TIDMIME

RNS Number : 8839O

Immediate Acquisition PLC

14 June 2022

This announcement is for information purposes only and does not

constitute or contain any invitation, solicitation, recommendation,

offer or advice to any person to subscribe for, otherwise acquire

or dispose of any securities in Immediate Acquisition Plc or any

other entity in any jurisdiction. Neither this announcement nor the

fact of its distribution shall form the basis of, or be relied on

in connection with, any investment decision in Immediate

Acquisition Plc.

The information contained within this announcement is deemed by

the Company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014 which forms part of

English law by virtue of the European Union (Withdrawal) Act 2018,

as amended. Upon the publication of this announcement via the

Regulatory Information Service, this inside information is now

considered to be in the public domain.

14 June 2022

Immediate Acquisition Plc

("IME" or "the Group" or "the Company")

Proposed Acquisition and

Proposed Placing to raise c.GBP8 million

The Directors of Immediate Acquisition Plc (AIM: IME) are

pleased to announce the proposed acquisition of Fiinu Holdings

Limited ("Fiinu") (the "Proposed Acquisition") for a total

consideration of approximately GBP37.5 million to be satisfied by

the issue of new ordinary shares in the capital of the Company to

the selling shareholders of Fiinu ("Sellers") at a price of 20p per

share ("Consideration Shares"), alongside its intention to raise

approximately GBP8 million, before expenses, by way of a

conditional placing of new ordinary shares in the capital of the

Company at 20p per share (the "Placing"). SP Angel Corporate

Finance LLP is acting as bookrunner in respect of the Placing.

The Proposed Acquisition will constitute a reverse takeover

under the AIM Rules for Companies and will also require a Rule 9

Waiver as a result of the issue of consideration shares to certain

of the Sellers who have been deemed to constitute a Concert Party

for the purposes of the City Code on Takeovers and Mergers. The

Placing and Proposed Acquisition are both subject to shareholder

approval and it is proposed that the enlarged issued share capital

of the Company will be admitted to trading on AIM

("Admission").

About Fiinu:

-- Fiinu, founded in 2017, is a technology platform and provider of consumer banking products.

-- For the year ended 31 March 2021, Fiinu generated no revenue

and recorded an audited loss before taxation of GBP1.19 million. As

at 30 September 2021, Fiinu had unaudited net assets of

approximately GBP0.73 million.

-- Fiinu is comprised of two businesses: Fiinu 2 Ltd (to be

renamed Fiinu Bank Ltd following Admission), which will, prior to

Admission, hold a Banking Licence issued by the Bank of England.

Fiinu 2 Ltd will offer the Fiinu group's flagship product, the

Plugin Overdraft(R). The other Fiinu business is Fiinu Services

Ltd, a provider of financial technology and alternative data

solutions.

-- On 7 June 2022 the Prudential Regulatory Authority, with the

consent of the FCA, issued an 'authorised subject to capital'

letter to Fiinu 2 Ltd.

-- Fiinu's Bank's Plugin Overdraft is a new banking product

which marks the first time an overdraft product has been unbundled

from a current account since the overdraft was first introduced.

Using the Plugin Overdraft(R), Fiinu 2 Ltd will be able provide its

customers with an overdraft facility without them having to switch

their current account with their present bank, giving customers

access to affordable credit. Importantly, an overdraft does not

negatively impact a consumer's credit score and helps avoid

expensive payday lenders, giving consumers the opportunity to build

their credit rating, rather than erode it.

-- Fiinu Services Ltd is the group's technology arm which will

manage and develop the group's platform utilising data insights and

analytics.

Proposed Fundraising:

-- The Placing is being conducted via an accelerated bookbuild,

pursuant to which the Company intends to raise gross proceeds of

approximately GBP8 million. Mark Horrocks, a director of IME, has

indicated that he may participate in the Placing; any such

participation would be a related party transaction under the AIM

Rules.

-- The accelerated bookbuild will be launched immediately following this announcement.

-- The Placing will comprise a placing of approximately 40

million new ordinary shares in the Company ("Placing Shares") at 20

pence per share (the "Placing Price").

-- The Company will also enter into a GBP2.49 million loan

facility agreement (the "Loan Facility") with Dewscope Limited, a

company controlled by Mark Horrocks. The Loan Facility will

constitute a related party transaction under the AIM Rules.

-- Taken together with existing cash held by IME, and subject to

shareholder approval in general meeting, this would provide the

Company and its wider group following completion of the Proposed

Acquisition ("Enlarged Group") with available funding, before

expenses, of approximately GBP14 million.

Other highlights:

-- Proposed change of name to Fiinu Group plc.

-- On completion of the Proposed Acquisition, it is intended

that David Hopton, Chris Sweeney, Philip Tansey, Marko Sjoblom and

Huw Evans will be appointed to the Board. The Board will include

four Independent Non-Executive Directors and three Executive

Directors. Simon Leathers, an existing director of the Company will

remain a director following completion.

