TIDMFDBK

RNS Number : 8469F

Feedback PLC

30 April 2014

30 April 2014

Feedback plc

("Feedback" or the "Company")

Proposed acquisition of Cambridge Computed Imaging Limited,

proposed acquisition of TexRAD Limited, Subscription to raise

GBP300,000 and readmission to trading on AIM

Headlines

-- Acquisition of highly complementary and synergistic Cambridge

Computed Imaging Limited and TexRAD Ltd

-- Subscription to raise GBP300,000, supported by the Company's

directors and an existing shareholder, completed at a 62 per cent.

premium to the closing middle-market price

-- The Acquisitions offer an exciting growth opportunity for the

Company and its shareholders to gain exposure to the medical

imaging software market

-- The cash raised from the subscription together with the

existing cash resources of the Company will help fund future

research and development efforts, sales and marketing initiatives,

and regulatory approval processes

Proposed Acquisitions and Subscription

Feedback announces that it has entered into conditional

agreements to acquire the issued share capital of CCI and TexRAD,

both medical imaging software companies, and the underlying IP

relating to TexRAD, for a total consideration of GBP473,900 to be

satisfied by the issue of the Consideration Shares and GBP26,400 in

cash.

The Company is proposing to raise GBP300,000 by way of a

conditional subscription for 24,000,000 Ordinary Shares at 1.25p

per share. It is intended that the proceeds of the Subscription

will be used to help grow the CCI and TexRAD businesses,

specifically to invest in sales, marketing, regulatory approval

processes and to provide additional working capital for the

Enlarged Group. Furthermore the Company will pay the professional

fees incurred in respect of the Acquisitions and the

Subscription.

The Acquisitions will constitute a reverse takeover under the

AIM Rules. As a consequence, the Directors are seeking shareholder

approval for the Acquisitions at a general meeting which is

expected to be convened for 10.00 a.m. on 16 May 2014 at the

offices of Stephenson Harwood LLP at 1 Finsbury Circus, London EC2M

7SH.

Irrevocable Undertakings to vote in favour of the Resolutions at

the General Meeting have been obtained from the Directors and

certain other Shareholders in respect of their shareholdings,

amounting to in aggregate 78,273,919 Ordinary Shares representing

59.78 per cent of the Existing Ordinary Shares.

Application will be made to the London Stock Exchange for the

Enlarged Issued Share Capital to be admitted to trading on AIM. The

AIM Admission Document, which comprises a circular to Shareholders

and notice of the General Meeting, will be posted to Shareholders

and will be available from the Company's website, www.fbk.com,

today.

It is expected that admission to AIM will become effective and

that dealings in the Enlarged Issued Share Capital will commence on

or before 19 May 2014.

Nick Shepheard, Chairman and Chief Executive of Feedback,

commented: "Medical imaging plays an ever more important role in

medical decision making and is fundamental to patient assessment

and treatment in cardiology and oncology. The board of Feedback

believe that there is a growing market for image analysis tools

that aid the decision making process and help clinicians assess

prognosis and evaluate the efficacy of existing and newly developed

treatments. Working together, CCI and TexRAD combine image

manipulation and processing expertise with a new technique for

analysing cancer tumours that has shown significant advantages over

other assessment techniques. Aided by the Enlarged Group's

strengthened balance sheet and access to public markets via an AIM

listing, we look forward to building on their successes to date by

progressing towards regulatory approval, entering the market to

help assess the effectiveness of drugs under development, and

creating shareholder value growth in the medium and longer

term."

Contacts:

Feedback plc

Nick Shepheard Tel: 020 3289

7747

Sanlam Securities UK Limited (Nominated

adviser and Joint Broker)

Simon Clements/Virginia Bull/Catherine Tel: 020 7628

Miles 2200

Peterhouse Corporate Finance Limited

(joint Broker)

Jon Levinson/Lucy Williams Tel: 020 7469

0930

Below are extracts from the Admission Document which has been

sent to shareholders today. The full Admission Document is

available on the Company's website: www.fbk.com.

Information on CCI

Background information on CCI

CCI specialises in providing software that helps doctors use

medical images in diagnosis and treatment. Since its foundation,

CCI has focused on supporting the needs of Papworth Hospital, the

UK's largest specialist cardiothoracic hospital, and other

facilities where its software is used to support diagnosis,

treatment planning, treatment response and knowledge sharing within

multi-disciplinary teams.

