TIDMDEST

RNS Number : 9813M

Destiny Pharma PLC

20 September 2023

Destiny Pharma plc

("Destiny Pharma" or the "Company")

Interim results for the six months ended 30 June 2023

Active discussions with potential partners for XF-73 nasal

supported by new market analysis that underscores $2bn market

opportunity

Partnering deal with Sebela Pharmaceuticals for NTCD-M3 in North

America fully funds phase 3 clinical development and

commercialisation with significant upside potential

Appointments of Chris Tovey as Chief Executive Officer and Sir

Nigel Rudd as Chairman add deal-making and commercial expertise to

Board

Strengthened balance sheet gives cash runway into 2025,

providing funding through significant value inflection points

Brighton, United Kingdom - 20 September 2023 - Destiny Pharma

(AIM: DEST), a clinical stage biotechnology company focused on the

development and commercialisation of novel medicines to prevent and

treat life threatening infections, announces its unaudited interim

financial results for the six months ended 30 June 2023 and

provides an update for the year to date.

Operational highlights

-- NTCD-M3 (prevention of C. difficile infection ("CDI") recurrence)

Partnering deal agreed with Sebela Pharmaceuticals in North

America (US, Canada, and Mexico) worth up to $570m plus

royalties

Clinical development and commercialisation in North America

financed by Sebela

Preparations for Phase 3 clinical study underway, with current

focus on optimising delivery of clinical trial product and

CMC process development

Peer reviewed paper published in Microbiology Spectrum

concludes that NTCD-M3 is effective alongside all currently

recommended antibiotics, including fidaxomicin, in the treatment

of CDI

-- XF-73 nasal (prevention of post-surgical staphylococcal

hospital infections including MRSA)

New survey of clinicians and payers in US and EU supports

significant global market opportunity and underscores $2

billion market potential in US alone

Active partnering discussions progressing with multiple

interested global parties

Landmark Phase 2b clinical data demonstrating primary endpoints

were met published in leading US peer reviewed journal,

Infection Control & Hospital Epidemiology

Recent scientific advisory board ("SAB") findings confirm

proposed Phase 3 development pathway (post period)

-- Earlier stage pipeline

US government's National Institute, Allergy, and Infectious

Diseases (NIAID) funding an extensive and on-going safety

study of XF-73 dermal. The second and final clinically-enabling

regulatory study is expected to complete by late 2023

Positive results from research into biotherapeutic treatment

(SPOR-COV(R)) for COVID- 19 models supports potential as

prophylactic nasal spray; partners reviewing options for

development in light of current status of COVID-19 pandemic

and current therapeutic options

Results of a recent publication in Frontiers of Fungal Biology

highlighted the potential of XF-70 and XF-73 as new drugs

for the management of topical infections caused by Candida

albicans (a common yeast infection) (post period)

-- Strengthened Board and management team

Board strengthened post period end with the appointments

of Chris Tovey, CEO, and Sir Nigel Rudd, Chairman; Dr Debra

Barker resumed her position as a Non-Executive Director

and assumed the role of Senior Independent Director from

1 September

Financial highlights

-- $1million upfront payment received from Sebela during the period

-- Cash and short-term deposits at 30 June 2023 of GBP9.8

million (30 June 2022: GBP8.4 million; 31 December 2022: GBP4.9

million)

-- Expenditure on R&D in the period of GBP1.9 million

(half-year 2022: GBP2.5 million; full year 2022: GBP4.9

million)

-- Company funded through to Q1 2025 following GBP7.3 million (gross) fundraise in Q1

Chris Tovey, Chief Executive Officer of Destiny Pharma,

commented :

" I am delighted to present my inaugural update as CEO of

Destiny Pharma. Destiny's mission is to reduce the emergence and

impact of drug resistant pathogens with preventative solutions. In

my brief tenure to date I have been impressed by both the Company's

pursuit of this mission and the science behind it, which has shown

its extraordinary ability to minimise the chances of bacteria

becoming resistant and is backed by compelling clinical data.

