TIDMDSCV

RNS Number : 0783B

discoverIE Group plc

09 February 2022

For Release

7.00am, 9 February 2022

discoverIE Group plc

Change to Operating Segments

discoverIE Group plc (LSE: DSCV, "discoverIE" or the "Group"), a

leading international designer and manufacturer of customised

electronics for industrial applications, is today announcing new

reportable operating segments.

Last quarter, the Group announced the disposals of the Acal BFi

distribution business and the Vertec SA business, both subject to

certain regulatory approvals. The disposal of Vertec SA has now

completed and the sale of Acal BFi is expected to complete this

quarter. These disposals conclude the Group's exit from its

distribution operations and in accordance with IFRS5, its Custom

Supply division was treated as a discontinued operation in the

Group's results for the six months ended 30 September 2021, with

the Group's continuing operations at that time being the Design

& Manufacturing ("D&M") division.

Reflecting the development of the business over recent years and

in line with certain growth initiatives, the Group has now divided

the ongoing D&M division into two operating segments, the

Magnetics & Controls division ("M&C") and the Sensing &

Connectivity division ("S&C").

This new structure, which aligns business units by technology

area, will enable greater collaboration between business units and

improve visibility for the Group's growth initiatives. Both

divisions have good exposure to the Group's target markets and

geographies. The management and structure of each business unit is

unchanged.

The Magnetics & Controls division comprises the magnetic

components businesses and the embedded computing and interface

controls businesses. The division consists of eight businesses

including a magnetics cluster and will be led Martin Pangels,

previously Group Development Director for D&M division and a

long standing member of the Group Executive Committee ('GEC').

The Sensing & Connectivity division comprises a cluster of

five component sensing businesses and seven component connectivity

businesses and will be led by Paul Hill, a GEC member since

December 2021 and prior to that, CEO of recently acquired

Antenova.

The following tables show the restated underlying operating

performance (unaudited) for the Group's ongoing operations on the

new divisional basis for the six months ended 30 September 2021 and

2020, and the full year ended 31 March 2021. The consolidated

results for the Continuing Group are unchanged.

H1 2021/22 H1 2020/21 Reported Organic Organic

revenue revenue order

growth growth growth

------------------------------

Revenue Underlying Margin Revenue Underlying Margin

GBPm operating GBPm operating

profit profit

GBPm GBPm

-------- ------------ ------- -------- ----------- -------

M&C 105.4 12.8 12.1% 90.8 10.4 11.5% 16% 18% 66%

S&C 68.9 11.1 16.1% 53.0 7.1 13.4% 30% 10% 60%

Unallocated (5.9) (3.9)

Total 174.3 18.0 10.3% 143.8 13.6 9.5% 21% 15% 64%

FY 2020/21

Revenue Underlying Margin

GBPm operating

profit

GBPm

-------- ------------ -------

M&C 190.4 23.4 12.3%

S&C 112.4 15.5 13.8%

Unallocated (8.1)

Total 302.8 30.8 10.2%

Further historical divisional analysis is provided in Appendix

1.

For further information, please contact:

discoverIE Group plc 01483 544 500

Nick Jefferies Group Chief Executive

Simon Gibbins Group Finance Director

Lili Huang Head of Investor Relations

Buchanan 020 7466 5000

Chris Lane, Toto Berger, Jack Devoy

discoverIE@buchanan.uk.com

Notes

1. Underlying Operating Profit is a non-IFRS financial measure

used by the Directors to assess the underlying performance of the

Group and excludes acquisition-related costs (amortisation of

acquired intangible assets and acquisition expenses). Prior years

also excluded the IAS19 pension-related charge.

Notes to Editors:

About discoverIE Group plc

discoverIE Group plc is an international group of businesses

that designs and manufactures innovative electronic components for

industrial applications.

The Group provides application-specific components to original

equipment manufacturers ("OEMs") internationally. By designing

components that meet customers' unique requirements, which are then

manufactured and supplied throughout the life of their production,

a high level of repeating revenue is generated with long term

customer relationships.

With a focus on key markets driven by structural growth and

increasing electronic content, namely renewable energy, medical,

transportation and industrial & connectivity, the Group aims to

achieve organic growth that is well ahead of GDP and to supplement

that with targeted complementary acquisitions. The Group has an

ongoing commitment to reducing the impact of its operations on the

environment, while its key markets are aligned with a sustainable

future.

The Group's continuing operations employs c.4,500 people and its

principal operating units are located in Continental Europe, the

UK, China, Sri Lanka, India and North America.

The Group is listed on the Main Market of the London Stock

Exchange and is a member of the FTSE250, classified within the

Electrical Components and Equipment subsector.

Appendix 1

Six months to 30 September 2021 (unaudited)

Magnetics Sensing & Unallocated Total continuing

& Controls Connectivity costs operations

GBPm GBPm GBPm GBPm

Revenue 105.4 68.9 - 174.3

------------------------------------- ------------ -------------- ------------ -----------------

Underlying operating profit/(loss) 12.8 11.1 (5.9) 18.0

Acquisition expenses (2.0) (1.3) - (3.3)

Amortisation of acquired intangible

assets (1.9) (4.5) - (6.4)

Operating profit/(loss) 8.9 5.3 (5.9) 8.3

------------------------------------- ------------ -------------- ------------ -----------------

Six months to 30 September 2020 (unaudited)

Magnetics Sensing & Unallocated Total continuing

& Controls Connectivity costs operations

GBPm GBPm GBPm GBPm

Revenue 90.8 53.0 - 143.8

------------------------------------- ------------ -------------- ------------ -----------------

Underlying operating profit/(loss) 10.4 7.1 (3.9) 13.6

Acquisition expenses (0.3) (0.3) - (0.6)

Amortisation of acquired intangible

assets (1.7) (3.6) - (5.3)

IAS 19 pension charge - - (0.2) (0.2)

Operating profit/(loss) 8.4 3.2 (4.1) 7.5

------------------------------------- ------------ -------------- ------------ -----------------

Year to 31 March 2021 (unaudited)

Magnetics Sensing Unallocated Total continuing

& Controls & Connectivity costs operations

GBPm GBPm GBPm GBPm

Revenue 190.4 112.4 - 302.8

------------------------------------- ------------ ---------------- ------------ -----------------

Underlying operating profit/(loss) 23.4 15.5 (8.1) 30.8

Acquisition expenses (0.8) (0.4) - (1.2)

Amortisation of acquired intangible

assets (3.5) (7.6) - (11.1)

IAS 19 pension charge - - (1.4) (1.4)

Operating profit/(loss) 19.1 7.5 (9.5) 17.1

------------------------------------- ------------ ---------------- ------------ -----------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUPURWPUPPGMR

(END) Dow Jones Newswires

February 09, 2022 01:59 ET (06:59 GMT)

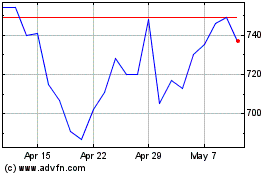

Discoverie (LSE:DSCV)

Historical Stock Chart

From Jun 2024 to Jul 2024

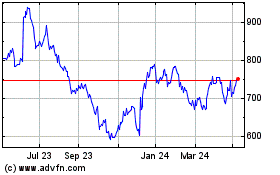

Discoverie (LSE:DSCV)

Historical Stock Chart

From Jul 2023 to Jul 2024