Christie Group PLC Trading Statement (0864W)

December 08 2023 - 1:00AM

UK Regulatory

TIDMCTG

RNS Number : 0864W

Christie Group PLC

08 December 2023

8 December 2023

Christie Group plc

("Christie Group" or the "Company")

Trading Update

The Board of Christie Group plc (CTG.L) advises that, as

anticipated, invoicing levels have improved markedly since the end

of the summer period and as such the Group expects to report an

improved second-half performance on that achieved in H1.

However, it now appears likely that a number of transactions

previously expected to exchange in the last few weeks of this year

will not now reach that stage until early 2024. Buyers and vendors

actively working towards contractual exchange have indicated their

intention to delay transactions into 2024 to avoid pre-Christmas

operational disruption to their businesses. These deals would be

expected to exchange early in the new year.

The resulting market uncertainty caused by transactional delays

and moving deal timings, mean that the full year result, before

exceptional costs is now likely to be below current full year

market expectations, but with transaction pipelines and activity

much improved from twelve months ago and heading into the start of

2024.

Enquiries:

Christie Group plc

Dan Prickett 07885 813101

Chief Executive

Simon Hawkins 07767 354366

Group Finance Director

Shore Capital

Patrick Castle 020 7408 4090

Nominated Advisor and Broker

Notes to Editors:

Christie Group plc, quoted on AIM, is a leading professional

business services group with 38 offices across the UK and Europe,

catering to its specialist markets in the hospitality, leisure,

healthcare, medical, childcare & education and retail

sectors.

Christie Group operates in two complementary business divisions:

Professional & Financial Services (PFS) and Stock &

Inventory Systems & Services (SISS). These divisions trade

under the brand names: PFS - Christie & Co, Pinders, Christie

Finance and Christie Insurance: SISS - Orridge, Venners and

Vennersys.

Tracing its origins back to 1846, the Group has a

long-established reputation for offering valued services to client

companies in agency, valuation services, investment, consultancy,

project management, multi-functional trading systems and online

ticketing services, stock audit and inventory management. The

diversity of these services provides a natural balance to the

Group's core agency business.

The information contained within this announcement is deemed by

the Company to constitute inside information under the Market Abuse

Regulations (EU) No. 596/2014.

For more information, please go to www.christiegroup.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTQDLFBXLLXFBE

(END) Dow Jones Newswires

December 08, 2023 02:00 ET (07:00 GMT)

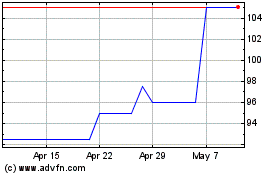

Christie (LSE:CTG)

Historical Stock Chart

From Dec 2024 to Jan 2025

Christie (LSE:CTG)

Historical Stock Chart

From Jan 2024 to Jan 2025