eEnergy Group PLC Trading Update (3959H)

July 27 2023 - 1:00AM

UK Regulatory

TIDMEAAS

RNS Number : 3959H

eEnergy Group PLC

27 July 2023

27 July 2023

eEnergy Group plc

("eEnergy" or "the Group")

Trading Update

eEnergy (AIM: EAAS), the net zero energy services provider, is

pleased to provide an update on trading for the 12 months ended 30

June 2023 (the "Period"). As previously announced on 22 June 2023,

the Group has changed its accounting reference date and financial

year end from 30 June to 31 December. Accordingly, the Group will

be publishing its unaudited interim accounts for the 12 months to

30 June 2023 by 30 September 2023.

Group Trading and Highlights for the Period (unaudited)

The Board is pleased to announce the Group generated revenue of

GBP33.1 million and Adjusted EBITDA of GBP4.7 million.

-- Revenue up 50% to GBP33.1 million (FY 2022: GBP22.0

million)

o Energy Services revenue GBP19.5 million, up 86%,

Adj EBITDA GBP2.3 million, up 137%

o Energy Management revenue GBP13.6 million, up 17%,

Adj EBITDA GBP4.4 million, up 19%

-- Adj EBITDA(1) up 55% to GBP4.7 million (FY 2022: GBP3.0

million)

-- Adj PBT(2) up 34% to GBP2.7 million (FY 2022: GBP2.0

million)

-- PBT GBP1.1 million (FY 2022 Loss Before Tax: GBP(2.2)

million)

Financing costs during the Period were higher due to, inter

alia, the new subordinated debt facility issued in November 2022

and the higher interest rate environment.

Business Segments

Energy Services revenues were GBP19.5 million (FY22: GBP10.5

million) delivering divisional operating profit of GBP2.3million

(FY22 GBP1.0 million) with substantial growth supported by

continuing strong customer demand for the Group's products and

services.

Energy Management revenues were GBP13.6 million (FY22: GBP11.6

million) delivering divisional operating profit of GBP4.4 million

(FY22: GBP3.7 million), achieved by high customer retention levels

and strong re-occurring revenues.

Net Debt

-- Cash at 30 June 2023 of GBP0.8 million (31 December 2022:

GBP1.1 million) excluding GBP0.5 million of restricted

cash balances (31 December 2022: GBP0.4 million)

-- Net Debt (excluding IFRS 16 lease liabilities) at 30 June

2023 of GBP7.0m (31 December 2022: GBP6.6m)

-- During the period since 1 January 2023, payments of GBP0.9

million relating to legacy HMRC liabilities have been

made, clearing all historic overdue amounts

Full Year Outlook

The Company's contracted revenue book remains strong and gives

good visibility on Q5 / Q6 revenues. Contracted forward revenues

("Forward Order Book") at 30 June 2023 were GBP27.5 million (31

December 2022: GBP26.4 million), of which GBP14.1 million are

expected to convert into revenues in the six months to 31 December

2023.

The Board is confident in the trading outlook for the remainder

of FY23 and beyond.

eEnergy expects to report its unaudited interim accounts for the

12 months to 30 June 2023 by 30 September 2023.

Harvey Sinclair, CEO of eEnergy, commented: "I am delighted to

be reporting another 12 months of strong growth for eEnergy in a

period where we have strengthened our profitable position. Revenues

and profits have grown significantly as a result of strong uptake

of our energy services offering, further supported by strong

customer retention and improved cross selling rates across our

existing client base."

Note: (1) Adjusted EBITDA including GBP2.0 million of Group

costs and excluding Exceptional Items. Exceptional Items are those

items which, in the opinion of the Directors, should be excluded in

order to provide a consistent and comparable view of the underlying

performance of the Group's ongoing business, including the costs

incurred in delivering the 'Buy & Build' strategy associated

with acquisitions and strategic investments, costs of restructuring

and transforming acquired businesses and share-based payments.

(2) Adjusted PBT excluding Exceptional Items and amortisation of

acquired intangible assets.

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No. 596/2014, as

it forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018, as amended.

Contacts:

eEnergy Group plc Tel: +44 20 7078 9564

Harvey Sinclair, Chief Executive Officer info@eenergyplc.com ; www.eenergyplc.com

Crispin Goldsmith, Chief Financial

Officer

Strand Hanson Limited (Nominated Tel: +44 20 7409 3494

Adviser)

Richard Johnson, James Harris

Canaccord Genuity Limited (Joint Tel: +44 20 7523 8000

Broker)

Max Hartley, Tom Diehl (Corporate

Broking)

Turner Pope Investments (Joint Broker) Tel: +44 20 3657 0050

Andy Thacker, James Pope info@turnerpope.com

Tavistock Tel: +44 207 920 3150

Jos Simson, Heather Armstrong, Katie eEnergy@tavistock.co.uk

Hopkins

About eEnergy Group plc

eEnergy (AIM: EAAS) is a net zero energy services provider,

empowering organisations to achieve net zero by tackling energy

waste and transitioning to clean energy, without the need for

upfront investment. It is making net zero possible and profitable

for all organisations in four ways:

-- Transition to the lowest cost clean energy through the

Group's digital procurement platform and energy management

services.

-- Tackle energy waste with granular data and insight on

energy use and dynamic energy management.

-- Reduce energy use with the right energy efficiency solutions

without upfront cost.

-- Reach net zero with onsite renewable generation and

electric vehicle (EV) charging.

eEnergy is a Top 5 B2B energy company and has been awarded The

Green Economy Mark by London Stock Exchange.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUBOVROSUBURR

(END) Dow Jones Newswires

July 27, 2023 02:00 ET (06:00 GMT)

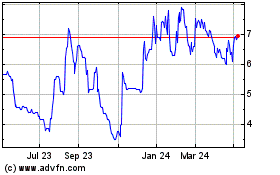

Eenergy (LSE:EAAS)

Historical Stock Chart

From Dec 2024 to Jan 2025

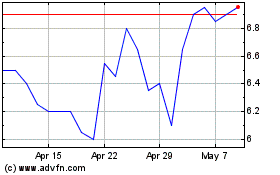

Eenergy (LSE:EAAS)

Historical Stock Chart

From Jan 2024 to Jan 2025