TIDMCVSG

RNS Number : 1882N

CVS Group plc

21 September 2023

For Immediate Release

21 September 2023

CVS GROUP plc

("CVS", the "Company" or the "Group")

Final results for the year ended 30 June 2023

Strong results reflect continued customer demand for

high-quality clinical care and investment in growth

CVS, the UK listed veterinary group and a leading provider of

veterinary services, is pleased to announce its final results for

the year ended 30 June 2023 ("2023").

Financial Highlights

Change

GBPm except where stated 2023 2022 %

----------------------------------- ------ ------ ----------

Revenue 608.3 554.2 9.8%

Group like-for-like ("LFL") sales

growth (%)(1) 7.3% 8.0% -0.7 ppts

Adjusted EBITDA (2) 121.4 107.4 13.0%

Adjusted EBITDA(2) margin (%) 20.0% 19.4% +0.6 ppts

Adjusted profit before tax (3) 85.4 75.5 13.1%

Adjusted earnings per share (4)

(p) 96.0 85.8 11.9%

Operating profit 62.3 42.8 45.6%

Profit before tax 53.9 36.0 49.7%

Basic earnings per share (p) 58.8 36.2 62.4%

Net bank borrowings(5) 74.0 36.0 105.6%

Final dividend (p) 7.5 7.0 7.1%

----------------------------------- ------ ------ ----------

-- Revenue increased by 9.8%, to GBP608.3m (2022: GBP554.2m),

with Group like-for-like(1) sales growth of 7.3% in line with the

Group's stated organic revenue growth target of between 4% and 8%,

reflecting continued demand for the Group's high-quality clinical

care

-- Adjusted EBITDA(2) growth of 13.0%, to GBP121.4m (2022:

GBP107.4m), underpinned by strong revenue performance and the

continued investment in our facilities, equipment, technology and

colleagues in addition to the recognition of research and

development expenditure tax credit

-- Profit before tax increased by 49.7%, to GBP53.9m (2022:

GBP36.0m) benefitting from the increase in adjusted EBITDA

partially offset by an increase in finance expense, depreciation

and costs relating to business combinations. The prior year was

impacted by the one-off impairment of investment relating to the

acquisition of Quality Pet Care Ltd

-- Leverage(6) increased to 0.73x (2022: 0.40x) as a result of

the above investment and acquisitions

-- Operating cash conversion improved 4.9ppts to 70.0%

-- In light of the continued growth of the Group and its

positive operating cash generation, the Board is recommending the

payment of a final dividend of 7.5p per Ordinary share (2022:

7.0p)

-- In February 2023, we successfully refinanced our debt

facilities increasing available funds to GBP350m from GBP170m. The

interest margin and covenants for the facility remain unchanged

Notes

1 Like-for-like sales shows revenue generated from like-for-like

operations compared to the prior year, adjusted for the number of

working days. For example, for a practice acquired in September

2021, revenue is included from September 2022 in the like-for-like

calculations.

2 Adjusted EBITDA (Earnings Before Interest, Tax, Depreciation

and Amortisation) is profit before tax adjusted for interest (net

finance expense), depreciation, amortisation, costs relating to

business combinations, and exceptional items. Adjusted EBITDA

provides information on the Group's underlying performance and this

measure is aligned to our strategy and KPIs.

3 Adjusted profit before tax is calculated as profit before

amortisation, taxation, costs relating to business combinations,

and exceptional items.

4 Adjusted earnings per share is calculated as adjusted profit

before tax less applicable taxation divided by the weighted average

number of Ordinary shares in issue in the year.

5 Net bank borrowings is drawn bank debt less cash and cash

equivalents

6 Leverage on a bank test basis is net bank borrowings, divided

by adjusted EBITDA annualised for the effect of acquisitions,

including costs relating to business combinations and excluding

share option costs, prior to the adoption of IFRS 16.

Significant operational and strategic progress

-- 6.5% increase in the average number of vets employed in the

year against a continued backdrop of constrained availability of

vets across the industry

-- We have continued to increase investment in our people,

facilities and equipment, investing GBP45.7m in 2023 (2022:

GBP24.5m), including completing 21 refurbishment and relocation

projects in the year (2022: 23) in accordance with our plans

outlined at our capital markets day in 2022

-- We have published our second standalone Sustainability

Report, describing the goals and activities of our ESG working

groups and introduced targets across our work groups

-- We have invested GBP54.6m in 11 acquisitions comprising 16

practice sites in line with our inorganic growth strategy

-- Our client Net Promoter Score (NPS) increased to 73.0 (2022:

71.9) reflecting our continued focus on delivering high-quality

clinical care

-- Our employee NPS increased to 14.6 (2022: 4.8) reflecting our

focus in supporting and developing our colleagues

Competition and Markets Authority (CMA)

On 7 September 2023, the CMA announced a Market Review of the

Veterinary sector for household pets in the UK. The review is

carried out under the CMA's general review function which allows it

to obtain, compile and keep under review information relating to

the CMA's functions. The Market Review is voluntary and we will

work closely with the CMA in support. The CMA have stated they will

provide a further update in early 2024.

Current trading in line with expectations

-- The new financial year has started well, we are pleased with

the momentum in the business and continue to trade in line with

market expectations

-- Continued growth in our Healthy Pet Club to 494,000 members

(+4% compared to 31 August 2022); representing roughly 40% of the

companion animal active client base.

-- Following our announcement in July 2023 of our entry into the

Australian veterinary services market, we have now completed total

acquisitions of five first-opinion small animal practices

(comprising five sites) for initial consideration of GBP23.8m and

exchanged contracts of a further two comprising of four practice

sites

-- We have acquired a further two Veterinary practices in the

UK, following submission of briefing papers to the Competition and

Markets Authority (CMA), for consideration of GBP6.6m

-- We have a strong pipeline of additional acquisition

opportunities in both the UK and Australia

-- Whilst we are mindful of the wider macroeconomic backdrop and

inflationary pressures, the Group remains well positioned to

continue delivering attractive growth and shareholder value

-- We are on track to continue to deliver against the KPIs set

out at the Capital Markets Day in November 2022

Richard Fairman, Chief Executive Officer, commented:

"I'm pleased that we have delivered another strong set of

results, with good growth against all of our six strategic targets

announced at our Capital Markets Day in November 2022. Our

continued focus on providing the best possible care to animals, led

by our passionate and caring colleagues who are committed to

high-quality veterinary care, has contributed to the strength of

our performance.

"I am delighted to announce we have now completed five

acquisitions in Australia (comprising five sites) and a further two

acquisitions in the UK (comprising two sites). We are excited by

the opportunity Australia presents and delighted to welcome the

teams from these Australian and UK practices into the Group.

"CVS remains committed to providing high-quality care to our

clients and their animals. With the continued support of our

outstanding colleagues and our planned investment in people,

practice facilities and technology, I look forward to sharing

further successes in 2024 and beyond."

Results webcast

Management will host a live webcast and Q&A for analysts at

9am GMT this morning. Those wishing to join should email

CVSG@camarco.co.uk for access. For those unable to join, there will

be a playback facility available on the CVS website later.

Contacts

CVS Group plc via Camarco

Richard Fairman, CEO

Ben Jacklin, Deputy CEO

Robin Alfonso, CFO

Peel Hunt LLP (Nominated Adviser & Broker) +44 (0)20 7418

8900

Adrian Trimmings / Michael Burke / Andrew Clark / Lalit Bose

Berenberg (Joint Broker) +44 (0)20 3207 7800

Toby Flaux / Ben Wright / James Thompson / Milo Bonser

Camarco (Financial PR)

Geoffrey Pelham-Lane +44 (0)7733 124 226

Ginny Pulbrook +44 (0)7961 315 138

About CVS Group plc ( www.cvsukltd.co.uk )

CVS Group is an AIM-listed provider of veterinary services in

the UK, Australia, the Netherlands and the Republic of Ireland. CVS

is focused on providing high quality clinical services to its

clients and their animals, with outstanding and dedicated clinical

teams and support colleagues at the core of its strategy.

