TIDMAVG

RNS Number : 6166Q

Avingtrans PLC

22 February 2023

22 February 2023

Avingtrans Plc

("Avingtrans", the "Company", or the "Group")

Interim results for the six months ended 30 November 2022

Avingtrans PLC (AIM: AVG), the international engineering group

which designs, manufactures and supplies original equipment,

systems and associated aftermarket services to the energy, medical

and industrial sectors, today announces its interim results for the

six months ended 30 November 2022.

Financial Highlights

-- Group Revenue increased to GBP50.0m (2022 H1: GBP44.5m)

in line with management expectations.

-- Gross Margin reduced marginally to 32.6% (2022 H1: 33.9%)

as a result of OEM versus aftermarket mix

-- Adj.*EBITDA increased by 11.4% to GBP6.4m, as a result

of higher revenues (2022 H1: GBP5.7m)

-- Adj.*EBITDA margin 12.8% (2022 H1: 12.9%)

-- Adj. Profit before tax GBP4.0m (2022 H1: GBP3.8m)

-- Adj. Diluted Earnings Per Share from continuing operations

increased to 10.8p (2022 H1:10.2p)

-- Cash inflow from operating activities of GBP4.1m (2022

H1: GBP4.0m)

-- Net cash (excluding IFRS16 debt) at 30 November of GBP17.3m,

(31 May 2022: GBP16.7m) after further investments in Magnetica,

Adaptix and working capital, due to on-going supply chain

disruption effects.

-- Interim Dividend of 1.7 pence per share (2022 H1: 1.6 pence)

*Adjusted to add back amortisation of intangibles from business

combinations, acquisition costs and exceptional items and

discontinued operations.

Operational Highlights

-- Investments at Hayward Tyler, Energy Steel and Booth continue

to bear fruit

-- Order book: stronger than average across the Group:

- Order cover for FY23 is over 90%, at the end of January

2023

- Nuclear sector orders and prospects increasing, especially

in the USA

-- PIE strategy (Pinpoint-Invest-Exit) for organic growth

and added value through M&A

- Exciting potential for Medical in compact, helium-free

MRI and 3D X-ray systems

- Post period end - further Magnetica investment round

completed, as planned

- Further GBP2.0m convertible loan investment in Adaptix

3D X-ray

- Planned exit of HT Luton site - continuing to pursue,

but progress is slow

- Post period end, Ormandy acquired the assets of competitors

HEVAC and HES for GBP852k

Commenting on the results, Roger McDowell, Chairman, said:

"Our proven Pinpoint-Invest-Exit ("PIE") model has once again

delivered robust results in the period, exhibited by increased

revenue and consistent gross margins, despite inflationary

pressures and supply chain instabilities, to deliver a double digit

% rising adjusted EBITDA.

"The Group continues to invest across its three divisions, with

a focus on the global energy and medical markets, to position them

for maximum shareholder value, by means of exits in the years to

come. The MRI system development at Magnetica and 3D X-ray system

development at Adaptix are proceeding to plan. We are witnessing

on-going improvements in other business units, such as at Booth, as

again demonstrated by the first half results. Our value creation

targets continue to be accomplished as anticipated and are

underpinned by a conservative approach to debt, which we see as

critical during a period of on-going economic challenges.

"Our markets are continuously evolving and strategic M&A

opportunities remain a priority for Avingtrans. Businesses like

ours can command high valuations at the point of exit. Whilst the

Board remains vigilant in the current environment, we are confident

about the current direction and potential future opportunities

across our markets.

"Strong order intake and timing of contract revenue recognition

has provided management with good visibility over H2 2023 revenue

and profits, on-going supply chain disruptions notwithstanding.

Therefore, the Board remains cautiously confident about achieving

full year market expectations."

Enquiries:

Avingtrans plc

Roger McDowell, Chairman

Steve McQuillan, Chief Executive Officer

Stephen King, Chief Financial Officer 0135 469 2391

Singer Capital Markets (Nominated Adviser

and Broker)

Shaun Dobson / Alex Bond / Oliver Platts 020 7496 3000

IFC Advisory (Financial PR)

Graham Herring / Tim Metcalfe / Zach

Cohen 0203 934 6630

Avingtrans business units

Hayward Tyler - Luton & East Kilbride, UK and USA, China and

India

Specialises in the design, manufacture and servicing of

performance-critical motors and pumps for challenging

environments.

Energy Steel, Inc - Rochester Hills, Michigan, USA

Provider of custom fabrications for the nuclear industry,

specialising in: OEM parts obsolescence; custom fabrications;

engineering design solutions; product refurbishment; on-site

technical support.

Stainless Metalcraft Ltd - Chatteris, UK and Chengdu, China

Provider of safety-critical equipment for the energy, medical,

science and research communities, worldwide, specialising in

precision pressure and vacuum vessels and associated fabrications,

sub-assemblies and systems.

Booth Industries - Bolton, UK

Designs, manufactures, installs and services doors and walls

which can be tailored to be: blast & explosion proof;

fireproof; acoustically shielded; high security/safety; or

combinations of the above.

Ormandy Group, Bradford, UK

Design, manufacturers and servicing of off-site plant, heat

exchangers and other HVAC (heating, ventilation and air

conditioning) products

Composite Products Ltd - Buckingham, UK

Centre for composite technology, parts and assemblies, serving

customers in industrial markets.

Magnetica Ltd - Brisbane, Australia

Magnetica Limited specialises in the development of next

generation MRI technologies, including dedicated extremity MRI

systems and MRI system components. Magnetica has successfully built

and tested a compact, integrated 3 Tesla orthopaedic MRI system,

demonstrating clinical-quality imaging. Commercialisation of this

system (and others) is on-going. Magnetica's structure now includes

two other business units:

Scientific Magnetics - Abingdon, UK

Designs and manufactures superconducting magnet systems and

associated cryogenics for a variety of markets including MRI and

provides services for Nuclear Magnetic Resonance instruments.

Tecmag Inc - Houston, USA

Designs, manufactures and installs instrumentation, including

consoles, system upgrades, and probes, mainly for Magnetic

Resonance Imaging (MRI) and Nuclear Magnetic Resonance (NMR)

systems.

Chairman's Statement

We are once again pleased to be able to report a healthy first

half performance by Avingtrans, despite the combined impact of

on-going supply chain disruptions driven by the Russia / Ukraine

conflict and the aftermath of Covid. A solid revenue performance

versus H1 FY22 has again been enhanced by an improved EBITDA

result, mainly due to increased revenue and profit in the EPM

division. The gross margin percentage reduced modestly year on

year, due to increased OEM sales in the mix. Gratifyingly, net cash

was marginally ahead of the year end position, even after further

investments in Magnetica, Adaptix and working capital expenditure,

to mitigate supply chain issues. Order cover for FY23 remains

robust across all divisions.

Our proven Pinpoint-Invest-Exit ("PIE") model continues to

deliver results, with Booth and Energy Steel continuing to improve.

