TIDMAAU

29 October 2012

AIM: AAU

POSITIVE INTERIM FEASIBILITY COMPLETED ON RED RABBIT GOLD PROJECT

Ariana Resources plc ('Ariana' or 'the Company'), the gold exploration and

development company focused on Turkey, is pleased to announce the completion of

an interim Feasibility Study ('FS') report which demonstrates that highly

attractive economic fundamentals are achievable from the Kiziltepe Sector of its

Red Rabbit Gold Project in western Turkey ('Red Rabbit' or 'the Project'), which

is held within a Joint Venture currently 86% owned by Ariana.

Highlights:

* Combined reserve in designed pits at the Kiziltepe Sector of the Red Rabbit

Gold Project is approximately 1.1 million tonnes at an average grade of 3.1

grams per tonne ('g/t') gold ('Au') and 39.8 g/t silver ('Ag'),

corresponding to 115,460 oz Au and 1,468,200 oz Ag.

* Output expected at a rate of 150,000 tonnes ore per annum, corresponding to

an average production of approximately 21,000 oz/year of Au equivalent over

the first five years of operation.

* Financial model at a 'current' gold price of US$1,650/oz and a silver price

of US$25/oz provides a (gross with respect to the JV terms) Net Present

Value ('NPV') (8% discount) of US$49.8 million and Internal Rate of Return

('IRR') of 47.8%, with payback secured in 2.1 years.

* Capital cost estimated at US$29.5 million, including US$14.2 million for the

processing plant and EPCM (Engineering, Procurement, Construction

Management).

* Cash costs estimated at between US$678 and US$693 per ounce across the

financial model range.

* Significant potential to identify additional resources at Kiziltepe and on

four other prospects in the vicinity currently held under licence by the

Company.

Dr. Kerim Sener, Managing Director, commented:

"The results from the interim FS demonstrate the potential of the Red Rabbit

Gold Project as we move to a decisive stage of permitting. The study reinforces

the Company's ability to generate significant revenues from the Kiziltepe Sector

of our Red Rabbit Project.

"Recent discoveries in the Kiziltepe area including bonanza grade intercepts

from strike extensions to the known veins, underscores the longer term potential

of the deposit. While the current life of mine will be approximately 8 years,

there is significant potential to locate further resources in the vicinity that

may be mined and trucked to the Kiziltepe plant. An example of this is the

Kizilcukur property upon which we recently secured a 10-year operating licence.

"At the present time, the Company remains in wait for the necessary permits to

enable access to the designated Tailings Storage Facility area for final

geotechnical and hydrogeological drilling. This remains the last major hurdle

for the project before completion of the feasibility and environmental impact

assessment works, and the approval for construction."

Feasibility Interim Report

Following on from the completion of the Pre Feasibility Study ('PFS') the

Company and its consultants, Tetra Tech WEI Inc. ('Tetra Tech'), formerly

Wardrop Engineering, have completed additional work on its Feasibility Study for

the Kiziltepe Sector of its Red Rabbit Gold Project. The interim FS has been

completed ahead of the Company's final Feasibility Study on the Project, which

is currently delayed as a consequence of a new permitting regime in Turkey.

Reserves and Resources

Mineral Resources (Table 1) and Mineral Reserves (Table 2) have been estimated

for the project. The Mineral Resource estimate has not changed since October

2011, though Mineral Reserves are provided here for the first time.

Table 1: Summary of Mineral Resources, reporting at a cut-off grade of 1 g/t Au;

inclusive of Ore Reserves. All figures are reported gross and need to be

multiplied by a factor of 0.86 to determine the net figures attributable to

Ariana with respect to the Red Rabbit Joint Venture.