-- The Proposed Acquisition, Placing, Waiver of Rule 9 of the

City Code and Change of Name will require shareholder approval at a

general meeting. An Admission Document, Notice of General Meeting

and Form of Proxy will be posted to IME shareholders in due

course.

Further announcements will be made as appropriate.

Tim Hipperson, Non-executive Chairman of IME, commented:

"As a Board, we have looked at and appraised a number of

opportunities in the technology and fintech sector and Fiinu stood

out when it came to a product in a market with incredibly high

barriers to entry and its consumer-focused operating model which

improves financial inclusion.

"Many people assume that everyone has on overdraft - they do

not. This is in the main due to regulatory changes which in effect

led to the disappearance of unarranged overdrafts. With its

proprietary product, the Plugin Overdraft(R), Fiinu will be the

first company to be able to unbundle an overdraft facility from a

primary current account."

For further information please contact:

Immediate Acquisition Plc Tel: +44 (0) 203 515 0233

Tim Hipperson, Non-executive Chairman

Simon Leathers, Non-executive Director

SPARK Advisory Partners Limited (Nomad) Tel: +44 (0) 203 368 3550

Mark Brady

Neil Baldwin

SP Angel Corporate Finance LLP (Broker) Tel: +44 (0) 207 470 0470

Abigail Wayne

Matthew Johnson

Buchanan Communications Tel: +44 (0) 207 466 5000

Chris Lane / Kim van Beeck

Forward Looking Statements

Certain statements made in this announcement are forward-looking

statements. These forward-looking statements are not historical

facts but rather are based on the Company's current expectations,

estimates, and projections about its industry; its beliefs; and

assumptions. Words such as 'anticipates,' 'expects,' 'intends,'

'plans,' 'believes,' 'seeks,' 'estimates,' and similar expressions

are intended to identify forward-looking statements. These

statements are not guarantees of future performance and are subject

to known and unknown risks, uncertainties, and other factors, some

of which are beyond the Company's control, are difficult to

predict, and could cause actual results to differ materially from

those expressed or forecasted in the forward-looking statements.

The Company cautions shareholders and prospective shareholder

holders not to place undue reliance on these forward-looking

statements, which reflect the view of the Company only as of the

date of this announcement. The forward-looking statements made in

this announcement relate only to events as of the date on which the

statements are made. The Company will not undertake any obligation

to release publicly any revisions or updates to these

forward-looking statements to reflect events, circumstances, or

unanticipated events occurring after the date of this announcement

except as required by law or by any appropriate regulatory

authority.

Important notices

The distribution of this Announcement and any other

documentation associated with the Placing into jurisdictions other

than the United Kingdom may be restricted by law. Persons into

whose possession these documents come should inform themselves

about and observe any such restrictions. Any failure to comply with

these restrictions may constitute a violation of the securities

laws or regulations of any such jurisdiction. In particular, such

documents should not be distributed, forwarded to or transmitted,

directly or indirectly, in whole or in part, in, into or from the

United States, Australia, Canada, Japan or the Republic of South

Africa or any other jurisdiction where to do so may constitute a

violation of the securities laws or regulations of any such

jurisdiction (each a "Restricted Jurisdiction").

The Placing Shares have not been and will not be registered

under the US Securities Act 1933 (as amended) (the "US Securities

Act") or with any securities regulatory authority of any state or

other jurisdiction of the United States and, accordingly, may not

be offered, sold, resold, taken up, transferred, delivered or

distributed, directly or indirectly, within the United States

except in reliance on an exemption from the registration

requirements of the US Securities Act and in compliance with any

applicable securities laws of any state or other jurisdiction of

the United States.

There will be no public offer of the Placing Shares in the

United States. The Placing Shares are being offered and sold

outside the US in reliance on Regulation S under the US Securities

Act. The Placing Shares and the Consideration Shares (together,

"New Ordinary Shares") have not been approved or disapproved by the

US Securities and Exchange Commission, any state securities

commission in the US or any other US regulatory authority, nor have

any of the foregoing authorities passed upon or endorsed the merits

of the offering of the Placing Shares or the accuracy or adequacy

of this Announcement. Any representation to the contrary is a

criminal offence in the US.

The Placing Shares have not been and will not be registered

under the relevant laws of any state, province or territory of any

Restricted Jurisdiction and may not be offered, sold, resold, taken

up, transferred, delivered or distributed, directly or indirectly,

within any Restricted Jurisdiction except pursuant to an applicable

exemption from registration requirements. There will be no public

offer of New Ordinary Shares in Australia, Canada, Japan, or the

Republic of South Africa.

This Announcement is for information purposes only and does not

constitute or form part of any offer to issue or sell, or the

solicitation of an offer to acquire, purchase or subscribe for, any

securities in any jurisdiction and should not be relied upon in

connection with any decision to subscribe for or acquire any of the

Placing Shares. In particular, this Announcement does not

constitute or form part of any offer to issue or sell, or the

solicitation of an offer to acquire, purchase or subscribe for, any

securities in the United States.