"The partnering of NTCD-M3 and the associated fundraising during

the period demonstrate our ability to generate significant value

from our assets, and have positioned the Company for success as we

advance the Phase 3 development programme for M3 and intensify our

partnering activities for our lead asset, XF-73 nasal. The Company

is now funded through to Q1 2025, allowing us to deliver our

planned activities.

"Destiny Pharma has a unique opportunity to make a difference,

and will play an important role in protecting vulnerable patients

from potential lethal infections. Working with the Board and the

leadership team, I am excited about what we can achieve."

Destiny Pharma will be hosting a presentation to all existing

and potential shareholders at 11.00am BST held via the Investor

Meet Company platform.

Investors can sign up to Investor Meet Company for free, and add

to meet Destiny Pharma plc via:

https://www.investormeetcompany.com/destiny-pharma-plc/register-investor

.

For further information, please contact:

Destiny Pharma plc

Chris Tovey, CEO

Shaun Claydon, CFO

+44 (0) 127 370 4440

pressoffice@destinypharma.com

Powerscourt Group

Sarah Macleod / Adam Michael / Ollie Simmonds / Christopher

Ward

+44 (0) 20 7250 1446

Destiny@powerscourt-group.com

Cavendish Capital Markets Limited (Nominated Adviser and Joint

Broker)

Geoff Nash / George Dollemore, Corporate Finance

Nigel Birks / Harriet Ward, ECM

+44 (0) 207 220 0500

Shore Capital (Joint Broker)

Daniel Bush / James Thomas / Lucy Bowden

+44 (0) 207 408 4090

About Destiny Pharma

Destiny Pharma is an innovative, clinical-stage biotechnology

company focused on the development and commercialisation of novel

medicines that can prevent life-threatening infections. The

company's drug development pipeline includes two late stage assets

NTCD-M3, a microbiome-based biotherapeutic for the prevention of C.

difficile infection (CDI) recurrence which is the leading cause of

hospital acquired infection in the US, and XF-73 nasal gel, a

proprietary drug targeting the prevention of post-surgical

staphylococcal hospital infections including MRSA.

For further information on the Company, please visit

www.destinypharma.com

Forward looking statements

Certain information contained in this announcement, including

any information as to the Group's strategy, plans or future

financial or operating performance, constitutes "forward-looking

statements". These forward-looking statements may be identified by

the use of forward-looking terminology, including the terms

"believes", "estimates", "anticipates", "projects", "expects",

"intends", "aims", "plans", "predicts", "may", "will", "seeks"

"could" "targets" "assumes" "positioned" or "should" or, in each

case, their negative or other variations or comparable terminology,

or by discussions of strategy, plans, objectives, goals, future

events or intentions. These forward-looking statements include all

matters that are not historical facts. They appear in a number of

places throughout this announcement and include statements

regarding the intentions, beliefs or current expectations of the

Directors concerning, among other things, the Group's results of

operations, financial condition, prospects, growth, strategies and

the industries in which the Group operates. The Directors of the

Company believe that the expectations reflected in these statements

are reasonable but may be affected by a number of variables which

could cause actual results or trends to differ materially. Each

forward-looking statement speaks only as of the date of the

particular statement. By their nature, forward-looking statements

involve risks and uncertainties because they relate to events and

depend on circumstances that may or may not occur in the future or

are beyond the Group's control. Forward looking statements are not

guarantees of future performance. Even if the Group's actual

results of operations, financial condition and the development of

the industries in which the Group operates are consistent with the

forward-looking statements contained in this document, those

results or developments may not be indicative of results or

developments in subsequent periods.

Chief Executive Officer's Statement

Introduction

I am pleased to present my first update since taking up the

position of CEO on 1 September.

People have asked what excites me most about Destiny Pharma. Two

things: the mission and the underlying science behind the Company's

products.

Described by experts as one of the greatest threats to public

health in the twenty first century, antimicrobial resistance (AMR)

is rising at an alarming rate. Bacteria, viruses, fungi and

parasites have mutated and no longer reliably respond to the drugs

we have available. Development of new therapeutics is needed, but

that won't on its own address the underlying issues.