=-------------------+---------+-----+-----+-------+---------+------------------

| Tonnes | Au | Ag | Au | Ag | Au equiv.

| (t) |(g/t)|(g/t)| (oz) | (oz) | (oz)(***)

=-------------------+---------+-----+-----+-------+---------+------------------

Vein Zones

=-------------------+---------+-----+-----+-------+---------+------------------

Measured | 782,942| 4.1 |51.4 |103,319|1,294,836| 118,080

=-------------------+---------+-----+-----+-------+---------+------------------

Indicated * | 619,029| 2.3 |41.4 | 46,496| 891,368| 56,658

=-------------------+---------+-----+-----+-------+---------+------------------

Measured & |1,401,971| 3.3 |47.0 |149,815|2,186,204| 174,738

Indicated | | | | | |

=-------------------+---------+-----+-----+-------+---------+------------------

Inferred | 164,998| 1.8 |40.9 | 9,752| 217,005| 12,226

=-------------------+---------+-----+-----+-------+---------+------------------

Alteration Halo**

=-------------------+---------+-----+-----+-------+---------+------------------

Indicated | 352,819| 1.6 |25.8 | 18,430| 293,007| 21,770

=-------------------+---------+-----+-----+-------+---------+------------------

Measured & | 352,819| 1.6 |25.8 | 18,430| 293,007| 21,770

Indicated | | | | | |

=-------------------+---------+-----+-----+-------+---------+------------------

Inferred | 76,059| 1.4 |33.7 | 3,544| 82,341| 4,483

=-------------------+---------+-----+-----+-------+---------+------------------

Subsidiary Veins

=-------------------+---------+-----+-----+-------+---------+------------------

Inferred | 115,941| 1.5 |51.3 | 5,505| 191,446| 7,687

=-------------------+---------+-----+-----+-------+---------+------------------

GLOBAL |2,111,788| 2.8 |43.7 |187,046|2,970,002| 220,904

=-------------------+---------+-----+-----+-------+---------+------------------

*Includes Kepez.

**Some of the Alteration Halo material will be necessarily mined and may be

processed at the end of mine

life but Tetra Tech considers more studies are required to determine the

nature of the mineralisation.

***Au equivalents are derived from the formula:

{(Ag g/t*Ag Recovery*Ag price*0.032)/Au oz Price}/Au Recovery=Au

equivalent oz/t

Au recovery determined by testwork at 85.5%, Ag recovery determined by

testwork at 64%.

Table 2: Summary of Ore Reserves by mining area at 1 g/t Au equiv. cut-off

grade. All figures are reported gross and need to be multiplied by a factor of

0.86 to determine the net figures attributable to Ariana with respect to the Red

Rabbit Joint Venture.

=----------------------------+---------+--------+--------+------------------

| | | | Contained Metal

Zone | Tonnes |Au Grade|Ag Grade| (oz)

