BH Macro Limited Proposed combination with BH Global Limited

May 28 2021 - 10:15AM

UK Regulatory

TIDMBHMG TIDMBHMU

THIS ANNOUNCEMENT IS NOT FOR DISTRIBUTION IN OR INTO THE UNITED STATES, CANADA,

AUSTRALIA OR JAPAN OR ANY OTHER JURISDICTION IN WHICH ITS DISTRIBUTION MAY BE

UNLAWFUL

THIS ANNOUNCEMENT INCLUDES INSIDE INFORMATION

BH MACRO LIMITED

(a closed-ended investment company incorporated in Guernsey with registration

number 46235)

LEI: 549300ZOFF0Z2CM87C29

28 May 2021

Proposed combination with BH Global Limited

Introduction

The Board of BH Macro Limited (the "Company" and "BHMG") is pleased to announce

that it has agreed heads of terms with the Board of BH Global Limited ("BHGG")

and Brevan Howard Capital Management LP, the manager of both BHMG and BHGG (the

"Manager") in respect of the combination of BHMG with BHGG (the "Combination")

to be effected by way of a scheme of reconstruction of BHGG (the "Scheme").

BHMG will be the continuing entity following the Combination and will continue

to follow its existing investment policy solely as a feeder fund into Brevan

Howard Master Fund Limited (the "Master Fund").

The Scheme will be subject to the approval of BHGG's shareholders. The largest

shareholders of both BHMG and BHGG have signalled their support in principle

for the Combination.

Under the Scheme, BHGG shareholders will be offered the option of exchanging

their shares for shares of the same currency class of BHMG or to receive a cash

payment. The Scheme will replace the proposed tender offer previously announced

by BHGG for up to 40% of each class of BHGG shares in issue (excluding treasury

shares).

BHMG will proceed with its tender offer (the "BHMG Tender Offer") for up to 40%

of its shares of each class in issue (excluding treasury shares) on the basis

previously announced. The BHMG Tender Offer will be completed prior to

implementation of the Scheme.

The Board of BHMG believes that BHMG shareholders should benefit from the

Combination on the basis that, subject also to the outcome of the BHMG Tender

Offer, BHMG should be enlarged by the Combination, allowing BHMG's fixed costs

to be spread over a larger cost base, alongside improving liquidity and aiding

marketing in respect of BHMG's shares.

Further details on the Combination

Pursuant to the Scheme, BHGG shareholders will (subject to any applicable

regulatory restrictions) be given the option to elect to receive in place of

their existing BHGG shares:

(a) BHMG shares of the same currency class and with the same value on

the basis of the relative NAVs per share of the relevant class of each company

on the effective date of the Combination (the "Share Alternative"); or

(b) a cash amount equal to 97.8% of the NAV per share of each BHGG share

held at the effective date of the Combination (the "Cash Alternative").

These figures will not include the costs of the Combination and the BHMG

figures will not include any uplift that may otherwise have been created by the

BHMG Tender Offer. BHGG shareholders electing for the Cash Alternative will

also receive an additional amount per share to offset the impact of the

increase of the BHGG management fee effective from 1 July 2021.

The assets of BHGG attributable to shares for which Share Alternative elections

are made will be transferred to the Company for investment in the Master Fund.

Any other assets of BHGG remaining after payment of the Cash Alternative and

the liabilities and costs of the liquidation of BHGG (including BHGG's costs in

respect of the Scheme) will also be transferred to the Company, subject to an

agreed retention being made by the liquidators in respect of any unknown or

unascertainable liabilities of BHGG.

BHGG will meet its costs of the Combination out of those of its assets

representing the difference between the payments made in respect of Cash

Alternative elections and the net asset value of the shares in respect of which

those elections were made. The Company has also agreed to make a contribution

to BHGG to cover any shortfall if such assets prove insufficient to meet BHGG's

budgeted costs (which will depend upon the extent of Cash Alternative elections

made by BHGG's shareholders).

The Company will meet its costs of the Combination from the uplift delivered

from the BHMG Tender Offer and any assets transferred from BHGG in excess of

those that are invested in the Master Fund in respect of shares issued pursuant

to the Share Alternative. In addition, the Manager has agreed to make a

contribution to the Company in respect of its costs of the Combination if

required to help ensure that the Combination is not NAV dilutive for continuing

shareholders.

Expected timetables

Subject to the receipt of applicable regulatory and tax approvals, it is

anticipated that documentation regarding the Combination will be sent to BHGG

shareholders by the end of June 2021 and, subject to BHGG shareholder approval

being obtained, the Combination will be effected prior to the end of August

2021 on the basis of BHMG's and BHGG's respective July 2021 month end NAVs.

A circular in respect of the BHMG Tender Offer will be sent to BHMG

shareholders shortly, with the tender period being open during June 2021, the

tender prices being calculated by reference to the BHMG June 2021 month end

NAVs and the tender consideration being paid prior to the end of July 2021.

Enquiries:

Richard Horlick

Chairman

William Simmonds

J.P. Morgan Cazenove

020 7742 4000

Edward Berry / Josh Sarson

FTI Consulting

07703 330 199 / 0755 499 1072

Important notices

J.P. Morgan Securities plc, which conducts its UK investment banking activities

as J.P. Morgan Cazenove ("J.P. Morgan Cazenove"), which is authorised by the

Prudential Regulation Authority and regulated by the Prudential Regulation

Authority and the Financial Conduct Authority in the United Kingdom, is acting

exclusively for the Company and no-one else in connection with the Combination,

the BHMG Tender Offer and will not be responsible to anyone other than the

Company for providing the protections afforded to customers of J.P. Morgan

Cazenove or for providing advice in relation to the Combination, the BHMG

Tender Offer or any other matter referred to herein.

This announcement does not constitute an offer or solicitation to acquire or

sell any securities in the Company. This announcement is not for distribution

in or into the United States, Canada, Australia or Japan or any other

jurisdiction in which its distribution may be unlawful. This announcement is

not an offer of securities for sale in the United States or elsewhere. The

securities of the Company have not been and will not be registered under the

United States Securities Act of 1933, as amended (the "Securities Act"), and

may not be offered or sold in the United States unless registered under the

Securities Act or pursuant to an exemption from such registration. The Company

has not been and will not be registered under the US Investment Company Act of

1940, as amended, and investors are not entitled to the benefits of that Act.

There has not been and there will be no public offering of the Company's

securities in the United States.

END

(END) Dow Jones Newswires

May 28, 2021 11:15 ET (15:15 GMT)

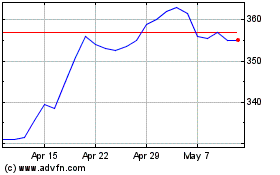

Bh Macro (LSE:BHMG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Bh Macro (LSE:BHMG)

Historical Stock Chart

From Jul 2023 to Jul 2024