TIDMCGO

RNS Number : 1811N

Contango Holdings PLC

20 September 2019

Contango Holdings Plc / Index: LSE / Epic: CGO / Sector: Natural

Resources

20 September 2019

Contango Holdings Plc

("Contango" or the "Company")

Audited Final Results for the year ended 31 May 2019

Overview

-- Entered into a Memorandum of understanding with Consolidated

Growth Holdings (CGH) in December 2017, to acquire the Lubu

Coalfield in Zimbabwe that hosts thermal and coking coal

-- Contango will acquire the Lubu Coalfield from CGH for gross

consideration of circa GBP6.45m through the issue of ordinary

shares at a price of 5p, subject to certain conditions being

met

-- Re-listing of the ordinary shares anticipated October 2019

-- Already working "on the ground" at the Lubu Coalfield;

Contango have advanced funds to accelerate drilling programme prior

to IPO for potential purchasers of the coal to review assays

Operating Review

In December 2017, we notified our shareholders that we had

entered into a Memorandum of understanding with Consolidated Growth

Holdings (CGH) to acquire a mining asset in Zimbabwe. During the

course of this financial year we have been working with our

professional advisers and various regulatory bodies to complete all

the due diligence and documentation necessary to finalise the

transaction that will see Contango Holdings acquire the Lubu

Coalfield in Zimbabwe. The transaction entails that Contango

acquires the Lubu Coalfield from CGH for gross consideration of

circa GBP6.45m through the issue of ordinary shares at a price of

5p. The shares last traded at 3.75p on 22 December 2017 whilst we

raised funds for the IPO at 3p.

The Board did not envisage that the transaction would take such

a lengthy period to finalise, however, we are now optimistic that

we can re-list in October 2019 having completed all the due

diligence and documentation that was subject to regulatory review.

Moreover, we have been working "on the ground" at the Lubu

Coalfield by advancing funds to the project so that we can commence

a drilling campaign designed to provide independent assays for

potential purchasers and off-takers to review with regard to coal

quality and composition. This work stream was accelerated given the

enquiries from potential customers.

Financial

Funding

The Company is funded through cash raised from the IPO.

Revenue

The Company has generated no revenue during the year, however is

focusing on acquisition targets that will ultimately generate

revenue for the Company.

Expenditure

The Company has low ongoing overheads and devoted its cash

resources to the transactions costs and advancing certain funds to

Consolidated Growth Holdings in order to progress activities on the

Lubu Coalfield site.

Liquidity, cash and cash equivalents

At 31 May 2019, the Company held GBP280,884 (2018:

GBP637,558).

Dividend

The Directors do not intend to declare a dividend in respect of

the period under review.

Outlook

The mining sector has continued to generally benefit from

improvements in commodity prices. However, these trends have not

led to an improvement in in the junior mining sector which

continues to be affected by risk averse investors seeking to avoid

companies that require development capital given the "financing

risk" faced in the sector. The major and mid-tier mining companies

have all enjoyed strong interest following the improvement of

certain commodities in their portfolio.

Against this background, Contango is looking forward to closing

the transaction and being able to fast track the Lubu Coalfield

into revenue especially given the recent work to engage with

potential customers by providing independent samples of the coal at

the Lubu Coalfield. The Board is acutely aware of the economic

environment in Zimbabwe, which presents both challenges and

opportunities, but they have not impacted on the rate of progress

at the Lubu Coalfield thus far. Also, we are mindful that the IMF

has now commenced a twelve month programme of monitoring the

economic policies of the country, before embarking on a decision to

provide funding. This would be a seminal moment in the country's

recent history and allow the sort of investment in the domestic

infrastructure to attract further foreign investment in future

years. We as a board have taken a long-term view that the country

will improve and that the discount on asset valuations will

diminish.

Finally, the company will raise further funds upon re-listing

and expects to outline the details of the transaction imminently

when the prospectus is launched in the very near future.

