TIDMCVSG

RNS Number : 3337H

CVS Group plc

27 July 2023

27 July 2023

CVS Group plc

("CVS" or the "Company" and, together with its subsidiaries, the

"Group")

Full year Trading Update, Expansion into Australia and UK

acquisitions

CVS, the UK quoted veterinary group and a leading provider of

integrated veterinary services, is pleased to issue the following

update on trading for the financial year ended 30 June 2023

("FY23")(1) . The Group expects to announce its FY23 preliminary

results on 21 September 2023.

The Group is also pleased to announce its entry into the

Australian veterinary services market. CVS's expansion into

Australia is in accordance with its growth objectives, outlined in

the five-year plan at the Group's Capital Markets Day in November

2022, to execute on scalable international consolidation

opportunities, subject to maintaining its disciplined acquisition

criteria. Having explored a number of new potential markets, the

Board has identified Australia as particularly attractive given the

relatively low levels of corporate consolidation, favourable market

dynamics and strong similarities with the UK, including highly

trained veterinary surgeons, shared language and culture, and the

Group's experience with UK vets working between Australia and the

UK.

FY23 Financial Highlights

-- Continued organic revenue growth with a 7.3% increase in

like-for-like sales(2) (FY22: 8.0%), consistent with the Group's

organic revenue growth ambition of between 4% and 8%;

-- Adjusted EBITDA(3) margins also expected to be within our

stated ambition of margins between 19% to 23%;

-- FY23 adjusted EBITDA(3) expected to be comfortably in line with market expectations;

-- Continued investment in our facilities and equipment to

support growth, with total capital expenditure of c.GBP46m (FY22:

GBP24.5m), within the Group's capital expenditure ambition of

GBP30m to GBP50m investment per annum;

-- Investment of c.GBP55m in 11 practice acquisitions

(comprising 16 practice sites) (FY22: GBP8.4m in three practice

acquisitions (comprising three practice sites)), in line with the

guidance of GBP50m+ investment per annum;

-- Leverage(5) comfortably less than 1.0x at 30 June 2023 (30

June 2022: 0.40x) well below our stated target of less than 2.0x

leverage. This reflects strong EBITDA growth and continued

operating cash conversion, partly offset by an increase in drawn

debt to fund growth investment in capital expenditure and

acquisitions;

-- Further increase in membership of our preventative healthcare

scheme, Healthy Pet Club to 489,000 members (30 June 2022:

470,000);

-- 6.5% increase in the average number of vets employed in FY23

reflecting a further reduction in attrition and a record graduate

vet intake.

FY23 Performance

The Board is pleased to report the Group delivered strong high

single-digit revenue growth for the full year. Like-for-like(2)

sales for the financial year increased by 7.3% (FY22: 8.0%), at the

upper end of the Group's ambition of like-for-like growth between

4% and 8%. We continue to see resilience in the veterinary sector,

with membership of our Healthy Pet Club preventative healthcare

scheme increasing in the year by 19,000 members (an increase of

4.0%) to 489,000 (30 June 2022: 470,000 members).

The Group expects to report adjusted EBITDA(3) for FY23

comfortably in line with market expectations, notwithstanding

increased utility costs and other inflationary pressures.

Adjusted EBITDA(3) margin is expected to be within the range of

19% to 23%, reflecting our continued focus on the provision of high

quality clinical care across our integrated veterinary services

platform.

In accordance with our five-year plan, we have increased

investment in our practice facilities, clinical equipment and

technology in support of future growth. Total capital expenditure

was c.GBP46m (FY22: GBP24.5m), in line with the GBP30m to GBP50m

per annum ambition. We completed 21 practice refurbishment and

projects in the financial year and our new practice management

system is now being trialled in the UK.

This investment was funded from a combination of cash generated

from our operations and additional drawing under our bank

facilities which were successfully refinanced in February 2023,

with margins on these facilities remaining unchanged. Net bank

borrowings(4) increased as at 30 June 2023 to GBP74.1m (31 December

2022: GBP57.6m, 30 June 2022: GBP36.0m). The Group expects to

report leverage(5) comfortably below 1.0x as at 30 June 2023 (30

June 2022: 0.40x).