| | (g/t) | (g/t) +-------+----------

| | | | Au | Ag

=----------------------------+---------+--------+--------+-------+----------

Proven

=----------------------------+---------+--------+--------+-------+----------

Arzu South | 588,110| 4.1| 45.4| 76,880| 858,500

=----------------------------+---------+--------+--------+-------+----------

Kepez | -| -| -| -| -

=----------------------------+---------+--------+--------+-------+----------

Arzu North | 210,620| 2.0| 37.5| 13,840| 253,620

=----------------------------+---------+--------+--------+-------+----------

Banu | 71,370| 2.2| 42.8| 5,050| 98,110

=----------------------------+---------+--------+--------+-------+----------

Derya | 45,680| 1.9| 42.8| 2,660| 61,410

=----------------------------+---------+--------+--------+-------+----------

Total | 914,770| 3.3| 43.2| 98,440| 1,271,650

=----------------------------+---------+--------+--------+-------+----------

Low Grade Stockpile | 7,880| 0.7| 7.1| 180| 1,808

(<1.0 g/t Au equiv.) | | | | |

=----------------------------+---------+--------+--------+-------+----------

Probable

=----------------------------+---------+--------+--------+-------+----------

Arzu South | 16,990| 2.4| 36.5| 1,340| 19,930

=----------------------------+---------+--------+--------+-------+----------

Kepez | 60,000| 4.6| 34.7| 8,870| 66,900

=----------------------------+---------+--------+--------+-------+----------

Arzu North | 37,900| 1.9| 29.7| 2,270| 36,150

=----------------------------+---------+--------+--------+-------+----------

Banu | 15,490| 1.7| 44.0| 860| 21,900

=----------------------------+---------+--------+--------+-------+----------

Derya | 63,700| 1.4| 20.5| 2,800| 41,890

=----------------------------+---------+--------+--------+-------+----------

Total | 194,070| 2.6| 19.2| 16,150| 119,880

=----------------------------+---------+--------+--------+-------+----------

Low Grade Stockpile | 30,830| 0.7| 8.0| 690| 7,970

(<1.0 g/t Au equiv.) | | | | |

=----------------------------+---------+--------+--------+-------+----------

Total | | | | |

=----------------------------+---------+--------+--------+-------+----------

Arzu South | 605,100| 4.0| 45.2| 78,220| 878,440

=----------------------------+---------+--------+--------+-------+----------

Kepez | 60,000| 4.6| 34.7| 8,870| 66,900

=----------------------------+---------+--------+--------+-------+----------

Arzu North | 248,510| 2.0| 36.3| 16,120| 289,770

=----------------------------+---------+--------+--------+-------+----------

Banu | 86,850| 2.1| 43.0| 5,920| 120,010

=----------------------------+---------+--------+--------+-------+----------

Derya | 108,370| 1.6| 29.6| 5,470| 103,310

=----------------------------+---------+--------+--------+-------+----------

Total |1,108,840| 3.2| 40.9|114,590| 1,458,424

=----------------------------+---------+--------+--------+-------+----------

Low Grade Stockpile | 38,710| 0.7| 7.9| 870| 9,780

(<1.0 g/t Au equiv.) | | | | |

=----------------------------+---------+--------+--------+-------+----------

Included Inferred Resources*| | | | |

=----------------------------+---------+--------+--------+-------+----------

Total | 38,020| 1.6| 28.1| 1,980| 34,400

=----------------------------+---------+--------+--------+-------+----------

Low Grade Stockpile | 8,130| 0.8| 8.1| 200| 2,110

(<1.0 g/t Au equiv.) | | | | |

=----------------------------+---------+--------+--------+-------+----------

*The reader is cautioned that the included Inferred material shown Table 2

contributes to the production scheduling and economic assessment of this

project. The included Inferred material represents less than 5% of the

scheduled reserve.

Open-pit Optimisation and Design

Whittle Pit Optimisation Software has been run on the resource and an open-pit

design (Figure 1) based on the optimised pit shapes have determined that part of

the total resource that could be extracted economically (Table 3). No pit was

designed for the Kepez area, as this will probably be extracted using only

mechanical methods.

The combined resource within the selected pit shapes, including the Arzu South,

Arzu North, Derya, Banu and Kepez pits, is estimated at 1,147,000 tonnes at an

average of 3.3 g/t Au and 41.9 g/t Ag. This resource is based on a fully

diluted vein model and takes in to account the probable dilution of higher-grade

vein material by lower-grade host-rock material in the hangingwall and footwall

of the vein. Importantly the new pit designs have enabled considerable savings

in waste rock movement reducing the strip ratio from 14.5:1 (waste:ore) at the

PFS level to 12.5:1 at the FS level.

A cut-off grade is estimated at 1 g/t Au equivalent for the reserves based on a

gold metal price of US$1,058/oz and a silver metal price of US$16.6/oz. For

this base case, only resource blocks of Measured and Indicated category are

used.

Table 3: History of pit optimisation results, comparing the scoping study with

the PFS outputs.

=---------------------+---------+----------+---------------+-----------

Output | Unit | Scoping |Pre-feasibility|Feasibility

=---------------------+---------+----------+---------------+-----------

Selected Pit Resource| Tonnes| 1,034,600| 1,177,800| 1,147,000

=---------------------+---------+----------+---------------+-----------

Au Grade | g/t Au| 3.56| 3.12| 3.3

=---------------------+---------+----------+---------------+-----------

Ag Grade | g/t Ag| 41.57| 38.36| 41.9

=---------------------+---------+----------+---------------+-----------

Au Metal | Oz Au| 109,600| 118,200| 117,647

=---------------------+---------+----------+---------------+-----------

Ag Metal | Oz Ag| 1,382,700| 1,452,600| 1,504,722

=---------------------+---------+----------+---------------+-----------

Waste Movement | Tonnes|11,373,000| 15,740,000| 14,906,000

=---------------------+---------+----------+---------------+-----------

Strip Ratio |waste:ore| 10.9| 14.5| 12.5

=---------------------+---------+----------+---------------+-----------

Figure 1: Three-dimensional projection of vein models (in blue), surrounded by

their corresponding designed pit shapes based on the output of Whittle pit

optimisation. These designed pits provide an average strip ratio of 12.5:1.

