TIDMCPP

RNS Number : 1135L

CPPGroup Plc

04 September 2019

CPPGROUP PLC

4 SEPTEMBER 2019

HALF YEAR REPORT

FOR THE SIX MONTHSED 30 JUNE 2019

CPPGROUP PLC

HALF YEAR REPORT FOR THE SIX MONTHSED 30 JUNE 2019

International expansion driving growth and building value

CPPGroup Plc (CPP or the Group), the partner focused, global

product and services company, today announces its results for the

six months ended 30 June 2019.

The Group has seen continued expansion in its international

revenues and customer numbers led by India. New business partners

continue to be added to our portfolio and further investment has

been made in our InsurTech capabilities to deliver strategic

advantage.

Highlights

-- Group revenue increased by 17% to GBP60.2 million (H1 2018:

GBP51.3 million) continuing the strong growth trajectory from

previous periods.

-- Revenue from Ongoing Operations increased by 28% to GBP51.4

million (H1 2018: GBP40.0 million), which includes a 45% increase

in Indian revenue to GBP40.9 million (H1 2018: GBP28.3

million).

-- Adjusted EBITDA increased by 25% to GBP3.6 million (H1 2018: GBP2.9 million).

-- EBITDA increased by 30% to GBP2.3 million (H1 2018: GBP1.8 million).

-- Overall, currency movements across our international markets

adversely impacted reported results. At constant currency:

-- Group revenue increased 19%.

-- Revenue from Ongoing Operations increased 30%.

-- Adjusted EBITDA increased by 34%.

-- EBITDA increased by 44%.

-- Profit before tax reduced by 36% to GBP0.9 million (H1 2018: GBP1.3 million).

-- Customer numbers have increased to 9.0 million (H1 2018: 6.7

million; 31 December 2018: 8.2 million).

Strategic progress

-- Diversification of our Indian business gathers pace through

the launch of a new product line, LivCare, and new business partner

contracts with Tata Capital Financial Services (Tata) and American

Express.

-- Strong existing and exciting new partners, such as Chinese

banking giant Bank of Communications (BoCom), gives potential

access to over 200 million customers.

-- Pioneering parametric insurance platform(1) developed by

Blink to transform the events-based insurance market.

-- Globiva performing ahead of expectations, forming

partnerships with global brands and colleague numbers increasing to

over 1,400.

1. Parametric insurance is a type of insurance that does not

indemnify the pure loss, but instead agrees to make a payment upon

the occurrence of a triggering event. Blink focuses on flight

disruption solutions and has developed an innovative technology

platform to deliver customers a proactive, real-time service.

Note - All subsequent percentage change figures within this

report are presented on a constant currency basis, unless otherwise

stated. The constant currency basis, which is an Alternative

Performance Measure (APM), retranslates the previous period

measures at the average actual periodic exchange rates used in the

current financial period. This approach is applied as a means of

eliminating the effects of exchange rate movements on the

period-on-period reported results.

Financial highlights

Six months ended 30 June 2019 Six months ended 30 June 2018(1)

GBP millions (Unaudited) (Unaudited) Change Constant currency change

----------------- ------------------------------ --------------------------------- ------ ------------------------

Group

Revenue 60.2 51.3 17% 19%

Adjusted

EBITDA(3) 3.6 2.9 25% 34%

Investments in

business growth

projects(4) (1.3) (1.1) (18)% (18)%

EBITDA(2) 2.3 1.8 30% 44%

Profit before

tax 0.9 1.3 (36)% (31)%

Basic

(loss)/earnings

per share

(pence) (0.01) 0.05 (126)% n/a

Net funds(5) 15.8 29.5 (46)% n/a

Segmental

revenue

Ongoing

Operations 51.4 40.0 28% 30%

Restricted

Operations 8.8 11.3 (21)% (21)%

================= ============================== ================================= ====== ========================

1. IFRS 16 Leases was effective from 1 January 2019, in

accordance with transition provisions allowed within the new

standard the rules have been applied retrospectively and as a

result 2018 comparative figures have not been restated.

2. EBITDA represents earnings before interest, taxation,

depreciation, amortisation, exceptional items and Matching Share

Plan (MSP) charges.

3. Adjusted EBITDA excludes costs associated with investments in business growth projects.

4. Investments in business growth projects of GBP1.3 million (H1

2018: GBP1.1 million) comprises start-up costs relating to the UK

GBP0.4 million (H1 2018: GBP0.2 million), Blink GBP0.5 million (H1

2018: GBP0.8 million), Bangladesh GBP0.1 million (H1 2018: GBPnil),

Southeast Asia GBP0.1 million (H1 2018: n/a) and our share of

losses in KYND GBP0.2 million (H1 2018: GBP0.1 million).

5. Net funds comprise cash and cash equivalents of GBP22.4

million (H1 2018: GBP29.4 million), a borrowing asset of GBPnil (H1

2018: GBP0.1 million) and net investment lease assets of GBP0.2

million (H1 2018: GBPnil) less lease liabilities of GBP6.8 million

(H1 2018: GBPnil). Lease liabilities and net investment lease

assets have been recognised following the adoption of IFRS 16

Leases on 1 January 2019, further detail is provided in note 10 to

the condensed consolidated interim financial statements.

Jason Walsh, Chief Executive Officer, commented:

"We are starting to see the rewards from the assembly of our

capabilities, each of which plays its part in supporting the

Group's operations. Blink is our InsurTech business where already

over 250,000 customers have had access to its parametric insurance

platform and Globiva, the start-up business process management

company, is growing rapidly and now has over 1,400 billable seats

and boasts global brands like Ola, American Express and Tui amongst

its third party clients.

We continue to grow our international revenues, with the strong

performance that we saw in 2018 being continued through the first

half of 2019. Our Indian operations have once again been the star

performer significantly growing its revenue, profitability and

customer numbers.

Ultimately, our success is built on our business partner

relationships which we continue to deepen and importantly we are

forming new partnerships with major brands in our strategically

important markets. These new and existing relationships will

develop over time and fuel the continued growth in our business. We

are investing in our technology-led capability which will continue

to strengthen our partnerships and enable more nimble and

cost-effective proposition delivery as well as an exceptional

customer experience."

Enquiries

CPPGroup Plc

Jason Walsh, Chief Executive Officer

Oliver Laird, Chief Financial Officer

Tel: +44 (0)113 487 7350

Nominated Adviser and Broker

Investec Bank plc: Sara Hale, James Rudd, Carlton Nelson

Tel: +44 (0)20 7597 5970

About CPP

CPP Group is a partner focused, global product and services

company, specialising in the financial services and insurance

markets. We use our local knowledge from 12 country markets within

Asia, Europe and Central America to provide our business partners

with technology-led product, marketing and distribution expertise

that deliver commercial benefits and bring meaningful solutions to

over 9 million end customers worldwide.

CPP's diverse range of insurance and assistance products can be

designed to suit the bespoke needs of our business partners through

providing their customers with peace of mind by reducing the

stresses of everyday life, ranging from protection of mobile

phones, payment cards and household belongings to keeping travel

plans moving and the monitoring of compromised personal data.

For more information on CPP visit

https://international.cppgroup.com

REGISTERED OFFICE

CPPGroup Plc

6 East Parade

Leeds

LS1 2AD

Registered number: 07151159

CHIEF EXECUTIVE'S STATEMENT

Financial performance

Constant

2019 2018(1) currency

Six months ended 30 June GBP'm GBP'm Change change

Revenue 60.2 51.3 17% 19%

------- -------- ------- ----------

EBITDA 2.3 1.8 30% 44%

------- -------- ------- ----------

Operating Profit 0.9 1.2 (25)% (18)%

------- -------- ------- ----------

Profit Before Tax 0.9 1.3 (36)% (31)%

------- -------- ------- ----------

1. IFRS 16 has been retrospectively applied and as a result 2018

comparatives have not been restated.

