TIDMAURA

RNS Number : 4123L

Aura Energy Limited

05 September 2023

Häggån Scoping Study Confirms the Scale and Optionality

of Aura's Critical Minerals Project in Sweden

=========================================================================================================================================================================================

* Scoping Study reveals extraordinary Häggån

scale and optionality

o Vanadium, potash, nickel, molybdenum, zinc and uranium [1] among

a diversified suite of future-facing commodities

o Swedish location positive in light of leadership in the European

resource industry

o 65MT Scoping Study covers less than 3% of Haggan's known 2.0Bn tonne

Mineral Resource Estimate.

* Scoping Study delivers strong project sample for

re-engagement with potential strategic partners

* Scoping Study underpins application for a 25-year

Exploitation Permit

* Sweden is Europe's leading mining and mineral nation,

and its minerals strategy and anticipated legislative

changes will strengthen that position

Processing V(2) SOP Capital NPV NPV IRR Payback

Rate O(5) ktpa US$ million Base Case (incl U3O8)(1) % years

Mtpa ktpa US$ million US$ million

$380 - $1,231 $756 - 1.5

3.5 10.4 217 $592M [2] $1,606 [3] 26-47%(2) to 2.0

---------------- ---------------- ----------------------- ------------------------- -------------------------- --------------------- -------------------

--

=========================================================================================================================================================================================

Aura Energy Limited (ASX: AEE, AIM: AURA) ("Aura" or "the

Company") is pleased to release its Scoping Study for the Häggån

Project ("Häggån" or "the Project") in Sweden.

To view the full Scoping Study for the Häggån Project, please

click here

http://www.rns-pdf.londonstockexchange.com/rns/4123L_1-2023-9-5.pdf

Aura Chairman Philip Mitchell said , "The Scoping Study

underpins our 25-year Exploitation Permit Application and addressed

<3% of the Haggan resource whilst confirming Haggan's scale and

optionality. Haggan's products are crucial to Battery Technology,

Agriculture and potentially with legislative change low carbon,

secure and affordable electricity.

The Swedish Government acknowledges that for Sweden's clean

power system to function, a large part must be readily

dispatchable, and nuclear power is the only non-fossil option. I

noted Sweden's Minister of the Environment's comments to the Times

of London on 18 August 2023 "There was a parliamentary majority

behind lifting Sweden's ban on uranium extraction and opening up by

far the largest deposits in the European Union.

She noted that "Nearly 40 years after the completion of the

country's last new nuclear power plant, Minister Pourmokhtari has

announced plans to build at least ten large reactors to meet an

anticipated surge in demand for zero-carbon power".

She said that while wind and solar power would be important, the

country also needed massive volumes of nuclear-generated

electricity because output can be reliably dialled up or down to

keep the power supply steady through the peaks and troughs of

renewable generation."

"The government is aiming at doubling electricity production in

20 years," Minister Pourmokhtari said. "For our clean power system

to function, a large part of this has to be dispatchable where

nuclear power is the only non-fossil option. Nuclear power also has

a reduced environmental footprint and requires limited

resources in comparison with most energy sources." ([4])

The 65MT Haggan Scoping Study covers <3% of Haggan's known

2.0Bn tonne Mineral Resource Estimate. The Study portends a Tier 1

polymetallic mineral resource providing key minerals for a

transitioning world. The remaining 97% of the resource will be

further studied and offers exciting future prospects including

further study of the potential of rare earth minerals known to

occur in the Alum shales. The Scoping Study will support the

engagement with potential strategic partners in the project."

Aura Managing Director Dave Woodall said "The Häggån ore body is

massive with a richly endowed polymetallic orebody that contains

significant quantities of critical metals that are essential to the

rapidly growing energy transition and agricultural supply chains

including significant quantities of vanadium, potash, uranium, and

base metals. Our project can be integral to the Swedish and

European supply of these critical metals that can significantly

de-risk the energy transition while providing benefits to all

stakeholders.

Our next steps in the Prefeasibility Study will be to further

infill drilling that aims to increase mine life and further enhance

the project economics. "

Figure 1 - Haggan Scoping Study Resource with less than 3% of

the total Mineral Resource Estimate currently included in the

mining plan

The Häggån Project is based on a substantial discovery in the

Jämtland province in central Sweden, with a polymetallic global

Mineral Resource Estimate of 2 billion tonnes at a 0.2% V(2) O(5)

cutoff [5] . While vanadium is a significant driver of Häggån's

value, it contains economically significant volumes of other

strategic metals and minerals including potassium, nickel, zinc,

molybdenum, and uranium. A significant benefit of the polymetallic

deposit is the potential for economically extractable sulphate of

potash (SOP) as a byproduct in the processing.