The Group has c.500 veterinary practices across its four

markets, including nine specialist referral hospitals and 39

dedicated out-of-hours sites. Alongside the core Veterinary

Practices division, CVS operates Laboratories (providing diagnostic

services to CVS and third-parties), Crematoria (providing pet

cremation and clinical waste disposal for CVS and third-party

practices), Buying Groups and the Group's online retail business

("Animed Direct").

The Group employs c.8,800 personnel, including c.2,300

veterinary surgeons and c.3,300 nurses.

Chair's statement

Building on our strong foundations to deliver continued

high-quality clinical care and investment in growth

Introduction

I am delighted to report on another successful year in which we

have increased investment in future growth, as well as announcing

our entry into the Australian veterinary services market post the

year end.

We have previously set out our clear strategy for growth

underpinned by our purpose to give the best possible care to

animals and our vision to be the veterinary company people most

want to work for. In November 2022, we outlined our updated

five-year plan in support of this strategy with continued focus on

organic growth and through investment in people, practice

facilities, clinical equipment and technology and further

acquisitions in the UK and overseas.

Whilst we are in the early stages of this five-year plan, we

have made a positive start with increased investment and eleven

practice acquisitions completed in the financial year.

I would like to take this opportunity to thank all CVS

colleagues for their continued professionalism and commitment in

providing great care for our clients and their animals.

Improved financial performance

We have delivered another strong set of financial results with

increased revenue and earnings, strong operating cash conversion

and improved balance sheet strength. This positions CVS well to

deliver investment in future growth.

Revenue for the financial year increased by 9.8% to GBP608.3m

(2022: GBP554.2m) reflecting our continued focus on providing the

best possible clinical care to animals. We continue to see robust

client demand for our high- quality services with long term drivers

of a growing pet population, improvements in animal healthcare and

the humanisation of pets.

Adjusted EBITDA increased by 13.0% to GBP121.4m (2022:

GBP107.4m) through revenue growth, our continued discipline in

managing costs and recognition of net Research and Development

Expenditure Tax Credit of GBP9.6m. Profit before tax increased by

49.7% to GBP53.9m (2022: GBP36.0m) with adjusted EPS increasing by

11.9% to 96.0p (2022: 85.8p) and basic EPS increasing by 62.4% to

58.8p (2022: 36.2p).

CVS continues to be highly cash generative with the improved

revenue and earnings resulting in cash generated from operations

increasing by 15.9% to GBP107.9m (2022: GBP93.1m). In accordance

with our strategy, we have increased our investment in our people,

our facilities and our equipment to further aid growth and, as a

result, net debt increased to GBP70.7m (2022: GBP35.3m) and

leverage increased to 0.73x, from 0.40x.

We successfully refinanced our bank debt facilities in February

2023, with GBP350.0m of total facilities now available comprising a

term loan of GBP87.5m and a GBP262.5m revolving credit facility.

The margin under these facilities remained unchanged. Financial

covenants also remained unchanged with considerable headroom at 30

June 2023 under both financial covenants. We also have access to a

GBP5.0m overdraft, renewable annually.

Strategic progress

Our strategy, purpose and vision are underpinned by our four

strategic pillars: to recommend and provide the best clinical care

every time; to be a great place to work and have a career; to

provide great facilities and equipment; and to take our

responsibilities seriously.

As outlined at our Capital Markets Day in November 2022, we have

increased investment in practice facilities, clinical equipment and

technology to drive growth with capital expenditure of GBP45.7m in

the financial year (2022: GBP24.5m). We completed 21 property

relocation and refurbishment projects in the year.

We acquired 11 veterinary practices (comprising 16 practice

sites) in the year for initial cash consideration of GBP54.6m.

In July 2023 we announced our entry into the Australian

veterinary services market with our first acquisitions of

veterinary practices. Having explored a number of new potential

markets we identified Australia as a particularly attractive market

given the relatively low levels of corporate consolidation,

favourable market dynamics and strong similarities with the UK,

including highly trained veterinary surgeons, shared language and

culture, and the Group's experience with UK vets working between

Australia and the UK.

At the heart of our growth ambitions is our vision to be the

veterinary company people most want to work for. We have taken

further positive steps in the year to provide additional support to

our colleagues with a number of new and enhanced employee benefits

introduced. These include a health care cash plan enabling

colleagues to cover the cost of a range of medical services and

support available to colleagues across a variety of health-related

life events, including fertility, pregnancy loss, major surgery and

hospitalisation.

CVS introduced a new Equity, Diversity and Inclusion (EDI)

strategy in 2022 and we have developed this in the past financial

year. New policies have been introduced covering bullying,

harassment and incivility and we introduced an EDI training course

for all CVS colleagues. We have also introduced a regular survey

question measure of whether our colleagues feel equally included at

work, and in June 2023 83.6% of colleagues responded positively.

Nearly 625 learners have enrolled in our Equity, Diversity and

Inclusion training course which raises awareness of bias and

prejudice in the workplace and recommends actions to consciously

improve.

Governance and the Board

We remain committed to the highest levels of corporate

governance and, as an AIM-listed group, we voluntarily adopt the UK

Corporate Governance Code 2018.

We continue to review the composition of the Board in order to

ensure that we have the right balance of skills and experience.

Joanne Shaw was appointed as a new Non-Executive Director with

effect from 1 July 2023. Joanne brings a wealth of healthcare

experience from her current roles as Trustee and Audit Committee

Chair at Cancer Research UK and Chair at the Royal College of

Paediatrics and Child Health, in addition to her previous roles as

Non-Executive Director at NHS England, Chair of NHS Direct,

Non-Executive Director at Kensington and Chelsea Primary Care Trust

and Chair of the British Equestrian Association.

Ben Jacklin was promoted to a newly created role of Deputy Chief

Executive Officer on 1 July 2023 reflecting Ben's significant

contribution over the past few years in his Chief Operating Officer

role. Ben retains responsibility for overseeing the Group's

operations in this new role.

Dividends

In light of the continued growth of the Group and its positive

operating cash generation, the Board is recommending a continuation

of our progressive dividend policy, with the payment of a final

dividend of 7.5p per Ordinary share (2022: 7.0p). The ex-dividend

date is 2 November 2023 and the dividend payment date is 8 December

2023.

Shareholder engagement

The Board continues to engage actively with existing and

potential new shareholders. Our Capital Markets Day in November

2022 was well attended in person and through a live stream of the

event. We outlined our growth ambitions over the next five years

and investors and analysts attending in person had the opportunity

to tour two of our veterinary practices and experience practical

demonstrations.

The Executive Directors attended a number of investor

conferences in the UK, the US and Europe during the financial year

and all Directors make themselves available to meet with investors

on request.

We continue to host a sell-side analysts and institutional

investors' webcast at our interim and full-year results, including

a question and answer session, with a replay facility provided on

our investor website.

Outlook

The financial performance achieved in the past financial year,

and our clear strategy for future growth, positions CVS well to

benefit from the sizeable and growing veterinary services market

and continued humanisation of pets.

I look forward to reporting on further success in the

future.

Richard Connell

Chair

21 September 2023

Chief Executive Officer's review

Continuing our focus of providing the best possible care to our

clients and their animals

Introduction

As a business whose purpose is to provide the best possible care

to animals, the passion and care of our colleagues are at the heart

of our success. I would like to begin by thanking each and every

one of our colleagues for their hard work and support over the past

year in delivering great care to our clients and their animals.