Group revenue of GBP60.2 million (H1 2018: GBP51.3 million) has

grown by 19% and customer numbers have increased by 10% to 9.0

million (H1 2018: 6.7 million; 31 December 2018: 8.2 million) we

have also increased our active business partners by 13%. This

growth has been led by our Indian market which has seen revenue

increase by 44% as we continue to deepen existing partner

relationships through additional product launches and opening up

incremental channels. In addition, we are expanding our partner

base in India with deals signed with Tata and American Express.

As a business we focus on EBITDA which has increased to GBP2.3

million (H1 2018: GBP1.8 million). The Group has opted not to

restate 2018 results for IFRS 16, however to aid comparability, H1

2018 EBITDA on an IFRS 16 basis would have been GBP0.3 million

higher at GBP2.1 million. The marginal increase in EBITDA of GBP0.2

million on a like-for-like basis reflects business growth in India

along with the benefit of restructuring activities in our European

markets, partly offset by the continued decline in our European

back books. Our adjusted EBITDA, which excludes the impact of

investment in business growth projects, has increased by 34% to

GBP3.6 million (H1 2018: GBP2.9 million).

The profile of our business continues to shift. Revenue and

customer growth is being led by our developing markets, whilst the

historic European renewal books continue to naturally decline.

Whilst this dynamic is driving revenue growth it is naturally

pressuring our gross profit margins as our Indian operation in

particular has higher costs associated with sales than the European

back books it is replacing. This is reflected in the reduced gross

profit margin of 32% (H1 2018: 39%), which we expect to settle at a

lower level in the medium term. We expect to generate longer-term

margin improvements through investment in the value chain and

digital capability.

Operating profit has reduced to GBP0.9 million (H1 2018: GBP1.2

million) reflecting our EBITDA growth offset by higher depreciation

charges associated with IFRS 16. As a result, profit before tax has

reduced to GBP0.9 million (H1 2018: GBP1.3 million).

The Group's effective tax rate of 118% (H1 2018: 68%) continues

to be significantly higher than the standard UK corporation tax

rate of 19%. The rate reflects charges on taxable profits in India

and our EU Hub where tax rates are higher than the UK. However, the

main driver of the rate is our policy to only recognise deferred

tax assets on start-up losses when profit forecasts indicate

short-term tax loss utilisation. The effective rate is expected to

continue to be high whilst we invest in business growth projects

which generate short-term start-up losses. As a result we report a

loss after tax of GBP0.2 million (H1 2018: GBP0.4 million

profit).

Segmental performance

H1 2019 H1 2018 Constant currency

Revenue GBP'm GBP'm Change change

Ongoing Operations:

-------- -------- ------- ------------------

India 40.9 28.3 45% 44%

-------- -------- ------- ------------------

EU Hub 6.8 8.1 (17)% (15)%

-------- -------- ------- ------------------

Turkey 2.1 2.5 (15)% 10%

-------- -------- ------- ------------------

Rest of World(1) 1.6 1.1 41% 37%

-------- -------- ------- ------------------

Total Ongoing Operations 51.4 40.0 28% 30%

-------------------------- -------- -------- ------- ------------------

Restricted Operations 8.8 11.3 (21)% (21)%

-------- -------- ------- ------------------

Group revenue 60.2 51.3 17% 19%

========================== ======== ======== ======= ==================

1. Rest of World comprises China, Malaysia, Mexico, the UK,

Blink, Bangladesh and Southeast Asia.

Constant

H1 2019 H1 2018 currency

EBITDA GBP'm GBP'm Change change

Ongoing Operations:

-------- -------- ------- ----------

India 2.2 0.6 263% 262%

-------- -------- ------- ----------

EU Hub 0.9 0.3 181% 191%

-------- -------- ------- ----------

Turkey 0.5 0.4 18% 91%

-------- -------- ------- ----------

Rest of World (1.5) (1.7) 12% 12%

-------- -------- ------- ----------

Total Ongoing Operations 2.1 (0.4) 589% 452%

-------------------------- -------- -------- ------- ----------

Restricted Operations 3.2 5.5 (42)% (42)%

-------- -------- ------- ----------

Central Functions (2.8) (3.2) 14% 14%

-------- -------- ------- ----------

Segmental EBITDA 2.5 1.9 34% 48%

-------- -------- ------- ----------

Share of loss of

joint venture (0.2) (0.1) (129)% (129)%

-------- -------- ------- ----------

Group EBITDA 2.3 1.8 30% 44%

========================== ======== ======== ======= ==========

Ongoing Operations

Revenue has increased 30% to GBP51.4 million (H1 2018: GBP40.0

million) due to strong new customer acquisitions in India and the

rapid expansion of Globiva, our majority owned business process

management (BPM) company in India. This growth has been partly

offset by a revenue reduction in our EU Hub where the renewal book

decline is outweighing new revenue generation.

EBITDA has increased significantly to GBP2.1 million (H1 2018:

GBP0.4 million loss), fuelled by the growth in India, along with

reduced costs in our EU Hub following the restructuring activity in

2018. The investments in business growth projects have increased

marginally period-on-period to GBP1.1 million (H1 2018: GBP1.0

million). These costs are included in Rest of World and comprise

the UK, Blink, Bangladesh and Southeast Asia.

The move to profit and a strongly growing EBITDA in our Ongoing

Operations segment represents a significant milestone for the Group

and one which will see us being much less dependent on our historic

legacy business which is in a natural decline.

Restricted operations

Revenue has decreased by 21% to GBP8.8 million (H1 2018: GBP11.3

million) reflecting the natural decline in the legacy renewal books

of Card Protection Plan Limited (CPPL) and Homecare Insurance

Limited (HIL), although renewal rates across these books of

customers remain strong at 84%. This decline along with marginally

higher transfer pricing charges, has led to a 42% reduction in

EBITDA to GBP3.2 million (H1 2018: GBP5.5 million). The prior

period also benefitted from a review of contractual provisions. Due

to the timing of headcount reductions the full cost benefit from

the 2018 restructuring activities in CPPL will be realised in

future periods.

Central Functions

The central cost base was reduced by 14% to GBP2.8 million (H1

2018: GBP3.2 million) following contractual savings and initial

steps in streamlining our UK-based IT function. Our decentralised

IT strategy is expected to generate further central cost savings in

the future.

Adjusted EBITDA

H1 2019 H1 2019 H1 2018 H1 2018

Investment

in business

growth adjusted adjusted adjusted adjusted

H1 2019 projects(1) EBITDA margin(2) EBITDA margin

Constant

currency

GBP'm GBP'm GBP'm % GBP'm % Change change

Ongoing Operations 2.1 1.1 3.2 6% 0.6 2% 416% 614%

-------- ------------- ---------- ------------ ---------- ---------- ------- ----------

Restricted

Operations 3.2 - 3.2 36% 5.5 49% (42)% (42)%

-------- ------------- ---------- ------------ ---------- ---------- ------- ----------

Central Functions (2.8) - (2.8) (100)% (3.2) (100)% 14% 14%

-------- ------------- ---------- ------------ ---------- ---------- ------- ----------

Segmental

EBITDA 2.5 1.1 3.6 6% 2.9 6% 25% 34%

-------- ------------- ---------- ------------ ---------- ---------- ------- ----------

Share of

loss of joint

venture (0.2) 0.2 - n/a - n/a n/a n/a

-------- ------------- ---------- ------------ ---------- ---------- ------- ----------

Group EBITDA 2.3 1.3 3.6 6% 2.9 6% 25% 34%

==================== ======== ============= ========== ============ ========== ========== ======= ==========

1. Investment in business growth projects in Ongoing Operations

are UK GBP0.4 million (H1 2018: GBP0.2 million), Blink GBP0.5

million (H1 2018: GBP0.8 million), Bangladesh GBP0.1 million (H1

2018: GBPnil) and Southeast Asia GBP0.1 million (H1 2018: GBPnil).