CCI's core product, the Cadran image platform, provides a

comprehensive range of PACS services designed to offer both

clinical and productivity benefits. Connecting with and accessing

images from all types of digital imaging equipment, such as CT and

PET scanners, Cadran enables connectivity with devices using the

DICOM standard. Cadran is built around its Image Storage Manager

which is a scalable system designed both to deliver images on

demand and provide long-term and secure archiving of sensitive

data. Images are served in an interface certified for clinical use

that allows doctors to display, review and manipulate the images

whilst using in-line measurement and analysis tools to assist with

diagnosis and quantifying treatment responses. Relevant information

can be accessed by users from any workstation connected to the

platform. Web functions are added to enable access to static and

dynamic images over an intranet or internet using standard web

browsers. Advanced compression and transmission techniques

typically mean bandwidth consumption is minimised and images load

at a faster pace, particularly useful for remote reviewing and

teaching applications.

CCI has worked with TexRAD since 2011 and has been responsible

for developing the platform that can be installed on a single

workstation, on a local server or on centrally hosted virtual

machines.

CCI's products under development are designed to enable a

multi-site multi-disciplinary team approach to using medical

images, a feature of complex decision making in fields such as

cardiothoracic and cancer care.

Competition

The PACS market grew rapidly in the early 2000s after small

companies worked closely with major centres to produce integrated

systems that offered clinical and workflow benefits. Following much

consolidation, the Directors believe that CCI's competitors in the

UK PACS market can generally be categorised into two groups: (i)

large established global OEMs supplying imaging hardware to medical

markets, such as GE Healthcare (USA), Siemens (Germany), Philips

(The Netherlands), Toshiba Medical systems (Japan), and (ii)

smaller software companies who have found their niche providing

imaging services to regional hospitals or to specialist interests,

such as CCI's focus on cardiothoracic and its development of the

multi-client simultaneous rendering of images for collaborative

working between locations.

Financial summary of CCI

The table below contains information extracted from the audited

financial information for CCI for the three financial periods ended

31 January 2014.

Year to Year to Year to

31 January 31 January 31 January

2012 2013 2014

GBP GBP GBP

Revenue 210,207 188,879 267,142

Cost of Sales (73,594) (64,528) (102,275)

------------ ------------ ------------

Gross Profit 136,613 124,351 164,867

Administrative expenses (172,661) (168,296) (170,695)

------------ ------------ ------------

Operating Loss (36,048) (43,945) (5,828)

------------ ------------ ------------

(Loss)/Profit for

the year (21,990) (29,933) 1,866

============ ============ ============

Information on TexRAD

Background information on TexRAD

TexRAD offers an innovative quantitative tool to those

researching the diagnosis, prognosis and treatment response of

cancer. The technology enables quantitative textural analysis of

heterogeneity to be found in routinely acquired clinical diagnostic

images which could serve to risk stratify tumours and assist in

response evaluation. Research customers have shown that using

TexRAD's quantitative textural analysis, heterogeneity could

further add value to existing markers of tumour size, density and

perfusion as a quantitative imaging biomarker and potentially

assist in clinical decision making by optimising care pathways for

improved patient outcomes and provide cost-effective patient

management.

Between 2004 and 2011, researchers from the University of

Sussex's Department of Engineering collaborated with Brighton &

Sussex Medical School to develop an innovative algorithm that

quantified textures in medical images. Following early adoption and

promising findings by research groups, TexRAD was incorporated in

February 2011 in order to translate a novel research tool into

commercial products.

Current treatment decisions for patients with cancer are

primarily based on the extent of tumour spread (i.e. tumour stage).

Diagnostic imaging, especially CT and PET are essential to

determining the stage for many cancers. However, patients with the

same tumour stage often follow differing clinical courses and may

therefore require different treatments. This has resulted in a need

for additional methods to assess cancer severity so that treatment

can be selected to more closely match the likely clinical course.

Medical images such as CT scans and MRI scans are used to make

decisions on patient care and treatment but are limited to what the

human eye can see. Diagnostic imaging systems have generally

enhanced fine detail (i.e. high spatial frequency information) with

the aim of optimising anatomical resolution. However, experience

from the automated identification of military targets indicated

that important discriminatory information is to be found within

coarser variations in image brightness (i.e. lower spatial

frequencies). If pronounced, these variations can be perceived as

abnormalities of texture.

