TIDMACP

Armadale Capital Plc / Index: AIM / Epic: ACP / Sector:

Investment Company

29 September 2020

Armadale Capital Plc

('Armadale' the 'Company' or the 'Group')

Interim Results

Armadale, the AIM quoted investment company focused on natural

resource projects in Africa, is pleased to announce its unaudited

interim results for the six months ended 30 June 2020.

Highlights:

-- Mahenge Liandu Graphite Project established as a large, long life

graphite deposit capable of producing high quality graphite concentrate

for the rapidly emerging EV market through optimised Definitive

Feasibility Study ('DFS')

-- High-grade JORC compliant Indicated and inferred mineral resource

estimate of 59.48Mt @ 9.8% TGC with outstanding purity of up to of

99.99% TGC achievable using conventional treatment

-- US$985m pre-tax cashflow to be generated from initial 15 year mine

life utilising just 25% of the resource, which remains open in

multiple directions offering significant further upside

-- Estimated pre-tax NPV of US$430m and IRR of 91%

-- Average annual production of large flake high-purity graphite of

109ktpa

-- Low cost, fast-tracked production to be delivered through staged ramp-up

-- 60,000tpa graphite concentrate to be produced for the first three

years (Stage 1) before increasing to life of mine average of

109,000tpa (Stage 2)

-- Low capital cost estimate - Stage 1 is US$39.7m, including

contingency of U$S4.1m or 15% of total direct capital cost with

1.6 year (after tax) payback period from first production based on

an average sales price of US$1,112/t

-- Stage 2 expansion to be funded from cashflow

-- Significant commercial potential, fuelled by growth in the electric

vehicle and renewable energy market

-- Signed NDAs with two separate parties with the aim of advancing

project level funding discussions with a view to bringing in an

investment partner to progress through to mine construction

-- Two additional MoUs signed to supply high quality graphite

products produced at Mahenge Liandu -- currently focussed on

converting these to binding offtake agreements

-- Post period, in August 2020, commenced testing with Australia's

Commonwealth Scientific and Industrial Research Organisation

('CSIRO') to better to evaluate Mahenge natural flake graphite for

its suitability for use in the battery graphite market

-- Progressing licencing applications ahead of commencing mine construction

-- Projected timeline to first production is expected to be

approximately 10-12 months from the start of construction

-- Mining Licence application process commenced in June 2020 with the

submission to the Department of Energy and Minerals

-- Post Period, in September 2020, submitted the Environmental and

Social Impact Assessment ('ESIA') to the National Environment

Management Council ('NEMC') of Tanzania

-- Board strengthened to support company transition from explorer to

producer with the appointments of:

-- Ms Amne Suedi as Non-Executive Director in January 2020

-- Mr Matt Bull as Non-Executive Director in April 2020

Nick Johansen, Director of Armadale, said: "The first half of

2020 has seen us firmly establish Mahenge Liandu as the large, long

life, low cost graphite deposit we know it to be. The enhanced

numbers of the DFS clearly highlight the significant value

potential of our flagship asset, which is primed to cater to rising

graphite demand in light of EV and renewable energy market

developments. Indeed, the outlook for graphite is strong with

market analysts predicting that the global graphite market will

grow to US$21.4bn by 2024 at a CAGR of 5.6%, with demand for flake

graphite, such as that which we will be producing at Mahenge,

rising from less than 600,000tpa in 2014 to more than 1.6Mtpa in

2025 and 2Mtpa by 2028. Our focus and commitment is therefore on

ensuring we meet this demand. To this end we have defined a staged

development model that will enable us to commence production in as

short a time frame as possible whilst minimising capital

expenditure to ensure we continue to maximise value for our

stakeholders.

"Testament to the quality of our asset and sense of our

development approach, we have received significant interest from a

number of commercial parties and are now progressing two MoUs into

binding offtake agreements for the supply of our graphite product.

Alongside this, we are advancing project level funding discussions

with two prospective parties so that we can progress our project

through to mine construction in a way that minimises dilution for

shareholders. We also very much look forward to the results from

the test work being undertaken by CSIRO, which we hope will further

support our marketing efforts in promoting Mahenge graphite as a

high-value product for the rapidly expanding EV market.

