TIDMALBA

RNS Number : 8670Y

Alba Mineral Resources PLC

24 August 2018

[Click on or paste the following link into your website browser

to view the associated PDF document (including maps and

images):

http://www.rns-pdf.londonstockexchange.com/rns/8670Y_1-2018-8-24.pdf]

ALBA MINERAL RESOURCES PLC

HALF-YEARLY REPORT

The Board of Directors of Alba Mineral Resources plc (the

"Company" or "Alba"), the diversified mineral exploration company,

is pleased to report the Company's interim results for the six

months ended 31 May 2018. They incorporate the results of its

subsidiary companies Aurum Mineral Resources Limited ("AMR"),

Mauritania Ventures Limited ("MVL"), Obsidian Mining Limited

("OML"), White Eagle Resources Limited ("WERL"), White Fox

Resources Limited ("WFRL") and Dragonfire Mining Limited ("DML")

(together the "Subsidiary Companies", collectively with Alba, the

"Group").

CHAIRMAN'S STATEMENT

During the six months to 31 May 2018, we have made significant

progress across our portfolio of mining projects and oil & gas

investments.

REVIEW OF ACTIVITIES

1) Horse Hill and Brockham (Oil & Gas, Surrey, United

Kingdom)

At Horse Hill, the oil & gas project in the Weald Basin in

which Alba is the second largest participant with an 18.1 per cent

interest in the Horse Hill Developments Limited ("HHDL") funding

consortium, significant progress was made during the period towards

obtaining the remaining regulatory approvals for the proposed 150

day extended well test ("EWT") programme. With all planning

conditions satisfied and permission granted by the Oil & Gas

Authority ("OGA"), EWT operations commenced in late June. As the

short flow test campaign in 2016 established commercially viable

initial flow rates for each of the Portland sandstone and the

Kimmeridge limestone zones 3 and 4, the EWT's primary objective is

to confirm that the wellbore is connected to a commercially viable

oil volume within one or more of these three zones. Initial results

from the testing of the Portland have been positive.

Meanwhile, at Brockham, also in the Weald Basin, the oil field

in which Alba has a 5 per cent participating interest, in March we

confirmed that the operator, Angus Energy, had resumed continuous

production from the Portland Reservoir at the Brockham no. 2 well.

Furthermore, as announced earlier this month, planning approval was

granted for the appraisal of the Brockham no. 4 side-track well. We

look forward to operations commencing in earnest at Brockham, where

testing of the Brockham no. 4 side-track will target some of the

same Kimmeridge zones as are found at Horse Hill.

2) Clogau Gold Mine (North Wales, United Kingdom)

Last December we announced that we had acquired a 49 per cent

interest in Gold Mines of Wales Limited ("GMOW"), the owner of the

Clogau Gold Project situated within the Dolgellau Gold Belt in

North Wales (the "Clogau Project"). The Clogau Project comprises

the Clogau Gold Mine and includes a large number of highly

prospective gold targets and former gold workings within a total

option area of 107 km(2).

The Dolgellau Gold Belt has produced about 131,000 oz of gold,

by far the most of any region within the United Kingdom. Most of

this gold (81,000 oz) has been exploited from the historic

Clogau-St David's mine that lies within the Clogau Project area.

Alba's review of the Clogau Project concluded that there is high

potential to find unworked veins containing gold mineralisation of

similar grade to that known in historic mines in the area.

Alba's objectives in investing in the Clogau Project are

two-fold: to bring the historic Clogau Gold Mine back into

production and at the same time to make a push into regional gold

exploration.

Post Period End Update

Post period end, in July we announced that we had entered into

an agreement to acquire a further 41 per cent of GMOW, to bring our

holding to 90 per cent. As announced on 24 August 2018, we have now

completed that acquisition.

Exploration has now commenced at the Clogau-St David's gold

project.

Key points:

-- Alba's field programme is the first ever concerted modern

exploration campaign conducted on the Dolgellau Gold Belt since the

first gold discovery there in 1853.