We continue to focus on the recruitment, retention and

development of our highly skilled and dedicated colleagues. We

employed an average of 6.5% more vets in FY23 vs FY22 reflecting a

further reduction in attrition and a record graduate vet

intake.

Australian acquisitions

On 10 July 2023, the Group signed four separate sale and

purchase agreements for the conditional acquisitions of four

independent small animal first opinion veterinary practices in

Australia (comprising six sites) namely:

-- McDowall Veterinary Practice, a nine-vet single site practice

in McDowall, Brisbane, Queensland;

-- Northgate Veterinary Surgery and St Vincents Vets, a five vet

two site practice in Brisbane, Queensland;

-- Warner Vet, a four-vet single site practice in Cashmere, Queensland; and

-- Southside Animal Hospital, a six vet two site practice in Sydney, New South Wales.

On 26 July 2023, the Group completed the acquisitions of

McDowall Veterinary and Warner Vet Practices with the remaining two

acquisitions expected to be completed shortly.

Combined initial consideration for the completed acquisitions

and the two pending acquisitions is A$31.9m (c.GBP16.8m) settled /

to be settled in cash. In addition, each acquisition is also

subject to market-standard performance based contingent

consideration, which will (if achieved) be settled in cash.

These four acquisitions are the first of a number of planned

Australian practice acquisitions which CVS expects to announce in

the coming months. The Group has identified a strong pipeline of

opportunities and a number of non-binding indicative offers have

been accepted for further practice acquisitions. The Group's focus

will be on acquisition opportunities in major urban conurbations,

including Sydney, Melbourne, Brisbane, Perth, Canberra, Newcastle

and Adelaide.

The Group has established an Australian-based senior management

team to support acquired practices and continue to develop the

pipeline of new acquisition opportunities. This team includes a

highly experienced operations director with seven years' service at

CVS on secondment from our UK veterinary practice division, and an

acquisitions director with extensive experience of the Australian

veterinary market. Members of the CVS executive committee will

continue to spend appropriate time in Australia to support the

establishment of our new operations.

The Group expects gradually to benefit from additional

advantages of scale as it further expands in Australia, including

improved drug purchasing terms, revenue growth and margin

enhancement with a focus on high quality clinical care and

developing a market leading employee experience.

Additional UK acquisitions

The Group is also pleased to announce the acquisition of a

further three veterinary practices (comprising five practice sites)

in the UK in the financial year to 30 June 2023 for combined

consideration of c.GBP20m, namely:

-- East of England Veterinary Specialists, a single site small

animal specialist referral practice in Wimpole, Cambridgeshire;

-- Brunswick Place Veterinary Clinic, a single site small animal

first opinion practice in Basingstoke, Hampshire; and

-- Riverside Veterinary Practice, a three-site small animal

first opinion practice near Edinburgh in West Lothian,

Scotland.

Including these acquisitions, the Group completed 11 practice

acquisitions (comprising 16 practice sites) in the financial year

to 30 June 2023 for combined consideration of c.GBP55m.

The consideration for the completed acquisitions was fully

satisfied in cash from the Group's existing funding resources, with

the Group's leverage(5) remaining below 1.0x post these

acquisitions, retaining significant headroom for further

growth.

Outlook

Whilst the Board remains mindful of the uncertain economic

outlook, the veterinary market continues to show resilience with

ongoing demand for the Group's services. With the growth delivered

in the financial year to 30 June 2023, ongoing investment in

delivering further organic growth and recent acquisitions in the UK

and Australia, the Group remains well placed to deliver further

increases in shareholder value.

The Board would like to acknowledge and thank all CVS colleagues

for their continued dedication and commitment in delivering the

best possible care to animals.

The Group expects to announce its preliminary results on

Thursday, 21 September 2023.