These projects are disclosed within Rest of World.

2. Adjusted margin is defined as adjusted EBITDA divided by revenue.

The Group's adjusted EBITDA is GBP3.6 million (H1 2018: GBP2.9

million). Adjusted EBITDA excludes investments in business growth

projects which reflect start-up losses in markets that will

contribute to growth in the future. The Group's adjusted EBITDA

margin, which is reflective of our more mature business, is 6% (H1

2018: 6%) compared to the reported margin of 4% (H1 2018: 3%).

Importantly, adjusted EBITDA in our Ongoing Operations is now at

the same level as the EBITDA from our Restricted Operations

demonstrating the shift in focus and dependency to growing markets

which will take the business forward.

Building value

The Group continues to follow its strategic principles, which

provide the foundations upon which future value will be built. CPP

is a diverse Group where structural, geographical and technical

differences in our countries mean that they drive and build value

for themselves and the Group in different ways. Following these

principles will mean that the Group will continue to focus on value

creation of its individual business lines as a route to increasing

overall Group valuation.

We operate a business to business to consumer (B2B2C) model and

recognise that the key to our success is the strength of the

reciprocal business partner relationships that we build and

nurture. Our priority is to establish strong relationships with

market-leading partners that have large accessible customer bases

where we can build trust and demonstrate the ability to deliver

innovative solutions. We are experts in providing technology-led

propositions that deliver additional revenue and customer loyalty

for our partners in a fully managed, brand enhancing customer

experience. It is this expertise that enables us to deepen our

partner relationships and gain access to a greater proportion of

their customer base through product and channel expansion. Our

existing partner base already allows us potential access to over

200 million customers.

In India, where we have successfully followed this strategy, we

are continuing to grow rapidly and are delivering increasingly

robust profits. We have a strong trusted relationship with the

Bajaj Group (Bajaj), successfully launching new innovative products

including, most recently in April 2019, a new life insurance and

wellness product, LivCare. New partnership deals with international

businesses like American Express add greatly to our potential

customer base whilst enhancing our market reputation. India

demonstrates how we identify and create propositions to fulfil the

needs of our partner's customers, whilst at the same time

significantly boosting our customer numbers, revenue streams and

market value.

Our strategy also includes investing in growth markets and

technology innovation. We have achieved this through shrewd

targeted investment in start-up companies like Blink and Globiva.

These companies, whilst providing different competitive advantages

to the Group, are similar in their innovative nature and drive to

grow at pace, which will over time add significant value to the

Group.

Blink is part of our investment in the InsurTech market and with

its in-house developed event-based parametric insurance platform is

pioneering technology that promises to transform the core travel

insurance market. Placing technology at the forefront of its

proposition delivery means that insurance solutions are delivered

in a customer-focused way with minimal ongoing delivery costs.

Whilst providing the necessary oversight and support, the Group has

deliberately not fully integrated Blink allowing it to operate

autonomously when delivering product and platform solutions to

partners. Blink already has two live campaigns in Canada with Blue

Cross and Manulife and there are more at final contract stage in

other parts of the world. We are excited by Blink's prospects and

the market value it represents both on a standalone basis and as

part of the Group.

Globiva forms an important part of the Group's margin expansion

plans as well as generating third party business relationships and

opportunities. Since acquisition, Globiva has grown rapidly,

exceeding our initial expectations, with international brands such

as Ola, American Express and TUI using the services. This growth

has resulted in the business expanding to three locations (two in

Delhi and one in Kolkata) with over 1,400 colleagues employed.

Globiva operates within a buoyant Indian economy and with growth

expected to continue over the next three years to in excess of

3,000 colleagues, we believe that the market value of the business

is already significantly in excess of our investment.

Building strategic advantage through technology

We understand the impact technology has on the successful

creation of value within any organisation. Our focus is on being a

technology-led business that invests in digital capabilities to

deliver strategic advantage to our partners by enhancing their

customer journeys and helping them to monetise their data.

We have commenced the build of our global technology platform

that can be delivered in-country according to local business

partner requirements. This will enable a nimble, responsive

platform to be created by local specialists at a cost that is

appropriate to that market. We will also be better positioned to

meet the global challenge that companies are facing where

in-country data residency and ownership is increasingly a demand of

local legislation. This decentralised approach to IT will prove to

be a competitive strength, although technology risk associated with

successfully executing our IT strategy remains in the short-term.

Focusing on this part of our technology journey will also enable us

to move away from inflexible legacy systems which will generate

further cost and operational efficiencies.

Operational review

Our Indian business has continued to grow rapidly with customer

numbers increasing by 1.0 million in H1 to 6.9 million (H1 2018:

4.4 million; 31 December 2018: 5.9 million) and is becoming

increasingly robust as we successfully diversify the partner and

product base. Bajaj continues to represent our most significant

partnership, however, importantly we have signed new Card

Protection campaigns with SBI Cards and Axis Bank which will lead

to a notable increase in customer numbers and strength in our

renewal business.

China is a strategically important market and we are pleased

that, under new leadership, revenue has grown by 84%

period-on-period. This reflects innovative marketing strategies

with key partners Ping-An Bank and SPDB to increase sales of our

Card Protection and Smart Travel products. In addition, we were

pleased to launch a new campaign with banking giant BoCom. Powered

by our standalone IT infrastructure we see further opportunities

for product and sector diversification in this market.

In our EU Hub the renewal books continue to perform well with

renewal rates of 82% (H1 2018: 84%). The profitability of the EU

Hub has improved reflecting the cost efficiencies generated through

the restructuring activities in H2 2018. EBITDA has increased to

GBP0.9 million (H1 2018: GBP0.3 million) at an EBITDA margin of 14%

(H1 2018: 4%). The restructuring has been successful and is in line

to deliver the expected annualised savings of GBP4.0 million to

GBP4.5 million (which includes CPPL savings which are not part of

the EU Hub).

Turkey has performed well against the backdrop of challenging

economic conditions, increasing revenue by 10% and EBITDA by 91%

and we have made good progress in a number of our other markets. We

have signed a new Card Protection contract with a second bank in

Bangladesh. The device protection segment in Bangladesh has huge

potential and we are close to agreeing our first Phone Insurance

deal with a leading market player. Following our re-entry in the UK

market, we continue to develop our product suite. We have a strong

pipeline with partner agreements in place that are expected to

generate new business in the second half of the year. Our Southeast

Asia expansion continues with a regional hub established in

Singapore led by an experienced dynamic regional CEO. With a solid

presence already established in Malaysia we continue to assess the

best markets in Southeast Asia to launch our product suite.

Financial position

The Group's net asset position is broadly unchanged at GBP16.3

million (31 December 2018: GBP16.3 million). Our net funds position

has reduced in the period to GBP15.8 million (31 December 2018:

GBP26.0 million) reflecting the recognition of lease liabilities

totalling GBP6.8 million following the adoption of IFRS 16 along

with our investment in technology and technology-led services, such

as the Blink parametric platform and digital services in India. Our

cash balances are GBP22.4 million which includes GBP1.1 million

required to be held in the UK for regulatory purposes and therefore

the Group's available cash balance is GBP21.3 million. Whilst this

represents a strong available cash position our borrowing facility

includes a cash covenant and increasingly cash is being generated

in India which is not currently available for repatriation in its

entirety due to historic trading losses. In the future our Indian

funds will become available for repatriation however a return of

cash is likely to suffer significant taxation costs. The cash

located in the UK and generated through the historic back books

currently supports Group IT, central support functions and key

strategic markets that are

presently loss-making. The Group is not currently utilising its

GBP5.0 million borrowing facility.

