TIDMENW

RNS Number : 1868I

Enwell Energy PLC

13 April 2022

13 April 2022

Enwell Energy plc

("Enwell" or the "Company")

Quarterly Operations Update

Enwell Energy plc (AIM: ENW), the AIM-quoted oil and gas

exploration and production group, provides an update on its

operational activities in Ukraine, where it operates the

Mekhediviska-Golotvshinska (MEX-GOL), Svyrydivske (SV) and

Vasyschevskoye (VAS) gas and condensate fields, as well as the

Svystunivsko-Chervonolutskyi (SC) exploration licence .

In light of the Russian military action in Ukraine, on 24

February 2022, Enwell shut-in and made safe its production and

drilling operations at all of its fields. Subsequently, on 11 March

2022, having taken a number of measures to ensure safe operations,

Enwell commenced the partial restart of production operations at

its MEX-GOL and SV fields. Further details can be found in the

Company's announcements dated 24 February 2022 and 15 March

2022.

The Company continues to be cautious and vigilant in continuing

these partial production operations and is taking all measures

available to protect and safeguard its personnel and business. The

safety and wellbeing of its personnel and contractors is paramount

and the Company will continue to take all possible steps to ensure

their safety.

Production - Q1 2022

The average daily production of gas, condensate and LPG for the

76 days that the MEX-GOL and SV fields were producing and for the

55 days that the VAS field was producing, during the period from 1

January 2022 to 31 March 2022, was as follows:-

Field Gas Condensate LPG Aggregate

(MMcf/d) (bbl/d) (bbl/d) boepd

Q1 2022 Q1 2021 Q1 2022 Q1 2021 Q1 2022 Q1 2021 Q1 2022 Q1 2021

-------- -------- -------- -------- -------- -------- -------- --------

MEX-GOL

& SV 11.6 18.2 487 635 286 336 2,730 4,079

-------- -------- -------- -------- -------- -------- -------- --------

VAS 2.2 2.5 24 27 - - 434 497

-------- -------- -------- -------- -------- -------- -------- --------

Total 13.8 20.7 511 662 286 336 3,164 4,576

-------- -------- -------- -------- -------- -------- -------- --------

The average daily production of gas, condensate and LPG from the

MEX-GOL, SV and VAS fields over the entire period from 1 January

2022 to 31 March 2022 (inclusive of shut-in periods) was as

follows:-

Field Gas Condensate LPG Aggregate

(MMcf/d) (bbl/d) (bbl/d) boepd

Q1 2022 Q1 2021 Q1 2022 Q1 2021 Q1 2022 Q1 2021 Q1 2022 Q1 2021

-------- -------- -------- -------- -------- -------- -------- --------

MEX-GOL

& SV 9.8 18.2 412 635 241 336 2,305 4,079

-------- -------- -------- -------- -------- -------- -------- --------

VAS 1.3 2.5 15 27 - - 265 497

-------- -------- -------- -------- -------- -------- -------- --------

Total 11.1 20.7 427 662 241 336 2,570 4,576

-------- -------- -------- -------- -------- -------- -------- --------

The disruption to production operations and the shut-in of the

fields during Q1 2022 meant that production volumes were materially

lower, both compared with Q1 2021 and the previous quarter. In

addition, drilling and remedial work on existing wells has been

stopped until there is an improvement in the situation in

Ukraine.

Notwithstanding the disruption to production operations, the

continuing high gas prices in Europe have fed through to Ukrainian

gas prices, which has benefited the sales prices being achieved by

the Company for its gas, as well as condensate and LPG. These

continued high hydrocarbons sales prices have helped to offset the

impact on revenues during the quarter due to the lower production

volumes.

Operations

Partial production operations are ongoing at the MEX-GOL and SV

fields, where a proportion of the wells have been put on

production, and currently the production rate is approximately

2,500 boepd. Other field operations, including the testing of the

SV-29 development well, the drilling of the SV-31 development well

and the workovers of the SV-2 and MEX-109 wells have been

suspended. In addition, construction work on the upgrades to the

gas processing facilities at the MEX-GOL and SV fields has also

been suspended.

Drilling of the SC-4 appraisal well at the SC licence and all

field operations at the VAS field have also been suspended.

Gas Price Regulation to Support Social Initiatives

The temporary and partial gas price regulation imposed by the

Ukrainian Government to support the production of certain food

products through the supply of gas at regulated prices to the

producers of such products is continuing to operate. Under this

scheme, all independent gas producers in Ukraine are required to

sell up to 20% of their natural gas production for the period until

30 April 2022 at a price set as the cost of sales of the relevant

gas producer (based on established accounting rules) for such gas,

plus a margin of 24%, plus existing subsoil production taxes (the

"Regulated Price"). This gas is then sold to specified producers of

designated socially important food products at the Regulated Price,

so as to reduce the energy costs of such producers during the

period through to 30 April 2022. The designated products are

certain types of flour, milk (with up to 2.5% fat), bread, eggs,

chicken and sunflower oil, for sale in the Ukrainian domestic

market. Further details are set out in the Company's announcement

dated 17 January 2022.

Subsoil Production and Excise Tax Changes

The Ukrainian Government has enacted changes to the subsoil

production tax rates applicable to gas production by modifying the

applicable rates based on gas prices, extending the incentive rates

for new wells for a further 10 years and making improvements to the

regulatory environment. These changes took effect on 1 March 2022,

and the legislation includes provisions that these rates will not

be increased for 10 years.

