TIDMBUR

RNS Number : 6828I

Burford Capital Limited

12 August 2019

12 August 2019

ANALYSIS IDENTIFIES EVIDENCE CONSISTENT WITH

ILLEGAL MARKET MANIPULATION IN BURFORD SHARES

Burford Capital Limited ("Burford Capital" or "Burford" or "the

Company"), the leading global finance and investment management

firm focused on law, announces the preliminary findings of its

analysis of the trading of its shares last week. We believe that

trading shows evidence consistent with illegal market

manipulation.

While Burford continues to analyse the data, it has made

regulatory authorities and criminal prosecutors aware of these

preliminary conclusions and Burford is considering its own options.

Burford has retained the law firms of Quinn Emanuel Urquhart &

Sullivan LLP, Freshfields Bruckhaus Deringer LLP and Morrison &

Foerster LLP in connection with these matters.

A forensic examination by Burford and its expert(1) of the

detailed trading data made generally available by the London Stock

Exchange for 6 August (the day on which Muddy Waters tweeted about

a forthcoming - but unidentified - short target) and 7 August (the

day on which Muddy Waters released its short attack on Burford)

discloses trading activity consistent with material illegal

activity.

Spoofing and layering

Background

Spoofing is the placement of a high volume of trading orders at

a price equal to or better (i.e., lower) than the

best-bid-best-offer price and subsequently cancelling these orders

to move the price in a given direction without actually concluding

any trades. For example, consider a stock where the current best

offer is GBP9.99 per share. A spoofer might place a high volume of

sell orders at GBP9.98, causing the best offer to decline to

GBP9.98, immediately cancel those sell orders before they can

execute, and then place a high volume of new sell orders at

GBP9.97. The strategy of repeatedly placing and cancelling sell

orders at or below the best offer without actually selling any

shares artificially drives down the share price.

Layering is similar to spoofing, except that instead of placing

and cancelling a high volume of orders at the best offer price, the

manipulator places these orders deeper in the order book, at prices

above the best offer. Continuing the prior example, suppose the

manipulator worries that the artificially "spoofed" sell orders at

GBP9.98 will be inadvertently executed before they can be

cancelled. Instead of placing these orders at GBP9.98 (or GBP9.99,

the original best offer), the manipulator may place a high volume

of orders at GBP10.01, GBP10.05, or some other price slightly above

GBP9.99. These orders are virtually certain not to be filled but

they affect pricing by suggesting falsely that there is a large

volume of shares for sale.

Spoofing and layering are both illegal and have resulted in

criminal convictions in the past. As an example, layering led to

the 2010 "flash crash" when the Dow Jones Industrial Average fell

600 points in five minutes; the perpetrator was found guilty of

fraud.

6 August trading following the Muddy Waters tweet

On 6 August, in the several hours following the 13:30 release of

the Muddy Waters tweet about a forthcoming short attack, almost

GBP90 million of sell orders were placed and cancelled without

being filled - for a stock whose average trading volume for an

entire day was less than one-fifth that amount. As discussed above,

that trading conduct is consistent with illegal market

manipulation. Moreover, during five one-minute periods on 6 August

(14:17, 14:30, 14:35, 14:43, 14:45), Burford's shares fell 6%, or

over GBP170 million in value, some of its sharpest declines of the

day. During these periods, executed sell orders totaled a mere

GBP186,000. That mismatch between price movement and executed

orders is consistent with market manipulation. To show the impact

we believe this behavior had on Burford's shares, compare five

other minutes of trading on 6 August with more significant levels

of actually executed orders: during the one-minute periods of

14:07, 14:59, 15:14, 15:15 and 15:43, executed orders totaled

GBP1.5 million - eight times as much as the periods identified

above - and the price of Burford's shares rose by nearly 2% during

those five one-minute periods.

7 August trading around and following the Muddy Waters

report

On 7 August, a day on which over 28 million Burford shares

traded, Burford's share price suffered its greatest declines over

just ten single minute periods with very low volumes of executed

sales and very high volumes of cancelled sales orders. Indeed,

Burford's share price declined by a full 60% over those 10

one-minute periods even though only 739,724 shares were actually

traded - around 0.3% of Burford's shares.