This Announcement has been issued by, and is the sole

responsibility of, the Company. No person has been authorised to

give any information or to make any representations other than

those contained in this Announcement and, if given or made, such

information or representations must not be relied on as having been

authorised by the Company or SPARK or SP Angel. Subject to the AIM

Rules for Companies, the issue of this Announcement shall not, in

any circumstances, create any implication that there has been no

change in the affairs of the Company since the date of this

Announcement or that the information contained in it is correct at

any subsequent date.

SPARK Advisory Partners Limited ("SPARK") which is authorised

and regulated in the UK by the Financial Conduct Authority ("FCA"),

is acting as nominated adviser to the Company. SPARK will not be

acting for or otherwise be responsible to any person (including a

recipient of this Announcement) other than the Company for

providing the protections afforded to its customers or for advising

any other person on the contents of any part of this Announcement

or otherwise in respect of the Proposed Acquisition, Placing or

Admission or any transaction, matter or engagement referred to in

this Announcement. The responsibilities of SPARK, as the Company's

nominated adviser under the AIM Rules, are owed solely to London

Stock Exchange plc and are not owed to the Company or any Existing

Director, Proposed Director or Shareholder or to any other person.

In respect of any decision to acquire Ordinary Shares in reliance

on any part of this Announcement or otherwise, SPARK is not making

any representation or warranty, express or implied, as to the

contents of this Announcement.

SP Angel Corporate Finance LLP ("SP Angel"), which is authorised

and regulated in the UK by the FCA and is a member of the London

Stock Exchange, is acting as broker to the Company. SP Angel will

not be responsible to any person other than the Company for

providing the protections afforded to its customers or for advising

any other person on the contents of any part of this Announcement

or otherwise in respect of the Proposed Acquisition, Placing or

Admission or any transaction, matter or engagement referred to in

this Announcement. The responsibilities of SP Angel as the

Company's broker under the AIM Rules are owed solely to London

Stock Exchange plc and are not owed to the Company or any Existing

Director, Proposed Director or Shareholder or to any other person.

In respect of any decision to acquire Ordinary Shares in reliance

on any part of this Announcement or otherwise, SP Angel is not

making any representation or warranty, express or implied, as to

the contents of this Announcement.

Apart from the responsibilities and liabilities, if any, which

may be imposed on SPARK or SP Angel by the Financial Services and

Markets Act 2000, as amended or the regulatory regime established

thereunder, neither SPARK nor SP Angel accepts any responsibility

whatsoever for the contents of this Announcement, and makes no

representation or warranty, express or implied, for the contents of

this Announcement, including its accuracy, completeness or

verification, or for any other statement made or purported to be

made by it, or on its behalf, in connection with the Company or the

Placing Shares or the Placing, and nothing in this Announcement is

or shall be relied upon as, a promise or representation in this

respect whether as to the past or future. SPARK and SP Angel

accordingly disclaim to the fullest extent permitted by law all and

any liability whether arising in tort, contract or otherwise (save

as referred to above) which it might otherwise have in respect of

this Announcement or any such statement.

No statement in this Announcement is intended to be a profit

forecast or profit estimate for any period and no statement in this

Announcement should be interpreted to mean that earnings or

earnings per share of the Company for the current or future

financial years would necessarily match or exceed the historical

published earnings or earnings per share of the Company.

This Announcement may include statements that are, or may be

deemed to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates", "plans",

"projects", "anticipates", "expects", "intends", "may", "will", or

"should" or, in each case, their negative or other variations or

comparable terminology. These forward-looking statements include

matters that are not historical facts. They appear in a number of

places throughout this Announcement and include statements

regarding the Directors' current intentions, beliefs or

expectations concerning, among other things, the Company's results

of operations, financial condition, liquidity, prospects, growth,

strategies and the Company's markets. By their nature,

forward-looking statements involve risk and uncertainty because

they relate to future events and circumstances. Actual results and

developments could differ materially from those expressed or

implied by the forward-looking statements. Forward-looking

statements may and often do differ materially from actual results.

Any forward-looking statements in this Announcement are based on

certain factors and assumptions, including the Directors' current

view with respect to future events and are subject to risks

relating to future events and other risks, uncertainties and

assumptions relating to the Company's operations, results of

operations, growth strategy and liquidity. Whilst the Directors

consider these assumptions to be reasonable based upon information

currently available, they may prove to be incorrect. Save as

required by applicable law or by the AIM Rules for Companies, the

Company undertakes no obligation to release publicly the results of

any revisions to any forward-looking statements in this

Announcement that may occur due to any change in the Directors'

expectations or to reflect events or circumstances after the date

of this Announcement.