Destiny's mission is to reduce the emergence and impact of drug

resistant pathogens with preventative solutions. The science at

Destiny has shown its extraordinary ability to minimise the chances

of bacteria evolving to become resistant and is supported by

compelling clinical data.

I'm honoured to be working with a Board and leadership team that

have the experience and ambition to drive the Company forward. I

would like to thank Debra Barker for her work as interim CEO and

look forward to her continued contribution on the Board as Senior

Independent Director.

Destiny Pharma has a unique opportunity to make a difference,

and an important role to play in protecting us from potential

lethal infections. I am excited about what we can achieve.

Review of the period

NTCD-M3 programme

During the period we signed an exclusive collaboration and

co-development agreement for the North American (U.S., Canada and

Mexico) rights of NTCD-M3, our lead asset for the prevention of

Clostridioides difficile infection (CDI) recurrence, with Sebela

Pharmaceuticals, a U.S. pharmaceutical company with a

market-leading position in gastroenterology.

Under the terms of the agreement, with a value of up to $570

million plus royalties, Sebela will lead and finance all future

clinical development and commercialisation activities of NTCD-M3 in

North America. The Company retains the majority of rights for

Europe and Rest of the World (ex China and ASEAN). Sebela has a

minority interest in any income generated in these non-North

American territories based on the clinical studies it is funding.

Destiny Pharma has the obligation to complete the manufacture of

all clinical trial supplies needed to undertake the required

clinical studies.

One of my first priorities as CEO has been to review the

development plans for NTCD-M3, including the CMC plan, to ensure

its robustness in delivering product not only for the required

clinical studies but also for commercial scale production. My

initial observations are that fundamentally the strategy is sound

and the overall development plan with Sebela is on track. We are

undertaking further work to revisit the assumptions behind specific

project timings which may result in some limited adjustments,

including a longer CMC finalisation schedule. As it stands, we do

not anticipate any material changes to the timing of the overall

programme .

This review notwithstanding, good ongoing engagement and

operational progress has been made since signing the deal. The

Joint Steering Committee, established to provide oversight to

day-to-day partnering activities, has been active in addressing

ongoing matters in the development programme and progress has also

been made toward preparation for the next clinical study including

CRO selection and anticipated geographical coverage.

NTCD-M3's effectiveness alongside all currently recommended

antibiotics in the treatment of CDI was further evidenced in a peer

reviewed paper published in Microbiology Spectrum during the

period. The paper concludes that NTCD-M3 is able to effectively and

fully colonise the gut following fidaxomicin administration,

indicating that NTCD-M3 would be effective in patients receiving

this antibiotic, as well as older antibiotics, such as vancomycin

and metronidazole .

XF-73 nasal programme

In line with our stated strategy, we are actively seeking

partners to complete final clinical development and

commercialisation of XF-73 nasal. Good progress has been made

during the period and we are already in discussions with multiple

interested global parties. We expect to make further progress

during the second half of the year with the intention of securing

the best possible deal and partner to maximise the significant

market potential for XF-73 nasal.

To support our view of the significant market potential of XF-73

nasal and our partnering activities we undertook further market

analysis with specialist consultants during the period. The review,

carried out with clinicians and payers in the US and EU, confirmed

that XF-73 nasal's target product profile is significantly superior

to existing treatments and further supports Destiny's pricing

assumptions used in its assessment of the global market opportunity

for XF-73 nasal. The r esearch also confirmed an increasing

awareness of the need for prophylaxis of surgical infections and

universal decolonization for this patient population with remaining

high unmet medical needs.

We were also pleased to report positive outcomes from our recent

Scientific Advisory Board (SAB) meeting, held shortly after the

period end. The SAB, comprising both US and UK-based infectious

disease specialists and surgeons, concluded that the proposed Phase

3 development pathway reflects the utility of XF-73 nasal in all

surgeries, and that the fast action and lack of resistance to XF-73

nasal will be a great advantage for patients and institutions.

Earlier Pipeline

Whilst our focus remains on our two lead clinical programmes, we

have sought to advance our earlier research projects which are

largely funded by external grants.