Our medical imaging strategy continues to advance with the

Magnetica teams making good progress with the design and build of

our own compact MRI product for the orthopaedics market. The

prospects for this new entity are exciting and, post period end, we

committed to a further investment in Magnetica, which will take our

overall stake to over 74%. We also made a further investment of

GBP2m in Adaptix, via a loan note and, post period end, we were

delighted to hear that their 3D X-ray system for orthopaedics was

awarded 510(k)(1) approval by the FDA in the USA. As a corollary,

we have now completed our exit from third party MRI component

manufacture in China. Also post period end, Ormandy acquired the

assets of local competitor businesses HEVAC and HES for GBP852k and

will integrate this business into its existing Bradford site.

The divisional management teams have shown fortitude in tackling

the significant supply chain disruption issues which have affected

us across the Group and we note some early signs of these issues

easing. Our aftermarket plans continue to progress positively in

EPM and PSRE, as we seek to outperform our competitors by winning a

larger share of the installed base service and support business,

both for our products and those of third parties. The improved

end-user access provides a predictable and repeatable pipeline and

enhances profitability. We remain keen to maximise the revenue

opportunities arising from the aftermarket access afforded by our

own businesses and through partnership deals.

The Engineered Pumps and Motors (EPM) division saw a first half

revenue rebound by 16.8% year-on-year, despite the supply chain

disruptions. Divisional margins also increased with Energy Steel's

performance being sustained and further improvements expected by

the year end. Although the Luton site sale process has been

frustrated, first by the pandemic and now by the current economic

challenges, the negotiations are on-going.

Process Solutions and Rotating Equipment (PSRE) reported more

modest growth in revenue in H1, with divisional EBITDA consistent

year-on-year, following a large jump in FY22. Booth's pleasing

trajectory continues, with the record order book being complemented

by steadily increasing revenues and profits. Year-on-year profits

were also up modestly at Ormandy. The Sellafield 3M3 box contract

is now solidly into its second phase at Metalcraft, with a steady

flow of boxes being delivered each month. Composite Products' first

half was subdued but there was no material impact on the

division.

Meanwhile, in the Medical division, Magnetica has made steady

progress in the development of its compact MRI system, which we

expect to launch at the end of 2023. As noted above, post period

end, we completed the latest fund-raising process for Magnetica and

we made a further investment in Adaptix. Both businesses are

targeting market sectors which currently lack effective MRI and

X-ray solutions, such as orthopaedics and veterinary

applications.

Following another solid performance, the Board is declaring an

increase in the interim dividend of 6%, to 1.7 pence per share,

demonstrating our continuing commitment to provide long term

shareholder returns. Our positive view of Group prospects,

supported by our prudent fiscal stance, underpins this

decision.

In conclusion, the Board would like to thank all Avingtrans

employees for their determination and resilience during another

challenging period. We look forward with guarded optimism and are

enthusiastic about the period to come.

Note 1: A 510(k) is a premarket submission made to the FDA in

the USA, to demonstrate that the device to be marketed is as safe

and effective

Roger McDowell

Chairman

21 February 2023

Strategy and business review

Group Performance

Avingtrans has a proven Pinpoint-Invest-Exit (PIE) business

model, which drives improvements in design, original equipment

manufacturing (OEM) and associated aftermarket services, affording

the Group an improving margin mix, both in the near and longer

term. The Group has progressively shifted to a product-based

strategy over time, away from "build to print". Our Energy

divisions, comprising Engineered Pumps and Motors and Process

Solutions and Rotating Equipment, form the bulk of Avingtrans'

operations. Effective longer-term development of the Group's

smaller Medical Imaging division is also a core focus for

management to create shareholder value.

Strategy

Avingtrans is an international precision engineering group,

operating in differentiated, specialist markets, within the supply

chains of many of the world's best known engineering original

equipment manufacturers (OEMs), as well as positioning itself as an

OEM to end users. Our core strategy is to build market-leading

niche positions in our chosen market sectors - currently focused on

the Energy and Medical sectors. Over the longer term, our

acquisition strategy has enabled our businesses to develop the

critical mass necessary to achieve leadership in our chosen

markets.

Our strategy remains consistent with previous statements. The

Group's unrelenting objective is to continue the proven strategy of

"buy and build" in regulated engineering markets, where we see

consolidation opportunities, potentially leading to significantly

increased shareholder returns over the medium to long term. At the

appropriate time, we will seek to crystallise these gains with

periodic sales of businesses at advantageous valuations and return

the proceeds to shareholders. We call this strategy PIE -

"Pinpoint-Invest-Exit". Previous transactions, such as the disposal

of Peter Brotherhood in 2021, have clearly demonstrated the success

of this approach, producing substantial increases in shareholder

value. We have built strong brands and value from smaller

constituent parts; we have demonstrated well-developed deal-making

skills and prudence in the acquisition of new assets.

The Board continues to focus on improvements in Hayward Tyler's

operations, along with driving the performance of Booth, Metalcraft

and Energy Steel. This programme is progressing to plan. We are

also focused on the opportunity to transform the medical imaging

division's performance, thanks to the merger of Magnetica with

Scientific Magnetics and Tecmag, as well as the more recent

investments in Adaptix. The objective for the Group is to become a

leading supplier in targeted energy and medical markets, of

operation critical products and services, with a reputation for

high quality and delivery on-time and on-budget. The Group has

production facilities in its three key geographical markets (the

Americas, Asia and Europe) with lower cost facilities in Asia,

where appropriate and product development and realisation in the

UK, the USA and Australia. The Group will continue to invest in

breakthrough and disruptive technologies in the energy and medical

markets.

Avingtrans' primary focus in Energy is the nuclear sector -

harvesting opportunities in decommissioning, life extension and

next generation nuclear markets. We are also engaged with a variety

of other niches in the renewable energy sector. The Directors will

continue to build on our footprint in the wider power and energy

sectors.

Following the HTG acquisition in 2017, in order to maximise long

term shareholder value via our PIE model, we reorganised the Energy

assets of the Group into two distinct divisions, currently

comprising:

-- Engineered Pumps and Motors (EPM) consisting of Hayward

Tyler's units in the UK (in Luton and East Kilbride), USA

(in Vermont and Michigan), China and India.

-- Process Solutions and Rotating Equipment (PSRE) consisting

of Metalcraft, Ormandy, Composite Products and Booth Industries.

In parallel, the focus of the Group's Medical Imaging division

(MII) has fully pivoted to becoming a market leader in the

production of compact, superconducting, cryogen-free MRI systems,

targeted at specific applications including orthopaedic imaging and

veterinary imaging. Production of certain existing products

continues to support the division overall. Metalcraft has completed

a phased exit of third-party MRI component manufacturing. This

division now consists of Magnetica in Australia (the majority stake

was acquired in January 2021) which has been successfully

integrated with Scientific Magnetics, UK and Tecmag in the USA.

Subsequently, we have sought to further strengthen our medical

imaging strategy, via investments in Adaptix 3D X-ray technology,

in Oxford, UK.

Our businesses have the capability to engineer products in

developed markets and to produce those products partly, or wholly,

in low-cost-countries, where appropriate. This allows us and our

customers to access low-cost sourcing at minimum risk, as well as

positioning us neatly in the development of the Chinese, Indian and

other Asian markets for our products. Hayward Tyler is well

established in China and India, providing integrated supply chain

options for our blue-chip customers.

