TIDMESYS

RNS Number : 3865U

essensys PLC

28 March 2023

28 March 2023

essensys plc

("essensys", the "Company" or the "Group")

Half year results

Revenue up 18%, accelerated strategy to drive profit and cash

generation

essensys plc (AIM:ESYS), the leading global provider of software

and technology to the flexible workspace industry, announces its

unaudited results for the six months ended 31 January 2023 ("H1

23"). All information relates to this period, unless otherwise

specified.

Financial summary:

GBPm unless otherwise stated Six months Six months Change

to January to January

2023 2022

Revenue 12.9 10.9 +18%

Recurring revenue(1) 10.6 9.9 +8%

Run Rate Annual Recurring Revenue

(ARR)(1) 21.0 20.3 +3%

Revenue at constant currency(2) 11.8 10.9 +8%

Recurring revenue at constant

currency(1,2) 9.8 9.9 -1%

Statutory loss before tax (7.7) (4.7) -64%

Adjusted EBITDA(3) (4.2) (2.9) -45%

Loss per share (pence) (11.89)p (7.63)p

Net Cash 12.6 30.5

Financial highlights:

-- Trading during H1 23 was in line with management's

expectations

-- Group total revenues up 18%, driven by strong growth

in North America

-- North American total revenues up 36% to GBP8.1m (up

18% in USD terms to $9.5m (H1 22 $8.0m)

-- High level of non-recurring revenue driven by new

site activity

-- Adjusted EBITDA loss of GBP4.2m in line with

management's expectations

-- Net cash of GBP12.6m with the Company remaining debt

free

Strategic highlights:

-- Accelerated strategy to drive profit and cash

generation -- as announced in February 2023

1. Reorganisation of global operations expected to

deliver GBP7.5m annualised cost savings

1. Move from regional to centralised leadership model to

deliver improved customer journey and operating

efficiencies

1. New Chief Revenue Officer to drive global

Go-To-Market strategy

-- Growing demand from new and existing strategic

customers4

1. 89% of new sites signed with strategic customers

1. US revenues continue to grow strongly, driven by new

logo wins and customer expansion

1. Strategic customers now represent 70% of revenue

1. Strategic customer Net Revenue Retention 109%, total

customer Net Revenue Retention 97%

1. Six new logos signed, of which four live in H1 23,

with further future expansion potential

1. Connect / essensys Platform total sites of 459, a

return to net growth with higher new sites than

closed (FY22: 458)

Current trading and outlook:

-- Trading during H1 23 was in line with management's

expectations

-- Cash burn in the second half is expected to normalise

following one-off impacts in H1 23 (including

payments for strategic inventory build which will

continue to unwind and payments for APAC data

centres)

-- Positive momentum continues in the beginning of the

second half:

1. The Group has 39 new Connect/essensys Platform sites

in delivery but not live at the end of H1 23 which

will deliver contracted ARR of GBP1.5m

1. Sales pipeline remains strong; currently in

late-stage conversations with a number of large high

quality landlords and operators who would become

strategic customers

-- The Group continues to manage its cost base

proactively to accelerate its return to profitability

and mitigate cost inflation with the reorganisation

announced in February 2023

-- The Group continues to expect to meet FY23 market

forecasts and remains confident in the longer-term

structural growth opportunity

Mark Furness, CEO of essensys, said:

"essensys delivered a strong performance during the first half

of the financial year, with Group revenues up 18% against a

backdrop of continued macroeconomic uncertainty. At the same time

we have accelerated our plans to return to profitability and cash

generation, taking significant measures to align our cost base and

investments to current revenues and the near-term market

opportunity.

Our focus on strategic customers is delivering strong results

and as these customers grow to meet the increasing demand for

premium flexible workspace products we remain well positioned to

support their expansion plans. Our opportunity pipeline with these

customers, both new and existing, is strong and growing with large

landlords and operators at the late stages of the sales process,

particularly in North America which remains our primary growth

market.

The global real-estate market is still in the early stages of

flex adoption as it adapts to hybrid/flexible working requirements

that are now embedded post-pandemic. With 30% of all office space

expected to be flexible by 2030, compared with less than 2% today,

the market opportunity remains sizeable. We remain confident in

meeting market expectations for FY23 and we continue to be excited

by the long-term global growth opportunity for essensys."

Notes

1. See CFO Review below for description and breakdown

2. Current period revenue and/or costs translated into GBP using

the average exchange rate for the comparative prior period

3. Adjusted EBITDA is earnings before interest, tax,

depreciation, amortisation, exceptional costs and other non-trading

items such as impairment, exchange differences and share option

charges

4. Strategic customers are those customers who have potential for at least $1m ARR

For further information, please contact:

+44 (0)20 3102

essensys plc 5252

Mark Furness, Chief Executive Officer

Sarah Harvey, Chief Financial Officer

Singer Capital Markets (Nominated Adviser +44 (0)20 7496

and Broker) 3000

Peter Steel / Harry Gooden / George Tzimas

FTI Consulting

Jamie Ricketts / Eve Kirmatzis / Talia Shirion +44 (0)20 3727

/ Victoria Caton 1000

About essensys plc

essensys is the leading global provider of software and

technology for flexible, digitally-enabled spaces, buildings and

portfolios. The essensys Platform simplifies and automates the

delivery and management of next generation, flexible, multi-tenant

real estate.

The real estate industry is transforming - it must be flexible

to changing market demands, accommodate hybrid working styles,

provide move-in ready spaces and deliver frictionless experiences

and on-demand services. The office sector is becoming an

increasingly digital-first landscape - driven by end-user demand

and delivering digitally enabled spaces is key to success. The

essensys Platform has been designed and developed to help solve the

complex operational challenges faced by landlords and flexible

workspace operators as they grow and scale their operations. It

helps our customers to deliver a simple, secure and scalable

proposition, respond to changing occupier demands, provide seamless

occupier experiences, and realise smart building and ESG

ambitions.

Founded in 2006 and listed on the AIM market of the London Stock

Exchange since 2019, essensys is active in the UK, Europe, North

America and APAC

Chief Executive Officer's Report

Continued growth

We continue to see strong performance in North America, where

total revenue increased by 36% and recurring revenue by 23%. The US

continues to be our key growth market providing a significant

market opportunity. We have a growing, high-quality sales pipeline

with new and existing strategic customers and many of these also

provide further international expansion opportunities.

The strong North American performance offset an 8% total revenue

decline in the UK which was driven primarily by the known site

closures and customer re-contracting announced in FY22, which had a

full period impact H1 23 compared with H1 22. This caused UK

recurring revenue to fall by 12%.

Across the Group we continued to see an increased level of churn

across our smaller, legacy customers, with 9 customers positioned

at the low-value end of the customer base leaving during the

period. This is an expected consequence of our focus on strategic

customers with our value proposition and aligning our product

development efforts to the needs of large landlords and real-estate

operators. We had no strategic customers leave us in the same

period and we added 13 new customers with further expansion

potential, mitigating the loss of those smaller customers.