In November 2022, we hosted a Capital Markets Day which included

tours of two of our small animal veterinary practices. At this

event, we announced our five year plan and the six strategic

targets underpinning this plan:

-- organic revenue growth of 4%-8% per annum;

-- adjusted EBITDA1 margins of between 19% and 23% through investment in our facilities;

-- investment in practice facilities, clinical equipment and

technology to deliver additional organic growth;

-- acquisitions subject to disciplined criteria for returns and earnings accretion;

-- operating cash conversion of more than 70%; and

-- leverage on a bank test basis remaining below 2.0x.

A clear capital allocation strategy

We have a clear strategic focus to provide high-quality clinical

care to animals, and key to the delivery of this is investment in

our existing practice facilities, clinical equipment and

technology, and expanding our Group through strategically aligned

acquisitions subject to disciplined criteria.

In support of this planned increase in investment, we

successfully refinanced our debt facilities in February 2023,

increasing the available funds to GBP350.0m, comprising:

-- a GBP87.5m term loan, repayable via bullet payment in February 2027; and

-- a GBP262.5m revolving credit facility

The interest margin and covenants for the facility remain

unchanged, with maximum leverage of 3.25x and interest cover no

less than 4.5x. We obtained commercial terms with increased

flexibility to support our growth ambitions, and welcomed Barclays,

JP Morgan, Lloyds Bank, Virgin Money and Danske Bank to our banking

syndicate, alongside long-term partners HSBC, NatWest and AIB.

In the financial year to June 2023, we invested GBP45.7m and

completed 21 practice refurbishments and relocation projects. We

are pleased with the returns to date from this investment, with

higher-quality facilities and enhanced technology allowing us to

provide high-quality care to our clients and their animals.

This investment included a brand new greenfield site, Southport

Vets, which opened in December 2022. This 3,000 sq ft building

comprises four consulting rooms together with an operating theatre

and specialist dental suite, plus an in-house laboratory and

digital x-ray facilities.

Alongside this investment, we invested initial cash

consideration of GBP54.6m in acquiring 11 practices (16 practice

sites) in the financial year, and it has been a pleasure to welcome

our new colleagues to CVS.

Financial performance

In terms of financial performance during the full year ended 30

June 2023 we have delivered:

-- continued organic revenue growth with a 7.3% increase in

like-for-like sales (2022: 8.0%), consistent with the Group's

organic revenue growth ambition of between 4% and 8%.

-- adjusted EBITDA margin expansion of 60bps to 20.0%, within

our stated ambition of margins between 19% and 23%.

-- continued investment in our facilities and equipment to

support growth, with total capital expenditure of GBP45.7m (2022:

GBP24.5m), within the Group's capital expenditure ambition of

GBP30m to GBP50m investment per annum.

-- investment of GBP54.6m in 11 practice acquisitions

(comprising 16 practice sites) (2022: GBP8.4m in three practice

acquisitions (comprising four practice sites)), in line with the

guidance of GBP50m+ investment per annum; and .

-- operating cash conversion of 70%, broadly in line with our

stated ambition of 70%. In light of the increased investment made

in the financial year, leverage increased to 0.73x at 30 June 2023

(30 June 2022: 0.40x), but remained well below our stated target of

less than 2.0x leverage as set out in our Capital Markets Day

ambitions.

Strategy

Our purpose is to give the best possible care to animals and our

vision is to be the veterinary company people most want to work for

and these are underpinned by our four clear strategic pillars: to

recommend and provide the best clinical care every time; to be a

great place to work and have a career; to provide great facilities

and equipment; and to take our responsibilities seriously.

In order to recommend and provide the best clinical care every

time we continue to invest in research and development towards

improved clinical standards. In 2022 we launched our Clinical

Research Awards and to date we are supporting 16 research projects,

with more funds to be made available in the coming year. These

awards facilitate colleagues to be able to undertake high-quality

and impactful research, as well as work collaboratively with

universities and research institutions to continue to break new

ground in veterinary care.

Our vision to be the veterinary company people most want to work

for is underpinned by our strategic pillar to be a great place to

work and have a career. During the year, we launched a range of new

benefits and policies. Among these is a zero-tolerance policy

towards abusive clients to put colleague safety in practices at the

forefront and this can result in veterinary services being

terminated for abusive clients. The BVA published data in 2021

which showed six out of ten vets had reported feeling intimidated

by clients' language or behaviour in the previous year. We hope

this policy helps our colleagues in handling difficult situations

with the confidence that the Group is in support of their

welfare.

We have increased investment in our practice facilities,

equipment and technology in the past year so that we can achieve a

minimum practice facility standard. This standard includes optimal

layout of clinical spaces, increasing the number of consult rooms

and operating theatres, installing improved technology such as

dental x-ray and advanced imaging facilities, and improving

colleague areas such as kitchens and office spaces.

As a veterinary business, taking our responsibilities seriously

is in our DNA. We work closely with industry bodies to ensure we

are improving standards of care and we fully embrace the RCVS

Practice Standards Scheme (PSS). In June 2023, the RCVS added a

Sustainability Award to its PSS whose requirements range from

having a written environmental sustainability policy, to

demonstration of techniques to minimise anaesthetic gas usage and

annual waste surveys being undertaken with demonstrable action as a

result. We are encouraging our practices to participate in this new

award.

Focus on our people

To enable us to provide great care we have invested in employing

an additional 6.5% vets and 8.4% nurses on average in the financial

year to 30 June 2023 in comparison to the previous financial year.

We continue to increase the number of clinical colleagues we employ

at a significantly faster rate than the growth of the population of

practicing vets in the UK.

We are pleased that the RCVS has seen a rise in the number of EU

vets registering to work in the UK for the first year post Brexit,

with a 30% increase in 2022. Meanwhile, the arrangements that allow

graduates from European Association of Establishments for

Veterinary Education (EAEVE)-accredited schools to be recognised by

the RCVS have been extended for another year.

Although these structural improvements are positive, our ability

to attract and retain colleagues is significantly enhanced by our

focus on our people and on being a great place to work and have a

career. We measure employee Net Promoter Score (eNPS) monthly, and

this score has increased consistently each year since we first

began to measure it. At June 2023 our eNPS was 14.6 (2022: 4.8)

with the increase a reflection of our efforts in improving the

satisfaction of our colleagues.

We continue to focus on the wellbeing of our colleagues with

over 300 first aiders for mental health trained, considerable

awareness built across CVS and regular initiatives to promote

positive wellbeing. 100 practice teams have utilised our new "What

matters to us?" framework, which helps colleagues feel empowered to

make local changes to improve their wellbeing. Some 400 managers

across CVS have undertaken a new course developed on supporting the

wellbeing of their teams.

Developing a culture where everybody can contribute

Our values are customer focus, commitment to excellence, success

through our people, and honesty and integrity. In our 2022 Annual

Report, we introduced our Group-wide culture survey, in which we

sought feedback from colleagues across the business on their

experiences of inclusion, support and fairness within CVS.

During 2023, we have developed actions in response to the

results of this survey, with our main focus being on developing an

Equity, Diversity and Inclusion programme that enables all our

colleagues to feel included and psychologically safe. We developed

a psychological safety course to give leaders practical knowledge

and skills for creating a psychologically safe team environment. By

the end of June 2023, 372 leaders had completed the course, with

positive feedback on its impact in the workplace.

Sustainability

We published our first Sustainability Report in 2022 and we have

concentrated our focus in the past year on six key areas, namely

Energy and Carbon, Waste, One Health, People Development, Wellbeing

and EDI.

During the year, we introduced our new network of Environment

Champions. These are volunteers from across the business supporting

us to reduce our impact on the environment, improve the way we deal

with our waste and cut our carbon footprint. Our aim is for each

practice or building to have an Environment Champion, forming a

network of CVS Group colleagues who volunteer to help raise energy

and environmental awareness.

