CML Microsystems PLC AGM Interim Management Statement (3843U)

July 29 2020 - 5:45AM

UK Regulatory

TIDMCML

RNS Number : 3843U

CML Microsystems PLC

29 July 2020

CML Microsystems Plc

AGM Interim Management Statement

CML Microsystems Plc (the "Group" or the "Company"), which

designs, manufactures and markets semiconductors, primarily for

global communication and solid state storage markets, today issues

the following trading update at its AGM for the period 1 April 2020

to 31 July 2020.

Trading Update

Total revenues and profit before tax for the opening months of

the financial year to 31 March 2021 have tracked slightly above

management expectations, with new order intake for Storage products

continuing to be at a healthy level. Recent market demand for the

Group's Communication products has been challenging.

We ended the previous financial year with the business tuned to

react swiftly as market conditions improve and that situation

remains. Geopolitical and pandemic headwinds continue to feature,

making future predictions highly speculative but it is pleasing to

see an improvement from the Storage market.

Order intake between now and the end of September will be a key

indicator for the shape of a recovery, but the Board continues to

believe we have the correct people, products and strategy in place

to drive growth as the trading environment improves.

CML Microsystems Plc www.cmlmicroplc.com

Chris Gurry, Group Managing Tel: +44(0)1621 875 500

Director

Nigel Clark, Group Chairman

and Financial Director

Shore Capital Tel: +44(0)20 7408 4090

Edward Mansfield

James Thomas

SP Angel Corporate Finance Tel: +44(0)203 463 2260

LLP

Jeff Keating

Alma PR Tel: +44 (0)20 3405 0212

Josh Royston

Caroline Forde

Robyn Fisher

About CML Microsystems PLC

CML designs and develops semiconductors for the industrial

storage and communications markets. The Group utilises a

combination of in-house and outsourced manufacturing and has

trading operations in Europe, the Far East and USA. CML targets

niche markets with strong growth profiles and high barriers to

entry. It has secured a diverse, blue chip customer base, including

some of the world's leading telecoms equipment providers and

industrial product manufacturers.

The spread of its customers and products largely protects the

business from the cyclicality usually associated with the

semiconductor industry. Growth in its end markets is being driven

by factors such as the ever increasing trend towards solid state

storage devices in the commercial and industrial sectors, the

upgrading of telecoms infrastructure around the world and the

growing prevalence of private commercial communications networks

for voice and/or data communications linked to the industrial

internet of things (IIoT).

The Group is cash-generative, has a net cash position and is

dividend paying.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

AGMKKFBKABKDNOB

(END) Dow Jones Newswires

July 29, 2020 06:45 ET (10:45 GMT)

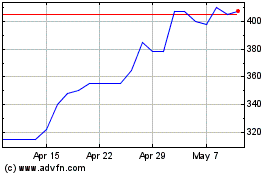

Cml Microsystems (LSE:CML)

Historical Stock Chart

From Apr 2024 to May 2024

Cml Microsystems (LSE:CML)

Historical Stock Chart

From May 2023 to May 2024