Active sites increased by 1 on FY22 closing at 459. This is a

return to net site growth in H1 23 after two consecutive reporting

periods of net decline (site count FY21: 474; H1 22: 470; FY22:

458).

Market opportunity and strategic customer focus

Our confidence in the market opportunity for essensys continues

to be high. We have a well-established and proven plan to Land,

Expand and Grow to capture the opportunity in the flexible

workspace market. We continued to evolve that plan in light of

continuing macroeconomic uncertainty, to focus on efficient,

sustainable long-term growth.

We target new strategic customers that are key to our long-term

ambition and have the potential to deliver at least $1m ARR, whilst

further expanding and growing with our existing strategic customer

base. Our strategic customers had 109% net revenue retention

compared with 97% for the full customer base. As at 31 January 2023

strategic customers represented 70% of our total revenue in H1 23

(H1 22: 63%).

Our total sales pipeline with these strategic clients is strong,

with some exciting new large landlords and flexible workspace

operators at advanced stages in the sales process, particularly in

the US.

Accelerated strategy to drive profit and cash generation

As announced in the recent trading update on 28 February, the

Group has commenced a reorganisation of its global operations to

return it to sustainable growth, profitability and cash generation

whilst remaining within its existing cash reserves.

The Covid pandemic led to fundamental changes in how and where

we work, with the move to flexible and hybrid working models

accelerating long-term demand for flexible workspaces. As a result,

we significantly increased our investment in product development,

our global operations and our go-to-market strategy as we sought to

take advantage of this long-term secular growth opportunity. This

led to a major increase in headcount across all parts of the

business, the establishment of new regional headquarters and

operations with the appointment of CEOs for North America, UK &

Europe and APAC.

The pandemic has now given way to a period of increased

macro-economic uncertainty with inflationary and market pressures

forcing organisations of all size to adapt. Our business is no

different and so, whilst we remain undeterred in our long-term

ambition, we have taken the necessary steps to align our cost

structure with our current revenues and near-term customer demand.

The Board believes that accelerating its pathway to profitability

is critically important, and this has served as the primary motive

behind the reorganisation of the GroupÕs operations and personnel.

This reorganisation is expected to deliver a total of GBP7.5m

annualised cost savings and is expected to result in the Group

being run-rate Adjusted EBITDA positive during the first quarter of

FY24 and run-rate cash flow positive by the end of FY24. The Group

expects to maintain a minimum cash balance of at least GBP3m going

forward.

The reorganisation comprises a centralisation of the sales and

marketing function, reorganisation of operational capabilities and

streamlining of the executive and regional management

structures.

-- the Group's go-to-market capability has been centralised under the leadership of a newly appointed Chief Revenue

Officer, Daniel Brown, who will is now responsible for all sales and marketing activities globally;

-- the Group's APAC operations have been centralised in a hub location in Sydney, Australia, resulting in the

closure of its Singapore and Hong Kong based offices;

-- all Group customer operations have been streamlined into global functional teams which are expected to deliver an

improved customer journey with better alignment and lower cost to serve; and

-- collectively, these actions have removed the need for regional executive leadership. As a result, the regional

CEO positions have been removed. James Lowery, previously CEO for UK & Europe, has moved into role of Chief

Customer Officer.

As at 31 January 2023, only a limited element of the

reorganisation had been implemented and therefore the financial

information for H1 23 includes the costs associated with that

element of the reorganisation. The remaining costs will be

recognised in H2 23.

Board Changes

The Board has concluded that the reorganisation and resultant

simplification of operational structures has also removed the need

for the Chief Operating Officer ("COO") role. As a consequence, and

by mutual agreement, Alan Pepper will be leaving the business. Alan

has been a valued and important leader at essensys as CFO and COO

over the past five years, helping to oversee the significant

development of the business including its culture, strategy and

global operations. Alan has stepped down from the Board as an

executive director with immediate effect but will remain with the

business until the end of May 2023 to provide an orderly handover

of his responsibilities.

Progressing our strategy to capture the expanding market

opportunity

We continue to make good progress in the execution of our growth

plan and towards our longer-term strategic goals.

We continue to win new customers globally with the most recent

new live customers including large landlords in the US, Australia,

Singapore and Ireland, each presenting significant expansion

opportunities. Our existing customer base, particularly in the US,

is indicating continued growth over the coming years as they look

to increase the amount of flexible space they operate. We remain

engaged at senior levels with large commercial real estate

organisations, helping them to understand how essensys Platform can

help their transition to more flexible, digital-first real-estate

offerings and whilst most of these landlords are in the early phase

of flex adoption it is these strategic customers that will continue

to provide the Group with significant long-term expansion

opportunities.

Continued growth in the US

The North American market remains the primary growth driver for

the Group. Revenue growth of 36% (18% at constant currency) is

primarily driven by non-recurring revenue from new sites going

live, with site numbers up by four year on year to 300 (H1 22:

296). A number of our key customers are setting out their expansion

plans for the rest of this calendar year and beyond providing

visibility of expected future site growth. Evidence of the

structural shift to a more flexible way of working continues to

grow with an increasing number of landlords using essensys

to deliver flexible real-estate solutions as they continue to

repurpose traditional office space assets. Those engagements

involve a number of recognisable global real estate operators which

each individually provide the opportunity for significant long term

account growth.

UK & Europe

We continue to see activity levels rebound in both the UK and

mainland Europe. We have upsold essensys Platform to an existing

large Operate customer in France, have expanded into Europe with

one of our large US customers and have added new sites in Ireland

in the first half of this financial year.

As previously announced, the UK experienced a higher level of

site closures with the increased churn of our smaller legacy

customers. We also saw continued site rationalisation with some

large UK customers as they have exercised their option to close

sites within their current contract. This contract mechanic allows

them to close an agreed number of sites within the contract period,

this is primarily used if the customer is exiting that

location.

This customer site rationalisation during FY22 led to a decline

in UK revenue and site numbers. H1 23 has seen some continuation of

this trend as some customers continue to optimise their portfolios.

We believe this optimisation is necessary and will serve to

strengthen our customers businesses and our relationship with them

and so will continue to provide this flexibility for our largest

partners.

APAC

We onboarded 3 new sites with new and existing strategic

customers in Australia and Singapore in H1 23, with additional new

strategic clients signed with sites due to go live over the coming

quarter. Our recent reorganisation will see our APAC team primarily

focused on sales and customer success with all associated

operational support provided centrally from the Group. Our pipeline

in the region is strong, and we have signed the first 4 sites with

a multi-site operator that we believe will be a key strategic

customer for APAC and serve as a powerful case study.