Site Layout

Site layouts have been finalised for the purposes of the Interim FS stage. The

currently envisaged site layout is shown in Figure 2. The layout minimises the

environmental footprint of the plant and related mine infrastructure. Current

studies in progress do not indicate that any major changes will be made to the

site layout on completion of the FS.

Figure 2: Site layout as envisaged for the Interim FS, showing the location of

the designed open pits, the waste rock dump and the tailings dam design

outlines. Access and haulage roads are shown as bright green lines and mine

building locations shown in red.

Production Schedule

The mine will be based on one central pit located at Arzu South with satellite

pits at Arzu North, Banu, Derya and Kepez. The location of the selected pits

(excluding Kepez) is shown in Figure 2. The mine will target production of

150,000 tonnes per year of ore over a mine life of 8 years, operating for six

days a week (Table 4). The production will be scheduled with mining starting at

Arzu South and progressively shifting to the Kepez, Arzu North, Banu and Derya

pits as grades decrease later in the mine life. The final material to be

processed will be a small quantity of low-grade stockpile that will be

accumulated over the mine life from the various open pits.

Material from the open pits will be split in to three categories, run-of-mine

ore grade (>1 g/t Au equ.), low-grade ore (<1 g/t Au equ.) and waste. The

division between low-grade ore and waste will be determined during grade control

and be influenced by the minimum mining width (1.5m) and the expected dilution

width (0.25m either side of the vein).

Table 4: Outline mining schedule for the various mineralised zones. Tonnages

for each pit are expressed in '000s tonnes.

=---------+-------+-------+-------+-------+-------+-------+-------+-------+---------

Zone |Year 1 |Year 2 |Year 3 |Year 4 |Year 5 |Year 6 |Year 7 |Year 8 | Total

=---------+-------+-------+-------+-------+-------+-------+-------+-------+---------

Arzu | | | | | | | | |

South | 150.4 | 150.0 | 150.0 | 150.0 | 4.6 | - | - | - | 605.1

(kt) | | | | | | | | |

=---------+-------+-------+-------+-------+-------+-------+-------+-------+---------

Kepez | - | - | - | - | 60.0 | - | - | - | 60.0

(kt) | | | | | | | | |

=---------+-------+-------+-------+-------+-------+-------+-------+-------+---------

Arzu | | | | | | | | |

North | - | - | - | - | 85.4 | 150.0 | 15.2 | - | 250.6

(kt) | | | | | | | | |

=---------+-------+-------+-------+-------+-------+-------+-------+-------+---------

Banu (kt)| - | - | - | - | - | - | 109.5 | - | 109.5

=---------+-------+-------+-------+-------+-------+-------+-------+-------+---------

Derya | - | - | - | - | - | - | 25.3 | 96.3 | 121.7

(kt) | | | | | | | | |

=---------+-------+-------+-------+-------+-------+-------+-------+-------+---------

Low Grade| | | | | | | | |

Mined | 4.0 | 0.4 | 0.3 | 0.2 | 2.3 | 0.9 | 12.7 | 25.9 | 46.8

(kt) | | | | | | | | |

=---------+-------+-------+-------+-------+-------+-------+-------+-------+---------

Process | | | | | | | | |

Tonnes | 150.4 | 150.0 | 150.0 | 150.0 | 150.0 | 150.0 | 150.0 | 143.2 | 1,193.7

(kt) | | | | | | | | |

=---------+-------+-------+-------+-------+-------+-------+-------+-------+---------

Process | | | | | | | | |

Au Grade | 3.44 | 3.95 | 4.30 | 4.44 | 2.87 | 2.15 | 1.99 | 1.31 | 3.07

(g/t) | | | | | | | | |

=---------+-------+-------+-------+-------+-------+-------+-------+-------+---------

Process | | | | | | | | |

Ag Grade | 36.87 | 41.64 | 50.92 | 51.40 | 28.36 | 42.83 | 36.75 | 24.22 | 39.21

(g/t) | | | | | | | | |

=---------+-------+-------+-------+-------+-------+-------+-------+-------+---------

