RNS Number:9607M

First Artist Corporation PLC

30 November 2006

30 November 2006

First Artist Corporation Plc

Preliminary Results for the period ended 31 August 2006

First Artist Corporation Plc (AIM:FAN) is one of the leading marketing and

entertainment management agencies in the UK today, with a full-service group

that includes wealth management, events, sponsorship, media marketing and sports

and entertainment representation.

Further acquisitions in the period, along with continued organic and synergistic

growth from ongoing businesses has seen the group transformed, in particular

into the Entertainment and Media sectors, whilst strategically growing its

Sports representation business to become a leading force in all the major

European markets.

KEY POINTS

The performance highlights from the last 10 month period compared to the

previous 12 months are:

* Turnover up 62% to #9,508,000

* EBITA* up 63% to #1,720,000

* Profit before tax up 57% to #1,267,000

* EPS before taxation, amortisation of goodwill and exceptional costs

1.01p,

* Net assets per share up 27% to 4.7 pence

* Consolidated net assets up 54% to #5,089,000

*(Earnings before interest, tax and amortisation (EBITA) is stated before

exceptional administrative expenses)

We have successfully completed the acquisition and integration of three

businesses that have strengthened the representation division and extended the

range of services that we offer into new business areas:

* ProActive Scandinavia A/S (renamed First Artist Scandinavia A/S) - Sport

Representation

* NCI Management Limited - Entertainment Representation Agency

* Sponsorship Consulting Limited - Corporate Sponsorship Advisors

Jon Smith, Chief Executive of First Artist Corporation commented:

'Another strong performance during the period has seen our acquisition strategy,

focussed on acquiring earnings enhancing businesses that will generate new

revenues through synergy with the rest of the group, transform a company, with a

significant dependency on a single source of revenue, to a broad-based group

with stable and growing, year-round income streams. The synergies within the

Group are not only revenue-generating; they also position First Artist as a key

player in the media marketplace through its involvement at different stages in

the content generation process.'

For further information please contact:

FIRST ARTIST CORPORATION PLC

Jon Smith, Chief Executive: +44 (0) 208 900 1818

Richard Hughes, Group Managing Director

Dawnay Day Corporate Finance

David Floyd: +44 (0) 0207 509 4570

Hudson Sandler Financial & Corporate Communications

Michael Sandler: +44 (0) 207 710 8916

CHAIRMAN'S STATEMENT

I am happy to report on another strong set of results, which demonstrates just

how exciting the future is for First Artist Corporation. This is now a

fully-fledged media, representation and management Group, rooted in high-quality

personal service. We enjoy strong relationships with our clients from the worlds

of sport and entertainment and this is a highly valuable asset in today's media

landscape.

STABLE GROWTH FROM A BROADER BASE

The strength and stability of our broader business model is shown by a 63% rise

in EBITA*, and the fact that the Group was able to report a profit at its

interim results for the first time. The Group is benefiting from a deliberate

strategy to reduce its dependence on football and the seasonal revenues that it

provides whilst continuing to grow this profitable and highly regarded division

and strengthen its position within its market. Non-football businesses now

account for 56% of the Group's turnover and strong growth is evident in our

wealth management, entertainment and events businesses.

We are proud to have developed a corporate culture dedicated to supporting

successful businesses and providing them with opportunities for further growth.

The synergies within the Group have already resulted in significant

cross-referral of new business, whilst First Artist Corporation's infrastructure

and international network provides our newly acquired businesses with important

strategic opportunities.

The three new acquisitions made this period have further broadened the Group's

income base, increasing the size of our entertainment division, opening up

exciting new opportunities in the field of sponsorship, and establishing a truly

pan-European player representation network.

TAKING A LEAD IN CORPORATE RESPONSIBILITY

A responsible approach to business is a key element of the First Artist

positioning, and provides us with a valuable competitive edge in each of our

markets.

First Artist Sport has long argued for stricter regulation of the player

representation business, and is co-operating fully with the English Premier

League inquiry. We believe that this will hasten the consolidation of the player

representation business around professional, respected and credible agents and

that our reputation for honesty and integrity will therefore become a major

asset in the medium-term.

It is a firm principle of our player representation business that sportsmen and

women should never be exploited beyond their own best interests. We carefully

manage commercial activities to allow rest and recuperation, and protect our

clients' most important asset: their performance on the field. This sensitive

approach to representation ensures quality service and strong client

relationships.

Sponsorship Consulting has a proud record advancing the role of sponsorship in

Corporate Responsibility (CR) strategy and we look forward to this continuing as

part of First Artist Corporation.

DEWYNTERS

We look forward to a successful EGM confirming the acquisition of Dewynters.