-- Geochemical soil sampling has commenced across the Clogau-St

David's mine area and will be followed by electromagnetic and

magnetic geophysical surveys, with the objective of defining new

gold targets within the existing mine area.

-- The results obtained will also be used to determine the most

suitable exploration techniques to then be rolled out to the

highest priority regional gold targets identified within the 107

km(2) licence area.

-- Alba believes that that there is the potential to find

unworked veins containing gold mineralisation of similar grade to

that known in historic mines in the area.

-- Baseline environmental studies are being undertaken at the

location of the historic Clogau gold mine itself, a key step in the

re-permitting process for re-opening the mine.

A team from SRK Exploration Services has mobilised to site to

begin a soil sampling and geophysical programme over the existing

mine area. This work has two objectives:

- to assess the mineralisation fingerprint over a known target

with the results being used to guide exploration over multiple

regional targets within the licence; and

- to seek to identify new gold targets within the mine area.

This exploration being undertaken by Alba, in conjunction with

Gold Mines of Wales Limited, utilises modern day exploration

techniques and is, to Alba's knowledge, the first exploration

programme of its kind that has ever been undertaken on the 107

km(2) licence area.

Aside from breaking new ground in exploring the wider Dolgellau

Gold Belt, Alba's principal objective remains the reopening of the

Clogau mine. With this in mind, the appointed consultants are in

the process of undertaking certain baseline environmental studies

which are an essential part of the re-permitting process involved

in the reopening of the mine.

The Project includes numerous historical gold mines, including

Cefn-Coch, Cesailgwm-Bach, Clogau-St David's, Garth-Gell, Old

Clogau, Prince Edward, Prysor, Vigra, etc. and many more workings

that are well distributed across the area. All these former mines

fall within the Clogau Gold Project.

Despite being an established gold-producing area, the Dolgellau

Gold Belt is considered to be underexplored in terms of the use of

modern exploration methods, such as low detection limit geochemical

soil sampling, close spaced ground geophysical surveys and

drilling. Hence Alba's two-pronged approach of kicking off

exploration of the wider Gold Belt at the same time as formulating

and implementing a programme of works to bring the Clogau Mine

itself back into production.

Exploration Programme

The exploration programme will follow a two-stage approach.

Stage one will involve geochemical soil sampling along lines with

close spaced samples. Samples from various soil depths will be

taken that will allow a range of assaying techniques to be applied.

This will be followed in the second stage by a ground magnetic and

electromagnetic survey to characterise the geophysical signature of

the mineralisation host rocks and controlling structures.

The results of the orientation geochemical and geophysical

surveys completed will be used to assess the most appropriate

exploration techniques on other, prospective areas of the

licence.

3) Greenland Exploration Activities (Thule Black Sands,

Inglefield Land, Amitsoq)

Thule Black Sands and Inglefield Land (North-West Greenland)

In relation to Alba's 100% owned Thule Black Sands ilmenite

project and Inglefield Land multi-commodity project in north-west

Greenland, much of the period was spent devising the field

programme for the current season and then planning the serious

logistical exercise involved in mobilising our field teams to site

in north-west Greenland. Alba's exploration team for the joint

Thule and Inglefield Land field campaigns this summer comprised

personnel covering a wide range of disciplines (including

geologists and environmental consultants) and involved the

chartering of an ex-Danish coastguard vessel and a helicopter for

the duration of the programme.

Post Period End Update - Thule Black Sands

A field programme has been completed across the Thule Black

Sands project involving drilling and mapping and sampling.

Key points:

o Extensive reconnaissance mapping and drilling completed

o Refined zones of interest extend across a total strike length of approximately 10km

o 3 tonnes of bulk samples collected across three material types

o Independent Competent Person site visit completed

o First year's environmental baseline studies completed

Exploration drilling and mapping has been completed across the

Thule Black Sands project across a strike length of approximately

10km. Drilling was completed on a grid with an approximate spacing

of 250m by 100m with a maximum drilled depth of up to 2m, being

constrained by the depth of the permafrost in the area. Drilling

was completed at the SE, Central and NW Targets. Licence scale

reconnaissance and mapping was also completed ahead of the drilling

to assist in the development of a geological model and ore genesis

theory for the Project.