Product development

Our targeted investment in our products continues, primarily

through the evolution of essensys Platform. The focus of our

development efforts is tightly tied to the requirements of

strategic customers, ensuring that our solutions solve specifically

for the needs of large-scale landlords and flex operators. This

year we have enhanced its core functionality and also added new

capability that is designed to extend essensys Platform further

into the spaces themselves, as we seek to help landlords connect

their existing tenants digitally to the amenities and communal

spaces in their buildings. We see this trend continuing as

enterprises of all size adopt hybrid models and landlords respond

by providing access to a wide variety of digitally connected spaces

across their portfolios.

We're excited by the progress we've made with our Smart Access

IoT (Internet of Things) hardware product which leverages the

ubiquity of smartphone wallets to create a seamless book-pay-access

experience for occupiers. This solution will converge access

control, booking and a sensor gateway to provide a powerful answer

to the problem of managing real-time access and control of space in

today's dynamic and flex-enabled world. We are currently expecting

final CE and FCC certification of the hardware components shortly

before the end of FY23.

Last year we announced a capital-light model which allows us to

take advantage of essensys Platform's new capabilities to reduce

the requirement for future essensys data centre expansion. This

de-couples our global private network from our software and allows

essensys Platform to be deployed over existing third-party internet

connectivity. We expect this to remove entry barriers for many new

customers and support existing customer expansion, as well as

reducing sales cycle length and speeding up onboarding. We also

expect that, over time, this will lead to an improvement in

per-site gross margins as cost of goods will significantly reduce

if we do not provide the lower margin network element of the

solution. Initial customer feedback has been very positive,

particularly as this is an option which is provided alongside our

global private network which remains of significant value to large

premium space operators due to its design and performance.

Current trading and outlook

We had an encouraging first half in terms of new business

activity and continue to see strong customer dynamics into the

second half of FY23. Our sales pipeline is growing, underlying

customer occupancy appears to have stabilised and both our operator

and landlord customers are reporting increased occupier demand. The

developments in our software platform also continue to progress

well with positive engagement with our large customers giving

confidence in our strategy.

We remain confident that the underlying structural shift towards

more flexible working in real estate is here to stay and we are

excited by the long-term global opportunity for essensys. Pipeline

activity is increasing with new and existing customers and we are

able to demonstrate a unique platform to support our customers'

expansion plans.

Like all businesses, we are mindful of the ongoing macroeconomic

environment and are keeping the Group's financial investment plans

under constant review. Our committed plan for accelerated return to

profitability and cash generation provides us with a sustainable

base for future growth. We remain confident in meeting market

expectations for FY23.

Mark Furness

Chief Executive Officer

28 March 2023

Chief Financial Officer's Report

The unaudited financial results included in this announcement

cover the Group's consolidated activities for the six months ended

31 January 2023. The comparatives for the previous six months were

for the Group's consolidated activities for the six months ended 31

January 2022.

Financial Key Performance Indicators

GBP'm unless otherwise stated Six months Six months Change

to January to January

2023 2022

Group Total Revenue 12.9 10.9 +18%

North America 8.1 5.9 +36%

UK & Europe 4.5 4.9 -8%

APAC 0.3 0.1

Recurring Revenue [1] 10.6 9.9 +8%

North America 6.4 5.2 +23%

UK & Europe 4.0 4.6 -12%

APAC 0.2 0.1

Recurring Revenue %age of Total 82.2% 90.8%

Run Rate Annual Recurring Revenue

(1) 21.0 20.3 +3%

Recurring Revenue at constant

currency 9.8 9.9 -1%

North America 5.6 5.2 +6%

UK & Europe 4.0 4.6 -11%

APAC 0.2 0.1

Non-recurring revenue 2.3 1.0 +112%

Gross Profit 7.3 6.9 +6%

Gross Profit percentage 56.8% 62.8%

Recurring Revenue margin %age 61.0% 65.2%

Statutory loss before tax (7.7) (4.7) -64%

Adjusted EBITDA [2] (4.2) (2.9) -45%

Cash 12.6 30.5 -59%

Revenue

Group total revenue grew 18% to GBP12.9m in H1 23 (H1 22

GBP10.9m). The solid momentum witnessed in the second half of FY22

has continued into the current financial year, with strong growth

in North America, particularly the US which continues to be our key

growth market. Total revenue in North America was up by 36% (22% in

local currency), mitigating the decline in the UK as we see the

wash through of previously announced FY22 site closures. Our APAC

region grew revenue in H1 23 with an increase in sites with

existing customers and deals signed with new customers contributing

GBP0.3m of revenue, noting that this region was only established

during H1 22.

Recurring revenue comprises income invoiced for services that

are repeatable, and are consumed and delivered on a monthly basis

over the term of a customer contract. Run Rate Annual Recurring

Revenue (Run Rate ARR) is an annualisation of the recurring revenue

for the month identified (January 2023); this is used by management

as an indication of the annual value of the recurring revenue for

that month and to monitor long term revenue growth of the

business.

Recurring revenue increased by 8% compared to H1 22 (-1% decline

at constant currency). North America recurring revenue grew by 23%

(6% at constant currency) following a net increase in site numbers

to 300 (from 296 as at 31 January 2022) and higher value activity

with large customers. UK & Europe recurring revenue declined by

12% as a result of the full period impact of the FY22 customer

re-contracting, and consolidation at the low end of the customer

base.

Run Rate ARR increased by 3% year on year reflecting the higher

value customer base and increase in sites but decreased by 4% from

FY22 year end as a result of some specific customer re-contract

activity, a continued decline in the Operate revenue stream and the

known loss of a UK customer from in the final month of FY22. These

factors offset the positive impact of higher average value sites

opened compared with sites closed during the period.

Gross margins

Gross profit increased by 6% in the period but overall gross

margins reduced as a result of a higher proportion of non-recurring

revenue. Recurring gross margin was also reduced as a result of the

higher proportion of revenue generated in North America, where the

components of recurring margins are generally lower margin than the

UK, with higher circuit cost revenue and lower marketplace revenue.

Gross margin is further impacted by an increase in the fixed

operational running costs of data centres in the period, with a

full period impact of the APAC region.

Administrative expenses

Excluding depreciation, amortisation and impairment charges,

administrative expenses grew by GBP2.6m (27%) compared to the prior

period. This growth was primarily driven by the full year impact of

headcount increases during FY22, particularly in the second half of

that year. Marketing expenditure and professional fees in the

period were also higher, reflecting a full period impact of the

APAC region with brand building activity and legal and compliance

cost.

Statutory loss for the half year

The Group incurred a GBP7.7.m statutory loss before tax for the

half year to January 2023 (H1 FY22: loss of GBP4.7m), analysed as

follows:

GBP'm H1 FY23 H1 FY22

UK (including non-capitalised

R&D) (2.6) (0.9)

US 0.2 (0.3)

Canada (0.1) -

Europe (0.2) (0.3)

Asia Pacific (2.4) (0.7)

Central costs (2.5) (2.3)

Loss before tax (before share

based payment expenses) (7.6) (4.5)

Share based payment expense (0.1) (0.2)

Loss before tax for the period (7.7) (4.7)

======== ========

The UK continues to bear the cost of the Group's product and

software development teams to the extent that these are not

capitalised.

