TIDMECO

RNS Number : 8758H

Eco (Atlantic) Oil and Gas Ltd.

01 August 2023

1 August 2023

ECO (ATLANTIC) OIL & GAS LTD.

("Eco," "Eco Atlantic," "Company," or together with its

subsidiaries, the "Group")

Audited Results for the Year Ended 31 March 2023

Eco (Atlantic) Oil & Gas Ltd. (AIM: ECO, TSX -- V: EOG) ,

the oil and gas exploration company focused on the offshore

Atlantic Margins, is pleased to announce its audited results for

the year ended 31 March 2023.

Highlights:

Financials (as at 31 March 2023)

-- The Company had cash and cash equivalents of US$3,770,614 and no debt.

-- Eco has cash and cash equivalents of US$6.4 million on the balance sheet as at 31 July 2023.

-- The Company had total assets of US$53,777,531, total

liabilities of US$5.9 million and total equity of US$48

million.

Operations:

South Africa

Block 3B/4B

-- Post period end, the Company signed a legally binding Letter

of Intent with Africa Oil to farm out a 6.25% Participating

Interest in Block 3B/4B, offshore South Africa for up to US$10.5

million in cash.

-- In March 2023, Africa Oil released a New Competent Person's

Resource Report confirming that the Block contains an estimated P50

Prospective Resources of approximately four billion barrels of oil

equivalent ("BOE"), one Billion BOE net to Eco Atlantic prior to

the sale of the aforementioned Participating Interest which is

expected to complete shortly.

-- Eco, alongside its JV Partners, applied for Environmental

Authorisation to undertake exploration activities in Block 3B/4B in

the Orange Basin. An application was made to drill one well and one

contingent well with an area of interest in the north of the Block.

A comprehensive Environmental and Social Impact Assessment ("ESIA")

process commenced in March 2023, in preparation for drilling

activity on the Block.

-- The JV partners continue to progress plans to conduct a

two-well campaign on the Block in conjunction with progressing the

collaborative farm out process, up to 55% gross working interest,

with various potential parties.

Block 2B

-- On November 15, 2022, a Production Right Application to the

Petroleum Agency of South Africa, for Block 2B, based on the

existing oil discovery of AJ-1 and potential future operations was

submitted by the JV Partners.

-- Eco continues to believe that Block 2B contains considerable

hydrocarbon resources and looks forward to providing further

updates as the Company looks to deliver value from the licence for

all stakeholders.

Namibia

-- Following the significant drilling success in the area, Eco

continues to receive third party interest in its strategic acreage

position offshore Namibia.

-- The Company continues to assess farm out opportunities with

its four licences in the region as it considers options for

progressing exploration and commercial activity on its acreage.

Guyana

-- Eco Atlantic and its JV partners remain committed to further

drilling on the Orinduik Block and continue assessing opportunities

to drill at least two exploration wells into the light oil

cretaceous targets as soon as practical. Further updates will be

made on the matter in due course.

Gil Holzman, President and Chief Executive Officer of Eco

Atlantic, commented:

"As a business we continue to make significant strides across

our strategic portfolio of hydrocarbon assets, in some of the

world's most prolific exploration areas. Following the stabilizing

of commodity prices during the first half of this year, alongside a

number of discoveries being made in and around the regions we

operate in, we continue to see strong industry interest in our

unique acreage positions in Orange Basin SA, Walvis Basin Namibia,

and the Guyana Suriname Basin.

"The agreed transfer of a portion of our WI on Block 3B/4B to

our strategic alliance partner Africa Oil will strengthen the JV

position amid our continued negotiations with third parties to farm

into the Block and execute a drilling campaign targeted for 2024.

The proceeds from this agreement give us the opportunity to fund

other growth opportunities elsewhere in the portfolio with no

shareholder dilution. Also, at 3B/4B, we applied for Environmental

Authorisation to undertake further drilling exploration activities

as we believe that the licence holds significant potential to be

explored by the Joint Venture partnership in South Africa.

"Namibia continues to produce globally significant hydrocarbon

discoveries, and as a sizeable licence holder in the region, Eco

continues to benefit from heightened levels of industry interest in

the area.

"As a Board and Management team, we continue to assess and

progress value accretive opportunities across our portfolio, with

the goal of delivering substantial shareholder returns over the

medium to long term.

"We remain excited about our prospects, and I look forward to

providing further updates to the markets during the remainder of

the year."

Issue of Azinam Shares, Admission and Total Voting Rights

In addition, further to the Company's announcement of 29

November 2022 regarding the closing of the acquisition of Azinam

Group Limited ("Azinam") and in accordance with the previously

announced Share Purchase Agreement, the Company has received TSX

Venture Exchange approval to issue the balance of 1,625,000 Common

Shares ("Azinam Shares") to the previous shareholders of Azinam

representing the full and final number of Common Shares to be

issued in respect of this transaction.