Richard Fairman, CEO commented;

"I am delighted to announce the continued growth of CVS in the

financial year ended 30 June 2023 and our entry into the Australian

veterinary services market. At our Capital Markets Day in November

2022, we set out our plans and ambition to double Adjusted EBITDA

over the next five years through a continued focus on organic

growth and through acquisitions in the UK and overseas. Our entry

into the Australian market is consistent with these plans and we

are excited by the opportunity. I am delighted to welcome the teams

at McDowall Vets, Northgate Veterinary Surgery & St Vincent

Vets, Warner Vet and Southside Animal Hospital in Australia, and

those of East of England Veterinary Specialists, Brunswick Place

Veterinary Clinic and Riverside Veterinary Practice in the UK to

the CVS Group."

Ben Jacklin, Deputy CEO stated;

"The announcement of this strong trading update, and our entry

into the Australia market represents more good news for CVS. Having

worked as a vet in Australia earlier in my career, I know well

their high standards of clinical care, and the dedication of highly

talented veterinary professionals that work there. As a company

dedicated to giving the best possible care to animals, I see a

fantastic opportunity for us to enter this growing market, with low

levels of corporate consolidation, and execute our vision of being

the veterinary company people most want to work for. I have spent

time in Australia over the last 12 months, including meeting some

fantastic veterinary practices, and it is clear we have a

significant opportunity. With the four outstanding practices that

are joining us, and a strong pipeline of further acquisition

opportunities, I am excited to build a significant CVS business in

Australia with the same culture and values that have brought us

success in the UK."

Notes

1 Numbers included are unaudited.

2 Like-for-like sales shows revenue generated from like-for-like

operations compared to the prior year, adjusted for the number of

working days. For example, for a practice acquired in September

2021, revenue is included from September 2022 in the

like-for-like

calculations.

3 Adjusted EBITDA (earnings before interest, tax, depreciation

and amortisation) is profit before tax adjusted for interest (net

finance expense), depreciation, amortisation, costs relating to

business combinations and exceptional items. Adjusted EBITDA is an

alternative performance measure and is defined in note 1 of the

2022 Annual Report.

4 Net bank borrowings is drawn bank debt less cash and cash equivalents.

5 Leverage on a bank test basis is net bank borrowings divided

by 'Adjusted EBITDA', annualised for the effect of acquisitions,

deducting costs relating to business combinations and adding back

share option costs, on an accounting basis prior to the adoption of

IFRS 16.

CVS Group plc via Camarco

Richard Fairman, CEO

Ben Jacklin, Deputy CEO

Robin Alfonso, CFO

Peel Hunt LLP (Nominated Adviser & Broker) +44 (0)20 7418

8900

Adrian Trimmings / Michael Burke / Andrew Clark / Lalit Bose

Berenberg (Joint Broker) +44 (0)20 3207 7800

Toby Flaux / Ben Wright / James Thompson / Milo Bonser

Camarco (Financial PR)

Geoffrey Pelham-Lane +44 (0)7733 124 226

Ginny Pulbrook +44 (0)7961 315 138

About CVS Group plc ( www.cvsukltd.co.uk )

CVS Group is an AIM-quoted fully-integrated provider of

veterinary services in the UK, with practices in Australia, the

Netherlands and the Republic of Ireland. CVS is focused on

providing high quality clinical services to its customers and their

animals, with outstanding and dedicated clinical teams and support

colleagues at the core of its strategy.

The Group has c.500 veterinary practices across its four

markets, including nine specialist referral hospitals and 39

dedicated out-of-hours sites. Alongside the core Veterinary

Practices division, CVS operates Laboratories (providing diagnostic

services to CVS and third-parties), Crematoria (providing pet

cremation and clinical waste disposal for CVS and third-party

practices), Buying Groups and the Group's online retail business

("Animed Direct").

The Group employs c.8,700 personnel, including c.2,250

veterinary surgeons and c.3,200 nurses.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUNRAROBUBUUR

(END) Dow Jones Newswires

July 27, 2023 02:00 ET (06:00 GMT)

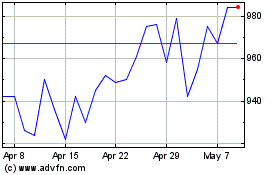

Cvs (LSE:CVSG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Cvs (LSE:CVSG)

Historical Stock Chart

From Dec 2023 to Dec 2024