Australia market entry

Since the year end, in July 2023 we announced our entry into the

Australian veterinary services market and we have now completed

five first-opinion small animal practices (comprising five sites)

with a strong pipeline of additional opportunities.

We identified Australia as an attractive market and I am

delighted to welcome our new colleagues in Australia to CVS.

Competition and Markets Authority (CMA)

On 7 September 2023, the CMA announced a Market Review of the

Veterinary sector for household pets in the UK. The review is

carried out under the CMA's general review function which allows it

to obtain, compile and keep under review information relating to

the CMA's functions. The Market Review is voluntary and we will

work closely with the CMA in support. The CMA have stated they will

provide a further update in early 2024.

Outlook

I am proud of the achievements of our team of colleagues over

the past year, as reflected in another set of strong financial

results.

We set out a clear five-year plan at our Capital Markets Day in

November 2022 and the achievements in the past year, the

refinancing of our bank facilities and balance sheet all position

us well to deliver against this ambition. Whilst we continue to be

mindful of inflationary pressures on household incomes, we are

confident that our strategy for growth focused on high-quality

clinical care and investment in facilities and technology positions

us well to deliver further growth over the coming years.

With the continued support of our outstanding colleagues, I look

forward to sharing further success in 2024 and beyond.

Richard Fairman

Chief Executive Officer

21 September 2023

Operational review

Continuing to attract great talent to deliver the best possible

care for our patients and their owners

I am once again proud to present a review of our operations, on

behalf of all our dedicated colleagues across each of our

divisions. In an inflationary environment which has been

challenging for consumers and businesses across many other

industries, we have seen another successful year characterised by

investment in our core businesses. These investments further our

pursuit of the best possible care for our patients and working

environments that attract the very best veterinary talent. They are

a testament to the continued resilience of clients in the

veterinary sector and, particularly for CVS, their ongoing desire

to give their pets the very best care they can.

We launched our strategy back in 2019: a purpose to give the

best possible care to animals, which we will deliver through our

vision to be the veterinary company people most want to work for.

Underlying our purpose and vision are our four strategic

pillars:

-- we recommend and provide the best clinical care every time;

-- we are a great place to work and have a career;

-- we provide great facilities and equipment; and

-- we take our responsibilities seriously.

We continue to demonstrate that through delivery of this

strategy we achieve strong and sustainable growth.

Our clinical leadership teams continue to work with our

colleagues and practices delivering clinical development and

quality improvement. During the year we executed a number of

clinical improvement projects, developed by our clinical leadership

teams. In 105 of our first-opinion companion animal practices we

launched a project to increase screening for hypertension (high

blood pressure) in older cats. Up to 40% of cats over seven years

old will have hypertension, many of which are undiagnosed.

Undiagnosed hypertension can lead to serious disorders affecting

the brain, heart and kidneys, including weight loss, retinal

disease and renal failure amongst other serious complications.

However, early diagnosis can lead to significantly better outcomes

for each patient. This project led to 5,984 additional blood

pressure measurements to screen cats for hypertension, and 444 more

cats being diagnosed and treated in the participating sites. This

is just one example of the difference we can make to all

stakeholders with clinical projects such as these. First and

foremost we can improve outcomes for patients, while improving the

experience and outcome for clients and ultimately generating

revenues from the accurate diagnosis and treatment of clinical

cases.

Being a great place to work and have a career is our ambition

for all of our colleagues, not just vets. Our veterinary nurses

perform a vital role in practice and during the year we took time

to understand why nurses leave their roles and the sector, and what

factors predict those who will leave. The study used multivariable

logistic regression analysis to identify that higher quality

property facilities were predictive of nurses choosing not to

leave, underlining the importance and benefit of investment in our

facilities.

The data used for the study was from 2021, and since then we

have seen a continued reduction in attrition within our nursing

population and across the Company, probably in part due to the

investments we have made in facilities across CVS. During the year

we completed 21 major property projects, including 15 major

relocations, 5 refurbishments and a new greenfield site in

Southport. Alongside those facilities investments we have continued

to invest in developing career pathways and new employee benefits,

and improving wellbeing and engagement, all of which move us

towards our vision.

We have opened a second nurse training school, based in Norfolk,

which is in addition to our existing school at Chestergates. This

enables us to train more of our own student veterinary nurses and

help them to qualify as Registered Veterinary Nurses, as well as

offering training to some external students. Such career

development opportunities are critical to those colleagues aspiring

to become veterinary nurses, and being able to train nurses in

house is a significant benefit.

The research into nurse attrition was led by our Group Director

of Clinical Research, and recognised by publication in the "Vet

Record", a leading peer-reviewed scientific journal in the

profession.

Alongside the continued opportunities to invest in and grow our

organic business, we continue to see significant opportunity for

acquisitions in the UK and further afield. We continue to follow

the guidance issued by the Competition and Markets Authority and

have successfully completed 11 acquisitions of 16 practice sites in

the year. Continuing the discipline of acquisition applied over the

last few years these are high-quality practices that fit with our

provision of the best possible care, and I warmly welcome these new

colleagues to CVS.

Sustainability remains at the heart of what we do, and I am

pleased that we continue to focus on a wide variety of initiatives

that we feel are material to CVS and its stakeholders. Outlined in

our 2022 Quality Improvement report, published during the year, we

shared that our data driven approach reduced the use of Highest

Priority Critically Important Antibiotics (HCPIA) by 20% in twelve

months.

Veterinary Practices division

Supporting our colleagues to deliver the best possible clinical

care

Our Veterinary Practices division comprises our companion

animal, referrals, farm animal and equine veterinary practices, as

well as our buying groups, veterinary wholesaler "Vet Direct", and

MiPet Insurance.

The division has performed well during the financial year with

like-for-like sales growth of 7.3%, contributing to total revenue

growth of 10.1%. Adjusted EBITDA increased 7.2%. We made 11

acquisitions during the financial year, adding 16 practice sites to

the Group.

Since the year end, a further seven practice sites have been

acquired, including five in Australia following CVS's entry into

that market.

Companion Animal

Our Companion Animal division forms the majority of our

Veterinary Practices division. The focus of our Companion Animal

division on delivering the best possible care for our patients

continues, and benefits from a growing market as customers continue

to seek out veterinary care for their pets.

We have placed particular emphasis on research and development

to support the progression of the profession. A series of clinical

excellence projects has been launched to provide a greater range of

clinical services with each project designed to help practices

identify where they may be able to improve the standard of clinical

care.

We continue to focus on the recruitment, retention and

development of our highly skilled and dedicated colleagues. We

employed an average of 6.5% more vets in 2023 vs 2022 reflecting a

further reduction in attrition, a record graduate vet intake and

the ongoing recruitment of some of the best talent in the

profession.

Referrals

Our Referrals operations have continued to grow, benefiting from

the leadership of a new management team. We continue to support our

colleagues with their careers, supporting them through their

specialist exams. We have also integrated our advance clinical

services network into our Referrals division, to aid collaboration

across our teams.

Equine

Our Equine operations have seen good top-line revenue growth,

despite being the one area of our Veterinary Practices division

more susceptible to macroeconomic pressures. During the year we

have expanded our Equicall dedicated out-of-hours service, which

benefits both CVS and third-party practices. This not only provides

vital specialist out-of-hours care to our patients but removes the

need for onerous out-of-hours rotas in practices, providing a

better work-life balance for colleagues.

Due to the ambulatory nature of this division, we are trialling

a diary optimisation tool, to help efficiently meet our clients'

needs, and improve collaboration between our practice sites.

Farm

Our Farm operations consists of 14 farm animal practice

locations and a large specialist poultry veterinary business.

