TIDMFAR

RNS Number : 1735O

Ferro-Alloy Resources Limited

30 January 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF THE MARKET ABUSE REGULATION (EU) NO. 596/2014 (INCLUDING AS IT

FORMS PART OF THE LAWS OF ENGLAND AND WALES BY VIRTUE OF THE

EUROPEAN UNION (WITHDRAWAL) ACT 2018 ("MAR").

30 January 2023

Ferro-Alloy Resources Limited

("Ferro-Alloy" or the "Company")

Trading update, operational update and receipt of grant funding

for electrolyte

Ferro-Alloy Resources Limited (LSE:FAR), the vanadium producer

and developer of the large Balasausqandiq vanadium deposit in

Southern Kazakhstan , announces a general trading update, an update

on the planned expansion of the existing processing plant treating

purchased concentrates and the receipt of Kazakhstan grant funding

for a vanadium electrolyte project

Trading Update

During Q4 2022 and primarily in December, the Company

experienced delays in the delivery of concentrates to the

processing plant which resulted in reduced output. The Company

therefore focused on the initiation of nickel concentrate

production which partially mitigated the impact but did not fully

make up the shortfall. Consequently, the trading results for the

final quarter of 2022 and the first half of January 2023 have been

lower than anticipated.

Concentrate deliveries have now started to arrive at the plant

site in significant quantities and, to help avoid repetition of the

shortfall, the Company has signed a new regular concentrate

delivery contract with an additional supplier, the first

consignment of which is scheduled for delivery at the plant site in

March 2023.

Nevertheless, the shortfall of production experienced during the

final quarter of 2022, and in particular December, will negatively

impact the Company's 2022 financial results. Gross revenue for the

year ended 31 December 2022 is expected to be in the region of

US$6.8m with a net loss expected to be in the region of US$3.3m,

lower than current market expectations, subject to the finalisation

of the year end accounts. The Company's cash position at 31

December 2022 was US$4.2m (2021: US$2.8m).

Existing Processing Plant Update

Vanadium pentoxide circuit

The design of the Company's new dissociation oven to convert AMV

to vanadium pentoxide, for which a higher price is obtained, has

been modified to allow for the future production of various oxides

of vanadium as part of the electrolyte project noted above. The

oven is in transit to the plant and will be commissioned

immediately upon receipt. A previous dissociation oven, procured

for this purpose in 2021, was diverted to the more profitable use

of drying calcium molybdate prior to smelting to produce

ferro-molybdenum.

The Company has also installed a further press-filter which is

used in a subsequent process to re-pulpate the solid residues and

achieve an additional recovery of vanadium, increasing the overall

recovery of vanadium from the concentrates.

Ferro-molybdenum circuit

The augmentation of the molybdenum recovery circuit has been

completed and is operating well. The capacity of the molybdenum

extraction process has almost doubled, although the actual amount

produced will depend on the molybdenum content of the purchased

concentrates.

Nickel circuit

After extraction of vanadium and molybdenum from the purchased

concentrates, the solid residues contain low grades of nickel

which, until the end of 2021, were sold at relatively low prices.

Since the beginning of 2022, the nickel-rich residues have been

stockpiled and the Company has installed a new roasting oven and

associated equipment to upgrade the nickel content to a level which

can be sold at commercial nickel concentrate prices or further

treated to produce ferro-nickel.

The circuit operates by way of a roasting and leaching process

to upgrade the concentrate to a grade which can be sold for around

half of the prevailing international nickel metal price. During

December 2022, the Company tested the process and developed the

appropriate operating regimes, producing 6.8 tonnes of contained

nickel in concentrate.

The process produces an additional by-product comprising sodium

hydroaluminate which can also be potentially sold, providing a

possible third revenue stream.

The flexibility to use the new equipment for nickel

concentration or further vanadium production, and the option to

further treat the nickel concentrate to make ferro-nickel, will

allow the Company to optimise the configuration to suit the

availability of concentrates, local product and reagent prices and

thereby maximise profitability.

Vanadium Electrolyte Grant Funding

The Company's wholly owned Kazakhstan subsidiary, TOO Firma

Balausa ("Balausa"), is to receive grant funding of KZT300 million

(approximately US$638,000) (the "Grant") for the development of

technology for the production of mixed vanadium oxides for use in

vanadium redox flow batteries ("VRFBs"). The Grant funding will be

received by Balausa during the course of 2023 and 2024.

The decision to award the Grant was made by Kazakhstan's

National Scientific Council which awarded the Grant for the most

promising commercialisation of the results of scientific and

scientific-technical activities.