The Häggån Project is a significant polymetallic deposit that

provides a key growth opportunity for Aura, with the scoping study

using the Indicated Mineral Resource shown in Figure 2, a small

percentage of the global resource. The Scoping Study is the

culmination of a significant package of work, including the 2019

resource upgrade [6] , and provides the Company with a solid

foundation for future growth and to undertake additional work to

assess the path forward in Sweden.

V (2) Class Mt V (2) Mo Ni Zn K Million Mt

O(5) Ore O(5) (2) lbs

Cut-Off O

---------- ------ ------ ---- ---- ---- ----- -------- ------

% % ppm ppm ppm % V (2) K(2)

O(5) O

--------- ---------- ------ ------ ---- ---- ---- ----- -------- ------

0.20 Indicated 42 0.35 217 375 512 4.13 320 1.74

--------- ---------- ------ ------ ---- ---- ---- ----- -------- ------

Inferred 1,963 0.30 212 337 463 3.80 13,010 127.6

--------- ---------- ------ ------ ---- ---- ---- ----- -------- ------

Figure 2 -2019 Häggån Mineral Resource Statement [7]

There is a low level of geological confidence with Inferred

Mineral Resources and there is no certainty that further

exploration work will result in the determination of Indicated

Mineral Resources or that the production target itself will be

realised.

Included in the global resource published on 22 August 2012,

"Outstanding Häggån uranium resource expands to 800 million pounds"

is an Inferred Mineral Resource of 2.35 billion tonnes with U(3)

O(8) grade of 155 ppm at a cut-off of 100 ppm U(3) O(8) , for

contained U(3) O(8) of 800 Mlbs. This information was prepared and

first disclosed under the JORC Code 2004. It has not been updated

since to comply with the JORC Code 2012 on the basis that the

information has not materially changed since it was last

reported.

The Project's major value drivers are vanadium and the key

agricultural by-product sulphate of potash (SOP), with a mixed

sulphide precipitate of nickel, zinc, and molybdenum proposed to be

produced. Uranium is present in the polymetallic resource, like

many deposits in Sweden, and while it can add to the Project's

economic value there exists at present a ban on the mining of

uranium in Sweden. The Scoping Study outlines an option for a

treatment and stabilisation plan that would treat the uranium into

an inert safe waste product for long-term disposal or with approval

from the government and community recover it in the processing

circuit for sale into the domestic and or European markets.

Figure 3 - Distribution of Revenue(2) by product inclusive of

U(3) O(8)

Cautionary Statement

The Scoping Study has been undertaken to ascertain whether a

business case can be made to proceed to more definitive studies on

the viability of the Häggån Project, which is based on the

extraction of vanadium and by-products from the Alum Shale within

the Häggån permits. It is a preliminary technical and economic

study of the potential viability of the Häggån Project and is based

on low-level technical and economic assessments, generally to a

level of +/- 35% accuracy, that is not sufficient to support the

estimation of Ore Reserves or to support any financial investment

or development decision.

Further exploration and evaluation work, test work and studies

are required before the Company will be in a position to estimate

any Ore Reserves, to provide any assurance of an economic

development case, or to provide certainty that the conclusions of

the Scoping Study will be realised.

Prefeasibility and Feasibility studies will be required to

confirm the project viability including drilling to expand the

Indicated Mineral Resource and to establish a Measured Resource,

metallurgical test work and process optimisation, detailed mine

design, mine planning, evaluation of mining methods, engineering,

updated and more accurate capital and operating cost estimates,

environmental studies and permitting, community engagement and the

establishment of ore reserves.

The Company believes it has reasonable grounds to report the

results of the Scoping Study including the forward-looking

statements and the forecast financial information that are based on

the material assumptions outlined in the Scoping Study.

The mine plan on which this Scoping Study is based contains 77%

Indicated Mineral Resources and 23% Inferred Mineral Resources over

the life of the Project. The first 5 years of mining are based on

88% Indicated Mineral Resources, the first 11 years of production

based on 95% Indicated Mineral Resources and thereafter the mine

plan includes increasing amounts of Inferred Mineral Resources. The

Inferred Mineral Resources are not a determining factor in

estimating the viability of the Häggån Project.

