TIDMEME

RNS Number : 9034Y

Empyrean Energy PLC

09 September 2022

This announcement contains inside information

Empyrean Energy Plc / Index: AIM / Epic: EME / Sector: Oil &

Gas

Empyrean Energy plc

Mako Gas Project - Updated Plan of Development

Empyrean Energy plc ("Empyrean" or the "Company"), the oil and

gas development company with interests in China, Indonesia and the

United States is delighted to announce that the partners in the

Duyung PSC have approved the updated Plan of Development ("PoD")

and have secured alignment with SKK Migas on the plan. The PoD has

now been submitted to the Indonesian Ministry of Energy and Mineral

Resources for approval. Empyrean holds an 8.5% interest in the

Duyung PSC.

Empyrean is also pleased to announce that an Operator

commissioned Competent Persons Report ("CPR") has been prepared by

GaffneyCline & Associates ("GCA") for the Mako development.

Highlights:

-- Revised PoD approved by partners and submitted for ministerial approval

-- Based on the CPR:

o Compelling project economics;

-- 51% IRR and

-- NPV10 net to Empyrean of US$49M (US$577M gross) in the Best

Case (2C) scenario

o 23.8 Bcf net entitlement 2C resources to Empyrean during the

PSC life;

o Plateau production of 120 MMscf/d for six years in the Best

Case (2C) scenario

o CPR capital expenditure requirement to first gas estimated at

US$251M gross (US$21.3M net to Empyrean). It is anticipated that a

reserve based lending ("RBL") debt structure would be appropriate

to fund the development.

-- Operator has indicated that termed Gas Sales Agreements

("GSA"), for gas sold into Singapore, are under discussion with SKK

Migas with a view to finalising sales arrangements in the near

future.

The Operator of the Duyung PSC is WNEL, a 100%-owned subsidiary

of Conrad Asia Energy Ltd, has continued to technically mature the

development of the Mako gas field alongside negotiations of GSA(s),

both in preparation for Final Investment Decision. This has

included finalising the revised PoD, on which the JV partners have

now secured alignment with governmental regulator, SKK Migas, and

submission for ministerial approval.

The GCA CPR is closely aligned with the PoD and is premised on a

two-phased development with six wells in phase 1 and a further two

wells in phase 2 after 5 years of production. The wells will be

tied back to a leased production platform at the field, with sales

gas transported via the West Natuna Transportation System pipeline

to Singapore for sales to the Singapore market. The development

plan includes first gas in 2025, with a 120 MMscf/d production

plateau and a gross recoverable 2C contingent resource of 413 Bcf

gas total and 281 Bcf net entitlement attributable to the Duyung

PSC JV partners (23.8 Bcf net to Empyrean) during the PSC life.

As reported in the CPR (dated 26 August 2022) and specified in

the PoD revision, upside exists to increase the plateau rate to 150

MMscf/d, should reservoir deliverability be sufficient. GCA has

confirmed Mako contingent resources that are broadly in agreement

with the PoD as set out in the table below.

Duyung PSC - Contingent Resources, GCA Operator CPR

MAKO GAS FIELD CONTINGENT RESOURCES CONTINGENT RESOURCES CONTINGENT RESOURCES

(Bcf gas) GROSS (100%) WITHIN PSC GROSS NET ATTRIBUTABLE

(100%) * TO EME (8.5%)

**

Reservoir: Low Best High Low Best High Low Best High

Upper sand,

intermediate

zone and Lower

sand

------- -------- -------- ------- -------- -------- ------- -------- --------

During Duyung

PSC life 249 413 442 219 363 389 14 24 26

------- -------- -------- ------- -------- -------- ------- -------- --------

Requires Duyung

PSC extension 24 336 21 296 1 19

------- -------- -------- ------- -------- -------- ------- -------- --------

Total 249 437 779 219 384 685 14 25 45

------- -------- -------- ------- -------- -------- ------- -------- --------

* The CPR assumes that 88% of the GIIP of the Mako field is

within the PSC boundary

** After allowing for boundary and all PSC terms

The Operator of the Duyung PSC is WNEL, a 100%-owned subsidiary

of Conrad Asia Energy Ltd, who hold a 76.5% interest in the Duyung

PSC. Coro Energy Plc hold 15%. Empyrean hold 8.5%.

The Operator CPR, and the updated PoD, assumes first gas in 2025

and calculates the l ast economic production years prior to the

current Duyung PSC expiry date for Low, Best and High cases of

2033, 2036 and 2036 respectively, which extend to 2039 and 2054 for

the Best and High respectively if the Duyung PSC is extended.

The Operator CPR utilises a gas price of US$9.97/Mscf in 2025

which is calculated on a Brent linked price formula with a Brent

slope of 12% and a Brent price deck of US$80/bbl in 2025,

escalating 2% pa from 2027 thereafter. Different gas prices may

eventually be agreed with the gas buyers and the regulator when the

GSA's are eventually signed. The Operator CPR estimates that the

post tax NPV10 resulting from the Best Case Contingent Resources

within the Duyung PSC acreage and within life of Duyung PSC (363

Bcf) is some US$578M (US$49M net to Empyrean) representing a 51%

IRR.

Under the PoD and CPR, first gas from the Mako gas project is

planned to be evacuated via the West Natuna Transportation System.

The development will utilise a Conductor Support Frame (CSF) for

one dry wellhead and gas import-export support, bridged-linked to a

leased Mobile Offshore Production Unit. The CPR Phase 1 capital

expenditure is estimated to be US$251M and total capital

expenditure will be US$303M. These estimates will be updated as a

consequence of envisaged Front End Engineering and Design (FEED)

studies. It is anticipated that RBL debt funding will be

appropriate to provide funds for the development.

The information contained in this announcement has been reviewed

by Empyrean's Executive Technical director, Gaz Bisht, who has over

32 years' experience as a hydrocarbon geologist and

geoscientist.

Empyrean CEO, Tom Kelly, stated:

"Empyrean would firstly like to thank the Conrad and SKK Migas

teams for the enormous volume of work that has gone into achieving

alignment with SKK Migas and the Duyung partners in order to submit

the PoD for ministerial approval. This is a great achievement. The

independent assessment of the project by Gaffney Cline shows that

the project economics are highly robust. Empyrean is also

encouraged by the significant upside that exists if the current

macro environment of higher South East Asian gas prices results in

any improvement on pricing assumptions contained in the CPR. There

also exists significant upside if the reservoir performs better

than the 2C Best case. We look forward to the conclusion of GSA

negotiations."

For further information please contact the following:

Empyrean Energy plc

Tom Kelly Tel: +61 6146 5325

Cenkos Securities plc (Nominated Advisor and Broker)

Neil McDonald Tel: +44 (0) 20 7297 8900

Pete Lynch

Pearl Kellie

First Equity (Join Broker)

Jason Robertson Tel: +44 (0) 20 7330 1883

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEKLBBLKLEBBZ

(END) Dow Jones Newswires

September 09, 2022 02:01 ET (06:01 GMT)

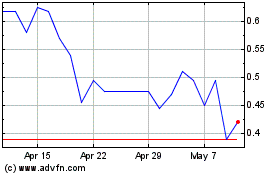

Empyrean Energy (LSE:EME)

Historical Stock Chart

From Feb 2025 to Mar 2025

Empyrean Energy (LSE:EME)

Historical Stock Chart

From Mar 2024 to Mar 2025