TIDMASCL

RNS Number : 8587O

Ascential PLC

12 February 2016

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN OR INTO OR FROM THE UNITED STATES,

AUSTRALIA, CANADA, JAPAN OR ANY OTHER JURISDICTION WHERE IT IS

UNLAWFUL TO DISTRIBUTE THIS ANNOUNCEMENT

This announcement is an advertisement for the purposes of the UK

Prospectus Rules of the Financial Conduct Authority (the "FCA") and

not a prospectus and not an offer of securities for sale in any

jurisdiction, including in or into or from the United States,

Australia, Canada or Japan. Neither this announcement nor anything

contained herein shall form the basis of, or be relied upon in

connection with, any offer or commitment whatsoever in any

jurisdiction. Investors should not subscribe for or purchase any

transferable securities referred to in this announcement except on

the basis of information in the prospectus (the "Prospectus")

published by Ascential plc (the "Company") on 9 February 2016 in

connection with the admission of its ordinary shares (the "Shares")

to the premium listing segment of the Official List of the FCA and

to trading on the main market for listed securities of the London

Stock Exchange plc (the "London Stock Exchange"). Copies of the

Prospectus are available at the Company's registered office at The

Prow, 1 Wilder Walk, London W1B 5AP and on the Company's website at

www.ascential.com.

12 February 2016

Ascential plc

Admission to trading on the London Stock Exchange

Further to its announcement on 9 February 2016, Ascential plc

("Ascential" or the "Company"), the international

business-to-business media company, is pleased to announce that its

entire ordinary share capital of 400,000,000 Shares has today been

admitted to the premium listing segment of the Official List of the

UK Financial Conduct Authority and to trading on the London Stock

Exchange's main market for listed securities under the ticker

"ASCL".

Enquiries

Media Enquiries

FTI Consulting (Public Relations +44 (0) 20 3727

Advisers to Ascential): 1000

Matt Dixon, Chris Lane, Ed Bridges

Joint Global Co-ordinators, Joint

Bookrunners and Joint Sponsors

+44 (0) 20 7628

BofA Merrill Lynch: 1000

Peter Luck, Antonin Baladi, James

Fleming

+44 (0) 20 7774

Goldman Sachs International: 1000

Anthony Gutman, Chris Emmerson,

Duncan Stewart

Joint Bookrunners

+44 (0) 20 7595

BNP Paribas: 2000

Ben Canning, Florence Sztuder

+44 (0) 20 7545

Deutsche Bank: 8000

Alastair Blackman, Lorcan O'Shea

+44 (0) 20 7260

Numis Securities: 1000

Lorna Tilbian, Nick Westlake

Financial Adviser to GMG

+44 (0) 20 7634

Moelis & Company: 3500

Geoffrey Austin, Liam Beere, Alexander

Hageman

Disclaimer

The information contained in this announcement is for background

purposes only and does not purport to be full or complete. No

reliance may be placed for any purpose on the information contained

in this announcement or its accuracy, fairness or completeness.

Neither this announcement nor the information contained herein

is for publication, distribution or release, in whole or in part,

directly or indirectly, in or into or from the United States

(including its territories and possessions, any State of the United

States and the District of Columbia), Australia, Canada, Japan or

any other jurisdiction where to do so would constitute a violation

of the relevant laws of such jurisdiction. The distribution of this

announcement may be restricted by law in certain jurisdictions and

persons into whose possession any document or other information

referred to herein comes should inform themselves about and observe

any such restriction. Any failure to comply with these restrictions

may constitute a violation of the securities laws of any such

jurisdiction.

This announcement does not contain or constitute an offer of, or

the solicitation of an offer to buy or subscribe for, the

securities referred to herein to any person in any jurisdiction,

including the United States, Australia, Canada or Japan or in any

jurisdiction to whom or in which such offer or solicitation is

unlawful.

The securities referred to herein may not be offered or sold,

directly or indirectly, in the United States unless registered

under the United States Securities Act of 1933, as amended (the "US

Securities Act") or offered in a transaction exempt from, or not

subject to, the registration requirements of the US Securities Act.

