U.K. CMA Clears BT's GBP12.5 Billion Acquisition of EE

January 15 2016 - 1:57AM

Dow Jones News

By Ian Walker

LONDON--The U.K. Competition and Markets Authority said Friday

it has cleared BT Group PLC (BT.A.LN)'s 12.5 billion pound ($18

billion) acquisition of EE Ltd. as it believes the deal won't

result in a substantial lessening of competition.

The CMA said BT and EE operate largely in separate areas, with

BT strong in supplying fixed communications services (voice,

broadband and pay TV), EE strong in supplying mobile communications

services, and limited overlap between them in both categories of

service.

"Since our provisional findings, we have taken extra time to

consider responses in detail but the evidence does not show that

this merger is likely to cause significant harm to competition or

the interests of consumers," John Wotton, Inquiry Chair, said.

BT said it welcomed the decision, adding that it paves the way

for BT to complete the acquisition from Deutsche Telekom AG of

Germany (DTEGY) and Orange SA of France (ORA.FR) in the coming

weeks and to incorporate the business into the wider BT Group in

the months to come.

"The combined BT and EE will be a digital champion for the U.K.,

providing high levels of investment and driving innovation in a

highly competitive market," BT Chief Executive Gavin Patterson

said.

BT said it will now start the formal process of completing the

deal. A prospectus will be issued shortly and the deal set to close

Jan. 29, when Deutsche Telekom and Orange will receive shares in

BT.

After the completion of the deal, Deutsche Telekom will have 12%

of BT shares and Orange will have 4%. A representative of Deutsche

Telekom will be appointed to the BT Board in due course.

-Write to Ian Walker at ian.walker@wsj.com; @IanWalk40289749

(END) Dow Jones Newswires

January 15, 2016 02:42 ET (07:42 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

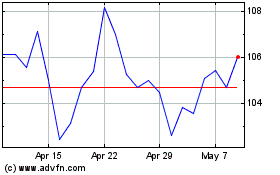

Bt (LSE:BT.A)

Historical Stock Chart

From May 2024 to Jun 2024

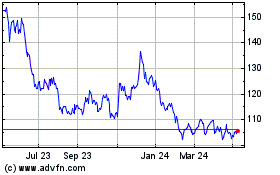

Bt (LSE:BT.A)

Historical Stock Chart

From Jun 2023 to Jun 2024