A central strategic theme for Avingtrans is to proactively

nurture and grow the proportion of our business stemming from

aftersales. In trojan horse fashion, we are targeting both our own

installed base and the wider competitive installed bases of such

equipment, in areas where we can offer an advantage to our end-user

customers. This focus now applies mainly to our Energy businesses,

with the Medical division having pivoted to new medical imaging

products and services.

Energy - Engineered Pumps and Motors ("EPM")

For Hayward Tyler ("HT"), the main priorities remain to

strengthen the aftermarket capabilities - so often the Achilles

heel of engineering businesses - and to maximise opportunities in

the nuclear life extension market. Whilst the division continues to

suffer from supply chain disruptions, EPM was nevertheless able to

deliver a robust result in H1, with a strong order book and

prospects for the year ahead.

At HT Luton, aftermarket activities remain the focus, including

the servicing of third-party equipment. The GBP10m contract in

Sweden with Vattenfall for the Forsmark plant (for nuclear life

extension) was completed in the period and the cash was collected

by period end. Further defence orders have been received and are

being executed on target.

Hydrocarbon related orders saw a significant bounce back as the

UK North Sea sector reopened for business. We are still doggedly

progressing with the sale of the Luton site, albeit that this

process has, as previously noted, been elongated by Covid-19 and

the economic downturn.

The HT Fluid Handling business in Scotland has been a

consistently good performer since acquisition and has fitted well

into our ambitions to build a wider nuclear capability. The

business has maintained a strong order book and the bolt-on

acquisition of Transkem (a specialist in industrial mixers) has

gone to plan.

HT Inc in Vermont (USA) again suffered from on-going supply

chain disruptions, but it was able to make good progress on the

previously booked KHNP orders in the period. The business continues

to see solid order intake in the nuclear life extension market in

the USA. HT Inc's new R&D opportunities in next generation

nuclear power have made good progress, with further TerraPower

prototype products shipped in the period.

HT Kunshan (China) has been less affected by supply chain issues

and has developed a healthy order book, including an improving

position in the aftermarket business, with new orders coming from

Chinese electricity producers working on reducing the environmental

impact of electricity production.

In India, the local team delivered a solid H1 performance.

Energy Steel ('ES') in Michigan (USA), continues to steadily

improve, with some significant new orders confirmed in the period,

notably from ITER. ES is now well settled-in to its new building in

Rochester Hills, having exited the previous building at the end of

FY21.

Energy - Process Solutions and Rotating Equipment ("PSRE")

PSRE is equally focused on the aftermarket where feasible, which

has gradually improved the margin mix. Following a jump in

performance last year, PSRE was also affected by supply chain

disruptions in H1, resulting in a relatively flat, if consistent

performance outcome versus H1 of FY22, although the division

expects to see improvement in H2.

Metalcraft has made good progress with Phase 2 of the Sellafield

3M3 ("three-cubic-metres") box contract, now worth GBP70m in total

over the next six years. The next follow-on 3M3 box contract

tender, expected to be worth over GBP900m, is now expected to be

tendered in 2025 by Sellafield. At the Chatteris site, construction

of the new training centre was completed in the period and the

first intake of apprentices commenced on time. This is a landmark

building for the town and a boost for local apprenticeships, which

dovetails neatly with the Government's "levelling-up" agenda.

Metalcraft in China has wrapped-up its activities for Siemens on

MRI component supply.

Ormandy's performance was again solid in the period and order

intake remains strong. Post period end, Ormandy acquired the assets

of HEVAC and HES for GBP852k. The plan is to integrate the majority

of the HEVAC employees into the Ormandy site, which is expected to

produce cost savings and thus return HEVAC to profit.

Booth Industries maintained a strong growth trajectory. Booth

has a record order book, including the GBP36m order for HS2

cross-tunnel doors. This project reached a key milestone recently,

with approval of the door design by HS2. The new building extension

in Bolton (Project Apollo) is fully operational and it incorporates

a range of energy saving measures, in contrast to the earlier, more

spartan facilities.

Finally, Composite Products had a relatively subdued first half,

with some supply chain issues and customer induced delays holding

back results, although the impact on the Group was not

material.

Medical and Industrial Imaging ("MII")

Magnetica, Scientific Magnetics (SciMag) and Tecmag are working

effectively together to make good progress on our promethean

development of compact, superconducting, helium-free MRI systems

entirely in-house. Magnetica remains broadly on track to launch its

first orthopaedic product later in calendar Q4 2023, as

planned.

Our initial estimate of the addressable orthopaedic imaging

market is circa GBP400m p.a. (approximately 10% of the total MRI

hardware and service market). However, our intended "pay per scan"

business model could mean that the opportunity is significantly

larger. It is more difficult to quantify other potential market

segments (e.g. veterinary imaging) at this stage because

equivalent, dedicated products do not exist. In the latest

investment round, which completed post period end, Avingtrans

committed to increase its investment in Magnetica, which will

ultimately increase its shareholding to c74% of the issued share

capital. We believe that materially reducing the size and total

costs of these dedicated MRI systems, coupled with them being much

easier to set up in a variety of locations, as well as increasing

the scan rate by up to 300%, will produce a compelling sales

proposition. In addition, these dedicated systems could free-up

capacity on the existing MRI system installed base, which should be

a major benefit to healthcare organisations.

SciMag and Tecmag will rebrand to Magnetica in due course, to

present a seamless image of the new entity. However, there is still

merit in continuing with various existing products and services at

SciMag and Tecmag, so long as they do not detract from our core

vision for MRI, which holds out the prospect of materially

increasing the value of Magnetica over the coming years. Orders for

existing SciMag and Tecmag products held up well in the period.

In the half, Avingtrans made a further investment of GBP2.0m in

Adaptix, Oxford, UK, via a convertible loan note, on favourable

terms. This brings the total investment in Adaptix to GBP6m.

Adaptix launched its compact 3D x-ray system for orthopaedics in

the USA late in 2022, to an encouraging market response.

Post-period end, Adaptix received its so called 510(k) approval to

sell the product in the USA, from the FDA. The strategies of

Magnetica and Adaptix are convergent, and we see potentially large

benefits in combining their approaches to market in technology,

software and distribution channels amongst others.

Markets - Energy

The global demand for energy experienced a hiatus during the

pandemic but we are seeing a consistent return to growth. According

to a recent report by BP, the effect of the pandemic and the Russia

/ Ukraine conflict may be to drive the world faster towards

increased efficiency and decarbonisation. This trend could benefit

our businesses in the nuclear and renewables sectors.

End User/Aftermarket

Operators and end-users demand a blend of quick response through

local support and a requirement to drive improvements through

equipment upgrades and modernisation. In the West, where facilities

are being operated for longer than their intended design lives,

there is a strong demand for solution providers in the supply chain

to partner with end-users for the longer term. The Avingtrans

energy divisions are well positioned to grow in this end-user

market space.