The offer and sale of securities referred to herein has not been

and will not be registered under the US Securities Act or under the

applicable securities laws of Australia, Canada or Japan. There

will be no public offer of the Shares in the United States,

Australia, Canada or Japan. Subject to certain exceptions, the

Shares referred to herein may not be offered or sold in Australia,

Canada or Japan or to, or for the account or benefit of, any

national, resident or citizen of Australia, Canada or Japan.

This announcement is only addressed to and directed at persons

in member states of the European Economic Area who are qualified

investors within the meaning of Article 2(1)(e) of the Prospectus

Directive (Directive 2003/71/EC), as amended.

Each of the Company and Merrill Lynch International ("BofA

Merrill Lynch"), Goldman Sachs International ("Goldman Sachs"),

Deutsche Bank AG, London Branch ("Deutsche Bank"), BNP Paribas

("BNP Paribas"), Numis Securities Limited ("Numis"), and Moelis

& Company UK LLP ("Moelis") (together, the "Banks") and their

respective affiliates expressly disclaim any obligation or

undertaking to update, review or revise any of the forward-looking

statements contained in this announcement whether as a result of

new information, future developments or otherwise.

Any purchase of Shares in the Offer should be made solely on the

basis of the information contained in the Prospectus. No reliance

may, or should, be placed by any person for any purposes whatsoever

on the information contained in this announcement or on its

completeness, accuracy or fairness. The information in this

announcement is subject to change.

Acquiring investments to which this announcement relates may

expose an investor to a significant risk of losing all or part of

the amount invested. Persons considering making such an investment

should consult an authorised person specialising in advising on

such investments. This announcement does not constitute a

recommendation concerning the Offer. The value of Shares can

decrease as well as increase. Potential investors should consult a

professional adviser as to the suitability of the Offer for the

person concerned.

Each of BofA Merrill Lynch and Goldman Sachs is authorised by

the Prudential Regulation Authority (the "PRA") and regulated in

the United Kingdom by the PRA and the FCA. Deutsche Bank is

authorised under German Banking Law (competent authority: the

European Central Bank (the "ECB")) and, in the United Kingdom, by

the PRA and is subject to supervision by the ECB and by BaFin,

Germany's Federal Financial Supervisory Authority, and is subject

to limited regulation in the United Kingdom by the PRA and the FCA.

BNP Paribas is authorised under French Banking Law by the ECB and

the Autorité de Contrôle Prudentiel (the "ACPR") and, in the United

Kingdom, by the PRA and is subject to supervision by the ECB and by

ACPR, and is subject to limited regulation in the United Kingdom by

the PRA and the FCA. Each of Numis and Moelis is authorised and

regulated by the FCA. The Banks (other than Moelis) are acting

exclusively for the Company and no one else in connection with the

Offer, and will not regard any other person as their respective

clients in relation to the Offer and will not be responsible to

anyone other than the Company for providing the protections

afforded to their respective clients nor for providing advice in

relation to the Offer, the contents of this announcement or any

transaction, arrangement or other matter referred to herein. Moelis

is acting exclusively for GMG and no one else in connection with

the Offer, and will not regard any other person as their respective

clients in relation to the Offer and will not be responsible to

anyone other than GMG for providing the protections afforded to

their respective clients nor for providing advice in relation to

the Offer, the contents of this announcement or any transaction,

arrangement or other matter referred to herein.