The following table shows the ten one-minute periods during

which the price of Burford's shares fell the most on 7 August, as

well as the number of sell orders(2) created, cancelled and

executed.

Time (approx.) Price Decline # of Sell Orders # of Sell Orders # of Sell Orders

(approx.) Created Cancelled Executed

08:22 -4.6% 359,541 352,878 32,905

-------------- ----------------- -----------------

08:53 -7.6% 291,364 275,306 27,885

08:59 -9.7% 354,681 442,350 122,988

-------------- ----------------- -----------------

09:22 -4.5% 260,083 250,894 9,568

09:51 -5.3% 287,962 261,342 16,714

-------------- ----------------- -----------------

09:57 -4.5% 777,319 825,095 271,231

10:03 -9.1% 372,296 426,233 164,833

-------------- ----------------- -----------------

10:51 -4.6% 352,630 343,851 14,962

11:22 -4.9% 230,362 181,128 66,754

-------------- ----------------- -----------------

13:52 -5.2% 322,016 309,847 11,884

--------------- -------------- ----------------- ----------------- -----------------

These ten minutes collectively reflect a 60% decline in the

price of Burford's shares. Yet it is striking how few shares were

actually sold over these windows.

For example, at 08:53, the minute which saw a 7.6% price

decline, there were only 27,885 shares actually sold - less than

10% of the number of shares underlying the orders created, 291,364.

It strains credulity to believe that a decline on the order of

hundreds of millions of pounds in market capitalization was driven

solely by actual trading amounting to a few hundred thousand pounds

absent market manipulation.

To see why in our view it is unreasonable to conclude that the

decline in Burford's share price was driven by actual sales of

shares, simply compare 08:53, when 27,885 shares were sold and the

share price declined 7.6%, with 11:22, when more than twice as many

shares were sold but the share price decline was just over half in

magnitude. What accounts for the difference between 08:53 and

11:22? The former had nearly 100,000 more orders for shares

cancelled than the latter - suggesting that it is the volume of

sell-side cancellations, not executions (actual trades), that drove

down the price.

The Muddy Waters delayed tweet

A large wave of sell order cancellations arrived in the few

minutes preceding Muddy Waters' first tweet on 7 August identifying

Burford Capital as the target of its short attack.

On 6 August, Muddy Waters posted a tweet stating that at "8 am

London time" the next day "we will announce a new short position on

an accounting fiasco that's potentially insolvent and possibly

facing a liquidity crunch."

An examination of Twitter microdata shows that Muddy Waters'

first tweet on 7 August actually announcing the identity of Burford

Capital as its victim was posted at 08:53:48, a delay of 53 minutes

and 48 seconds from the previously promised time of 08:00.

Muddy Waters did not publicly reschedule its announcement to

08:53 or otherwise provide any public indication of the actual

timing of the report's release.

The LSE data show that an unusual flood of sell-side

cancellations began to arrive in the three minutes immediately

preceding this tweet. Specifically, from 8:50am-8:53:47am, sell

orders totaling over 578,000 shares were cancelled - approaching

Burford's entire regular daily trading volume in less than four

minutes. In fact, during those three minutes and forty-eight

seconds before the tweet, there were 578,112 shares worth of

cancelled sell-side orders as compared to only 36,597 shares sold

in actual executed sales, a ratio of 15.8 to 1. We currently see no

non-manipulative explanation for that market phenomenon.

Given that Muddy Waters made no public announcement about the

actual timing of the release of the report, we do not see why a

legitimate market participant without knowledge of the actual

tweet's expected release time and content would be placing and

cancelling a large number of sell orders in the three minutes

before the release of the tweet.

It is also worth noting that according to FCA data Muddy Waters

initiated its short position in Burford on 5 August, the day before

its teaser tweet about a report being forthcoming, reduced its

short position by 20% on 6 August, the day of the teaser tweet, and

exited a further 63% of the position on 7 August, the day of the

report's release. In other words, while Muddy Waters was suggesting

that Burford was insolvent, it was at the same time buying Burford

shares.

Twitter and algorithmic trading

Muddy Waters asserted in a tweet and in its report that Burford

was "arguably insolvent".