Nuclear

As a result of the Russia / Ukraine conflict, global government

attitudes to nuclear power have risen, phoenix-like, from the ashes

of previous perceived energy security. Nevertheless, nuclear

energy, as a low carbon, baseload power source, remains an

asymmetric market with respect to future growth. Almost all the

1GW+ new build opportunities are currently in Asia, with the

exception of the limited UK and proposed French programmes.

However, certain market segments remain robust, including

supporting the operational fleet, continued safe operation and life

extensions, decommissioning and reprocessing. We are also working

on the long-term development of the next generation of

technologies, such as Small Modular Reactors (SMRs), or Advanced

Generation IV Reactors - eg with TerraPower, USA. In addition,

these segments have a consolidating supply chain and a lack of

expert knowledge. The USA still operates the biggest civil nuclear

fleet in the world, with 92 reactors generating around 30 percent

of the world's nuclear electricity. Coupled with the heritage

Westinghouse technology operating in Europe and Asia, the EPM

division's long-standing position in this market provides

opportunities for further growth. Obsolescence and life extension

are key issues for nuclear operators worldwide and the Avingtrans

Energy Divisions are well positioned to support operators in

addressing this critical risk. Energy Steel bolsters the Group's

capabilities in this regard.

The UK remains pre-eminent when it comes to decommissioning, in

terms of innovative technology and overall spend. The Group is

embedded in the future manufacture of waste containers for

Sellafield and will continue to expand its presence in the UK and

globally in the long term. The development of new nuclear

technologies is ongoing, with pockets of activity in the UK, South

Korea, the USA and China dominating development activity. The Group

views these new technologies as an attractive route forward and is

well positioned to develop as a global industry partner.

Power Generation

The world continues to electrify, with an increasing amount of

primary energy going to the power sector, which remains a key focus

across the Group's energy divisions. Aside from nuclear, the main

sub-sectors include:

-- Coal - the Group continues to see good aftermarket activity

from coal fired power stations even though the demand for

new power stations is in decline globally. Opportunities

still exist in India, China, Southeast Asia, Eastern Europe

and the Middle East. EPM is putting products into new applications,

eg - scrubbers, to reduce emissions from power stations.

-- Gas - natural gas, primarily in the form of combined cycle

gas turbine power plants is a growing market space, primarily

in the West. The Group is moving into this market with both

existing and new product lines.

-- Renewables - renewable technologies and their supporting

infrastructure are a growing market globally. The Group

has a range of products that can be applied directly to

this market segment and has expertise that can be used to

develop new products for parts of this market, such as molten

salt for concentrated solar power applications.

Hydrocarbons

As oil demand has picked up following both the pandemic easing

and then being driven by the Russia / Ukraine conflict, so the oil

price has followed - and the Brent crude price is now trading in

the range of $75 to $85 per barrel. As a result, new capital

expenditure in this sector has begun to recover but our forecasts

remain prudent, although we continue to see momentum building in

aftermarket orders.

Markets - Medical

The diagnostic imaging market is a large global sector,

dominated by a few large systems manufacturers. In 2022, the total

Diagnostic Imaging Market was estimated to be worth $32.3bn,

according to Grand View Research and is expected to continue to

grow at almost 5% per annum until 2030. The largest market is the

USA, followed by Europe and Japan. The fastest growing markets are

China and India.

After the acquisition of a majority stake in Magnetica (AUS) in

January 2021, we merged Magnetica with Scientific Magnetics (UK)

and Tecmag (US), to create an innovative, niche-MRI systems

supplier, which can address specific parts of the market, not well

served by dedicated products at present. This includes, for

example, orthopaedic and veterinary imaging. Although Magnetica is

primarily targeting the Magnetic Resonance Imaging (MRI) market,

Nuclear Magnetic Resonance (NMR) and magnets for physics continue

to be of interest, due to the similar requirements for

spectrometers, superconducting magnets and cryogenics. Market

drivers for MRI include: an increased incidence of chronic

diseases; the rise in geriatric populations; growing awareness

about early benefits of diagnosis; and the introduction of advanced

systems with superior image quality.

According to ResearchAndMarkets, MRI itself is approximately 19%

by value of the total diagnostic Imaging market and is projected to

grow at 5.0% p.a. In the period, our initial investment in Adaptix

allowed us access to the X-ray segment of diagnostic imaging. X-ray

itself represents circa 33% of the total market. For both Magnetica

and Adaptix, the portion of the X-ray and MRI markets we believe we

can access is over 20% of the total, representing a potential

addressable market of over $3bn.

End User/Aftermarket

The MRI market segment is dominated by a handful of

manufacturers, including titans like GE, Siemens, Philips and

Canon, who account for circa 80% of revenue globally. These players

also dominate the aftermarket, although there are a few independent

MRI service businesses in existence. Magnetica and Adaptix are not

present in the MRI aftermarket at this time but both will naturally

service the aftermarket for their own products once these are

launched.

As noted above, the MRI market segment is dominated by a handful

of global manufacturers and we do not intend to compete with them

directly, since Magnetica and Adaptix are planning to create new

niche markets for MRI and X-ray. Following the pivot to niche full

system supply, Avingtrans moved in parallel to exit third-party MRI

component supply and this process is now complete, culminating with

the sale of Metalcraft China, post period end. Our first target is

orthopaedic imaging, where encouraging development of Magnetica's

prototype system is on-going. The earliest commercial launch of

this product could be later in 2023, subject to regulatory approval

in target markets. Post period end, Adaptix received its 510(k)

approval from the FDA in the USA, for its 3D X-ray product - also

targeted at orthopaedic imaging.

Security

High security and integrity doors became a new market for the

Group, following the acquisition of Booth Industries in 2019.

Global safety and security concerns, as well as risk mitigation on

large infrastructure projects, are key drivers for growth at Booth

and we are cultivating these opportunities carefully. Thus far,

most of Booth's sales are still in the UK but the business has

begun to build up a prospect pipeline overseas. We also believe

that there is an aftermarket opportunity, which is now being

developed.

Threat detection standards for baggage handling at airports and

package scanning have been tightened everywhere around the world -

especially in Europe and the USA. With many millions of bags and

packages flowing across border crossings every day, screening

devices have to comply with threat detection standards without

impacting throughput. Rapiscan, the biggest customer for Composite

Products, is a market leader in this sector, whose presence is

increasing as new standards are rolled out.

Financial Performance

Key Performance Indicators

The Group uses a number of financial key performance indicators

to monitor the business, as set out below. The Company publishes

more detailed and operational KPIs in its annual report. The

figures relate only to continuing operations.

Revenue: increase year on year largely driven by additional OEM

business in EPM

Overall Group revenue increased by 12.3% to GBP50.0m (2022 H1:

GBP44.5m). All three divisions saw some improvement but the

increase was mainly driven by additional OEM business in the EPM

division.

Gross margin ('GM') - a modest reduction

GM decreased to 32.6% (2022 H1: 33.9%), driven by increased OEM

sales in the mix.

Profit margin: EBITDA increase driven by increased revenue.