Adjusted EBITDA

As previously reported, adjusted results are presented to

provide a more comparable indication of the Group's core business

performance by removing the impact of share-based payment expenses,

exceptional costs (where material and non-recurring), and other,

non-trading, items that are reported separately. Adjusted results

exclude adjusting items as set out in the consolidated statement of

comprehensive income and as below, with further details given in

the notes to the unaudited interim financial information below,

where applicable. In addition, the Group also measures and presents

performance in relation to various other non-GAAP measures, such as

recurring revenue, run-rate annual recurring revenue and revenue

growth as shown and defined above.

Adjusted results are not intended to replace statutory results.

These have been presented to provide users with additional

information and analysis of the Group's performance, consistent

with how the Board monitors results on an ongoing basis.

Adjusted EBITDA (being EBITDA prior to share based payment

expenses, impairment charges and exceptional items) is calculated

as follows:

GBP'm H1 FY23 H1 FY22

Operating (loss) (7.7) (4.7)

Add back:

Depreciation & Amortisation 2.3 1.6

Impairment charge 0.6 -

EBITDA (4.8) (3.1)

Add back:

Share Option Charge 0.1 0.2

Exceptional costs 0.5 -

-------- --------

Adjusted EBITDA (4.2) (2.9)

======== ========

The Adjusted EBITDA loss for the half year was GBP1.3m higher

than H1 FY22 due to the full period impact of headcount increases

during FY22 and a full period impact of investment in the APAC

region.

Taxation

The tax charge incurred by the Group in the prior year is in

relation to calculated income tax payable in the US.

Cash

Cash at the half year end was GBP12.6m. The Group continues to

maintain sufficient cash reserves to fund its working capital

requirements and its return to cash generating operations. The

Group has no debt.

In light of the continued impacts of global macroeconomic

uncertainty, the Board has considered a number of different

scenarios regarding trading and financial performance over the

balance of this financial year and into FY24 and is confident that,

in the event of a significant long-term downturn, the Group will

have sufficient cash resources.

Working capital movements

The Group had a GBP3.3m negative working capital impact during

H1 23 as a result of one-off payments for a significant inventory

purchase to mitigate supply chain issues and price increases in

addition to a wider creditor unwind following FY22.

Leasehold payments

The Group had a full period cash impact of leasehold payments

for data centres and office space in the APAC region and an end to

the rent-free period of UK leasehold space.

Capitalised Software Development Costs

As previously reported, the Group continues to invest heavily in

product development. These costs are now all borne in the UK as the

Group ceased work in its outsourced offshore development centre at

the start of FY23. Where such work is expected to result in future

revenue, costs incurred that meet the definition of software

development in accordance with IAS38, Intangible Assets, are

capitalised in the statement of financial position. During the half

year the Group capitalised GBP1.8m in respect of software

development (H1 FY22: GBP1.5m).

Capital Expenditure

In addition to the capitalisation of software development costs

noted above, the Group made its final payments in relation to data

centre equipment for the expansion of its private network in the

APAC region. Capital expenditure in the period was GBP0.5m (H1 FY22

GBP0.3m).

Sarah Harvey

Chief Financial Officer

28 March 2023

UNAUDITED INTERIM FINANCIAL INFORMATION OF ESSENSYS PLC

GROUP

Consolidated statement of comprehensive income

Six months Six months

ended ended

31 January 31 January

2023 2022

GBP'000 GBP'000

Note (unaudited) (unaudited)

------------ ------------

Revenue 3 12,909 10,928

Cost of sales (5,580) (4,068)

------------ ------------

Gross profit 7,329 6,860

Administrative expenses (14,955) (11,220)

Expected credit loss provision charge (86) (324)

Other operating income - 4

------------ ------------

Operating loss (7,712) (4,680)

Operating loss analysed by:

Operating loss before share based payments

and exceptional items (7,054) (4,479)

Share based payment expenses (137) (201)

Exceptional restructuring costs (521) -

Finance income 127 9

Finance expense (67) (49)

Loss before taxation (7,652) (4,720)

Taxation - (195)

------------ ------------

Loss for the period (7,652) (4,915)

Other comprehensive loss

Exchange differences arising on translation

of foreign operations (518) 197

------------ ------------

Total comprehensive loss for the period (8,170) (4,718)

============ ============

Loss per share

Basic and diluted loss per share 4(11.89p) (7.63p)

UNAUDITED INTERIM FINANCIAL INFORMATION OF ESSENSYS PLC

GROUP

Consolidated statement of financial position

As at As at

31 January 31 July

2023 2022

GBP'000 GBP'000

Note (unaudited) (audited)

------------- -----------

ASSETS

Non-current assets

Intangible assets 5 9,706 8,922

Property, plant and equipment 6 2,387 2,819

Right of use assets 7 1,588 2,482

------------- -----------

13,681 14,223

============= ===========

Current assets

Inventories 3,084 2,546

Trade and other receivables 6,966 6,434

Cash at bank and in hand 10 12,601 24,122

------------- -----------

22,651 33,102

============= ===========

TOTAL ASSETS 36,332 47,325

============= ===========

EQUITY AND LIABILITIES

Equity

Shareholders' equity

Called up share capital 8 161 161

Share premium 51,660 51,660

Share based payment reserve 2,945 2,811

Merger reserve 28 28

Retained earnings (26,870) (18,700)

------------- -----------

Total equity 27,924 35,960

============= ===========

Non-current liabilities

Lease liabilities 9 981 1,659

Deferred tax - -

Total non- current liabilities 981 1,659

============= ===========

Current liabilities

Trade and other payables 4,837 7,422

Contract liabilities 3 1,136 815

Lease liabilities 9 1,454 1,469

Current taxes - -

------------- -----------

7,427 9,706

============= ===========

TOTAL LIABILITIES 8,408 11,365

============= ===========

TOTAL EQUITY AND LIABILITIES 36,332 47,325

============= ===========

UNAUDITED INTERIM FINANCIAL INFORMATION OF ESSENSYS PLC

GROUP

Consolidated statement of changes in equity

Share

based

Share Share payment Merger Retained

capital premium reserve Reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------- -------- --------- --------- --------- --------

Balance at 1 August

2022 (audited) 161 51,660 2,811 28 (18,700) 35,960

Comprehensive Income

Loss for the period - - - - (7,652) (7,652)

Currency translation

differences - - (3) - (518) (521)

Total comprehensive

loss - - (3) - (8,170) (8,173)

-------- -------- --------- --------- --------- --------

Transactions with owners

Currency translation - - - - - -

differences

Share based payment expense - - 137 - - 137

Balance at 31 January

2023 (unaudited) 161 51,660 2,945 28 (26,870) 27,924

======== ======== ========= ========= ========= ========

Balance at 1 August 2021

(as restated) 161 51,660 2,045 28 (8,484) 45,410

Comprehensive Income

Loss for the period - - - - (4,915) (4,915)

Currency translation

differences - - 6 - 191 197

-------- -------- --------- ---------

Total comprehensive loss - - 6 - (4,724) (4,718)

-------- -------- --------- --------- --------- --------

Transactions with owners

Currency translation - - - - - -

differences

Share based payment expense - - 201 - - 201

Balance at 31 January

2022 (unaudited) 161 51,660 2,252 28 (13,208) 40,962

======== ======== ========= ========= ========= ========

Prior year adjustment

The opening reserves on the comparatives for the consolidated

statement of changes in equity have been restated to incorporate

the correct accounting treatment under IAS 12 - Income Taxes for

the offset of deferred tax assets against deferred tax liabilities

where the balances are relating to the same tax authority. The

impact of the adjustment was to reduce the deferred taxation

liability in the financial year 2021 by GBP485,000 and increase

distributable reserves by the same amount. The prior year

adjustment did not have an impact on the brought forward position

as at 1 August 2022.