"Ultimately we are doing all we can to ensure that once we have

our Mining Licence granted, we are ready for action. The next 12-18

months should be incredibly formative for our company and we look

forward to continuing to keep shareholders abreast of developments.

In the meantime, I would like to give my thanks to all for their

continued to support and commend the team on their excellent hard

work during what has become an unprecedented time globally.

Ensuring the safety of our team is naturally our priority and as we

implement new COVID compliant safety measures, we are delighted to

confirm that progress continues to be made and our overriding

objectives for Mahenge Liandu remain unchanged."

Directors' Statement

The six-month period to 30 June 2020 has seen considerable

advancement of the Mahenge Liandu Graphite Project in Tanzania

('Mahenge Liandu' or the 'Project'), with delivery of the

Definitive Feasibility Study ('DFS'), which was completed in March

2020, and an updated DFS, which was announced in June 2020.

The Board continues to review additional investment

opportunities and also holds a portfolio of quoted investments

where the Board considers there is an opportunity for material

capital appreciation. The Board may invest in additional

opportunities, in line with its investing policy, with any material

investments notified to the market as appropriate.

The Company raised GBP550,000 in a private placement during the

period. A further GBP438,000 has been raised from warrant and

option exercises and GBP395,000 of the loan notes issued in 2019

have been converted into ordinary shares. The Company finished the

period with GBP436,000 cash at hand.

The Directors would like to take this opportunity to thank

shareholders for their ongoing support and commitment and look

forward to providing further updates as the Company continues to

advance Mahenge Liandu towards production, realising its

increasingly demonstrable potential and building value for

shareholders.

For and on behalf of the Board

29 September 2020

FINANCIAL STATEMENTS

FOR THE SIX MONTHSED 30 JUNE 2020

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2020

Unaudited

Six months ended

30 June 30 June

2020 2019

GBP'000 GBP'000

Administrative expenses (176) (187)

Share based payment charges - (21)

Change in fair value of derivative 37 -

Change in fair value of investments 2 -

Finance costs (22) (8)

Loss before taxation (159) (216)

Taxation - -

Loss from continuing operations (159) (216)

Profit from discontinued operations, net of tax (note

3) - 240

(Loss)/profit after taxation (159) 24

Other comprehensive income

Items that may be reclassified to profit or loss:

Exchange differences on translating foreign entities (13) 26

Total comprehensive (loss)/income attributable to

equity holders of the parent company (172) 50

Pence Pence

(Loss)/Earnings per share attributable to equity

holders of the parent company (note 4) Total

(loss)/profit per share - basic (0.04) 0.01

- fully diluted (0.04) 0.01

Loss per share from continuing operations - basic (0.04) (0.06)

- fully diluted (0.04) (0.06)

Consolidated Statement of Financial Position

At 30 June 2020

Unaudited Audited

30 June 30 June 31 December

2020 2019 2019

GBP'000 GBP'000 GBP'000

Assets

Non-Current assets

Exploration and evaluation assets 4,084 3,457 3,705

Investments 108 60 106

4,192 3,517 3,811

Current assets

Trade and other receivables 303 92 159

Cash and cash equivalents 436 42 96

739 134 255

Total assets 4,931 3,651 4,066

Equity and liabilities

Equity

Share capital (note 5) 3,197 3,111 3,139

Share premium 22,122 21,160 21,037

Shares to be issued 286 286 286

Share option and warrant reserve 813 116 662

Foreign exchange reserve 75 208 88

Retained earnings (22,420) (22,106) (22,400)

Total equity 4,073 2,775 2,812

Current liabilities

Trade and other payables 253 180 268

Loans 604 696 867

Derivative liability 1 - 119

Total liabilities 858 876 1,254

4,931 3,651 4,066

Total equity and liabilities

Unaudited Consolidated Statement of Changes in Equity

For the period ended 30 June 2020

Shares Share Foreign

Share Share to be Option Exchange Retained

Capital Premium Issued Reserve Reserve Earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance 1

January 2019 3,038 20,570 286 95 421 (22,129) 2,281

Loss for the

period - - - - - (273) (273)