TexRAD's proprietary technology employs filters specifically to

highlight these coarser features and uses histogram analysis to

quantify and assess the distribution of grey-levels, coarseness and

regularity within a lesion. By using filters that extract and

enhance for image features at larger scales, the effect of photon

noise is reduced whilst biological heterogeneity is enhanced.

TexRAD allows heterogeneity parameters measured at different

spatial scales to be compared and presented as 'texture ratios' or

'texture spectra' enabling quantitative assessment of imaging

biomarkers within a tumour.

TexRAD has recently commenced the process necessary to achieve

regulatory approval that will enable its use in clinical practice

and add quantitative textural analysis to trials of pharmaceuticals

under development. Revenues to date have primarily come from

leading medical research centres where TexRAD is being applied in a

wide range of studies including colorectal, breast, lung,

prostrate, oesophageal, head and neck, and renal cancers. TexRAD

has supported customers around the world including:

-- University College London Hospitals, London, UK

-- The Institute of Cancer Research Royal Marsden Hospital, Surrey, UK

-- University of Cambridge, Cambridge, UK

-- Aarhus University Hospitals, Aarhus, Denmark

-- European Institute of Oncology, Milan, Italy

-- Johns Hopkins University, Baltimore, Maryland, USA

-- Massachusetts General Hospital, Boston, Massachusetts, USA

-- Tata Memorial Hospital, Mumbai, India

Competition

As far as the Directors are aware, TexRAD is the only

commercially available software offering analysis of image texture

at user-defined spatial scales. TexRAD is protected by a patent

(pending in EU and USA, granted in Canada) and the searches

undertaken in taking out the patent have not identified any likely

challenges. So far as the Directors are aware, other research

groups have predominantly focused on segmenting and classifying

lesion/organ/tissue as benign or malignant and have not focused as

much on prognosis and treatment response markers. TexRAD's approach

is to first establish the biological correlates and relevant image

features and then show their association to patient outcome and

disease-severity. TexRAD's comparison studies have either shown

complementarity or superior prognostic performance for TexRAD

compared to other imaging biomarkers such as CT perfusion and PET

measurements of glucose uptake. Modelling studies have also

indicated a complementary role for TexRAD alongside clinical

biomarkers such as performance status.

Emerging competitor serum and tissue-based biomarkers such as

the promising prognostic markers for CRC and NSCLC, microRNA

analysis and microsatellite instability testing, are comparable in

cost to TexRAD. Although not tested in the same cohorts, the

reported prognostic performance measures for these biomarkers are

comparable or lower than those for TexRAD. Tissue-based biomarkers

are also constrained by their invasive nature and by tumour

heterogeneity resulting in biopsy sampling error. By being

image-based, TexRAD can non-invasively evaluate larger tumour

volumes and exploit tumour heterogeneity rather than being

constrained by this fundamental property of malignancy.

Financial summary of TexRAD

The table below contains information extracted from the audited

financial information for TexRAD for the three financial periods

ended 31 January 2014.

17 months 12 months Six months

to 31 July to to

2012 31 July 31 January

2013 2014

GBP GBP GBP

Revenue 3,167 76,261 52,886

Cost of sales (1,000) (47,359) (26,927)

------------ ----------- ------------

Gross Profit 2,167 28,902 25,959

Administrative expenses (18,226) (55,473) (40,825)

------------ ----------- ------------

Loss before income

tax (16,059) (26,571) (14,866)

------------ ----------- ------------

Loss for the period (16,059) (26,571) (14,866)

------------ ----------- ------------

Current trading and prospects

CCI

Due to the high percentage of longstanding customer agreements

which provide recurring revenue, trading in CCI has been in line

with management's expectations during the first quarter of the

financial year. CCI continues to undertake a programme of

consultancy developments which lead to additional project based

revenues. CCI has also commenced work on developing a

multidisciplinary team toolkit, which it proposes to launch as a

stand-alone product later this year. The Directors consider this

product to be a milestone in the development of the business as it

provides new opportunities in the cardiothoracic sector and expands

the markets in which CCI operates.

TexRAD

TexRAD continues to make revenues working with its research

customers. The Directors are encouraged by the current pipeline and

by a number of recent sales that moved to an accelerated

completion. TexRAD's current intention is, following regulatory

approval, to launch an updated version of its product for the

clinical trials market in late 2014 and to secure early adopter

clinical customers looking to use quantitative textural analysis to

measure treatment response. The Directors expect modest revenues

from new markets in the first 12 months following such launch but

consider adoption in clinical use as a strategic priority.