Adjusted EBITDA (note 4) increased by 11.4%, to GBP6.4m, on

higher revenues (2022 H1: GBP5.7m) mainly due to increased revenue

and profit in the EPM division, in turn driven by higher orders

from nuclear life extension and recovery in the North Sea

sector.

Tax: future profits and cash protected by available losses

The effective rate of taxation at Group level was a 13.8% tax

charge. A US tax prior year adjustment kept the rate lower than

expected and the use of brought forward losses in the UK. The Group

tax position will continue to be aided in the coming years by the

utilisation of historic losses available in the UK and US.

Adjusted Earnings per Share (EPS): modest improvement.

Adjusted diluted earnings per share from continuing operations

was up at 10.8p (2022 H1:10.2p).

Basic and diluted earnings per share from continuing operations

reduced to 7.8p (2022 H1: 9.0p) and to 7.6p (2022 H1: 8.7p).

Funding and Liquidity: net cash position remains robust.

Net cash increased to GBP17.3m, excluding IFRS16 debt (31 May

2022: GBP16.7m), despite the further investments in Magnetica and

Adaptix and in additional working capital, used to mitigate

on-going supply chain disruption risks. Cash inflow from operating

activities in the period was GBP4.1m (2022 H1: GBP4.0m)

Dividend: interim dividend progressively increased.

The Board is continuing with its policy of gradual increases in

dividends. The dividend is 1.7 pence per share (2022 H1: 1.6

pence). The dividend will be paid on 16 June 2023, to shareholders

on the register as at 12 May 2023.

ESG (Environmental, Social, and Governance)

Avingtrans is endeavouring to attain a high level of clarity on

ESG matters. We will be reporting on this herculean task once more

in our next Annual Report. However, we comment on some ESG related

matters below, to keep our investors informed.

People

There were no personnel changes at Board or divisional

management level.

Despite a currently tight labour market in the UK and the USA,

we continue to strengthen the management teams in the divisions,

with further appointments being made in the period and with an

emphasis on aftermarket opportunities, where applicable. Skills

availability is always challenging, especially so this year but we

do not expect to be materially disadvantaged in the market. We

continue to invest significant effort in developing skills and

talent, both through structured apprenticeship programmes and

graduate development plans, across a number of business units. The

construction of the apprentice training school based at Metalcraft

was completed and we have partnered with West Suffolk College (WSC)

to be the operator and training provider at the centre. The first

apprentices have now commenced their courses in the new building.

The Group continues to be recognised nationally for the strength of

its apprenticeship training schemes.

Sustainability

We have developed a robust governance structure which supports

proactive and collaborative working aimed at addressing

Environmental, Social and Governance (ESG) risks and opportunities

across the Group.

Our approach to sustainability is aligned with the UN's

Sustainable Development Goals (SDGs) and our priorities are:

-- Health, safety, and wellbeing

-- Operational eco-efficiency

-- Development of cleaner technologies

Health, safety and wellbeing

As regular acquirers, we nd varying levels of capability and

knowledge across different businesses. A frequent investment need

in smaller acquisitions is to spread HSE best practice from other

Group businesses and bring local processes up to the required

standards. Larger acquisitions (eg HTG previously) generally have

well developed HSE practices and we seek to learn from these in

other business units. Health and Safety incident reporting has

improved across the Group and incident trends have generally been

improving over recent years. Near miss reporting and knowledge

exchange is also positively encouraged, to facilitate learning and

improvement. At Board level, Les Thomas has HSE oversight and he

conducts inspections and reviews with local management, as

appropriate and the Board takes an active interest in progress,

during site visits around board meetings.

Operational eco-efficiency

We are very pleased with the reduction in carbon intensity which

the UK sites achieved in FY22, with tCO2e GBPm of revenue falling

from 40.2 to 36.8. We are looking to build on this success in FY23,

with further replacement of lighting with LEDs, local sourcing of

materials, and transport emission reduction strategies.

We continue to develop appropriate metrics and targets for the

Group. A significant part of our operating activities in the

Medical and Industrial Imaging division is the development of new

products and technologies, which do not currently generate

revenues. Consequently, we are looking at moving to a tCO2e per

employee or labour hour model for FY23.

Development of cleaner technologies

Our Hayward Tyler business continues to have success winning

work for new nuclear projects, securing a contract extension during

the period relating to the US Department of Energy's Advanced

Reactor Demonstration Program. For this program Hayward Tyler are

developing high-temperature molten salt pumps destined for a

state-of-the-art Integrated Effects Test facility, under

development by Southern Company and TerraPower to advance

development of the Molten Chloride Fast Reactor.

Magnetica's helium-free, compact MRI product development is

proceeding to plan, with an expected launch of the orthopaedic

product in Q4 2023. Helium is a scarce, non-renewable resource,

mostly obtained as a by-product of oil extraction.

Social Responsibility

The Group maintains the highest ethical and professional

standards across all of its activities and social responsibility is

embedded in operations and decision making. We understand the

importance of managing the impact that the business can have on

employees, customers, suppliers and other stakeholders. The impact

is regularly reviewed to sustain improvements, which in turn

supports the long-term performance of the business. Our focus is to

embed the management of these areas into our business operations,

both managing risk and delivering opportunities that can have a

positive in uence on our business.

The Group places considerable value on the involvement of its

employees and has continued to keep them informed on matters

affecting them directly and on nancial and broader economic factors

affecting the Group. Avingtrans regularly reviews its employment

policies. The Group is committed to a global policy of equality,

providing a working environment that maintains a culture of respect

and re ects the diversity of our employees. We are committed to

offering equal opportunities to all people regardless of their sex,

nationality, ethnicity, language, age, status, sexual orientation,

religion, or disability.

We believe that employees should be able to work safely in a

healthy workplace, without fear of any form of discrimination,

bullying or harassment. We believe that the Group should

demonstrate a fair gender mix across all levels of our business,

whilst recognising that the demographics of precision engineering

and manufacturing remain predominantly male, which is, to an

extent, beyond our control.

Ethical policy

The Group complies with the Bribery Act 2010. We do not tolerate

bribery, corruption, or other unethical behaviour on the part of

any of our businesses, or business partners, in any part of the

world. Employee training has been refreshed in all areas of the

business, to ensure that the Act is complied with.

Outlook

The Group continues to invest across its three divisions, with a

focus on the global energy and medical markets, to position them

for maximum shareholder value, via exits in the years to come.

Magnetica is making good progress on the development of compact MRI

systems, reinforced by the strategic collaboration with Adaptix in

3D X-ray. We continue to see improvements in other business units -

eg at Booth and Energy Steel, as demonstrated by the first half

results. Our value creation targets continue to be accomplished as

planned and are underpinned by a conservative approach to debt,

which is important during on-going economic challenges.

The energy divisions have a strong emphasis on the nuclear

power, thermal and hydrocarbon markets and the associated

aftermarkets. The medical division has successfully pivoted to

focus on novel compact MRI systems and associated 3D X-ray systems

for niche applications. To drive profitability and market

engagement, each division has a clear strategy to support end-user

aftermarket operations, servicing their own equipment and that of

pertinent third parties, where appropriate, to capitalise on the

continued customer demand for efficient, reliable and safe

facilities.