During the year we have introduced the procurement of drugs for all

of our Farm division through our Pharmsure practice, to deliver

best price and secure supply.

We have continued our investment in advanced breeding work, with

Castle Farm Vets expanding its advanced breeding programme. In

addition, we have introduced recruiting Approved Tuberculin Testers

to undertake tuberculosis testing across England, allowing vets to

focus on clinical work.

International

Our International division comprises 27 practices in the

Netherlands and three practices in the Republic of Ireland. These

include companion animal, equine and farm practices.

During the year we continued to focus on our people and their

careers. We have supported our colleagues through further training

with eight veterinary nurses from CVS Netherlands successfully

completing their training to become Supervisory Radiation

Protection colleagues, the first veterinary nurses in the

Netherlands with this qualification. In addition, we have focused

on attracting further clinical colleagues to ensure we can continue

to service client demand across our practices.

As we continue to review and ensure we are able to meet the high

standards of service and clinical care across our practices, during

the year we made the difficult decision to close our Gilabbey site

in Cork, Republic of Ireland. The existing facilities required

major investment and a protracted renovation to meet both our high

clinical standards and the very highest standards of health and

safety that we set ourselves. Accordingly the best course of action

was to close the site and in the interests of our patients and

clients, transition client services to neighbouring competitor

practices.

Since the year end, the Group has entered the Australian

veterinary services market. Having explored a number of new

potential markets, the Board has identified Australia as

particularly attractive given the relatively low levels of

corporate consolidation, favourable market dynamics and strong

similarities with the UK, including highly trained veterinary

surgeons, shared language and culture, and the Group's experience

with UK vets working between Australia and the UK. The practices

that have joined us are of the highest quality, and with a long

pipeline of accepted offers we expect to grow our Australian

business strongly over the coming years.

Healthy Pet Club

As well as offering first class care to sick or injured animals,

we continue to offer preventative healthcare through our Healthy

Pet Club scheme, which offers routine flea and worming treatments

and vaccinations, as well as twice yearly health checks. These

clients can spread the cost of accessing the best preventative

healthcare, allowing our clinicians to identify diseases and

recommend the best diagnostics and treatments. The scheme

membership has grown by 4.0% over the past year to around 489,000

members, representing roughly 40% of our companion animal active

client base.

MiPet products

We continue to enhance our own brand range, MiPet, with a

further four products planned to be added in the new financial

year. Our own-brand spend consistently makes up c.39% of the UK

practices' pharmaceutical spending in 2023 and 2022.

Vet Direct

We continue to see strong growth in Vet Direct, our equipment

and consumables business, both from CVS and third-party practices.

We introduced a dedicated marketing team to promote Vet Direct to

third-party customers.

Outlook

As we continue to focus on delivery of high-quality clinical

care alongside our people-focused strategy, we are optimistic that

our Veterinary Practices division will continue to deliver

year-on-year growth despite the economic uncertainties ahead. We

operate in a resilient market and are comforted that the results we

are publishing for 2023 demonstrate spend on high-quality

veterinary care continues to be a priority for pet owners.

Our colleagues have always been and remain our biggest asset and

I continue to admire the hard work and dedication across our

clinical teams. We have seen attrition fall to its lowest level

since we began recording it, and employee net promoter score peaked

at its highest level during the year, ending strongly at 14.6.

Since the financial year end, the announcement of our entry into

the Australia market represents more good news for CVS. As a

company dedicated to giving the best possible care to animals, we

see a fantastic opportunity for us to enter this growing market,

with low levels of corporate consolidation, and execute our vision

of being the veterinary company people most want to work for.

Having spent time in Australia over the last twelve months,

including meeting some fantastic veterinary practices, it is clear

we have a significant opportunity. We are excited to build a

significant CVS business in Australia with the same culture and

values that have brought us success in the UK.

Laboratories division

Supporting clinical care through in-house analysers and

nationwide coverage of diagnostic testing

Our Laboratories division provides diagnostic services and

in-practice desktop analysers to both CVS and third-party practices

and employs a national courier network to facilitate the collection

and timely processing of samples from practices across the UK. We

continue to develop our capability to ensure we can support the

wider Group focus on growing diagnostic care and introduced further

tests in the year.

Revenue has increased 7.7% compared to the prior year and

adjusted EBITDA increasing 10.8%, with strong case numbers

contributing towards the rise. We saw approximately a 3% increase

in case volume, with approximately 45% of diagnostic laboratory

tests performed for CVS practices.

Outlook

The Laboratories division has remained resilient despite

increasing consolidation in the veterinary sector. By increasing

the speed and range of testing we offer in our laboratories, along

with providing great client service, we are optimistic for growth

in the years to come.

Crematoria

Supporting clients to achieve a compassionate goodbye

Our Crematoria division provides both individual and communal

cremation services for companion animal and equine clients, as well

as clinical waste disposal services for both CVS and third-party

veterinary practices. The strong revenue and adjusted EBITDA growth

in the division was driven by the Direct Pet Cremation service we

introduced in 2021 and rolled out across all our sites during the

year. Putting customers directly in contact with crematoria to make

pet aftercare arrangements, and giving them more time to consider

their range of options, has resulted in significant changes to

customers' choices and generated improved customer care. We

relocated our Valley Pet Crematoria to a new site and incorporated

temperature and oxygen-controlled systems, which to date have only

been used in human cremators, to minimise our environmental impact

by delivering optimal combustion efficiency.

Outlook

The outlook for our Crematoria division remains strong, as

owners continue to value the opportunity to remember their beloved

pet and utilise the offering the Crematoria division provides in

the experience of losing their pet, through our range of more

premium offerings. Whilst Direct Pet Cremation has now been rolled

out to all our CVS clinics, there are opportunities to broaden our

premium range of services in due course.

Online Retail Business

A trusted provider of your pets' food and pharmacy needs

Our online pet food and pharmacy retailer, "Animed Direct",

focuses on supplying pet food and prescription and non-prescription

medication, directly to customers. This is supported by the buying

power of the Group as a whole, which ensures the business is able

to provide the best value for customers.

During the financial year, our Online Retail Business division

delivered revenue growth of 5.4% and adjusted EBITDA growth of

11.4% and an increase in visits to our website to 8.1m from 7.6m in

2022.

We have invested in two new pharmacy robots to bring

efficiencies in warehouse space, increasing dispatch productivity

along with improving quality control.

Outlook

During the year we continued the design and implementation of a

new website. We continue to work on this and expect the new site to

go live during 2024. Our improved website and warehouse systems

will enable us to increase capacity, delivering future growth in

online sales and improving customer satisfaction.

Central administration

Central administration costs include those of the central

finance, IT, human resources, purchasing, legal, Board and property

functions. Total costs were GBP11.9m (2022: GBP16.6m), representing

2.0% of revenue (2022: 3.0%). The decrease in central

administration costs primarily relates to increase Research and

development claims recognised centrally partially offset by

increased spend on support functions.

Ben Jacklin

Deputy Chief Executive Officer

21 September 2023

Financial review

Our continued opportunities for investment in growth underpin

our strategy

Financial highlights

As highlighted at our Capital Markets Day, we continue to focus

on our strategy to invest in the growth of our business with a

record investment of GBP45.7m in our facilities and equipment and

GBP54.6m invested in acquisitions in the UK during the year.

With operating cash conversion of 70.0%, leverage remained low

at 0.73x (2022: 0.40x).

We were also delighted to announce our entry into the Australian

veterinary services market in July 2023. Our expansion into the

Australian market is in line with our growth objectives outlined in

our five-year plan and since entering the market in July we have

successfully complet ed five ac quisitions.

The Group continues to deliver its strategy, which translates

and is supported by the financial highlights below.