Corporate vision and strategy

In an environment with ever more powerful computing

possibilities, new drugs under development, and the constant need

to evaluate the effectiveness of complex treatment choices, medical

imaging is an integral and growing part of medical practice.

The Directors' vision is to build on CCI's image processing and

analysis expertise with TexRAD's novel quantification technique to

position Feedback as a medical imaging tools company. The mission

of the Enlarged Group is to extract every potential benefit from

medical images. The Board proposes to develop innovative techniques

and improved workflows for practitioners involved in medical

research and treating patients. The Enlarged Group intends to build

products that put new and more effective tools into the hands of

clinical decision makers, with a view to improving patient care and

reducing costs.

TexRAD has already proven its value in medical research and is

now working towards regulatory approval when it can be used to

enrich clinical trials and help understand the effects of new

pharmaceuticals. It is intended that products will be developed to

help medical decision makers evaluate the treatment choices on a

patient-by-patient basis and which are intended to support industry

moves towards a personalised approach to patient care. As its

technologies are manufacturer neutral, and can be used with

historical images, for example, on longitudinal research projects

and to monitor disease progression, the addressable market will

include all existing specialist imaging centres.

As the market develops, the Directors intend to base the

business model on the clinical use of its tools designed to

identify imaging biomarkers that can be used in the early detection

of cancer, in determining prognosis and predicted outcomes and in

evaluating treatment response.

The Directors believe that Feedback can create shareholder value

growth in the medium and longer term through CCI and TexRAD's

expertise in cardiac imaging and oncology by further developing

existing products whilst moving into the clinical trials market,

and developing new tools to measure patients' treatment response.

The Directors intend to fund these developments from existing

revenue streams in the research market, the Company's cash

resources and from grant funding (where available). There will be

potential new sources of revenue when TexRAD has completed its

regulatory approval process.

In addition to existing CCI and TexRAD products, the Company

will look for opportunities to widen its offerings in its target

markets through collaborations and corporate activity which may

include mergers and acquisitions.

Reasons for the Proposals

The Directors believe that the Proposals offer an exciting

growth opportunity for the Company and its Shareholders and that

the Enlarged Group has the potential to benefit from:

-- the fact that the CCI and TexRAD businesses are complementary to each other;

-- an enhanced ability to attract and incentivise key management;

-- an enhanced corporate profile as a public company;

-- the availability of the Company's cash reserves and resources

to CCI and TexRAD and the potential to provide CCI and TexRAD with

an opportunity to access new capital for future research and

development; and

-- an ability to use quoted shares as consideration for strategic acquisitions.

Regulatory environment

In order to market its technologies as a medical device for use

in clinical trials, TexRAD must undergo a process of regulatory

approval. The Directors believe that TexRAD and CCI are working

towards the necessary European and USA regulatory requirements

including Medical Devices Directive 93/42/EEC, ISO13485:2003, and

Code of Federal Regulations Title 21 Part 11 (which defines

criteria under which FDA considers electronic records and

electronic signatures to be trustworthy, reliable, and equivalent

to paper records). A regulatory pathway for TexRAD's medical device

products has been identified and it has selected a preferred

supplier to assist in getting approval with the US Food and Drug

Administration and the UK Medicines and Healthcare Products

Regulatory Agency.

Principal terms of the Acquisitions

CCI

Under the terms of the CCI Acquisition Agreement, the Company

has conditionally agreed to acquire the entire issued share capital

of CCI from the CCI Vendors for a total consideration of

GBP213,200, to be satisfied by GBP13,200 in cash and the balance by

the issue of the CCI Consideration Shares (representing 8.39 per

cent. of the Enlarged Issued Share Capital) on Admission.

During the period between the date of the execution of the CCI

Acquisition Agreement and Completion, the CCI Vendors have

undertaken to operate the business of CCI in the normal manner of

such business. The CCI Acquisition Agreement contains certain

warranties (subject to certain limitations of liability) and

undertakings given by the CCI Vendors in favour of the Company.

