out in the South African Code for the Reporting of

Exploration Results, Mineral Resource and Mineral Reserve (The SAMREC Code,

2007 edition). Mineral Resource is inclusive of the Ore Reserve component

unless otherwise stated.

Mineral Resource

When the 2009 Mineral Resource is restated to exclude the sale of Tau Lekoa

(6.2Moz), the Mineral Resource is reduced from 226.7Moz to 220.5Moz. The total

Mineral Resource remained steady, dropping slightly from 220.5Moz in 2009 to

220.0Moz in December 2010. A year-on-year increase of 5.8Moz occurred before

the subtraction of depletion and a decrease of 0.5Moz after the subtraction of

depletion. It should be noted that changes in economic assumptions from 2009 to

2010 resulted in the Mineral Resource increasing by 3.5Moz whilst exploration

and modelling resulted in an increase of 0.7Moz. The remaining increase of

1.6Moz resulted from various other factors. Depletions from the Mineral

Resource for 2009 totalled 6.3Moz.

MINERAL RESOURCE Moz

Mineral Resource as at 31 December 2009 226.7

Sale of Tau Lekoa (6.2)

Restated 2009 Mineral Resource 220.5

Reductions

Great Due to economics and depletion (2.4)

Noligwa

TauTona Transfers to Mponeng so as to improve change of mining (1.3)

Siguiri Revision to modelling procedures and increased costs (1.0)

Other Total of non-significant changes (3.6)

Additions

Vaal River An economic study demonstrated that these tailings can be 3.0

Surface economically reworked to recover uranium

West Wits 1.3

Surface

Other Total of non-significant changes 3.5

Mineral Resource as at 31 December 2010 220.0

Rounding of numbers may result in computational discrepancies.

Mineral resource has been calculated at a gold price of US$1,100/oz (2009:

US$1,025/oz).

ORE RESERVE

When the 2009 Ore Reserve is restated to exclude Tau Lekoa (0.8Moz), the 2009

Ore Reserve is reduced from 71.4Moz to 70.6Moz. Using the restated figure, the

AngloGold Ashanti Ore Reserve increased from 70.6Moz in 2009 to 71.2Moz in

December 2010. A year-on-year increase of 6.2Moz occurred before the

subtraction of 5.6Moz for depletion, resulting in an increase of 0.6Moz after

the subtraction of depletion. It should be noted that changes in the economic

assumptions from 2009 to 2010 resulted in the Ore Reserve increasing by 2.4Moz

while exploration and modelling resulted in a further increase of 3.8Moz.

ORE RESERVE Moz

Ore Reserve as at 31 December 2009 71.4

Sale of Tau Lekoa (0.8)

Restated 2009 Ore Reserve 70.6

Reductions

Geita Depletions and model changes (0.9)

Obuasi Depletions and refinements to Ore Reserve (0.7)

estimation

Siguiri Remodelling in accordance with reconciliation and (0.7)

depletion

TauTona Depletion and transfers to Mponeng, minor model (0.7)

changes

Other Total non-significant changes (1.2)

Additions

Cripple Creek & MLE2 project study incorporated 1.4

Victor

Mponeng Transfers from TauTona countered some model losses 1.2

Sadiola Additions from the Deep Suphide project 0.8

Other Total non-significant changes 1.3

Ore Reserve as at 31 December 2010 71.2

Rounding of numbers may result in computational discrepancies.

Some of the Ore Reserves previously reflected against TauTona have now been

transferred to Mponeng to facilitate the mining plan.

Ore reserve has been calculated using a gold price of US$850/oz (2009: US$800/

oz).

BY-PRODUCTS

Several by-products are recovered as a result of the processing of gold Ore

Reserve. These include 21,591t of uranium oxide from the South African

operations, 443,761t of sulphur from Brazil and 34.6Moz of silver from

Argentina. Details of by-product Mineral Resource and Ore Reserve are given in

the Mineral Resource and Ore Reserve Report 2010(1).

EXTERNAL AUDIT OF MINERAL RESOURCE

During the course of the year and as part of the rolling audit programme,

AngloGold Ashanti's 2010 Mineral Resource at the following operations were

submitted for external audit by the Australian-based company Quantitative Group

(QG):

Vaal Reef at Great Noligwa, Kopanang and Moab Khotsong mines

Cerro Vanguardia

Serra Grande

Cripple Creek and Victor

Mongbwalu

AngloGold Ashanti's 2010 Ore Reserve at the following operations were submitted

for external audit by a number of international consulting companies, namely:

Geita AMC

Obuasi AMC

Siguiri AMC

Sunrise Dam: underground Optiro

Cripple Creek and Victor Pincock Allen and Holt

Cerro Vanguardia Xstract

Serra Grande Xstract

Brasil Mineração - Cuiabá Xstract

The company has been informed that the audits identified no material

shortcomings in the process by which AngloGold Ashanti's Mineral Resource and

Ore Reserve were evaluated. It is the company's intention to continue this

process so that each of its operations will be audited, on average, every three

years.

COMPETENT PERSONS

The information in this report relating to exploration results, Mineral

Resource and Ore Reserve is based on information compiled by the Competent

Persons. These individuals are identified in the expanded Mineral Resource and

Ore Reserve Report 2010(1). The Competent Persons consent to the inclusion of

Exploration Results, Mineral Resource and Ore Reserve information in this

report, in the form and context in which it appears.

During the past decade, the company has developed and implemented a rigorous

system of internal and external reviews of Exploration Results, Mineral

Resource or Ore Reserve. A documented chain of responsibility exists from the

Competent Persons at the operations to the company's Mineral Resource and Ore

Reserve Steering Committee. Accordingly, the Chairman of the Mineral Resource

and Ore Reserve Steering Committee, VA Chamberlain, MSc (Mining Engineering),

BSc (Hons) (Geology), MGSSA, MAusIMM, assumes responsibility for the Mineral

Resource and Ore Reserve processes for AngloGold Ashanti and is satisfied that

the Competent Persons have fulfilled their responsibilities.