The Project is viable on the basis of the Indicated Mineral

Resources and the payback period of the Project of between 1.5 and

2.0 years is also based purely on the Indicated Mineral

Resources.

There is a low level of geological confidence with Inferred

Mineral Resources and there is no certainty that further

exploration work will result in the determination of Indicated

Mineral Resources or that the production target itself will be

realised.

Metallurgical recoveries used in this Scoping Study are based on

test work results for the key stages of the process flowsheet.

The Scoping Study is based on the material assumptions outlined

in the Scoping Study. These include assumptions about the

availability of funding. While the Company considers all the

material assumptions to be based on reasonable grounds, there is no

certainty that they will prove to be correct or that the outcomes

anticipated by the Scoping Study will be achieved.

To achieve the outcomes of the Scoping Study, funding in the

order of US$592 million is estimated to be required for the Project

development capital with an expected construction period of 3

years, in addition to pre-development funding of approximately

US$15 million to convert the Mineral Resources to an Ore Reserve

and to complete a Prefeasibility and a Feasibility Study. Investors

should note that there is no certainty that the Company will be

able to raise that amount of funding when needed. It is also

possible that such funding may only be available on terms that may

be dilutive to or otherwise affect the value of the Company's

existing shares. It is also possible that Aura could pursue other

'value realisation' strategies, such as direct financing into the

Häggån Project via a joint venture or partial sale. If it does,

this could materially reduce Aura's proportionate ownership of the

Project.

Given the uncertainties involved, investors should not make

investment decisions based solely on the results of this Scoping

Study

Scoping Study highlights:

-- A projected post-tax net present value ('NPV') ranging from

US $380 - $ 1,231 million [8] , depending on final plant

configuration and forward price assumptions.

-- A post-tax Internal Rate of Return of 26% to 47% and a payback period of 1.5 to 2.0 yrs.

-- Initial capital cost of US$592M would aim to generate an

operating cash flow of between US$140M to US$270M per annum.

-- Häggån currently has defined a global Mineral Resource

Estimate of 2 billion tonnes at an average grade of 0.3% V(2) O(5)

, containing 13.3 billion lbs V(2) O(5) , at a 0.2% V(2) O(5)

cutoff [9] .

-- The Base Case scenario proposes mining the high-grade zone at

5.9Mtpa producing approximately:

o 10,400 tpa V(2) O(5) high-quality vanadium flake.

o 217,000 tpa sulphate of potash (SOP) by-product for sale as

fertiliser.

o 3,000 tpa Mixed sulphide product.

The Scoping Study is based on the material assumptions outlined

in the Scoping Study.

Aura recognises the potential value that could be unlocked from

Häggån's should uranium be recovered in an alternative

configuration to the planned processing path. The Scoping Study

analyses the potential value that could be unlocked should Häggån's

uranium be extracted and sold, subject to changes in Swedish

legislation and demonstration that the proposed operation will not

impact the water quality or the environment. Aura continues to work

with the Swedish Government, local community and relevant

authorities and notes recent Swedish Government support for the

removal of the uranium mining ban. The Swedish parliament also

recently adopted a new energy target, changing from a "100%

renewable" target to a "100% fossil-free" electricity target, which

opened the door for increasing electricity generation from nuclear

power. [10]

This shift in government tone has been a consistent narrative

since the election of the coalition of government in September

2022. The new government came to power with a policy proposal to

lift the uranium mining ban.

Formal implementation of the legislation to change the policy is

progressing through the normal parliamentary process, with

appropriate drafting and review underway [11] .

The release of this Scoping Study provides a critical part of

the information that is required for the application of an

exploitation concession for the development of the Project and

expanding consultation with all stakeholders at the national,

regional, and community levels, critically with traditional

inhabitants, the Sami people.

Next Steps

Following the positive outcome of this Scoping Study, Aura plans

to progress the Häggån Project with the application for an

exploitation concession. This work will include:

-- The commencement of baseline flora, fauna and water studies.

These will be done using independent consultants and will be shared

with the community to ensure transparency and collaboration with

the project,

-- Undertake a Pre-Feasibility Study ('PFS') including further

resource and infill drilling, geotechnical and hydrogeological

investigations, preliminary pit design scheduling options, and more

detailed metallurgical test work, to further assess options, reduce

risk and better define the Project, and

-- Commence discussions with preferred strategic partners with

financial capability to advance this world-class project.