The detailed reconnaissance completed of the NW Target has

established that the section of coastline north of the area drilled

consists largely of Dundas Formation sediments (siltstones and

shales) and not mineral sands and is not therefore of interest for

future exploration. The refined zones of interest within the

licence are primarily those areas which were drilled, which amount

to a total strike length of ilmenite-bearing sands of approximately

10km.

In addition to the drill samples collected, three tonnes of bulk

samples were collected across three different material types for

future metallurgical testwork. An independent Competent Person site

visit was also completed during the field programme. A team of

external environmental specialists also completed the required

first year studies to support a future Environmental Impact

Assessment, including the extensive collection of samples of flora

and fauna. This work is part of the essential groundwork of any

future development plans at the site.

All samples collected from the programme will be dispatched to a

specialist mineral sand laboratory overseas for the determination

of heavy mineral content. The results will be used to develop a

geological model for the project. Composite samples will be created

from the appropriate geological domains and will be used to

determine the mineralogy of the heavy mineral component of the

sand. Following the completion of the laboratory test work, an

independent Competent Person will then commence the necessary work

to assess the generation of a maiden mineral resource estimate for

the project.

Post Period End Update - Inglefield Land

A field campaign has been completed across selected targets at

Inglefield Land with targets being accessed via helicopter from a

base camp at the Four-Finger Lake target. The exploration campaign

was led by Mr Mark Hutchison, a Greenland-based exploration

geologist, supported by Mr Ole Christiansen, a senior Greenlandic

geologist who has extensive and unrivalled experience of the

geology and mineralisation styles at Inglefield Land, not least

from his time leading NunaMinerals, the previous licence holder at

Inglefield Land. Mr Howard Baker, Alba's Technical Director

(Mining), accompanied the team to assist in the sampling operations

along with leading the Thule exploration programme.

A key objective of the exploration campaign is to identify

possible targets for a future drilling campaign.

In summary, samples were collected at the Four-Finger Lake

target which hosts previously identified cobalt, copper and gold

mineralisation. Further samples were taken at Kap Aggaziz which

encompasses the Marble East, Marble Lake and Martome Fjord Targets

with previously identified anomalies of copper, gold, nickel and

cobalt and four samples were taken from the southwest zinc and

cobalt target.

Previous historical results at Four Finger Lake include a

copper-gold (Cu-Au) and copper-lead-zinc-gold (Cu-Pb-Zn-Au) anomaly

from rock chip and soil samples, including 1.8 g/t Au and 0.24%

Cu.

Previous historical results from Kap Aggaziz includes:

- at Martome Fjord - a Cu-Au target with >1% Cu and 1.6 g/t Au from rock chip samples

- at Marble East - a nickel-cobalt (Ni-Co) target with 0.16% Co

and 0.2% Ni from rock chip samples

- at Marble Lake - a strong Cu-Au anomaly from rock chip samples

returning grades >1% Cu and up to 1.7 g/t Au

Malachite copper mineralisation and gossans were observed at Kap

Aggaziz. Gossans are iron-enriched zones which may signify areas of

deeper seated metallic mineralisation, so the presence of multiple

gossans may suggest widespread mineralised targets.

All samples collected are currently being prepared for dispatch

to independent laboratories for assaying.

Following the receipt of the raw assay results, Alba intends to

undertake petrological testwork on samples of interest. This will

be combined with desktop studies utilising satellite imagery and

available geophysical data to complement the geological

understanding of the Project.

Amitsoq Graphite Project (southern Greenland)

Meanwhile, at our 90% owned Amitsoq graphite project in southern

Greenland, which includes the former producing Amitsoq graphite

mine, during the period we reported the geochemical assays on the

samples taken during our 2017 field programme. This included

graphitic carbon content at the new Kalaaq graphite discovery on

the mainland portion of our licence area, averaging 25.62% carbon

with a maximum content of 29% carbon.