Oliver Stansfield

Executive Director

*S *

For further information, please visit

www.contango-holdings-plc.co.uk or contact:

Contango Holdings plc E: info@contango-holdings-plc.co.uk

Brandon Hill Capital Limited T: +44 (0)20 3463 5000

Financial Adviser & Broker

Jonathan Evans

St Brides Partners Ltd T: +44 (0)20 7236 1177

Financial PR & Investor Relations

Catherine Leftley

Statements of comprehensive income

For the year ended 31 May 2019

Year ended Year ended

31 May 2019 31 May 2018

Notes GBP GBP

Administrative fees and other expenses 4 (320,229) (326,676)

-------------- -------------

Operating loss (320,229) (326,676)

Finance revenue - -

Finance expense -

-------------- -------------

Loss before tax (320,229) (326,676)

Income tax - -

Loss for the year and total comprehensive loss for the year (320,229) (326,676)

-------------- -------------

Basic and diluted loss per Ordinary Share (pence) 5 (0.75) (1.00)

The notes to the financial statements form an integral part of

these financial statements.

Statements of financial position

For the year ended 31 May 2019

As at As at

Notes 31 May 2019 31 May 2018

GBP GBP

Current assets

Other receivables 9 31,311 12,188

Cash and cash equivalents 10 280,884 637,558

Total current assets 312,195 649,746

Current liabilities

Trade and other payables 11 75,748 93,070

------------- -------------

Total current liabilities 75,748 93,070

Net assets 236,447 556,676

------------- -------------

Equity

Share capital 7 429,500 429,500

Share premium 7 368,978 368,978

Warrant reserve 7 84,874 84,874

Retained earnings 7 (646,905) (326,676)

----------------- -------------

Total equity 236,447 556,676

----------------- -------------

The notes to the financial statements form an integral part of

these financial statements.

Statements of changes in equity

For the year ended 31 May 2019

Warrant Total

Share Capital Share premium Reserve Retained earnings Equity

GBP GBP GBP GBP GBP

Balance as at 31 May 2017 1 - - 1

Loss for the year 31 May 2018 - - - (326,676) (326,676)

Ordinary Shares and warrants issued (note

7) 429,500 549,126 84,874 - 1,063,500

Ordinary Share issue costs (note 7) - (180,148) - - (180,148)

-------------- --------------

Balance as at 31 May 2018 429,500 368,978 84,874 (326,676) 556,676

-------------- -------------- --------- ------------------ ----------

Loss for the year (320,229) (320,229)

Balance as at 31 May 2019 429,500 368,978 84,874 (646,905) 236,447

-------- -------- ------- ---------- --------

The notes to the financial statements form an integral part of

these financial statements.

Statements of cash flows

For the year ended 31 May 2019

Year Year

ended ended

Notes 31 May 2019 31 May 2018

GBP GBP

Operating activities

Loss after tax (320,229) (326,676)

Changes in working capital

(Increase)/decrease in trade and other receivables (19,123) 4,812

Increase/(Decrease) in trade and other payables (17,322) 24,320

------------- -------------

Increase/(Decrease) in Net cash from operating activities (356,674) (297,544)

Financing activities

Ordinary Shares issued (net of issue costs) 7 - 883,352

------------- -------------

Net cash flows from financing activities - 883,352

(Decrease)/Increase in cash and short-term deposits (356,674) 585,808

Cash and short-term deposits as at the start of the period 637,557 51,750

Cash and short-term deposits at the end of the period 280,884 637,558

------------- -------------

The notes to the financial statements form an integral part of

these financial statements.

Notes to the Financial Statements

For the year ended 31 May 2019

1. General information

The Company was incorporated in England under the Laws of

England and Wales with registered number 10186111 on 18 May 2016.

All of the Company's Ordinary Shares were admitted to the London

Stock Exchange's Main Market and commenced trading on 1 November

2017. The company was re-registered as a public company under

Companies Act 2006 on 1 June 2017, by the name Contango Holdings

plc.

