Dalata Hotel Group PLC: Conclusion of Buy-back Programme

October 14 2024 - 10:15AM

EQS Regulatory News

|

Dalata Hotel Group PLC (DAL,DHG)

Dalata Hotel Group PLC: Conclusion of Buy-back Programme

14-Oct-2024 / 16:15 GMT/BST

Conclusion of

Buy-back Programme

ISE: DHG LSE: DAL

Dublin and

London: Dalata Hotel Group

plc (“Dalata” or the “Company”), announces that on 14 October 2024,

it concluded the €30 million share buy-back programme announced on

04 September 2024. In aggregate, during the course of the buy-back

programme the Company repurchased 7,353,210 Ordinary Shares at a

VWAP of €4.0799 per share.

Total voting

rights

Following settlement of all buy-back purchases

and cancellation of the Ordinary Shares purchased, the Company will

have 217,076,950 Ordinary Shares in issue, each with one voting

right. The Company holds no Ordinary Shares in treasury.

The total number of voting rights in the

Company will therefore be 217,076,950. The above figure may be used

by shareholders as a denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change to their interest in, Dalata Hotel Group plc under the

Transparency (Directive 2004/109/EC) Regulations 2007.

Contacts

|

Dalata Hotel Group

plc

|

investorrelations@dalatahotelgroup.com

|

|

Dermot Crowley, CEO

|

Tel +353 1 206 9400

|

|

Carol Phelan, CFO

|

|

Niamh Carr, Head of Investor Relations &

Strategic Forecasting

|

|

Joint Group

Brokers

|

|

|

Davy: Anthony Farrell

|

Tel +353 1 679 6363

|

|

Berenberg:

Ben Wright / Clayton

Bush

|

Tel +44 20 3753 3069

|

|

|

|

|

Investor Relations and PR |

FTI Consulting

|

Tel +353 86 401 5250

|

|

Melanie Farrell / Rugile Nenortaite

|

dalata@fticonsulting.com

|

About Dalata

Dalata Hotel Group plc is a leading hotel

operator backed by €1.7bn in hotel assets primarily in Ireland and

the UK. Established in 2007, Dalata has become Ireland’s largest

hotel operator with an ambitious growth strategy to expand its

portfolio further in excellent locations in select, large cities in

the UK and Continental Europe. The Group’s portfolio comprises a

mix of owned and leased hotels with 57 primarily four-star hotels

operating through its two main brands, Clayton and Maldron Hotels,

with 12,258 rooms and a pipeline of over 700 rooms. For the

six-month period ended 30 June 2024, Dalata reported revenue of

€302 million, basic earnings per share of 16.0 cent and Free

Cashflow per Share of 21.5 cent. Dalata is listed on the Main

Market of Euronext Dublin (DHG) and the London Stock Exchange

(DAL). For further information visit:

www.dalatahotelgroup.com

Dissemination of a Regulatory Announcement, transmitted by EQS

Group.

The issuer is solely responsible for the content of this

announcement.

|

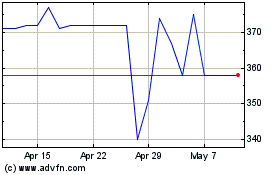

Dalata Hotel (LSE:DAL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Dalata Hotel (LSE:DAL)

Historical Stock Chart

From Jan 2024 to Jan 2025