The on-going disruption to supply chains remains our biggest

uncertainty, though we believe that we have perhaps now passed

"peak disruption". Inflationary pressures are continuing to have an

impact on our businesses, but we remain broadly able to mitigate

these risks, to maintain stable margins, though not without

considerable effort.

Our markets are continuously evolving and strategic M&A

opportunities remain a priority for us. We remain particularly

interested in turnaround opportunities and in longer term buy and

build scenarios. Businesses like ours can command high valuations

at the point of exit. Whilst the Board remains vigilant, we are

confident about the current direction and potential future

opportunities across our markets. We will continue to refine our

strategy by pinpointing specific additional acquisitions, as the

opportunities arise, to build businesses which can create

sustainable shareholder value, whilst maintaining a prudent level

of financial headroom, to mitigate any unforeseen risks. After the

performance in the first half coupled with the strength in our

order book, the Group is well placed to achieve market expectations

for the full year.

Roger McDowell Steve McQuillan Stephen King

Chairman Chief Executive Officer Chief Financial Officer

21 February 2023 21 February 2023 21 February 2023

Consolidated Income Statement (Unaudited)

for the six months ended 30 November 2022

6 months 6 months Year to

to to

30 Nov 30 Nov 31 May

2022 2021 2022

GBP'000 GBP'000 GBP'000

Revenue 50,010 44,541 99,075

Cost of sales (33,714) (29,434) (65,241)

Gross profit 16,296 15,107 33,834

Distribution costs (2,319) (1,566) (3,630)

Other administrative expenses (10,390) (10,369) (23,019)

------------------------------------------------ --------- --------- ---------

Operating profit before amortisation

of acquired intangibles, other non-underlying

items and exceptional items

4,203 3,744 8,494

Amortisation of intangibles from

business combinations (583) (404) (869)

Other non-underlying items (2) (76) (318)

Acquisition costs - - (29)

Restructuring costs (31) (92) (93)

------------------------------------------------ --------- --------- ---------

Operating profit 3,587 3,172 7,185

Finance income (Note 5) 2 145 176

Finance costs (Note 5) (291) (134) (386)

Profit before taxation 3,298 3,183 6,975

Taxation (Note 3) (454) (252) (971)

Profit after taxation from continuing

operations 2,844 2,931 6,004

(Loss)/profit after taxation from

discontinuing operations (327) (64) 57

Profit for the financial period 2,517 2,867 6,061

Profit is attributable to:

Owners of Avingtrans PLC 2,660 3,111 6,478

Non-controlling interest (143) (244) (417)

Total 2,517 2,867 6,061

Profit per share :

From continuing operations

- Basic (Note 6) 8.8p 9.2p 18.7p

- Diluted (Note 6) 8.6p 8.9p 18.1p

From continuing and discontinuing

operations

- Basic (Note 6) 7.8p 9.0p 18.9p

- Diluted (Note 6) 7.6p 8.7p 18.3p

Consolidated statement of comprehensive income (Unaudited)

for the six months ended 30 November 2022

6 months 6 months Year to

to to

30 Nov 30 Nov 31 May

2022 2021 2022

GBP'000 GBP'000 GBP'000

Profit for the period 2,517 2,867 6,061

Items that will not be subsequently

be reclassified to profit or loss

Remeasurement of net defined benefit

liability - - 95

Income tax relating to items not

reclassified - - (24)

Items that may/will subsequently

be reclassified to profit or loss

Exchange differences on translation

of foreign operations 514 631 1,445

Total comprehensive profit for

the period 3,031 3,498 7,577

Summarised consolidated balance sheet (Unaudited)

at 30 November 2022

30 Nov 30 Nov 31 May

2022 2021 2022

GBP'000 GBP'000 GBP'000

Non current assets

Goodwill 21,420 21,233 21,420

Other intangible assets 16,224 14,547 15,675

Property, plant and equipment 23,195 25,013 25,239

Investments 4,000 2,500 4,000

Deferred tax asset 1,756 1,757 1,544

Pension and other employee obligations 1,829 1,425 1,688

68,424 66,475 69,566

Current assets

Inventories 13,945 11,756 11,759

Trade and other receivables: falling

due within one year 49,213 38,293 46,817

Trade and other receivables: falling

due after one year 1,518 1,650 1,579

Current tax asset 285 598 686

Assets held for sale 1,614 - -

Cash and cash equivalents 22,007 29,304 24,287

88,583 81,601 85,128

Total assets 157,007 148,076 154,694

Current liabilities

Trade and other payables (32,496) (28,511) (29,629)

Lease liabilities (1,083) (1,020) (1,605)

Borrowings (2,676) (4,799) (5,497)

Current tax liabilities (941) (309) (710)

Provisions (1,659) (1,711) (1,770)

Derivatives (10) (6) -

Liabilities associated with assets (218) - -

held for sale

Total current liabilities (39,082) (36,356) (39,211)

Non-current liabilities

Borrowings (674) (839) (762)

Lease liabilities (3,069) (2,691) (3,097)

Deferred tax (4,458) (4,094) (4,465)

Other creditors (1,268) (1,235) (1,342)

Total non-current liabilities (9,469) (8,859) (9,666)

Total liabilities (48,551) (45,215) (48,877)

Net assets 108,455 102,861 105,817

Equity

Share capital 1,607 1,607 1,607

Share premium account 15,693 15,663 15,693

Capital redemption reserve 1,299 1,299 1,299

Translation reserve 1,368 (73) 825

Merger reserve 28,949 28,949 28,949

Other reserves 1,457 1,457 1,457

Investment in own shares (4,235) (4,235) (4,235)

Retained earnings 60,490 56,332 58,223

Total equity attributable to equity

holders of the parent 106,628 100,999 103,818

Non-controlling interest 1,827 1,862 1,999

Total equity 108,455 102,861 105,817

Consolidated statement of changes in equity (Unaudited)

at 30 November 2022

Capital Total

Share redemp- Trans- Invest-ment Attributable

Share premium tion Merger lation Other in own Retained owners of Non-controlling Total

capital account reserve reserve reserve reserves shares earning the Group interest Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 June 2021 1,599 15,347 1,299 28,949 (732) 1458 (4,235) 53,614 97,298 1,665 98,963

Ordinary shares

issued 8 316 - - - - - - 324 - 324

Share-based

payments - - - - - - - 76 76 - 76

-------- ------- ------- ------- ------- -------- ------------ --------- ------------- ----------------- --------

Total

transactions

with owners 8 316 - - - - - 76 400 - 400

Profit for the

period - - - - - - - 3,111 3,111 (244) 2,867

Investment in

subsidiary with

non-controlling

interest - - - - 28 - - (469) (441) 441 -

Other

comprehensive

income

Exchange rate

gain - - - - 631 - - - 631 - 631

-------- ------- ------- ------- ------- -------- ------------ --------- ------------- ----------------- --------

Total

comprehensive

income for the

period - - - - 659 - - 2,642 3,301 197 3,498

-------- ------- ------- ------- ------- -------- ------------ --------- ------------- ----------------- --------