We reported positive results from our research collaboration

with SporeGen under an Innovate UK grant award to develop a

biotherapeutic treatment ( SPOR-COV(R) ) for COVID-19 models which

support its potential as a prophylactic nasal spray. We also signed

a manufacturing and regional licencing deal with HURO Biotech JSC

for Vietnam and HURO successfully completed Phase 1 clinical

studies in Vietnam and launched a retail product based on

SPOR-COV(R) in the territory . We are currently reviewing options

with SporeGen for the next stage in development of SPOR-COV (R) in

light of the current status of the Covid pandemic and available

therapeutic options.

Destiny Pharma's regional partner and investor, China Medical

System Holdings ("CMS") reported positive results from its dermal

programme, targeting the prevention and treatment of superficial

skin infections caused by bacteria, shortly after the period end.

The results showed superiority of XF-73 against Mupirocin (the

current leading topical antibiotic) in an in-vivo model of skin

infection. Destiny Pharma has cross-reference rights to data

generated from the programme and so retains the option to develop

dermal XF-73 products for US, European, Japanese and other

territories outside those held by CMS (mainland China, Hong Kong

Special Administrative Region, Macao Special Administrative Region,

Taiwan Region and other certain Asian countries/regions).

We continue to work with the US National Institute of Allergy

and Infectious Diseases (NIAID) to develop XF-73 -dermal, with

NIAID funding an extensive and on-going safety study of XF-73

-dermal. This second and final clinically-enabling regulatory study

is expected to complete by late 2023.

The results of a recent publication in Frontiers in Fungal

Biology highlighted the potential of XF-70 and XF-73 as new drugs

for the management of topical infections, particularly those with

activity against fungal biofilms caused by Candida albicans. There

is a large unmet need for new topical antifungal agents and the

global candidiasis therapeutic market is currently estimated at

over $3 billion.

Board changes

During the period, Debra Barker stepped in as interim CEO

following the departure of Neil Clark. Shortly after the period

end, Nick Rodgers stepped down after serving on the Board for five

years as Chairman, and was replaced by Sir Nigel Rudd, who returns

to the position having chaired the Company from 2010 to 2018 and

led its flotation on the AIM market. Debra has resumed her position

as a Non-Executive Director on the Board and has taken up the role

of Senior Independent Director following my appointment as CEO on 1

September.

Finance

Cash balances at the end of the period were GBP9.8 million,

providing a cash runway through to Q1 2025. Period end cash was

bolstered by the completion of a GBP7.3 million (gross) equity

fundraise and a $1 million upfront milestone payment received from

Sebela during the period. Proceeds from the fundraise are being

used to advance our two lead programmes and strengthen the

Company's balance sheet as we intensify partnering activities for

XF-73 nasal.

Change of Name of Nominated Adviser and Joint Broker

The Group also announces that its Nominated Adviser and Joint

Broker has changed its name to Cavendish Capital Markets Limited

following completion of its own corporate merger.

Outlook

Destiny's priorities remain the partnering of our XF-73 nasal

asset, as we look to maximise the substantial market potential for

this product, whilst progressing NTCD-M3 to commencement of

clinical studies in collaboration with our partner, Sebela

Pharmaceuticals. The Board and I remain highly focused on

delivering these objectives while maintaining tight cost

control.

It is encouraging that our scientific advisory board has

confirmed that the fast action and lack of resistance to XF-73 will

be a great advantage for patients and institutions. In addition,

market research confirms an increasing awareness of the need for

prophylaxis of surgical infections and also universal

decolonisation for this patient population with remaining high

unmet needs. We remain excited about the substantial opportunities

ahead of us.

Chris Tovey

Chief Executive Officer

20 September 2023

Condensed Statement of Comprehensive Income

For the 6 months ended 30 June 2023

6 months ended 6 months ended Year ended

30 June 2023 30 June 2022 31 December

Unaudited Unaudited 2022

GBP GBP Audited

GBP

Continuing operations

Licence fee income 831,552 - -

Administrative expenses (3,866,500) (3,550,876) (7,397,014)

Other operating income - 12,967 154,499

Share option charge (207,974) (275,854) (533,829)

---------------------------------- --------------- --------------- -------------

Operating loss (3,242,922) (3,813,763) (7,776,344)

