TIDMBWNG

RNS Number : 0730A

Brown (N.) Group PLC

18 January 2024

18 January 2024

Q3 TRADING UPDATE FOR THE 18 WEEKSED 6 JANUARY 2024

Transforming the business and building resilience. Full year

EBITDA on track

N Brown Group Plc ("N Brown" or the "Group"), a top 10 UK

clothing & footwear digital retailer, today provides an update

on trading for the 18 weeks ended 6 January 2024 ("Q3 FY24").

Highlights

-- Improving product revenue trend continued in Q3

-- FY24 Adjusted EBITDA(1) guidance remains unchanged

-- Ongoing investment in transformational priorities with

further progress expected in 2024

-- Strong balance sheet, with total accessible liquidity of over

GBP150m

Revenue

Q3 FY24 Change Q3 FY24 YTD Change FY24

FY24 v Q3 YTD v FY23

FY23(2) YTD(2)

Product revenue GBP150.2m (9.7)% GBP337.7m (10.6)%

----------- ----------- ---------- ------------

Strategic brands(3) GBP111.4m (7.9)% GBP250.8m (7.6)%

----------- ----------- ---------- ------------

Heritage brands(4) GBP38.8m (14.7)% GBP86.9m (18.1)%

----------- ----------- ---------- ------------

Financial Services

revenue GBP75.8m (8.5)% GBP185.3m (8.8)%

----------- ----------- ---------- ------------

Group revenue GBP226.0m (9.3)% GBP523.0m (9.9)%

----------- ----------- ---------- ------------

The improving product revenue trend reported in the Group's

Interim Results on 12 October 2023 continued in Q3 (Q1: -11.9%; Q2:

-10.4%; Q3: -9.7%). This reflects an improvement in both our

Clothing & Footwear and Home businesses in the quarter. Strong

performance was seen in categories including third-party branded

womenswear and lingerie, beauty, gaming consoles and our premium

own-brand, Anthology.

Average item values have continued to be higher, driven by

pricing discipline and product mix, whilst volumes, as expected,

reflect the continuation of lower consumer confidence and measured

choices which we have taken around margin, including the level of

marketing investment.

Within partnerships, the launch of Simply Be on Sainsbury's

online clothing platform and selected stores is performing strongly

in its first year, as well as providing enhanced exposure to

different customer segments.

The debtor book continues to perform as expected despite the

cost of living pressures on customers, supported by our ongoing

assessment and refinement of credit scoring. Financial Services

revenue reflects the lower FY24 opening debtor book position and

the product revenue performance during FY24 YTD.

Transforming the business through strategic and operational

progress

We are continuing to invest in our transformational priorities,

building on progress over the last 12 months. Following the

successful launch of the new Jacamo website, customers are

benefitting from faster site speeds, and the sales conversion rate

has increased by around 20% despite lower promotional activity.

We expect to make further progress to enhance the customer

experience in 2024, including the roll-out of the new JD Williams

website and the addition of new technologies such as our Product

Information Management ('PIM') system, enhancing product

descriptions for customers to inform their purchases and which we

expect will also lead to reduced returns.

The Net Promoter Score ('NPS') for Q3 of 64 is 11pts ahead of

last year and includes benefits from better delivery performance as

well as customer experience improvements.

The Group received the Drapers Award for Diversity and Inclusion

during the period, which is testament to the broader work taking

place in the business, in addition to the technology-focussed

transformation.

Building resilience through a strong balance sheet

The proactive moderation of stock intake and clearance of older

items reported in the Interim Results allowed the business to enter

peak trading with a cleaner stock position. Stock and other working

capital items have continued to be well managed, with stock at 6

January 2024 c. GBP26m lower year-on-year, and with the continued

cleaner position providing a good platform into the remainder of

FY24 and into FY25.

As at 6 January 2024, the Group had a total of GBP66.3m across

unsecured net cash (GBP48.9m) and amounts voluntarily undrawn on

the securitisation facility (GBP17.4m), an increase of GBP30.8m

during the financial year when compared to the unsecured net cash

at 4 March 2023 of GBP35.5m with nil voluntarily undrawn on

securitisation facility. The Group's Revolving Credit Facility and

overdraft remain undrawn and total accessible liquidity at 6

January 2024 was GBP150.2m, up from GBP143.9m at 4 March 2023(5)

.

Adjusted net debt at 6 January 2024 of GBP246.1m has reduced

from the 4 March 2023 position of GBP297.4m and is now under half

of the peak level of adjusted net debt reported at the FY20

year-end (GBP497.2m), despite the GBP49.5m payment made to Allianz

in January 2023.