Statutory financial highlights are shown below:

Change

2023 2022 %

-------------------- ----- ----- ------

Revenue (GBPm) 608.3 554.2 9.8%

Gross profit (GBPm) 262.3 239.1 9.7%

Operating profit

(GBPm) 62.3 42.8 45.6%

Profit before tax

(GBPm) 53.9 36.0 49.7%

Profit after tax

(GBPm) 41.9 25.7 63.0%

Basic earnings per

share (p) 58.8 36.2 62.4%

-------------------- ----- ----- ------

Adjusted financial highlights

2023 2022 Change

GBPm GBPm %

----------------------- ----- ----- ------

Adjusted EBITDA (GBPm) 121.4 107.4 13.0%

Adjusted profit before

tax (GBPm) 85.4 75.5 13.1%

Adjusted earnings

per share (p) 96.0 85.8 11.9%

----------------------- ----- ----- ------

Revenue

Total revenue increased 9.8% to GBP608.3m from GBP554.2m with

CVS continuing to deliver high-quality clinical invention for an

increasing pet population. There was good growth across each of our

four divisions notwithstanding a challenging economic climate and

cost of living crisis.

The Group continues to deliver against its strategy for

sustainable growth. There was strong like-for-like revenue growth

of 7.3% (2022: 8.0%), with the remaining revenue growth coming from

acquisitions.

Our preventative Healthy Pet Club scheme saw membership continue

to grow with membership at June 2023 of 489,000, a 4.0% increase

year on year (2022: 470,000) and we are pleased to be able to

highlight a 6.5% increase in the average number of vets employed in

2023 versus 2022.

We continue to invest in our practice facilities, clinical

equipment and technology with total capital expenditure of GBP45.7m

(2022: GBP24.5m). We are confident the investment creates an

opportunity for us to further increase organic growth and

like-for-like sales by facilitating better clinical care and

providing our colleagues with a better working environment, which

we believe will support attracting and retaining talent.

Gross profit/gross profit margin

Gross profit of GBP262.3m increased by 9.7% from GBP239.1m

benefiting from revenue growth with gross profit margin flat at

43.1%. During the year, there was an improvement in gross margin

before clinical staff costs to 77.7% from 76.9%; offset by an

increase in clinical staff costs as we continue to invest in

people. We continue to focus on ensuring we purchase drugs at the

best possible price whilst maintaining the highest quality to

enable us to focus on great clinical care.

Adjusted EBITDA and adjusted earnings per share

Adjusted EBITDA increased by 13.0% to GBP121.4m from GBP107.4m

benefiting from an increase in gross profit and includes GBP9.6m

(2022: GBP2.0m) of net Research and Development Expenditure Tax

Credits; offsetting utility inflation, investment in people and to

a lesser extent wage inflation.

Adjusted EBITDA margin increased to 20.0% from 19.4%, in line

with our ambition from the Capital Markets Day for organic

expansion of our margin from 19.0% to 23.0%.

Adjusted EPS (as defined in note 1 to the FY23 Annual Report)

increased 11.9%, to 96.0p from 85.8p. Adjusted EPS exclude the

impact of amortisation of intangible assets, costs relating to

business combinations and exceptional items.

Operating profit, profit before tax and basic earnings per

share

Operating profit increased by 45.6% to GBP62.3m from GBP42.8m

benefiting from the improvement in adjusted EBITDA and a reduction

in exceptional items.

Profit before tax increased by 49.7% to GBP53.9m from GBP36.0m.

Finance expense increased to GBP8.4m from GBP6.8m following an

increase in SONIA rates and increased bank borrowings to support

investment. Consequently, basic EPS increased 62.4%, to 58.8p from

36.2p.

A reconciliation between statutory operating profit and adjusted

EBITDA is shown below:

2023 2022

GBPm GBPm

---------------------------- ----- -----

Operating profit 62.3 42.8

Adjustments for:

Amortisation, depreciation,

impairment and profit

on disposal 50.2 47.3

Costs relating to business

combinations 6.6 4.9

Exceptional items* 2.3 12.4

---------------------------- ----- -----

Adjusted EBITDA 121.4 107.4

---------------------------- ----- -----

* Exceptional items relate to the closure of Gilabbey Veterinary

Hospital and include a trading loss for the year of GBP1.3m, loss

of disposal of patient data records of GBP0.8m and impairment of

right-of-use asset, net of reduction in lease liability, of

GBP0.2m.

We believe the Group is well placed to continue to deliver

further growth underpinned by our strategy and integrated business

model. Our balance sheet further supports investment opportunities

to deliver on our growth ambitions.

Taxation

The Group's tax charge for the year is GBP12.0m (2022:

GBP10.3m), an increase of GBP1.7m at an effective tax rate of 22.2%

(2022: 28.6%).

A reconciliation of the expected tax charge, at the standard

rate, to the actual charge is shown below:

GBPm % *

----------------------------- ----- ------

Profit before tax 53.9

----------------------------- ----- ------

Expected tax at UK standard

rate of tax 11.1 20.5%

Expenses not deductible

for tax purposes 1.3 2.4%

Adjustments to deferred

tax in respect of previous

periods 0.4 0.8%

Adjustments to previous

year tax charge (2.3) (4.3%)

Impact of unrecognised

losses 0.6 1.1%

Effect of difference between

closing deferred tax rate

and current tax rate 0.9 1.7%

----------------------------- ----- ------

Actual charge/effective

rate of tax 12.0 22.2%

----------------------------- ----- ------

* Percentage of profit before tax.

All of the Group's revenues and the majority of its expenses are

subject to corporation tax. The main expenses that are not

deductible for tax purposes are costs relating to acquisitions and

depreciation on fixed assets that do not qualify for tax relief.

Tax relief for some expenditure, mainly fixed assets, is received

over a longer period than that for which the costs are charged in

the financial statements.

Financial position

2023 2022 Change

GBPm GBPm GBPm

------------------------ ------- ------- ------

Intangible assets 256.1 216.5 39.6

Property, plant and

equipment 101.5 69.7 31.8

Right-of-use assets 102.9 101.7 1.2

Other non-current

assets - 2.4 (2.4)

Current assets 111.8 127.9 (16.1)

Current liabilities (105.1) (101.4) (3.7)

Non-current liabilities (210.6) (199.4) (11.2)

Equity 256.6 217.4 39.2

------------------------ ------- ------- ------

Intangible assets

The Group's intangible assets consist of goodwill, patient data

records and computer software. The increase during the year is

mainly from business combinations of GBP59.6m, partially offset by

amortisation of GBP22.6m. In addition, GBP0.8m was impaired and

treated as an exceptional item in respect of the closure of

Gilabbey. The Group reviews goodwill for impairment and as at 30

June 2023 maintains significant headroom with no indications of

impairment.

Plant, property and equipment

The Group's continued focus and commitment to investing in our

facilities and equipment resulted in additions of GBP44.5m,

(including business combinations) (2022: GBP23.7m), offset by a

depreciation charge in the year of GBP12.6m (2022: GBP11.3m).

Other non-current assets

The Group maintains a cash flow hedge for the purpose of hedging

interest rates; as at 30 June 2023 the fair value of this hedge was

GBP2.1m which is now included within current assets as the hedge

expires in February 2024 (2022: GBP2.3m). In addition, during the

year available for sale investments with a carrying value of

GBP0.1m were disposed.

Current assets

The net decrease in current assets of GBP16.1m to GBP111.8m from

GBP127.9m is driven from the reduction in cash held to GBP21.5m

from GBP49.0m; partially offset by an increase in working capital

balances, including stock and debtors following the growth in

revenue.

Equity

The net increase in equity of GBP39.2m is mainly attributable to

profit for the year of GBP41.9m (2022: GBP25.7m), transactions

related to share-based payments taken to reserves of GBP3.0m (2022:

GBP3.3m), partially offset by annual dividends of GBP5.0m (2022:

GBP4.6m).