The Company's focus is to identify, acquire and scale projects

focused on mining. At present, the Company is looking to reverse a

mining asset into the Company. The Company had no employees during

the period other than the Directors.

2. Summary of Significant Accounting Policies

The Board has reviewed the accounting policies set out below and

considers them to be the most appropriate to the Company's business

activities.

a) Basis of Preparation

The Company Financial Information has been prepared in

accordance with and comply with IFRS as adopted by the European

Union, International Financial Reporting Interpretations Committee

interpretations and the Companies Act 2006. The financial

statements have been prepared under the historical cost convention

as modified for financial assets carried at fair value.

At the date of authorisation of these financial statements.

certain new standards, amendments and interpretations to existing

standards have been published but are not effective, and have not

been adopted early by the Company. The Directors anticipate that

all of the pronouncements will be adopted in the Company's

accounting policies for the first period beginning on or after the

effective date of the pronouncement.

The Company has not early adopted amended standards and

interpretations which are currently in issue but not effective for

accounting periods commencing from 1 June 2018 as adopted by the

EU. The Directors do not anticipate that the adoption of standards

and interpretations will have a material impact on the Company's

financial statements in the periods of initial application.

The financial information of the company is presented in British

Pound Sterling ("GBP").

b) Going concern

The directors have, at the time of approving the financial

statements, a reasonable expectation that the Company has adequate

resources to continue in operational existence for the foreseeable

future, which is defined as twelve months from the signing of this

report. The directors accept that there is a material uncertainty

in respect of going concern are confident that the Company will be

able to raise additional finance as and when required. For this

reason, the directors continue to adopt the going-concern basis of

accounting in preparing the financial statements.

c) Standards and interpretations issued but not yet applied

At the date of authorisation of this Document, the Directors

have reviewed the accounting standards in issue by the

International Accounting Standards Board and the International

Financial Reporting Interpretations Committee, which are effective

for annual accounting periods ending on or after the stated

effective date. In their view, none of these standards would have a

material impact on the financial reporting of the Company

d) Taxation

The tax currently payable is based on the taxable profit for the

period. Taxable profit differs from net profit as reported in the

income statement because it excludes items of income or expense

that are taxable or deductible in other periods and it further

excludes items that are never taxable or deductible. The Company's

liability for current tax is calculated using tax rates that have

been enacted or substantively enacted by the reporting date.

Deferred income tax is provided for using the liability method

on temporary timing differences at the balance sheet date between

the tax basis of assets and liabilities and their carrying amounts

for financial reporting purposes. Deferred income tax liabilities

are recognised in full for all temporary differences. Deferred

income tax assets are recognised for all deductible temporary

differences carried forward of unused tax credits and unused tax

losses to the extent that it is probable that taxable profits will

be available against which the deductible temporary differences,

and carry-forward of unused tax credits and unused losses can be

utilised. The carrying amount of deferred income tax assets is

assessed at each balance sheet date and reduced to the extent that

it is no longer probable that sufficient taxable profits will be

available to allow all or part of the deferred income tax asset to

be utilised. Unrecognised deferred income tax assets are reassessed

at each balance sheet date and are recognised to the extent that is

probable that future taxable profits will allow the deferred income

tax asset to be recovered.

e) Financial Instruments

The Company has applied IFRS 9 for the first time in these

financial statements. IFRS 9 sets out requirements for recognising

and measuring financial assets and financial liabilities and

replaces IAS 39 Financial Instruments: Recognition and

Measurement.

The company has applied the new standard with effect from 1

January 2018 [add comment here on impact on opening equity - if

none, state no impact]. This has not lead to any changes in the

basis of the measurement categories of either financial assets or

financial liabilities, [although it has led to changes in the

carrying amounts of certain financial assets arising from a change

in the measurement of impairment]. The comparative period have not

been restated and reflect the requirements of IAS 39.

Financial Assets

On initial recognition, a financial asset is classified as

measured at amortised cost, fair value through other comprehensive

income (FVTOCI) or fair value through profit or loss (FVTPL).