Application has been made for admission of the 1,625,000 Azinam

Shares, which will rank pari passu with existing Common Shares, to

trading on AIM ("Admission"). It is expected that Admission will

become effective, and trading in the Azinam Shares will commence,

on or around 8:00 a.m. on 2 August 2023.

On Admission, the enlarged issued share capital of the Company

will be 370,173,680 Common Shares. The above figure may be used by

shareholders as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change to their interest in, the share capital of the

Company.

The Company's audited financial statement for the year ended 31

March 2023 is available for download on the Company's website at

www.ecooilandgas.com and on Sedar at www.sedar.com .

The following are the Company's Balance Sheet, Income

Statements, Cash Flow Statement and selected notes from the annual

Financial Statements. All amounts are in US Dollars, unless

otherwise stated.

Balance Sheet

March 31, March 31,

------------------------------------

2023 2022

------------------------------------ ------------------------- ---------------------

Assets

Current Assets

Cash and cash equivalents 4,110,734 3,438,834

Short-term investments 13,107 52,618

Government receivable 22,494 27,487

Amounts owing by license 477,578 -

partners, net

Accounts receivable

and prepaid expenses 1,529,451 257,911

Assets held for sale - 2,061,734

------------------------------------ ------------------------- ---------------------

Total Current Assets 6,153,364 5,838,584

------------------------------------ ------------------------- ---------------------

Non- Current Assets

Investment in associate 8,612,267 9,277,162

Petroleum and natural

gas licenses 40,852,020 30,753,034

------------------------------------ ------------------------- ---------------------

Total Non-Current Assets 49,464,287 40,030,196

------------------------------------ ------------------------- ---------------------

Total Assets 55,617,651 45,868,780

------------------------------------ ------------------------- ---------------------

Liabilities

Current Liabilities

Accounts payable and

accrued liabilities 4,416,789 1,931,823

Advances from and amounts 286,553 -

owing to license partners,

net

Current liabilities

related to assets held

for sale - 473,254

Warrant liability 261,720 3,241,762

------------------------------------

Total Current Liabilities 4,965,062 5,646,839

Total Liabilities 4,965,062 5,646,839

------------------------------------ ------------------------- ---------------------

Equity

Share capital 121,570,983 63,141,609

Shares to be issued - 20,766,996

Restricted Share Units

reserve 920,653 267,669

Warrants 14,778,272 7,806,000

Stock options 2,804,806 958,056

Foreign currency translation

reserve (1,458,709) (1,309,727)

Accumulated deficit (87,963,416) (51,408,662)

------------------------------------ ------------------------- ---------------------

Total Equity 50,652,589 40,221,941

------------------------------------ ------------------------- ---------------------

Total Liabilities and

Equity 55,617,651 45,868,780

------------------------------------ ------------------------- ---------------------

Income Statement

Year ended

March 31,

-----------------------------------------------------

2023 2022

-------------------------- -------------------------

Revenue

Interest income 66,571 3,556

-------------------------- -------------------------

66,571 3,556

Operating expenses :

Compensation costs 905,974 852,383

Professional fees 694,304 551,751

Operating costs, net 33,039,264 1,932,826

General and administrative

costs 848,893 603,145

Share-based compensation 2,968,294 14,495

Foreign exchange loss (gain) 559,947 (116,631)

-------------------------- -------------------------

Total operating expenses 39,016,676 3,837,969

-------------------------- -------------------------

Operating loss (38,950,105) (3,834,413)

Fair value change in warrant

liability 2,980,042 (263,136)

Share of losses of company

accounted for at equity (664,895) (1,154,838)

-------------------------- -------------------------

Net loss for the year from

continuing operations (36,634,958) (5,252,387)

Gain (loss) from discontinued

operations, after-tax 80,204 (1,304,937)

Net loss for the year (36,554,754) (6,557,324)

Foreign currency translation

adjustment (148,982) (111,630)

Comprehensive loss for the

year (36,703,736) (6,668,954)

-------------------------- -------------------------

Basic and diluted net loss

per share:

from continuing operations (0.105) (0.027)

========================== =========================

from discontinued operations 0.000 (0.007)

========================== =========================

Weighted average number of

ordinary shares used in computing

basic and diluted net loss

per share 349,622,239 195,869,114

========================== =========================

Cash Flow Statement

Year ended

March 31,

----------------------------------------------

2023 2022

-------------------- ------------------------

Cash flow from operating

activities - continued operations

Net loss from continuing

operations (36,634,958) (5,252,387)

Items not affecting cash:

Share-based compensation 2,968,295 14,495

Revaluation of warrant

liability (2,980,042) 263,136

Share of losses of companies

accounted for at equity 664,895 1,154,838

Changes in non--cash working

capital:

Government receivable 4,993 (4,790)

Accounts payable and accrued

liabilities 2,484,966 (7,279)

