TIDMFAR

RNS Number : 4103H

Ferro-Alloy Resources Limited

27 July 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF THE MARKET ABUSE REGULATION (EU) NO. 596/2014 (INCLUDING AS IT

FORMS PART OF THE LAWS OF ENGLAND AND WALES BY VIRTUE OF THE

EUROPEAN UNION (WITHDRAWAL) ACT 2018 ("MAR").

27 July 2023

Ferro-Alloy Resources Limited

("Ferro-Alloy" or the "Group" or the "Company")

Launch of Bond Programme and Listing of First Tranche

Ferro-Alloy Resources Limited (LSE:FAR), the vanadium producer

and developer of the large Balasausqandiq vanadium deposit in

Southern Kazakhstan , is pleased to announce the launch of a new

phased US$20 million exempt offer bond programme valid until 31

July 2033 (the "Programme"). The Company has listed the first

tranche of the bonds under the Programme on the Astana

International Exchange ("AIX") with the ability to raise up to US$3

million initially.

Summary

-- The Company's previously issued bonds amounting to US$1.1

million were redeemed at maturity in March 2023. Further to this

redemption, the Company has launched the Programme, which was

approved by the AIX on 24 July 2023.

-- The highlights of the Programme are as follows:

o The Programme will comprise one or more tranches of bonds,

each listed on the AIX;

o The total nominal value of all tranches issued under Programme

shall not exceed US$20 million;

o Each tranche of the Programme will be offered only to

accredited investors (as defined by 1.1.2(6)(a) of AIFC MAR Rules)

based in Kazakhstan and governed by the laws and regulations of the

Astana International Financial Centre ("AIFC");

o Bonds issued under the Programme will be denominated in either

US dollars or Kazakhstan tenge with interest payable to bondholders

bi-annually;

o All bonds issued will rank as unsecured debt obligations of

the Company; and

o The applicable coupon rate, duration, issue price and other

relevant terms of any bonds issued under the Programme will be

defined and determined by the terms and conditions of each tranche

of bonds issued.

First Tranche

-- On 27 July 2023, the Company listed the first tranche of

bonds under the Programme on the AIX ("the First Tranche") with the

ability to raise up to US$3 million.

-- A summary of the terms and conditions of the First Tranche is as follows:

- ISIN: KZX000001474

- Specified currency: US Dollars

- Face value: US$2,000

- Number of bonds: 1,500 units

- Total nominal amount of the bonds: US$3 million

- Issue date: 27 July 2023

- First date of trading: 28 July 2023

- Last date of the circulation period: 26 July 2026

- Maturity date: 27 July 2026

- Coupon rate: 9.0% fixed of the nominal value of the bonds issued

- Frequency of interest payments: twice a year, 27 January, and

27 July of each year, commencing on 27 January 2024

- Coupon basis: 30 days in a month / 360 days in a year

-- Trading of the First Tranche of bonds will commence on 28 July 2023.

Commenting on the Programme, Nick Bridgen, CEO of Ferro-Alloy

Resources said:

" The Programme will provide the Company with the opportunity to

replace the bonds that were repaid in March 2023, and provide the

flexibility to make further bond issuances to finance the

acceleration of the Company's development as required in the

future."

For further information, visit www.ferro-alloy.com or contact:

Ferro-Alloy Resources Nick Bridgen (CEO) info@ferro-alloy.com

Limited / William Callewaert

(CFO)

Shore Capital Toby Gibbs/Lucy Bowden

(Joint Corporate Broker) +44 207 408 4090

Liberum Capital Limited Scott Mathieson/Kane

(Joint Corporate Broker) Collings +44 20 3100 2000

------------------------ ---------------------

St Brides Partners

Limited

(Financial PR & IR Catherine Leftley/Ana

Adviser) Ribeiro +44 207 236 1177

------------------------ ---------------------

About Ferro-Alloy Resources Limited:

The Company's operations are all located at the Balasausqandiq

deposit in Kyzylordinskoye Oblast in the South of Kazakhstan.

Currently the Company has two main business activities:

a) the high grade Balasausqandiq vanadium project (the

"Project"); and

b) an existing vanadium concentrate processing operation (the

"Existing Operation")

Balasausqandiq is a very large deposit, with vanadium as the

principal product together with several by-products. Owing to the

nature of the ore, the capital and operating costs of development

are very much lower than for other vanadium projects.

The most recent mineral resource estimate for ore-body one (of

seven) provided an Indicated Mineral Resource of 32.9 million

tonnes at a mean grade of 0.62% V(2) O(5) equating to 203,364

contained tonnes of vanadium pentoxide ("V(2) O(5) "). In the

system of reserve estimation used in Kazakhstan the reserves are

estimated to be over 70m tonnes in ore-bodies 1 to 5 but this does

not include the full depth of ore-bodies 2 to 5 or the remaining

ore-bodies which remain substantially unexplored.

The Project will be developed in two phases, Phase 1 and Phase

2, treating 1m tonnes per year and an additional 3m tonnes per

year. Production will be some 5,600 tonnes of V(2) O(5) from Phase

1, rising to 22,400 tonnes V(2) O(5) after Phase 2 is

commissioned.

There is an existing concentrate processing operation at the

site of the Balasausqandiq deposit. The production facilities were

originally created from a 15,000 tonnes per year pilot plant which

was then expanded and adapted to recover vanadium, molybdenum and

nickel from purchased concentrates.

The existing operation is located on the same site and uses some

of the same infrastructure as the Project, but is a separate

operation which will continue in parallel with the development and

operation of the Project.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCKZGZNNNMGFZG

(END) Dow Jones Newswires

July 27, 2023 04:00 ET (08:00 GMT)

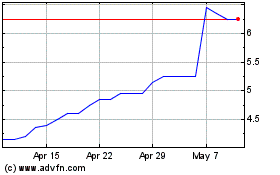

Ferro-alloy Resources (LSE:FAR)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ferro-alloy Resources (LSE:FAR)

Historical Stock Chart

From Feb 2024 to Feb 2025