Balausa will provide contributing funding of KZT60 million

(approximately US$128,000). The total funding will be used to

install the equipment needed at the existing plant to manufacture

the mixed vanadium oxides required to produce vanadium electrolyte

and to procure and install test-equipment and a VRFB at the

premises of the Physical-Technical Institute in Almaty, a part of

the Satbayev University.

After further development and testing of the technology and the

evaluation of the performance of the VRFB, the project involves the

production and sale by Balausa, on a commercial basis, of three

tonnes of mixed vanadium oxides. Balausa will have ownership of all

project assets and will receive all revenues, continuing after the

project period.

The project is scheduled to last for 26 months, after which the

Company plans to continue the production of vanadium oxides to

satisfy any regional demand for electrolyte or for other

purposes.

The Company announced on 2 September 2020 that it had developed

and patented the technology to produce vanadium electrolyte

directly from ammonium metavanadate ("AMV"). The ability to make

vanadium electrolyte directly from AMV provides not only the

required know-how to enter this market, but also a cost advantage

over traditional processes. The Grant will enable the next steps to

be taken to progress the commercialisation of vanadium

electrolyte.

Outlook for 2023

The Company believes that both the production and financial

results for 2023 are likely to be significantly better than 2022

and result in the Company being operationally profitable because

of:

-- increased quantity of concentrates to be treated;

-- increased recoveries of vanadium, molybdenum and nickel from each tonne treated;

-- higher prices expected for vanadium as a result of the

conversion of AMV to vanadium pentoxide or other oxides; and

-- return to more normal levels of transport, fuel and reagent

costs which in 2022 were impacted by the ending of the pandemic and

the commencement of the Ukrainian invasion.

The main activity in 2023 will continue to be the completion of

the feasibility study into the giant Balasausqandiq vanadium

project, expected in Q4 2023.

Nick Bridgen, CEO, commented : "The completion of these plans

means that we are now recovering far more value from each tonne of

concentrate treated, greatly increasing operating margins. Together

with the new procurement contract, which should greatly increase

the tonnes throughput, the impact on 2023 should be

substantial."

S

For further information, visit www.ferro-alloy.com or contact:

Ferro-Alloy Resources Nick Bridgen (CEO) info@ferro-alloy.com

Limited / William Callewaert

(CFO)

Shore Capital Toby Gibbs/John More

(Joint Corporate Broker) +44 207 408 4090

Liberum Capital Limited Scott Mathieson/William

(Joint Corporate Broker) King +44 20 3100 2000

St Brides Partners

Limited

(Financial PR & IR Catherine Leftley/Ana

Adviser) Ribeiro +44 207 236 1177

Notes to Editors

About Ferro-Alloy Resources Limited:

The Company's operations are all located at the Balasausqandiq

deposit in the Kyzylordinskaya Oblast in the South of Kazakhstan.

Currently the Company has two main business activities:

a) the high grade Balasausqandiq vanadium project (the

"Project"); and

b) an existing vanadium concentrate processing operation (the

"Existing Operation").

Balasausqandiq is a very large deposit, with vanadium as the

principal product together with several by-products. Owing to the

nature of the ore, the capital and operating costs of development

are very much lower than for other vanadium projects.

A reserve on the JORC 2012 basis has been estimated only for the

first ore-body (of five) which amounts to 23 million tonnes, not

including the small amounts of near-surface oxidised material which

is in the Inferred resource category. In the system of reserve

estimation used in Kazakhstan the reserves are estimated to be over

70m tonnes in ore-bodies 1 to 5 but this does not include the full

depth of ore-bodies 2 to 5.

There is an existing concentrate processing operation at the

site of the Balasausqandiq deposit. The production facilities were

originally created from a 15,000 tonnes per year pilot plant which

was then adapted to treat concentrates and expanded. Further

expansion is being undertaken which is expected to result in

annualised production capacity of around 1,500 tonnes of contained

vanadium pentoxide plus significant by-product molybdenum.

The strategy of the Company is to develop both the Project and

the Existing Operation in parallel. Although they are located on

the same site and use some of the same infrastructure, they are

separate operations.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCSEFSUUEDSEDF

(END) Dow Jones Newswires

January 30, 2023 02:00 ET (07:00 GMT)

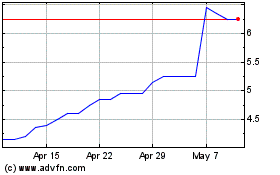

Ferro-alloy Resources (LSE:FAR)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ferro-alloy Resources (LSE:FAR)

Historical Stock Chart

From Feb 2024 to Feb 2025