During the period the Group extended its securitisation facility

commitment to December 2026, maintaining the facility limit of

GBP400m. This continues to provide an efficient form of funding to

the Group and is well covered by the customer receivables book,

with a limit of up to 72 per cent of the 'eligible' customer

receivables book (current and 0-28 days past due) funded.

Outlook and guidance

Our expectations for FY24 Adjusted EBITDA(1) remain unchanged

from those outlined in our Interim Results, with slightly softer

revenues expected to be offset by further margin discipline.

Adjusted net debt is anticipated to improve when compared to

previous guidance and is expected to be under GBP260m at the end of

FY24, whilst retaining a strong unsecured net cash position.

The Board remains confident in the strategic direction of the

business and in the benefits of the ongoing investment in our

digital transformation, with a focus on delivering sustainable

profitable growth. T here has been a slight uptick in customer

optimism during 2023 and although we are assuming that

macro-economic conditions felt by consumers will still be a feature

of our performance during 2024, we believe that conditions will

gradually improve.

Steve Johnson, Chief Executive, said:

"We are pleased with the progress we have made in transforming

the business, the resilience built through our strong balance

sheet, and that our full year EBITDA expectations are on track.

"Building on what's been achieved in the last 12 months, we

continue to make progress on our strategic transformation, with the

launch of the new Jacamo website another recent milestone. 2024

will be about further improving the customer experience and

positioning the business for future growth, with scheduled launches

of the new JD Williams website as well as our Product Information

Management system, which will ensure our customers have better

product descriptions to inform their purchases. Our strong

liquidity position provides a solid base for continued investment

in our strategic priorities.

"I'd like to thank all our colleagues for their commitment

during peak trading, and their continued hard work in progressing

our transformation of the business. Change on this scale takes time

and energy, but we are confident in our strategy and in building a

stronger N Brown for all stakeholders."

Conference call

A conference call will be held at 10:00am today for analysts and

investors. To register for access, please contact Hawthorn on +44

(0)7719 078 196 or email nbrown@hawthornadvisors.com

For further information:

N Brown Group

David Fletcher, Head of Investor Relations +44 (0)7876 111 242

Hawthorn

Henry Lerwill +44 (0)7894 608 607

Simon Woods +44 (0)7719 078 196

nbrown@hawthornadvisors.com

Shore Capital - Nomad and Broker

Stephane Auton / Daniel Bush / Rachel Goldstein

Fiona Conroy (Corporate Broking) +44 (0) 20 7408 4090

About N Brown Group:

N Brown is a top 10 UK clothing and footwear digital retailer,

with a home proposition, headquartered in Manchester and employs

over 1,700 people nationwide. Through our strategic retail brands

including JD Williams, Simply Be and Jacamo, we exist to make our

customers look and feel amazing, and take great pride in

passionately championing inclusion and serving the under-served.

Our customer-first shopping experience, supported by our innovative

financial services proposition, is designed to deliver choice,

affordability, and value to our customers, and allows us to be

truly inclusive and accessible.

1. Adjusted EBITDA is defined as operating profit, excluding

adjusting items, with depreciation and amortisation added back.

2. Q3 FY24 is the 18 weeks to 6 January 2024; FY24 YTD is the 44 weeks to 6 January 2024.

3. JD Williams, Simply Be and Jacamo.

4. Ambrose Wilson, Home Essentials, Fashion World, Marisota, Oxendales and Premier Man.

5. As previously disclosed, subsequent to the 4 March 2023

balance sheet date, the Group refinanced its borrowings and

extended their maturities to December 2026, with the new RCF having

a limit of GBP75m (previous RCF facility limit of GBP100m).

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTZZGMMLNRGDZM

(END) Dow Jones Newswires

January 18, 2024 02:00 ET (07:00 GMT)

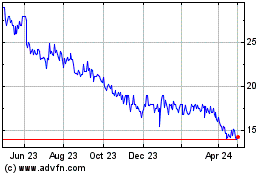

Brown (n) (LSE:BWNG)

Historical Stock Chart

From Dec 2024 to Jan 2025

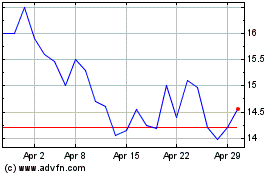

Brown (n) (LSE:BWNG)

Historical Stock Chart

From Jan 2024 to Jan 2025