Information to Distributors

UK product governance

Solely for the purposes of the product governance requirements

contained within of Chapter 3 of the FCA Handbook Production

Intervention and Product Governance Sourcebook (the "UK Product

Governance Requirements"), and disclaiming all and any liability,

whether arising in tort, contract or otherwise, which any

"manufacturer" (for the purposes of the UK Product Governance

Requirements) may otherwise have with respect thereto, the Placing

Shares have been subject to a product approval process, which has

determined that such securities are: (i) compatible with an end

target market of investors who meet the criteria of retail

investors and investors who meet the criteria of professional

clients and eligible counterparties, each as defined in paragraph 3

of the FCA Handbook Conduct of Business Sourcebook; and (ii)

eligible for distribution through all distribution channels (the

"Target Market Assessment"). Notwithstanding the Target Market

Assessment, distributors (for the purposes of UK Product Governance

Requirements) should note that: (a) the price of the Placing Shares

may decline and investors could lose all or part of their

investment; (b) the Placing Shares offer no guaranteed income and

no capital protection; and (c) an investment in the Placing Shares

is compatible only with investors who do not need a guaranteed

income or capital protection, who (either alone or in conjunction

with an appropriate financial or other adviser) are capable of

evaluating the merits and risks of such an investment and who have

sufficient resources to be able to bear any losses that may result

therefrom. The Target Market Assessment is without prejudice to the

requirements of any contractual, legal or regulatory selling

restrictions in relation to the Placing. Furthermore, it is noted

that, notwithstanding the Target Market Assessment, SP Angel will

only procure investors who meet the criteria of professional

clients and eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of Chapter 9A or 10A respectively of the FCA

Handbook Conduct of Business Sourcebook; or (b) a recommendation to

any investor or group of investors to invest in, or purchase, or

take any other action whatsoever with respect to the Placing

Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the Placing Shares and determining

appropriate distribution channels.

Neither the content of the Company's website nor any website

accessible by hyperlinks to the Company's website is incorporated

in, or forms part of, this Announcement.

Certain figures contained in this Announcement, including

financial information, have been subject to rounding adjustments.

Accordingly, in certain instances, the sum or percentage change of

the numbers contained in this Announcement may not conform exactly

with the total figure given.

All references to time in this Announcement are to London time,

unless otherwise stated.

BACKGROUND TO AND REASONS FOR THE ACQUISITION

In August 2021, Fiinu and the Company signed a non-binding heads

of agreement for the Company to acquire Fiinu Holdings Limited and

its 100% owned subsidiaries, Fiinu 2 Limited and Fiinu Services

Limited. The key reason for the acquisition is Fiinu's future

potential as an innovative fintech group which will, prior to

Admission, hold a banking licence issued by the Bank of England.

The Company considers that Fiinu has a customer-centric operating

model which improves financial inclusion, a strong leadership team

with experience, alternative data analytics and insights vision and

a forward-looking approach to bringing to the market potentially

revolutionary products and services enabled by open banking.

Open Banking, in summary, allows connections between different

banks, third parties and service providers to enable them to simply

and securely exchange data which is aimed at benefitting

customers.

The Directors are confident that the leadership team can execute

its plan and bring increased long-term value to new investors and

current shareholders. The Company believes in Fiinu's vision in

which Open Banking increases competition and innovation in UK

banking.

PRINCIPAL TERMS OF THE ACQUISITION

The Company will enter into two share purchase agreements (the

"Main Acquisition Agreement" and the "Minority Acquisition

Agreement") pursuant to which it will conditionally agree to

acquire the entire issued share capital of Fiinu, for an aggregate

total consideration of approximately GBP37.5 million, to be

satisfied by the issue of the Consideration Shares at the Placing

Price to the Sellers. The Main Acquisition Agreement is

conditional, amongst other things, on the passing of the

Resolutions at the IME General Meeting, the granting of the

required approvals and confirmations from the PRA and the FCA in

respect of the confirmation of the Banking Licence ("Regulatory

Approvals") and the Placing and Admission becoming effective on or

before 9 July 2022. In the Main Acquisition Agreement, the Company

and Dr Marko Sjoblom have given customary warranties to each other.

The remaining Sellers who are a party to the Main Acquisition

Agreement will provide customary fundamental warranties to the

Company. The Minority Acquisition Agreement is conditional on

completion of the Main Acquisition Agreement and the Sellers who

are a party to the Minority Acquisition Agreement will provide

customary fundamental warranties to the Company.

Any Sellers who do not sign the Main Acquisition Agreement or

the Minority Acquisition Agreement will transfer their shares in

Fiinu to the Company, at the same price, on completion of the

Acquisition pursuant to the "drag along" provisions set out in

Fiinu's articles of association.