Contained| | | | | | | | |

Au Metal |16,620 |19,038 |20,745 |21,404 |13,821 |10,369 | 9,615 | 6,035 | 117,647

(oz) | | | | | | | | |

=---------+-------+-------+-------+-------+-------+-------+-------+-------+---------

Contained| | | | | | | | |

Ag Metal |178,294|200,848|245,588|247,893|136,782|206,567|177,259|111,491|1,504,722

(oz) | | | | | | | | |

=---------+-------+-------+-------+-------+-------+-------+-------+-------+---------

Contained| | | | | | | | |

Au eqv. |18,653 |21,328 |23,545 |24,230 |15,380 |12,724 |11,636 | 7,306 | 134,802

(oz)* | | | | | | | | |

=---------+-------+-------+-------+-------+-------+-------+-------+-------+---------

*Au equivalents are derived from the formula:

{(Ag g/t*Ag Recovery*Ag price*0.032)/Au oz Price}/Au Recovery=Au equivalent

oz/t

Au recovery determined by testwork at 85.5%, Ag recovery determined by

testwork at 64%.

Processing Plant Design

A conventional hydrometallurgical process will be used for the project. The

confirmed configuration will involve a six tank Carbon-in-Column circuit,

proceeding to a two aerated pre-leach tanks and finally a five tank Carbon-in-

Leach circuit (Figure 3). The plant will be placed on a slope to allow for

gravity-flow assistance between tanks and to save on pumping costs. This

process offers the best recoveries of gold and silver at the lowest capital and

operating costs. At full production, the process will treat up to 500 tonnes

per day of run-of-mine ('ROM') ore. Assuming 96% availability and 97%

utilisation the process is scheduled to operate 340 days per year. The

feasibility level estimated metallurgical recoveries are 85.5% for gold and 64%

for silver.

Figure 3: Schematic view of the feasibility stage processing plant layout.

Environmental Impact Assessment

Environmental baseline work has been completed while Environmental Impact

Assessment studies are ongoing. A project summary document has been prepared in

accordance with Turkish government regulations and will be submitted to the

Ministry of the Environment and Urban Planning once the current delays with

permits for the designated Tailings Storage Facility area are resolved.

Financial Model

An economic evaluation of the Kiziltepe Project was prepared based on a pre-tax

financial model of an 8 year mine life and 1,194,000 tonnes processed. The pre-

tax financial model was established on a 100% equity basis, excluding debt

financing and loan interest charges on a total capital expenditure estimate of

US$29.5 million. The financial outcomes have been tabulated for NPV, IRR and

Payback of Capital. Discount rates of 8% and 10% were applied to all cases

identified by metal price scenario. Tetra Tech's base case prices for this

analysis were as follows:

* Gold - US$1,265/oz

* Silver - US$20/oz

The continued use of the US$1,058/oz Au for the pit optimisation study and final

pit design was to maintain continuity with the PFS and a subsequent trade-off

study, which demonstrated that this price captured much of the resource that

could otherwise be captured even with very much higher gold prices. Sensitivity

analyses on the financial models were carried out to evaluate the project

economics with plus or minus (+/-) 10%, US$1,500/oz and US$1,650/oz Au metal

prices (Table 5).

The US$1,265/oz Au price is used as a forecast long-term price obtained from the

Energy and Metals Consensus Forecast (EMCF), at31 August 2012. A 'current'

price of US$1,650/oz Au is also included, which provides a view on the present

worth of the project.

Table 5: Sensitivity analysis results based on variation of the gold and silver

price away from the base case. The cash costs provided are the operating costs

including on-site and all off-site charges and royalties. Consequently the cash

costs scale in line with the gold and silver price across the financial model

range. The sensitivity analysis results are reported gross with respect to the

Red Rabbit JV of which 86% is currently attributable to Ariana.