Outlook

Our success is built on our business partner relationships which

we continue to deepen and importantly we are forming new

partnerships with major brands in our strategically important

markets. These new and existing relationships will develop over

time and fuel the continued growth in our business. We are

investing in our technology-led capability which will continue to

strengthen our partnerships and enable more nimble and

cost-effective proposition delivery as well as an exceptional

customer experience.

We have continued to grow significantly in India and following

the successful launch of LivCare and expanded Card Protection

contracts with major banking partners, we expect revenue in 2019 to

exceed current market consensus. EBITDA margins in India are

typically 5% and other parts of the business that are currently

loss-making have progressed slower than expected, therefore

although revenue is expected to be higher our EBITDA expectations

for 2019 remain unchanged.

Jason Walsh

Chief Executive Officer

CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

CONSOLIDATED INCOME STATEMENT

6 months ended Year ended

30 June 2019 6 months ended 30 June 2018 31 December 2018

GBP'000 GBP'000 GBP'000

Note (Unaudited) (Unaudited) (Audited)

Revenue 3 60,229 51,264 110,070

Cost of sales (40,730) (31,020) (68,993)

Gross profit 19,499 20,244 41,077

Administrative expenses (18,448) (18,984) (41,031)

Share of loss of joint venture (152) (66) (199)

Operating profit/(loss) 899 1,194 (153)

Analysed as:

EBITDA 3 2,319 1,779 3,911

Depreciation and amortisation (1,420) (364) (866)

Exceptional items - (153) (3,137)

MSP charges - (68) (61)

------------------------------------ -----

Investment revenues 253 252 531

Finance costs (302) (112) (51)

Profit before taxation 850 1,334 327

Taxation 4 (1,006) (902) (712)

(Loss)/profit for the period (156) 432 (385)

=============== ============================ ==================

Attributable to:

Equity holders of the Company (113) 432 (380)

Non-controlling interests (43) - (5)

--------------- ---------------------------- ------------------

(156) 432 (385)

=============== ============================ ==================

(Loss)/earnings per share

Pence Pence Pence

Basic (loss)/earnings per share 6 (0.01) 0.05 (0.04)

=============== ============================ ==================

Diluted (loss)/earnings per share 6 (0.01) 0.05 (0.04)

=============== ============================ ==================

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Year ended

6 months ended 30 June 2019 6 months ended 30 June 2018 31 December 2018

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

(Loss)/profit for the period (156) 432 (385)

Items that may be reclassified

subsequently to profit or loss:

Exchange differences on

translation of foreign

operations 20 (173) (286)

Other comprehensive

income/(expense) for the period

net of taxation 20 (173) (286)

---------------------------- ---------------------------- ------------------

Total comprehensive

(expense)/income for the period (136) 259 (671)

============================ ============================ ==================

Attributable to:

Equity holders of the Company (93) 259 (666)

Non-controlling interests (43) - (5)

---------------------------- ---------------------------- ------------------

(136) 259 (671)

============================ ============================ ==================

CONSOLIDATED BALANCE SHEET

30 June 2019 30 June 2018 31 December 2018

GBP'000 GBP'000 GBP'000

Note (Unaudited) (Unaudited) (Audited)

Non-current assets

Goodwill 7 1,492 880 1,492

Other intangible assets 7 3,168 1,507 2,788

Property, plant and equipment 7 2,236 1,590 1,717

Right-of-use asset 10 6,087 - -

Investment in joint venture 882 438 1,034

Deferred tax asset 1,376 1,203 1,225

Net investment lease assets 10 63 - -

Contract assets 578 780 479

------------- ------------- -----------------

15,882 6,398 8,735

------------- ------------- -----------------

Current assets

Insurance assets - 30 24

Inventories 142 68 159

Net investment lease assets 10 168 - -

Contract assets 4,969 3,095 4,553

Trade and other receivables 13,263 10,016 13,704

Cash and cash equivalents 22,372 29,438 25,955

------------- ------------- -----------------

40,914 42,647 44,395

Total assets 56,796 49,045 53,130

------------- ------------- -----------------

Current liabilities

Insurance liabilities (471) (639) (617)

Income tax liabilities (779) (1,437) (536)

Trade and other payables (19,109) (20,364) (22,906)

Provisions (70) (369) (571)

Lease liabilities 10 (1,390) - -

Contract liabilities (11,971) (8,370) (10,934)

------------- ------------- -----------------

(33,790) (31,179) (35,564)

------------- ------------- -----------------

Net current assets 7,124 11,468 8,831

------------- ------------- -----------------

Non-current liabilities

Borrowings 71 116 90

Deferred tax liabilities (90) - (90)

Provisions (310) - (291)

Lease liabilities 10 (5,440) - -

Contract liabilities (926) (1,846) (1,009)

(6,695) (1,730) (1,300)

------------- ------------- -----------------

Total liabilities (40,485) (32,909) (36,864)

------------- ------------- -----------------

Net assets 16,311 16,136 16,266

============= ============= =================

Equity

Share capital 8 24,040 23,995 24,021

Share premium account 45,225 45,225 45,225

Merger reserve (100,399) (100,399) (100,399)

Translation reserve 498 591 478

ESOP reserve 16,249 15,476 15,884

Retained earnings 29,882 31,248 30,323

------------- ------------- -----------------

Equity attributable to equity holders of the Company 15,495 16,136 15,532

Non-controlling interests 816 - 734

------------- ------------- -----------------

Total equity 16,311 16,136 16,266

============= ============= =================

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share

Share Premium Merger Translation ESOP Retained Non-controlling Total

Capital Account reserve reserve reserve earnings Total interest equity

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

6 months ended

30 June 2019

(Unaudited)

At 1 January

2019 24,021 45,225 (100,399) 478 15,884 30,323 15,532 734 16,266

Change of

accounting

policy - IFRS

16 10 - - - - - (203) (203) - (203)

Loss for the

period - - - - - (113) (113) (43) (156)

Other

comprehensive

income for the

period - - - 20 - - 20 - 20

Equity-settled

share-based

payment charge 9 - - - - 365 - 365 - 365

Exercise of

share options 8 19 - - - - - 19 - 19

Movement in

non-controlling

interest - - - - - (125) (125) 125 -

-------- -------- ---------- ------------ -------- --------- -------- ---------------- --------

At 30 June 2019 24,040 45,225 (100,399) 498 16,249 29,882 15,495 816 16,311

======== ======== ========== ============ ======== ========= ======== ================ ========

6 months ended

30 June 2018

(Unaudited)

At 1 January

2018 23,978 45,225 (100,399) 764 15,114 30,816 15,498 - 15,498

Profit for the

period 432 432 - 432

Other

comprehensive

expense for the

period - - - (173) - - (173) - (173)

Equity-settled

share-based

payment charge 9 - - - - 362 - 362 - 362

Exercise of

share options 17 - - - - - 17 - 17

-------- -------- ---------- ------------ -------- --------- -------- ---------------- --------

At 30 June 2018 23,995 45,225 (100,399) 591 15,476 31,248 16,136 - 16,136

======== ======== ========== ============ ======== ========= ======== ================ ========

Year ended

31 December 2018

(Audited) -

At 1 January

2018 23,978 45,225 (100,399) 764 15,114 30,816 15,498 - 15,498

Loss for the

year - - - - - (380) (380) (5) (385)

Other

comprehensive

expense for the

year - - - (286) - - (286) - (286)

Equity-settled

share-based

payment charge 9 - - - - 770 - 770 - 770

Deferred tax on

share-based

payment charge - - - - - (113) (113) - (113)

Exercise of

share options 43 - - - - - 43 - 43

Non-controlling

interest on

acquisition of

a subsidiary - - - - - - - 739 739

-------- -------- ---------- ------------ -------- --------- -------- ---------------- --------