This will be a significant milestone in our Group's growth and development. We

look forward to working with Anthony Pye-Jeary and his team over the coming

years

Jarvis Astaire

Chairman

29 November 2006

*(Earnings before interest, tax and amortisation (EBITA) is stated before

exceptional administrative expenses)

CHIEF EXECUTIVE'S STATEMENT

I would like to thank all at First Artist Corporation for their diligent efforts

in a hugely important period. We have successfully integrated the events and

wealth management businesses acquired at the end of last year, boosted our

offering in entertainment and opened up major new opportunities in sponsorship.

The result is a broad, full-service and highly profitable media and

entertainment management group and the strength of this positioning is clearly

demonstrated by this period's results.

First Artist has been transformed in the last two periods to become a strong and

growing integrated business benefiting from strong synergies and increasing

cross referral of business between group companies. This strength has allowed us

to now take that quantum leap forward with the acquisition of marketing services

and advertising group Dewynters, which we hope to be confirmed at the

forthcoming Extraordinary General Meeting.

Led by Anthony Pye-Jeary, Dewynters is the UK's leading entertainment and

theatre media business, dominating London's West End theatre marketing, but also

working with a considerable number of clients in the Arts and Culture sector,

all of which have natural synergies with the rest of the group, in particular

events and sponsorship. The group has a rapidly expanding US merchandising

operation based in New York and Las Vegas and with the increasing number of

shows moving east and west across the Atlantic the future looks very good for

this business and the benefits it can bring to First Artist.

Upon the successful completion of this acquisition and to reflect the level of

expansion of First Artist, Richard Hughes will become Group Managing Director,

whilst Simon Bent will step up to become our Prospective Group Finance Director.

Julianne Coutts will also join us and become Group Company Secretary and Head of

Human Resources.

Phil Smith will remain as Chief Operating Officer with special responsibility

for the Sport and Entertainment divisions.

I would very much like to thank Vincenzo Morabito for his significant and

continuing contribution to this group. Vincenzo is stepping down as a Group

Board Director to become Group Head of Football, concentrating his talents and

efforts co-ordinating the development of and communications between our 3 main

football offices and associated agents worldwide.

Vincenzo will join the Executive Management Board, which consists of the

Directors of each divisional group company. This Board has direct responsibility

to promote cross referral opportunities, ensure the quality of internal

communications and promote group management responsibilities.

2006 Divisional Performance

Optimal Wealth Management (formerly ABG Financial Management) is now established

as a cornerstone of the Group delivering a 35% increase in turnover and a 95%

increase in operating profit on the like for like audited 12 month periods ended

June 2006 and 2005. The changes in pension regulation introduced in April on "A

day" have resulted in significant new business, the benefits of which we believe

will continue for sometime. Optimal has also benefited sizably from increasing

cross referral of business from within the group. Our joint venture with the Top

25 audit firm HW Fisher will provide a new market for the high quality, in-depth

financial advice offered by the company. Optimal is now a vital part of the

integrated service provided by our sport and entertainment representation

businesses.

Our event management company, The Finishing Touch, also enjoyed a strong period,

with turnover increasing by 11% on the like for like audited 12 month periods

ended April 2006 and 2005. Our joint venture with Lord Coe's Complete Leisure

Group is a significant transaction that we believe will deliver sizable benefits

to each company in the coming years.

The acquisition of NCI Management has transformed the scale of First Artist

Entertainment. The enlarged company's expertise in discovering talent and

developing the media brand of clients such as Dr. Gillian McKeith, Amanda Lamb

and Peter Schmeichel will be a key element in First Artist Entertainment's

strategy going forward.

Sponsorship Consulting, which was acquired in August 2006, will play a key role

in the future development of the First Artist Group. Our activities in sport and

entertainment have always produced significant opportunities to refer

sponsorship-related business and Sponsorship Consulting will allow us to provide

these services from within the Group.

Finally, the arrival of First Artist Scandinavia (formerly Proactive

Scandinavia) completes the establishment of a truly pan-European First Artist

Management network, with our operations centred in Denmark and Italy as well as

the UK. This will produce both a broader income base and new strategic

opportunities for our player management business.

We fully support the English Premier League inquiry into the way football

transfers are conducted and are working to introduce more transparency to the

industry through discussions with the FA and FIFA, and our role as a founding

Board Member of the Football Agents Association. We believe that the

consolidation of the industry around professional, credible agents will deliver

long term benefits to First Artist Management.

Ongoing Group Development

Our approach to building the Group has centred on finding strong, successful

businesses and then providing them with a rich environment for finding

additional revenues. The natural synergies of the Group have delivered major new

business opportunities for Optimal Wealth Management and The Finishing Touch,

and First Artist's existing international network will give a significant

strategic advantage to Sponsorship Consulting.