FINTECH MARKET OPPORTUNITY FOR THE ENLARGED GROUP

Fiinu 2 (to be renamed Fiinu Bank Limited at Admission)

Nearly two-thirds (62%) of the UK adult population with a PCA

used some form of overdraft in 2019. In April 2020, the FCA imposed

new overdraft rules which resulted in an estimated 16.5 million

adults losing access to a form of overdraft in 2020, namely

unarranged overdrafts. The loss of access to unarranged overdrafts

has resulted in a more than GBP10 billion funding gap in the GBP300

billion unsecured lending market.

Fiinu's flagship product is the Plugin Overdraft, a personal

finance management app which is trademarked in the United Kingdom,

European Union and the United States (US application pending). When

confirmed by the Prudential Regulation Authority ("PRA"), the

Banking Licence will allow Fiinu to promote overdraft products and

provide Financial Services Compensation Scheme guaranteed deposits

in the UK, guaranteed for up to GBP85,000. The word 'overdraft',

like the word 'bank', is a protected and restricted expression in

financial legislation. The Banking Licence will therefore form the

foundation for Fiinu's business because only banks can offer

overdrafts. Subject to the conditions under the Banking Licence

being met, the Banking Licence will also allow Fiinu to scale its

lending through an ability to fund its loan book with affordable

and stable access to retail deposits.

Fiinu intends to initially source all of its deposits through

deposit aggregators, including Flagstone Investment Management

Limited and Raisin Platforms Limited, which are platforms that

allow consumers to spread their money across multiple accounts with

different banks. Fiinu will not require its overdraft customers to

switch their bank account to Fiinu or to pay a minimum amount per

month into their Fiinu current account to qualify for an overdraft.

In fact, it is expected that most customers will continue to use

their current debit card, and other services, from their current

bank account as before without any changes. Fiinu will provide a

plugin third-party bank overdraft facility. Fiinu's risk appetite

is to provide overdraft limits for up to GBP1,500 to any qualifying

UK bank account. The use of an overdraft is more common than people

generally think and through the Open Banking-enabled use of

technology, Fiinu can extend the use of the product further.

FCA data suggests that over the last four years, the number of

personal current accounts in the UK has increased by 15%, from 87

million to over 100 million. This means that, on average, each

adult in the UK now has approximately 1.9 current accounts. The

majority of these accounts, 55 million (FCA, 2018) do not have

access to arranged overdrafts at all. This is predominantly caused

by the underlying risk-based underwriting principle and methods

which are based on the Probability of Default ("PD"). The

prevailing methods are also driving the incumbent banks to tighten

their lending criteria in the aftermath of the global

COVID-pandemic and possible economic downturn. The PD model is a

mature underwriting approach that is ideally suited for the secured

lending markets. However, it is a sub-optimal method for unbundled

overdrafts as empirical data suggests that, in most cases, the PD

model results in a binary decision, on pre-determined one-size fits

for all overdraft limits, resulting in the majority of potential

customers being rejected. On the other hand, the principles of

Fiinu's Open Banking-led underwriting models are different to these

traditional methods. Fiinu 2 will be able to adopt a sophisticated

approach to assess affordability and to set credit limits, thereby

potentially enabling it to extend its overdraft credit to a

substantially wider population than traditional banks. Fiinu's

borrowing long and lending short business model could result in a

Net Interest Margin ("NIM") for the bank of over ten percent net

which is considerably higher than UK, US and world banking averages

of 1.3%, 3% and 3.8% respectively.

Fiinu Services Limited

Fiinu Services may be able to drive secondary revenue streams by

licensing the Group's intellectual property rights. Once the

platform is operational, Fiinu Services will analyse transactional

banking data, which is invaluable to learning and understanding

granular consumer behaviour, which would allow Fiinu to analyse and

package the data for a variety of data insights. The Enlarged Group

would establish the platform during the mobilisation period and

such secondary revenues would only be available to Fiinu Services

once it has exited mobilisation. Fiinu aims to become a leader in

servicing the plugin market, whilst improving financial inclusion

and providing depositors and investors with attractive returns. The

Group will be subject to customer consent requirements and data

protection regulations.

Overseas Markets

Whilst Fiinu does not currently have plans for an American or

European roll-out, there may be future opportunities because Open

Banking APIs (software which allows applications to communicate

with each other) have been fully implemented across Europe. The

Fiinu Plugin Overdraft(R) could theoretically be made available to

450 million European Union nationals through thousands of banks

which have adopted standardised Open Banking APIs. As in the UK,

Fiinu would not need other banks' consent or permission to provide

their customers with a plug-in overdraft as this is a

customer-controlled choice.

CURRENT TRADING AND FUTURE PROSPECTS OF THE ENLARGED GROUP

Immediate Acquisition Plc and AIM Rule 15

On 9 May 2022, the Company disposed of its main trading

subsidiary, Immedia Broadcast Limited. The Company was renamed

Immediate Acquisition Plc and became an AIM Rule 15 cash shell and,

as such, is required to make an acquisition or acquisitions which

constitute(s) a reverse takeover under AIM Rule 14 (including

seeking re-admission as an investing company (as defined under the

AIM Rules)) on or before the date falling six months from

completion or be re-admitted to trading on AIM as an investing

company under the AIM Rules (which requires the raising of at least

GBP6 million), failing which the Company's Ordinary Shares would

then be suspended from trading on AIM pursuant to AIM Rule 40.