Other

comprehensive

loss - - - - (333) - (333)

Total

comprehensive

loss for the

period - - - - (333) (273) (606)

Issue of

shares and

warrants 101 658 - 546 - - 1,305

Expenses of

issue - (191) - - - - (191)

Transfer on

exercise of

warrants - - - (2) - 2 -

Share based

payment

charges - - - 23 - - 23

Total other

movements 101 467 - 567 - 2 1137

Balance 30

December

2019 3,139 21,037 286 662 88 (22,400) 2,812

Loss for the

period - - - - - (159) (159)

Other

comprehensive

loss - - - - (13) - (13)

Total

comprehensive

loss for the

period - - - - (13) (159) (172)

Issue of

shares 58 1,085 - 240 - - 1,383

Transfer on

exercise of

warrants - - - (89) - 89 -

Release on

conversion of

loan notes - - - - - 50 50

Total other

movements 58 1,085 - 151 - 139 1,433

Balance 30

June 2020 3,197 22,122 286 813 75 (22,420) 4,073

The following describes the nature and purpose of each reserve

within shareholders' equity:

Reserve Description and purpose

Share capital Amount subscribed for share capital at

nominal value

Share premium Amount subscribed for share capital in

excess of nominal value, net of allowable

expenses

Shares to be issued Share capital to be issued in connection

with historical acquisition

Share option and warrant reserve Cumulative charge recognised under IFRS2 in

respect of share-based payment awards

Foreign exchange reserve Gains/losses arising on re-translating the

net assets of overseas operations into

sterling

Retained earnings Cumulative net gains and losses recognised

in the statement of comprehensive income

Consolidated Statement of Cash Flows

For the period ended 30 June 2020

Unaudited Audited

Six Months ended Year ended

30 June 2020 30 June 2019 31 December 2019

GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

(Loss)/profit before taxation (159) 24 (273)

Foreign exchange release on

disposal of overseas operation - (240) (240)

Share based payment charge - 21 23

Change in fair value of

derivative (37) - 45

Change in fair value of

investments (2) - (46)

Finance costs 22 7 21

(176) (188) (470)

Changes in working capital

Receivables (16) (38) (44)

Payables 8 (133) (15)

Net cash used in operating

activities (184) (359) (529)

Cash flows from investing

activities

Expenditure on exploration and

evaluation assets (350) (162) (479)

Purchase of listed investments - (59) (59)

Net cash used in investing

activities (350) (221) (538)

Cash flows from financing

activities

Proceeds from share placement 845 709 969

Issue costs - (132) (46)

Issue of loan notes - - 400

Loan repayment - - (235)

Proceeds from loan 50 - 30

Interest paid (21) - -

Net cash from financing

activities 874 577 1,118

Net increase/(decrease) in cash

and cash equivalents 340 (3) 51

Cash and cash equivalents at 1

January 2020 96 45 45

Cash and cash equivalents at 30

June 2020 436 42 96

Notes to the unaudited condensed consolidated financial

statements

For the period ended 30 June 2019

1. Incorporation and principal activities

Country of incorporation

Armadale Capital Plc was incorporated in the United Kingdom as a

public limited company on 19 August 2005. Its registered office is

1 Arbrook Lane, Esher, Surrey, KT10 9EG.

Principal activities

The principal activity of the Group during the period was that

of an investment company.

2. Accounting policies

2.1 Statement of compliance

The financial information for the six months ended 30 June 2020

and 30 June 2019 is unreviewed and unaudited and does not

constitute the Group's statutory financial statements for those

periods within the meaning of Section 434 of the Companies Act

2006. The comparative financial information for the year ended 31

December 2019 has been derived from the Annual Report and Accounts,

which were approved by the Board of Directors on 2 June 2020 and

delivered to the Registrar of Companies. The report of the Auditors

on those accounts was unqualified and did not contain any statement

under Section 498 of the Companies Act 2006.

This condensed set of financial statements has been prepared in

accordance with IAS 34 'Interim Financial Reporting' as adopted by

the European Union. This condensed set of financial statements

should be read in conjunction with the annual financial statements

for the year ended 31 December 2019 which have been prepared in

accordance with International Financial Reporting Standards (IFRSs)

as adopted by the European Union.