Balance at

30 Nov 2021 1,607 15,663 1,299 28,949 (73) 1,458 (4,235) 56,332 100,999 1,862 102,861

======== ======= ======= ======= ======= ======== ============ ========= ============= ================= ========

At 1 Dec 2021 1,607 15,663 1,299 28,949 (73) 1,458 (4,235) 56,332 100,999 1,862 102,861

Ordinary shares issued 30 - - - - - - 30 - 30

Dividends paid - - - - - - - (1,265) (1,265) - (1,265)

Share-based payments - - - - - - - 112 112 - 112

------ ------- ----- ------ ---- ----- -------- -------- -------- ------ -------

Total transactions with

owners - 30 - - - - - (1,153) (1,123) - (1,123)

Profit for the period - - - - - - - 3,367 3,367 (173) 3,194

Investment in subsidiary

with non-controlling

interest - - - - 84 - - (394) (310) 310 -

Other comprehensive

income

Actuarial gain for the

period on pension scheme - - - - - - - 95 95 - 95

Deferred tax on actuarial

movement on pension

scheme - - - - - - - (24) (24) - (24)

Exchange gain - - - - 814 - - - 814 - 814

------ ------- ----- ------ ---- ----- -------- -------- -------- ------ -------

Total comprehensive income

for the period - - - - 898 - - 3,044 3,942 137 4,079

------ ------- ----- ------ ---- ----- -------- -------- -------- ------ -------

Balance at

31 May 2022 1,607 15,693 1,299 28,949 825 1,458 (4,235) 58,223 103,818 1,999 105,817

====== ======= ===== ====== ==== ===== ======== ======== ======== ====== =======

At 1 June 2022 1,607 15,693 1,299 28,949 825 1,458 (4,235) 58,223 103,818 1,999 105,817

Ordinary shares issued - - - - - - - - - - -

Dividends paid - - - - - - - (507) (507) - (507)

Share-based payments - - - - - - - 114 114 - 114

------ ------- ----- ------ ----- ----- -------- ------- -------- ------ -------

Total transactions with

owners - - - - - - - (393) (393) - (393)

Profit for the period - - - - - - - 2,660 2,660 (143) 2,517

Investment in subsidiary

with non-controlling

interest - - - - 29 - - - 29 (29) -

Other comprehensive

income

Exchange rate gain - - - - 514 - - - 514 - 514

------ ------- ----- ------ ----- ----- -------- ------- -------- ------ -------

Total comprehensive income

for the period - - - - 543 - - 2,660 3,204 (172) 3,031

------ ------- ----- ------ ----- ----- -------- ------- -------- ------ -------

Balance at

30 Nov 2022 1,607 15,693 1,299 28,949 1,368 1,458 (4,235) 60,490 106,628 1,827 108,455

====== ======= ===== ====== ===== ===== ======== ======= ======== ====== =======

Consolidated cash flow statement (Unaudited)

for the six months ended 30 November 2022

6 months 6 months Year to

to to

30 Nov 30 Nov 31 May

2022 2021 2022

GBP'000 GBP'000 GBP'000

Operating activities

Cash flows from operating activities 4,639 4,499 4,173

Finance costs paid (301) (193) (388)

Income tax (paid)/repaid (78) (140) 203

Contributions to defined benefit

plan (141) (141) (282)

Net cash inflow from operating

activities 4,119 4,025 3,706

Investing activities

Purchase of unlisted investments - (2,500) (4,000)

Acquisition of subsidiary undertakings - - (582)

Finance income 2 - 176

Purchase of intangible assets (1,358) (800) (1,996)

Purchase of property, plant and

equipment (722) (1,220) (2,989)

Net cash used by investing activities (2,077) (4,520) (9,347)

Financing activities

Equity dividends paid (507) - (1,265)

Repayments of bank loans (3,047) (148) (468)

Repayments of leases (707) (682) (1,486)

Proceeds from issue of ordinary

shares - 324 355

Borrowings raised - 125 2,493

Net cash outflow from financing

activities (4,261) (381) (371)

Net decrease in cash and cash equivalents (2,220) (876) (6,012)

Cash and cash equivalents at beginning

of period 23,902 29,736 29,736

Effect of foreign exchange rate

changes (61) 77 178

Cash and cash equivalents at end

of period 21,622 28,937 23,902

Cashflows from operating activities (Unaudited)

for the six months ended 30 November 2022

6 months 6 months Year to

to to

30 Nov 30 Nov 31 May

2022 2021 2022

GBP'000 GBP'000 GBP'000

Profit before income tax from continuing

operations 3,299 3,183 6,975

(Loss)/profit before income tax

from discontinuing operations (327) (64) 57

Adjustments for :

Depreciation of property, plant

and equipment 2,023 1,844 3,675

Amortisation of intangible assets 117 277 374

Amortisation of intangibles from

business combinations 583 404 869

Loss on disposal of property, plant

and equipment 10 61 44

Finance income (2) (145) (176)

Finance expense 291 137 393

Share based payment charge 114 76 188

Changes in working capital

(Increase)/decrease in inventories (2,363) (979) (1,033)

(Increase)/decrease in trade and

other receivables (2,673) 2,756 (7,837)

Increase/(decrease) in trade and

other payables 3,719 (2,956) 783

(Decrease)/increase in provisions (139) (101) 32

Other non-cash changes (10) 6 (171)

Cash inflow from operating activities 4,639 4,499 4,173

6 months 6 months Year to

to to

30 Nov 30 Nov 31 May

2022 2021 2022

GBP'000 GBP'000 GBP'000

Cash and cash equivalents

Cash 22,007 29,304 24,287

Overdrafts (385) (367) (385)

21,622 28,937 23,902

Notes to the half year statement

30 November 2022

1. Basis of preparation

The Group's interim results for the six-month period ended 30

November 2022 are prepared in accordance with the Group's

accounting policies which are based on the recognition and

measurement principles of International Financial Reporting

Standards ('IFRS') as adopted by the EU and effective, or expected

to be adopted and effective, at 31 May 2023. As permitted, this

interim report has been prepared in accordance with the AIM rules

and not in accordance with IAS34 'Interim financial reporting'.

These interim results do not constitute full statutory accounts

within the meaning of section 434 of the Companies Act 2006 and are

unaudited. The unaudited interim financial statements were approved

by the Board of Directors on 21 February 2023 and will shortly be

available on the Group's website at www.avingtrans.plc.uk.

The consolidated financial statements are prepared under the

historical cost convention as modified to include the revaluation

of financial instruments. The accounting policies used in the

interim financial statements are consistent with IFRS and those

which will be adopted in the preparation of the Group's annual

report and financial statements for the year ended 31 May 2023.

The statutory accounts for the year ended 31 May 2022, which

were prepared under IFRS, have been filed with the Registrar of

Companies. These statutory accounts carried an unqualified

Auditor's Report and did not contain a statement under either

Section 498(2) or (3) of the Companies Act 2006.