(1)A detailed breakdown of Mineral Resource and Ore Reserve is provided in the

Mineral Resource and Ore Reserve Report 2010, which will be available on or

about 31 March 2011 on the AngloGold Ashanti website

(www.anglogoldashanti.com), from where it may be downloaded as a PDF file using

Adobe Acrobat Reader. The report will also be available in printed format on

request from the AngloGold Ashanti offices at the addresses given at the back

of the Annual Financial Statements.

MINERAL RESOURCE BY COUNTRY (ATTRIBUTABLE) INCLUSIVE OF ORE RESERVE

Contained Contained

Tonnes Grade

Category gold gold

million g/t

as at 31 December 2010 tonnes Moz

South Africa Measured 26.51 15.30 405.52 13.04

Indicated 753.04 2.76 2,075.87 66.74

Inferred 40.82 13.81 563.55 18.12

Total 820.38 3.71 3,044.94 97.90

Democratic Republic of the Congo Measured 0.00 - 0.00 0.00

Indicated 59.67 3.64 217.41 6.99

Inferred 30.54 3.27 99.94 3.21

Total 90.21 3.52 317.35 10.20

Ghana Measured 77.12 4.83 372.49 11.98

Indicated 83.38 3.82 318.84 10.25

Inferred 105.26 3.71 390.99 12.57

Total 265.76 4.07 1,082.33 34.80

Guinea Measured 43.18 0.65 28.28 0.91

Indicated 101.78 0.77 78.19 2.51

Inferred 77.77 0.85 66.11 2.13

Total 222.73 0.77 172.58 5.55

Mali Measured 15.52 1.36 21.17 0.68

Indicated 54.86 1.79 98.07 3.15

Inferred 19.87 1.66 32.98 1.06

Total 90.24 1.69 152.22 4.89

Namibia Measured 23.30 0.86 20.09 0.65

Indicated 72.57 1.28 92.78 2.98

Inferred 23.33 1.13 26.41 0.85

Total 119.20 1.17 139.28 4.48

Tanzania Measured 0.00 - 0.00 0.00

Indicated 80.32 3.37 270.88 8.71

Inferred 21.95 3.62 79.57 2.56

Total 102.27 3.43 350.46 11.27

Australia Measured 34.88 1.74 60.55 1.95

Indicated 35.49 2.85 101.12 3.25

Inferred 19.84 2.90 57.63 1.85

Total 90.21 2.43 219.30 7.05

Argentina Measured 11.12 1.50 16.63 0.53

Indicated 20.86 3.82 79.69 2.56

Inferred 10.20 3.19 32.55 1.05

Total 42.18 3.06 128.87 4.14

Brazil Measured 11.18 6.39 71.43 2.30

Indicated 15.60 6.10 95.14 3.06

Inferred 30.80 6.81 209.73 6.74

Total 57.57 6.54 376.31 12.10

Colombia Measured 0.00 - 0.00 0.00

Indicated 15.78 0.93 14.75 0.47

Inferred 414.06 0.98 406.06 13.06

Total 429.85 0.98 420.81 13.53

United States of America Measured 283.04 0.78 221.76 7.13

Indicated 216.53 0.73 157.18 5.05

Inferred 79.61 0.75 59.66 1.92

Total 579.18 0.76 438.60 14.10

Total Measured 525.84 2.32 1,217.92 39.16

Indicated 1,509.88 2.38 3,599.94 115.74

Inferred 874.07 2.32 2,025.18 65.11

Total 2,909.79 2.35 6,843.04 220.01

Rounding of figures may result in computational discrepancies.