This announcement has been authorised by the Board of Aura

Energy Limited.

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by

the Company to constitute

inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014 as it forms

part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ('MAR'). Upon the

publication of this announcement via Regulatory Information

Service ('RIS'), this inside information

is now considered to be in the public domain.

For further information, please contact:

David Woodall Paul Ryan

Managing Director and CEO Citadel-MAGNUS

Aura Energy Limited Investor & Media Relations

info@auraenergy.com.au pryan@citadelmagnus.com

+61 409 296 511

SP Angel Corporate Finance LLP WH Ireland Limited

(Nominated Advisor and Joint (Joint Broker)

Broker) James Bavister

David Hignell Andrew de Andrade

Kasia Brzozowska +44 (0) 207 220 1666

+44 (0) 203 470 0470

----------------------------

About Aura Energy (ASX: AEE, AIM: AURA)

Aura Energy is an Australian-based minerals company that has

major uranium and battery metals projects with large resources in

both Africa and Europe. The Company is primarily focused on

progressing the development to commence uranium production from the

Tiris Project, a major greenfield uranium discovery in

Mauritania.

A recent Enhanced Feasibility Study at Tiris has increased the

project NPV significantly reconfirming the project as one of the

lowest capex, lowest operating cost uranium projects that remain

undeveloped in the world.

A Scoping Study into the Häggån Project in Sweden has outlined

compelling economic value. Aura plans to follow up this study with

further exploration to lift the Resource categorisation alongside

close collaboration with the community surrounding the project to

foster support to proceed.

Aura will continue to transition from a uranium explorer to a

uranium producer, to capitalise on the rapidly growing demand for

nuclear power as the world continues to shift towards a

decarbonised energy sector.

Disclaimer Regarding Forward-Looking Statements

This ASX announcement (including the Scoping Study) contains

various forward-looking statements. Forward-looking statements

include but are not limited to statements concerning Aura Energy

Limited's planned activities and other statements that are not

historical facts. When used in this report, words such as "could",

"plan", "estimate", "expect", "intend", "may", "potential",

"should" and similar expressions are forward-looking statements. In

addition, summaries of Exploration Results and estimates of Mineral

Resources and Ore Reserves could also be forward-looking

statements. Although Aura Energy Limited believes that its

expectations reflected in these forward-looking statements are

reasonable, such statements involve risks and uncertainties and no

assurance can be given that actual results will be consistent with

these forward-looking statements. The entity confirms that it is

not aware of any new information or data that materially affects

the information included in this announcement and that all material

assumptions and technical parameters underpinning this announcement

continue to apply and have not materially changed. Nothing in this

report should be construed as either an offer to sell or a

solicitation to buy or sell Aura Energy Limited securities. For

more information of specific risks associated with forward looking

statements refer to the Key Risks section of the Scoping Study.

Competent Person Statements

Resource Modelling

The Competent Person for the 2012 Häggån Mineral Resource

Estimate and classification, updated in 2019, is Mr Arnold van der

Heyden of H&S Consultants Pty Ltd. The information in the

report to which this statement is attached that relates to the 2019

Resource Estimate is based on information compiled under the

supervision of Mr Arnold van der Heyden, who has sufficient

experience that is relevant to the resource estimation. This

qualifies Mr van der Heyden as a Competent Person as defined in the

2012 edition of the 'Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves'. Mr van der Heyden is

a consultant and director of H&S Consultants Pty Ltd, a

Sydney-based geological consulting firm. Mr van der Heyden is a

Member and Chartered Professional of The Australasian Institute of

Mining and Metallurgy (AusIMM) and consents to the inclusion in the

report of the matters based on his information in the form and

context in which it appears.

The information in this announcement that relates to estimated

Mineral Resources underpinning the production targets and the

forecast financial information derived from the production targets

for Häggån Project were initially reported by the Company in the

announcement entitled "Häggån Battery Metal Project Resource

Upgrade Estimate Successfully Completed" dated 10 October 2019. The

Company confirms that it is not aware of any new information or

data that materially affects the information included in the

original market announcement and that all material assumptions and

technical parameters underpinning the Mineral Resources Estimates

in the market announcement continue to apply and have not

materially changed. The Company confirms that the form and context

in which the Competent Person's findings are presented have not

been materially modified from the original market announcement.