Admission to trading on AIM would be cancelled six months from the

date of suspension should the reason for the suspension not be

rectified during that period.

Any failure in completing an acquisition or acquisitions which

constitute(s) a reverse takeover under AIM Rule 14, including

seeking re-admission as an investing company (as defined under the

AIM Rules), will result in the cancellation of the Company's

Ordinary Shares from trading on AIM.

Fiinu - initial operations to be commenced following the

confirmation of the Banking Licence

On 7 June 2022, the PRA and the FCA issued a joint 'authorised

subject to capital' letter for Fiinu 2.

Following the approval of the Proposed Acquisition at the

General Meeting, the Company and Fiinu Holdings will immediately

provide the necessary evidence to the PRA and the FCA to prove that

the required capital is in place and available to the licensed

entity, Fiinu 2 Limited, which will be evidenced through the

availability of the Company's existing cash resources and,

following Admission, the net proceeds of the Placing. Additionally,

the Company and Fiinu Holdings will complete the necessary UK CRR

and UK Holding Company application forms for the Company to be

approved by the PRA and the FCA as a UK "parent financial holding

company" in respect of the Enlarged Group in accordance with the UK

CRR. The draft documentation and application has been reviewed by

the PRA and the FCA prior to the publication of this document.

Admission will take place, and the Acquisition will complete,

following receipt of the Regulatory Approvals in writing. Further

details of the 'authorised subject to capital' letter, the Banking

Licence, the restrictions and the applicable banking regime are set

out in Part VI of this Admission Document: Regulation of the

Enlarged Group. During the first half of the 12-month mobilisation

period, which will commence following completion of the Acquisition

and Admission, the Enlarged Group will complete, test, and

externally audit its bespoke technology stack for operational

resilience. It is anticipated that the Enlarged Group will start

test lending during the second half of the mobilisation period,

which will be restricted to friends and family. This test lending

would allow the Enlarged Group to test its operational resilience

before the Enlarged Group can apply for a Variation of Permission

to lift the deposit-taking restriction on the Banking Licence.

During the mobilisation phase, lending will be restricted and a

formal restriction will be applied to the Enlarged Group's deposit

taking, limiting this to a maximum of GBP50,000 of Financial

Services Compensation Scheme covered deposits.

In order for Fiinu 2 to be granted a Variation of Permission,

the Enlarged Group will need to demonstrate it has sufficient

regulatory and working capital to exit mobilisation and commence

unrestricted operations following further approval by the PRA/FCA.

The current estimate for this proposed fundraising, which is

expected to occur within 12 months of Admission, is cGBP30 million,

some two thirds of which would be for additional regulatory

capital. If the Enlarged Group is unable to raise this capital, or

to satisfy the other applicable conditions, it will be unable to

exit mobilisation or commence unrestricted operations. Should this

occur, the Enlarged Group could seek to extend mobilisation, with

the permission of the PRA/FCA, if they considered this to be the

best course of action or decide to surrender its Banking Licence

and focus solely on developing its IP/technology as a fintech

company. If the Enlarged Group decided to move away from its

original plan, it would then be able to release its regulatory and

buffer capital (which should be c.GBP6 million) and re-allocate it

for use in its Tech services business.

The Enlarged Group also has a Formal Recovery and a Solvent Wind

Down Plan in place for such a situation, but there can be no

guarantee that these options can be executed in such a way to avoid

a material adverse impact on the Enlarged Group's prospects.

DIRECTORS, PROPOSED DIRECTORS AND KEY MANAGEMENT

Brief biographical details of the Existing Directors, Proposed

Directors and senior management are set out below:

Existing Directors

All the Existing Directors, with the exception of Simon

Leathers, will be resigning at Admission.

Tim Hipperson - Non-Executive Chairman (aged 52)

Tim is an experienced and innovative business leader with

specialist knowledge in digital technology, data, content

development, media and mobile and has held CEO positions within

WPP, Interpublic Group and Publicis Groupe, and more recently as

Interim CEO of Weve Ltd, the jointly funded mobile venture invested

in by O2, EE and Vodafone. He has his own consultancy business,

Morph Management Ltd, running strategic business reviews, business

changes and M&A projects, and advises the investment market

(PE/VC) on current and future investment opportunities in

technology-based companies. Tim was appointed to the Board in

August 2017.

Mark Horrocks - Non-Executive Director (aged 60)

Mark joined the City in 1982 as a Financial Analyst for the

Guardian Royal Exchange Group Plc and went on to manage the UK

equity portfolios of the main Pension and Life funds representing

assets of over GBP2bn until leaving in 1997 to pursue his own

interests in the small company marketplace. He went on to join the

boards of several quoted small companies and gained a thorough

understanding of the needs of such companies as quoted businesses.