There is no factual basis for that statement and we debunked it

in our rebuttal to the report. To reach it, Muddy Waters needed to

engage in an entirely contrived and unrealistic analysis that we do

not believe it has defended or reiterated since.

Burford is informed that posting certain phrases, such as

"insolvent", on Twitter can induce an algorithmic sell off in a

stock, and that a wider analysis of short seller tweets in general

shows that references to "liquidity risks" and "insolvent," which

appeared in Muddy Waters' tweet at 08:56, lead to sharp price

declines. Statistically speaking, these terms jointly increase the

odds of an artificial price decline in a manner that is highly

unlikely to have been caused by random chance.

Next steps

Burford is continuing its analysis and considering next steps.

Burford also intends to continue to monitor trading activity going

forward and will refer any further evidence it believes to be

indicative of manipulation to the appropriate prosecutorial

authorities.

Christopher Bogart, Chief Executive Officer of Burford,

commented:

"We are committed to working with investors to address any

questions and concerns they may have about Burford and its business

and we are grateful for their feedback. Burford's market-leading

business today is the same as Burford was a week ago. What has

changed is that a substantial amount of market value was wiped out

by activity we believe is consistent with illegal market

manipulation that has nothing to do with Burford's business. That

is wrong and that is illegal."

(1) The analysis summarized in this release was predominantly

conducted by Professor Joshua Mitts of Columbia University, who

specializes in the analysis of market data surrounding short

attacks such as this. See, e.g.,

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3198384.

Burford's and Professor Mitts' analysis is ongoing, and it is

possible that the final results will differ, perhaps materially,

from these preliminary findings. However, Burford's view is that it

is important for the market and investors to be appraised of these

preliminary results even though they are preliminary and may later

be refined or amended.

(2) Figures for orders reflect number of shares underlying those

orders. Rows in the table may not sum given the inherent nature of

isolating single minutes of trading.

For further information, please contact:

Burford Capital Limited

Elizabeth O'Connell, CFA, Chief Financial Officer +1 212 235 6825

Macquarie Capital (Europe) Limited - NOMAD +44 (0)20 3037

and Joint Broker 2000

Jonny Allison

Alex Reynolds

+44 (0)20 3100

Liberum Capital Limited - Joint Broker 2222

Richard Crawley

Jamie Richards

+44 (0)20 7260

Numis Securities Limited - Joint Broker 1000

Charlie Farquhar

Jonathan Abbott

Montfort Communications Limited - Financial +44 (0)20 3770

Communications 7908

Robert Bailhache - email

About Burford Capital

Burford Capital is the leading global finance and investment

management firm focused on law. Its businesses include litigation

finance and risk management, asset recovery and a wide range of

legal finance and advisory activities. Burford is publicly traded

on the London Stock Exchange, and it works with law firms and

clients around the world from its principal offices in New York,

London, Chicago, Washington, Singapore and Sydney.

For more information about Burford: www.burfordcapital.com

This release does not constitute an offer of any Burford fund.

Burford Capital Investment Management LLC ("BCIM"), which acts as

the fund manager of all Burford funds, is registered as an

investment adviser with the U.S. Securities and Exchange

Commission. The information provided herein is for informational

purposes only. Past performance is not indicative of future

results. The information contained herein is not, and should not be

construed as, an offer to sell or the solicitation of an offer to

buy any securities (including, without limitation, interests or

shares in the funds). Any such offer or solicitation may be made

only by means of a final confidential Private Placement Memorandum

and other offering documents.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

STRGGUCWRUPBUAP

(END) Dow Jones Newswires

August 12, 2019 02:00 ET (06:00 GMT)

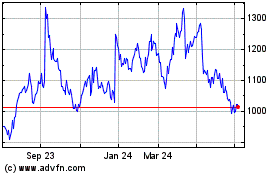

Burford Capital (LSE:BUR)

Historical Stock Chart

From Nov 2024 to Dec 2024

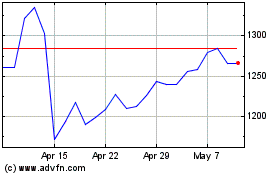

Burford Capital (LSE:BUR)

Historical Stock Chart

From Dec 2023 to Dec 2024