Finance income 111,309 16,613 64,800

---------------------------------- --------------- --------------- -------------

Loss before tax (3,131,613) (3,797,150) (7,711,544)

Income Tax 471,949 608,848 1,207,975

---------------------------------- --------------- --------------- -------------

Loss and total comprehensive

loss from continuing operations (2,659,664) (3,188,302) (6,503,569)

Loss per share (Note 5)

Basic and diluted (3.1)p (4.8)p (9.3)p

---------------------------------- --------------- --------------- -------------

Condensed Statement of Financial Position

For the 6 months ended 30 June 2023

As at As at As at

30 June 2023 30 June 2022 31 December

Unaudited Unaudited 2022

GBP GBP Audited

GBP

ASSETS

Non-current assets

Property, plant and equipment

(Note 6) 21,635 29,521 24,621

Intangible assets (Note 7) 2,341,469 2,261,435 2,261,435

Non-current assets 2,363,104 2,290,956 2,286,056

-------------------------------- -------------- -------------- -------------

Current assets

Other receivables 663,132 720,673 1,410,452

Prepayments and accrued income 176,824 119,974 195,814

Cash and cash equivalents 9,842,975 8,371,047 4,903,461

Current assets 10,682,931 9,211,694 6,509,727

-------------------------------- -------------- -------------- -------------

11,502,650

TOTAL ASSETS 13,046,035 ) 8,795,783

-------------------------------- -------------- -------------- -------------

EQUITY AND LIABILITIES

Current liabilities

Trade and other payables 1,127,080 819,337 1,169,762

-------------------------------- -------------- -------------- -------------

Current liabilities 1,127,080 819,337 1,169,762

-------------------------------- -------------- -------------- -------------

Shareholders' equity

Issued share capital (Note

8) 952,639 733,071 733,071

Share premium 39,568,625 33,043,569 33,043,569

Accumulated losses (28,602,309) (23,093,327) (26,150,619)

-------------------------------- -------------- -------------- -------------

Total shareholders' equity 11,918,955 10,683,313 7,626,021

-------------------------------- -------------- -------------- -------------

TOTAL EQUITY AND LIABILITIES 13,046,035 11,502,650 8,795,783

-------------------------------- -------------- -------------- -------------

Condensed Statement of Changes in Equity

For the 6 months ended 30 June 2023

Issued

share Share Accumulated

capital premium losses Total

GBP GBP GBP GBP

As at 1 January 2023 733,071 33,043,569 (26,150,619) 7,626,021

Loss and total comprehensive

loss

for the period - - (2,659,664) (2,659,664)

Issue of share capital 219,568 7,127,065 - 7,346,633

Costs of share issue - (602,009) - (602,009)

Share based payment

expense - - 207,974 207,974

As at 30 June 2023 952,639 39,568,625 (28,602,309) 11,918,955

------------------------------ --------- ----------- -------------- --------------

Issued

share Share Accumulated

capital premium losses Total

GBP GBP GBP GBP

As at 1 January 2022 598,719 27,091,466 (20,180,879) 7,509,306

Total comprehensive

loss and loss

for the period - - (3,188,302) (3,188,302)

Issue of share capital 134,352 6,332,565 - 6,466,917

Costs of share issue - (380,462) - (380,462)

Share based payment

expense - - 275,854 275,854

As at 30 June 2022 733,071 33,043,569 (23,093,327) 10,683,313

------------------------ --------- ----------- -------------- --------------

Issued

share Share Accumulated

capital premium losses Total

GBP GBP GBP GBP

As at 1 January 2022 598,719 27,091,466 (20,180,879) 7,509,306

Total comprehensive

loss and loss

for the period - - (6,503,569) (6,503,569)

Issue of share capital 134,352 6,332,565 - 6,466,917

Costs of share issue - (380,462) - (380,462)

Share based payment

expense - - 533,829 533,829

As at 31 December 2022 733,071 33,043,569 (26,150,619) 7,626,021

------------------------ --------- ----------- -------------- --------------

Condensed Statement of Cash Flows

For the 6 months ended 30 June 2023

6 months ended 6 months ended Year ended

30 June 2023 30 June 2022 31 December

Unaudited Unaudited 2022

GBP GBP Audited

GBP

Cash flows from operating

activities

Loss before income tax (3,131,613) (3,797,150) (7,711,544)