Cash flow and movement in net debt

Net debt increased by GBP35.4m during the year from GBP35.3m to

GBP70.7m following an increase in investment in our facilities and

equipment of GBP45.7m from GBP24.5m and an increase in investment

in acquisitions in the UK of GBP54.6m from GBP8.4m.

The movement in net debt is explained as follows:

2023 2022

GBPm GBPm

------------------------------ ------ ------

Adjusted EBITDA 121.4 107.4

Working capital movements (10.9) (14.0)

Capital expenditure -

maintenance (11.4) (10.8)

Repayment of right-of-use

liabilities (14.1) (12.7)

------------------------------ ------ ------

Operating cash flow 85.0 69.9

Operating cash conversion

(%) 70.0% 65.1%

------------------------------ ------ ------

Taxation paid (14.9) (11.2)

Net interest paid (7.2) (6.4)

------------------------------ ------ ------

Free cash flow 62.9 52.3

Capital expenditure -

investment (34.3) (13.7)

Business combinations

(net of cash acquired)/other

investments (54.6) (20.8)

Contingent consideration (2.6) (0.3)

Dividends paid (5.0) (4.6)

Other financing activities (4.4) 2.4

------------------------------ ------ ------

Net (outflow)/inflow (38.0) 15.3

Increase/(decrease) in

unamortised borrowing

costs 2.6 (0.4)

------------------------------ ------ ------

(Increase)/decrease in

net debt (35.4) 14.9

------------------------------ ------ ------

The Group continues to remain highly cash generative with

operating cash flow of GBP85.0m (2022: GBP69.9m). Negative working

capital movements of GBP10.9m was mainly driven by an increase in

stock and other receivables.

Operating cash conversion of 70.0% (2022: 65.1%) was in line

with our capital markets day ambition of 70%.

Interest paid of GBP7.2m (2022: GBP6.4m) reflects the increasing

SONIA rates from 1.1874% on 30 June 2022 to 4.9286% on 30 June

2023, together with increased bank borrowings following enhanced

investment in capital expenditure and strategic acquisitions.

Maintenance capital expenditure of GBP11.4m (2022: GBP10.8m)

reflects expenditure required in order to maintain the quality of

our facilities and services.

Investment capital expenditure of GBP34.3m (2022: GBP13.7m)

includes new sites, relocations, significant refurbishments and

extensions and new equipment. We are pleased with the additional

investment we have made in the year and continue to see further

opportunities to grow organic revenue in line with our growth

ambitions and commitment to spend between GBP30.0m and GBP50.0m per

annum.

Business combinations of GBP54.6m (2022: GBP8.4m) consisted of

11 practices (comprising 16 practice sites). This investment in the

year is again in line with our growth ambition set out at the

Capital Markets Day in November 2022.

A dividend of GBP5.0m (2022: GBP4.6m) was paid in the year

reflecting a final dividend for the prior year of 7.0p per

share.

Other financing activities includes GBP3.6m of costs in respect

of refinancing our facilities which were capitalised on the balance

sheet.

Net debt and borrowing costs

The Group's net debt comprises the following:

2023 2022

GBPm GBPm

-------------------------- ------ ------

Borrowings repayable:

Within one year - -

After more than one year:

Term loan and revolving

credit facility 95.5 85.0

Unamortised borrowing

costs (3.3) (0.7)

-------------------------- ------ ------

Total borrowings 92.2 84.3

Cash and cash equivalents (21.5) (49.0)

-------------------------- ------ ------

Net debt 70.7 35.3

-------------------------- ------ ------

In February 2023, the Group successfully increased its loan

facilities from GBP170.0m to GBP350.0m which comprises a GBP87.5m

term loan and GBP262.5m revolving credit facility. This facility is

supported by eight banks and for a four-year term. The facility has

two key financial covenants:

-- net debt to bank test EBITDA of no more than 3.25x; and

-- bank-test EBITDA to interest ratio of no less than 4.5x.

Bank test EBITDA is based on the last twelve months' adjusted

EBITDA performance annualised for the effect of acquisitions,

deducting costs relating to business combinations and adding back

share option expense, prior to the adoption of IFRS 16.

The increase in loan facilities supports the Group's ambition to

continue to invest via both organic growth and acquisition

opportunities in the future in line with our Capital Markets Day

ambitions.

The Group manages its banking arrangements centrally. Funds are

swept daily from its various bank accounts into central bank

accounts to optimise the Group's net interest payable position.

Interest rate risk is also managed centrally and derivative

instruments are used to mitigate this risk. On 28 February 2020,

the Group entered into two four-year fixed interest rate swap

arrangements to hedge fluctuations in interest rates on GBP70.0m of

its term loan facility, which end on 31 January 2024. In the prior

year the two hedge arrangements were transitioned from LIBOR to the

SONIA benchmark rate.

The Group has a strong balance sheet with a leverage at 30 June

2023 of 0.73x, an increase from 0.40x at 30 June 2022. The Group

has the ability to generate cash which enables it to effectively

manage working capital. The Group targets a long-term net debt to

EBITDA ratio of less than 2.0x and closely monitors this in line

with acquisition investment opportunities.

Going concern and viability

At the 30 June 2023, the Group had cash balances of GBP21.5m and

an unutilised overdraft facility of GBP5.0m. Total facilities of

GBP350.0m, of which GBP254.5m were undrawn at 30 June 2023, are

available to support the Group's organic and acquisitive growth

initiatives over the coming years, comprising a term loan of

GBP87.5m and an RCF of GBP262.5m. The Group is fully compliant with

all covenants in respect of these facilities.

The Directors consider that the GBP5.0m overdraft and the

GBP350.0m facility enable them to meet all current liabilities when

they fall due. Since the year end, the Group has continued to trade

profitably and to generate cash.

After consideration of market conditions, the Group's financial

position (including the level of headroom available within the bank

facilities), financial forecasts for the five years to 30 June

2028, its profile of cash generation and the timing and amount of

bank borrowings repayable, and principal risks, the Directors have

a reasonable expectation that both the Company and the Group will

be able to continue in operation and meet its liabilities as they

fall due over the period. For this reason, the going concern basis

continues to be adopted in preparing the financial statements.

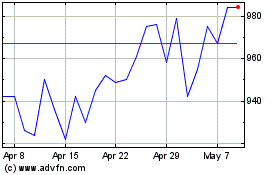

Share price performance

At the year end the Company's market capitalisation was GBP1.4bn

(1,970p per share), compared to GBP1.2bn (1,656p per share) at the

previous year end.

Key contractual arrangements

The Directors consider that the Group has only two significant

third-party supplier contracts which are for the supply of

veterinary drugs. In the event that these suppliers ceased trading,

the Group would be able to continue in business without significant

disruption in trading by purchasing from alternative suppliers.

Forward-looking arrangements

Certain statements and arrangements described in the Annual

Report and results release are forward looking. Although the Board

is comfortable that the expectations reflected in these

forward-looking statements are reasonable, it can give no assurance

that these expectations will prove to be correct. Because these

statements involve risks and uncertainties, actual results may

differ materially from those expressed or implied by these

forward-looking statements.

Robin Alfonso

Chief Financial Officer

21 September 2023

The Group's principal risks and uncertainties are available on

pages 60 to 68 of the Group's FY23 Annual Report and the Group's

key performance indicators are available on pages 24 to 27 of the

Group's FY23 Annual Report.