UNAUDITED INTERIM FINANCIAL INFORMATION OF ESSENSYS PLC

GROUP

Consolidated cash flow statements

Six months Six months

ended ended

31 January 31 January

2023 2022

GBP'000 GBP'000

(unaudited) (unaudited)

------------ ------------

Cash flows from operating activities

Loss before taxation (7,652) (4,720)

Adjustments for non-cash/non-operating

items:

Amortisation of intangible assets 1,056 701

Depreciation of property, plant and equipment 628 343

Impairment of property, plant and equipment 305 -

Amortisation of right-of-use assets 602 524

Impairment of right-of-use assets 303 -

Share based payment expense 137 201

Finance income (127) (9)

Finance expense 67 49

Receipts from government grants treated

as income - (4)

------------ ------------

(4,681) (2,915)

Changes in working capital:

Increase in inventory (538) (253)

Increase in trade and other receivables (529) (789)

Decrease in trade and other payables (2,277) (326)

------------ ------------

Cash (used by)/from operations (8,025) (4,283)

Taxation (paid)/received - (90)

Net cash (used)/from operating activities (8,025) (4,373)

Cash flows from investing activities

Purchase of intangible assets (1,840) (1,513)

Purchase of property, plant and equipment (486) (332)

Interest received 127 9

Net cash used in investing activities (2,199) (1,836)

------------ ------------

Cash flows from financing activities

Receipts from government grants - 4

Repayment of lease liabilities (779) (413)

Interest on lease liabilities (67) (49)

Net cash used in financing activities (846) (458)

------------ ------------

Net decrease in cash and cash equivalents (11,070) (6,667)

Cash and cash equivalents beginning of

period 24,122 36,903

Effects of foreign exchange rate changes (451) 217

------------ ------------

Cash and cash equivalents at end of

period 12,601 30,453

============ ============

UNAUDITED INTERIM FINANCIAL INFORMATION OF ESSENSYS PLC

GROUP

Notes to the unaudited interim financial information

1. Basis of preparation

The unaudited condensed interim financial information presents

the consolidated financial results of essensys plc and its wholly

owned subsidiaries (together, "essensys plc Group" or "the Group")

for the six-month period to 31 January 2023. The annual financial

statements of the Group are prepared in accordance with the UK

adopted international accounting standards and as applied in

accordance with the provisions of the Companies Act 2006. The

condensed set of financial statements included in this half-yearly

financial report has been prepared in accordance with International

Accounting Standard 34 Interim Financial Reporting. This financial

information does not include all disclosures that would otherwise

be required in a complete set of financial statements and should be

read in conjunction with the Annual Report for the year ended 31

July 2022. The financial information for the half year ended 31

January 2023 does not constitute statutory accounts within the

meaning of Section 434 (3) of the Companies Act 2006 and both

periods are unaudited.

The comparative financial information presented herein for the

year ended 31 July 2022 does not constitute full statutory accounts

for that period. The statutory Annual Report and Financial

Statements for the year ended 31 July 2022 have been filed with the

Registrar of Companies. The Independent Auditors' Report on the

Annual Report and Financial Statements for the year ended 31 July

2022 was unqualified, did not draw attention to any matters by way

of emphasis and did not contain a statement under 498(2) or 498(3)

of the Companies Act 2006.

The Group has applied the same accounting policies and methods

of computation in its interim consolidated financial statements as

in its 2022 annual financial statements, except for those that

relate to new standards and interpretations effective for the first

time for periods beginning on (or after) 1 January 2022 and will be

adopted in the 2023 financial statements. There were no new

standards impacting the Group that will be adopted in the annual

financial statements for the year ended 31 July 2023.

essensys plc is the Group's ultimate parent company. It is a

public listed company and is domiciled in the United Kingdom. The

address of its registered office and principal place of business is

Aldgate Tower 7th Floor, 2 Leman Street, London E1 8FA. essensys

plc's shares are listed on the Alternative Investment Market (AIM)

of the London Stock Exchange.

2. Going Concern

The consolidated financial statements have been prepared on a

going concern basis. In reaching their assessment, the directors

have considered a period extending at least twelve months from the

date of approval of this half yearly financial report.

The directors have prepared cash flow forecasts covering the 16

month period up to the end of July 2024 (FY24). As well as

modelling the realisation of the sales pipeline, these forecasts

also cover a number of scenarios and sensitivities in order for the

Board to satisfy itself that the Group remains within its current

cash facilities. At 31 January 2023 the Group had cash reserves of

GBP12.6m and no debt.

Whilst the Directors are confident in the Group's ability to

grow revenue, the Board's sensitivity modelling shows that the

Group can remain within its cash facilities in the event that

revenue growth is delayed (i.e. new sales bookings are not achieved

or are offset by continued attrition) for a period in excess of

twelve months. The Directors' financial forecasts and operational

planning and modelling also include the actions, under the control

of the Group, that they could take to further reduce the cash

outflow expected as the Group expands geographically. On the basis

of this financial and operational modelling, the Directors believe

that the Group has the capability and the operational agility to

react quickly, cut further costs from the business and ensure that

the cost base of the business is aligned with its revenue and

funding scale. The Board is mindful of general levels of inflation

and cost increases that may impact the business. The Group is

confident that its capability to adjust its future investment plans

and reduce its cost base will sufficiently mitigate any impact from

cost inflation.

Based on the sensitised cash flow forecasts prepared, the

directors are confident that any funding needs required by the

business will be sufficiently covered by the existing cash

reserves.

As a consequence, the Directors have a reasonable expectation

that the Group can continue to operate and be able to meet its

commitments and discharge its liabilities in the normal course of

business for a period of not less than twelve months from the date

of release of these interim financial statements. Accordingly, they

continue to adopt the going concern basis in preparing the interim

financial statements.

Notes to the unaudited interim financial information

3. Segmental reporting

The Group has one single business reportable segment which is

the provision of software and technology platforms that manage the

critical infrastructure and business processes, primarily to the

flexible workspace segment of the real estate industry. The Group

has two revenue segments and three geographical segments, as

detailed in the tables below.