Depreciation charges 3,669 6,361 12,328

Share based payment expense 207,974 275,854 533,829

Finance income (111,309) (16,613) (64,800)

Decrease in other receivables

and prepayments 21,234 180,808 14,316

(Decrease)/increase in trade

and other payables (42,682) 45,901 396,326

Tax received 1,217,025 927,256 927,256

-------------------------------- --------------- --------------- -------------

Net cash used in operating

activities (1,835,702) (2,377,583) (5,892,289)

-------------------------------- --------------- --------------- -------------

Cash flows from investing

activities

Purchase of tangible fixed

assets (683) - (1,067)

Purchase of intangible assets (80,034) - -

Interest received 111,309 16,613 64,800

Net cash flow from investing

activities 30,592 16,613 63,733

-------------------------------- --------------- --------------- -------------

Cash flows from financing

activities

New shares issued net of issue

costs 6,744,624 6,086,455 6,086,455

-------------------------------- --------------- --------------- -------------

Net cash inflow from financing

activities 6,744,624 6,086,455 6,086,455

-------------------------------- --------------- --------------- -------------

Net increase in cash and cash

equivalents 4,939,514 3,725,485 257,899

Cash and cash equivalents at

the beginning of the period 4,903,461 4,645,562 4,645,562

-------------------------------- --------------- --------------- -------------

Cash and cash equivalents

at the end of the period 9,842,975 8,371,047 4,903,461

-------------------------------- --------------- --------------- -------------

Notes to the Condensed Financial Statements

1. General Information

Destiny Pharma plc ("Destiny" or the "Company") was incorporated

and domiciled in the UK on 4 March 1996 with registration number

03167025. Destiny's registered office is located at Unit 36 Sussex

Innovation Centre Science Park Square, Falmer, Brighton, BN1

9SB.

Destiny is engaged in the discovery, development and

commercialisation of new antimicrobials that have unique properties

to improve outcomes for patients and the delivery of medical care

into the future.

2. Basis of Preparation

These interim unaudited financial statements have been prepared

in accordance with AIM Rule 18, 'Half yearly reports and accounts'.

The financial information contained in these interim financial

statements have been prepared under the historical cost convention

and on a going concern basis.

The interim financial information for the six months ended 30

June 2023, six months ended 30 June 2022 and the year ended 31

December 2022 contained within this interim report do not comprise

statutory accounts within the meaning of section 434 of the

Companies Act 2006. The financial information for the year ended 31

December 2022 is based on the statutory accounts for the year ended

31 December 2022. Those accounts, upon which the auditors issued an

unqualified opinion, have been delivered to the Registrar of

Companies and did not contain statements under section 498(2) or

(3) of the Companies Act 2006.

In the opinion of the Directors, the interim financial

information presents fairly the financial position, and results

from operations and cash flows for the period. Comparative amounts

for the six months ended 30 June 2022 are also unaudited.

The interim financial statements for the six months ended 30

June 2023 were approved by the Board on 19 September 2023.

3. Accounting Policies

The unaudited interim financial statements for the period have

been prepared on the basis of the accounting policies adopted in

the audited report and accounts of the Company for the year ended

31 December 2022 and expected to be adopted in the financial year

ending 31 December 2023.

4. Segmental Information

The chief operating decision-maker is considered to be the Board

of Directors of Destiny Pharma. The chief operating decision-maker

allocates resources and assesses performance of the business and

other activities at the operating segment level.

The chief operating decision maker has determined that Destiny

Pharma has one operating segment, the discovery, development and

commercialisation of pharmaceutical formulations.

Geographical Segments

The Company's only geographical segment during the period was

the UK.