=----------------+-------+-------+----+-------+-----------------------

Scenario |NPV 10 | NPV 8 |IRR |Payback|Cash Cost (US $/ oz Au)

|(US $M)|(US $M)|(%) | year |

=----------------+-------+-------+----+-------+-----------------------

Minus 10% | 10.0 | 12.7 |19.5| 3.2 | 678

=----------------+-------+-------+----+-------+-----------------------

Base Case | 18.7 | 22.0 |27.1| 2.9 | 682

=----------------+-------+-------+----+-------+-----------------------

Plus 10% | 27.4 | 31.3 |34.3| 2.6 | 685

=----------------+-------+-------+----+-------+-----------------------

US $1,500 /oz Au| 36.1 | 40.6 |41.1| 2.3 | 689

=----------------+-------+-------+----+-------+-----------------------

US $1,650 /oz Au| 44.8 | 49.8 |47.8| 2.1 | 693

=----------------+-------+-------+----+-------+-----------------------

It is important to note that there remains further potential to identify

additional resources at Kiziltepe and on prospects in the vicinity of this

location. At Kiziltepe, the potential remains to identify further high-grade

resources at depth and along blind structures that have little or no surface

expression. Furthermore, there is potential to identify new resources in the

vicinity of Kiziltepe and the recent announcement on the 2 October 2012

concerning the grant of a 10 year operational licence status on the Kizilcukur

property, located 21km from Kiziltepe, is a part of the Company strategy to

identify satellite resources.

Contacts:

Ariana Resources plc Tel: +44 (0) 20 7407 3616

Michael Spriggs, Chairman

Kerim Sener, Managing Director

Beaumont Cornish Limited Tel: +44 (0) 20 7628 3396

Roland Cornish / Felicity Geidt

Fairfax I.S. PLC Tel: +44 (0) 20 7598 5368

Ewan Leggat / Laura Littley

St Brides Media & Finance Ltd Tel: +44 (0) 20 7236 1177

Hugo de Salis / Susie Geliher

Editors' note:

The Competent Persons responsible for this study are as follows:

For the Resource Estimate, Paul Gribble, FIMMM, C.Eng., a senior geologist with

Tetra Tech in Swindon, UK.

For the mining studies, Richard Hope, MIMMM, C.Eng., a senior mining engineer

with Tetra Tech in Swindon, UK.

For the processing studies, Dr. Arun Vathavooran, PhD., MIMMM, C.Eng., a senior

processing engineer with Tetra Tech, Swindon, UK.

The above persons have reviewed this press release and consent to the inclusion

of data and text taken from the study report in the form and context in which it

appears.

Dr Kerim Sener, BSc (Hons), MSc, PhD, is the Managing Director of Ariana

Resources plc. A graduate of the University of Southampton in Geology, he also

holds a Master's degree from the Royal School of Mines (Imperial College,

London) in Mineral Exploration and a doctorate from the University of Western

Australia. He is a Fellow of The Geological Society of London and has worked in

geological research and mineral consultancy in Southern Africa and Australia.

He has read and approved the technical disclosure in this regulatory

announcement.

About Ariana Resources

Ariana is an exploration and development company focused on epithermal gold-

silver and porphyry copper-gold deposits in Turkey. The Company is developing a

portfolio of prospective licences selected on the basis of its in-house

geological and remote-sensing database, on its own in western Turkey and in

Joint Venture with Eldorado Gold Corporation in north-eastern Turkey. Eldorado

owns 51% of this joint venture and is fully funding all exploration work on the

JV properties, while Ariana owns 49% and is the operator.

The Company's flagship assets are its Sindirgi and Tavsan gold projects which

form the Red Rabbit Gold Project. Both contain a series of prospects, within

two prolific mineralised districts in the Western Anatolian Volcanic and

Extensional (WAVE) Province in western Turkey. This Province hosts the largest

operating gold mines in Turkey and remains highly prospective for new porphyry

and epithermal deposits. These core projects, which are separated by a distance

of 75km, are presently being assessed as to their economic merits and now form

part of a Joint Venture with Proccea Construction Co. Proccea is earning in to

50% of this Joint Venture on expenditure of US$8 million. The total resource

inventory of the Company stands at 448,000 ounces of gold equivalent.

Ariana also has a strategic investment in Tigris Resources Limited

(www.tigrisresources.com), a private Jersey-based exploration company, which is

focused on the exploration of copper and gold deposits in southeastern Turkey.

Ariana retains 12.3% of Tigris Resources Limited.

Fairfax I.S. PLC are brokers to the Company and Beaumont Cornish Limited is the

Company's Nominated Adviser.