In March we announced that the Amitsoq exploration licence had

been renewed to Alba for a further five-year period and that the

Government of Greenland had granted a 12-month moratorium on the

exploration expenditure commitment attaching to the Amitsoq

licence. Further metallurgical test work carried out during this

period confirmed the ability to produce a marketable grade

concentrate from Amitsoq graphite.

4) Limerick (Base Metals, Ireland)

Alba's 100% owned Limerick Project, comprising an exploration

licence in the Limerick Basin in the Republic of Ireland, is

prospective for base metals and is only 10 km away from and part of

the same target unit as the Pallas Green zinc discovery. During the

reporting period, Alba applied to renew the licence for a further

two years, until May 2020, and earlier this month we were pleased

to receive confirmation of licence renewal. We intend to drill one

or more identified targets at Limerick following receipt of the

necessary regulatory approvals.

5) Corporate

During the reporting period, we raised a total of GBP1,550,000

(before expenses) in two share placings. Prior to that, we had last

raised funds in September 2017. The funds raised during this period

were essential in order to ensure that we were in a position to

meet our commitments to the budgeted field programmes at Horse

Hill, Thule and Inglefield Land in particular.

In March, we announced two senior oil and gas appointments. Sue

Corrigan joined as Alba's Technical Consultant - Oil & Gas. Sue

is a geologist and geoscientist with 40 years' industry experience

in both exploration and development geology, including for a number

of years at Tullow Oil. In addition, Feroz Sultan was appointed as

Alba's Special Adviser - Oil & Gas. Feroz has since taken on

the position as Alba's Technical Director - Oil & Gas. He is a

petroleum geologist with over 40 years of diverse experience in the

management, exploration, development and production of oil &

gas. We firmly believe that their expertise will prove invaluable

in guiding us through this important phase in the development of

both the Horse Hill and the Brockham projects, and provide us with

a much-needed internal resource to assess the performance of our

investment in those projects over the current and forthcoming

long-term testing phase.

These appointments, allied to the highly experienced team we

have on the mining side, headed up by Howard Baker, our Technical

Director - Mining, formerly a Principal Consultant at SRK

Consulting, mean that we have a team at Alba which is fit for the

purpose of driving our mining projects and oil & gas

investments forward in the coming months and years.

6) Results for the Period

The Group made a loss attributable to equity holders of the

parent for the period, after taxation, of GBP380,358 (2017:

GBP334,972). The basic and diluted loss per share was 0.015p (2017:

0.02p).

7) Outlook

After a significant hiatus at our oil & gas investments in

the Weald Basin, as the operators at both Horse Hill and Brockham

spent much of the past 12 months navigating their way through the

regulatory maze, and as previously announced, we are finally seeing

welcome progress at both sites. At Horse Hill, we are currently in

the middle of a long-term testing programme that should tell us a

great deal about the commercial viability of the project. And we

await the start of flow testing at Brockham, which project already

benefits from a production licence.

As for our mining projects, while we have completed our summer

programmes at both Thule and Inglefield Land in Greenland, we now

turn to the test work phase so that we can assess the results of

those campaigns. And as those field programmes come to an end, so

we have just begun field work at the Clogau Gold Project in north

Wales, the first time in the project's history that systematic

exploration has been carried out over the mine area and the

identified regional targets.

The rest of the year promises to be a busy time for the Company,

as we push our mining projects through the next phase in their

development and oversee what we hope to be the rapid progress of

the onshore oil & gas assets in which we are invested.

George Frangeskides

24 August 2018

Executive Chairman

Glossary

Mesothermal A class of hydrothermal mineral deposits originating

in the earth's interior by deposition of a mineral

mass from hot mineralized aqueous solutions,

circulating at depths of approximately 1,000

m; the solutions are under great pressure and

have temperatures of 300deg-200degC.