2. Segmental analysis

Energy Energy Medical Unallocated Total

EPM PSRE MII central

items

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

6 months to 30 November

2022

Original equipment 9,080 20,809 1,498 - 31,388

Aftermarket 17,341 1,280 2 - 18,623

------------- ---------- -------- ------------ -----------

Revenue 26,421 22,089 1,500 - 50,010

============= ========== ======== ============ ===========

Operating profit/(loss) 1,949 2,531 (310) (582) 3,588

Net finance costs (289)

Taxation (454)

-----------

Profit after tax from continuing

operations 2,844

===========

Energy Energy Medical Unallocated Total

EPM PSRE MII central

items

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Year ended 31

May 2022

Original equipment 14,089 40,408 2,426 - 56,922

Aftermarket 39,115 3,006 31 - 42,153

------------ ----------- --------- ------------ ------------

Revenue 53,204 43,414 2,457 - 99,075

============ =========== ========= ============ ============

Operating profit/(loss) 4,592 4,956 (1,291) (1,072) 7,185

Net finance costs (210)

Taxation (971)

------------

Profit after tax from continuing

operations 6,004

============

Energy Energy Medical Unallocated Total

EPM PSRE MII central

items

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

6 months to 30

November 2021

Original equipment 6,131 19,741 813 - 26,685

Aftermarket 16,486 1,369 - - 17,856

------------ ----------- --------- ------------ ------------

Revenue 22,618 21,110 813 - 44,540

============ =========== ========= ============ ============

Operating profit/(loss) 1,435 2,764 (524) (504) 3,171

Net finance costs 11

Taxation (252)

------------

Profit after tax from

continuing operations 2,931

============

3. Taxation

The taxation charge is based upon the expected effective rate

for the year ended 31 May 2023.

4. Adjusted Earnings before interest, tax, depreciation and

amortisation

6 months 6 months Year to

to to

30 Nov 30 Nov 31 May

2022 2021 2022

GBP'000 GBP'000 GBP'000

Profit before tax from continuing

operations 3,298 3,183 6,975

Share based payment expense 114 76 188

Acquisition costs - - 29

Restructuring costs 31 92 93

Other exceptionals 2 - 130

Gain /(loss) on derivatives 9 (139) (144)

Amortisation of intangibles from

business combinations 583 404 869

Adjusted profit before tax 4,037 3,616 8,140

Finance income (2) (145) (176)

Finance cost 291 134 386

(Loss)/gain on derivatives (9) 139 144

Adjusted profit before interest,

tax and amortisation from business

combinations ('EBITA') 4,317 3,744 8,494

Depreciation 1,906 1,724 3,433

Amortisation of other intangible

assets 117 222 374

Amortisation of contract assets 61 55 132

Adjusted Earnings before interest,

tax, depreciation and amortisation

('EBITDA') 6,401 5,744 12,432

5. Finance income and costs

6 months 6 months Year to

to to 31 May

30 Nov 30 Nov 2022

2022 2021

GBP'000 GBP'000 GBP'000

Finance income

Bank balances and deposits 2 6 4

Gain on the fair value of derivative

contracts - 139 144

Interest from other - - 28

2 145 176

Finance costs

Interest on banking facilities and

lease liabilities 282 134 386

Loss on the fair value of derivative 9 - -

contracts

291 134 386

6. Earnings per share

Basic earnings per share is based on the earnings attributable

to ordinary shareholders and the weighted average number of

ordinary shares in issue during the year.

For diluted earnings per share the weighted average number of

ordinary shares is adjusted to assume conversion of all dilutive

potential ordinary shares, being the CSOP and ExSOP share

options.

6 months 6 months Year to

to to 31 May 2022

30 Nov 2022 30 Nov 2021 No

No No

Weighted average number of

shares - basic 32,141,445 31,995,372 32,070,325

Share Option adjustment 939,646 1,031,656 1,063,674

Weighted average number of

shares - diluted 33,081,091 33,027,028 33,133,999

GBP'000 GBP'000 GBP'000

Earnings from continuing operations 2,844 2,931 6,004

Share based payments 114 76 188

Acquisition costs - - 29

Restructuring costs 31 92 93

Other exceptionals 2 - 130

Loss/(gain) on derivatives 9 (139) (144)

Amortisation of intangibles

from business combinations 583 404 868

Adjusted earnings from continuing

operations 3,583 3,364 7,168

From continuing operations:

Basic earnings per share 8.8p 9.2p 18.7p

Adjusted basic earnings per

share 11.1p 10.5p 22.4p

Diluted earnings per share 8.6p 8.9p 18.1p

Adjusted diluted earnings per

share 10.8p 10.2p 21.6p

Earnings from discontinuing

operations (327) (64) 57

From discontinuing operations:

Basic (loss)/gain per share (1.0)p (0.2)p 0.2p

Adjusted basic (loss)/gain

per share (1.0)p (0.2)p 0.2p

Diluted (loss)/gain per share (1.0)p (0.2)p 0.2p

Adjusted diluted (loss)/gain

per share (1.0)p (0.2)p 0.2p

Earnings attributable to shareholders

including non-controlling interest 3,256 3,300 7,225

Basic earnings per share 7.8p 9.0p 18.9p

Adjusted basic earnings per

share 10.1p 10.3p 22.5p

Diluted earnings per share 7.6p 8.7p 18.3p

Adjusted diluted earnings per

share 9.8p 10.0p 21.8p

The Directors believe that the above adjusted earnings per share

calculation from continuing operations is the most appropriate

reflection of the Group performance.

7. Net cash/(debt) and gearing

The gearing ratio at the year-end is as follows: 30 Nov 2022 30 Nov 2021 31 May 2022

GBP'000 GBP'000 GBP'000

Cash 22,007 29,304 24,287

Loans (2,965) (5,271) (5,874)

Lease liability - finance leases under IAS17 (1,406) (968) (1,313)

Lease liability - under IFRS 16 (2,746) (2,743) (3,389)

Overdrafts (385) (367) (385)

------------------ --------------------- ------------------

Net cash 14,505 19,955 13,326

Equity 108,455 102,861 105,817

------------------ --------------------- ------------------

Net cash/(debt) to equity ratio 13.4% 19.4% 12.6%

================== ===================== ==================

Net cash/(debt) to equity ratio excluding IFRS16 debt 15.9% 22.1% 23.6%

================== ===================== ==================

8. Events after the balance sheet date

On 1 December, the Group invested GBP2.0m in Adaptix Limited, in

the form of a convertible loan note.

On 30 December 2022, Maloney Metalcraft (Ormandy) acquired the

assets of local competitors, HEVAC and HES.

The Group is continuing to negotiate the sale of the Metalcraft

China assets following the exit from MRI component supply.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAKAFASFDEFA

(END) Dow Jones Newswires

February 22, 2023 02:00 ET (07:00 GMT)

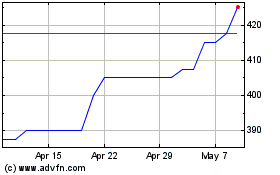

Avingtrans (LSE:AVG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Avingtrans (LSE:AVG)

Historical Stock Chart

From Nov 2023 to Nov 2024