MINERAL RESOURCE BY COUNTRY (ATTRIBUTABLE) EXCLUSIVE OF ORE RESERVE

Contained Contained

Tonnes Grade

Category gold gold

million g/t

as at 31 December 2010 tonnes Moz

South Africa Measured 15.29 17.73 271.14 8.72

Indicated 563.41 1.65 927.58 29.82

Inferred 19.64 18.69 367.04 11.80

Total 598.34 2.62 1,565.75 50.34

Democratic Republic of the Congo Measured 0.00 - 0.00 0.00

Indicated 26.23 2.93 76.72 2.47

Inferred 30.54 3.27 99.94 3.21

Total 56.77 3.11 176.66 5.68

Ghana Measured 29.69 6.96 206.52 6.64

Indicated 34.46 2.45 84.26 2.71

Inferred 105.26 3.71 391.01 12.57

Total 169.41 4.02 681.79 21.92

Guinea Measured 4.46 0.80 3.59 0.12

Indicated 34.07 0.77 26.22 0.84

Inferred 77.77 0.85 66.11 2.13

Total 116.30 0.82 95.91 3.08

Mali Measured 4.69 0.75 3.50 0.11

Indicated 18.27 1.69 30.79 0.99

Inferred 19.09 1.70 32.37 1.04

Total 42.05 1.59 66.66 2.14

Namibia Measured 9.03 0.58 5.24 0.17

Indicated 42.83 1.11 47.50 1.53

Inferred 23.33 1.13 26.41 0.85

Total 75.20 1.05 79.15 2.54

Tanzania Measured 0.00 - 0.00 0.00

Indicated 41.62 2.93 121.83 3.92

Inferred 21.95 3.62 79.57 2.56

Total 63.57 3.17 201.40 6.48

Australia Measured 10.83 0.93 10.10 0.32

Indicated 12.10 2.92 35.29 1.13

Inferred 19.84 2.90 57.63 1.85

Total 42.77 2.41 103.02 3.31

Argentina Measured 1.36 3.61 4.91 0.16

Indicated 16.70 2.20 36.72 1.18

Inferred 9.95 2.97 29.56 0.95

Total 28.01 2.54 71.18 2.29

Brazil Measured 6.37 6.15 39.19 1.26

Indicated 8.35 6.10 50.93 1.64

Inferred 28.08 6.78 190.31 6.12

Total 42.81 6.55 280.44 9.02

Colombia Measured 0.00 - 0.00 0.00

Indicated 15.78 0.93 14.75 0.47

Inferred 414.06 0.98 406.06 13.06

Total 429.85 0.98 420.81 13.53

United States of America Measured 135.85 0.75 102.38 3.29

Indicated 137.77 0.71 98.42 3.16

Inferred 69.52 0.77 53.85 1.73

Total 343.14 0.74 254.66 8.19

Total Measured 217.57 2.97 646.57 20.79

Indicated 951.59 1.63 1,551.01 49.87

Inferred 839.05 2.15 1,799.86 57.87

Total 2,008.21 1.99 3,997.44 128.52

Rounding of figures may result in computational discrepancies.

ORE RESERVE BY COUNTRY (ATTRIBUTABLE)

Contained Contained

Tonnes Grade

Category gold gold

million g/t

as at 31 December 2010 tonnes Moz

South Africa Proved 12.03 8.24 99.07 3.19

Probable 191.99 4.41 845.74 27.19

Total 204.02 4.63 944.81 30.38

Democratic Republic of the Congo Proved - - - -

Probable 33.44 4.21 140.69 4.52

Total 33.44 4.21 140.69 4.52

Ghana Proved 44.01 3.13 137.85 4.43

Probable 49.30 4.41 217.28 6.99

Total 93.31 3.81 355.13 11.42

Guinea Proved 39.05 0.62 24.38 0.78

Probable 67.44 0.74 49.71 1.60

Total 160.49 0.70 74.08 2.38

Mali Proved 4.96 2.23 11.03 0.35

Probable 39.18 1.78 69.82 2.24

Total 44.14 1.83 80.86 2.60

Namibia Proved 14.27 1.02 14.49 0.47

Probable 29.74 1.45 42.99 1.38

Total 44.01 1.31 57.48 1.85

Tanzania Proved - - - -

Probable 40.92 3.20 131.06 4.21

Total 40.92 3.20 131.06 4.21

Australia Proved 24.05 2.10 50.45 1.62

Probable 23.39 2.81 65.83 2.12

Total 47.44 2.45 116.28 3.74

Argentina Proved 9.54 1.22 11.63 0.37

Probable 8.57 5.32 45.62 1.47

Total 18.10 3.16 57.25 1.84

Brazil Proved 6.91 5.80 40.06 1.29

Probable 7.40 5.26 38.88 1.25

Total 14.30 5.52 78.94 2.54

United States of America Proved 147.19 0.81 119.37 3.84

Probable 78.76 0.75 58.76 1.89

Total 225.95 0.79 178.13 5.73

Total Proved 302.00 1.68 508.32 16.34

Probable 570.12 2.99 1,706.39 54.86

Total 872.12 2.54 2,214.71 71.20

Rounding of figures may result in computational discrepancies.

Group income statement

Quarter Quarter Quarter Year Year

ended Ended ended Ended ended

December September December December December

2010 2010 2009 2010 2009

SA Rand million Notes Unaudited Unaudited Unaudited Unaudited Audited

Revenue 2 11,095 10,668 9,514 40,135 31,961

Gold income 10,614 10,372 9,234 38,833 30,745

Cost of sales 3 (7,016) (6,659) (6,219) (25,833) (23,220)

Loss on non-hedge derivatives and other

commodity contracts 4 (529) (1,041) (2,706) (5,136) (11,934)

Gross profit (loss) 3,069 2,672 309 7,864 (4,409)

Corporate administration and other expenses (488) (350) (359) (1,491) (1,275)

Market development costs (30) (26) (10) (98) (87)

Exploration costs (338) (440) (442) (1,446) (1,217)

Other operating (expenses) income 5 (27) (50) 58 (149) (80)

Special items 6 (208) (424) 4,761 (894) 5,209

Operating profit (loss) 1,978 1,382 4,317 3,786 (1,859)

Interest received 119 58 133 311 444

Exchange gain (loss) 93 (113) 527 18 852

Fair value adjustment on option component of

convertible bonds (280) (166) (66) 39 (249)

Finance costs and unwinding of obligations 7 (357) (285) (268) (1,203) (1,146)

Fair value loss on mandatory convertible bonds (222) (160) - (382) -

Share of equity accounted investments' profit 63 151 227 467 785

Profit (loss) before taxation 1,394 867 4,870 3,036 (1,173)

Taxation 8 (878) (318) (1,522) (2,018) (1,172)

Profit (loss) for the period 516 549 3,348 1,018 (2,345)

Allocated as follows:

Equity shareholders 404 443 3,179 637 (2,762)

Non-controlling interests 112 106 169 381 417

516 549 3,348 1,018 (2,345)

Basic profit (loss) per ordinary share (cents) 1 105 120 867 171 (765)

Diluted profit (loss) per ordinary share (cents)

2 105 120 865 171 (765)

1 Calculated on the basic weighted average number of ordinary shares

2 Calculated on the diluted weighted average number of ordinary share

Rounding of figures may result in computational discrepancies.