At 31 December

2018 24,021 45,225 (100,399) 478 15,884 30,323 15,532 734 16,266

======== ======== ========== ============ ======== ========= ======== ================ ========

CONSOLIDATED CASH FLOW STATEMENT

6 months ended 6 months ended Year ended

Note 30 June 2019 30 June 2018 31 December 2018

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Net cash used in operating activities 11 (1,406) (160) (833)

Investing activities

Interest received 248 252 531

Purchases of property, plant and equipment (836) (582) (792)

Purchases of intangible assets (844) (748) (1,931)

Acquisition of a subsidiary, net of cash acquired - (126) (704)

Investment in joint venture - (480) (1,224)

Net cash used in investing activities (1,432) (1,684) (4,120)

--------------- --------------- ------------------

Financing activities

Costs of refinancing the bank facility - (83) (126)

Capital lease repayments 10 (837) - -

Lessor capital receipts 10 78

Interest paid (61) (89) (51)

Issue of ordinary share capital 8 19 17 43

Net cash used in financing activities (801) (155) (134)

--------------- --------------- ------------------

Net decrease in cash and cash equivalents (3,639) (1,999) (5,087)

Effect of foreign exchange rate changes 56 (28) (423)

Cash and cash equivalents at start of period 25,955 31,465 31,465

Cash and cash equivalents at end of period 22,372 29,438 25,955

=============== =============== ==================

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

1 General information

The condensed consolidated interim financial statements for the

six months ended 30 June 2019 do not constitute statutory accounts

as defined under Section 434 of the Companies Act 2006. The Annual

Report and Financial Statements (the 'Financial Statements') for

the year ended 31 December 2018 were approved by the Board on 26

March 2019 and have been delivered to the Registrar of Companies.

The Auditor, Deloitte LLP, reported on these financial statements;

their report was unqualified, did not contain an emphasis of matter

paragraph and did not contain statements under s498 (2) or (3) of

the Companies Act 2006.

2 Accounting policies

Basis of preparation

The unaudited condensed consolidated interim financial

statements for the six months ended 30 June 2019 have been prepared

in accordance with IAS 34 Interim Financial Reporting as adopted by

the European Union.

The condensed consolidated interim financial statements should

be read in conjunction with the Financial Statements for the year

ended 31 December 2018, which have been prepared in accordance with

International Financial Reporting Standards (IFRSs) as adopted by

the European Union.

The condensed consolidated interim financial statements were

approved for release on 3 September 2019.

New and amended standards and interpretations need to be adopted

in the interim financial statements issued after their effective

date (or date of early adoption). The Group has applied the

following standards and amendments for the first time for their

annual reporting period commencing 1 January 2019:

-- IFRS 16 Leases

-- IFRIC 23 Uncertainty over tax treatments

-- IAS 28 (amendments) Long-term interests in Associates and Joint Ventures

-- Annual improvements to IFRSs 2015 - 2017 cycle

Following the adoption of IFRS 16, the Group has changed its

accounting policies and made certain transition adjustments, which

are disclosed in note 10. All other new or amended standards and

interpretations applied for the first time in the period commencing

1 January 2019 have not had a material impact on the Group.

The Group has revised income statement and segmental reporting

formats to include EBITDA from 1 January 2019. EBITDA is an APM

prior to which the Group used an alternative APM, underlying

operating profit. The Group is investing in technology, which will

be an ongoing focus, and as a result EBITDA provides a better

understanding of the underlying performance of our business. The

prior period income statement and relevant notes have been

represented to reflect the change.

The comparative balance sheet position as at 30 June 2018 has

been represented to reflect a change applied subsequent to the

approval of the 2018 Half Year Report in our transitionary

accounting for IFRS 15 Revenue from contracts with customers. As a

result, net assets have increased GBP320,000 compared to original

presentation, comprising an increase in current contract assets of

GBP588,000 and a reduction in deferred tax asset of GBP268,000.

Going concern

After making enquiries, the Directors have satisfied themselves

that taking account of reasonably possible changes in trading

performance, the Group's forecasts show that the Group has adequate

resources to continue in operational existence for the foreseeable

future. Accordingly, they continue to adopt the going concern basis

in preparing the condensed consolidated interim financial

statements.

Leases

The adoption of IFRS 16 Leases with effect from 1 January 2019

has led to amendments in the Group's accounting policy for leases.

The revised sections of the policy are below.

The Group assesses whether a contract is or contains a lease, at

inception of the contract. The Group's leases include properties,

equipment and motor vehicles. The Group recognises a right-of-use

asset and a corresponding lease liability with respect to all lease

arrangements in which it is the lessee, except for short-term

leases (defined as leases with a lease term of 12 months or less)

and low value assets. For these leases, the Group recognises the

lease payments as an expense through the consolidated income

statement on a straight-line basis over the term of the lease.

Lease liabilities

The lease liability is initially measured at the present value

of the lease payments, discounted by using the relevant incremental

borrowing rate available to the Group in each territory where a

lease is held. Lease liabilities include the net present value of

the following: lease payments; fixed payments, including any

incentives; variable lease payments; and amounts payable under

residual value guarantees.

Each lease payment is allocated between the liability and

finance cost. The finance cost is charged to the consolidated

income statement over the lease period providing a constant

periodic rate of interest on the remaining balance of the liability

for each period.

Right-of-use assets

Right-of-use assets are measured at cost comprising the

following: the amount of the initial measurement of lease liability

and any lease payments made at or before the commencement date;

less any lease incentives received, any initial direct costs and

final committed restoration costs.

The right-of-use asset is depreciated on a straight line basis

over the shorter of the asset's useful life and the lease term.

Variable lease payments

When a lease includes terms that change the future lease

payments, such as index-linked reviews, the lease liability (and

related right-of-use asset) is re-measured based on the revised

future lease payments at the date on which the revision is

triggered.

Extension and termination options

A number of the Group's lease arrangements include extension and

termination options. These terms are used to maximise operational

flexibility in respect of managing contracts. The majority of

extension and termination options held are exercisable only by the

Group and not by the respective lessor. Extension options (or

periods after termination options) are only included in the lease

term if the lease is reasonably certain to be extended (or not

terminated), considering historic trends and circumstances of the

lease arrangement.

3 Segmental analysis

IFRS 8 Operating segments requires operating segments to be

identified on the basis of internal reports about components of the

Group that are regularly reviewed by the Board of Directors to

allocate resources to the segments and to assess their performance.

The Group's operating segments are:

-- Ongoing Operations; India, China, Turkey, Spain, Germany,

Portugal, Italy, Mexico, Malaysia, UK, Bangladesh, Blink and

Southeast Asia. We continue to invest and drive new business

opportunities in these markets.

-- Restricted Operations: historic renewal books of our UK

regulated entities; CPPL, including its overseas branches; and

HIL.

-- Central Functions: central cost base required to provide

expertise and operate a listed Group. Central Functions is stated

after the recharge of certain central costs that are appropriate to

transfer to both Ongoing Operations and Restricted Operations for

statutory purposes.