5. Loss Per Share

The calculation for loss per ordinary share (basic and diluted)

for the relevant period is based on the earnings after income tax

attributable to equity shareholders for the period. As the Company

made losses during the period, there are no dilutive potential

ordinary shares in issue, and therefore basic and diluted loss per

share are identical. The calculation is as follows:

6 months ended 6 months ended Year ended

30 June 2023 30 June 2022 31 December

Unaudited Unaudited 2022

GBP GBP Audited

GBP

Loss for the period from

continuing operations (2,659,664) (3,188,302) (6,503,569)

-------------------------- --------------- --------------- -------------

Weighted average number

of shares 85,995,027 66,600,552 70,182,231

Loss per share - pence

-------------------------- --------------- --------------- -------------

Basic and diluted (3.1)p (4.8)p (9.3)p

-------------------------- --------------- --------------- -------------

6. Property, plant and equipment

Plant

and machinery

GBP

Cost

At 1 January 2023 151,515

Additions 683

Disposals (46,526)

At 30 June 2023 105,672

-------------------------------- ---------------

Depreciation

At 1 January 2023 126,894

Charge for the period 3,669

Disposals (46,526)

At 30 June 2023 84,037

-------------------------------- ---------------

Net book value at 30 June 2023 21,635

-------------------------------- ---------------

Plant

and machinery

GBP

Cost

At 1 January 2022 150,448

Additions -

At 30 June 2022 150,448

-------------------------------- ---------------

Depreciation

At 1 January 2022 114,566

Charge for the period 6,361

At 30 June 2022 120,927

-------------------------------- ---------------

Net book value at 30 June 2022 29,521

-------------------------------- ---------------

Plant

and machinery

GBP

Cost

At 1 January 2022 150,448

Additions 1,067

At 31 December 2022 151,515

------------------------------------ ---------------

Depreciation

At 1 January 2022 114,566

Charge for the year 12,328

At 31 December 2022 126,894

------------------------------------ ---------------

Net book value at 31 December 2022 24,621

------------------------------------ ---------------

7. Intangible assets

Acquired

development

programmes

GBP

Cost

At 1 January 2023 2,261,435

Additions 80,034

Cost and Net book value at 30 June 2023 2,341,469

----------------------------------------- -------------

Cost

At 1 January 2022 2,261,435

Additions -

Cost and Net book value at 30 June 2022 2,261,435

----------------------------------------- ----------

Cost

At 1 January 2022 2,261,435

Additions -

Cost and Net book value at 31 December 2022 2,261,435

--------------------------------------------- ----------

8. Share capital

During March 2023, 20,961,956 new Ordinary shares were issued

following a fundraise comprised of a placing, subscription and open

offer. The Company raised gross proceeds of GBP7.3m from the

fundraise to complete final Phase 3 clinical trial preparation for

NTCD-M3, including clinical trial material manufacturing; progress

XF-73 Nasal CMC manufacturing and Phase 3 preparation; to further

progress its preclinical projects; and to provide general working

capital to strengthen the balance sheet.

994,856 new Ordinary shares were issued in the half-year ended

30 June 2023 following the exercise of share options: On 01

February 2023, 150,000 new shares were issued, on 09 March 2023,

40,000 new shares were issued and on 03 May 2023, 804,856 new

shares were issued.

9. Events after the end of the reporting period

There are no events subsequent to the reporting period that

require adjustment or disclosure.

10. Copies of the interim financial statements

Copies of these interim unaudited financial statements are

available on the Company's website at www.destinypharma.com and

from the Company's registered office, Unit 36 Sussex Innovation

Centre Science Park Square, Falmer, Brighton, BN1 9SB.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SFDFWUEDSEDU

(END) Dow Jones Newswires

September 20, 2023 02:00 ET (06:00 GMT)

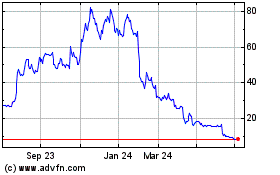

Destiny Pharma (LSE:DEST)

Historical Stock Chart

From Feb 2025 to Mar 2025

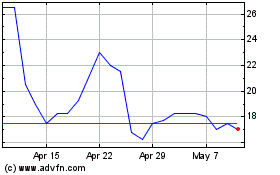

Destiny Pharma (LSE:DEST)

Historical Stock Chart

From Mar 2024 to Mar 2025