TexRAD

Under the terms of the TexRAD Acquisition Agreement, the Company

has conditionally agreed to acquire the entire issued share capital

of TexRAD (other than a nine per cent. stake in TexRAD that is

already held by CCI) from the TexRAD Vendors for a total

consideration of GBP240,700. In addition, TexRAD has also reached

agreement with the University of Sussex that, conditional on

Admission, certain intellectual property rights held by the

University of Sussex relating to TexRAD will also be transferred to

TexRAD for a total consideration of GBP20,000. The aggregate total

of GBP260,700 is to be satisfied by GBP13,200 in cash and the

balance by the issue of the TexRAD Consideration Shares and the IP

Consideration Shares (together representing 10.38 per cent. of the

Enlarged Issued Share Capital) on Admission. As additional

consideration, the TexRAD Vendors will also receive the TexRAD

Warrants.

The TexRAD Warrants will be issued such that 4,550,000 warrants

will have an exercise price of GBP0.0125 and a vesting period of

between two and 10 years from the date of Admission; and 18,200,000

warrants will have an exercise price of GBP0.03 and a vesting

period of between three and 10 years from the date of the

Admission.

During the period between the date of the execution of the

TexRAD Acquisition Agreement and Completion, the TexRAD Vendors

have undertaken to operate the business of TexRAD in the normal

manner of such business. The TexRAD Acquisition Agreement contains

certain warranties (subject to certain limitations of liability)

and undertakings given by the TexRAD Vendors in favour of the

Company.

Completion of the Acquisitions is conditional, inter alia, on

the passing of the Resolutions and Admission becoming effective by

not later than 16 May 2014. Subject to the conditions being

satisfied, Completion is expected to take place upon Admission.

Reasons for the Subscription and use of funds

The proceeds of the Subscription will be used to help grow the

CCI and TexRAD businesses, specifically to invest in sales,

marketing, regulatory approval processes and to provide additional

working capital for the Enlarged Group and to pay the various fees

and expenses incurred by the Company in respect of the

Proposals.

Details of the Subscription

Under the terms of the Subscription Letters, Tom Charlton,

Trevor Brown and Roy Ruffler have conditionally agreed to subscribe

for an aggregate of 24,000,000 Subscription Shares at the

Subscription Price to raise GBP300,000 (before expenses) for the

Company.

The Subscription is conditional, inter alia, upon Admission.

The Subscription Shares, the CCI Consideration Shares and the

TexRAD Consideration Shares, when issued and fully paid, will rank

equally in all respects with the issued Ordinary Shares, including

the right to receive all dividends and other distributions

declared, made or paid after Admission.

It is expected that Admission will become effective and dealings

in the Enlarged Issued Share Capital will commence on 19 May

2014.

Following the Subscription and completion of the Acquisitions,

the Company will have 190,746,746 Ordinary Shares in issue and

admitted to trading on AIM.

Related party transaction

Trevor Brown and Tom Charlton, Non-executive Directors of the

Company, have agreed to subscribe for 10,400,000 Subscription

Shares each, as part of the Subscription. In addition, as one of

the CCI Vendors, Tom Charlton will be receiving 2,232,600 CCI

Consideration Shares pursuant to the CCI Acquisition. Following

Admission their holding in the Enlarged Issued Share Capital will

be as follows:

Number Percentage

of Subscription Number of holding

Shares Consideration Shareholding of the

subscribed Shares received Following Enlarged

for Admission Issued

Share Capital

Trevor

Brown 10,400,000 - 49,589,111 26.00

Tom Charlton 10,400,000 2,232,600 46,717,408 24.49

Trevor Brown and Tom Charlton are classified as related parties

of the Company for the purposes of the AIM Rules by virtue of them

having a substantial shareholding (as defined by the AIM Rules) in

the Company and by virtue of them being Directors. The independent

Directors for the purposes of the Subscription, being Nick

Shepheard and Simon Barrell, consider, having consulted with the

Company's Nominated Adviser, Sanlam Securities UK Limited, that the

terms of the Subscription are fair and reasonable insofar as

Shareholders are concerned.

The CCI Acquisition is also classified as a related party

transaction for the purposes of the AIM Rules. This is due to the

fact that Tom Charlton is a Director and major shareholder of the

Company and a significant shareholder of CCI. The independent

Directors for the purposes of the CCI Acquisition, being the

Directors other than Tom Charlton, consider, having consulted with

the Company's Nominated Adviser, Sanlam Securities UK Limited, that

the terms of the CCI Acquisition are fair and reasonable insofar as

the Shareholders are concerned.