Segment revenue and performance for the current and comparative

periods are presented below:

Ongoing Restricted Central

Operations Operations Functions Total

Six months ended 30 June 2019 GBP'000 GBP'000 GBP'000 GBP'000

(Unaudited)

Revenue - external sales 51,362 8,867 - 60,229

Segmental EBITDA 2,057 3,197 (2,783) 2,471

------------- ------------ -----------

Share of loss of joint venture (152)

--------

EBITDA 2,319

Depreciation and amortisation (1,420)

Operating profit 899

Investment revenues 253

Finance costs (302)

--------

Profit before taxation 850

Taxation (1,006)

--------

Loss for the period (156)

========

Ongoing Restricted Central

Operations Operations Functions Total

Six months ended 30 June 2018 GBP'000 GBP'000 GBP'000 GBP'000

(Unaudited)

Revenue - external sales 40,005 11,259 - 51,264

Segmental EBITDA (421) 5,513 (3,247) 1,845

------------ ------------ -----------

Share of loss of joint venture (66)

--------

EBITDA 1,779

Depreciation and amortisation (364)

Exceptional items (153)

MSP charges (68)

Operating profit 1,194

Investment revenues 252

Finance costs (112)

--------

Profit before taxation 1,334

Taxation (902)

--------

Profit for the period 432

========

Ongoing Restricted Central

Operations Operations Functions Total

Year ended 31 December 2018 GBP'000 GBP'000 GBP'000 GBP'000

(Audited)

Revenue - external sales 88,033 22,037 - 110,070

Segmental EBITDA 13 10,097 (6,000) 4,110

------------ ------------ -----------

Share of loss of joint venture (199)

--------

EBITDA 3,911

Depreciation and amortisation (866)

Exceptional items (3,137)

MSP charges (61)

--------

Operating loss (153)

Investment revenues 531

Finance costs (51)

Profit before taxation 327

Taxation (712)

--------

Loss for the year (385)

========

Segmental assets

30 June 2019 30 June 2018 31 December 2018

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Ongoing Operations 36,931 23,305 30,637

Restricted Operations 14,021 18,886 17,114

Central Functions 2,094 4,333 1,628

Total segment assets 53,046 46,524 49,379

Unallocated assets 3,750 2,521 3,751

Consolidated total assets 56,796 49,045 53,130

============= ============= =================

Goodwill, deferred tax and investment in joint venture are not

allocated to segments.

Capital expenditure

Other intangible assets Property, plant and equipment

----------------------------------------- ------------------------------------------

6 months 6 months

ended ended Year ended

30 June 30 June 31 December 30 June 30 June 31 December

2019 2018 2018 2019 2018 2018

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited) (Unaudited) (Unaudited) (Audited)

Ongoing

Operations 502 389 1,387 528 434 728

Restricted

Operations 32 - 20 137 3 61

Central Functions 310 363 878 171 151 277

Total assets 844 752 2,285 836 588 1,066

============ ============ ============= ============ ============ ============

Right-of-use asset additions in the period of GBP1,569,000

following the adoption of IFRS 16 from 1 January 2019 are not

included in the table above. The right-of-use asset additions are

located in our Ongoing Operations segment. Further information

relating to IFRS 16 is included in note 10

Timing of revenue recognition

The Group derives revenue from the transfer of goods and

services over time and at a point in time as follows:

6 months ended 30 June 2019 6 months ended 30 June 2018 Year ended 31 December 2018

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

At a point in time 49,070 43,478 89,116

Over time 11,159 7,786 20,954

---------------------------- ---------------------------- ----------------------------

60,229 51,264 110,070

============================ ============================ ============================

Revenue from major products

Year ended

6 months ended 30 June 2019 6 months ended 30 June 2018 31 December 2018

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Retail assistance policies 56,627 49,509 105,006

Retail insurance policies 96 168 336

Wholesale policies 1,682 1,375 4,162

Non-policy revenue 1,824 212 566

---------------------------- ---------------------------- ------------------

Consolidated revenue 60,229 51,264 110,070

============================ ============================ ==================

Major product streams are disclosed on the basis monitored by

the Board of Directors. For the purpose of this product analysis,

"retail assistance policies" are those which may be insurance

backed but contain a bundle of assistance and other benefits;

"retail insurance policies" are those which protect against a

single insurance risk; "wholesale policies" are those which are

provided by business partners to their customers in relation to an

ongoing product or service which is provided for a specified period

of time; "non-policy revenue" is that which is not in connection

with providing an ongoing service to policyholders for a specified

period of time.

The increase in non-policy revenue period-on-period reflects

third party revenues earned by Globiva.

Geographical information

The Group operates across a wide number of territories, of which

India, the UK and Spain are considered individually material.

Revenue from external customers and non-current assets (excluding

investment in joint venture and deferred tax) by geographical

location is detailed below:

External revenues Non-current assets

----------------------------------------- ------------------------------------------

6 months 6 months

ended ended Year ended

30 June 30 June 31 December 30 June 30 June 31 December

2019 2018 2018 2019 2018 2018

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited) (Unaudited) (Unaudited) (Audited)

India 40,894 28,267 65,326 6,347 855 2,115

UK 7,174 9,223 18,051 4,406 2,483 2,468

Spain 4,415 5,452 10,514 564 282 281

Other 7,746 8,322 16,179 2,307 1,137 1,612

Total 60,229 51,264 110,070 13,624 4,757 6,476

============ ============ ============= ============ ============ ============

Non-current assets at 30 June 2019 include GBP6,087,000

right-of-use assets recognised following adoption of IFRS 16

effective from 1 January 2019. Further details on IFRS 16 are

included in note 10.

Information about major customers

Revenue from customers of one business partner in our Ongoing

Operations segment represented approximately GBP27,708,000 (H1

2018: GBP20,577,000; year ended 31 December 2018: GBP48,158,000) of

the Group's total revenue.

4 Taxation

The effective tax rate at the half year is 118.4% (H1 2018:

67.6%; year ended 31 December 2018: 217.7%). The tax charge of

GBP1,006,000 (H1 2018: GBP902,000; year ended 31 December 2018:

GBP712,000) reflects charges on taxable profits arising in India

and our EU Hub. The corporate income tax in these overseas

jurisdictions is higher than the UK corporate income tax rate of

19%. Profits from UK entities are expected to be covered by group

relief from losses arising in other UK entities, brought forward

tax losses and double taxation relief.

The Group's effective tax rate is significantly higher than the

UK corporate income tax rate due to losses in our developing

markets which do not in the short-term indicate sufficient

certainty of future profitability to recognise deferred tax assets.

The Group's policy is to recognise deferred tax assets when profit

forecasts indicate that tax losses can be utilised in the

short-term. The 2019 full year rate may vary from the H1 2019 rate

as the territory mix of future 2019 profits or losses may differ,

however it is expected to continue to be significantly higher than

the UK rate in the future.

5 Dividends

The Directors have not proposed an interim dividend for 2019.

Neither an interim or final dividend was proposed in 2018.

6 (Loss)/earnings per share

Basic and diluted (loss)/earnings per share have been calculated

in accordance with IAS 33 Earnings per share. Underlying

(loss)/earnings per share, which exclude exceptional items and MSP

charges, have also been presented in order to give a better

understanding of the performance of the business. In accordance

with IAS 33, potential ordinary shares are only considered dilutive

when their conversion would decrease the earnings per share or

increase the loss per share attributable to equity holders. The

diluted loss per share is therefore equal to the basic loss per

share in the six months ended 30 June 2019 and year ended 31

December 2018.