In 1999 he jointly created and launched the Small Company

Investment Trust Intrinsic Value Plc and is currently a Partner in

Intrinsic Capital LLP.

Simon Leathers FCA - Non-Executive Director (aged 47)

Simon qualified as a Chartered Accountant in 1999 and became a

Chartered Member of the Chartered Institute for Securities &

Investment (Chartered MCSI) in 2010. He has over 20 years of

corporate finance experience with PwC, BDO and several Equity

Capital Market brokerages. Over this period, Simon acted as an AIM

Qualified Executive, a LSE Main Market Sponsor and acted as lead

corporate financier on a broad range of capital market

transactions. Outside of Fiinu, Simon works as the CFO of

Conversity Limited, a B2B SaaS provider of Intelligent Guided

Selling Solutions. At Conversity, Simon has secured finance to

further product and sales development and has deployed payroll and

IT infrastructure in support of nascent overseas sales

operations.

On Admission, Simon, will remain on the Company's board as an

Independent Non-Executive Director and chair the Remuneration

Committee. He will also be a member of the Board Audit

Committee.

Fiinu Group Plc Directors

With effect from Admission, it is intended that the following

directors will be appointed. The Board construct is four

Independent Non-Executive Directors and three Executive Directors

with the Chair having

the casting vote.

David Hopton - Independent Non-Executive Chairman (aged 72)

David is an experienced Board member with over 40 years'

experience in financial services. He is a former banker and

regulator with extensive knowledge of financial services and

governance. Prior to Fiinu, David's experience includes 17 years at

the Bank of England, 22 years in Senior Management teams in UK

banking industry and five years as a Non-Executive Director and

External Adviser.

As a central banker, David was involved in research, policy,

regulation, money and government bond markets, industrial finance

and industrial relations, including two years at the Bank of

International Settlement in Basel, as Secretariat to the G10

Governors Committee.

At Abbey National / Santander, David was the Deputy Head of

Santander Global Banking and Markets UK, and a member of Santander

UK senior management team. David was member of ALCO, Risk and

Executive Committees. David was responsible for a Short-Term

Markets trading profit centre and for the management of short-term

liquidity.

After retiring from executive management, David was appointed as

Independent Non-Executive Director for Punjab National Bank

International Limited, a retail bank catering specifically for the

needs of Indian communities in the UK, where as well as being

Senior Independent Director David served as the Chair of Management

Committee of Board and Chair of Board Risk Committee. David was

also a member of Audit and Compliance Committee and Nomination and

Remuneration Committee. David is currently also an Independent

Non-Executive Director at Masthaven Bank in the UK.

Chris Sweeney - Chief Executive Officer (aged 56)

Chris is an experienced executive. Prior to joining Fiinu, Chris

was CEO at 118 118 Money and prior to that he was CEO of Vanquis

Bank and Executive Director with over 20 years' experience in

consumer finance and retail banking with a track record of driving

businesses through strategic transformational change in UK and

overseas markets. He is adept at building and leading robust and

delivery focused teams and a passionate believer that strategic

change is led by really understanding what customers truly value

and that meeting those insights will deliver outstanding commercial

results and good customer outcomes.

At Vanquis Bank, Chris drove forward the bank's key

digitalisation agenda, attracting over 850,000 customers on to the

mobile app by the time he left the bank. He grew Vanquis Bank

business year on year and played a key role in settling the GBP172

million Financial Conduct Authority investigation into the

Vanquis Bank Repayment Option Plan.

Prior to joining Vanquis Bank, Chris was the Chief Executive of

Personal Banking, International at Standard Bank, and became Group

Executive of Card Payment Solutions in January 2013. Between 2001

and 2010 he worked for Barclaycard and Barclays, across the UK,

Europe and Africa. Chris has an BSc (Hons) degree in Chemistry from

the University of Birmingham and has completed the Advanced

Management Programme at Harvard Business School.

Philip Tansey FCA - Chief Financial Officer (aged 55)

Philip is the former CFO for WH Ireland plc, an AIM quoted

financial services group comprising bespoke personal wealth

management services with a corporate and institutional broker.

Philip has extensive experience leading global operations in

dynamic enterprises. He joined Panmure Gordon as a main Board

Executive Director from BGC Partners Inc where he was Chief Control

Officer. Over six years he managed the day-to-day operation of the

firm's infrastructure, its public accounts and significant

transactions including acquisitions, restructurings and legal

negotiations including a major turn-around and clean-up

operation.

He also acted as Company Secretary. Before joining BGC, he was a

director within Deutsche Bank's Office of Internal Controls. His

career has also spanned Credit Suisse First Boston, where he was

Chief Operating Officer of the bank's fixed income and derivatives

product control group. Phillip's early career included roles at

CIBC Wood Gundy, Bankers Trust, Salomon Brothers and BDO Stoy

Hayward, where he qualified as a chartered accountant.