In connection with the Offer, any of the Banks and any of their

affiliates, acting as investors for their own accounts, may take up

a portion of the Shares in the Offer as a principal position, and

in that capacity may retain, purchase, sell, offer to sell or

otherwise deal for their own accounts in such Shares and other

securities of the Company or related investments and may offer or

sell such Shares or other investments otherwise than in connection

with the Offer. Accordingly, references in the Prospectusto the

Shares being issued, offered, subscribed for, acquired, placed or

otherwise dealt in should be read as including any issue or offer

to, or subscription, acquisition, placing of or dealing in the

Shares by, any Bank and any of its affiliates acting as an investor

for their own accounts. In addition, certain of the Banks or their

affiliates may enter into financing arrangements (including swaps)

with investors in connection with which the Banks (or their

affiliates) may from time to time acquire, hold or dispose of

Shares. Neither the Banks nor any of their affiliates intend to

disclose the extent of any such investment

February 12, 2016 03:01 ET (08:01 GMT)

or transactions otherwise than in accordance with any legal or

regulatory obligations to do so.

None of the Banks or any of their respective directors,

officers, employees, advisers or agents accepts any responsibility

or liability whatsoever for, or makes any representation or

warranty, express or implied, as to, the truth, accuracy or

completeness of the information in this announcement (or whether

any information has been omitted from the announcement) or any

other information relating to the Company, its subsidiaries or

associated companies, whether written, oral or in a visual or

electronic form, and howsoever transmitted or made available or for

any loss howsoever arising from any use of this announcement or its

contents or otherwise arising in connection therewith.

In connection with the Offer, BofA Merrill Lynch (as stabilising

manager), or any of its agents, may (but will be under no

obligation to), to the extent permitted by applicable law and for

stabilisation purposes, over-allot Shares up to a total of 15% of

the total number of Shares included in the Offer or effect other

transactions with a view to supporting the market price of the

Shares or any options, warrants or rights with respect to, or other

interest in, the Shares or other securities of the Company, in each

case at a higher level than that which might otherwise prevail in

the open market. BofA Merrill Lynch is not required to enter into

such transactions and such transactions may be effected on any

securities market, over-the-counter market, stock exchange or

otherwise and may be undertaken at any time during the period

commencing on the date of the conditional dealings in the Shares on

the London Stock Exchange and ending no later than 30 calendar days

thereafter. Such stabilisation, if commenced, may be discontinued

at any time without prior notice. However, there will be no

obligation on BofA Merrill Lynch or any of its agents to effect

stabilising transactions and there is no assurance that stabilising

transactions will be undertaken. In no event will measures be taken

to stabilise the market price of the Shares above the offer price.

Except as required by law or regulation, neither BofA Merrill Lynch

nor any of its agents intends to disclose the extent of any

over-allotments made and/or stabilisation transactions conducted in

relation to the Offer.

For the purposes of allowing it to cover short positions

resulting from any such over-allotments and/or from sales of Shares

effected by it during the stabilising period, BofA Merrill Lynch

will enter into over-allotment arrangements pursuant to which BofA

Merrill Lynch may purchase, or procure purchasers for, additional

Shares up to 15 per cent. of the total number of Shares included in

the Offer (the "Over-allotment Shares") at the offer price. The

over-allotment arrangements may be exercised in whole or in part

upon notice by BofA Merrill Lynch at any time on or before the 30th

calendar day after the commencement of conditional dealings in the

Shares on the London Stock Exchange. Any Over-allotment Shares made

available pursuant to the over-allotment arrangements will be made

available on the same terms and conditions as Shares being offered

pursuant to the Offer and will rank pari passu in all respects

with, and form a single class with, all other Shares (including for

all dividends and other distributions declared, made or paid on the

Shares).

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCAKDDKFBKDPBD

(END) Dow Jones Newswires

February 12, 2016 03:01 ET (08:01 GMT)

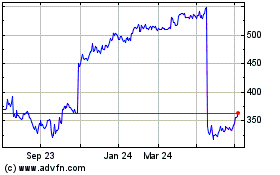

Ascential (LSE:ASCL)

Historical Stock Chart

From Dec 2024 to Jan 2025

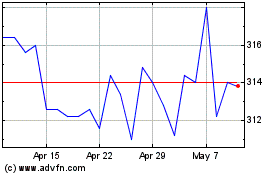

Ascential (LSE:ASCL)

Historical Stock Chart

From Jan 2024 to Jan 2025