For further information on Ariana you are invited to visit the Company's website

at www.arianaresources.com.

Ends

Glossary of Technical Terms

(1) Gold equivalence is derived from the formula:

{(Ag g/t*Ag Recovery*Ag price*0.032)/Au oz Price}/Au Recovery=Au equivalent oz/t

Au recovery by testwork 87%, Ag recovery by testwork 64%

"Au" the chemical symbol for gold;

"cut-off grade" The lowest grade, or quality, of mineralised material that

qualifies as economically mineable and available in a given deposit. May be

defined on the basis of economic evaluation, or on physical or chemical

attributes that define an acceptable product specification;

"g/t" grammes per tonne;

"low-sulphidation" a style of gold mineralisation which is typically found

distal to volcanic centres and is characterised by adularia-sericite alteration

and quartz veins;

"Indicated resource" a part of a mineral resource for which tonnage, densities,

shape, physical characteristics, grade and mineral content can be estimated with

a reasonable level of confidence. It is based on exploration, sampling and

testing information gathered through appropriate techniques from locations such

as outcrops, trenches, pits, workings and drill holes. The locations are too

widely or inappropriately spaced to confirm geological and/or grade continuity

but are spaced closely enough for continuity to be assumed;

"Inferred resource" a part of a mineral resource for which tonnage, grade and

mineral content can be estimated with a low level of confidence. It is inferred

from geological evidence and has assumed, but not verified, geological and/or

grade continuity. It is based on information gathered through appropriate

techniques from locations such as outcrops, trenches, pits, workings and drill

holes that may be limited or of uncertain quality and reliability;

"Inverse Distance Squared" a conventional mathematical method used to calculate

mineral resources. Near sample points provide a greater weighting than samples

further away for any given resource block;

"JORC" the Joint Ore Reserves Committee;

"m" Metres;

"Measured resource" a part of a Mineral Resource for which tonnage, densities,

shape, physical characteristics, grade and mineral content can be estimated with

a high level of confidence. It is based on detailed and reliable exploration,

sampling and testing information gathered through appropriate techniques from

locations such as outcrops, trenches, pits, workings and drill holes. The

locations are spaced closely enough to confirm geological and grade continuity;

"Nearest Neighbour" a methodology used to derive the value of an attribute from

surrounding sample data on the basis of point-to-point proximity;

"Ordinary Kriging" is a geostatistical approach to resource estimation. Instead

of weighting nearby data points by some power of their inverted distance, OK

relies on the spatial correlation structure of the data to determine the

weighting values. This is a more rigorous approach to modelling, as correlation

between data points determines the estimated value at an unsampled point;

"oz" Ounces;

"porphyry" an igneous rock with larger crystals contained within a matrix of

much smaller crystals;

"stockwork" a mineral deposit in the form of a branching network of small

irregular veins;

"top cut" the maximum gold content for samples used to calculate an average gold

content for a resource;

"variographic" the use of semi-variograms (a mathematical technique) as part of

the geostatistical methodology used to derive resource estimates;

"Whittle" computer software that uses the Lerch-Grossman algorithm, which is a

3-D algorithm that can be applied to the optimisation of open-pit mine designs.

The purpose of optimisation is to produce the most cost effective and most

profitable open-pit design from a resource block model.

Ends

Positive Interim Feasibility Completed on Red Rabbit Gold Project:

http://hugin.info/138153/R/1652919/533772.pdf

This announcement is distributed by Thomson Reuters on behalf of

Thomson Reuters clients. The owner of this announcement warrants that:

(i) the releases contained herein are protected by copyright and

other applicable laws; and

(ii) they are solely responsible for the content, accuracy and

originality of the information contained therein.

Source: Ariana Resources plc via Thomson Reuters ONE

[HUG#1652919]

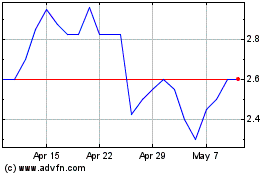

Ariana Resources (LSE:AAU)

Historical Stock Chart

From Dec 2024 to Jan 2025

Ariana Resources (LSE:AAU)

Historical Stock Chart

From Jan 2024 to Jan 2025