As at the date of the Admission Document, CCI has outstanding

debts owed to Tom Charlton amounting to GBP189,000. Conditional on

Admission, CCI will repay these debts utilising funds from Feedback

which will be made available to it pursuant to the Shareholder Loan

from Tom Charlton. The Shareholder Loan is for GBP189,000, does not

accrue interest and is repayable on the earlier of 1 December 2016

and the satisfaction of certain conditions, further details of

which are set out in the Admission Document.

Entry into the Shareholder Loan is also classified as a related

party transaction for the purposes of the AIM Rules. This is due to

the fact that Tom Charlton is a Director and substantial

shareholder in the Company. The independent Directors, being the

Directors other than Tom Charlton, consider, having consulted with

the Company's Nominated Adviser, Sanlam Securities UK Limited, that

the terms of the Shareholder Loan are fair and reasonable insofar

as the Shareholders are concerned.

In advising the independent directors, Sanlam Securities UK

Limited has taken into account the commercial judgement of the

independent directors.

Directors and Senior Management

Nick Shepheard (Chairman and Chief Executive) aged 48, has been

the Executive Chairman of Feedback since February 2011. Prior to

that, Mr Shepheard worked for eight years as an independent

consultant to a number of hardware and software technology and

service businesses enabled by technology. Earlier in his career Mr

Shepheard was the General Manager of the London, Edinburgh and

Belfast Gazettes.

Simon Barrell (Non-executive Director) aged 55, qualified as a

chartered accountant with Arthur Young in 1983. He then joined an

accountancy practice in Nairobi, Kenya as a Senior Manager. On his

return to the UK in 1987, he joined Binder Hamlyn. In 1994 Mr

Barrell was appointed finance director of Napier Brown &

Company Limited and subsequently was appointed finance director of

Napier Brown Foods Plc in December 2003. Since leaving Napier Brown

Foods Plc in 2005 Mr Barrell has been finance director in an

executive and non-executive capacity for a number of public

companies and continues to act as an adviser to listed and

non-listed companies. Mr Barrell joined the Board of Feedback in

November 2012.

Trevor Brown (Non-Executive Director) aged 67, joined the board

of Feedback in January 2014. Mr Brown has been a strategic investor

in real estate and equities for more than 30 years. He was most

recently a director of Advanced Oncotherapy plc where he was

involved in the strategy of transition to the provision of advanced

cancer treatment services.

Tom Charlton (Non-Executive Director) aged 56, joined the board

of Feedback in January 2014. Mr Charlton previously served as a

director of Feedback between January 2003 and November 2004 and has

been a significant shareholder in the company since December 1997.

He acted as Chairman of Pinnacle Staffing Group plc from September

2008 until April 2011. Earlier in his career he was a managing

director of Merrill Lynch Investment Managers and a director of

Mercury Asset Management Ltd.

Senior Management

Dr Balaji Ganeshan (Scientific Director, TexRAD) aged 32, has

been the Scientific Director of TexRAD since incorporation and

before that was instrumental in the invention, research and

development of the original IP in his various capacities as a PhD

researcher, post-doctorate researcher, principal investigator and

project manager. He now takes the lead in sales and marketing of

TexRAD in the clinical research market and is also a Senior

Research Associate at the Institute of Nuclear Medicine at the

University College London, UK and is a Visiting Research Fellow

with the Brighton & Sussex Medical School, University of

Sussex.

Mike Hayball (Technical Director, CCI) aged 47, is the architect

of the TexRAD software and has been instrumental in its development

as a commercial system. He started his career as a medical

physicist at Addenbrooke's Hospital in Cambridge where he took his

MSc in Radiation Physics. At Addenbrooke's he worked on the first

CT perfusion implementation for modern CT scanners, leading to

publication in The Lancet in 1991. From there he went on to work on

cardiac imaging at Papworth Hospital, working with Stephen Brown

and Richard Coulden on ECG-triggered spiral CT. In 2001, Mr Hayball

and Stephen Brown formed CCI, with Mr Hayball as Managing Director

where as well as working on CCI and TexRAD products, he has led

projects to develop software for a number of other medical imaging

companies.

Dr Stephen Brown (Operations Director, CCI) aged 44, is CCI's

systems architect and regulatory lead. He completed an industry

sponsored Solid State Physics PhD at the University of Cambridge,

before going on to work for a number of years in industry. In 1997,

Dr Brown joined the Papworth Radiology Development Group where he

was involved in a number of research projects looking at ECG

triggered CT, CT coronary calcium measurement and analysis of MR

and nuclear medicine images. In 2001, Dr Brown and Mr Hayball

formed CCI, where he is also involved in software development and

customer liaison.