Ore genesis Geological evolution and mineralisation controls

theory that have resulted in the zones of elevated

ilmenite concentrations.

Orogenic An orogeny is an event that leads to a large

structural deformation of the Earth's lithosphere

(crust and uppermost mantle) due to the interaction

between plate tectonics.

Petrological Thin section analysis of rock samples to assist

testwork in the understanding of the observed mineralisation.

Turbidite A turbidite is the geologic deposit of a turbidity

current, which is a type of sediment gravity

flow responsible for distributing vast amounts

of clastic sediment into the deep ocean.

The information contained within this announcement is deemed by

the Company to constitute inside information under the Market Abuse

Regulation (EU) No. 596/2014.

For further information please contact:

Alba Mineral Resources plc

George Frangeskides, Executive Chairman +44 20 7264 4366

Cairn Financial Advisers LLP (Nomad)

James Caithie / Liam Murray +44 20 7213 0880

First Equity Limited (Broker)

Jason Robertson +44 20 7374 2212

Yellow Jersey PR (Financial PR/ IR)

Tim Thompson / Henry Wilkinson +44 77 1071 8649

alba@yellowjerseypr.com

UNAUDITED CONSOLIDATED INCOME STATEMENT

FOR THE SIX MONTHSED 31 MAY 2018

Unaudited Unaudited Audited

6 months 6 months Year ended

ended 31 ended 31 30 Nov 2017

May 2018 May 2017

Revenue - - -

Cost of sales - - -

Gross loss - - -

Administrative expenses (381,367) (335,320) (649,125)

Impairment of deferred exploration

expenditure - - (569,218)

Operating (loss)/profit (381,367) (335,320) (1,218,343)

Revaluation of investment - - 700,000

(Loss)/profit before tax (381,367) (335,320) (518,343)

---------- ------------- -------------

Taxation - - -

---------- ------------- -------------

(Loss)/profit for the year (381,367) (335,320) (518,343)

---------- ------------- -------------

Attributable to:

Equity holders of the parent (380,358) (334,972) (227,699)

Non-controlling interests (1,009) (348) (290,644)

---------- ------------- -------------

(381,367) (335,320) (518,343)

---------- ------------- -------------

Loss per ordinary share

Basic and diluted (0.015) (0.02) pence (0.012)

pence pence

UNAUDITED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 MAY 2018

Unaudited Unaudited Audited Year

6 months 6 months ended 30

ended 31 ended 31 Nov 2017

May 2018 May 2017

Non-current assets

Intangible fixed assets 1,543,177 1,447,780 1,145,336

Investments 4,061,467 2,288,320 3,619,465

Available for sale assets 18,495 56,285 14,335

Total non-current assets 5,623,139 3,792,385 4,779,136

------------ ------------ -------------

Current assets

Trade and other receivables 209,260 36,371 35,276

Cash and cash equivalents 1,151,385 350,280 626,939

------------ ------------ -------------

Total current assets 1,360,645 386,651 662,215

------------ ------------ -------------

Current liabilities

Trade and other payables (202,606) (153,934) (180,014)

Financial liabilities (253,074) (253,074) (253,073)

------------ ------------ -------------

Total current liabilities (455,680) (407,008) (433,087)

------------ ------------ -------------

Net assets 6,528,104 3,772,028 5,008,264

------------ ------------ -------------

Capital and reserves

Called up share capital 3,686,246 2,720,503 3,086,246

Share premium account 5,836,868 3,610,303 4,655,702

Warrant reserve 350,979 246,050 231,969

Retained losses (3,475,478) (3,224,727) (3,095,120)

Merger reserve 200,000 200,000 200,000

Foreign currency reserve 194,716 193,821 193,685

------------ ------------ -------------

Equity attributable to equity

holders of the parent 6,793,331 3,745,950 5,272,482

Non-controlling interests (265,227) 26,078 (264,218)