The Group generates revenue from the following activities:

- Establishing services at customer sites (e.g. providing and

managing installation services, equipment and providing training on

software and services)

- Recurring monthly fees for using the Group's platforms

- Revenue from usage of on demand services such as internet and

telephone usage and other, on demand, variable services.

- Other ad-hoc services

The Group has one single business reportable segment which is

the provision of software and technology platforms that manage

their critical infrastructure and business processes, primarily to

the flexible workspace industry.

The Group has two main revenue streams, the essensys

Platform/Connect and Operate. Given that support for both revenue

streams is provided in such a way as to make cost and therefore

operating performance impractical, the two revenue streams are

combined into a single reportable segment. The essensys plc Group's

revenue per revenue stream is as follows:

The Group operates in three main geographic areas, North

America; the United Kingdom & Europe; and Asia Pacific region.

The Group's revenue per geographical area is as follows:

Six months Six months

ended ended

31 January 31 January

2023 2022

unaudited unaudited

GBP'000 GBP'000

----------- -----------

North America 8,063 5,948

United Kingdom & Europe 4,501 4,904

Asia Pacific 345 76

12,909 10,928

=========== ===========

The Group has two main revenue streams, the essensys

Platform/Connect and Operate. The Group's revenue per revenue

stream is as follows:

Six months Six months

ended ended

31 January 31 January

2023 2022

unaudited unaudited

GBP'000 GBP'000

----------- -----------

Connect/essensys Platform - software enabled

infrastructure platform 12,029 10,020

Operate - workspace management software 880 908

12,909 10,928

=========== ===========

Group revenue disaggregated between revenue recognised 'at a

point in time' and 'over time' is as follows:

Six months Six months

ended ended

31 January 31 January

2023 2022

unaudited unaudited

GBP'000 GBP'000

----------- -----------

Revenue recognised at a point in time 2,281 1,075

Revenue recognised over time 10,628 9,853

12,909 10,928

=========== ===========

Notes to the unaudited interim financial information

3. Segmental reporting (continued)

Revenue from customers greater than 10% in each reporting period

is as follows:

Six months Six months

ended ended

31 January 31 January

2023 2022

unaudited unaudited

GBP'000 GBP'000

----------- -----------

Customer 1 3,565 2,037

Contract assets and liabilities

Contract asset movements were as follows:

Unaudited GBP000

-------

At 1 August 2022 887

Transfers in the period from contract assets to

trade receivables (556)

Excess of revenue recognised over cash (or rights

to cash) being recognised during the period 217

Capital asset contract contributions capitalised 10

Capital asset contract contributions released

as contract obligations are fulfilled (2)

Capitalised commission cost released as contract

obligations fulfilled (21)

Commission costs capitalised on contracts 5

-------

At 31 January 2023 540

=======

Audited GBP000

At 1 August 2021 345

Transfers in the period from contract assets to

trade receivables (85)

Excess of revenue recognised over cash (or rights

to cash) being recognised during the period 558

Capital asset contract contributions capitalised 37

Capital asset contract contributions released

as contract obligations are fulfilled (28)

Capitalised commission cost released as contract

obligations fulfilled (111)

Commission costs capitalised on contracts 171

-------

At 31 July 2022 887

=======

Contract liability movements were as follows:

Unaudited GBP000

-------

At 1 August 2022 815

Amounts included in contract liabilities that

were recognised as revenue during the period (815)

Cash received and receivables in advance of performance

and not recognised as revenue during the period 1,136

At 31 January 2023 1,136

=======

Audited GBP000

At 1 August 2021 323

Amounts included in contract liabilities that

were recognised as revenue during the period (323)

Cash received and receivables in advance of performance

and not recognised as revenue during the period 815

At 31 July 2022 815

=======

Contract assets are included within 'trade and other

receivables' and contract liabilities is shown separately on the

face of the statement of financial position. Contract assets arise

from the group's revenue contracts, where work is performed in

advance of invoicing customers, and contract liabilities arise

where revenue is received in advance of work performed.

Cumulatively, payments received from customers at each balance

sheet date do not necessarily equal the amount of revenue

recognised on the contracts. Capital asset contract contributions

represents costs incurred by the Group in the form of customer

incentives spread over the life of the customer contract.

Commission costs capitalised on contracts represents internal sales

commission costs incurred on signing of customer contracts and, in

line with the requirements of IFRS15, spread over the life of the

customer contract.

Notes to the unaudited interim financial information

4. Loss per share

The loss per share has been calculated using the loss for the

period and the weighted average number of ordinary shares

outstanding during the period, as follows:

Six months Six months

ended ended

31 January 31 January

2023 2022

unaudited unaudited

GBP'000 GBP'000

----------- -----------

Loss for the period attributable to equity

holders of essensys Group (7,652) (4,915)

----------- -----------

Weighted average number of ordinary shares 64,385,219 64,385,219

----------- -----------

Loss per share (11.89p) (7.63p)

=========== ===========

As the Group is loss making in both periods presented, the share

options over ordinary shares have an anti-dilutive effect and

therefore no dilutive loss per share is disclosed.

5. Intangible assets

Unaudited Assets Customer Internal

in course software

of construction relationships development Software Goodwill Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------- -------------- ------------ --------- --------- -------

Cost

At 1 August 2022 215 335 13,116 280 1,263 15,209

Transfers (215) - 215 - - -

Additions - - 1,840 - - 1,840

---------------- -------------- ------------ --------- --------- -------

At 31 January

2023 - 335 15,171 280 1.263 17,049

================ ============== ============ ========= ========= =======

Amortisation

At 1 August 2022 - 335 5,550 280 122 6,287

Charge for year - - 1,056 - - 1,056

----------------

At 31 January

2023 - 335 6,606 280 122 7,343

================ ============== ============ ========= ========= =======

Net book value

At 31 January

2023 - - 8,565 - 1,141 9,706

================

At 31 July 2022 215 - 7,566 - 1,141 8,922

================ ============== ============ ========= ========= =======

Audited Assets Customer Internal

in course software

of construction relationships development Software Goodwill Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------- -------------- ------------ --------- --------- -------

Cost

At 1 August 2021 1,412 335 7,832 280 1,263 11,122

Additions 215 - 3,872 - - 4,087

Transfers (1,412) - 1,412 - - -

---------------- -------------- ------------ --------- --------- -------

At 31 July 2022 215 335 13,116 280 1,263 15,209

================ ============== ============ ========= ========= =======

Amortisation

At 1 August 2021 - 335 4,309 280 - 4,924

Charge for year - - 1,241 - - 1,241

Impairment - - - - 122 122

----------------

At 31 July 2022 - 335 5,550 280 122 6,287

================ ============== ============ ========= ========= =======

Net book value

At 31 July 2022 215 - 7,566 - 1,141 8,922

================

At 31 July 2021 1,412 - 3,523 - 1,263 6,198

================ ============== ============ ========= ========= =======

Notes to the unaudited interim financial information

6. Property, plant and equipment

Unaudited Fixtures Computer Leasehold

and fittings equipment improvements Total

GBP000 GBP000 GBP000 GBP000

-------------- ----------- -------------- -------

Cost

At 1 August 2022 242 10,605 686 11,533

Additions - 421 65 486

Exchange adjustments - (23) - (23)