Options

The Board believes that the recruitment, motivation and

retention of key employees is vital for the successful growth of

the Enlarged Group. The Board considers that an important element

in achieving these objectives is the ability to incentivise and

reward staff by reference to the market performance of the Company

in a manner which aligns the interests of those staff with the

interest of Shareholders generally. The Company will utilise its

Existing Share Option Plan pursuant to which Options have been and

will be granted to directors and employees of the Enlarged

Group.

It has been agreed that, for tax reasons, Options to acquire

4,000,000 Ordinary Shares that were granted prior to the date of

the Admission Document be surrendered and replaced with new Options

over the same number of Ordinary Shares. In addition, further

Options over 13,800,000 Ordinary Shares have been granted,

conditional on Admission. The table below sets out details of all

such Options.

No. of Ordinary Exercise Issued under

Shares under Price Vesting the EMI scheme

Option period

Simon Barrell 800,000 1.25p 1 year Not EMI

Nick Shepheard 1,000,000* 1.25p Immediate EMI

3,000,000* 1.25p 1 year EMI

1,000,000 1.25p 1 year EMI

Mike Hayball 1,200,000 1.25p 1 year EMI

2,000,000 3.00p 1 year EMI

2,000,000 5.00p 1 year EMI

Deryan Gilbert 1,600,000 1.25p 1 year EMI

Stephen

Brown 1,200,000 1.25p 1 year EMI

2,000,000 3.00p 1 year EMI

2,000,000 5.00p 1 year EMI

----------------

17,800,000

----------------

* Issued in replacement of existing options

The total number of Ordinary Shares that may be committed under

the Existing Share Option Plan will not exceed 10 per cent. of the

Enlarged Group's issued ordinary share capital from time to

time.

Definitions

The following words and expressions shall have

the following meanings in this announcement unless

the context otherwise requires:

"Acquisitions" together the CCI Acquisition and

the TexRAD Acquisition

"Admission" admission of the Enlarged Issued

Share Capital to trading on AIM

and such admission becoming effective

in accordance with Rule 6 of the

AIM Rules

"Admission Document" the circular to Shareholders dated

30 April 2014 which comprises an

admission document for the purposes

of the AIM Rules

"AIM" the market of that name operated

by the London Stock Exchange

"AIM Rules" the AIM Rules for Companies published

by the London Stock Exchange

"Board" or "Directors" the directors of the Company

"CCI" Cambridge Computed Imaging Limited,

a private limited company incorporated

in England and Wales under registered

number 04025026

"CCI Acquisition" the acquisition by the Company of

the entire issued share capital

of CCI pursuant to the CCI Acquisition

Agreement

"CCI Acquisition the conditional agreement dated

Agreement" 30 April 2014 between (1) the CCI

Vendors and (2) the Company for

the CCI Acquisition

"CCI Consideration the 16,000,000 new Ordinary Shares

Shares" proposed to be issued to the CCI

Vendors in consideration for the

CCI Acquisition

"CCI Vendors" those persons being the existing

shareholders of CCI

"Completion" completion of the Acquisitions in

accordance with the terms of the

Acquisition Agreements

"Consideration together the CCI Consideration Shares,

Shares" the TexRAD Consideration Shares

and the IP Consideration Shares

"Enlarged Group" the Company and its subsidiaries

as enlarged by the Acquisitions,

to include CCI and TexRAD

"Enlarged Issued the entire issued ordinary share

Share Capital" capital of the Company being the

Existing Ordinary Shares, the Consideration

Shares and the Subscription Shares

"Existing Ordinary the 130,946,746 Ordinary Shares

Shares" in issue as at the date of the Admission

Document

"Existing Share the share option plan adopted by

Option Plan" the Company on 2 July 2007 (and

amended and restated on 29 April

2014)