Group income statement

Quarter Quarter Quarter Year Year

ended ended ended ended ended

December September December December December

2010 2010 2009 2010 2009

US Dollar million Notes Unaudited Unaudited Unaudited Unaudited Audited

Revenue 2 1,613 1,461 1,273 5,514 3,916

Gold income 1,543 1,420 1,236 5,334 3,768

Cost of sales 3 (1,021) (911) (833) (3,550) (2,813)

Loss on non-hedge derivatives and other

commodity contracts 4 (77) (152) (363) (702) (1,533)

Gross profit (loss) 445 357 40 1,082 (578)

Corporate administration and other expenses (71) (48) (48) (206) (154)

Market development costs (5) (4) (1) (14) (10)

Exploration costs (49) (60) (59) (198) (150)

Other operating (expenses) income 5 (4) (7) 8 (20) (8)

Special items 6 (31) (60) 636 (126) 691

Operating profit (loss) 285 178 576 518 (209)

Interest received 17 8 18 43 54

Exchange gain (loss) 14 (16) 71 3 112

Fair value adjustment on option component of

convertible bonds (41) (24) (9) (1) (33)

Finance costs and unwinding of obligations 7 (52) (39) (36) (166) (139)

Fair value loss on mandatory convertible bonds (33) (22) - (55) -

Share of equity accounted investments' profit 9 21 30 63 94

Profit (loss) before taxation 199 106 650 405 (121)

Taxation 8 (127) (41) (204) (276) (147)

Profit (loss) for the period 72 65 446 129 (268)

Allocated as follows:

Equity shareholders 56 51 424 76 (320)

Non-controlling interests 16 14 22 53 52

72 65 446 129 (268)

Basic profit (loss) per ordinary share (cents) 1 15 14 116 20 (89)

Diluted profit (loss) per ordinary share (cents) 2 14 14 115 20 (89)

1 Calculated on the basic weighted average number of ordinary shares.

2 Calculated on the diluted weighted average number of ordinary shares.

Rounding of figures may result in computational discrepancies.

Group statement of comprehensive income

Quarter Quarter Quarter Year Year

ended ended ended ended ended

December September December December December

2010 2010 2009 2010 2009

SA Rand million Unaudited Unaudited Unaudited Unaudited Audited

Profit (loss) for the period 516 549 3,348 1,018 (2,345)

Exchange differences on translation of foreign

operations (759) (1,100) (618) (1,766) (2,645)

Share of equity accounted investments' other

comprehensive expense (income) 1 2 - (1) -

Net loss on cash flow hedges - - (140) - (132)

Net loss on cash flow hedges removed from

equity and reported in gold income - - 181 279 1,155

Hedge ineffectiveness on

cash flow hedges - - 15 - 40

Realised gain (loss) on hedges of capital items 1 - 2 3 (12)

Deferred taxation thereon - (1) (13) (99) (263)

1 (1) 45 183 788

Net gain on available-for-sale financial assets 298 43 346 440 482

Release on disposal of available-for-sale

financial assets (194) - - (235) -

Deferred taxation thereon - - (5) 13 (13)

104 43 341 218 469

Actuarial (loss) gain recognised (175) - 88 (175) 88

Deferred taxation thereon 47 - (28) 47 (28)

(128) - 60 (128) 60

Other comprehensive expense

for the period net of tax (781) (1,056) (172) (1,494) (1,328)

Total comprehensive (expense) income

for the period net of tax (265) (507) 3,176 (476) (3,673)

Allocated as follows:

Equity shareholders (377) (613) 3,007 (857) (4,099)

Non-controlling interests 112 106 169 381 426

(265) (507) 3,176 (476) (3,673)

Rounding of figures may result in computational discrepancies.

Group statement of comprehensive income

Quarter Quarter Quarter Year Year

ended ended ended ended ended

December September December December December

2010 2010 2009 2010 2009

US Dollar million Unaudited Unaudited Unaudited Unaudited Audited

Profit (loss) for the period 72 65 446 129 (268)

Exchange differences on translation of foreign

operations 123 151 (45) 213 318

Share of equity accounted investments' other

comprehensive expenses - 1 - - -

Net loss on cash flow hedges - - (17) - (16)

Net loss on cash flow hedges removed from

equity and reported in gold income - - 26 38 138

Hedge ineffectiveness on

cash flow hedges - - 2 - 5

Realised gain (loss) on hedges of capital items - - 1 - (1)

Deferred taxation thereon - - (3) (13) (35)

- - 9 25 91

Net gain on available-for-sale financial assets 41 5 41 60 57

Release on disposal of available-for-sale

financial assets (26) - - (32) -

Deferred taxation thereon - - (1) 2 (2)

15 5 40 30 55

Actuarial (loss) gain recognised (24) - 10 (24) 10

Deferred taxation thereon 6 - (3) 6 (3)

(18) - 7 (18) 7

Other comprehensive income

for the period net of tax 120 157 11 250 471

Total comprehensive income

for the period net of tax 192 222 457 379 203

Allocated as follows:

Equity shareholders 176 208 435 326 150

Non-controlling interests 16 14 22 53 53

192 222 457 379 203

Rounding of figures may result in computational discrepancies.

Group statement of financial position

As at As at As at

December September December

2010 2010 2009

SA Rand million Note Unaudited Unaudited Audited

ASSETS

Non-current assets

Tangible assets 40,600 41,489 43,263

Intangible assets 1,277 1,296 1,316

Investments in associates and equity accounted joint ventures 4,087 4,329 4,758

Other investments 1,555 1,627 1,302

Inventories 2,268 2,268 2,508

Trade and other receivables 1,000 994 788

Derivatives 6 8 40

Deferred taxation 131 88 451

Cash restricted for use 214 214 394

Other non-current assets 59 92 63

51,197 52,405 54,883

Current assets

Inventories 5,848 5,860 5,102

Trade and other receivables 1,625 1,588 1,419

Derivatives - 453 2,450

Current portion of other non-current assets 4 2 3

Cash restricted for use 69 84 87

Cash and cash equivalents 3,776 9,313 8,176

11,322 17,300 17,237

Non-current assets held for sale 110 114 650

11,432 17,414 17,887

TOTAL ASSETS 62,629 69,819 72,770

EQUITY AND LIABILITIES

Share capital and premium 11 45,678 45,598 39,834

Retained earnings and other reserves (19,470) (19,159) (18,276)