We will look to make further acquisitions over the next year, where we identify

businesses that will find similar opportunities to grow within the Group. The

transformation of our business will allow us to expand our offer into TV

production and other areas of sponsorship and management, producing still more

synergies and opportunities for growth.

It is a disappointment to us that the share price of the Group has yet to

reflect the transformation of our business. Our profits growth, continued

expansion, earnings enhancing acquisitions, diversity and visibility of

earnings, strong balance sheet and cash flows we hope, will lead to a

strengthening share price on the Market, where the Group currently trades at a

p/e ratio significantly below the sector average.

We are actively working with analysts and the media to correct any outdated

perceptions of our business in the city and we look forward to seeing the

advances made by the Group more closely reflected in future trading.

Jon Smith

Chief Executive Officer

29 November 2006

CONSOLIDATED PROFIT AND LOSS ACCOUNT

FOR THE PERIOD ENDED 31 AUGUST 2006

Continuing

operations Acquisitions Total

10 months 10 months 10 months Year

ended ended ended ended

31 August 31 August 31 August 31 October

2006 2006 2006 2005

#000 #000 #000 #000

TURNOVER 8,402 1,106 9,508 5,861

Cost of sales (3,086) (82) (3,168) (1,325)

-------- -------- -------- --------

GROSS PROFIT 5,316 1,024 6,340 4,536

Administrative expenses (4,231) (559) (4,790) (3,686)

-------------------------- -------- -------- -------- --------

EBITA before exceptional

administrative expenses 1,255 465 1,720 1,054

Exceptional administrative

expenses (170) - (170) (161)

Goodwill impairment and

amortisation - - - (43)

-------------------------- -------- -------- -------- --------

OPERATING PROFIT 1,085 465 1,550 850

======== ========

Interest receivable 21 11

Interest payable (304) (52)

-------- --------

PROFIT ON ORDINARY

ACTIVITIES BEFORE TAXATION 1,267 809

Taxation (502) (299)

-------- --------

RETAINED PROFIT FOR THE

PERIOD / YEAR 765 510

======== ========

EARNINGS PER SHARE 0.83 0.89

Basic earnings per share pence pence

======== ========

Fully diluted earnings per

share 0.81 0.88

pence pence

======== ========

CONSOLIDATED BALANCE SHEET

AS AT 31 AUGUST 2006

31 August 31 October

2006 2005

#000 #000

FIXED ASSETS

Intangible assets 9,517 5,295

Tangible assets 835 719

Investments 118 -

-------- --------

10,470 6,014

-------- --------

CURRENT ASSETS

Debtors 6,895 4,746

Cash at bank and in hand 1,108 1,527

-------- --------

8,003 6,273

CREDITORS: Amounts falling due within one year (7,709) (5,055)

-------- --------

NET CURRENT ASSETS 294 1,218

-------- --------

TOTAL ASSETS LESS CURRENT LIABILITIES 10,764 7,232

CREDITORS: Amounts falling due after more than one

year (2,252) (1,303)

PROVISIONS for liabilities and charges (3,423) (2,623)

-------- --------

NET ASSETS 5,089 3,306

======== ========

CAPITAL AND RESERVES

Called up share capital 270 224

Capital redemption reserve 15 15

Share premium account 8,849 7,888

Shares to be issued 5 -

Profit and loss account (4,050) (4,821)

-------- --------

EQUITY SHAREHOLDERS' FUNDS 5,089 3,306

-------- --------

CONSOLIDATE CASH FLOW STATEMENT

FOR THE PERIOD ENDED 31 AUGUST 2006

10 months Year

ended ended

31 August 31 October

2006 2005

#000 #000

Cash inflow/(outflow) from operating activities 80 (12)

Returns on investments and servicing of finance (102) (35)

Taxation (450) (4)

Capital expenditure and financial investment (241) (3)

Acquisitions and disposals (2,749) (2,126)

------- -------

CASH OUTFLOW BEFORE FINANCING (3,462) (2,180)

Financing 3,071 3,095

------- -------

(DECREASE) / INCREASE IN CASH IN THE PERIOD / YEAR (391) 915

======= =======

RECONCILIATION OF NET CASH FLOW TO MOVEMENT IN NET DEBT

10 months Year

ended ended

31 August 31 October

2006 2005

#000 #000

(Decrease)/increase in cash in the period (391) 915

Cash from increase in debt financing (2,173) (1,412)

New finance leases 34 -

Loan notes and additional funding (623) -

------- -------

(3,153) (497)

NET DEBT AT 1 NOVEMBER 2005 (648) (151)

------- -------

NET DEBT AT 31 AUGUST 2006 (3,801) (648)

======= =======

STATEMENT OF RECOGNISED GAINS AND LOSSES

FOR THE PERIOD ENDED 31 AUGUST 2006

10 months Year

ended ended

31 August 31 October

2006 2005

#000 #000

Profit for the financial period/year 765 510

Currency translation differences on net foreign

currency investments 6 (56)

------- -------

Total recognised gains and losses relating to the

period/year 771 454

======= =======

NOTES

1. BASIS OF ACCOUNTING

The financial information contained in this report does not constitute

statutory accounts within the meaning of Section 240 of the Companies act 1985.

