Anglo American Diamon Sales Fall; Blames Indian Demonetization Program

December 13 2016 - 2:59AM

Dow Jones News

By Ian Walker

LONDON--Anglo American PLC (AAL.LN) said Tuesday its

majority-owned De Beers Group reported lower diamond sales, which

it blamed on a temporary slowdown in volumes resulting from the

demonetization program in India.

De Beers, the world's largest rough diamond producer by value,

reported provisional diamond sales of $418 million for the tenth

sales cycle ending on Dec. 12, down 12% from $476 million generated

in the previous sales cycle. However, sales were much higher than

the $248 million generated in same period in 2015.

"While the trade in lower value rough diamonds is experiencing a

temporary slowdown as a result of the demonetization program in

India, demand across the rest of the product mix continued to be

healthy and overall sales remained in line with seasonal

expectations," said Bruce Cleaver, CEO of De Beers.

-Write to Ian Walker at ian.walker@wsj.com; @IanWalk40289749

(END) Dow Jones Newswires

December 13, 2016 03:44 ET (08:44 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

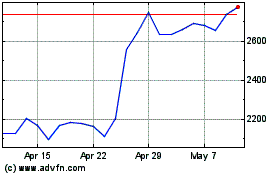

Anglo American (LSE:AAL)

Historical Stock Chart

From May 2024 to Jun 2024

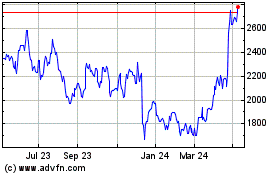

Anglo American (LSE:AAL)

Historical Stock Chart

From Jun 2023 to Jun 2024