Non-controlling interests 815 916 966

Total equity 27,023 27,355 22,524

Non-current liabilities

Borrowings 16,877 17,363 4,862

Environmental rehabilitation and other provisions 3,873 3,332 3,351

Provision for pension and post-retirement benefits 1,258 1,187 1,179

Trade, other payables and deferred income 110 119 108

Derivatives 1,158 947 1,310

Deferred taxation 5,910 5,776 5,599

29,186 28,724 16,409

Current liabilities

Current portion of borrowings 886 1,864 9,493

Trade, other payables and deferred income 4,630 4,061 4,332

Derivatives - 7,316 18,770

Taxation 882 499 1,186

6,398 13,740 33,781

Non-current liabilities held for sale 22 - 56

6,420 13,740 33,837

Total liabilities 35,606 42,464 50,246

TOTAL EQUITY AND LIABILITIES 62,629 69,819 72,770

Net asset value - cents per share 8,532 8,654 6,153

Rounding of figures may result in computational discrepancies.

Group statement of financial position

As at As at As at

December September December

2010 2010 2009

US Dollar million Note Unaudited Unaudited Audited

ASSETS

Non-current assets

Tangible assets 6,180 5,961 5,819

Intangible assets 194 186 177

Investments in associates and equity accounted joint ventures 622 622 640

Other investments 237 234 175

Inventories 345 326 337

Trade and other receivables 152 143 106

Derivatives 1 1 5

Deferred taxation 20 13 61

Cash restricted for use 33 31 53

Other non-current assets 9 13 8

7,793 7,530 7,381

Current assets

Inventories 890 842 686

Trade and other receivables 247 228 191

Derivatives - 65 330

Current portion of other non-current assets 1 - -

Cash restricted for use 10 12 12

Cash and cash equivalents 575 1,338 1,100

1,723 2,485 2,319

Non-current assets held for sale 16 17 87

1,739 2,502 2,406

TOTAL ASSETS 9,532 10,032 9,787

EQUITY AND LIABILITIES

Share capital and premium 11 6,627 6,615 5,805

Retained earnings and other reserves (2,638) (2,817) (2,905)

Non-controlling interests 124 132 130

Total equity 4,113 3,930 3,030

Non-current liabilities

Borrowings 2,569 2,495 654

Environmental rehabilitation and other provisions 589 479 451

Provision for pension and post-retirement benefits 191 170 159

Trade, other payables and deferred income 17 17 14

Derivatives 176 136 176

Deferred taxation 900 830 753

4,442 4,127 2,207

Current liabilities

Current portion of borrowings 135 268 1,277

Trade, other payables and deferred income 705 584 582

Derivatives - 1,051 2,525

Taxation 134 72 159

974 1,975 4,543

Non-current liabilities held for sale 3 - 7

977 1,975 4,550

Total liabilities 5,419 6,102 6,757

TOTAL EQUITY AND LIABILITIES 9,532 10,032 9,787

Net asset value - cents per share 1,299 1,243 828

Rounding of figures may result in computational discrepancies.

Group statement of cash flows

Quarter Quarter Quarter Year Year

ended ended ended ended ended

December September December December December

2010 2010 2009 2010 2009

SA Rand million Unaudited Unaudited Unaudited Unaudited Audited

Cash flows from operating activities

Receipts from customers 10,955 10,566 9,596 39,717 31,473

Payments to suppliers and employees (5,944) (7,105) (5,889) (26,682) (20,896)

Cash generated from operations 5,011 3,461 3,707 13,035 10,577

Dividends received from equity accounted investments 218 116 136 939 751

Taxation paid (153) (339) (233) (1,371) (1,232)

Cash utilised for hedge buy-back costs (7,312) (11,021) - (18,333) (6,315)

Net cash (outflow) inflow from operating activities (2,236) (7,783) 3,610 (5,730) 3,781

Cash flows from investing activities

Capital expenditure (2,470) (1,771) (2,243) (7,108) (8,656)

Proceeds from disposal of tangible assets 12 468 1,814 500 9,029

Other investments acquired (152) (432) (229) (832) (750)

Acquisition of associates and equity accounted joint ventures (100) (48) (2,638) (319) (2,646)

Proceeds on disposal of associate - - - 4 -

Loans advanced to associates and equity accounted joint

ventures - - (17) (22) (17)

Loans repaid from associates and equity accounted joint

ventures - - - - 3

Proceeds from disposal of investments 578 280 196 1,039 680

Decrease (increase) in cash restricted for use 8 142 19 182 (91)

Interest received 59 57 129 232 445

Loans advanced (8) 4 - (41) (1)

Repayment of loans advanced 2 - 2 3 4

Net cash outflow from investing activities (2,071) (1,300) (2,967) (6,362) (2,000)

Cash flows from financing activities

Proceeds from issue of share capital 31 5,596 39 5,656 2,384

Share issue expenses (31) (113) (39) (144) (84)

Proceeds from borrowings 1,880 7,139 162 16,666 24,901

Repayment of borrowings (2,400) (21) (57) (12,326) (24,152)

Finance costs paid (398) (46) (180) (821) (946)

Mandatory convertible bonds transaction costs (30) (155) - (184) -

Dividends paid (139) (264) (43) (846) (474)

Net cash (outflow) inflow from financing activities (1,087) 12,136 (118) 8,001 1,629

Net (decrease) increase in cash and cash equivalents (5,394) 3,053 525 (4,091) 3,410

Translation (70) (347) (677) (236) (672)