At 31 January 2023 242 11,003 751 11,996

============== =========== ============== =======

Depreciation

At 1 August 2022 207 8,109 398 8,714

Charge for year 5 588 35 628

Impairment - 305 - 305

Exchange adjustments - (38) - (38)

At 31 January 2023 212 8,964 433 9,609

Net book value

At 31 January 2023 30 2,039 318 2,387

At 31 July 2022 35 2,496 288 2,819

============== =========== ============== =======

Audited Fixtures Computer Leasehold

and fittings equipment improvements Total

GBP000 GBP000 GBP000 GBP000

-------------- ----------- -------------- -------

Cost

At 1 August 2021 382 8,387 130 8,899

Additions 34 1,504 3 1,541

Disposals (188) - (33) (221)

Transfers (note

7) - 180 584 764

Exchange adjustments 14 534 2 550

At 31 July 2022 242 10,605 686 11,533

============== =========== ============== =======

Depreciation

At 1 August 2021 322 7,020 86 7,428

Charge for year 29 564 24 617

Disposals (152) - (33) (185)

Transfers (note

7) - 129 318 447

Exchange adjustments 8 396 3 407

At 31 July 2022 207 8,109 398 8,714

Net book value

At 31 July 2022 35 2,496 288 2,819

At 31 July 2021 60 1,367 44 1,471

============== =========== ============== =======

As a result of the reorganisation that has centralised the

Group's APAC operations in Sydney, Australia and the evolution of

the 'capital light' strategy, Management have reviewed the carrying

value of assets within the APAC region and have impaired those

assets where the carrying value was in excess of their recoverable

value resulting in an impairment of GBP305,000 and as such the

impairment charge has been booked in this period.

Transfers represent right of use assets which reached their

contract term and where legal title transferred to the Group.

Notes to the unaudited interim financial information

7. Right of use assets

Unaudited Leasehold Computer Leasehold

property equipment improvements Total

GBP000 GBP000 GBP000 GBP000

---------- ---------- ------------- -------

Cost

At 1 August 2022 7,049 162 - 7,211

Additions - - - -

Lease remeasurement - - - -

Transfers (note - - - -

6)

Exchange adjustments (6) - - (6)

At 31 January

2023 7,043 162 - 7,205

Depreciation

At 1 August 2022 4,567 162 - 4,729

Charge for year 602 - - 602

Transfers (note - - - -

6)

Impairment 303 - - 303

Exchange adjustments (17) - - (17)

At 31 January

2023 5,455 162 - 5,617

Net book value

At 31 January

2023 1,588 - - 1,588

At 31 July 2022 2,482 - - 2,482

Audited Leasehold Computer Leasehold

property equipment improvements Total

GBP000 GBP000 GBP000 GBP000

---------- ---------- ------------- -------

Cost

At 1 August 2021 5,482 342 584 6,408

Additions 1,062 - - 1,062

Lease remeasurement 1,136 - - 1,136

Disposal (872) - - (872)

Transfers (note

15) - (180) (584) (764)

Exchange adjustments 241 - - 241

At 31 July 2022 7,049 162 - 7,211

Depreciation

At 1 August 2021 3,693 278 277 4,248

Charge for year 1,214 13 41 1,268

Disposal (462) - - (462)

Transfers (note

15) - (129) (318) (447)

Exchange adjustments 122 - - 122

At 31 July 2022 4,567 162 - 4,729

Net book value

At 31 July 2022 2,482 - - 2,482

At 31 July 2021 1,789 64 307 2,160

As a result of the reorganisation that has centralised the

Group's APAC operations in Sydney, Australia and the evolution of

the 'capital light' strategy, Management have reviewed the carrying

value of the right of use assets within the APAC region and have

impaired those assets where the carrying value was in excess of

their recoverable value resulting in an impairment of GBP303,000

and as such the impairment charge has been booked in this

period.

The transfers are assets that were classified as right of use

assets where the lease term expired and the Group chose to purchase

the assets at the end of the lease term, as they were still in

active use within the Group. The assets are now listed within note

6.

Notes to the unaudited interim financial information

8. Called up share capital

As at As at

31 January 31 July

2023 2022

unaudited audited

No. No.

----------- ----------

Allotted, called up and fully paid

0.25p ordinary shares 64,385,219 64,385,219

=========== ==========

31 January 31 July

2023 2022

unaudited audited

GBP'000 GBP'000

----------- ----------

Allotted, called up and fully paid

0.25p ordinary shares 161 161

=========== ==========

9. Lease liabilities

Unaudited Leasehold Fixtures Computer Leasehold

and

Property fittings equipment improvements Total

GBP000 GBP000 GBP000 GBP000 GBP000

---------- --------- ---------- ------------- -------

At 1 August 2022 3,128 - - - 3,128

Additions - - - - -

Interest expense 79 - - - 79

Effect of modifying - - - - -

lease term

Variable lease

payment adjustment 78 - - - 78

Lease payments (858) - - - (858)

Foreign exchange

movements 8 - - - 8

At 31 January

2023 2,435 - - - 2,435

========== ========= ========== ============= =======

Analysis by current and non-current:

Unaudited

Leasehold Fixtures Computer Leasehold

and

property Fittings equipment improvements Total

GBP000 GBP000 GBP000 GBP000 GBP000

---------- --------- ---------- ------------- -------

Due within a year 1,454 - - - 1,454

Due in more than

one year 981 - - - 981

2,435 - - - 2,435

========== ========= ========== ============= =======

Notes to the unaudited interim financial information

9. Lease liabilities (continued)

Audited Leasehold Fixtures Computer Leasehold

and

property fittings equipment improvements Total

GBP000 GBP000 GBP000 GBP000 GBP000

---------- --------- ---------- ------------- --------

At 1 August 2021 1,841 29 20 45 1,935

Additions 1,061 - - - 1,061

Interest expense 145 1 - 1 147

Effect of modifying

lease term 877 - - - 877

Lease payments (944) (30) (20) (46) (1,040)

Foreign exchange

movements 148 - - - 148

At 31 July 2022 3,128 - - - 3,128

========== ========= ========== ============= ========

Analysis by current and non-current:

Audited

Leasehold Fixtures Computer Leasehold

and

property fittings equipment improvements Total

GBP000 GBP000 GBP000 GBP000 GBP000

---------- --------- ---------- ------------- -------

Due within a year 1,469 - - - 1,469

Due in more than

one year 1,659 - - - 1,659

3,128 - - - 3,128

========== ========= ========== ============= =======

10. Financial instruments

Financial assets

Financial assets measured at amortised cost comprise trade

receivables, other receivables, accrued income and cash, as

follows:

As at As at

31 January 31 July

2023 2022

unaudited audited

GBP'000 GBP'000

------------ ---------

Cash and cash equivalents 12,601 24,122

Trade and other receivables 5,307 4,707

17,908 28,829

============ =========

Financial liabilities

Financial liabilities measured at amortised cost comprise trade

payables, accruals, other payables and lease liabilities, as

follows:

As at As at

31 January 31 July

2023 2022

unaudited audited

GBP'000 GBP'000

----------- --------

Trade and other payables 4,551 7,178

Lease liabilities 2,435 3,128

6,986 10,306

=========== ========

Notes to the unaudited interim financial information

11. Financial instruments (continued)

The Group's activities expose it to a variety of financial

risks:

á Market risk (including foreign exchange risk, price

risk and interest rate risk)

á Credit risk

á Liquidity risk

The financial risks relate to the following financial

instruments:

á Cash and cash equivalents

á Trade and other receivables

á Trade and other payables

Risk management is carried out by the key management personnel.

Key management personnel include all the directors of the Company

and the senior management and directors of essensys (UK) Limited,

the Group's principal trading subsidiary, who together have

authority and responsibility for planning, directing, and

controlling the activities of the Group. The key management

personnel identify and evaluate financial risks and provide

principals for overall risk management.

(a) Credit Risk

Credit risk is the risk of financial loss to the Group if a

customer fails to meet its contractual obligations. The Group is

mainly exposed to credit risk from credit sales. It is Group

policy, implemented locally, to assess the credit risk of new

customers before entering contracts. There has been no change to

the credit risk in the period.

(b) Market risk

(i) Foreign exchange risk

Foreign exchange risk arises because the Group operates in the

United Kingdom, Europe, North America and the Asia Pacific region,

whose functional currency is not the same as the presentational

currency of the Group. Foreign exchange risk also arises when

individual companies within the group enter into transactions

denominated in currencies other than their functional currency.

Such transactions are kept to a minimum either through the choice

of suppliers or presenting sales invoices in the functional

currency.

Certain assets of the group companies are denominated in foreign

currencies. Similarly, the Group has financial liabilities

denominated in those same currencies. In general, the Group seeks

to maintain the financial assets and financial liabilities in each

of the foreign currencies at a reasonably comparable level, thus

providing a natural hedge against foreign exchange risk and

reducing foreign exchange exposure to a minimal level.

(ii) Interest rate risk

The Group's interest rate exposure arises mainly from the

interest-bearing borrowings. All the Group's facilities were

floating rates excluding interest from leases, which exposed the

group to cash flow risk. As at 31 January 2023 there are no loans

outstanding. Therefore, there is no material exposure to interest

rate risk.

(c) Liquidity Risk

Prudent liquidity risk management implies maintaining sufficient

cash flows for operations. The Group manages its risk to shortage

of funds by monitoring forecast and actual cash flows. The Group

monitors its risk to a shortage of funds using a recurring

liquidity planning tool. This tool considers the majority of both

its borrowings and payables.

10. Post balance sheet events

Following the period end the Group announced a Group

reorganisation which positions it for sustainable growth,

profitability and a return to cash generation. This includes the

simplification of global operations and moves the Group from a

regional to a functional structure. The cost of activity undertaken

by 31 January 2023 of GBP521,000 is reflected in the unaudited half

year financial information as exceptional costs; the cost of the

remaining activity will be recognised in the second half of the

financial year ending 31 July 2023.

UNAUDITED INTERIM FINANCIAL INFORMATION OF ESSENSYS PLC

INDEPENDENT REVIEW REPORT TO ESSENSYS PLC

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 31

January 2023 is not prepared, in all material respects, in

accordance with UK adopted International Accounting Standard 34 and

the London Stock Exchange AIM Rules for Companies.

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 31 January 2023 which comprises the consolidated

statement of comprehensive income, the consolidated statement of

financial position, the consolidated statement of changes in

equity, the consolidated cash flow statement and the related

explanatory notes that have been reviewed.

Basis for conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410, "Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity" ("ISRE (UK) 2410"). A review of interim financial

information consists of making enquiries, primarily of persons

responsible for financial and accounting matters, and applying

analytical and other review procedures. A review is substantially

less in scope than an audit conducted in accordance with

International Standards on Auditing (UK) and consequently does not

enable us to obtain assurance that we would become aware of all

significant matters that might be identified in an audit.

Accordingly, we do not express an audit opinion.

As disclosed in note 1, the annual financial statements of the

group are prepared in accordance with UK adopted international

accounting standards. The condensed set of financial statements

included in this half-yearly financial report has been prepared in

accordance with UK adopted International Accounting Standard 34,

"Interim Financial Reporting.

Conclusions relating to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

conclusion section of this report, nothing has come to our

attention to suggest that the directors have inappropriately

adopted the going concern basis of accounting or that the directors

have identified material uncertainties relating to going concern

that are not appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with ISRE (UK) 2410, however future events or conditions

may cause the group to cease to continue as a going concern.

Responsibilities of directors

The directors are responsible for preparing the half-yearly

financial report in accordance with

the London Stock Exchange AIM Rules for Companies which require

that the half-yearly report be presented and prepared in a form

consistent with that which will be adopted in the Company's annual

accounts having regard to the accounting standards applicable to

such annual accounts.

In preparing the half-yearly financial report, the directors are

responsible for assessing the company's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the company or to cease

operations, or have no realistic alternative but to do so.

Auditor's responsibilities for the review of the financial

information

In reviewing the half-yearly report, we are responsible for

expressing to the Company a conclusion on the condensed set of

financial statement in the half-yearly financial report. Our

conclusion, including our Conclusions Relating to Going Concern,

are based on procedures that are less extensive than audit

procedures, as described in the Basis for Conclusion paragraph of

this report.

Use of our report

Our report has been prepared in accordance with the terms of our

engagement to assist the Company in meeting the requirements of the

rules of the London Stock Exchange AIM Rules for Companies for no

other purpose. No person is entitled to rely on this report unless

such a person is a person entitled to rely upon this report by

virtue of and for the purpose of our terms of engagement or has

been expressly authorised to do so by our prior written consent.

Save as above, we do not accept responsibility for this report to

any other person or for any other purpose and we hereby expressly

disclaim any and all such liability.

BDO LLP

Chartered Accountants

London, UK

27 March 2023

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

[1] See Revenue section for explanation

[2] See Adjusted EBITDA explanation below

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR JRMTTMTBTTJJ

(END) Dow Jones Newswires

March 28, 2023 02:00 ET (06:00 GMT)

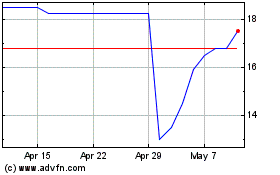

Essensys (LSE:ESYS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Essensys (LSE:ESYS)

Historical Stock Chart

From Dec 2023 to Dec 2024