------------ ------------ -------------

Total equity 6,528,104 3,772,028 5,008,264

------------ ------------ -------------

UNAUDITED CONSOLIDATED CASH FLOW STATEMENT

FOR THE SIX MONTHSED 31 MAY 2018

Unaudited Unaudited Audited Year

6 months 6 months ended 30

ended 31 ended 31 Nov 2017

May 2018 May 2017

Cash flows from operating activities

Operating loss (381,367) (335,320) (1,218,343)

Consulting fees settled in shares - - 65,000

Share option charge 119,010 119,443 127,695

Provision for impairment (4,160) - 611,168

Foreign exchange revaluation

adjustment 1,030 4,663 4,526

Increase / (decrease) in creditors 22,593 (42,378) 23,702

(Increase)/ decrease in debtors (173,984) (21,110) (20,015)

---------- ---------- -------------

Net cash used in operating activities (416,878) (274,702) (406,267)

---------- ---------- -------------

Cash flows from investing activities

Payments for deferred exploration

expenditure (81,174) (169,784) (356,616)

Investments (442,002) (27,005) (449,049)

---------- ---------- -------------

Net cash used in investing activities (523,176) (196,789) (805,665)

---------- ---------- -------------

Cash flows from financing activities

Proceeds from issue of shares

and warrants 1,552,000 153,431 1,223,431

Cost of issue (87,500) - (62,900)

---------- ---------- -------------

Net cash generated from financing

activities 1,464,500 153,431 1,170,531

---------- ---------- -------------

Net increase in cash and cash

equivalents 524,446 (318,060) (41,401)

Cash and cash equivalents at

beginning of period 626,939 668,340 688,340

---------- ---------- -------------

Cash and cash equivalents at

end of year 1,151,385 350,280 626,939

---------- ---------- -------------

NOTES TO THE HALF-YEARLY FINANCIAL INFORMATION

1. Basis of preparation

The Group consolidates the financial statements of the Company

and its subsidiary undertakings.

The financial information has been prepared under the historical

cost convention in accordance with International Financial

Reporting Standards ("IFRS"), International Accountant Standards

("IAS") and IFRS Interpretations Committee ("IFRIC")

interpretations as adopted by the European Union. The financial

information set out in this half-yearly report does not constitute

statutory accounts as defined in Section 434 of the Companies Act

2006. The same accounting policies, presentation and methods of

computation are followed in this interim condensed consolidated

report as were applied in the Group's annual financial statements

for the year ended 30 November 2017. The auditor's report on those

financial statements was unqualified and did not contain any

statements under section 498(2) or section 498(3) of the Companies

Act 2006. The auditor's report for the year ended 30 November 2017

did include a paragraph on material uncertainty related as to

whether the Group can raise sufficient funds to continue to develop

the Group's exploration assets.

2. Taxation

No charge for corporation tax for the period has been made due

to the expected tax losses available.

3. Loss per share

Basic loss per share is calculated by dividing the loss

attributable to ordinary shareholders of GBP380,358 (May 2017:

GBP334,972; November 2017: GBP227,699) by the weighted average

number of shares of 2,458,569,272 (May 2017: 1,863,339,824;

November 2017: 1,949,148,404) in issue during the period. The

diluted loss per share calculation is identical to that used for

basic loss per share as the exercise of warrants would have the

effect of reducing the loss per ordinary share and therefore is not

dilutive under the terms of Financial Reporting Standard 22

"Earnings Per Share".

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR FKQDBQBKDFFB

(END) Dow Jones Newswires

August 24, 2018 10:32 ET (14:32 GMT)

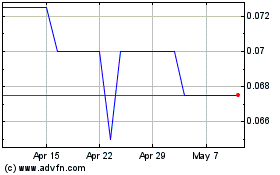

Alba Mineral Resources (LSE:ALBA)

Historical Stock Chart

From Jun 2024 to Jul 2024

Alba Mineral Resources (LSE:ALBA)

Historical Stock Chart

From Jul 2023 to Jul 2024