Cash and cash equivalents at beginning of period 9,313 6,607 8,328 8,176 5,438

Cash and cash equivalents at end of period (1) 3,849 9,313 8,176 3,849 8,176

Cash generated from operations

Profit (loss) before taxation 1,394 867 4,870 3,036 (1,173)

Adjusted for:

Movement on non-hedge derivatives and other commodity

contracts 499 241 2,281 2,946 14,417

Amortisation of tangible assets 1,341 1,240 1,152 5,022 4,615

Finance costs and unwinding of obligations 357 285 268 1,203 1,146

Environmental, rehabilitation and other expenditure 470 53 (70) 535 (47)

Special items 279 542 (4,708) 1,076 (5,148)

Amortisation of intangible assets 7 4 4 18 18

Deferred stripping 156 237 205 921 (467)

Fair value adjustment on option component of convertible bonds 280 166 66 (39) 249

Fair value loss on mandatory convertible bonds 222 160 - 382 -

Interest received (119) (58) (133) (311) (444)

Share of equity accounted investments' profit (63) (151) (227) (467) (785)

Other non-cash movements 133 88 (675) 250 (853)

Movements in working capital 55 (213) 674 (1,537) (951)

5,011 3,461 3,707 13,035 10,577

Movements in working capital

(Increase) decrease in inventories (101) 306 (183) (667) 634

Decrease (increase) in trade and other receivables (200) (80) 438 (781) 106

Increase (decrease) in trade and other payables 356 (439) 419 (89) (1,691)

55 (213) 674 (1,537) (951)

(1) The cash and cash equivalents balance at 31 December 2010 includes cash and

cash equivalents included on the statement of financial position as part of

non-current assets held for sale of R73m.

Rounding of figures may result in computational discrepancies.

Group statement of cash flows

Quarter Quarter Quarter Year Year

ended ended ended ended ended

December September December December December

2010 2010 2009 2010 2009

US Dollar million Unaudited Unaudited Unaudited Unaudited Audited

Cash flows from operating activities

Receipts from customers 1,589 1,441 1,283 5,448 3,845

Payments to suppliers and employees (925) (995) (805) (3,734) (2,500)

Cash generated from operations 664 446 478 1,714 1,345

Dividends received from equity accounted investments 39 25 19 143 101

Taxation paid (24) (47) (32) (188) (147)

Cash utilised for hedge buy-back costs (1,061) (1,550) - (2,611) (797)

Net cash (outflow) inflow from operating activities (382) (1,126) 465 (942) 502

Cash flows from investing activities

Capital expenditure (350) (242) (281) (973) (1,019)

Proceeds from disposal of tangible assets 2 64 242 69 1,142

Other investments acquired (23) (58) (29) (114) (89)

Acquisition of associates and equity accounted joint ventures (15) (6) (353) (44) (354)

Proceeds on disposal of associate - - - 1 -

Loans advanced to associates and equity accounted joint

ventures - - (2) (3) (2)

Loans repaid from associates and equity accounted joint

ventures - - - - -

Proceeds from disposal of investments 80 38 25 142 81

Decrease (increase) in cash restricted for use 2 19 2 25 (10)

Interest received 8 8 17 32 55

Loans advanced (1) - - (6) -

Repayment of loans advanced - - - - 1

Net cash outflow from investing activities (297) (177) (379) (871) (195)

Cash flows from financing activities

Proceeds from issue of share capital 4 790 5 798 306

Share issue expenses (4) (16) (5) (20) (11)

Proceeds from borrowings 276 1,011 29 2,316 2,774

Repayment of borrowings (324) (3) (22) (1,642) (2,731)

Finance costs paid (58) (8) (23) (115) (111)

Mandatory convertible bonds transaction costs (4) (22) - (26) -

Dividends paid (20) (37) (6) (117) (56)

Net cash (outflow) inflow from financing activities (130) 1,715 (22) 1,194 171

Net (decrease) increase in cash and cash equivalents (809) 412 64 (619) 478

Translation 57 60 (72) 105 47

Cash and cash equivalents at beginning of period 1,338 866 1,108 1,100 575

Cash and cash equivalents at end of period (1) 586 1,338 1,100 586 1,100

Cash generated from operations

Profit (loss) before taxation 199 106 650 405 (121)

Adjusted for:

Movement on non-hedge derivatives and other commodity

contracts 72 43 306 408 1,787

Amortisation of tangible assets 195 170 154 690 555

Finance costs and unwinding of obligations 52 39 36 166 139

Environmental, rehabilitation and other expenditure 69 8 (9) 78 (6)

Special items 42 76 (629) 152 (683)

Amortisation of intangible assets 1 - - 2 2

Deferred stripping 23 32 27 125 (48)

Fair value adjustment on option component of convertible bonds 41 24 9 1 33

Fair value loss on mandatory convertible bonds 33 22 - 55 -

Interest received (17) (8) (18) (43) (54)

Share of equity accounted investments' profit (9) (21) (30) (63) (94)

Other non-cash movements 19 13 (90) 37 (115)

Movements in working capital (56) (58) 72 (299) (50)

664 446 478 1,714 1,345

Movements in working capital

Increase in inventories (85) (63) (35) (236) (155)

Decrease (increase) in trade and other receivables (46) (34) 55 (142) (45)

Increase in trade and other payables 75 39 52 79 150

(56) (58) 72 (299) (50)

(1) The cash and cash equivalents balance at 31 December 2010 includes cash and

cash equivalents included on the statement of financial position as part of

non-current assets held for sale of $11m.

Rounding of figures may result in computational discrepancies.