The accounting policies adopted are consistent with those of the

annual financial statements for the year ended 31 December 2019 as

described in those annual financial statements.

In respect of new financial reporting standards which came into

effect for reporting periods beginning on 1 January 2020, the

Directors consider that their implementation has no material effect

on the financial information presented in this statement.

2.2 Going Concern

The financial statements have been prepared on the going concern

basis as, in the opinion of the Directors, there is a reasonable

expectation that the Group will continue in operational existence

for the foreseeable future. The Company's ability to continue as a

going concern and to achieve its long term strategy of developing

its exploration projects is dependent on the extension and/or

conversion of its loan notes and further fundraising.

2.3 Exploration and evaluation assets

These assets are recorded at cost and are amortised over their

expected useful life on a pro rata basis of actual production for

the period to expected total production.

2.4 Investments

Investments are stated at fair value.

3. Release of exchange gains on overseas operation

The Company's interest in the Mpokoto gold project was sold on

11 January 2019, at which point the accumulated net foreign

exchange gains arising on historical revaluations of the investment

were released to income from the foreign exchange reserve.

4. Loss per share

The calculation of total basic loss per share is based on a loss

of GBP159,000 (2019, profit of GBP24,000) and on 419,492,599 (2019,

352,164,475) Ordinary Shares, being the weighted average number of

Ordinary Shares in issue during the period.

The calculation of fully diluted earnings per share in 2019 was

based on 406,666,587 diluted shares, being the weighted average

number of diluted shares during the period. In 2020, there was no

difference between basic loss per share and diluted loss per share

as the Group reported a loss for the period.

5. Share capital

During the period, the Company placed 24,444,444 Ordinary Shares

in the Capital of the Company to raise GBP550,000 with

institutional and other investors. Also during the period,

GBP395,000 of loan notes were converted into 13,166,663 ordinary

shares and 19,979,702 options and warrants were exercised providing

proceeds of GBP437,553

**ENDS**

For further information, please visit the Company's website

www.armadalecapitalplc.com, follow Armadale on Twitter

@ArmadaleCapital or contact:

Enquiries:

Armadale Capital Plc

Tim Jones, Company Secretary +44 (0)20 7236 1177

Nomad and joint broker: finnCap Ltd

Christopher Raggett / Edward Whiley +44 (0)20 7220 0500

Joint Broker: SI Capital Ltd

Nick Emerson +44 (0)1483 413500

Press Relations: St Brides Partners Ltd

Charlotte Page / Beth Melluish +44 (0)20 7236 1177

Notes

Armadale Capital Plc is focused on investing in and developing a

portfolio of investments, targeting the natural resources and/or

infrastructure sectors in Africa. The Company, led by a team with

operational experience and a strong track record in Africa, has a

strategy of identifying high growth businesses where it can take an

active role in their advancement.

The Company owns the Mahenge Liandu graphite project in

south-east Tanzania, which is now its main focus. The Project is

located in a highly prospective region with a high-grade JORC

compliant inferred mineral resource estimate of 51.1Mt @ 9.3% TGC.

Marking the project one of the largest high-grade resources in

Tanzania, and work to date has demonstrated Mahenge Liandu's

potential as a commercially viable deposit with significant

tonnage, high-grade coarse flake and near surface mineralisation

(implying a low strip ratio) contained within one contiguous ore

body.

In addition to this project Armadale has a portfolio of quoted

investments.

View source version on businesswire.com:

https://www.businesswire.com/news/home/20200929005476/en/

CONTACT:

Armadale Capital Plc

SOURCE: Armadale Capital Plc

Copyright Business Wire 2020

(END) Dow Jones Newswires

September 29, 2020 03:46 ET (07:46 GMT)

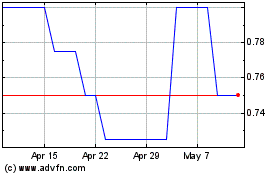

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Dec 2024 to Jan 2025

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Jan 2024 to Jan 2025