Six months ended 30 June 2019 (Unaudited) Total

Losses GBP'000

Loss for the purposes of basic and diluted earnings per share and underlying earnings

per

share (113)

===========

Number of shares Number

(thousands)

Weighted average number of ordinary shares for the purposes of basic and diluted loss

per

share 862,015

Loss per share Total

Pence

Basic and diluted loss per share (0.01)

Basic and diluted underlying loss per share (0.01)

Six months ended 30 June 2018 (Unaudited) Total

Earnings GBP'000

Earnings for the purposes of basic and diluted earnings per share 432

Exceptional items (net of tax) 153

MSP charges (net of tax) 39

Earnings for the purposes of underlying basic and diluted earnings per share 624

Number of shares Number

(thousands)

Weighted average number of ordinary shares for the purposes of basic earnings per share 856,902

Effect of dilutive potential ordinary shares: share options 19,616

Weighted average number of ordinary shares for the purposes of diluted earnings per

share 876,518

Earnings per share Total

Pence

Basic and diluted earnings per share:

Basic 0.05

Diluted 0.05

Basic and diluted underlying earnings per share:

Basic 0.07

Diluted 0.07

Year ended 31 December 2018 (Audited) Total

(Loss)/earnings GBP'000

Loss for the purposes of basic and diluted loss per share (380)

Exceptional items (net of tax) 2,289

MSP charges (net of tax) 55

Earnings for the purposes of underlying basic and diluted earnings per share 1,964

Number of shares Number

(thousands)

Weighted average number of ordinary shares for the purposes of basic and diluted

loss per

share and basic underlying earnings per share 858,474

Effect of dilutive potential ordinary shares: share options 28,308

Weighted average number of ordinary shares for the purposes of diluted underlying

earnings

per share 886,782

(Loss)/earnings per share Total

Pence

Basic and diluted loss per share (0.04)

Basic and diluted underlying earnings per share:

Basic 0.23

Diluted 0.22

7 Tangible and intangible assets

Property,

Other intangible plant and

Goodwill assets equipment Total

GBP'000 GBP'000 GBP'000 GBP'000

Six months ended 30 June 2019

(Unaudited)

Carrying amount at 1 January

2019 1,492 2,788 1,717 5,997

Additions - 844 836 1,680

Disposals - (7) (32) (39)

Amortisation/depreciation - (471) (293) (764)

Exchange adjustments - 14 8 22

Carrying amount at 30 June

2019 1,492 3,168 2,236 6,896

Six months ended 30 June 2018

(Unaudited)

Carrying amount at 1 January

2018 776 882 1,281 2,939

Additions 104 752 588 1,444

Disposals - - (7) (7)

Amortisation/depreciation - (128) (236) (364)

Exchange adjustments - 1 (36) (35)

Carrying amount at 30 June

2018 880 1,507 1,590 3,977

Year ended 31 December 2018

(Audited)

Carrying amount at 1 January

2018 776 882 1,281 2,939

Additions 716 1,931 792 3,439

Acquisition of subsidiaries - 354 274 628

Disposals - (11) (75) (86)

Amortisation/depreciation - (412) (454) (866)

Impairment - - (71) (71)

Exchange adjustments - 44 (30) 14

Carrying amount at 31 December

2018 1,492 2,788 1,717 5,997

8 Share capital

Share capital at 30 June 2019 is GBP24,040,000 (H1 2018:

GBP23,995,000; 31 December 2018: GBP24,021,000). To satisfy share

option exercises in the six month period to 30 June 2019 the

Company has issued 1,894,000 ordinary shares for a total

consideration of GBP19,000.

9 Share-based payment

Equity-settled share-based payments

Share-based payment charges for the six month period to 30 June

2019 comprise Long Term Incentive Plan 2016 (2016 LTIP) charges of

GBP365,000 (H1 2018: GBP294,000; 31 December 2018: GBP680,000).

There have been no MSP charges in the period (H1 2018: GBP68,000;

31 December 2018: GBP90,000). These costs are disclosed within

administrative expenses, although the MSP share-based payment

charge formed part of the MSP charges not included in EBITDA.

There have been 18,092,000 options granted in the six month

period to 30 June 2019 as part of the 2016 LTIP (30 June 2018 and

31 December 2018: 16,071,000 options granted). There have been no

MSP options granted in either the current period or the comparative

periods.

Number of share options Weighted average exercise price

(thousands) (GBP)

Six months ended 30 June 2019 (Unaudited)

2016 LTIP

Outstanding at 1 January 2019 37,981 -

Granted during the period 18,092 -

Lapsed/forfeited during the period (11,886) -

Outstanding at 30 June 2019 44,187 -

MSP

Outstanding at 1 January 2019 6,343 0.01

Exercised during the period (1,894) 0.01

Outstanding at 30 June 2019 4,449 0.01

Exercisable at 30 June 2019 4,449 0.01

Six months ended 30 June 2018 (Unaudited)

2016 LTIP

Outstanding at 1 January 2018 22,551 -

Granted during the period 16,071 -

Forfeited during the period (641) -

Outstanding at 30 June 2018 37,981 -

MSP

Outstanding at 1 January 2018 10,669 0.01

Forfeited during the period (53) 0.01

Exercised during the period (1,703) 0.01

Outstanding at 30 June 2018 8,913 0.01

Exercisable at 30 June 2018 5,944 0.01

Number of share options Weighted average exercise price

(thousands) (GBP)

Year ended 31 December 2018 (Audited)

2016 LTIP

Outstanding at 1 January 2018 22,551 -

Granted during the year 16,071 -

Forfeited during the year (641) -

Outstanding at 31 December 2018 37,981 -

MSP

Outstanding at 1 January 2018 10,669 0.01

Forfeited during the year (52) 0.01

Exercised during the year (4,274) 0.01

Outstanding at 31 December 2018 6,343 0.01

Exercisable at 31 December 2018 6,343 0.01

Nil cost options and conditional shares granted under the 2016

LTIP normally vest after three years, lapse if not exercised within

ten years of grant and will lapse if option holders cease to be

employed by the Group. Vesting of 2016 LTIP options and shares are

also subject to achievement of certain performance criteria

including revenue and profit-based targets and non-financial event

measures over the vesting period.

The options outstanding at 30 June 2019 had a weighted average

remaining contractual life of two years (30 June 2018: two years;

31 December 2018: two years) in the 2016 LTIP and no years (30 June

2018: no years; 31 December 2018: no years) in the MSP.

The principal assumptions underlying the valuation of the 2016

LTIP options granted during the period at the date of grant are as

follows:

LTIP 2016

April 2019

Weighted average share price GBP0.05

Weighted average exercise price -

Expected volatility n/a

Expected life 3 years

Risk-free rate n/a

Dividend yield 0%

There have been 18,092,000 share options granted in the current

period. The aggregate estimated fair value of the options granted

in the current period under the 2016 LTIP was GBP950,000.

Cash-settled share-based payments

On 29 April 2019, the Group granted certain employees with

notional share options that require the Group to pay the intrinsic

value of the notional share to the employee at the date of

exercise. The fair value of the notional share options has been

determined by the Black Scholes model using the assumptions noted

in the table above. The Group has recorded a total expense in

relation to this award in the six months to 30 June 2019 of

GBP24,000 (H1 2018: GBPnil; year ended 31 December 2018:

GBP30,000). The Group has recorded liabilities of GBP24,000 (30

June 2018: GBPnil and 31 December 2018: GBP30,000) in relation to

these notional awards.

10 Change in accounting policy

The Group adopted IFRS 16 Leases effective from 1 January 2019,

which has led to updates in the Group's accounting policy for

leases. In accordance with the transition provisions for IFRS 16,

the Group has adopted the new rules retrospectively and has opted

not to restate comparative reporting periods. As a result, the

reclassification and adjustments arising from the new leasing rules

are recognised in the opening balance sheet on 1 January 2019. The

new accounting policies are disclosed in note 2.

On adoption of IFRS 16, the Group has recognised lease

liabilities in relation to leases which had previously been

classified as 'operating leases' under the principles of IAS 17

Leases. The lease liabilities were measured at the present value of

the remaining lease payments, discounted using the lessee's

incremental borrowing rate as at 1 January 2019. The weighted

average lessee's incremental borrowing rate applied to the lease

liabilities on 1 January 2019 was 7.1%.

In applying IFRS 16 for the first time, the Group has used the

following practical expedients permitted by the standard:

-- the use of a single discount rate to a portfolio of leases

with reasonably similar characteristics, including geographical

location;

-- the accounting for operating leases with a remaining lease

term of less than 12 months as at 1 January 2019 as short-term

leases;

-- the exclusion of initial direct costs for the measurement of

the right-of-use asset at the date of initial application;

-- the use of hindsight in determining the lease term where the

contract contains options to extend or terminate the lease; and

-- relying on previous assessment of whether a lease is onerous.