"Form of Proxy" the form of proxy sent to holders

of Existing Ordinary Shares for

use by Shareholders in connection

with the General Meeting

"General Meeting" the General Meeting of the Company,

to be held at the offices of Stephenson

Harwood LLP, 1 Finsbury Circus,

London EC2M 7SH on 16 May 2014 at

10.00 a.m. and any adjournment thereof

to be held for the purpose of considering

and, if thought fit, passing the

Resolutions

"IP Consideration the 1,600,000 new Ordinary Shares

Shares" proposed to be issued to the University

of Sussex in consideration for the

TexRAD IP Assignment

"Irrevocable the agreement by certain of the

Undertakings" Directors and certain other Shareholders

to vote in favour of the Resolutions

"London Stock London Stock Exchange plc

Exchange"

"Non-Executive the option granted by the Company,

Option" conditional on Admission, to Simon

Barrell to subscribe for 800,000

new Ordinary Shares

"Options" share options in the Company pursuant

to the Existing Share Option Plan

"Ordinary Shares" ordinary shares of 0.25p each in

capital of the Company

"Proposals" means (a) the CCI Acquisition; (b)

the TexRAD Acquisition; (c) the

Subscription; and (d) Admission

"Resolutions" the resolutions set out in the notice

convening the General Meeting

"Shareholder the loan agreement dated 30 April

Loan" 2014 between (1) Tom Charlton and

(2) the Company

"Shareholders" holder(s) of Ordinary Shares

"Subscribers" the subscribers for the Subscription

Shares pursuant to the Subscription

"Subscription" the conditional placing of the Subscription

Shares at the Subscription Price

pursuant to the Subscription Letters

"Subscription the letters provided by Tom Charlton,

Letters" Trevor Brown and Roy Ruffler pursuant

to which they have committed to

acquire the Subscription Shares

in the Subscription

"Subscription 1.25 pence per Subscription Share,

Price" being the price at which each Subscription

Share is to be issued

"Subscription the 24,000,000 new Ordinary Shares

Shares" which have been conditionally placed

with the Subscribers pursuant to

the Subscription Letters

"TexRAD" TexRAD Limited, a private limited

company incorporated in England

and Wales under registered number

07535227

"TexRAD Acquisition" the acquisition by the Company of

the entire issued share capital

of TexRAD (save for those shares

held by CCI) pursuant to the TexRAD

Acquisition Agreement

"TexRAD Acquisition the conditional agreement dated

Agreement" 30 April 2014 between (1) the TexRAD

Vendors and (2) the Company for

the TexRAD Acquisition

"TexRAD Consideration the 18,200,000 new Ordinary Shares

Shares" proposed to be issued to the TexRAD

Vendors in consideration for the

TexRAD Acquisition

"TexRAD IP Assignment" the assignment into TexRAD of certain

intellectual property rights relating

to TexRAD which are currently held

by the University of Sussex

"TexRAD Vendors" those persons being the existing

shareholders of TexRAD (other than

CCI)

"TexRAD Warrants" the warrants over 22,750,000 Ordinary

Shares to be issued to the TexRAD

Vendors pursuant to the TexRAD Acquisition

Agreement

"UK" or "United the United Kingdom of Great Britain

Kingdom" and Northern Ireland

Glossary of Abbreviations and Scientific Terms

"CRC" Colorectal cancer

"CT" Computed tomography

"DICOM" Digital Imaging and Communications

in Medicine, a standard for handling,

storing, printing, and sharing medical

imaging - DICOM enables the integration

of scanners, servers, workstations,

printers, and network hardware from

multiple manufacturers into a PACS

"FDA" Food and Drug Administration, US

regulator

"MHRA" Medicines and Healthcare Products

Regulatory Agency, UK regulator

"microRNA" A small non-coding RNA molecule

(containing about 22 nucleotides)

found in plants, animals, and some

viruses, which functions in transcriptional

and post-transcriptional regulation

of gene expression.

"MRI" Magnetic resonance imaging

"NSCLC" Non-small-cell lung cancer

"PACS" Picture Archiving and Communication

System

"PET" Positron emission tomography

"Quantitative a quantifiable feature from a medical

Imaging Biomarker" image for the assessment of normal

or the severity, degree of change,

or status of a disease, injury,

or chronic condition relative to

normal

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQQKCDPDBKBPQB

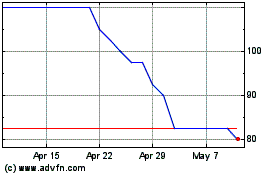

Feedback (LSE:FDBK)

Historical Stock Chart

From Jun 2024 to Jul 2024

Feedback (LSE:FDBK)

Historical Stock Chart

From Jul 2023 to Jul 2024