Group statement of changes in equity

Equity holders of the parent

Cash Available Foreign

Share Other flow for Actuarial currency

capital & capital Retained hedge sale (losses) translation

SA Rand million Premium reserves Earnings reserve reserve gains reserve

Balance at 31 December 2008 37,336 799 (22,765) (1,008) (18) (347) 8,959

(Loss) profit for the year (2,762)

Other comprehensive income (expense) 779 469 60 (2,645)

Total comprehensive (expense) income - - (2,762) 779 469 60 (2,645)

Shares issued 2,582

Shares issue expenses (84)

Share-based payment for share awards

net of exercised 122

Dividends paid (392)

Dividends of subsidiaries

Equity transaction of joint venture 306

Translation (33) 180 55 (37) 2

Balance at 31 December 2009 39,834 1,194 (25,739) (174) 414 (285) 6,314

Profit for the year 637

Other comprehensive (expense) income (1) 183 218 (128) (1,766)

Total comprehensive (expense) income - (1) 637 183 218 (128) (1,766)

Shares issued 5,988

Shares issue expenses (144)

Share-based payment for share awards

net of exercised 92

Dividends paid (492)

Dividends of subsidiaries

Transfers to other reserves 25 (25)

Translation (35) 157 1 (64) 4

Balance at 31 December 2010 45,678 1,275 (25,437) (15) 568 (409) 4,548

US Dollar million

Balance at 31 December 2008 5,485 85 (2,361) (107) (2) (37) (635)

(Loss) profit for the year (320)

Other Comprehensive income 90 55 7 318

Total comprehensive (expense) income - - (320) 90 55 7 318

Shares issued 331

Shares issue expenses (11)

Share-based payment for share awards

net of exercised 15

Dividends paid (45)

Dividends of subsidiaries

Equity transaction of joint venture 37

Translation 24 (18) (6) 3 (8)

Balance at 31 December 2009 5,805 161 (2,744) (23) 56 (38) (317)

Profit for the year 76

Other comprehensive income (expense) 25 30 (18) 213

Total comprehensive income (expense) - - 76 25 30 (18) 213

Shares issued 842

Shares issue expenses (20)

Share-based payment for share awards

net of exercised 13

Dividends paid (67)

Dividends of subsidiaries

Transfers to other reserves 3 (3)

Translation 17 (15) (1) (6

Balance at 31 December 2010 6,627 194 (2,750) (2) 86 (62) (104)

Rounding of figures may result in computational discrepancies.

Group statement of changes in equity

Non-

controlling Total

SA Rand million Total interests equity

Balance at 31 December 2008 22,956 790 23,746

(Loss) profit for the year (2,762) 417 (2,345)

Other comprehensive income (expense) (1,337) 9 (1,328)

Total comprehensive (expense) income (4,099) 426 (3,673)

Shares issued 2,582 2,582

Shares issue expenses (84) (84)

Share-based payment for share awards

net of exercised 122 122

Dividends paid (392) (392)

Dividends of subsidiaries - (83) (83)

Equity transaction of joint venture 306 306

Translation 167 (167) -

Balance at 31 December 2009 21,558 966 22,524

Profit for the year 637 381 1,018

Other comprehensive (expense) income (1,494) (1,494)

Total comprehensive (expense) income (857) 381 (476)

Shares issued 5,988 5,988

Shares issue expenses (144) (144)

Share-based payment for share awards

net of exercised 92 92

Dividends paid (492) (492)

Dividends of subsidiaries - (469) (469)

Transfers to other reserves - -

Translation 63 (63) -

Balance at 31 December 2010 26,208 815 27,023

US Dollar million

Balance at 31 December 2008 2,428 83 2,511

(Loss) profit for the year (320) 52 (268)

Other Comprehensive income 470 1 471

Total comprehensive (expense) income 150 53 203

Shares issued 331 331

Shares issue expenses (11) (11)

Share-based payment for share awards

net of exercised 15 15

Dividends paid (45) (45)

Dividends of subsidiaries - (11) (11)

Equity transaction of joint venture 37 37

Translation (5) 5 -

Balance at 31 December 2009 2,900 130 3,030

Profit for the year 76 53 129

Other comprehensive income (expense) 250 250

Total comprehensive income (expense) 326 53 379

Shares issued 842 842

Shares issue expenses (20) (20)

Share-based payment for share awards

net of exercised 13 13

Dividends paid (67) (67)

Dividends of subsidiaries - (64) (64)

Transfers to other reserves - -

Translation (5) 5 -

Balance at 31 December 2010 3,989 124 4,113

Segmental reporting

for the quarter and year ended 31 December 2010

AngloGold Ashanti has implemented IFRS 8 "Operating Segments" with effect from

1 January 2009. AngloGold Ashanti's operating segments are being reported based

on the financial information provided to the Chief Executive Officer and the

Executive Management team, collectively identified as the Chief Operating

Decision Maker ("CODM"). As a result of changes in management structure and

reporting from 1 January 2010, the CODM has changed its reportable segments.

Individual members of the Executive Management team are responsible for

geographic regions of the business. Comparative information has been presented

on a consistent basis. Navachab which was previously included in Southern

Africa now forms part of Continental Africa and North and South America has

been combined into Americas. Southern Africa has been renamed to South Africa.

The Johannesburg corporate office was previously included in Southern Africa

and now forms part of "Other".

