BioPharma Credit PLC UPDATE ON INVESTMENT

November 01 2024 - 2:00AM

RNS Regulatory News

RNS Number : 5084K

BioPharma Credit PLC

01 November 2024

BioPharma Credit PLC

1 November 2024

BIOPHARMA

CREDIT PLC

(THE

"COMPANY")

UPDATE ON

INVESTMENT

BioPharma Credit PLC (LSE: BPCR),

the specialist life sciences debt investment trust, is pleased to

announce an additional investment in Insmed Incorporated

("Insmed"). The Company announced on 20 October 2022 a US$350

million senior secured loan to Insmed, with the Company investing

US$140 million and BioPharma Credit Investments V (Master) LP

("BioPharma-V") investing US$210 million. The Company is

investing US$60 million in a new US$150 million tranche, with

BioPharma-V investing US$90 million. Together with the

accrual and capitalization of the partial paid-in-kind interest,

the Company's total exposure to Insmed will be approximately

US$223.5 million.

Based in the US, Insmed is a

publicly traded biopharmaceutical company with a current market

capitalization of ~US$12 billion (Ticker: INSM -

NASDAQ). Insmed, a commercial stage global biopharmaceutical

company striving to deliver first- and best-in-class therapies to

transform the lives of patients facing serious diseases, reported

trailing nine-month net sales of US$259 million during

the period ending 30 September 2024 and USD$1.468 billion in cash

and marketable securities as of 30 September

2024. Insmed is advancing a diverse

portfolio of approved and mid- to late-stage investigational

medicines as well as cutting-edge drug discovery focused on serving

patient communities where the need is greatest. Insmed's most

advanced programs are in pulmonary and inflammatory

conditions.

In addition to the new tranche,

certain amendments were made to the Insmed loan, including

extending the maturity to September 2029, resetting the make-whole

period to three years from the amendment date, reducing the

interest rate from 3-month SOFR plus 7.75 per cent. per annum to a

fixed rate of 9.60 per cent. per annum, and adding a 2.00 per cent.

exit fee payable upon any payment of principal, scheduled or

otherwise. A one-time additional consideration of 2.00 per

cent. of the second tranche was paid on the funding of the second

tranche.

Enquiries

Burson Buchanan

Mark Court / Jamie Hooper /

Henry Wilson / Samuel Adams

+44 (0) 20 7466 5000

biopharmacredit@buchanan.uk.com

Notes to Editors

BioPharma Credit

PLC is London's only specialist debt investor to the

life sciences industry and joined the LSE in March 2017. The

Company seeks to provide long-term shareholder returns, principally

in the form of sustainable income distributions from exposure to

the life sciences industry. The Company seeks to achieve this

objective primarily through investments in debt assets secured by

royalties or other cash flows derived from the sales of approved

life sciences products.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

UPDMBBBTMTAJTBI

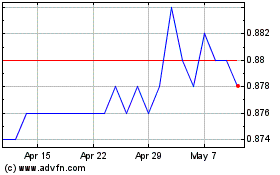

Biopharma Credit (LSE:BPCR)

Historical Stock Chart

From Dec 2024 to Jan 2025

Biopharma Credit (LSE:BPCR)

Historical Stock Chart

From Jan 2024 to Jan 2025