BP Reports Steep Fourth-Quarter Loss -- 3rd Update

February 02 2016 - 9:32AM

Dow Jones News

By Sarah Kent

LONDON--BP PLC's earnings collapsed in 2015, the company said

Tuesday, amounting to a full-year loss of $5.2 billion that

illustrates the toll a 20-month slide in oil prices is taking on

the world's energy industry.

The U.K. oil titan said it would have to cut another 3,000 jobs

by the end of 2017 in another move to slash costs to respond to oil

prices that averaged just $44 a barrel in the last three months of

2015. For the fourth quarter alone, BP said it posted a

replacement-cost loss--a number analogous to the net income that

U.S. oil companies report--of $2.2 billion.

BP's results come after Chevron Corp. said last week it would

slash its spending by $9 billion and lay off 4,000 workers in 2016

after reporting a surprise fourth-quarter loss of more than half a

billion dollars. Exxon Mobil Corp. said Tuesday that its earnings

tumbled 58% in the fourth quarter to their lowest level since 2002.

Royal Dutch Shell PLC is also expected to report sharply lower

profits this week, after indicating last month that its adjusted

earnings fell 50% in 2015.

The pressure remains on the oil sector as the glut in supply

that has caused the downturn in oil prices shows no sign of letting

up. Prices have continued to tumble in the first two months of

2016, falling to $27 a barrel in January and trading around $33 a

barrel on Tuesday. That is down from their peak of $114 a barrel in

June 2014.

Analysts and banks lowered their price outlooks for 2016 to $50

a barrel, down from $57 a barrel, and ratings firms say their

outlook for the sector is negative. Standard & Poor's

downgraded Shell on Monday and said it would review its status

again once its roughly $50 billion acquisition of smaller rival BG

Group PLC completes. The ratings agency also placed BP and a number

of its peers on credit watch, suggesting a downgrade could follow

soon.

Despite the current market turmoil, BP's management struck an

optimistic note Tuesday, with CEO Bob Dudley replacing his mantra

of 2015--that oil prices would be "lower for longer"--with the view

that prices won't "be lower forever."

That didn't soften the blow to the company in the fourth

quarter, which suffered a significant loss at its exploration and

production unit, and impairment and restructuring charges amounting

to $2.6 billion. Its full-year loss of $5.2 billion is comparable

to the mammoth hit BP took in 2010 following its blowout in the

Gulf of Mexico.

BP's performance was much worse than analysts' already dismal

expectations. A poll of six analysts by Dow Jones Newswires

suggested the company would report a 60% slide in underlying profit

in the fourth quarter. It tanked more than 90%, prompting a 9%

selloff in BP's shares.

Mr. Dudley said he was "surprised by the reaction" to BP's

results, which he said were largely down to exploration write-offs.

"We're moving quite fast down the path to reset the company," Mr.

Dudley said at a news conference. Still, he added, "2016 is going

to be tough."

In January, BP announced plans to cut its

exploration-and-production staff by 4,000 this year. It added to

this number on Tuesday, highlighting its intention to reduce the

head count in its refining and marketing arm by 3,000 by the end of

2017. The company has outlined plans to manage spending so that it

can cover exploration-and-production costs and shareholder payouts

with cash by 2017 with oil at $60 a barrel, though that is still

nearly double the current price.

BP's downstream division remained profitable in the fourth

quarter, but its performance was significantly weaker than earlier

in the year, hurt by the performance in its trading business. For

the year, the company reported a record result in its downstream

division as profits before interest and tax nearly doubled to $7.1

billion.

Chief Financial Officer Brian Gilvary said the company's

strategy for this year was based on an oil price below $50 a

barrel, but supply and demand is expected to begin to rebalance in

the second half of the year.

BP already brought down costs by $3.4 billion in 2015 and

expects them to be $7 billion lower by 2017. Capital spending over

the next two years is expected to stay between $17 billion and $19

billion and it plans to sell off $3 billion to $5 billion worth of

assets this year.

The company's dividend, though, remains untouched at 10 cents a

share, reflecting big oil companies' continued commitment to

shareholder payouts--a measure they regard as practically

sacrosanct--despite the difficult environment.

"Provided we remain confident we can get everything back in

balance, i.e. the cash we generate will cover capital expenditure

and dividends by 2017, then the dividend remains sustainable," Mr.

Gilvary said, though he acknowledged that calculation could come

under pressure if the company's view of the market changes.

BP also took a charge of $443 million in the fourth quarter

relating to its 2010 blowout in the Gulf of Mexico. Though the

company's move to finalize the terms of a $20.8 billion settlement

with the U.S. government last year has given it some certainty over

the size of its liabilities, it will likely be decades before it

has fully shaken the incident. So far, the company has paid out

$55.5 billion before taxes in relation to the spill.

Write to Sarah Kent at sarah.kent@wsj.com

(END) Dow Jones Newswires

February 02, 2016 10:17 ET (15:17 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

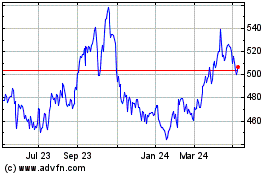

Bp (LSE:BP.)

Historical Stock Chart

From Jan 2025 to Feb 2025

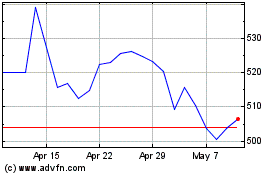

Bp (LSE:BP.)

Historical Stock Chart

From Feb 2024 to Feb 2025