Accounts receivable and

prepaid expenses (1,271,540) 530,121

Reallocation to discontinued

operations cashflows - (317,340)

Advance from and amounts (191,025) -

owing to license partners

------------------------------------ -------------------- ------------------------

(34,954,416) (3,619,206)

------------------------------------ -------------------- ------------------------

Cash flow from operating

activities - discontinued

operations (839,029) (1,008,182)

Cash flow from investing

activities

Investment in associate - (10,000,000)

Short-term investments 39,511 1,500,022

Acquisition of interest (1,598,986) -

in property

------------------------------------ --------------------

(1,559,475) (8,499,978)

------------------------------------ -------------------- ------------------------

Cash flow from investing 2,507,713 -

activities - discontinued

operations

Cash flow from financing

activities

Proceeds from private placements,

net 35,666,089 4,793,814

Acquisition of Azinam - 2,590

Exercise of stock options - 74,212

35,666,089 4,870,616

------------------------------------ -------------------- ------------------------

Increase (decrease) in

cash and cash equivalents 820,882 (8,256,750)

Foreign exchange differences (148,982) (111,725)

Cash and cash equivalents,

beginning of year 3,438,834 11,807,309

------------------------------------ -------------------- ------------------------

Cash and cash equivalents,

end of year 4,110,734 3,438,834

------------------------------------ -------------------- ------------------------

For more information, please visit www.ecooilandgas.com or

contact the following :

Eco Atlantic Oil and Gas c/o Celicourt +44 (0) 20

8434 2754

Gil Holzman, CEO

Colin Kinley, COO

Alice Carroll, Head of Corporate Sustainability +44(0)781 729 5070

Strand Hanson Limited (Financial &

Nominated Adviser) +44 (0) 20 7409 3494

James Harris

James Bellman

Berenberg (Broker) +44 (0) 20 3207 7800

M atthew Armitt

Detlir Elezi

Echelon Capital (Financial Adviser

N. America Markets)

Ryan Mooney +1 (403) 606 4852

Simon Akit +1 (416) 8497776

Celicourt (PR) +44 (0) 20 7770 6424

Mark Antelme

Jimmy Lea

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018 (as amended).

Notes to editors:

About Eco Atlantic:

Eco Atlantic is a TSX-V and AIM-quoted Atlantic Margin-focused

oil & gas exploration company with offshore license interests

in Guyana, Namibia, and South Africa. Eco aims to deliver material

value for its stakeholders through its role in the energy

transition to explore for low carbon intensity oil and gas in

stable emerging markets close to infrastructure.

Offshore Guyana in the proven Guyana-Suriname Basin, the Company

holds a 15% Working Interest in the 1,800 km2 Orinduik Block

Operated by Tullow Oil. In Namibia, the Company holds Operatorship

and an 85% Working Interest in four offshore Petroleum Licences:

PELs: 97, 98, 99, and 100, representing a combined area of 28,593

km2 in the Walvis Basin.

Offshore South Africa, Eco is Operator and holds a 50% working

interest in Block 2B and a 26.25% Working Interest in Block 3B/4B

operated by Africa Oil Corp., totalling some 20,643km2.

Cautionary Notes:

This news release contains certain "forward-looking statements",

including, without limitation, statements containing the words

"will", "may", "expects", "intends", "anticipates" and other

similar expressions which constitute "forward-looking information"

within the meaning of applicable securities laws. Forward-looking

statements reflect the Company's current expectations, assumptions,

and beliefs, and are subject to a number of risks and uncertainties

that could cause actual results to differ materially from those

anticipated. These forward-looking statements are qualified in

their entirety by the inherent risks and uncertainties surrounding

future expectations.

Important factors that could cause actual results to differ

materially from expectations include, but are not limited to,

general economic and market factors, competition, the effect of the

global pandemic and consequent economic disruption, and the factors

detailed in the Company's ongoing filings with the securities

regulatory authorities, available at www.sedar.com . Although

forward-looking statements contained herein are based on what

management considers to be reasonable assumptions based on

currently available information, there can be no assurance that

actual events, performance or results will be consistent with these

forward-looking statements, and our assumptions may prove to be

incorrect. Readers are cautioned not to place undue reliance on

these forward-looking statements. The Company undertakes no

obligation to publicly update or revise any forward-looking

statements either as a result of new information, future events or

otherwise, except as required by applicable laws.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

STRGSGDIBXGDGXB

(END) Dow Jones Newswires

August 01, 2023 02:00 ET (06:00 GMT)

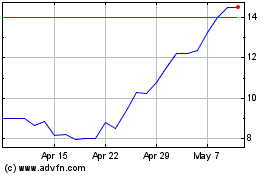

Eco (atlantic) Oil & Gas (LSE:ECO)

Historical Stock Chart

From Jan 2025 to Feb 2025

Eco (atlantic) Oil & Gas (LSE:ECO)

Historical Stock Chart

From Feb 2024 to Feb 2025