As at the reporting date the Company holds no financial assets

other than cash.

f) Financial liabilities and equity instruments

Classification as debt or equity

Financial liabilities and equity instruments issued by the

company are classified according to the substance of the

contractual arrangements entered into and the definitions of a

financial liability and an equity instrument.

Equity instruments

An equity instrument is any contract that evidences a residual

interest in the assets of the company after deducting all of its

liabilities. Equity instruments are recorded at the proceeds

received, net of direct issue costs.

Financial liabilities

Financial liabilities are classified as either financial

liabilities at fair value through profit or loss or financial

liabilities measured at amortised cost.

Financial liabilities are classified as at fair value through

profit or loss if the financial liability is either held for

trading or it is designated as such upon initial recognition

Other financial liabilities

Trade and other payables are initially measured at fair value,

net of transaction costs, and are subsequently measured at

amortised cost, where applicable, using the effective interest

method, with interest expense recognised on an effective yield

basis.

Warrants

Warrants classified as equity are recorded at fair value as of

the date of issuance on the Company's Balance Sheet and no further

adjustments to their valuation are made. Management estimates the

fair value of these liabilities using option pricing models and

assumptions that are based on the individual characteristics of the

warrants or instruments on the valuation date, as well as

assumptions for future financing, expected volatility, expected

life, yield, and risk-free interest rate.

g) Derecognition of financial liabilities

The company derecognises financial liabilities when, and only

when, the company's obligations are discharged, cancelled or they

expire.

h) Financial Risk Management Objectives and Policies

The Company's major financial instruments include bank balances,

trade payables and accruals. Details of these financial instruments

are disclosed in respective notes. The risks associated with these

financial instruments, and the policies on how to mitigate these

risks are set out below. The management manages and monitors these

exposures to ensure appropriate measures are implemented on a

timely and effective manner.

Liquidity Risk - the Company raises funds as required on the

basis of budgeted expenditure and inflows. When funds are sought,

the Company balances the costs and benefits of equity and debt

financing. When funds are received they are deposited with banks of

high standing in order to obtain market interest rates.

3. Critical accounting estimates and judgements

The preparation of financial statements in conformity with IFRS

requires management to make estimates and assumptions that affect

the reported amounts of income, expenditure, assets and

liabilities. Estimates and judgements are continually evaluated,

including expectations of future events to ensure these estimates

to be reasonable.

The estimates and associated assumptions are based on historical

experience and various other factors that are believed to be

reasonable under the circumstances, the results of which form the

basis of making the judgements about carrying values of assets and

liabilities that are not readily apparent from other sources.

Actual results may differ from these estimates.

The Company's nature of operations is to act as a special

purpose acquisition company.

Going concern is assessed to be a significant judgement which is

detailed in accounting policy note 2 (b)

4. Loss before taxation

Loss before income tax is stated Year Year

after charging: ended ended

31 May 2019 31 May 2018

GBP GBP

Directors' remuneration 72,000 48,000

Fee payable to the Company's

auditor for the audit of the

company's annual accounts 16,800 15,000

Fee payable to the Company's

auditor in respect of all other

services 60,750 28,650

The Company did not employ any staff during the period under

review other than the Directors. The Directors are the only members

of key management and their remuneration related solely to

short-term employee benefits.

5. Loss per Ordinary Share

The calculation of the basic and diluted loss per Ordinary Share

is based on the following data:

Year Year

ended ended

31 May 31 May

2019 2018

Earnings

Loss from continuing operations for the period attributable to the equity holders of the

Company (320,229) (326,676)

Number of Ordinary Shares

Weighted average number of Ordinary Shares for the purpose of basic and diluted earnings

per

Ordinary Share (number) 42,949,987 32,596,294

----------- -----------

Basic and diluted loss per Ordinary Share (pence) (0.75) (1.00)

----------- -----------

There are no potentially dilutive Ordinary Shares in issue.