The new subsoil production tax rates are as follows:

(i) when gas prices are up to $150/Mm(3) , the rate for wells

drilled prior to 1 January 2018 ("old wells") is 14.5% for gas

produced from deposits at depths shallower than 5,000 metres and 7%

for gas produced from deposits deeper than 5,000 metres, and for

wells drilled after 1 January 2018 ("new wells") is 6% for gas

produced from deposits at depths shallower than 5,000 metres and 3%

for gas produced from deposits deeper than 5,000 metres;

(ii) when gas prices are between $150/Mm(3) and $400/Mm(3) , the

rate for old wells is 29% for gas produced from deposits at depths

shallower than 5,000 metres and 14% for gas produced from deposits

deeper than 5,000 metres, and for new wells is 12% for gas produced

from deposits at depths shallower than 5,000 metres and 6% for gas

produced from deposits deeper than 5,000 metres;

(iii) when gas prices are more than $400/Mm(3) , for the first

$400/Mm(3) , the rate for old wells is 29% for gas produced from

deposits at depths shallower than 5,000 metres and 14% for gas

produced from deposits deeper than 5,000 metres, and for new wells

is 12% for gas produced from deposits at depths shallower than

5,000 metres and 6% for gas produced from deposits deeper than

5,000 metres, and for the difference between $400/Mm(3) and the

actual price, the rate for old wells is 65% for gas produced from

deposits at depths shallower than 5,000 metres and 31% for gas

produced from deposits deeper than 5,000 metres, and for new wells

is 36% for gas produced from deposits at depths shallower than

5,000 metres and 18% for gas produced from deposits deeper than

5,000 metres.

Prior to the changes, the tax rate for old wells was 29% for gas

produced from deposits at depths shallower than 5,000 metres and

14% for gas produced from deposits deeper than 5,000 metres, and

for new wells was 12% for gas produced from deposits at depths

shallower than 5,000 metres and 6% for gas produced from deposits

deeper than 5,000 metres. The tax rates applicable to condensate

production were unchanged and remain at 31% for condensate produced

from deposits shallower than 5,000 metres and 16% for condensate

produced from deposits deeper than 5,000 metres, for both old and

new wells.

In addition, the excise tax of EUR52/ML applicable to LPG sales

was cancelled entirely with effect from 24 February 2022, and the

VAT rate applicable to condensate and LPG sales was reduced to 7%

(from 20%) with effect from 18 March 2022.

Cash Holdings

At 31 March 2022, the Company's cash resources were

approximately $81.3 million, comprised of $21.8 million equivalent

in Ukrainian Hryvnia and the balance of $59.5 million equivalent in

a combination of US Dollars, Pounds Sterling and Euros.

The Company has contributed funds and is intending to allocate

further funds to certain humanitarian aid organisations to assist

with the valuable work that such organisations are undertaking in

Ukraine.

VAS Licence Order for Suspension

The Company does not have any further information to report in

relation to the Order for suspension relating to the production

licence for the VAS field since the announcements made on 12 March

2019 and 19 March 2019 respectively, other than to report that the

legal proceedings issued in the Ukrainian Courts to challenge the

validity of the Order are ongoing, and the Com pany remains

confident that it will ultimately be successful in such legal

proceedings.

COVID-19 Pandemic

The Group continues to monitor the situation relating to the

COVID-19 pandemic, and to take any steps necessary to protect its

staff and operations. The Group remains acutely aware of the risks,

and is taking action to mitigate them where possible, with the

safety of individuals and communities continuing to be the

priority.

Sergii Glazunov, Chief Executive Officer, said : "The situation

in Ukraine is extremely challenging at present, but we continue to

focus on taking all available measures to protect our business and

ensure the safety and wellbeing of our personnel ."

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014, which forms part of United

Kingdom domestic law by virtue of the European Union (Withdrawal)

Act 2018, as amended.

For further information, please contact:

Enwell Energy plc Tel: 020 3427 3550

Chris Hopkinson, Chairman

Sergii Glazunov, Chief Executive Officer

Bruce Burrows, Finance Director

Strand Hanson Limited Tel: 020 7409 3494

Rory Murphy / Matthew Chandler

Arden Partners plc Tel: 020 7614 5900

Ruari McGirr / Elliot Mustoe (Corporate

Finance)

Simon Johnson (Corporate Broking)

Citigate Dewe Rogerson Tel: 020 7638 9571

Ellen Wilton

Dmitry Sazonenko, MSc Geology, MSc Petroleum Engineering, Member

of AAPG, SPE and EAGE, Director of the Company, has reviewed and

approved the technical information contained within this press

release in his capacity as a qualified person, as required under

the AIM Rules.

Definitions

bbl/d barrels per day

boepd barrels of oil equivalent per day

cf cubic feet measured at 20 degrees Celsius and

one atmosphere

LPG liquefied petroleum gas

ML thousand litres

Mm(3) thousand cubic metres

MMcf/d million cubic feet per day

% per cent

$ US Dollars

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDDLLFFLZLXBBE

(END) Dow Jones Newswires

April 13, 2022 02:00 ET (06:00 GMT)

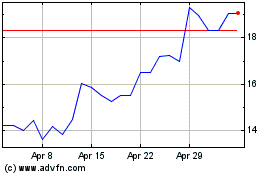

Enwell Energy (LSE:ENW)

Historical Stock Chart

From Jan 2025 to Feb 2025

Enwell Energy (LSE:ENW)

Historical Stock Chart

From Feb 2024 to Feb 2025