The Group has also elected not to apply IFRS 16 to contracts

that were not identified as containing a lease under IAS 17 and

IFRIC 4 Determining whether an arrangement contains a lease.

Measurement of lease liabilities

GBP'000

Operating lease commitments as at 1 January 2019 5,532

Operating lease commitments as at 1 January 2019 restated net of VAT 5,291

Discounted using the lessee's incremental borrowing rate of 7.1% (656)

Add: finance lease liabilities recognised as at 1 January 2019 1,347

(Less): short-term leases recognised as expense on a straight line basis (146)

(Less): contracts re-assessed as service agreements (102)

Add: adjustments as a result of reassessment of extension and termination options 83

Lease liability recognised at 1 January 2019 5,817

Comprising:

Non-current lease liabilities 4,530

Current lease liabilities 1,287

5,817

The movement in the lease liability in the period is as

follows:

Lease liability 30 June 2019

GBP'000

(Unaudited)

At 1 January 2019 5,817

Additions 1,569

Interest 220

Lease payments (837)

Exchange adjustments 61

At 30 June 2019 6,830

Comprising:

Non-current lease liabilities 5,440

Current lease liabilities 1,390

6,830

Measurement of right-of-use assets

The associated right-of-use assets for all leases were measured

on a retrospective basis as if the new rules had always been

applied. Any identified restoration costs were added to the initial

costs of the right-of-use assets. Any right-of-use assets

associated with leases previously deemed to be onerous were

impaired where the previous assessment of the nature of the onerous

lease remained appropriate. Right-of-use assets are depreciated

using a straight-line approach over their deemed useful economic

life, which is based on interpretation of lease contract length in

line with the requirements of the standard.

30 June 2019 1 January 2019

GBP'000 GBP'000

(Unaudited) (Unaudited)

Properties 5,854 4,873

Motor vehicles 203 213

Equipment 30 37

Total right-of-use assets 6,087 5,123

The movement in the right-of-use asset in the period is as

follows:

Right-of-use asset 30 June 2019

GBP'000

(Unaudited)

At 1 January 2019 5,123

Additions 1,569

Depreciation (656)

Exchange adjustments 51

At 30 June 2019 6,087

Lessor accounting

The Group has certain finance lease arrangements where it acts

as a lessor and has made adjustments to accounting for the

associated sublet assets. The subleases were previously accounted

for as operating leases under IAS 17. On adoption of IFRS 16, the

Group recognised a net investment asset through reclassification of

the associated right-of-use assets.

The net investment asset is measured at the present value of the

remaining future minimum sub lease payments to be received,

discounted using the relevant incremental borrowing rate as at 1

January 2019. The right-of-use asset reclassified is measured at

the proportion of the existing right-of-use assets that are sublet

to the lessees in the arrangement. Any resulting differences are

recognised as a gain or loss in the consolidated income

statement.

Reconciliation of sublease future minimum payments to net investment assets

1 January 2019

GBP'000

(Unaudited)

Future minimum sublease payments disclosed as at 1 January 2019 278

(Less): adjustments as a result of reassessment of extension and termination options (3)

Add: residual value of sub-leased asset returned on conclusion of sublease 41

Discounted using the incremental borrowing rate (12)

Net investment asset recognised at 1 January 2019 304

Comprising:

Non-current net investment assets 148

Current net investment assets 156

304

Net investment lease assets 30 June 2019

GBP'000

(Unaudited)

At 1 January 2019 304

Payments received (78)

Interest 5

At 30 June 2019 231

Comprising:

Non-current net investment assets 63

Current net investment assets 168

231

In addition to lease liabilities, right-of-use assets and net

investment lease assets, the transition also reduced provisions.

Overall, the change in accounting policy impacted the balance sheet

on 1 January 2019 by increasing assets by GBP5,427,000 and

increasing liabilities by GBP5,630,000. The net impact on retained

earnings on 1 January 2019 was GBP203,000 reduction.

At 30 June 2019 assets were affected by an increase of

GBP6,318,000 and liabilities by an increase of GBP6,995,000.

11 Reconciliation of operating cash flows

6 months ended Year ended

6 months ended 30 June 2019 30 June 2018 31 December 2018

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

(Loss)/profit for the period (156) 432 (385)

Adjustments for:

Depreciation and amortisation 1,420 364 866

Share-based payment expense 389 362 800

Impairment loss on intangible assets - - 71

Loss on disposal of intangible assets 6 - 11

Loss on disposal of property, plant and equipment 31 6 75

Share of loss of joint venture 152 66 199

Investment revenues (253) (252) (531)

Finance costs 302 112 51

Income tax charge 1,006 902 712

Operating cash flows before movement in

working capital 2,897 1,992 1,869

Decrease/(increase) in inventories 17 9 (82)

Increase in contract assets (443) (600) (1,756)

Decrease/(increase) in receivables 321 (49) (2,691)

Decrease in insurance assets 24 - 6

(Decrease)/increase in payables (3,700) (2,198) 1

Increase in contract liabilities 846 780 2,407

Decrease in insurance liabilities (146) (67) (89)

(Decrease)/increase in provisions (482) (121) 372

Cash (used in)/from operations (666) (254) 37

Income taxes (paid)/received (740) 94 (870)

Net cash used in operating activities (1,406) (160) (833)

12 Related party transactions

Transactions with related parties

ORConsulting Limited (ORCL) is an organisation used by the Group

for consulting services in relation to leadership coaching.

Organisation Resource Limited (ORL), a company owned by Mark Hamlin

who is a Non-Executive Director of the Group, retains intellectual

property in ORCL for which it is paid a license fee. In the six

months to 30 June 2019, the Group has paid GBP25,000 plus VAT (six

months ended 30 June 2018: GBP25,000; year ended 31 December 2018:

GBP90,000) to ORCL, which was payable under 30 days credit

terms.

OR Talent Inc (ORTI) is an organisation which provides advice to

the Group in senior leadership recruitment and integration. ORTI is

a wholly owned subsidiary of OR Talent Limited (ORTL) in which Mark

Hamlin holds 75% of the voting rights. In the six months to 30 June

2019, the Group has paid GBP25,000 (six months ended 30 June 2018;

GBPnil; year ended 31 December 2018: GBPnil) to ORTI, which was

payable under 30 days credit terms.

Mark Hamlin is the Chairman of Globiva. The fees for this role

are paid to his consultancy company, ORL. The fee paid to ORL by

the Group in the six months ended 30 June 2019 was GBP38,000 (six

months ended 30 June 2018: GBPnil; year ended 31 December 2018:

GBP28,000) and was payable under 25 day credit terms.

Remuneration of key management personnel

The remuneration of the Directors and Senior Management Team,

who are the key management personnel of the Group, is set out

below:

6 months ended 6 months ended Year ended

30 June 2019 30 June 2018 31 December 2018

GBP'000 GBP'000 GBP'000

(Unaudited) (Unaudited) (Audited)

Short-term employee benefits 1,107 1,070 2,248

Post-employment benefits 43 42 82

Share-based payments 317 217 512

1,467 1,329 2,842

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR UGURPBUPBGMW

(END) Dow Jones Newswires

September 04, 2019 02:00 ET (06:00 GMT)

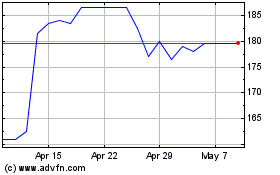

Cppgroup (LSE:CPP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cppgroup (LSE:CPP)

Historical Stock Chart

From Jul 2023 to Jul 2024