The Competent Person for drill hole data, cut-off grade and

prospects for eventual economic extraction is Mr Neil Clifford. The

information in the Scoping Study to which this statement is

attached that relates to drill hole data, cut-off grade and

prospects for eventual economic extraction is based on information

compiled by Mr Neil Clifford. Mr Clifford has sufficient experience

that is relevant to the style of mineralisation and type of deposit

under consideration and to the activity which he is undertaking.

This qualifies Mr Clifford as a Competent Person as defined in the

2012 edition of the 'Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves'. Mr Clifford is an

independent consultant to Aura Energy. Mr Clifford is a Member of

the Australasian Institute of Mining and Metallurgy (AusIMM). Mr

Clifford consents to the inclusion in the Scoping Study of the

matters based on his information in the form and context in which

it appears.

Metallurgical Test Work Outcomes

The Competent Person for the Häggån Metallurgical Test Work is

Dr Will Goodall. Dr Goodall is Chief Development Officer with Aura

Energy Ltd. The information in the report to which this statement

is attached that relates to the test work is based on information

compiled by Dr Will Goodall. Dr Goodall has sufficient experience

that is relevant to the test work program and to the activity which

he is undertaking. This qualifies Dr Goodall as a Competent

Personas defined in the 2012 edition of the 'Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore

Reserves'. Dr Goodall is a Member of The Australasian Institute of

Mining and Metallurgy (AusIMM). Dr Goodall consents to the

inclusion in the Scoping Study of the matters based on his

information in the form and context in which it appears.

Reasonable Basis for Forward-Looking Statements

No Ore Reserve has been declared in the Scoping Study. This ASX

release has been prepared in compliance with the JORC Code (2012)

and the ASX Listing Rules. All material assumptions on which the

Scoping Study production target and projected financial information

are based have been included in this release (including the

attached Scoping Study). Consideration of Modifying Factors in the

format specified by JORC Code (2012) Table 1, Section 4 is attached

to the Scoping Study.

[1] This recognises the uranium ban is still in place, with the

present government's stated aim to remove the ban.

[2] V(2) O(5) price of between US$7.0/lb and $13/lb, SOP price

of US$650/t K(2) O, a Nickel price of US$20,000/t, Mo price of

US$51,000/t and Zn price of US$2,500/t, with 70% payability for

base metal units.

[3] V(2) O(5) price of between US$7.0/lb and $13/lb, SOP price

of US$650/t K(2) O, U(3) O(8) price of US$65/lb, a Nickel price of

US$20,000/t, Mo price of US$51,000/t and Zn price of US$2,500/t,

with 70% payability for base metal units. Subject to anticipated

Swedish legislative change

[4] The Times - Sweden to return to uranium mining

2023-08-18

[5] ASX Release: Häggån Battery Metal Project Resource Upgrade

Estimate Successfully Completed, 10 October 2019

[6] ASX Release: Häggån Battery Metal Project Resource Upgrade

Estimate Successfully Completed, 10 October 2019

[7] ASX Release: Häggån Battery Metal Project Resource Upgrade

Estimate Successfully Completed, 10 October 2019

[8] 2 V(2) O(5) price of between US$7.0/lb and $13/lb, SOP price

of US$650/t K(2) O, U(3) O(8) price of US$65/lb, a Nickel price of

US$20,000/t, Mo price of US$51,000/t and Zn price of US$2,500/t,

with 70% payability for base metal units.

[9] ASX Release: Häggån Battery Metal Project Resource Upgrade

Estimate Successfully Completed, 10 October 2019

[10]

https://www.euractiv.com/section/energy-environment/news/sweden-adopts-100-fossil-free-energy-target-easing-way-for-nuclear/

[11] The Times - Sweden to return to uranium mining

2023-08-18

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLEAXNSEELDEEA

(END) Dow Jones Newswires

September 05, 2023 03:07 ET (07:07 GMT)

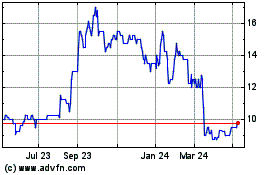

Aura Energy (LSE:AURA)

Historical Stock Chart

From Dec 2024 to Jan 2025

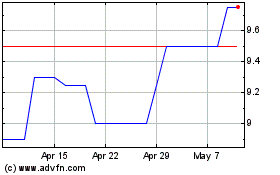

Aura Energy (LSE:AURA)

Historical Stock Chart

From Jan 2024 to Jan 2025