Half Yearly Report -2-

February 22 2011 - 2:00AM

UK Regulatory

UNAUDITED CONSOLIDATED CASH FLOW STATEMENT

6 months 6 months

to to Year to

30 November 30 November 31 May

2010 2009 2010

GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

(Loss)/profit before tax (118) 37 (250)

Adjustments for:

Finance charges 4 - (4)

Depreciation and

amortisation 188 212 439

Foreign exchange

difference (13) - 28

Decrease/(increase) in

inventories 200 122 34

Decrease/(increase) in

trade receivables 559 396 130

Decrease in other

receivables 26 49 53

(Decrease)/increase in

trade payables (35) (33) 214

Decrease in other payables (225) (386) (284)

-------------- -------------- --------------

Net cash generated from

operating activities 586 397 360

-------------- -------------- --------------

Cash flows from investing

activities

Interest received - - 5

Purchase of tangible fixed

assets (35) (21) (122)

Purchase of intangible

assets (193) (225) (486)

-------------- -------------- --------------

Net cash used in investing

activities (228) (246) (603)

-------------- -------------- --------------

Cash flows from financing

activities

Interest paid (4) - (1)

-------------- -------------- --------------

Net cash generated from

financing activities (4) - (1)

-------------- -------------- --------------

Net movement in cash and

cash equivalents 354 151 (244)

Cash and cash equivalents

at beginning of period 25 269 269

-------------- -------------- --------------

Cash and cash equivalents

at end of period 379 420 25

======= ======= =======

NOTES TO THE UNAUDITED INTERIM REPORT

1. BASES OF PREPARATION

The consolidated interim financial statements have been prepared

in accordance with the recognition and measurement principles

of International Financial Reporting Standards as endorsed

by the European Union ("IFRS") and expected to be effective

at the year end of 31 May 2011. The accounting policies are

unchanged from the financial statements for the year ended

31 May 2010.

The information set out in this interim report for the six

months ended 30 November 2010 does not comprise statutory

accounts within the meaning of section 434 of The Companies

Act 2006. The results for the period ended 31 May 2010 are

based on the published accounts for that period on which

the auditors gave a report which did not contain statements

under section 498 of the Companies Act 2006. The accounts

for the period ended 31 May 2010 have been filed with the

Registrar of Companies.

This interim report was approved by the directors on 17 February

2011.

2. EARNINGS PER SHARE

The earnings per share for the six months ended 30 November

2010 is based on the Group loss on ordinary activities after

taxation of GBP136,000 (2009: profit GBP25,000) attributed

to the weighted average of 109,146,176 Ordinary Shares (2009:

109,146,746), being the weighted average number of shares

in issue.

INDEPENDENT REVIEW REPORT TO FEEDBACK PLC

Introduction

We have been engaged by the Company to review the condensed set

of financial statements in the interim financial report for the six

months ended 30 November 2010 which comprises the Consolidated

Income Statement, the Consolidated Statement of Total Recognised

Income and Expense, the Consolidated Balance Sheet, the

Consolidated Cash Flow Statement and the Notes to the Unaudited

Interim Report. We have read the other information contained in the

interim financial report and considered whether it contains any

apparent misstatements or material inconsistencies with the

information in the condensed set of financial statements.

This report, including the conclusion, has been prepared for and

only for the Company for the purpose of meeting the requirements of

the AIM Rules for Companies and for no other purpose. We do not,

therefore, in producing this report, accept or assume

responsibility for any other purpose or to any other person to whom

this report is shown or into whose hands it may come save where

expressly agreed by our prior consent in writing.

Directors' Responsibilities

The interim financial report, is the responsibility of, and has

been approved by the directors. The directors are responsible for

preparing and presenting the interim financial report in accordance

with the AIM Rules for Companies.

As disclosed in note 1, the annual financial statements of the

Group are prepared in accordance with International Financial

Reporting Standards and International Financial Reporting

Interpretations Committee ("IFRIC") pronouncements as adopted by

the European Union. The condensed set of financial statements

included in this interim financial report has been prepared in

accordance with the measurement and recognition criteria of

International Financial Reporting Standards and International

Financial Reporting Interpretations Committee ("IFRIC")

pronouncements, as adopted by the European Union.

Our Responsibility

Our responsibility is to express to the Group a conclusion on

the condensed set of financial statements in the interim financial

report based on our review.

Scope of Review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity" issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK and Ireland) and consequently does not enable us to

obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do

not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the interim financial report for the six months ended 30

November 2010 is not prepared, in all material respects, in

accordance with the measurement and recognition criteria of

International Financial Reporting Standards and International

Financial Reporting Interpretations Committee ("IFRIC")

pronouncements as adopted by the European Union, and the AIM Rules

for Companies.

haysmacintyre

Chartered Accountants

Fairfax House

15 Fulwood Place

London

WC1V 6AY

21(st) February 2011

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR TTMRTMBATMBB

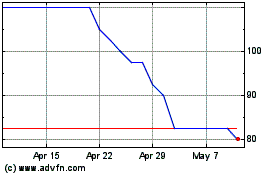

Feedback (LSE:FDBK)

Historical Stock Chart

From Jun 2024 to Jul 2024

Feedback (LSE:FDBK)

Historical Stock Chart

From Jul 2023 to Jul 2024