6. Income tax

Corporation tax is calculated at 19% of the estimated taxable

loss for the period.

As the Company continues to be non-trading, no account has been

made for Corporation Tax nor for Deferred Tax in the year ended 31

May 2019. The Company also believes there are no accumulated losses

to be carried forward. The Board believes that the previously

reported losses in the year ended 31 May 2018 may not be

recoverable against future gains.

7. Share capital

Number of Share Share Warrants Total

Ordinary Capital premium Reserve share capital

Shares issued

and fully

paid

GBP GBP GBP GBP

31 May 2017 1 - - - -

Subdivision

of GBP1 shares

into 99 - - - -

100 1p shares

Issue of Ordinary

Shares and

Warrants:

1 June 2017

26 October

2017

1 November

2017 4,999,900 50,000 - - 50,000

12,500,000 125,000 76,906 48,094 250,000

Share Issue

Cost 25,449,987

254,500 472,220 36,780 763,500

(180,148)

(180,148)

As at 31 May

2018 and 2019 42,949,987 429,500 368,978 84,874 883,352

--------------- ---------- ------------- --------- --- ---------------

The Ordinary Shares issued by the Company have par value of 1p

each and each Ordinary Share carries one vote on a poll vote. The

Authorised share capital of the company is GBP5,000,000 ordinary

shares at GBP0.01 per share resulting in 500,000,000 ordinary

shares.

8. Financial instruments

As at As at

31 May 31 May

2019 2018

GBP GBP

Financial assets

Cash and cash equivalents 280,884 637,558

Financial liabilities

At amortised cost 75,748 93,070

9. Other receivables

2019 2018

GBP GBP

Prepayments 31,311 12,188

31,311 12,188

====== ======

10. Cash and Cash Equivalents

2019 2018

GBP GBP

Cash at Bank 280,884 637,558

=================== ===================

11. Trade and other payables

2019 2018

GBP GBP

Trade payables 35,350 48,000

Accruals and other payables 40,398 45,070

75,748 93,070

================== ==========================

12. Events after the reporting date and Capital Commitments

The company advanced to Consolidated Growth Holdings Ltd (CGH)

$120,000, $130,000 and $24,000 in June 2019 August and September

2019 respectively. These advances were made in order to accelerate

the work programme at the Lubu Coalfield. In the event the proposed

acquisition of the Lubu Coalfield project in Zimbabwe does not

complete, CGH will be obliged to repay by 24(th) December 2019 the

funds advanced plus interest at 3% per month rising to 6% after

three months in the event that the transaction lapses.

There were no other significant subsequent events.

13. Related Party Transactions

All directors hold shares and warrants as disclosed on pages 11

and 12 in the Directors' Remuneration Report. Neal Griffiths and

Oliver Stansfield are Directors of both Brandon Hill Capital and

the Company. Brandon Hill Capital acts as the broker to the Company

and are paid an annual retainer of GBP25,000 per annum.

14. Warrants

No warrants were issued or exercised in the year ended 31 May

2019.

During the year ended 31 May 2018 the Company issued the

following warrants to subscribe for shares:

Warrant exercise Number of Vesting Expiry Fair value

Price warrants Date Date of individual

granted option

GBP0.03 18,666,667 26 Oct 31 Oct GBP0.0026

2017 2019

GBP0.05 11,666,650 1 Nov 31 Oct GBP0.0032

2017 2019

Total granted 30,333,317

during the year

ended 31 May

2018

The weighted average fair value of each warrant granted last

year was GBP0.0028.

No warrants have been exercised in the Company.

20 September 2019

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR SEFFISFUSEEU

(END) Dow Jones Newswires

September 20, 2019 11:31 ET (15:31 GMT)

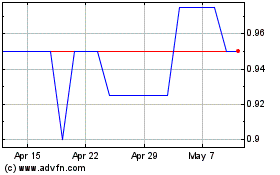

Contango (LSE:CGO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Contango (LSE:CGO)

Historical Stock Chart

From Jul 2023 to Jul 2024