The financial information contained in this report has been extracted from the

audited accounts of the Company for the year to 31st August 2006 for which the

auditors have given an unqualified report.

The financial statements have been prepared under the historical cost convention

and in accordance with applicable accounting standards in the United Kingdom.

10 months Year

ended ended

31 August 31 October

2006 2005

2. TAXATION #000 #000

Current tax:

UK corporation tax charge on profits of

the period 351 106

Foreign taxes 175 118

Adjustments in respect of previous periods (24) -

------- -------

Current tax charge for the period 502 224

Deferred taxation:

Origination and reversal of timing differences - 75

------- -------

Tax charge on profit on ordinary activities 502 299

======= =======

3. EARNINGS PER SHARE

The calculation of earnings per share are based on the following profits and

number of shares:

10 months Year

ended ended

31 August 31 October

2006 2005

#000 #000

Profit on ordinary activities after taxation 765 510

======= =======

2006 2005

No of Shares No of Shares

For basic earnings per share 92,664,723 57,034,181

Dilutive effect of share options 2,181,826 1,005,773

---------- -----------

For diluted earnings per share 94,846,549 58,039,954

========== ===========

4. RESERVES AND RECONCILIATION OF MOVEMENT IN SHAREHOLDERS' FUNDS

Profit

Shares Capital and Total

Share to be redemption Share Loss shareholders'

capital issued reserve premium account funds

#000 #000 #000 #000 #000 #000

GROUP

1 November 2005 224 - 15 7,888 (4,821) 3,306

Retained profit for

the financial period - - - - 765 765

Share placement issue 42 - - 963 - 1,005

Shares issued to vendors

to acquire subsidiary

undertakings 2 - - 69 - 71

Shares issued to vendors

as deferred consideration 1 - - 35 - 36

Shares to be issued to

vendors as deferred

consideration - 5 - - - 5

Shares issued 1 - - 14 - 15

Issue costs - - - (120) - (120)

Exchange adjustments - - - - 6 6

------- ------- ------- ------- ------- -------

31 August 2006 270 5 15 8,849 (4,050) 5,089

======= ======= ======= ======= ======= =======

Profit

Shares Capital and Total

Share to be redemption Share Loss shareholders'

capital issued reserve premium account funds

#000 #000 #000 #000 #000 #000

COMPANY

1 November 2005 224 - 15 7,888 (5,432) 2,695

Retained profit/(loss)

for the financial

period - - - - 1,385 1,385

Share placement issue 42 - - 963 - 1,005

Shares issued to vendors

to acquire subsidiary

undertakings 2 - - 69 - 71

Shares issued to vendors

as deferred consideration 1 - - 35 - 36

Shares to be issued to

vendors as deferred

consideration - 5 - - - 5

Shares issued 1 - - 14 - 15

Issue costs - - - (120) - (120)

------- ------- ------- ------- ------- -------

31 August 2006 270 5 15 8,849 (4,047) 5,092

======= ======= ======= ======= ======= =======

10 months Year

ended ended

31 August 31 October

5. CASH FLOWS 2006 2005

#000 #000

Reconciliation of operating profit to net cash

inflow / (outflow) from operating activities

Operating profit 1,550 850

Depreciation 73 65

Impairment of goodwill - 43

(Profit)/loss on disposals of fixed assets (9) 5

(Increase) in debtors (1,389) (1,608)

(Decrease)/increase in creditors (151) 689

Exchange differences 6 (56)

------- -------

Net cash inflow / (outflow) from operating

activities 80 (12)

------- -------

6. ANNUAL REPORT

Copies of the Annual report and Financial Statements will be will be

circulated to Shareholders shortly and may be obtained after the posting date

from the Company Secretary, First Artist Corporation plc, First Artist House,

87 Wembley Hill Road, Middlesex, HA9 8BU, or from the Companies Website

www.firstartist.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR BLBLTMMBTBBF

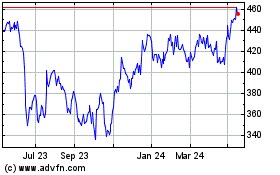

Volution (LSE:FAN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Volution (LSE:FAN)

Historical Stock Chart

From Jul 2023 to Jul 2024