Dr Marko Sjoblom - Founder and Executive Director (aged 51)

Marko is a successful second-time entrepreneur and the Founder

of Fiinu. He is the CEO of Fiinu's technology business, Fiinu

Services Ltd. He is a former elite athlete with a doctorate in

artificial intelligence and unbundling banking services. His

fintech experience includes over ten years on Wall Street and in

the City of London including ten years with leading banking,

treasury, risk and payments companies. He has served as a treasury

steering committee member at four DAX-30 companies.

Prior to Fiinu, Marko founded one of the largest overdraft-style

lenders in the UK which developed a fully automated software robot

that lent and recovered over $1 billion in small increments in the

UK without reliance on credit bureau data. His previous business

was independently valued at $171 million after five years.

Prior to becoming an entrepreneur, Marko was a sales director at

Reval, a Wall Street based hedge accounting and quant risk

modelling platform. The company was acquired by Carlyle Group,

through a $280 million LBO. Marko was a director at Kyriba, an

in-house bank and payment factory SaaS platform which became a

unicorn after receiving a $160 million investment from Bridgepoint

Capital. Marko was also with Trema for five years, helping large

incumbent banks and corporate treasuries to manage their risk

through straight-through-process automation. The company was

acquired by Warburg Pincus, through a $150 million LBO in 2006 and

later by ION Group.

Huw Evans - Independent Non-Executive Director (aged 62)

Huw worked for Barclays Bank for 30 years in various roles. He

has a very strong banking risk and credit background including a

role as the Risk Director with the 12 countries that then comprised

Barclays Africa & Middle East and, latterly, ten years with

banks in the Middle East in similar roles. Huw is an

enterprise-wide risk professional who is used to building strong

relationships at C-Suite and board level.

He is an experienced wholesale and debt capital markets

practitioner, as well as being thoroughly versed in all aspects of

consumer lending, portfolio optimisation and auto-decisioning,

developed and proven over many years. Prior to joining Fiinu, Huw

was Group Chief Credit Officer at the Commercial Bank of Qatar

where he was responsible, amongst other things, for all aspects of

enterprise-wide consumer credit origination, processing, scoring

and recovery. Huw also owned the risk control framework for BMI

Bank (Bank Muscat International) in Bahrain, as their Chief Risk

Officer.

He is currently an Independent Non-Executive Director at All

Africa Capital Limited, a financial consultancy based in

London.

On the commitments of the Banking Licence, Huw will become Chair

of the Fiinu 2 Board Risk and Compliance Committee ("BRCC") and a

member of the Fiinu Bank Board Audit Committee ("BAC") and the

Remuneration and Nominations Committee ("BRNC") subject to

regulatory approval of his appointment.

Jerry Loy FCA - Independent Non-Executive Director (aged 53)

Jerry has served over 25 years in financial services with a

focus on accounting and audit. He has worked across the private and

public sectors and led the development of small to large companies

through multiple transformations (be it systems, processes, people)

including start-up, growth, maturing and decline.

Prior to joining Fiinu, Jerry gained valuable banking, financial

and operational experience with KPMG, The Capital Group, the

private banking arms of two Middle Eastern banks as well as

managing programmes for the UK Government's Department for

International Trade and the Japanese Government's Ministry of

Foreign Affairs.

Jerry has extensive experience of working with audit committees

and with regulatory bodies. At NBAD Private Bank (Suisse) SA and

QNB Banque Privée (Suisse) SA, two start up banks, Jerry served as

Secretary to the Audit Committee and The Board of Directors. Jerry

now chairs the audit committees for two other regulated financial

services entities and is an Independent Non-Executive Director at

Redwood Bank. Jerry is a Fellow of the Institute of Chartered

Accountants in England and in Wales, qualifying with KPMG.

On Admission, Jerry will also become an Independent

Non-Executive Director at Fiinu 2. He will also Chair the board of

Fiinu Services and the Fiinu 2 BAC and be a member of BRNC and

BRCC, bringing his extensive audit and senior executive management

experience to the business.

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEDZLFFLQLLBBB

(END) Dow Jones Newswires

June 14, 2022 13:22 ET (17:22 GMT)

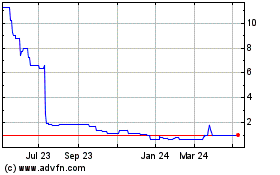

Fiinu (LSE:BANK)

Historical Stock Chart

From Oct 2024 to Nov 2024

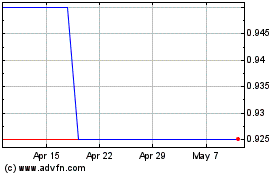

Fiinu (LSE:BANK)

Historical Stock Chart

From Nov 2023 to Nov 2024