Consolidated income statement

for the year ended 30 June 2023

2023 2022

Note GBPm GBPm

---------------------------------- ---- ------- -------

Revenue 2 608.3 554.2

Cost of sales (346.0) (315.1)

---------------------------------- ---- ------- -------

Gross profit 262.3 239.1

Administrative expenses (200.0) (196.3)

---------------------------------- ---- ------- -------

Operating profit 62.3 42.8

Finance expense (8.4) (6.8)

---------------------------------- ---- ------- -------

Profit before tax 2 53.9 36.0

Tax expense 3 (12.0) (10.3)

---------------------------------- ---- ------- -------

Profit for the year 41.9 25.7

---------------------------------- ---- ------- -------

Earnings per Ordinary share (EPS)

Basic 4 58.8p 36.2p

Diluted 4 58.5p 35.9p

---------------------------------- ---- ------- -------

All activities derive from continuing operations.

Reconciliation of alternative performance measures

The Directors believe that adjusted measures, being adjusted

EBITDA, adjusted PBT and adjusted EPS, provide additional useful

information for shareholders. These measures are used by the Board

and management for planning, internal reporting and setting

Director and management remuneration. In addition, they are used by

the investor analyst community and are aligned to our strategy and

KPls. These measures are not defined by IFRS and therefore may not

be directly comparable with other companies' adjusted measures.

Adjusted EBITDA is calculated by reference to profit before tax,

adjusted for interest (net finance expense), depreciation,

amortisation, costs relating to business combinations and

exceptional items. The following table provides the calculation of

adjusted EBITDA:

2023 2022

Alternative performance measure: adjusted EBITDA Note GBPm GBPm

---------------------------------------------------- ---- ----- -----

Profit before income tax 53.9 36.0

Adjustments for:

Finance expense 8.4 6.8

Amortisation of intangible assets 22.6 22.2

Depreciation of property, plant and equipment 12.6 11.3

Depreciation of right-of-use assets 15.2 14.1

Profit on disposal of property, plant and equipment

and right-of-use assets (0.2) (0.3)

Costs relating to business combinations1 6.6 4.9

Exceptional items2 2.3 12.4

---------------------------------------------------- ---- ----- -----

Adjusted EBITDA 2 121.4 107.4

---------------------------------------------------- ---- ----- -----

Adjusted earnings per share (EPS):

Adjusted EPS 4 96.0p 85.8p

Diluted adjusted EPS 4 95.5p 85.0p

---------------------------------------------------- ---- ----- -----

1. Includes amounts paid in respect of acquisitions in prior

years expensed to the income statement.

2. Exceptional items relate to impairment in respect of the

Gilabbey Veterinary practice closure in the current year and the

impairment of Quality Pet Care Ltd in the prior year. Further

information is available in note 6 of the FY23 Annual report.

Consolidated statement of financial position

as at 30 June 2023

Company registration number: 06312831

Group Group

2023 2022

Note GBPm GBPm

------------------------------------- ---- ------- -------

Non-current assets

Intangible assets 256.1 216.5

Property, plant and equipment 101.5 69.7

Right-of-use assets 102.9 101.7

Investments - 0.1

Amounts owed by Group undertakings - -

Derivative financial instruments - 2.3

------------------------------------- ---- ------- -------

460.5 390.3

------------------------------------- ---- ------- -------

Current assets

Inventories 28.4 26.2

Trade and other receivables 58.1 52.7

Derivative financial instruments 2.1 -

Current tax receivable 1.7 -

Cash and cash equivalents 21.5 49.0

------------------------------------- ---- ------- -------

111.8 127.9

------------------------------------- ---- ------- -------

Total assets 2 572.3 518.2

------------------------------------- ---- ------- -------

Current liabilities

Trade and other payables (91.1) (86.6)

Provisions (0.7) (2.1)

Lease liabilities (13.3) (9.4)

Current tax liabilities - (3.3)

------------------------------------- ---- ------- -------

(105.1) (101.4)

------------------------------------- ---- ------- -------

Non-current liabilities

Borrowings 6 (92.2) (84.3)

Lease liabilities (93.6) (95.1)

Deferred tax liabilities (24.8) (20.0)

------------------------------------- ---- ------- -------

(210.6) (199.4)

------------------------------------- ---- ------- -------

Total liabilities 2 (315.7) (300.8)

------------------------------------- ---- ------- -------

Net assets 256.6 217.4

------------------------------------- ---- ------- -------

Shareholders' equity

Share capital 0.1 0.1

Share premium 107.0 105.4

Capital redemption reserve 0.6 0.6

Treasury reserve - -

Cash flow hedge reserve 1.4 1.6

Cost of hedging reserve - -

Merger reserve (61.4) (61.4)

Foreign exchange translation reserve (0.2) -

Retained earnings 209.1 171.1

------------------------------------- ---- ------- -------

Total equity 256.6 217.4

------------------------------------- ---- ------- -------

The financial information comprising the consolidated income

statement, the statement of consolidated comprehensive income, the

consolidated balance sheet, the consolidated statement of changes

in shareholders' equity, the consolidated cash flow statement and

related notes, were authorised for issue by the Board of Directors

on 21 September 2023 and were signed on its behalf by:

Richard Fairman Robin Alfonso

Director Director

Consolidated statement of changes in equity

for the year ended 30 June 2023

Cash Cost Foreign

Capital flow of exchange

Share Share redemption Treasury hedge hedging Merger translation Retained Total

capital premium reserve reserve reserve reserve reserve reserve earnings equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

--------------------- ------- ------- ---------- -------- ------- ------- ------- ----------- -------- ------

At 1 July 2022 0.1 105.4 0.6 - 1.6 - (61.4) - 171.1 217.4

---------------------- ------- ------- ---------- -------- ------- ------- ------- ----------- -------- ------

Profit for the year - - - - - - - - 41.9 41.9

---------------------- ------- ------- ---------- -------- ------- ------- ------- ----------- -------- ------

Other comprehensive

income and losses

Cash flow hedges:

Fair value loss - - - - (0.2) - - - - (0.2)

Deferred tax on

cash

flow hedge and

available-for-sale

financial assets - - - - - - - - - -

Exchange differences

on translation of

foreign operations - - - - - - - (0.2) - (0.2)

---------------------- ------- ------- ---------- -------- ------- ------- ------- ----------- -------- ------

Total other

comprehensive

loss - - - - (0.2) - - (0.2) - (0.4)

---------------------- ------- ------- ---------- -------- ------- ------- ------- ----------- -------- ------

Total comprehensive

(loss)/income - - - - (0.2) - - (0.2) 41.9 41.5

---------------------- ------- ------- ---------- -------- ------- ------- ------- ----------- -------- ------

Transactions with

owners

Issue of Ordinary

shares - 1.6 - - - - - - - 1.6

Purchase of Treasury

Shares - - - (1.2) - - - - - (1.2)

Disposal of Treasury

shares - - - 1.2 - - - - (0.7) 0.5

Credit to reserves

for share -- based

payments - - - - - - - - 1.7 1.7

Deferred tax relating

to share -- based

payments - - - - - - - - 0.1 0.1

Dividends to equity

holders of the

Company - - - - - - - - (5.0) (5.0)

---------------------- ------- ------- ---------- -------- ------- ------- ------- ----------- -------- ------

Total transactions

with owners - 1.6 - - - - - - (3.9) (2.3)

---------------------- ------- ------- ---------- -------- ------- ------- ------- ----------- -------- ------

At 30 June 2023 0.1 107.0 0.6 - 1.4 - (61.4) (0.2) 209.1 256.6

---------------------- ------- ------- ---------- -------- ------- ------- ------- ----------- -------- ------

Cash Cost Foreign

Capital flow of exchange

Share Share redemption Treasury hedge hedging Merger translation Retained Total

capital premium reserve reserve reserve reserve reserve reserve earnings equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

--------------------- ------- ------- ---------- -------- ------- ------- ------- ----------- -------- ------

At 1 July 2021 0.1 103.1 0.6 - (0.5) 0.1 (61.4) - 149.1 191.1