Quarter ended Year ended

Dec Sep Dec Dec Dec

2010 2010 2009 2010 2009

Unaudited Unaudited Unaudited Unaudited Audited

SA Rand million

Gold income

South Africa 4,499 4,633 3,469 16,056 13,625

Continental Africa 3,654 3,490 3,920 13,604 11,723

Australasia 988 711 848 3,391 1,819

Americas 2,073 2,082 1,823 8,202 6,552

11,214 10,916 10,060 41,253 33,719

Equity accounted investments

included above (600) (544) (826) (2,420) (2,974)

10,614 10,372 9,234 38,833 30,745

Quarter ended Year ended

Dec Sep Dec Dec Dec

2010 2010 2009 2010 2009

Unaudited Unaudited Unaudited Unaudited Audited

SA Rand million

Gross profit (loss)

South Africa (345) 2,742 242 3,180 (1,778)

Continental Africa 4,412 (573) (74) 4,219 (976)

Australasia (513) (992) 31 (1,452) (1,325)

Americas (317) 1,636 344 2,664 735

Other 13 28 86 171 244

3,250 2,841 629 8,782 (3,100)

Equity accounted investments

included above (180) (168) (320) (918) (1,309)

3,069 2,672 309 7,864 (4,409)

Quarter ended Year ended

Dec Sep Dec Dec Dec

2010 2010 2009 2010 2009

Unaudited Unaudited Unaudited Unaudited Audited

SA Rand million

Adjusted gross profit excluding hedge

buy-back costs

South Africa 1,652 1,374 880 4,580 4,556

Continental Africa 971 795 920 3,314 2,856

Australasia 279 (38) 57 217 473

Americas 863 979 896 3,563 3,181

Other 13 28 88 171 243

3,778 3,137 2,841 11,845 11,309

Equity accounted investments

included above (180) (168) (320) (918) (1,308)

3,598 2,969 2,521 10,927 10,001

Rounding of figures may result in computational discrepancies.

Segmental reporting (continued)

Quarter ended Year ended

Dec Sep Dec Dec Dec

2010 2010 2009 2010 2009

Unaudited Unaudited Unaudited Unaudited Audited

kg

Gold production (1)

South Africa 14,801 14,859 13,418 55,528 55,908

Continental Africa 11,623 11,600 12,993 46,390 49,292

Australasia 3,175 2,894 3,331 12,313 12,477

Americas 6,105 6,776 7,025 26,187 25,372

35,703 36,129 36,767 140,418 143,049

Quarter ended Year ended

Dec Sep Dec Dec Dec

2010 2010 2009 2010 2009

Unaudited Unaudited Unaudited Unaudited Audited

SA Rand million

Capital expenditure

South Africa 1,009 731 931 3,096 3,228

Continental Africa 685 439 510 1,708 1,654

Australasia 71 72 60 290 1,599

Americas 782 604 737 2,270 2,157

Corporate and other 25 9 36 49 88

2,572 1,855 2,275 7,413 8,726

Equity accounted investments

included above (102) (84) (33) (305) (70)

2,470 1,771 2,242 7,108 8,656

As at As at As at

Dec Sep Dec

2010 2010 2009

Unaudited Unaudited Audited

SA Rand million

Total assets

South Africa 16,226 16,394 17,061

Continental Africa 26,060 26,896 29,401

Australasia 3,644 3,466 4,494

Americas 13,855 13,918 14,642

Corporate and other 3,384 9,667 7,739

63,169 70,341 73,337

Equity accounted investments

included above (540) (522) (567)

62,629 69,819 72,770

(1) Gold production includes equity accounted investments.

Rounding of figures may result in computational discrepancies.

Segmental reporting

for the quarter and year ended 31 December 2010

AngloGold Ashanti has implemented IFRS 8 "Operating Segments" with effect from

1 January 2009. AngloGold Ashanti's operating segments are being reported based

on the financial information provided to the Chief Executive Officer and the

Executive Management team, collectively identified as the Chief Operating

Decision Maker ("CODM"). As a result of changes in management structure and

reporting from 1 January 2010, the CODM has changed its reportable segments.

Individual members of the Executive Management team are responsible for

geographic regions of the business. Comparative information has been presented

on a consistent basis. Navachab which was previously included in Southern

Africa now forms part of Continental Africa and North and South America has

been combined into Americas. Southern Africa has been renamed to South Africa.

The Johannesburg corporate office was previously included in Southern Africa

and now forms part of "Other".

Quarter ended Year ended

Dec Sep Dec Dec Dec

2010 2010 2009 2010 2009

Unaudited Unaudited Unaudited Unaudited Audited

US Dollar million

Gold income

South

Africa 654 634 465 2,207 1,665

Continental

Africa 532 478 525 1,868 1,435

Australasia 143 98 113 466 221

Americas 301 285 244 1,124 805

1,630 1,495 1,346 5,665 4,126

Equity

accounted

investments

included

above (87) (75) (111) (331) (358)

1,543 1,420 1,236 5,334 3,768

Quarter ended Year ended

Dec Sep Dec Dec Dec

2010 2010 2009 2010 2009

Unaudited Unaudited Unaudited Unaudited Audited

US Dollar million

Gross

profit

(loss)

South

Africa (50) 375 32 429 (255)

Continental

Africa 640 (86) (10) 604 (116)

Australasia (75) (139) 4 (206) (168)

Americas (46) 226 46 357 89

Other 2 4 11 23 28

471 380 83 1,207 (422)

Equity

accounted

investments

included

above (26) (23) (43) (125) (156)

445 357 40 1,082 (578)

Quarter ended Year ended

Dec Sep Dec Dec Dec

2010 2010 2009 2010 2009

Unaudited Unaudited Unaudited Unaudited Audited

US Dollar million

Adjusted

gross

profit

excluding

hedge

buy-back

costs

South

Africa 239 189 118 634 539

Continental

Africa 141 109 123 455 351

Australasia 41 (5) 8 33 56

Americas 125 134 120 487 390

Other 2 4 11 23 28

548 431 380 1,632 1,364

Equity

accounted

investments

included

above (26) (23) (43) (125) (156)

522 408 337 1,507 1,209

Quarter ended Year ended

Dec Sep Dec Dec Dec

2010 2010 2009 2010 2009

Unaudited Unaudited Unaudited Unaudited Audited

oz (000)

Gold

production

(1)

South

Africa 476 478 431 1,785 1,797

Continental

Africa 374 373 418 1,492 1,585

Australasia 102 93 107 396 401